Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cornerstone Building Brands, Inc. | d363162d8k.htm |

75

92

113

151

159

184

180

130

157

172

26.1%

25.1%

24.8%

24.1%

24.0%

25.6%

25.7%

23.3%

24.0%

25.0%

0

050

100

150

200

250

$300

03

04

05

06

07

08

09

10

11

LTM

3/31

0%

5%

10%

15%

20%

25%

30%

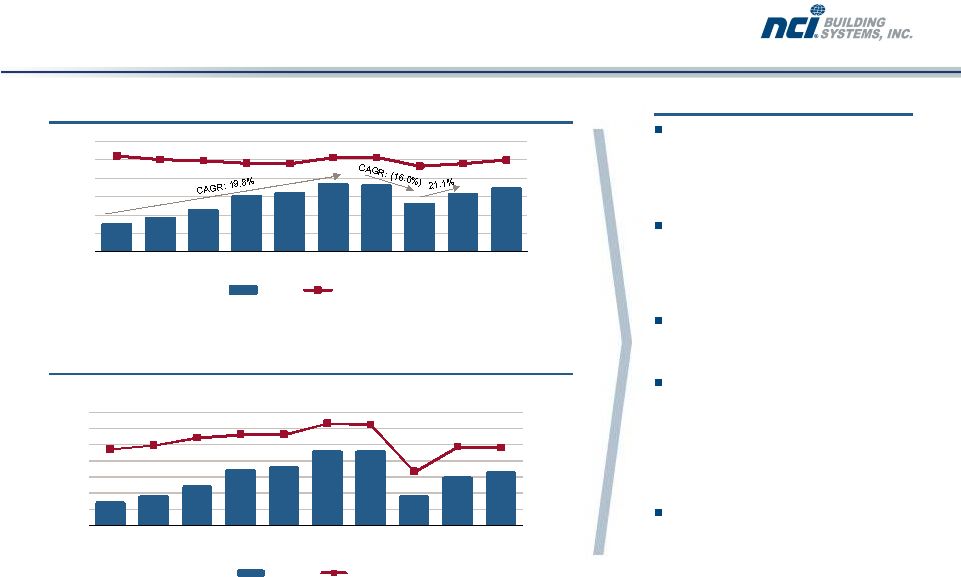

Sales

Contribution margin

Metl-Span's philosophy to be a high-

quality customer focused producer

has achieved excellent financial

results

Sales and EBITDA have grown at

9.8% and 10.0% CAGRs

respectively from FY 2003 to FY

2011

Remained profitable throughout the

economic downturn

Tight focus on project selection and

plant management has delivered

consistent contribution margins of

23–26% over the past 9 years,

including during the economic

downturn

EBITDA margins hurt in FY 2010 on

the back of lower volumes

7

9

12

17

18

23

23

9

15

17

9.5%

10.0%

10.9%

11.3%

11.3%

12.7%

12.5%

6.7%

9.8%

9.7%

0%

2%

4%

6%

8%

10%

12%

14%

0

5

10

15

20

25

30

$35

03

04

05

06

07

08

09

10

11

LTM

3/31

EBITDA

EBITDA margin

Note:

2003 –

2009 unaudited. 2010 –

2011 audited. Non-GAAP EBITDA reconciliation provided in the Appendix.

Source:

Metl-Span management accounts.

($ in millions)

($ in millions)

Demonstrated strong performance record

Exhibit 99.1

FYE June 30

Sales and contribution margin

EBITDA and EBITDA margin

Notes |

Metl-Span historical financial overview

Note:

2007

–

2009

and

LTM

3/31/2012

unaudited.

2010

–

2011

audited.

Source:

Metl-Span management accounts.

(1)

Increase from 2008 relates to amortization on acquisition intangibles.

Historical figures

FYE June 30

2007

2008

2009

2010

2011

LTM 3/31/12

Revenue

$158.6

$183.9

$179.9

$129.9

$157.2

$171.5

% growth

5.2%

16.0%

(2.2%)

(27.8%)

21.1%

15.3%

Contribution margin

$38.0

$47.1

$46.1

$30.3

$37.7

$42.8

% of revenue

24.0%

25.6%

25.7%

23.3%

24.0%

25.0%

EBITDA

$18.0

$23.3

$22.5

$8.7

$15.4

$16.6

% margin

11.3%

12.7%

12.5%

6.7%

9.8%

9.7%

Less: Depreciation

$3.7

$4.0

$4.4

$4.4

$4.4

$4.5

EBITA

$14.3

$19.3

$18.1

$4.3

$11.0

$12.1

% margin

9.0%

10.5%

10.0%

3.3%

7.0%

7.1%

Less: Amortization

(1)

$0.2

$4.3

$3.5

$3.5

$3.4

$3.4

EBIT

$14.1

$15.0

$14.5

$0.8

$7.5

$8.7

% margin

8.9%

8.2%

8.1%

0.6%

4.8%

5.1%

Capital expenditures

$2.7

$14.8

$5.0

$3.6

$1.8

$3.4

% of sales

1.7%

8.0%

2.8%

2.8%

1.1%

2.0%

($ in millions) |

Metl-Span EBITDA reconciliation

2007

2008

2009

2010

2011

LTM 3/31/12

Net income

$14.4

$16.7

$14.5

$0.5

$5.6

$6.5

Interest expense / (income)

(0.2)

(0.5)

0.0

–

(1.3)

(1.1)

Taxes

–

2.9

–

0.3

3.2

3.2

Depreciation

3.7

4.0

4.4

4.5

4.4

4.5

Amortization

0.2

0.2

3.5

3.4

3.4

3.4

EBITDA

$18.0

$23.3

$22.5

$8.7

$15.4

$16.6

($ in millions) |