Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IRON MOUNTAIN INC | a12-14137_18k.htm |

| EX-99.1 - EX-99.1 - IRON MOUNTAIN INC | a12-14137_1ex99d1.htm |

Exhibit 99.2

|

|

Iron Mountain Proposed Conversion to REIT June 5, 2012 |

|

|

Safe Harbor / Forward Looking Statements This presentation contains a number of forward looking statements. Please see Slides 29 to 31 for a description of these statements and the factors that may cause our actual results to differ materially from our current expectations. |

|

|

Key Messages Conversion to REIT structure enhances strategy to extend and sustain long-term durability of the business No assurance conversion to REIT will ultimately be successful Must secure required approvals Long-term capital strategy as REIT will naturally shift toward lower leverage and use of equity financing Resetting $1B stockholder payout plan to support conversion REIT structure provides significant benefits to stockholders Substantial tax savings Disciplined capital allocation strategy New opportunities for value creation |

|

|

REIT structure aligns with operating strategy Significant benefits from REIT structure REIT structure naturally leads to new capital allocation strategy Successful conversion requires approvals; significant hurdles remain Q & A Agenda |

|

|

REIT Structure Aligns with Strategic Priorities Board completed comprehensive evaluation of long-term growth and capital allocation strategies Assessed a variety of potential structures to maximize value through alternative financing, capital and tax strategies REIT structure aligns with shift toward return of excess capital to stockholders Effective way to optimize stockholder value Comfortable with ability to execute strategy within framework of REIT requirements Can fund investment while supporting payouts to stockholders Virtually no impact on our customers Have team and resources to execute conversion Have developed an approach under which we expect to: Meet and maintain REIT tests under a range of growth outcomes Ensure adequate funding to extend and sustain durability of high-return business |

|

|

Iron Mountain Fits as a REIT Owns, leases and operates income-producing real estate Holds at least 75% of total assets in real estate (Asset Test) Derives at least 75% of gross income from real property rents, including storage revenues, or other real property sources (75% Gross Income Test) Derives at least 95% of gross income from sources qualifying under 75% Gross Income Test and certain other sources (95% Gross Income Test) Distributes annually at least 90% of qualifying taxable income in the form of dividends Derives distributable income from Qualified REIT Subsidiaries (QRS) Generates service and non-property related income within Taxable REIT Subsidiaries (TRS) Significant global real estate holdings with attractive characteristics Opportunity to acquire select leased assets Long-term growth strategy focused on core storage business Bulk of revenue and profit related to rental income derived from storage Divested non-core digital services business Ability to separate businesses between QRS and TRS Ability to align U.S. and International businesses to meet Asset and Income Tests A REIT is an entity that: IRM fits as a REIT due to: |

|

|

Foundation of Our Business is Storage Iron Mountain rents space to its customers to store information assets Storage is the primary driver of profits and free cash flow Storage relationships support additional value-added services Drives attractive ROIC globally North America 16% International 8% INTERNATIONAL NORTH AMERICA |

|

|

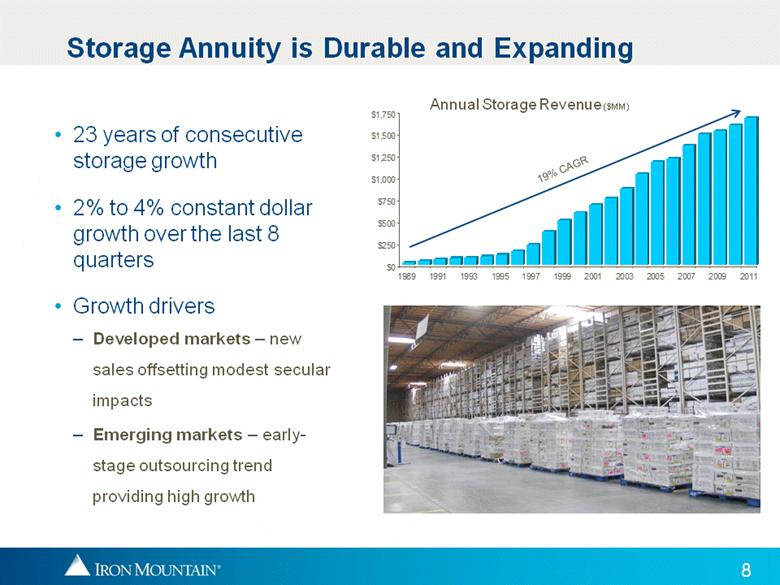

Storage Annuity is Durable and Expanding Annual Storage Revenue ($MM) 19% CAGR 23 years of consecutive storage growth 2% to 4% constant dollar growth over the last 8 quarters Growth drivers Developed markets – new sales offsetting modest secular impacts Emerging markets – early-stage outsourcing trend providing high growth $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 |

|

|

North America: Sustain strong, growing, high-return business for the long-term Capture un-vended opportunity through a combination of Selling new accounts Further penetrating existing accounts Acquire businesses in a consolidating market, driving incremental returns Leverage storage efficiencies to sustain high after-tax ROIC Add adjacent services to capture value from storage relationships International: Augment total growth and extend durability of business Drive higher after-tax returns through market leadership Invest in core sales & marketing to capture outsourcing trends Expand through M&A with focus on high-growth emerging markets Our Plan is to Extend and Sustain Durability of High-Return Business Pure un-vended Partially un-vended Competitors Iron Mountain Large Un-vended Market Segment(1) (1) North American records management and data protection market segment Source: Iron Mountain |

|

|

REIT structure aligns with operating strategy Significant benefits from REIT structure REIT structure naturally leads to new capital allocation strategy Successful conversion requires approvals; significant hurdles remain Q & A Agenda |

|

|

REIT Provides Significant Stockholder Benefits Three Key Value Drivers Higher dividends over time supported by: U.S. federal & state income tax savings Higher distributable pre-tax income Both U.S. & international rental (QRS) income Potential to create value and reduce cost of financing through acquisition of select leased storage facilities Potential to expand investor base through higher yield and attractive business characteristics |

|

|

Multiple Factors Drive High Dividend Payout Significant tax savings Vast majority of U.S. income flows through an efficient tax structure best aligned with our business 2011PF tax savings of ~$120MM to ~$130MM Distributable income increases due to lower tax D&A versus book D&A Characterization of assets as real property increases depreciable lives and lowers annual D&A expense for tax purposes Adds ~$60MM(3) to total dividends in 2011PF International QRS after-tax income builds on strong U.S. base to increase stockholder payouts ~90% of global storage revenues to be included in the QRS over time 2011 Pro Forma dividends more than 2x current per share payout levels $MM except per share data 2011 Pro Forma Dividends(1)(2)(6) U.S. dividends(4) ~$325 to ~$350 International dividends(4) ~$60 to ~$70 Total dividends ~$385 to ~$420 Current shares outstanding(5) 172MM Dividends per share(5) ~$2.24 to ~$2.44 Assumes Iron Mountain, including several substantial international operations, fully converted to a REIT as of January 1, 2011. Assumes starting with 2011 adjusted EPS, adds incremental interest expense associated with additional debt for estimated conversion costs and E&P distributions, 38% structural tax rate and 100% payout of QRS income as indicated. Annual impact may be significantly lower in future years and in some years may decrease distributable income. Including the impact of lower tax basis depreciation and amortization expense. Assumes 172MM shares which represents the approximate number of shares currently outstanding. We expect to issue additional shares to pay up to 80% of our E&P distributions, as is customary in accordance with IRS rules and guidelines, in connection with our planned conversion to a REIT. At a stock price of $27.50 per share, $1 billion of E&P distribution paid in stock would require the issuance of more than 36 million shares, or ~21% of total shares currently outstanding. This would reduce the dividends per share illustrated above by ~17%. See appendix for additional information. For Illustrative Purposes Only |

|

|

Potential to Create Value by Acquiring Select Leased Facilities Within Our Portfolio Higher return investment potential Increases storage income while maintaining or reducing total leverage (lease-adjusted leverage) Helps reduce borrowing costs over time due to higher-quality collateral Replaces higher-cost lease financing with lower-cost direct ownership Supports REIT Asset Test Higher real estate residual value Potential $2.5B - $3.0B Purchase Universe(1) Represents the total universe of our current leased portfolio . The potential value is based on assumed purchase prices of $50 - $60 per square foot in North America and $90 - $100 per square foot internationally. Total Square Feet (MM) |

|

|

Attractive Business Characteristics May Expand Investor Base REIT structure promotes further diversification of investor base, including both active and passive REIT investors and yield investors With 64MM square feet, IRM is a significant operator of storage space Iron Mountain has desirable real estate characteristics IRM’s Business Stable, sustainable storage income Diversified, investment-grade customer base Solid occupancy with upside potential High margin storage business Strong customer retention Low capex and turnover costs per square foot |

|

|

REIT structure aligns with operating strategy Significant benefits from REIT structure REIT structure naturally leads to new capital allocation strategy Successful conversion requires approvals; significant hurdles remain Q & A Agenda |

|

|

New Long-term Capital Allocation Strategy Plan to reduce consolidated leverage and cost of financing over time No tax advantages related to deductibility of interest expense in U.S. QRS Naturally leads to shift in debt/equity mix toward more equity financing to support real estate investment and lower leverage over time Will monitor capital markets for opportunities to issue equity as needed Several approaches available to shift debt/equity mix, including: Using At-The-Market (ATM) equity drawdown programs Opportunistic follow-on equity offerings Paying a portion of REIT dividends in stock, subject to applicable tax rules Dividend Reinvestment Program (DRIP) |

|

|

Significant Costs to Convert Currently estimated to be $325MM to $425MM Potential tax payment related to D&A recapture ($225MM to $275MM, payable over up to 5 years) Significant portion may be payable in 2012 May be required to pay tax even if conversion is unsuccessful Other one-time conversion costs estimated to be between $100MM and $150MM Incurring cost prior to receiving approvals necessary for conversion On-going annual compliance costs estimated to be $5MM to $10MM May incur costs and record non-cash charges to realign employee equity compensation plans with REIT structure |

|

|

Expect Large E&P Distribution in Connection with Conversion Current estimate is ~$1.0B to ~$1.5B Expect to pay E&P distributions in a combination of at least 20% in cash and up to 80% in stock Expect to distribute significant portion of E&P in 2012 Balance to be paid over several years beginning in 2013 based, in part, on IRS rules and the timing of additional international conversions May access capital markets for additional interim funding to support projected conversion-related cash needs, including stockholder distributions |

|

|

Resetting $1B Commitment to Support Conversion Stockholders to receive $0.5B to $0.6B in cash; additional $0.8B to $1.2B to be paid in stock Regular dividend increased 8% to $0.27 per share(2) Additional $0.2B to $0.3B in cash for the E&P distribution Total expected cash and stock distributions to stockholders $1.3B to $1.8B Total expected cash outlay $0.8B to $1.0B Quarterly Dividends per Share Estimated Payouts(1) ($B) Cash Stock Total E&P distributions $0.2 to $0.3 $0.8 to $1.2 $1.0 to $1.5 Quarterly dividends(2) $0.3 ---- $0.3 Stockholders $0.5 to $0.6 $0.8 to $1.2 $1.3 to $1.8 Income taxes $0.2 to $0.3 ---- $0.2 to $0.3 Others(3) $0.1 to $0.2 ---- $0.1 to $0.2 Total(4) $0.8 to $1.0 $0.8 to $1.2 $1.6 to $2.2 All amounts approximate. Covers anticipated disbursements from 2012 – 2016. Assumes 172MM shares outstanding, 80/20 stock/cash split for stockholder payout of E&P. Regular quarterly dividends of $0.27/share through 2013, based on current shares outstanding. Represents estimated one-time conversion costs. Columns may not foot due to rounding. |

|

|

REIT structure aligns with operating strategy Significant benefits from REIT structure REIT structure naturally leads to new capital allocation approach Successful conversion requires approvals; significant hurdles remain Q & A Agenda |

|

|

Conversion Requires IRS Approval on Key Issues Necessary to seek IRS approval on numerous technical tax issues through a PLR request Anticipate filing PLR request in July 2012 Typical PLR process can take up to 12 months Favorable PLR necessary in order to complete REIT conversion May incur significant depreciation and amortization recapture tax liability even if IRS doesn’t issue a favorable PLR |

|

|

Aggressive Plan to Convert by 2014 Must be operating as a REIT by January 1st of conversion year Larger, much more complicated task than other REIT conversions Broader geographic footprint Separation of numerous operations into QRS/TRS structure Substantial realignment of tax and legal structures in multiple jurisdictions Major modifications to accounting, IT and real estate systems required Currently spending significant amounts to prepare for conversion without assurance of IRS approval of requested PLR |

|

|

Risks to Conversion Failure to receive favorable PLR from the IRS Changes to U.S. federal tax code Failure to complete necessary pre-conversion tasks by January 1, 2014 Failure to receive necessary stockholder approvals See forward looking statements beginning on Slide 29 for a description of risks to conversion |

|

|

Summary REIT structure enhances operating strategy No unmanageable constraints on pursuing long-term strategic priorities identified Significant benefits from REIT structure Tax savings, high dividends, new opportunities for value creation, expanded investor base Disciplined capital allocation strategy across ~90% of global storage revenues REIT structure naturally leads to new capital allocation strategy Likely shift to lower leverage over time Resetting $1B stockholder payout plan to support conversion Aggressive plan to convert by 2014 – significant hurdles remain Requires IRS approvals Significant implementation and operational complexities to be addressed prior to conversion |

|

|

REIT structure aligns with operating strategy Significant benefits from REIT structure REIT structure naturally leads to new capital allocation approach Successful conversion requires approvals; significant hurdles remain Q & A Agenda |

|

|

Appendix |

|

|

2011 Pro Forma Information Assumptions Method used for QRS/TRS split QRS TRS Revenues Storage associated with Records Management, Data Protection & Recovery, Film & Sound, Intellectual Property Management All other revenues Gross Profit Storage Gross Profit dollars linked to revenues above All other Gross Profit dollars Overhead Allocated based on revenue with certain exceptions All Real Estate department expenses ~8% of HR department expenses Allocated based on revenue w/exceptions No Real Estate department expenses ~92% of HR department expenses Interest Interest on related debt Interest on related debt Fixed Assets Land, Buildings, Racks, Vaults, Building Improvements/Leasehold Improvements associated with revenues listed above All other fixed assets Intangibles (including goodwill) 70% 30% |

|

|

Iron Mountain Real Estate Portfolio @ 12/31/2011 All Facilities North America Europe Latin America Asia Pacific Total Total # Buildings 641 246 56 51 994 Total Sq Ft (MM’s) 50 9 3 2 64 Leased Facilities # Buildings 471 208 25 51 755 Sq Ft (MM’s) 31 7 1 2 41 Owned Facilities # Buildings 170 38 31 0 239 Sq Ft (MM’s) 19 2 2 0 23 64MM Sq Ft 36% owned, 64% leased 994 properties in 35 Countries WW Portfolio Sq Ft Composition by Facility Type |

|

|

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation states that the Company plans to pursue conversion to a REIT. In fact, there are significant implementation and operational complexities to address before the Company can convert to a REIT, including obtaining a favorable PLR from the IRS, completing internal reorganizations and modifying accounting, information technology and real estate systems, receiving stockholder approvals and making required stockholder payouts. The Company can provide no assurance when conversion to a REIT will be successful, if at all. In addition, REIT qualification involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended (the “Code”) to the Company’s operations as well as various factual determinations concerning matters and circumstances not entirely within the Company’s control. Although, if it converts to a REIT, the Company plans to operate in a manner consistent with the REIT qualification rules, the Company cannot give assurance that it will so qualify or remain so qualified. Further, under the Code, no more than 25% of the value of the assets of a REIT may be represented by securities of one or more TRS and other non-qualifying assets. This limitation may affect the Company’s ability to make large investments in other non-REIT qualifying operations or assets. As such, compliance with REIT tests may hinder the Company’s ability to make certain attractive investments, including the purchase of significant non-qualifying assets and the material expansion of non-real estate activities. This presentation states that the REIT structure aligns with the Company’s strategy to extend and sustain the long-term durability of its business, provides significant benefits to stockholders and opens potential new opportunities for value creation. The Company’s Board of Directors considered a variety of other alternatives and there can be no assurance that conversion to a REIT will be the most beneficial of the alternatives considered. Further, conversion to a REIT may not result in increases in distributable income or increased dividends to stockholders. This presentation states that the Company’s long-term capital strategy will naturally shift toward lower leverage, use equity financing as a funding source and issue a portion of its E&P distribution in shares of its common stock. The Company can provide no assurance that it will lower its leverage. The cost of the Company’s debt will depend on numerous factors, many of which are outside the Company’s control, including interest rates. Whether the Company issues equity, at what price and amount and the other terms of any such issuances will depend on many factors, including alternative sources of capital, the Company’s then existing leverage, the Company’s need for additional capital, market conditions and other factors beyond the Company’s control. If the Company raises additional funds through the issuance of equity securities or debt convertible into equity securities, including for the purposes of funding the Company’s conversion costs, among other reasons, the percentage of stock ownership by the Company’s existing stockholders may be reduced. In addition, new equity securities or convertible debt securities could have rights, preferences, and privileges senior to those of the Company’s current stockholders, which could substantially decrease the value of the Company’s securities owned by them. Depending on the share price the Company is able to obtain, the Company may have to sell a significant number of shares in order to raise the capital it deems necessary to execute its long-term strategy, and the Company’s stockholders may experience dilution in the value of their shares as a result. This presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. The forward looking statements are subject to various known and unknown risks, uncertainties and other factors. When the Company uses words such as “believes,” “expects,” “anticipates,” “estimates,” “plans” or similar expressions, the Company is making forward looking statements. Although the Company believes that its forward looking statements are based on reasonable assumptions, its expected results may not be achieved, and actual results may differ materially from its expectations. For example: |

|

|

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation states that the Company will experience large conversion-related outflows that will impact near-term capital deployment and provides an estimated range of the Company’s tax and other costs to convert to and remain a REIT, including estimated tax liabilities associated with a change in the Company’s method of depreciating and amortizing various assets and compliance costs, and an estimated range of the Company’s E&P distributions. The Company’s estimate of these taxes and other costs may not be accurate, and such costs may turn out to be higher than the Company’s estimates due to different outcomes in the PLR than the Company currently anticipates, changes in the Company’s business support functions and support costs, the unsuccessful execution of internal planning, including restructurings and cost reduction initiatives, or other factors. Furthermore, the Company is in the process of conducting a study of its pre-REIT accumulated earnings and profits as of the close of the Company’s 2010 taxable year using the Company’s historic tax returns and other available information. This is a very involved and complex study, which is not yet complete, and the actual result of the study relating to the Company’s pre-REIT accumulated earnings and profits as of the close of the Company’s 2010 taxable year may be materially different from the Company’s current estimates. In addition, the estimated range of the Company’s E&P distribution is also based on its projected taxable income for its 2011, 2012 and 2013 taxable years and its current business plans and performance, but the Company’s actual earnings and profits (and the actual E&P distribution) will vary depending on, among other items, the timing of certain transactions, the Company’s actual taxable income and performance for 2012 and 2013, possible changes in legislation or tax rules and IRS revenue procedures relating to distributions of earnings and profits. For these reasons and others, the Company’s actual E&P distribution may be materially different from the Company’s estimated range. This presentation states that the Company will be able to, and plans to, separate its businesses between QRS and TRS, convert various entities to international QRS and meet certain REIT asset and income tests. These plans may change over time as necessary to support the Company’s conversion to a REIT, and the Company can provide no assurance that its final steps for reorganization will be the same as those described in this presentation. In addition, the Company can provide no assurance that it will satisfy the various asset and income tests necessary to maintain qualification as a REIT. This presentation discusses the Company’s plans to extend and sustain the durability of its business. The Company can provide no assurance that it will be able to execute its plan, and the Company’s ability to realize its plan depends on market conditions and numerous other factors, many of which are beyond the Company’s control. This presentation states that the Company anticipates conversion to a REIT would lower its cost of financing through increased ownership of currently leased real estate, generate higher dividend payouts to stockholders and potentially expand its investor base. The Company can provide no assurance that its cost of financing will be lowered, its investor base will be expanded or that it will increase or even maintain its current level of dividend payouts. The cost of the Company’s debt will depend on numerous factors, many of which are outside the Company’s control, including interest rates. In addition, future dividends will be dependent on the Company’s cash flows, as well as the impact of alternative, more attractive investments to dividends. |

|

|

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation states that the Company expects to pay up to 80% of the E&P distribution and future dividends after converting to a REIT in the form of Company common stock. The Company may in fact decide, based on its cash flows, strategic plans, IRS revenue procedures relating to distributions of earnings and profits, leverage and other factors, to pay some or all of these amounts in all cash or a mix of cash and common stock that pays stockholders up to 80% in common stock. This presentation states that the Company will seek a PLR from the IRS and that the Company requires favorable rulings from the IRS before converting to a REIT. The Company can provide no assurance that the IRS will ultimately provide the Company with a favorable PLR or that any favorable PLR will be received in a timely manner for the Company to convert successfully to a REIT as of January 1, 2014. Further, changes in legislation or the federal tax rules can adversely impact the Company’s ability to convert to a REIT or the benefits of being a REIT. This presentation states that the Company plans to elect REIT status no earlier than the taxable year beginning January 1, 2014. In fact, the Company does not know when, if at all, it will elect REIT status, and it may not do so. Further, as described in this presentation, many conditions must be met in order to complete the conversion to a REIT, and the timing and outcome of many of these are beyond the Company’s control. The Company’s forward looking statements should not be relied upon except as statements of the Company’s present intentions and of the Company’s present expectations, which may or may not occur. Cautionary statements should be read as being applicable to all forward looking statements wherever they appear. Except as required by law, the Company undertakes no obligation to release publicly the result of any revision to these forward looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures the Company has made in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the sections “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC on February 28, 2012. |