Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHOICE HOTELS INTERNATIONAL INC /DE | d360068d8k.htm |

Investor Presentation

June 2012

Exhibit 99.1 |

2

DISCLAIMER

2

Certain matters discussed throughout all of this presentation constitute forward-looking

statements within the meaning of the federal securities laws. Generally, our use of words such

as “expect,” “estimate,” “believe,” “anticipate,”

“will,” “forecast,” “plan,” “project,” “assume” or similar words of futurity identify statements that

are forward-looking and that we intend to be included within the Safe Harbor protections provided

by Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934.

Such forward-looking statements are based on management’s current beliefs, assumptions

and expectations regarding future events, which in turn are based on information currently

available to management. Such statements may relate to projections for the company’s

revenue, earnings and other financial and operational measures, company debt levels, payment of

dividends and future operations. We caution you not to place undue reliance on any

forward-looking statements, which are made as of the date of this presentation. Forward-

looking statements do not guarantee future performance and involve known and unknown risks,

uncertainties and other

factors. Several

factors could cause actual results, performance or achievements of the company to differ materially

from those expressed in or contemplated by the forward-looking statements. Such risks include, but

are not limited to, changes to general, domestic and foreign economic conditions; operating

risks common in the lodging and franchising industries; changes to the desirability of our

brands as viewed by hotel operators and customers; changes to the terms or termination of our

contracts with franchisees; our ability to keep pace with improvements in technology utilized

for reservations systems and other operating systems; fluctuations in the supply and demand for

hotel rooms; and our ability to effectively manage our indebtedness. These and other risk

factors are discussed in detail in the Risk Factors section of the company’s Form 10-K

for the year ended December 31, 2011, filed with the Securities and Exchange Commission on

February 29, 2012. We undertake no obligation to publicly update or revise any forward-

looking statement, whether as a result of new information, future events or otherwise. |

3

CHOICE HOTELS OVERVIEW

Growing US hotel market share*

–

9.6% share of branded US hotels (+80 basis

points over trailing 5 years)*

–

2

nd

largest U.S. hotelier

70+ year-old hotel distribution company

with well-known, diversified brands

suitable for various stages of hotel life

cycle

Core competencies and services drive

demand for our brands and deliver

business for our franchisees

Global pipeline of 471 hotels under

construction, awaiting conversion or

approved for development

Source: Choice Internal Data, March 31, 2012 and December 31, 2011

* Based on number of hotels as March 31, 2012 (Smith Travel Research)

Fee-for-service business model

Predictable, profitable, long-term growth

in a variety of lodging and economic

environments

Cumulative free cash flows of

approximately $1.4 billion from 1997

through 2011.

–

100% returned to shareholders through

share repurchases and dividends

Capital “light”

model generates strong

after-tax returns on invested capital

Long-term franchise contracts and scale

represent barriers to entry

Strong, Growing, Global Hotel

Franchising Business

Highly Attractive Business Model

With Strong Financial Returns

3 |

4

Source: Smith Travel Research, March 31, 2012

ONE OF THE LARGEST HOTELIERS

Market

Share %

11.2%

9.6%

6.3%

6.0%

5.9%

3.8%

2.0%

1.1%

0.9%

0.7%

5 yr. bps

(07-12)

-10

+80

+110

+30

+80

-70

+30

-50

+20

-70

Market Share (% of Hotels Open in U.S.)

4

0

2

4

6

8

10

12

Wyndham

Choice

Hilton

IHG

Marriott

Best Western

Accor

Carlson

Starwood

Hyatt

Q1 2007

Q1 2008

Q1 2009

Q1 2010

Q1 2011

Q1 2012 |

5

5

Conversion

$42,000+

$120,000+

$50

$70

$100+

Targeted

Average Daily Rate

$85

FAMILY OF WELL-KNOWN

AND DIVERSIFIED BRANDS

New Construction

* Excludes cost of land; based on average domestic per-room investment.

Source: Choice Internal Data, April 2012 |

6

6

STRONG LIMITED SERVICE

NEW CONSTRUCTION BRANDS

POSITIONED WELL FOR LONG-TERM GROWTH

Source: Smith Travel Research, Choice Internal Data, March 31, 2012

Hampton

Inn / Inn &

Suites

Holiday Inn

Express

La Quinta

Inn / Inn &

Suites

Fairfield Inn

Country Inn

& Suites

Domestic Hotels |

7

7

SIGNIFICANT GROWTH OPPORTUNITIES

REMAIN IN LARGE CONVERSION MARKET

Chart does not include

independent hotels

in budget, economy and

mid-scale

segments

Domestic Hotels

Hampton Inn /

Hampton Inn

& Suites

Holiday Inn

Express

Days Inn

Motel 6

America’s

Best

Value Inn

Holiday

Inn /

Holiday

Inn Select

La Quinta

Inn / La Quinta

Inn & Suites

Fairfield

Inn

Ramada /

Ramada

Plaza

Travelodge

Red Roof

Inn

Howard

Johnson

Knight’s

Inn

Microtel

Best

Western

Super 8

Source: Smith Travel Research, Choice Internal Data, March 31, 2012

® |

8

8

DOMESTIC PIPELINE OF 388 HOTELS

Mid-scale

Extended Stay

Economy

Upscale

Source: Choice Internal Data, March 31, 2012 |

9

9

SERVICES LIFECYCLE IMPROVES

BRANDS AND PROPERTY PERFORMANCE

Brand Planning

and Management

Brand Performance

•

Revenue and guest service

consulting

•

Inventory and rate management

•

Local sales and marketing

•

Independent third-party quality

assurance

Training

•

On-site

•

Regional

•

Web-based

•

GM Certification

Opening Services

•

Ensure hotels open

successfully and meet or

exceed brand standards

Portfolio

Management

•

Repositioning

•

Relicensing

•

Termination

Procurement Services

•

Value-engineered prototypes

and design packages

•

Negotiated vendor

relationships

Targeted, differentiated

programs, amenities and

services for each brand

FRANCHISED

FRANCHISED

PROPERTIES

PROPERTIES

RETURN ON

RETURN ON

INVESTMENT

INVESTMENT |

10

10

1,168 properties in approximately

30 countries and territories on five

continents

Multi-year

investments in

IT and marketing

planned to enhance

value proposition for

international hotels

STRONG PRESENCE IN MAJOR

TRAVEL MARKETS OUTSIDE OF THE U.S.

Source: Choice Internal Data, March 31, 2012

307 hotels

Canada

160 hotels

Scandinavia

3 hotels

China

52 hotels

Japan

251 hotels

Continental

Europe, UK

& Ireland

23 hotels

Mexico

15 hotels

Central

America

59 hotels

Brazil

1 hotel

Jordan

27 hotels

India

1 hotel

Singapore

1 hotel

Malaysia

268 hotels

Australia & New

Zealand

Significant long-

term growth

opportunity in

underrepresented

regions/countries |

11

11

MARKETING AND CENTRAL

RESERVATION SYSTEM LEVERAGES

SIZE, SCALE AND DISTRIBUTION

$300-plus million in annual marketing and reservation system fees

Leverage expertise and innovation in on-line, targeted interactive

marketing to influence guest hotel stay decisions

Powerful advertising campaigns

Focus on driving guests to Choice central channels

Facilitate “one-stop”

shopping

Strong and growing global loyalty program

Increasing brand awareness

Source: Choice Internal Data, December 2011 |

12

12

STRONG AND GROWING

AIDED BRAND AWARENESS

Source: Percentage of survey respondents. Millward Brown, December 2011.

*Econo Lodge, Rodeway Inn and Suburban Extended Stay measured among economy hotel

users. N/A

N/A

N/A

N/A |

13

13

STRONG, GROWING LOYALTY PROGRAM

Choice Privileges Revenue as Percent

of Domestic Gross Room Revenues*

Source: Choice Internal Data, December 31, 2011

* 2001-2008 Data Excludes Econo Lodge and Rodeway Inn brands

Comprehensive loyalty rewards program

14 million members worldwide –

contribute over ¼

of domestic

gross room revenues

2.1 million new members added in 2011

Delivers incremental business to all Choice brand hotels

Important selling point for franchise sales |

14

14

CENTRAL RESERVATIONS SYSTEM (CRS)

DELIVERY PUTS “HEADS IN BEDS”

All Hotel

Direct

Reservation

Choice Central

Reservation

Contribution

1/3

1/3

Domestic Franchise System

Gross Room Revenue Source

Domestic Choice CRS

Net Room Revenue

Source: Choice Internal Data, December 31, 2011 |

15

15

Central Channel ADR

“Premium”

Domestic Choice CRS

Net Channel Share

CENTRAL RESERVATIONS BOOKINGS

CREATE SIGNIFICANT VALUE

FOR FRANCHISEES

Source: Choice Internal Data, December 2011

$68.42

$71.93

$74.53

$76.90

$77.56

$82.31

2006

2007

2008

2009

2010

2011

Systemwide

Call Center

choicehotels.com |

16

CONVERSION BRAND FRANCHISE

SALES OPPORTUNITY IN SOFT NEW CONSTRUCTION

ENVIRONMENT

Source: Choice Internal Data, December 31, 2011 |

17

STRONG, STEADY FRANCHISE

SYSTEM GROWTH

Domestic Hotels On-Line

Domestic Rooms On-Line

(in thousands)

CAGR = 4.2%

CAGR = 3.5%

CAGR = 3.8%

CAGR = 3.0%

Source: Choice Internal Data, December 31, 2011 |

18

18

FRANCHISING REVENUE STREAM

LESS VOLATILE THAN REVPAR

$0

$50

$100

$150

$200

$250

$300

$350

-17%

-12%

-7%

-2%

3%

8%

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

CHH RevPAR

STR Chain Scale (Supply Weighted)

Industry RevPAR

CHH Franchising Revenue

($ in millions)

Source: Smith Travel Research, Choice Internal Data, December 2011

|

19

19

ADJUSTED EBITDA LESS VOLATILE

THAN INDUSTRY PROFITABILITY

Source: Smith Travel Research, Choice Internal Data, December 2011

($ in millions)

($ in billions)

0

50

100

150

200

250

0

5

10

15

20

25

30

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Industry Profits

CHH Adjusted EBITDA |

20

20

CAPITAL “LIGHT”

MODEL GENERATES

STRONG RETURNS ON INVESTED CAPITAL

15.2%

16.1%

14.7%

19.5%

27.6%

36.7%

49.7%

62.9%

78.5%

68.8%

59.5%

48.1%

48.0%

47.2%

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

After-Tax Return On Invested Capital

Source: Choice Internal Data, December 2011 |

21

21

TRACK RECORD OF STRONG EARNINGS

PER SHARE PERFORMANCE

Adjusted Diluted Earnings Per Share

Note: See appendix for reconciliation of adjusted diluted earnings per share to

diluted earnings per share. To improve comparability certain employee severance

amounts included in the determination of adjusted diluted earnings per share in

this presentation for 2007 through 2011 differ from amounts reported in

Exhibits 8 of our various earnings announcements.

Source: Choice Internal Data, December 2011. Per Share Amounts Retroactively

Adjusted For 2005 Stock Split. 1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

$0.40

$0.51

$0.51

$0.58

$0.76

$0.93

$1.07

$1.25

$1.48

$1.73

$1.73

$1.68

$1.81

$1.90 |

22

22

Remaining authority on current authorization –

1.6 million shares as of March 31, 2012

OPPORTUNISTIC SHARE REPURCHASES KEY

PART OF CAPITAL ALLOCATION STRATEGY

Source: Capital IQ, December 2011, Choice Internal Data, March 31, 2012 and

December 31, 2011. Share amounts for 2005 and prior years retroactively

adjusted for 2005 two-for-one stock split. |

23

23

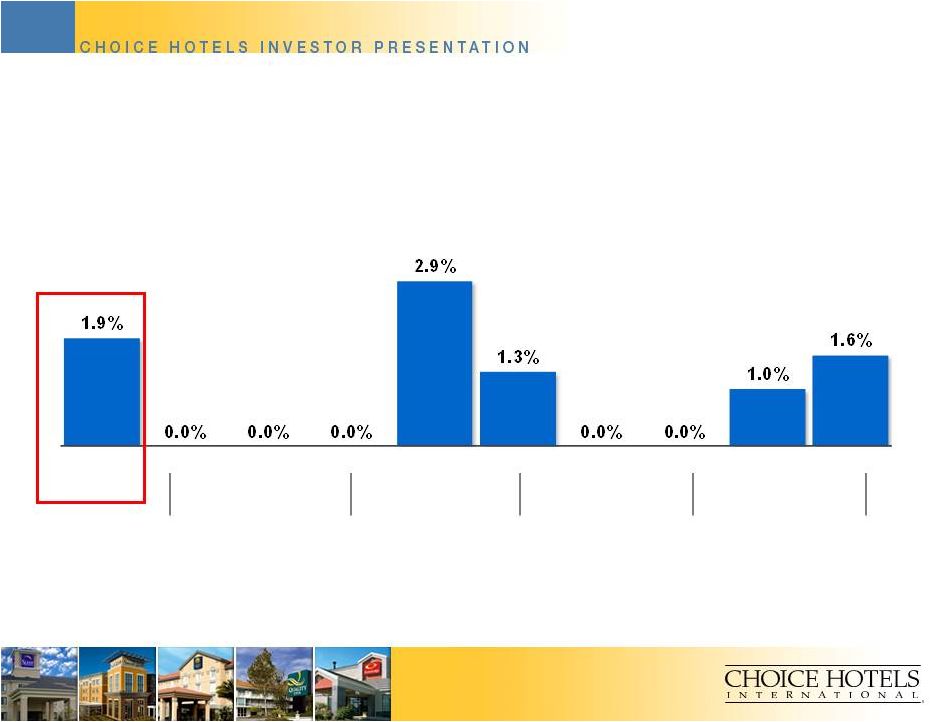

HIGH CASH DIVIDEND YIELD COMPARED

TO OTHER LODGING C-CORPS

Source: Thomson One, May 31, 2012

Choice

Great

Wolf

Wyndham

Gaylord

Hyatt

Orient-

Express

Starwood

Red Lion

Marriott

IHG |

24

24

STRATEGY FOR CHOICE’S BRANDS,

GROWTH AND SHAREHOLDERS

Improve and Grow Brands

–

Increase portfolio profitability of the Comfort brand family

–

Refresh Sleep Inn to improve long-term brand growth potential

–

Invest

in

and

expand

emerging

brands/segments

–

Cambria,

Ascend,

International

Capture Greater Share of Reservations Via Central Channels

–

Grow

Choice

Privileges

loyalty

program

–

target

2.0

million

new

members

in

2012

–

Continue to enhance ChoiceHotels.com to increase traffic and conversion

Allocate Free Cash Flows To “Best And Highest”

Use

–

Continue shareholder-friendly capital allocation policies

–

Leverage financial capacity/strength to support expansion of emerging brands

–

Evaluate opportunities to enter new segments

–

Invest in IT infrastructure to shore up value proposition for international

properties |

25

25

Appendix

Reconciliation of Non-GAAP

Financial Measurements to GAAP |

26

26

DISCLAIMER

Adjusted

franchising

margins,

adjusted

earnings

before

interest,

taxes

depreciation and amortization (EBITDA), adjusted net income, adjusted diluted

earnings per share (EPS), franchising revenues, net operating profit after

tax (NOPAT),

return

on

average

invested

capital

(ROIC)

and

free

cash

flows

are

non-

GAAP financial measurements. These financial measurements are presented as

supplemental disclosures because they are used by management in reviewing

and analyzing the company’s performance. This information should not be

considered as an alternative to any measure of performance as promulgated

under accounting principles generally accepted in the United States (GAAP), such

as operating income, net income, diluted earnings per share, total revenues

or net cash

provided

by

operating

activities.

The

calculation

of

these

non-GAAP

measures may be different from the calculation by other companies and therefore

comparability may be limited. The company has included the following

appendix which reconcile these measures to the comparable GAAP

measurement. |

27

27

FRANCHISING REVENUES AND ADJUSTED

FRANCHISING MARGINS

Note: To improve comparability certain employee severance amounts included in the

determination of adjusted franchising margins in this presentation for 2007

through 2011 differ from amounts reported in exhibit 8 of our year-end earnings

announcements for those years. Source: Choice Internal Data, December

2011 ($ amounts in thousands)

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

2011

2010

2009

2008

2007

2006

2005

Total Revenues

638,793

$

596,076

$

564,178

$

641,680

$

615,494

$

539,903

$

472,098

$

Adjustments:

Marketing and Reservation

(349,036)

(329,246)

(305,379)

(336,477)

(316,827)

(273,267)

(237,822)

Product Sales

-

-

-

-

-

-

-

Hotel Operations

(4,356)

(4,031)

(4,140)

(4,936)

(4,692)

(4,505)

(4,293)

Franchising Revenues

285,401

$

262,799

$

254,659

$

300,267

$

293,975

$

262,131

$

229,983

$

Operating Income

171,863

$

160,762

$

148,073

$

174,596

$

185,199

$

166,625

$

143,750

$

Adjustments

Hotel Operations

(890)

(845)

(987)

(1,502)

(1,451)

(1,311)

(1,068)

Acceleration of Management Succession Plan

-

-

-

6,605

-

-

-

Executive Termination Benefits

2,704

1,217

3,321

-

3,690

-

-

Curtailment of SERP

-

-

1,209

-

-

-

-

Loss on Sublease of Office Space

-

-

1,503

-

-

-

-

Loan Reserves Related to Impaired Notes Receivable

-

-

-

7,555

-

-

-

Product Sales

-

-

-

-

-

-

-

Impairment of Friendly Investment

-

-

-

-

-

-

-

Net

173,677

$

161,134

$

153,119

$

187,254

$

187,438

$

165,314

$

142,682

$

Adjusted Franchising Margin

60.9%

61.3%

60.1%

62.4%

63.8%

63.1%

62.0% |

28

28

FRANCHISING REVENUES AND ADJUSTED

FRANCHISING MARGINS

(Continued)

Source: Choice Internal Data, December 2011

($ amounts in thousands)

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

2004

2003

2002

2001

2000

1999

1998

Total Revenues

428,208

$

385,866

$

365,562

$

341,428

$

352,841

$

324,203

$

165,474

$

Adjustments:

Marketing and Reservation

(220,732)

(195,219)

(190,145)

(168,170)

(185,367)

(162,603)

-

Product Sales

-

-

-

-

-

(3,871)

(20,748)

Hotel Operations

(3,729)

(3,565)

(3,331)

(3,215)

(1,249)

-

(1,098)

Franchising Revenues

203,747

$

187,082

$

172,086

$

170,043

$

166,225

$

157,729

$

143,628

$

Operating Income

124,983

$

113,946

$

104,700

$

73,577

$

92,427

$

94,170

$

85,151

$

Adjustments

Hotel Operations

(725)

(842)

(385)

(714)

(640)

-

35

Acceleration of Management

Succession Plan -

-

-

-

-

-

-

Executive Termination Benefits

-

-

-

-

-

-

-

Curtailment of SERP

-

-

-

-

-

-

-

Loss on Sublease of Office

Space -

-

-

-

-

-

-

Loan Reserves Related to Impaired

Notes Receivable -

-

-

-

-

-

-

Product Sales

-

-

-

-

-

12

(1,216)

Impairment of Friendly Investment

-

-

-

22,713

-

-

-

Net

124,258

$

113,104

$

104,315

$

95,576

$

91,787

$

94,182

$

83,970

$

Adjusted Franchising Margin

61.0%

60.5%

60.6%

56.2%

55.2%

59.7%

58.5% |

29

29

RETURN ON INVESTED CAPITAL

(a) Operating income and tax rate for the year ended December 31, 2001 have been

adjusted to exclude the effect of a $22.7 million impairment charge related

to the write-off of the company’s investment in Friendly Hotels.

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2011

2010

2009

2008

2007

2006

2005

Operating Income (a)

$171.9

$160.8

$148.1

$174.6

$185.2

$166.6

$143.8

Tax Rate(a)

30.1%

32.1%

34.8%

36.3%

36.0%

27.4%

33.0%

After-Tax Operating Income

120.2

109.2

96.6

111.2

118.5

121.0

96.3

+ Depreciation & Amortization

8.0

8.3

8.3

8.2

8.6

9.7

9.1

- Maintenance CAPEX

8.0

8.3

8.3

8.2

8.6

9.7

9.1

Net Op. Profit After-tax (NOPAT)

$120.2

$109.2

$96.6

$111.2

$118.5

$121.0

$96.3

Total Assets

$447.7

$411.7

$340.0

$328.2

$328.4

$303.3

$265.3

- Current Liabilities

184.6

165.3

131.8

135.1

147.5

139.8

120.3

Invested Capital

$263.1

$246.4

$208.2

$193.1

$180.9

$163.5

$145.0

Return on Average Invested Capital

47.2%

48.0%

48.1%

59.5%

68.8%

78.5%

62.9% |

30

30

RETURN ON INVESTED CAPITAL (Continued)

(a) Operating income and tax rate for the year ended December 31, 2001 have been

adjusted to exclude the effect of a $22.7 million impairment charge related

to the write-off of the company’s investment in Friendly Hotels.

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2004

2003

2002

2001

2000

1999

1998

Operating Income (a)

$125.0

$113.9

$104.7

$96.3

$92.4

$94.2

$85.2

Tax Rate(a)

35.1%

36.1%

36.5%

35.0%

39.0%

39.5%

41.7%

After-Tax Operating Income

81.1

72.8

66.5

62.6

56.4

57.0

49.7

+ Depreciation & Amortization

9.9

11.2

11.3

12.5

11.6

7.7

6.7

- Maintenance CAPEX

9.9

11.2

11.3

12.5

11.6

7.7

6.7

Net Op. Profit After-tax (NOPAT)

$81.1

$72.8

$66.5

$62.6

$56.4

$57.0

$49.7

Total Assets

$263.4

$267.3

$316.8

$321.2

$484.1

$464.7

$398.2

- Current Liabilities

102.1

102.2

84.3

71.2

93.8

88.7

64.7

Invested Capital

$161.3

$165.1

$232.5

$250.0

$390.3

$375.9

$333.6

Return on Average Invested Capital

49.7%

36.7%

27.6%

19.5%

14.7%

16.1%

15.2% |

31

31

FREE CASH FLOWS

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2011

2010

2009

2008

2007

2006

2005

Net Cash Provided by Operating Activities

134,844

$

144,935

$

112,216

$

104,399

$

145,666

$

153,680

$

133,588

$

Net Cash Provided (Used) by Investing Activities

(23,804)

(32,155)

(3,349)

(20,265)

(21,284)

(17,244)

(24,531)

Free Cash Flows

111,040

$

112,780

$

108,867

$

84,134

$

124,382

$

136,436

$

109,057

$ |

32

32

FREE CASH FLOWS (Continued)

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2004

2003

2002

2001

2000

1999

1998

Net Cash Provided by Operating Activities

108,908

$

115,304

$

99,018

$

101,712

$

53,879

$

65,040

$

38,952

$

Net Cash Provided (Used) by Investing Activities

(14,544)

27,784

(14,683)

87,738

(16,617)

(36,031)

(9,056)

Free Cash Flows

94,364

$

143,088

$

84,335

$

189,450

$

37,262

$

29,009

$

29,896

$ |

33

33

Note: To improve comparability certain employee severance amounts included in the

determination of adjusted EBITDA in this presentation for 2007 through 2011

differ from amounts reported in exhibits 8 of our various earnings announcements.

Source: Choice Internal Data, December 2011

ADJUSTED EBITDA

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

($ in thousands)

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

2011

2010

2009

2008

2007

2006

2005

Operating Income

171,863

$

160,762

$

148,073

$

174,596

$

185,199

$

166,625

$

143,750

$

Adjustments

Acceleration of Management Succession Plan

-

-

-

6,605

-

-

-

Loss on Sublease of Office Space

-

-

1,503

-

-

-

-

Executive Termination Benefits

2,704

1,217

3,321

-

3,690

-

-

Curtailment of SERP

-

-

1,209

-

-

-

-

Loan Reserves Related to Impaired Notes Receivable

-

-

-

7,555

-

-

-

Product Sales

-

-

-

-

-

-

-

Impairment of Friendly investment

-

-

-

-

-

-

-

Depreciation and Amortization

8,024

8,342

8,336

8,184

8,637

9,705

9,051

Adjusted EBITDA

182,591

$

170,321

$

162,442

$

196,940

$

197,526

$

176,330

$

152,801

$ |

34

34

ADJUSTED EBITDA (Continued)

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

($ in thousands)

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

2004

2003

2002

2001

2000

1999

1998

Operating Income

124,983

$

113,946

$

104,700

$

73,577

$

92,427

$

94,170

$

85,151

$

Adjustments

Acceleration of Management Succession Plan

-

-

-

-

-

-

-

Loss on Sublease of Office Space

-

-

-

-

-

-

-

Executive Termination Benefits

-

-

-

-

-

-

-

Curtailment of SERP

-

-

-

-

-

-

-

Loan Reserves Related to Impaired Notes Receivable

-

-

-

-

-

-

-

Product Sales

-

-

-

-

-

12

(1,216)

Impairment of Friendly investment

-

-

-

22,713

-

-

-

Depreciation and Amortization

9,947

11,225

11,251

12,452

11,623

7,687

6,710

Adjusted EBITDA

134,930

$

125,171

$

115,951

$

108,742

$

104,050

$

101,869

$

90,645

$ |

35

35

ADJUSTED DILUTED EARNINGS PER SHARE

Note: To improve comparability certain employee severance amounts included in the

determination of adjusted franchising margins in this presentation for 2007

through 2011 differ from amounts reported in exhibit 8 of our year-end earnings

announcements for those years. Source: Choice Internal Data, December

2011 Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

(In thousands, except per share amounts)

2011

2010

2009

2008

2007

2006

2005

Net Income

110,396

$

107,441

$

98,250

$

100,211

$

111,301

$

112,787

$

87,565

$

Adjustments:

Loss(Gain) on Extinguishment of Debt, Net of Taxes

-

-

-

-

-

217

-

Acceleration of Management Sucession Plan, Net of

Taxes -

-

-

4,135

-

-

-

Executive Termination Benefits, Net of Taxes

1,711

762

2,079

-

2,310

-

-

Loss on Land Held For Sale

1,119

-

-

-

-

-

-

Loss on Sublease of Office Space, Net of

Taxes -

-

941

-

-

-

-

Curtailment of SERP, Net of Taxes

-

-

757

-

-

-

-

Loan Reserves Related to Impaired Notes Receivable,

Net of Taxes -

-

-

4,729

-

-

-

Resolution of Provisions for Income Tax

Contingencies -

-

-

-

-

(12,791)

(4,855)

Income Tax Expense Incurred Due to Foreign Earnings Repatriation

-

-

-

-

-

-

1,192

Loss(Gain) on Sunburst Note Transactions, Net of Taxes

-

-

-

-

-

-

-

Impairment of and Equity Losses in Friendly Hotels

PLC Investment, Net of Taxes -

-

-

-

-

-

-

Adjusted Net Income

113,226

$

108,203

$

102,027

$

109,075

$

113,611

$

100,213

$

83,902

$

Weighted Average Shares Outstanding-Diluted

59,525

59,656

60,224

62,994

65,766

67,490

66,759

Diluted Earnings Per Share

1.85

$

1.80

$

1.63

$

1.59

$

1.69

$

1.67

$

1.31

$

Adjustments:

Loss(Gain) on Extinguishment of Debt, Net of Taxes

-

-

-

-

-

-

-

Acceleration of Management Sucession Plan, Net of

Taxes -

-

-

0.07

-

-

-

Executive Termination Benefits, Net of Taxes

0.03

0.01

0.02

-

0.04

-

-

Loss on Land Held For Sale

0.02

-

-

-

-

-

-

Loss on Sublease of Office Space, Net of

Taxes -

-

0.02

-

-

-

-

Curtailment of SERP, Net of Taxes

-

-

0.01

-

-

-

-

Loan Reserves Related to Impaired Notes Receivable,

Net of Taxes -

-

-

0.07

-

-

-

Resolution of Provisions for Income Tax

Contingencies -

-

-

-

-

(0.19)

(0.08)

Income Tax Expense Incurred Due to Foreign Earnings Repatriation

-

-

-

-

-

-

0.02

Loss(Gain) on Sunburst Note Transactions, Net of Taxes

-

-

-

-

-

-

-

Impairment of and Equity Losses in Friendly Hotels

PLC Investment, Net of Taxes -

-

-

-

-

-

-

Adjusted Diluted Earnings Per Share (EPS)

1.90

$

1.81

$

1.68

$

1.73

$

1.73

$

1.48

$

1.25

$

|

36

36

ADJUSTED DILUTED EARNINGS PER SHARE

(Continued)

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

(In thousands, except per share amounts)

2004

2003

2002

2001

2000

1999

1998

Net Income

74,345

$

71,863

$

60,844

$

14,327

$

42,445

$

57,155

$

55,305

$

Adjustments:

Loss(Gain) on Extinguishment of Debt, Net of Taxes

433

-

-

-

-

-

(7,232)

Acceleration of Management Sucession Plan, Net of Taxes

-

-

-

-

-

-

-

Executive Termination

Benefits, Net of Taxes -

-

-

-

-

-

-

Loss on Land Held For

Sale -

-

-

-

-

-

-

Loss on Sublease of Office

Space, Net of Taxes -

-

-

-

-

-

-

Curtailment of SERP, Net of

Taxes -

-

-

-

-

-

-

Loan Reserves Related to

Impaired Notes Receivable, Net of Taxes -

-

-

-

-

-

-

Resolution of Provisions

for Income Tax Contingencies (1,182)

-

-

-

-

-

-

Income Tax Expense Incurred

Due to Foreign Earnings Repatriation -

-

-

-

-

-

-

Loss(Gain) on Sunburst Note

Transactions, Net of Taxes -

(3,383)

-

-

4,721

-

-

Impairment of and Equity

Losses in Friendly Hotels PLC Investment, Net of Taxes -

-

-

37,166

7,532

-

-

Adjusted Net Income

73,596

$

68,480

$

60,844

$

51,493

$

54,698

$

57,155

$

48,073

$

Weighted Average Shares Outstanding-Diluted

69,000

73,349

80,114

89,144

106,506

111,334

119,096

Diluted Earnings Per Share

1.08

$

0.98

$

0.76

$

0.16

$

0.40

$

0.51

$

0.46

$

Adjustments:

Loss(Gain) on Extinguishment of Debt, Net of Taxes

0.01

-

-

-

-

-

(0.06)

Acceleration of Management Sucession Plan, Net of Taxes

-

-

-

-

-

-

-

Executive Termination Benefits, Net of Taxes

-

-

-

-

-

-

-

Loss on Land Held For Sale

-

-

-

-

-

-

-

Loss on Sublease of Office Space, Net of

Taxes -

-

-

-

-

-

-

Curtailment of SERP, Net of Taxes

-

-

-

-

-

-

-

Loan Reserves Related to Impaired Notes Receivable,

Net of Taxes -

-

-

-

-

-

-

Resolution of Provisions for Income Tax

Contingencies (0.02)

-

-

-

-

-

-

Income Tax Expense Incurred Due to Foreign Earnings

Repatriation -

-

-

-

-

-

-

Loss(Gain) on Sunburst Note Transactions, Net of

Taxes -

(0.05)

-

-

0.04

-

-

Impairment of and Equity Losses in Friendly Hotels

PLC Investment, Net of Taxes -

-

-

0.42

0.07

-

-

Adjusted Diluted Earnings Per Share (EPS)

1.07

$

0.93

$

0.76

$

0.58

$

0.51

$

0.51

$

0.40

$

|