Attached files

| file | filename |

|---|---|

| 8-K - ORBIT INTERNATIONAL CORP 8-K 5-30-2012 - ORBIT INTERNATIONAL CORP | form8k.htm |

AMENDMENT TO CREDIT AGREEMENT

This Amendment to Credit Agreement (this "Amendment") is dated as of the 30th day of May, 2012 and is by and between Orbit International Corp., Behlman Electronics, Inc., Tulip Development Laboratory, Inc. and Integrated Consulting Services, Inc. d/b/a Integrated Combat Systems (each a "Borrower" and collectively, the "Borrowers"), and Capital One, National Association ("Bank") (this "Amendment").

WHEREAS, on March 10, 2010 the Bank made available to the Borrowers a line of credit in the amount of $3,000,000.00 and a term loan in the amount of $4,654,761.84 pursuant to a Credit Agreement dated as of March 10, 2010 between the Borrowers and the Bank (as amended from time to time, the "Credit Agreement") and evidenced by, respectively, a Line of Credit Note dated March 10, 2010 from the Borrowers to the Bank (as amended from time to time, the "Line of Credit Note") and the Term Loan Note dated March 10, 2010 from the Borrowers to the Bank (as amended from time to time, the "Term Loan Note") and secured by a Security Agreement dated March 10, 2010 from the Borrowers to the Bank (the "Security Agreement") (the Credit Agreement, the Line of Credit Note, the Term Loan Note, the Security Agreement, and all other documents executed and delivered in connection therewith, collectively, the "Financing Documents");

WHEREAS, the Borrowers have requested that the Bank modify certain covenants set forth in the Credit Agreement and waive compliance with certain covenants set forth in the Credit Agreement to which the Bank has agreed provided the Borrowers enter into this Amendment;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Borrowers and the Bank hereby agree as follows:

1. Capitalized terms not defined herein shall have the meaning set forth in the Credit Agreement.

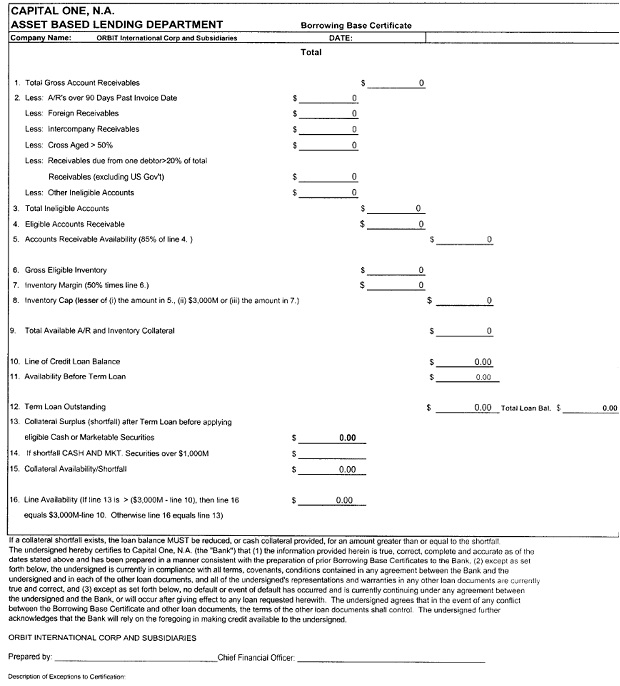

2. The definitions of "Applicable Margin" and “Line of Credit Maturity Date” set forth in Section 1.01 of the Credit Agreement are hereby amended to read in their entirety as follows:

"Applicable Margin" means (i) with respect to Line of Credit Loans which are LIBOR Loans, two percent (2.00%) and with respect to Line of Credit Loans which are Prime Rate Loans, zero percent (0%), and (ii) with respect to the Term Loan which is a LIBOR Loan, three percent (3.00%) and with respect to the Term Loan which is a Prime Rate Loan, zero percent (0%).

“Line of Credit Maturity Date” means June 1, 2013.

1

3. Section 2.01(b) of the Credit Agreement is hereby amended to read in its entirety as follows:

(b) Each Line of Credit Loan shall be a LIBOR Loan or a Prime Rate Loan as a Borrower may request subject to and in accordance with the terms and conditions hereof. Subject to the other provisions of this Agreement, Line of Credit Loans of more than one Type may be outstanding at the same time. Each such request shall be submitted to Bank on the Bank’s standard form, a copy of which is attached hereto as Exhibit C. Notwithstanding anything to the contrary contained herein, not more than four (4) LIBOR Loans shall be outstanding at any time under the Line of Credit Commitment.

4. Section 2.07 of the Credit Agreement is hereby amended and restated in ite entirety as follows:

Section 2.07. Interest Periods. In the case of each LIBOR Loan, the Borrowers shall select an Interest Period in accordance with the definition of Interest Period in “Definitions”, subject to the following limitations (1) no Interest Period shall have a duration of less than one (1) month, and (2) no Interest Period of particular duration with respect to a LIBOR Loan may be selected by the Borrowers if Bank determines, in its sole discretion, that a LIBOR Loan with such maturities are not generally available.

5. The last sentence of Section 5.07 of the Credit Agreement is hereby amended to read in its entirety as follows:

In addition, the Bank shall have the right to obtain a field examination of the Borrowers’ Accounts and inventory, at Borrowers’ expense, by the Bank’s field examiner or an outside firm engaged by the Bank, in either case at Borrowers’ expense, at any time provided that so long as no Event of Default has occurred and is continuing, such field examination shall not be required more than once in any twelve (12) month period. Currently, the cost of a field examination is $950.00 per day per examiner plus expenses.

6. Section 5.10(4) of the Credit Agreement is hereby amended to read in its entirety as follows:

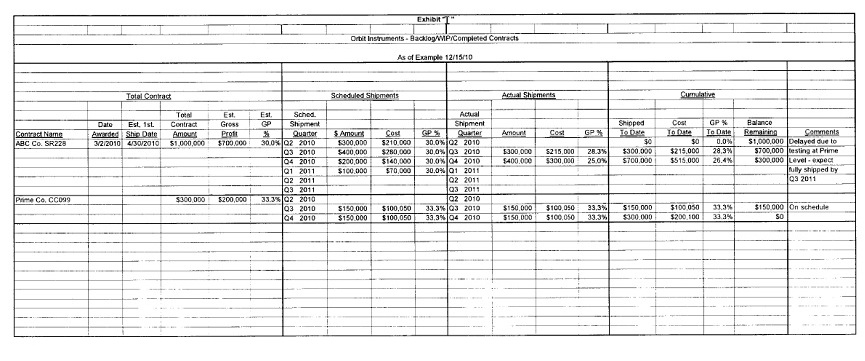

(4) Borrowing Base Certificate. (a) Within fifteen (15) days of the end of each month, a Borrowing Base Certificate with an accounts receivable aging schedule (including the scheduling of all respective due dates and cancel dates and setting forth those due more than 30 days, 60 days, 90 days, 120 days and over 121 days), and (b) within fifteen (15) days of the end of each quarter, (i) a quarterly summary report of inventory broken down by raw material, finished goods and work-in-process which quarterly summary report shall be as of the date of the end of the most recent fiscal quarter, and (b) a schedule of all backlog work in process and completed contracts in the form attached hereto as Exhibit I in substance reasonably satisfactory to the Bank.

7. Section 5.12 of the Credit Agreement is hereby deleted in its entirety.

8. Section 6.11 of the Credit Agreement is amended to add the following:

(provided the repurchase of stock shall be permitted only if such repurchase will not cause a violation of any financial covenants set forth in Article VII herein)

9. Section 7.04 of the Credit Agreement is hereby deleted in its entirety.

10. Exhibit H of the Credit Agreement is hereby amended and restated in its entirety as follows:

[CONTINUED ON NEXT PAGE]

2

11. The following Exhibit I is hereby added to the Credit Agreement:

[CONTINUED ON NEXT PAGE]

3

4

12. The Bank hereby agrees to release the Cash Deposit previously pledged to the Bank.

13. The Blocked Account Agreement dated as of April 20, 2011 between Tulip Development Laboratory, Inc. and the Bank, the Blocked Account Agreement dated as of April 20, 2011 between Orbit International Corp. and the Bank, the Blocked Account Agreement dated as of April 19, 2011 between Integrated Consulting Services, Inc. d/b/a Integrated Combat Systems and the Bank, and the Pledge Agreement dated as of October 17, 2011 between the Borrowers and the Bank are each hereby terminated.

14. The obligation of the Bank to enter into this Amendment is subject to the following:

(a) Receipt by the Bank of a fully executed counterpart of this Amendment from the Borrowers;

(b) The Borrowers shall pay to the Bank all of its out-of-pocket fees and disbursements incurred by the Bank in connection with this Amendment, including legal fees incurred by the Bank in the preparation, consummation, administration and enforcement of this Amendment.

15. The Borrowers ratify and reaffirm the Financing Documents and the Financing Documents, as hereby amended, shall remain in full force and effect.

16. The Borrowers represent and warrant that (a) the representations and warranties contained in the Credit Agreement are true and correct in all material respects as of the date of this Amendment, (b) no condition, at, or event which could constitute an event of default under the Credit Agreement, the Notes or any other Financing Documents exists, and (c) no condition, event, act or omission has occurred, which, with the giving of notice or passage of time, would constitute an event of default under the Credit Agreement, the Notes or any other Financing Document.

17. The Borrowers acknowledge that as of the date of this Amendment they have no offsets or defenses with respect to all amounts owed by it to the Bank arising under or related to the Financing Documents on or prior to the date of this Amendment. The Borrowers fully, finally and forever release and discharge the Bank and its successors, assigns, directors, officers, employees, agents and representatives from any and all claims, causes of action, debts and liabilities, of whatever kind or nature, in law or in equity, whether now known or unknown to them, which they may have and which may have arisen in connection with the Financing Documents or the actions or omissions of the Bank related to the Financing Documents on or prior to the date hereof. The Borrowers acknowledge and agree that this Amendment is limited to the terms outlined above and shall not be construed as an agreement to change any other terms or provisions of the Financing Documents. This Amendment shall not establish a course of dealing or be construed as evidence of any willingness on the Bank’s part to grant other or future agreements, should any be requested.

18. This Amendment is a modification only and not a novation. Except for the above-quoted modifications, the Financing Documents, any loan agreements, credit agreements, reimbursement agreements, security agreements, mortgages, deeds of trust, pledge agreements, assignments, guaranties, instruments or documents executed in connection with the Financing Documents, and all the terms and conditions thereof, shall be and remain in full force and effect with the changes herein deemed to be incorporated therein. This Amendment is to be considered attached to the Financing Documents and made a part thereof. This Amendment shall not release or affect the liability of any guarantor of the Notes or credit facility executed in reference to the Financing Documents, if any, or release any owner of collateral granted as security for the Financing Documents. The validity, priority and enforceability of the Financing Documents shall not be impaired hereby. To the extent that any provision of this Amendment conflicts with any term or condition set forth in the Financing Documents, or any document executed in conjunction therewith, the provisions of this Amendment shall supersede and control. The Bank expressly reserves all rights against all parties to the Financing Documents.

19. This Amendment shall be governed and construed in accordance with the laws of the State of New York

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

5

IN WITNESS WHEREOF, the undersigned have caused this Amendment to be executed as of the day and year first above written.

|

BORROWERS:

|

|

|

ORBIT INTERNATIONAL CORP.

|

|

|

By: /s/ David Goldman

|

|

|

Name: David Goldman

|

|

|

Title: Chief Financial Officer

|

|

|

BEHLMAN ELECTRONICS, INC.

|

|

|

By: /s/ David Goldman

|

|

|

Name: David Goldman

|

|

|

Title: Chief Financial Officer

|

|

|

TULIP DEVELOPMENT LABORATORY, INC.

|

|

|

By: /s/ David Goldman

|

|

|

Name: David Goldman

|

|

|

Title: Chief Financial Officer

|

|

|

INTEGRATED CONSULTING SERVICES, INC.

|

|

|

By: /s/ David Goldman

|

|

|

Name: David Goldman

|

|

|

Title: Chief Financial Officer

|

|

|

BANK:

|

|

|

CAPITAL ONE,

|

|

|

NATIONAL ASSOCIATION

|

|

|

By: /s/ Dawn Juliano

|

|

|

Name: Dawn Juliano

|

|

|

Title: Vice President

|

6