Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BERKSHIRE HILLS BANCORP INC | v315084_8k.htm |

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Acquisition of Beacon Federal Bancorp, Inc. May 31, 2012

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Forward Looking Statements This document contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the proposed merger of Berkshire and Beacon. These statements include statements regarding the anticipated closing date of the transaction and anticipated future results. Forward - looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Certain factors that could cause actual results to differ materially from expected results include delays in completing the merger, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected time frame, difficulties in integrating Berkshire and Beacon, increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which Berkshire and Beacon are engaged, changes in the securities markets and other risks and uncertainties disclosed from time to time in documents that Berkshire files with the Securities and Exchange Commission. 1

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Additional Information for Shareholders 2 In connection with the proposed merger, Berkshire will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S - 4 that will include a Proxy Statement of Beacon and a Prospectus of Berkshire, as well as other relevant documents concerning the proposed transaction. Stockholders are urged to read the Registration Statement and the Proxy Statement/prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Berkshire Hills and Beacon, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Berkshire Hills Bancorp at www.berkshirebank.com under the tab “Investor Relations ”. Berkshire and Beacon and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Beacon Bancorp in connection with the proposed merger. Information about the directors and executive officers of Berkshire Hills Bancorp is set forth in the proxy statement for Berkshire Hills Bancorp’s 2012 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on March 30, 2012. Information about the directors and executive officers of Beacon is set forth in the proxy statement for Beacon Federal Bancorp’s 2012 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on April 16, 2012. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Merger Benefits 3 • Financial Pro Forma ◦ 10 % core EPS accretion in year one ◦ 15% IRR ◦ 4 Year approximate payback of TBV dilution; 6 month payback from total pro forma core earnings • Strategic ◦ Enhances position in markets with 1 million population ◦ Builds on successful expansion in New York region ◦ Commercial market share opportunities • Operational ◦ Improves core profitability metrics ◦ Leverages recent investment in Rome acquisition ◦ Adds first Eastern Mass. branch, complementing commercial and residential lending offices

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Overview of Beacon Federal Bancorp 4 • Beacon, founded in 1953, is a $1.0 billion bank headquartered in East Syracuse, New York. • Beacon operates 7 branches, with a primary focus on local consumer banking, and a presence concentrated in central New York, in the Syracuse and Rome/Utica MSAs • Stock symbol – BFED • Financial profile (as of and for LTM ending 3/31/12): ◦ Loans: $ 756 million ◦ Deposits: $677 million ◦ Tangible common equity : $114 million ◦ Net income : $5.5 million ◦ Net interest margin : 2.99% ◦ Efficiency ratio : 60.4% ◦ Net loan charge - offs/Average loans : 1.45% ◦ NPA/s/Assets: 4.00% ◦ Risk b ased capital ratio : 15.3%

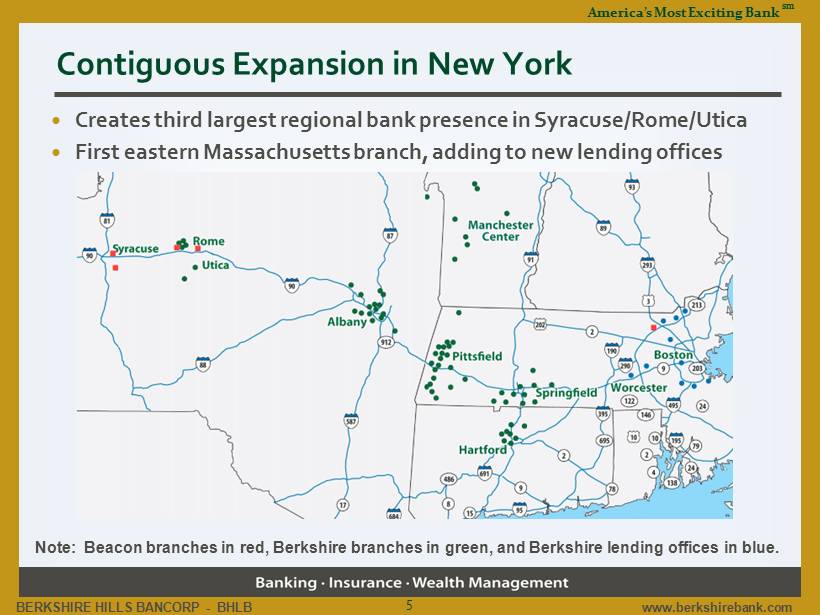

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Contiguous Expansion in New York 5 • Creates third largest regional bank presence in Syracuse/Rome/Utica • First e astern Massachusetts branch, adding to new lending offices Note: Beacon branches in red, Berkshire branches in green, and Berkshire lending offices in blue.

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Central New York Market Opportunity 6 • Attractive demographics ◦ Syracuse MSA population : 700,000 ◦ Rome/Utica MSA population : 300,000 ◦ Projected five year household income growth of 18 - 19% exceeds U.S. average • Combined Berkshire/Beacon deposit market share among top three regional banks • Long term revenue synergy potentials ◦ Higher lending capacity ◦ Commercial banking capabilities ◦ Insurance and wealth management

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Merger Summary 7 • Berkshire to acquire Beacon in transaction valued at approximately $132 million or $20.35 per Beacon share • Consideration will be 50% Berkshire stock and 50% cash, subject to election and proration procedures ◦ Stock exchange ratio fixed at .92 Berkshire shares for each Beacon share (50%) ◦ Cash will be $20.50 for each Beacon share (50 %) • Subject to customary regulatory approvals and Beacon shareholder approval Notes: Transaction value based on assumed 6,088,482 shares outstanding at closing . Deal value includes option consideration described in merger agreement for 649,345 options outstanding . Berkshire currently owns 129 thousand Beacon shares. Deal value per share based on $21.96 Berkshire closing stock price as of May 30, 2012.

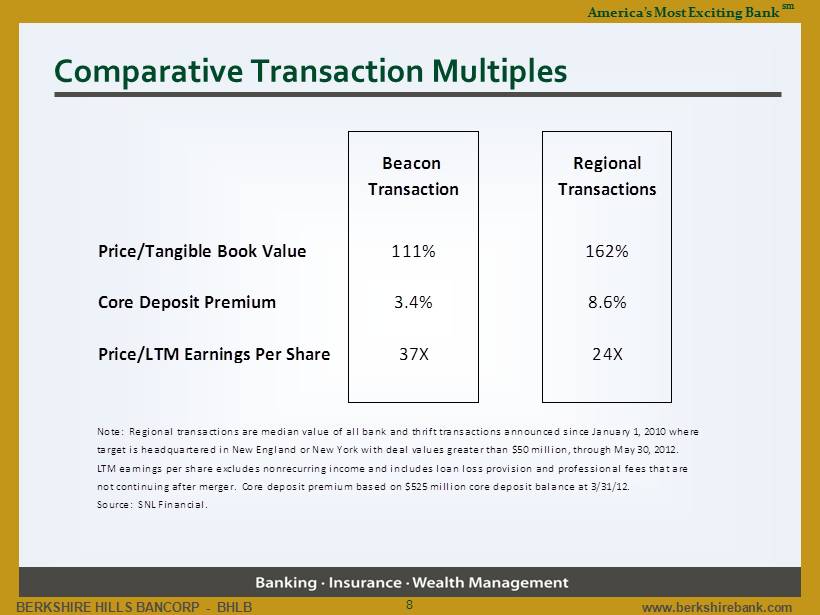

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Comparative Transaction Multiples 8 Beacon Regional Transaction Transactions Price/Tangible Book Value 111% 162% Core Deposit Premium 3.4% 8.6% Price/LTM Earnings Per Share 37X 24X Note: Regional transactions are median value of all bank and thrift transactions announced since January 1, 2010 where target is headquartered in New England or New York with deal values greater than $50 million, through May 30, 2012. LTM earnings per share excludes nonrecurring income and includes loan loss provision and professional fees that are not continuing after merger. Core deposit premium based on $525 million core deposit balance at 3/31/12. Source: SNL Financial.

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Transaction Assumptions 9 • Deal costs are $14 million pre - tax; $10 million after - tax. Model assumes they are an adjustment to equity at close. Most are expected to be recorded as non - core expenses • Cash consideration for 50% of outstanding shares expected to be financed 10% with liquid assets and 40% with subordinated debt • Cost saves are projected at 30% of non - interest expense, with 90% capture in first full year. Additional cost saves from termination of ESOP • Net fair value adjustments for purchase accounting are estimated at $ 31 million after - tax. These include $44 million in gross credit marks (5.8% of total loans), including $17 million of credit discount accretable over 5 years SYD • All outstanding Beacon options rolled into equivalent Berkshire options • Core deposit intangible of 2.5% based on non - jumbo CD deposits; 10 year SYD amortization • Anticipate the divestiture of Tennessee operations. Assume $57 million in deposits and $98 million in loans divested • Closing expected in Q4 2012; date assumed to be December 31, 2012 for modeling purposes

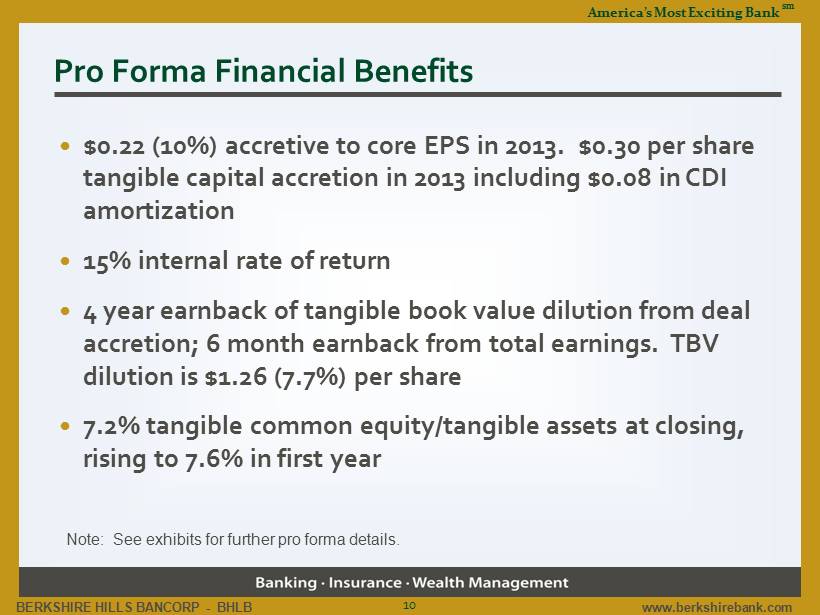

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Pro Forma Financial Benefits 10 • $0.22 (10%) a ccretive to core EPS in 2013. $0.30 per share tangible capital accretion in 2013 including $0.08 in CDI amortization • 15% internal rate of return • 4 year earnback of tangible book value dilution from deal accretion; 6 month earnback from total earnings. TBV dilution is $1.26 (7.7%) per share • 7.2% tangible common equity/tangible assets at closing, rising to 7.6% in first year Note: See exhibits for further pro forma details.

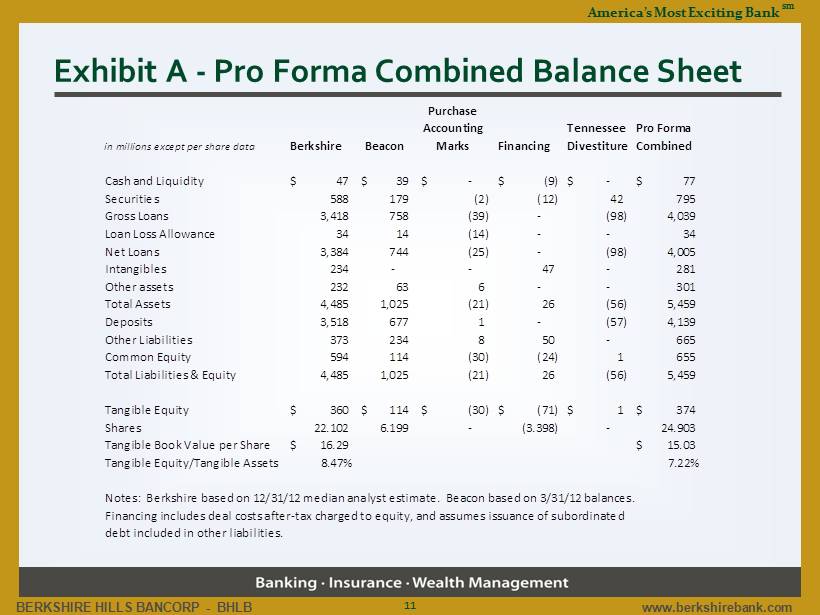

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Exhibit A - Pro Forma Combined Balance Sheet 11 Purchase Accounting Tennessee Pro Forma in millions except per share data Berkshire Beacon Marks Financing Divestiture Combined Cash and Liquidity 47$ 39$ -$ (9)$ -$ 77$ Securities 588 179 (2) (12) 42 795 Gross Loans 3,418 758 (39) - (98) 4,039 Loan Loss Allowance 34 14 (14) - - 34 Net Loans 3,384 744 (25) - (98) 4,005 Intangibles 234 - - 47 - 281 Other assets 232 63 6 - - 301 Total Assets 4,485 1,025 (21) 26 (56) 5,459 Deposits 3,518 677 1 - (57) 4,139 Other Liabilities 373 234 8 50 - 665 Common Equity 594 114 (30) (24) 1 655 Total Liabilities & Equity 4,485 1,025 (21) 26 (56) 5,459 Tangible Equity 360$ 114$ (30)$ (71)$ 1$ 374$ Shares 22.102 6.199 - (3.398) - 24.903 Tangible Book Value per Share 16.29$ 15.03$ Tangible Equity/Tangible Assets 8.47% 7.22% Notes: Berkshire based on 12/31/12 median analyst estimate. Beacon based on 3/31/12 balances. Financing includes deal costs after-tax charged to equity, and assumes issuance of subordinated debt included in other liabilities.

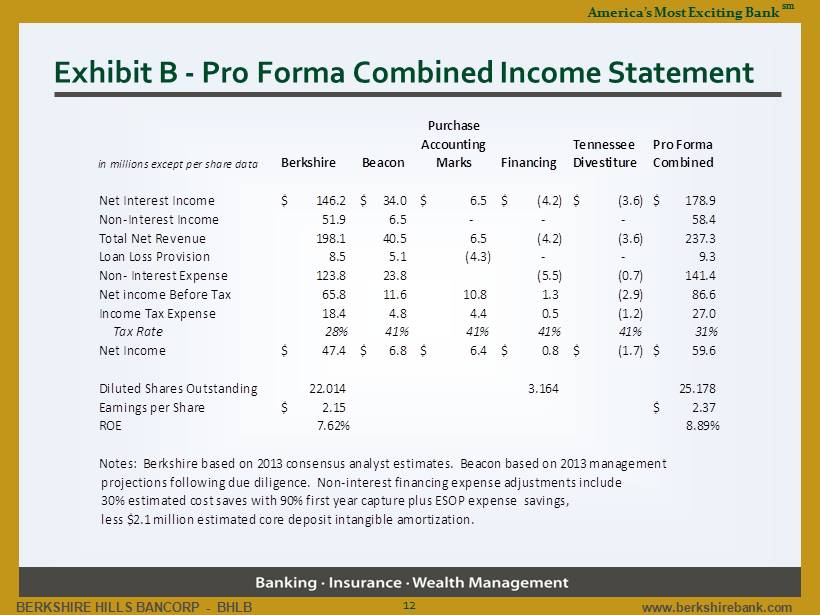

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Exhibit B - Pro Forma Combined Income Statement 12 Purchase Accounting Tennessee Pro Forma in millions except per share data Berkshire Beacon Marks Financing Divestiture Combined Net Interest Income 146.2$ 34.0$ 6.5$ (4.2)$ (3.6)$ 178.9$ Non-Interest Income 51.9 6.5 - - - 58.4 Total Net Revenue 198.1 40.5 6.5 (4.2) (3.6) 237.3 Loan Loss Provision 8.5 5.1 (4.3) - - 9.3 Non- Interest Expense 123.8 23.8 (5.5) (0.7) 141.4 Net income Before Tax 65.8 11.6 10.8 1.3 (2.9) 86.6 Income Tax Expense 18.4 4.8 4.4 0.5 (1.2) 27.0 Tax Rate 28% 41% 41% 41% 41% 31% Net Income 47.4$ 6.8$ 6.4$ 0.8$ (1.7)$ 59.6$ Diluted Shares Outstanding 22.014 3.164 25.178 Earnings per Share 2.15$ 2.37$ ROE 7.62% 8.89% Notes: Berkshire based on 2013 consensus analyst estimates. Beacon based on 2013 management projections following due diligence. Non-interest financing expense adjustments include 30% estimated cost saves with 90% first year capture plus ESOP expense savings, less $2.1 million estimated core deposit intangible amortization.

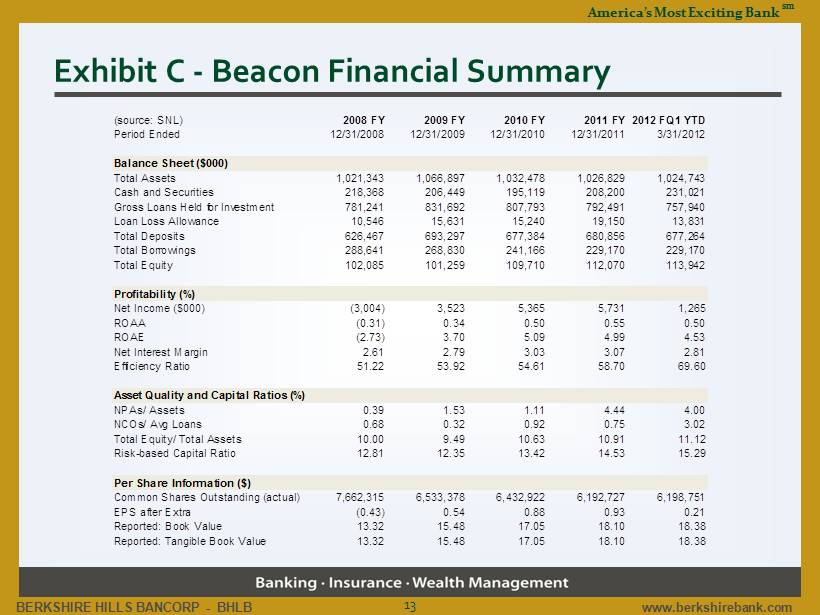

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Exhibit C - Beacon Financial Summary 13 (source: SNL) 2008 FY 2009 FY 2010 FY 2011 FY 2012 FQ1 YTD Period Ended 12/31/2008 12/31/2009 12/31/2010 12/31/2011 3/31/2012 Balance Sheet ($000) Total Assets 1,021,343 1,066,897 1,032,478 1,026,829 1,024,743 Cash and Securities 218,368 206,449 195,119 208,200 231,021 Gross Loans Held for Investment 781,241 831,692 807,793 792,491 757,940 Loan Loss Allowance 10,546 15,631 15,240 19,150 13,831 Total Deposits 626,467 693,297 677,384 680,856 677,264 Total Borrowings 288,641 268,830 241,166 229,170 229,170 Total Equity 102,085 101,259 109,710 112,070 113,942 Profitability (%) Net Income ($000) (3,004) 3,523 5,365 5,731 1,265 ROAA (0.31) 0.34 0.50 0.55 0.50 ROAE (2.73) 3.70 5.09 4.99 4.53 Net Interest Margin 2.61 2.79 3.03 3.07 2.81 Efficiency Ratio 51.22 53.92 54.61 58.70 69.60 Asset Quality and Capital Ratios (%) NPAs/ Assets 0.39 1.53 1.11 4.44 4.00 NCOs/ Avg Loans 0.68 0.32 0.92 0.75 3.02 Total Equity/ Total Assets 10.00 9.49 10.63 10.91 11.12 Risk-based Capital Ratio 12.81 12.35 13.42 14.53 15.29 Per Share Information ($) Common Shares Outstanding (actual) 7,662,315 6,533,378 6,432,922 6,192,727 6,198,751 EPS after Extra (0.43) 0.54 0.88 0.93 0.21 Reported: Book Value 13.32 15.48 17.05 18.10 18.38 Reported: Tangible Book Value 13.32 15.48 17.05 18.10 18.38

BERKSHIRE HILLS BANCORP - BHLB www.berkshirebank.com America’s Most Exciting Bank sm Exhibit D - Beacon Loan and Deposit Composition 14 Loan Composition Deposit Composition Source: Company filings as of March 31, 2012