Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Allison Transmission Holdings Inc | d362316d8k.htm |

| EX-99.2 - J.P. MORGAN DIVERSIFIED INDUSTRIES CONFERENCE PRESENTATION MATERIALS - Allison Transmission Holdings Inc | d362316dex992.htm |

0

Investor Relations Presentation

First Quarter 2012 (Published June 4, 2012)

Exhibit 99.1 |

Safe

Harbor Statement 1

The following information contains, or may be deemed to contain, “forward-looking

statements” (as defined in the U.S. Private Securities Litigation Reform Act of

1995). Most forward-looking statements contain words that identify them as

forward-looking, such as “may”, “plan”, “seek”, “will”, “expect”,

“intend”, “estimate”, “anticipate”, “believe”,

“project”, “opportunity”, “target”, “goal”, “growing” and

“continue” or other words that relate to future events, as opposed to past or current

events. By their nature, forward-looking statements are not statements of historical

facts and involve risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. These statements give Allison

Transmission’s current expectation of future events or its future performance and do not

relate directly to historical or current events or Allison Transmission’s historical or

future performance. As such, Allison Transmission’s future results may vary from any

expectations or goals expressed in, or implied by, the forward-looking statements included in this

presentation, possibly to a material degree.

Allison Transmission cannot assure you that the assumptions made in preparing any of the

forward- looking statements will prove accurate or that any long-term financial goals

will be realized. All forward- looking statements included in this presentation speak only

as of the date made, and Allison Transmission undertakes no obligation to update or revise

publicly any such forward-looking statements, whether as a result of new information,

future events, or otherwise. In particular, Allison Transmission cautions you not to

place undue weight on certain forward-looking statements pertaining to potential growth

opportunities, long-term financial goals or the value we currently ascribe to certain tax attributes

set forth herein. Actual results may vary significantly from these statements.

Allison Transmission’s business is subject to numerous risks and uncertainties, which may cause

future results of operations to vary significantly from those presented herein. |

Business Overview

2 |

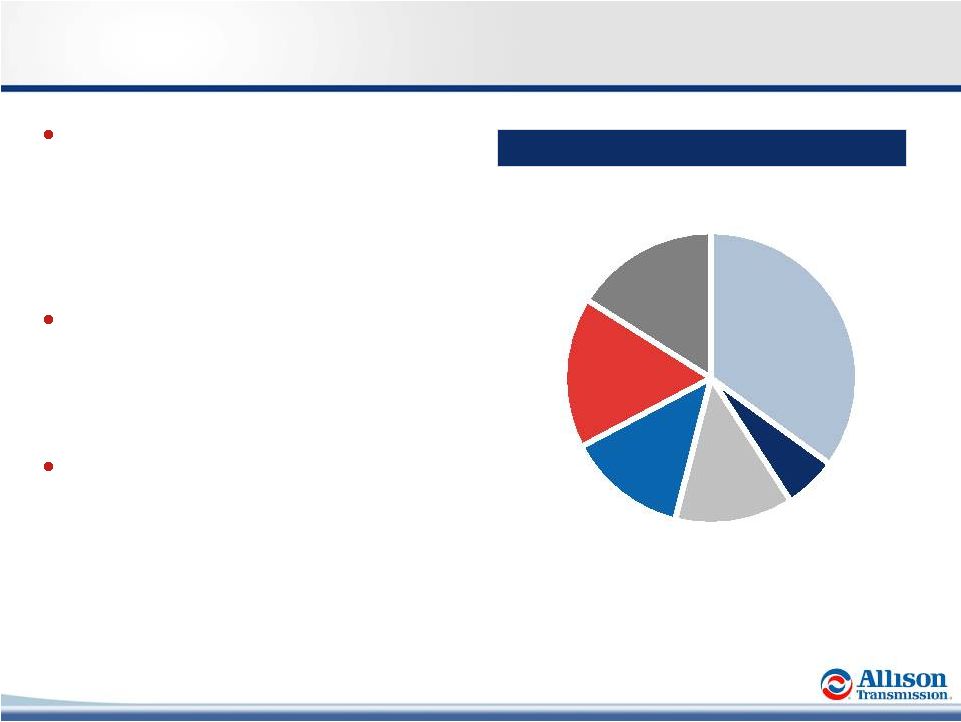

3

Allison Transmission at a Glance

North

America

On-highway

35%

North

America

Off-highway

13%

Outside

North America

17%

Military

13%

Parts,

Support

Equipment

and Other

16%

Hybrid

Transit Bus

6%

LTM

(1)

Net Sales by End Market

(1) LTM 3/31/2012.

LTM Net Sales: $2.2 billion

World’s largest manufacturer of fully-

automatic

transmissions

for

medium-

and heavy-duty commercial vehicles

–

62% global market share of fully-automatic

transmissions

–

Virtually no exposure to Class 8 line-haul

tractors

Allison is the premier fully-automatic

transmission brand

–

Premium price component frequently

specified by end users

–

Differentiated technology

Well positioned for revenue and earnings

growth

–

Continued recovery in North America

–

Further adoption outside North America

–

Global off-highway growth opportunities

–

Expanding addressable market |

4

Allison Key Financial Highlights

(1) LTM 3/31/2012.

(2) Note: See appendix for comments regarding the presentation of

non-GAAP financial information. Strong Financial Profile

(2)

$501

$766

$712

$544

$617

34.1%

32.9%

32.0%

28.4%

26.4%

4.5%

2.8%

14.2%

14.1%

15.1%

17.5%

9.4%

8.0%

16.4%

17.2%

2008

2009

2010

2011

LTM

Adj. EBITDA

Adj. EBITDA Margin

Adj. NI Margin

Free Cash Flow (% of Net Sales)

($ in millions)

(1)

Strong, sustainable operating margins

Low capital expenditure requirements

Minimal cash income taxes / valuable U.S. tax shield ($0.9-1.1bn present value)

Positioned for long-term cash earnings growth

|

5

Allison Is a Premier Industrial Asset

Improved Margins and Low Capex Drive Strong Cash Flow Generation

Experienced Management Team

Premier Brand and End User Value Proposition

Multiple Organic Growth Opportunities

Global Market Leader

Diverse End Markets with Long-Standing OEM Customer Relationships

Technology Leadership - The Allison Advantage

|

6

The “de facto”

standard in medium-

and heavy-duty applications

–

Well established as standard in North America

Increasing presence in rapidly growing emerging markets (China and India) which

today are predominantly manual

Virtually no exposure to more cyclical Class 8 line-haul tractors

Global On-Highway Fully-Automatic Share

(1)

North American Market Share

(1)

Allison

~62%

Other

(2)

~38%

Global Market Leader

(1) 2011 Units. Source: Allison management estimates and ACT research.

(2)

Majority

of

“Other”

volume

is

in

North

American

Class

4-5

truck

and

European

bus.

Substantially

All

Allison’s Core Addressable Market

Expansion Market

42%

54%

80%

4%

46%

96%

68%

20%

58%

32%

100%

School Bus

Motorhome

Class 6-7 Truck

Class 8

Straight Truck

Hybrid Bus

Class 8 Metro

Allison

Other Automatics

AMT, Manual |

7

Allison Is a Recognized and Respected Brand

The Allison brand is associated with:

–

High Quality

–

Reliability

–

Durability

–

Vocational Value and Expertise

–

Technological Leadership

–

Superior Customer Service

–

Attractive Total Lifecycle Value

90+ year history of providing high-

quality innovative products and

demonstrated value to end users

End Users Frequently Request Allison Transmissions by Name and Pay a Premium for

Them |

8

End User Value Proposition

Productivity (acceleration)

Maintenance Savings (life cycle

costs)

Fuel Efficiency

Driver Skillset / Wages

Training (time, cost)

Shift Quality

Safety

Residual Value

Low

High

Included in Vehicle Price

$3,000 - $7,000

$3,000 - $11,000

Manual

Transmission

Automated

Manual

Transmission

(AMT)

Allison

(Fully-Automatic)

Relative

Customer

Value

Approximate Option Pricing

End Users are Willing to Pay a Premium Price for Allison

Allison Advantage |

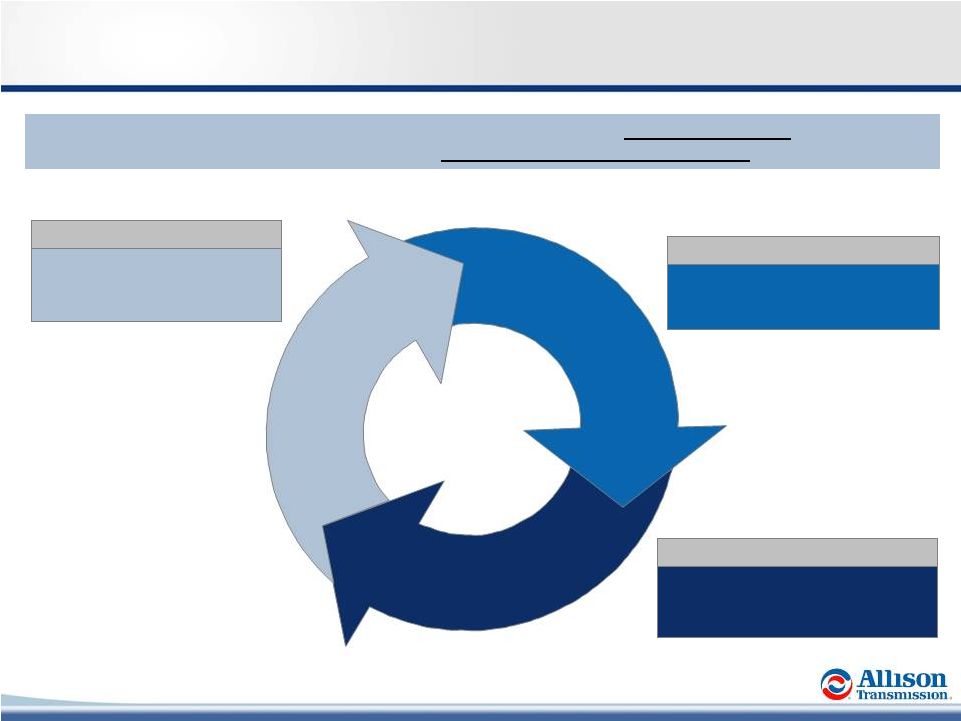

9

Technology

Leadership

–

The

Allison

Advantage

Lower Vehicle Life Cycle Costs

Superior Performance

Proprietary and patented

technology developed over many

decades and 5.7 million units

Properly Matched to Selected Engine

Optimized for Intended Vocation

Customer

Benefits

Superior

Technology

Engine &

Vocation

Optimized

Generating

Pull-Through

Demand

Allison Advantage

Allison Advantage

Technology Differentiators

Allison transmissions employ complex software algorithms that are individually tailored to maximize

end user performance in thousands of vocational duty cycles |

10

Distribution

Emergency

Vehicle

Motorhome

Rugged Duty

School Bus /

Shuttle Bus

Transit Bus

End Market & Vocation Overview

Global On-Highway

Military

Sample Vocations

Select End Users

Select End Users

North America Hybrid Transit Bus

Select End Users

Beijing City

Transit

New Delhi

Transit

Global Off-Highway

Select End Users

Parts, Support Equipment and

Other |

11

OEMs Rely on Allison for Fully-Automatic Transmissions

On-Highway

Hybrid

Transit Bus

Off-Highway

On-Highway

Off-Highway

U.S. Government

Medium-

and

Heavy-

Tactical

Over 45 Year Relationship with Many Industry-Leading OEMs

|

12

2008

Today

2012

(1)

Net Sales

Adj. EBITDA

% Margin

Adj. Net Income

$2,061mm

$544mm

26.4%

$93mm

$2,248mm

$766mm

34.1%

$339mm

+9.0%

+40.8%

+770bps

+265.2%

Despite cyclical low industry

volumes, significant improvement in

EBITDA margin and Adjusted Net

Income

Employees

UAW Contract

UAW Wage

Structure

3,300

Part of GM

Single-Tier

2,800

Allison Only

Multi-Tier

(15.2%)

2009 Hourly buyout plan reduced

headcount by ~25%, positioning the

company to replace Tier I with Tier II

workers and realize operating

leverage

Technology Focus

Enhance Existing

Products

New, More Fuel

Efficient Technologies

Investing in the development of next

generation technologies

Note: See appendix for comments regarding the presentation of non-GAAP

financial information. (1) LTM 3/31/2012

Premier Industrial Asset Financial Profile Resulting from

Experienced Management and Execution

(1)

Net Debt Reduction of More Than $1.2 Billion Since Acquisition in August 2007 |

13

Premier Industrial Asset

(2)

(2)

EBITDA

Margin

(1)

EBITDA

–

CapEx

Margin

(1)

(1) The LTM period and LTM EBITDA, which excludes non-recurring or one-time items as

designated by each entity, are based on information available in the entity’s most recent quarterly or annual report

as of 4/30/2012. EBITDA included above may not be consistent with such entity’s reported EBITDA or

Adjusted EBITDA, if available. (2) Represents Adjusted LTM EBITDA and Adjusted LTM EBITDA less capex (excluding

non-recurring capex related to non-North American manufacturing expansion and new product-related capex) as of 3/31/2012.

See appendix for comments regarding the presentation of non-GAAP information.

|

14

Multiple Organic Growth Opportunities

Benefit from Developed Markets Recovery

Increase Penetration of Fully Automatic Transmissions

Accelerate Adoption in Emerging Markets

Capitalize on Rising Demand for Energy and Commodities

Continue New Technology and Product Development

Increase Share in Underserved Markets |

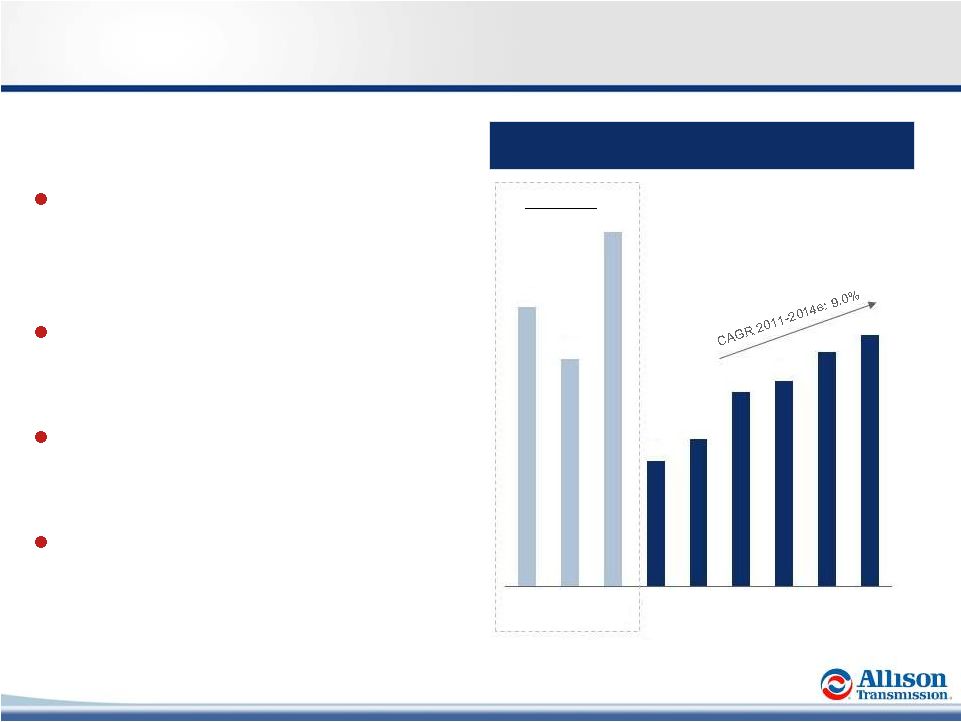

(1) Source: ACT Research, May 2012. Includes Class 4-7 Truck and

Bus (Excluding Transit and Coach) and Class 8 Straight Truck. Cyclical

Recovery in Developed On-Highway Markets North America Production in

Allison’s Core Addressable

Market

(units

in

000s)

(1)

Growth opportunity driven by continued

cyclical recovery in core North American

market (~34% of 2011 sales)

Production has rebounded from cyclical

lows and growth is expected

Allison’s growth is supported by pent up

demand from deferred purchases

Continued demand for fuel efficient

vehicles to provide incremental growth

Note: Excludes Class 8 line-haul units.

15

1998 –

2008

337

274

427

151

178

234

247

283

303

Avg.

Min

(2003)

Max

(2006)

2009

2010

2011

2012e

2013e

2014e |

16

Increase Penetration of Fully-Automatic Transmissions

Global Penetration of Fully-Automatic Transmissions

Non-North America

(2)

North America

(1)

2011

Source: Allison Management.

(1) Includes Class 4-7 trucks, Class 8 straight trucks, buses (school,

conventional transit, shuttle and coach) and motorhomes. (2) Includes

medium- and heavy-duty commercial vehicles.

Low penetration in markets

outside North America

presents a significant growth

opportunity

2011

Ongoing need for productivity

improvements

Better acceleration and trip times allow

increased miles and revenue

Improved fuel efficiency as a function of

work performed

More vehicle uptime

Focus on reducing life-cycle costs

Lower maintenance expense

Improved fuel efficiency

Increased vehicle residual value

Micro / demographic trends

Easier

to

operate

–

increases

pool

of

qualified drivers

Less driver training and turnover

Safety factors

Allison has significantly

increased market share in

North America |

17

Increasing Adoption in Emerging Markets –

China Case Study

Allison’s China Truck Vocational Focus

2004 -

2006

2007 -

2009

2010+

Fire and Emergency

Oil Field

Crane Carrier

Construction / Dump

Airport Services

Terminal Tractor

Refuse

Allison’s

Cumulative

China

Truck

OEM

Releases

(1)

Allison is the #1 supplier of fully-

automatic transmissions in China as a

result of targeting specific vocations

Substantial installed base of over 35,000

transmissions in China

Secular growth due to low penetration

Allison’s existing bus presence serves as

entry point for incremental penetration

Significant growth opportunities by

targeting a wide range of vocational

applications

Government emphasis on equipment

modernization for mining, rescue operations,

school buses and other applications

Construction and oil field sector

(1) Source: Allison.

17

22

53

72

2008

2009

2010

2011 |

Global Off-Highway Growth Opportunities

LTM

(1)

Allison Global Off-Highway Sales

Hydraulic Fracturing Activity

NA

29%

ROW

71%

Total

Recoverable

Shale

Gas

(4)

Current Activity

(3)

NA

88%

(2) Source: Spears & Associates, January 2012.

(3) Source: U.S. Energy Information Administration, April 2011.

ROW

12%

Energy Sectors

14% of total sales

(1)

Considerable end market cyclicality

Multiple opportunities in exploration, fracturing and

oil and gas support

Mining and Construction

3% of total sales

(1)

NA, Europe, Middle East, Africa and China

Increasing global demand for commodities

Increasing urbanization in emerging markets

18

Non-NA Energy

7%

Non-NA Hauling

13%

NA Hauling

1%

NA Energy

59%

2012 LTM Global Off-Highway Sales: $485 million (21% of total sales)

Parts, Support

Equipment and

Other

20%

(1)

Excluding replacement parts.

(2)

LTM 3/31/2012. |

19

New Product Development

Hybrid Commercial Vehicle

Class 8 Metro

Developing a ten-speed fully-automatic

transmission targeted at Class 8 tractors serving

urban markets

–

Large, addressable market size of ~60k units

–

Historically

a

“manual”

market

under

addressed by Allison’s fully-automatic

product portfolio

Currently being tested by customers

Leading development of first fully-automatic hybrid

truck transmission for the Class 6-7 market

Awarded $62.8 million U.S. Department of Energy

cost-share grant for hybrid development

–

Fuel economy improvements of ~25%-35%

–

Target Vocations: Refuse, Pick-Up &

Delivery/Distribution, Utility and Shuttle Bus

Average Annual Spend over $110 Million in Product-Related Research and

Development Since Acquisition |

20

Well Positioned to Gain Share in Underserved Markets

Core Addressable Market

Underserved

Note: Analysis excludes Allison’s Transit/Coach Bus and Hybrid Transit Bus

Segments. Source: Allison and ACT Research.

Underserved

“Metro”

is a term for tractors that are used

primarily in urban environments, which

represent ~30% of the Class 8 tractor

market between 1998 and 2011; target

market for the TC10 transmission

Historically, this market has been dominated by

Ford and GM who offered their own light-

duty/uprated automotive transmissions

GM exited Medium-Duty truck market in

2009

North America

Class 1-3

Class 4-5

Motor Home

School Bus

Class 6-7

Class 8

Straight

Class 8

Metro

Class 8

Linehaul

Vehicles

Weight

(000s of lbs)

< 14 lbs

14 –

19 lbs

16 –

33 lbs

16 –

33 lbs

19 –

33 lbs

33 lbs+

33 lbs+

33 lbs+

2011 Industry

Units Produced

5,239,866

59,080

12,255

23,230

72,147

61,611

60,806

132,844

2011 Allison

Share

0%

13%

42%

99%

68%

54%

4%

0% |

Financial Overview

21 |

22

Allison Financial Highlights

Note: See appendix for comments regarding the presentation of non-GAAP

information. (1)

LTM 3/31/2012

(2)

2.6%

excluding

non-North

American

manufacturing

expansion

and

new

product

related.

Strong, sustainable operating margins

–

End markets diversity

–

Premium vocational pricing model

–

Cost controls and productivity improvement

–

Multi-Tier UAW wage and benefits structure

Low capital expenditure requirements

–

Maintenance capital spending ~$55mm/year

Minimal cash income taxes / valuable U.S. tax shield

($0.9-1.1bn present value)

Positioned for long-term cash earnings growth

–

Multiple growth opportunities

–

De-leveraging

Strong free cash flow supports $0.06 per share

quarterly dividend

LTM

(1)

Financial Metrics

5.4%

34.1%

44.9%

15.1%

0.3%

17.5%

Cash Income

Taxes (% of

sales)

Capex (% of

sales)

Adj Net Income

Margin

Free Cash Flow

(% of Sales)

EBITDA Margin

Gross Margin

(2) |

23

Strong Financial Profile

Financial Summary

Significant sales growth since the

2009 trough

Resiliency through the downturn,

evidenced by increasing EBITDA

margins and strong free cash flow

generation

Continued investments in global

commercial capabilities, new product

development and low-cost country

manufacturing

Strong free cash flow driven by high

margins, low maintenance capex,

and de minimis cash income taxes

In $ millions

Annual

Quarterly

2008

2009

2010

2011

1Q 2011

1Q 2012

Net Sales

$2,061

$1,767

$1,926

$2,163

$517

$602

% Growth

(5.2%)

(14.3%)

9.0%

12.3%

9.1%

16.4%

Adjusted EBITDA

544

501

617

712

169

223

% Margin

26.4%

28.4%

32.0%

32.9%

32.7%

37.0%

Effective Cash Tax Rate

(2)

NM

NM

2.7%

3.9%

2.9%

3.5%

Adjusted Net Income

93

50

274

305

111

144

% of Net Sales

4.5%

2.8%

14.2%

14.1%

21.5%

23.9%

Total CapEx

75

88

74

97

12

36

% of Net Sales

3.7%

5.0%

3.8%

4.5%

2.1%

5.9%

Free cash flow

(3,4,5)

193

142

315

372

98

120

% of Net Sales

9.4%

10.4%

16.4%

17.2%

19.0%

19.9%

Note:

See appendix for comments regarding the presentation of non-GAAP

measures. (1)

LTM 03/31/2012

(2)

Effective cash tax rate defined as cash income taxes divided by income (loss) before taxes.

(3)

Based on operating cash flow less capex.

(4)

2009 free cash flow adjusted for non-recurring activity of: (a) capitalized accrued interest on

Senior Toggle Notes ($29) million, (b) cash restructuring charge $51 million, (c) accounts payable early

payments $3 million, (d) delayed accounts receivable receipts $19 million and (e) Lehman LIBOR swap

settlement $17 million.

(5)

2011 free cash flow adjusted for non-recurring activity of: Fee to terminate services

agreement with Sponsors $16 |

Sustainable Margins with Further Enhancement Opportunities

24

International Manufacturing

India (~$107mm total investment; ~$7mm remaining

(1)

)

–

New facility constructed to better serve Asia-Pacific

–

Phase I: In-source component manufacturing (Q3 2010)

–

Phase II: Assembly of 1000/2000 Series (Q3 2012)

Hungary (~$17mm total investment

(1)

)

–

Relocate assembly of 3000/4000 Series (Q2 2011)

~90% of 2011 N.A. On-Highway Unit Volume was covered by long-

term customer supply agreements

Workforce Optimization (cost/employee)

Hours Per Unit continue to decline

Source: Allison.

(1) As of 3/31/2012.

~30% of total

UAW workforce

Manufacturing Efficiencies (hours/unit)

Long-Term Customer Supply Agreements

~90%

Significant savings driven by retirement of Tier I workers; 800 hourly

employees are retirement eligible (~53% of workforce)

1000/2000 Series

3000 Series

4000 Series

2005

2011

Tier I

Tier II |

25

Significant Cash Flow Generation

$4,204

$3,753

$3,721

$3,419

$3,065

$2,981

6.9x

7.4x

5.5x

4.3x

3.9x

At

Acquisition

2008

2009

2010

2011

LTM

Free Cash Flow Generation

(1)

Net Debt

(2)

$378

$81

$61

$16

$315

$142

$193

$372

$394

9.4%

17.2%

17.5%

16.4%

8.0%

2008

2009

2010

2011

LTM

Free Cash Flow

Certain Non-Recurring Activity

% of Sales

($ in millions)

($ in millions)

(3,4)

Note: See appendix for comments regarding the presentation of non-GAAP

measures. Net

debt

reduction

of

more

than

$1.2

bn

since

acquisition

(6)

(5)

(5)

(1)

Free cash flow defined as cash flow from operations less capex.

(2)

Net debt defined as total debt minus cash and cash equivalents.

(3)

2009 free cash flow adjusted for certain non-recurring activity of (a) capitalized accrued

interest on Senior Toggle Notes ($29) million, (b) cash restructuring charge $51 million, (c)

accounts payable early payments $3 million, (d) delayed accounts receivable receipts $19 million and

(e) Lehman LIBOR swap settlement $17 million.

(4)

LTM free cash flow adjusted for certain non-recurring activity: 1Q 2012 Fee to terminate

services agreement with sponsors $16

(5)

LTM 3/31/2012

(6)

Represents debt reduction through 3/31/2012.

|

26

Income Tax Attributes

Carlyle and Onex acquired Allison from General Motors in August 2007

–

Asset deal structure

–

Step-up in basis for U.S. federal income tax purposes

As of 12/31/2011 Allison had $3.3bn of unamortized intangible assets

–

Expect annual U.S. federal income tax deductions of $315mm through 2021 and

$183mm in 2022

Net operating loss carryforward of $382mm as of 12/31/2011

Income Tax attributes overview

(1)

Assuming continued profitability and no limitations at an assumed 38.5% federal

and state tax rate. (2)

Calculated at a 35.0% federal tax rate on the $382mm of federal NOL carryforward

balance as of 12/31/2011. (3)

Based on annual discount rate of 5-10%; includes both amortization of

intangibles and federal NOL’s (contingent on timing of taxable income).

Results

in

present

value

tax savings

of

$900-$1,100mm

(3)

($ millions)

Total

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Annual tax amortization

$3,333

$315

$315

$315

$315

$315

$315

$315

$315

$315

$315

$183

Cash tax savings

1

1,283

121

121

121

121

121

121

121

121

121

121

70

Cash tax savings of NOLs

2

134

Grand total

$1,417 |

Summary / Guidance / Q&A

27 |

Strategic Priorities

Expand global market leadership

–

Capitalize on continued market recovery

–

New vocational offerings

Emerging markets penetration

–

Vocational ladder strategy

–

Increase number of vehicle releases

Continued focus on new technologies and product development

–

Address markets adjacent to core

–

Advanced fuel efficient technologies

Deliver strong financial results

–

Earnings growth and cash flow generation

–

Focus on continued margin enhancement

28 |

Full Year 2012 Guidance

Guidance

Commentary on Full Year

Net Sales Growth from 2011

5 to 7 percent

Assumes year over year growth in global on-

highway and Outside North America off-highway

end markets partially offset by year over year

reductions in North America off-highway, tracked

military products and North America hybrid-

propulsion systems for transit bus end markets

Adjusted EBITDA %

(1)

33.5 to 34.5 percent

Driven by sales mix and volume timing

CapEx

($ in millions)

Maintenance

New Facilities

New Product Programs

$55 to $60

$25 to $30

$30 to $40

New facilities and product programs subject to

timely completion of development and sourcing

milestones

Cash Income Taxes ($ in millions)

$10 to $15

U.S. income tax shield and net operating loss

utilization

Note: See appendix for comments regarding the presentation of non-GAAP

information. 29 |

Appendix: Non-GAAP Financial Information

30 |

Non-GAAP Financial Information

We use Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free

cash flow and free cash flow to evaluate our performance relative to that of

our peers. In addition, the Senior Secured Credit Facility has certain

covenants that incorporate Adjusted EBITDA. However, Adjusted net income, Adjusted

EBITDA, Adjusted EBITDA margin, adjusted free cash flow and free cash flow

are not measurements of financial performance under GAAP, and these

metrics

may

not

be

comparable

to

similarly

titled

measures

of

other

companies.

Adjusted

net

income

is

calculated

as the sum of net income (loss), interest expense, net, income tax expense, trade

name impairment and amortization of intangible assets, less cash interest

expense, net and cash income taxes. Adjusted EBITDA is calculated as the sum of

Adjusted net income, cash interest expense, net, cash income taxes, depreciation of

property, plant and equipment and other adjustments as defined by the Senior

Secured Credit Facility and as further described below. Adjusted EBITDA

margin is calculated as Adjusted EBITDA divided by net sales. Free cash flow is

calculated as net cash provided by operating activities less capital

expenditures. Adjusted free cash flow is free cash flow adjusted for non-recurring items.

We use Adjusted net income to measure our overall profitability because it better

reflects our cash flow generation by capturing

the

actual

cash

taxes

paid

rather

than

our

tax

expense

as

calculated

under

GAAP

and

excludes

the

impact

of

the non-cash annual amortization of certain intangible assets that were created

at the time of the Acquisition Transaction. We use Adjusted EBITDA and

Adjusted EBITDA margin to evaluate and control our cash operating costs

and

to

measure

our

operating

profitability.

We

use

adjusted

free

cash

flow

and

free

cash

flow

to

evaluate

the

amount

of

cash generated by the business that, after the capital investment needed to

maintain and grow our business, can be used for strategic opportunities,

including investing in our business and strengthening our balance sheet. We believe

the presentation of Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin,

adjusted free cash and free cash flow enhances our investors' overall

understanding of the financial performance and cash flow of our business. You

should not consider Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash flow and

free cash flow as an alternative to net income (loss), determined in accordance

with GAAP, as an indicator of operating performance, or as an alternative to

net cash provided by operating activities, determined in accordance with GAAP, as

an indicator of Allison’s cash flow.

31 |

Non-GAAP Reconciliations

(1 of 2)

32

Adjusted Net Income and Adjusted EBITDA Reconciliation

(1) Includes charges or income related to legacy employee

benefits, shared income with General Motors, benefit plan adjustments, transitional costs to establish

Allison as a stand-alone entity, pension curtailment adjustments, employee

stock compensation expense, service fees paid to Allison’s Sponsors and an

adjustment for the settlement of litigation which originated with the Predecessor

but was assumed by the Company as part of the Acquisition Transaction.

$ in millions

Last twelve

months ended

March 31,

2008

2009

2010

2011

2011

2012

2012

Net (Loss) Income

($328.1)

($323.9)

$29.6

$103.0

$36.9

$58.0

$124.1

plus:

Interest expense,

net

385.9

234.2

277.5

217.3

49.6

40.7

208.4

Cash interest expense,

net

(334.2)

(242.5)

(239.1)

(208.6)

(29.9)

(36.1)

(214.8)

Income tax

expense

37.1

41.4

53.7

47.6

18.0

25.2

54.8

Cash income

taxes

(4.3)

(5.5)

(2.2)

(5.8)

(1.6)

(2.9)

(7.1)

Fee to terminate services agreement with Sponsors

—

—

—

—

—

16.0

16.0

Initial public offering expenses

—

—

—

—

—

5.7

5.7

Trade name

impairment

179.8

190.0

—

—

—

—

—

Amortization of intangible

assets

156.5

155.9

154.2

151.9

38.0

37.5

151.4

Adjusted Net

Income

$92.7

$49.6

$273.7

$305.4

$111.0

$144.1

$338.5

Cash interest expense,

net

334.2

242.5

239.1

208.6

29.9

36.1

214.8

Cash income

taxes

4.3

5.5

2.2

5.8

1.6

2.9

7.1

Depreciation of property, plant and equipment

106.6

105.9

99.6

103.8

25.7

24.6

102.7

Loss on repurchases of long-term debt

—

—

—

—

—

13.5

13.5

Premiums and expenses on tender offer of long-term debt

—

—

—

56.9

—

—

56.9

Dual power inverter module extended coverage

2.2

11.4

(1.9)

—

—

—

—

(Gain) / loss on repurchases of long-term debt

(21.0)

(8.9)

(3.3)

16.0

—

—

16.0

Unrealized (gain) loss on hedge contracts

—

(5.8)

0.1

6.8

(1.6)

(0.7)

7.7

Reduction of supply contract liability

—

—

(3.4)

—

—

—

—

Restructuring charges

15.7

47.9

—

—

—

—

—

Other, net

(1)

9.3

53.2

10.9

8.6

2.7

2.5

8.4

Adjusted

EBITDA

$544.0

$501.3

$617.0

$711.9

$169.3

$223.0

$765.6

Net

Sales

$2,061.4

$1,766.7

$1,926.3

$2,162.8

$517.0

$601.9

$2,247.7

Adjusted EBITDA

Margin

26.4%

28.4%

32.0%

32.9%

32.7%

37.0%

34.1%

For the year ended December 31,

Three months ended

March 31, |

$ in millions

Last twelve

months ended

March 31,

2008

2009

2010

2011

2011

2012

2012

Net Cash Provided by Operating Activities

$268.1

$168.7

$388.9

$469.2

$109.9

$139.6

$498.9

(Deductions) or Additions:

Long-lived assets

(75.3)

(88.2)

(73.8)

(96.9)

(11.6)

(35.7)

(121.0)

Fee to terminate services agreement with Sponsors

—

—

—

—

—

16.0

16.0

Non-Recurring Activity

(1)

—

61.0

—

—

—

—

—

Adjusted Free Cash Flow

$192.8

$141.5

$315.1

$372.3

$98.3

$119.9

$393.9

Net

Sales

$2,061.4

$1,766.7

$1,926.3

$2,162.8

$517.0

$601.9

$2,247.7

Adjusted Free Cash Flow (% to Net Sales)

9.4%

8.0%

16.4%

17.2%

19.0%

19.9%

17.5%

For the year ended December 31,

Three months

ended

March 31,

Non-GAAP Reconciliations

(2 of 2)

33

Adjusted Free Cash Flow

(1)

2009 adjusted for certain non-recurring activity: (a) capitalized accrued interest on Senior

Toggle Notes ($29) million, (b) cash restructuring charge $51 million, (c) accounts payable

early payments $3 million, (d) delayed accounts receivable receipts $19 million and (e) Lehman

LIBOR swap settlement $17 million. |

Key Definitions

34 |

Key

Definitions Types of Transmissions

Fully-automatic transmission

Utilize technology that smoothly

shifts gears without power

interruption

Automated manual transmission

Manual transmissions that feature

automated operation of the

disconnect clutch with power

interruption

Manual transmission

Utilize a disconnect clutch with

power interruption

Most prevalent transmission type

used in North America Class 8

tractors and in medium and heavy-

duty commercial vehicles outside

North America

35

End Markets

North America

Outside North America

On-Highway

On-Highway

Off-Highway

Off-Highway

Hybrid Transit Bus

Military

Service Parts, Support Equipment

and Other

Service Parts, Support Equipment

and Other |

End

Markets – North America

(1 of 2)

On-Highway

Trucks

Classes

Vocation

Class 4-5 -

Medium duty

Class 6-7 -

Heavy duty

Lease and rental

Emergency -

ambulance, fire, rescue

Distribution -

logistics, parcel delivery

Airport operations

Refuse

Utilities

Class 8

Straight

Metro Tractor

Tractor

Refuse

Distribution

Emergency -

fire

Construction

Transport cargo (dock spotters)

Distribution

Line haul

Buses

Buses

School

Transit:

Conventional (urban)

Shuttle (airport)

Coach (long distance)

Motorhomes

Type A -

large (gasoline and diesel)

36

Hybrid Transit Bus

Buses and shuttle buses

Public transit |

Off-Highway

Vehicle

Vocation

Well-stimulation equipment (stationary and mobile)

Pumping equipment, Well servicing rigs

Rigid dump trucks

Underground trucks

Heavy haul tractor trailer trucks

Specialty vehicles

Airport crash trucks (large fire trucks)

Energy

Mining

Construction / Specialty

37

End Markets –

North America

(2 of 2)

Military

Medium-

and heavy-

tactical wheeled platforms

Armored security vehicle (ASV)

Family of medium tactical vehicles (FMTV)

Heavy expanded mobility tactical truck (HEMTT)

Heavy equipment transporter (HET)

Logistic vehicle system replacement (LVSR)

Mine resistant ambush protected (MRAP)

Palletized load system (PLS)

M900 family of vehicles

Stryker

Tracked combat platforms

Abrams Tank

M113

Service Parts, Support

Equipment and Other

Service parts, support equipment, remanufactured

transmissions, fluids |

38

End Markets –

Outside North America

(1 of 2)

On-Highway

Trucks

Classes

Vocation

3.5 –

7.5 tonnes

7.5 –

16 tonnes

Commercial –

lease and rental

Emergency –

ambulance, fire,

rescue

Distribution –

logistics, parcel

delivery

Airport operations

Refuse

Utilities

Greater than 16 tonnes

Straight Truck

Metro Tractor

Refuse

Distribution

Emergency –

fire

Transport cargo (dock spotters)

Specialty vehicles (crane carriers)

Construction

Distribution

Buses

Buses

School

Transit:

Conventional (urban)

Shuttle (airport)

Coach (long distance) |

Off-Highway

Vehicle

Vocation

Well stimulation equipment (stationary and

mobile)

Rigid dump trucks

Underground trucks

Heavy haul tractor trailer trucks

Specialty vehicles

Airport crash trucks (large fire trucks)

Energy

Mining

Construction / Specialty

39

End Markets –

Outside North America

(2 of 2)

Service Parts, Support

Equipment and Other

Service parts, support equipment,

remanufactured transmissions, fluids |