Attached files

| file | filename |

|---|---|

| 8-K - FORM8K - PPL Corp | form8k.htm |

©PPL Corporation 2012

1

June 4-5, 2012

©PPL Corporation 2012

Exhibit 99.1

©PPL Corporation 2012

2

Cautionary Statements and Factors

That May Affect Future Results

That May Affect Future Results

Any statements made in this presentation about future

operating results or other future events are forward-looking

statements under the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Actual results may

differ materially from such forward-looking statements. A

discussion of factors that could cause actual results or events

to vary is contained in the Appendix to this presentation and

in the Company’s SEC filings.

operating results or other future events are forward-looking

statements under the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Actual results may

differ materially from such forward-looking statements. A

discussion of factors that could cause actual results or events

to vary is contained in the Appendix to this presentation and

in the Company’s SEC filings.

©PPL Corporation 2012

3

PPL Well-Positioned for Future Success

Increased mix of rate-regulated earnings provides stability in weak

economic environment

economic environment

Approximately 70% of projected 2012 EPS from regulated businesses

Substantial organic growth in rate base: ~8% CAGR from 2012-2016

Business Risk Profile rated “Excellent” by S&P

Secure dividend with strong platform for continued growth

Highly attractive competitive generation fleet with diverse fuel mix allows

for significant upside when power markets recover

for significant upside when power markets recover

Strong baseload footprint in PJM complemented by flexible gas-fired units

No major exposure to currently proposed environmental regulations

Strong management team with track record of execution

UK team already showing meaningful improvement in Midlands operations

ECR approval received in Kentucky

Successfully hedging competitive generation and locking in margins in a challenging

market

market

©PPL Corporation 2012

4

U.K. Regulated Segment

Investment Highlights

Investment Highlights

Highly attractive rate-regulated business with significant growth

prospects

prospects

Regulator-approved 5-year forward-looking revenues based on future business plan,

including capital expenditures and O&M plus adjustments for inflation

including capital expenditures and O&M plus adjustments for inflation

Real-time return of and return on capital investment - no lag

No volumetric risk

Additional incentives for operational efficiency and high-quality service

Top performing electricity distribution business in the U.K.

Leader in capital and operating cost efficiency, customer service and reliability

Over $380 million in incentive revenues earned over past 7 years

Highest percentage of bonus revenue among peers

Best-in-class U.K. management team

Experienced team with record of delivering results

Completely transformed acquired Midlands operation in 9 months

Strong potential to earn additional incentive revenues

Consistent pattern of dividend repatriation to U.S. parent

©PPL Corporation 2012

5

Kentucky Regulated Segment

Investment Highlights

Investment Highlights

Efficient, well-run utility focused on safety, reliability and customer

service

service

Projected rate base CAGR of 9.6% through 2016

Constructive regulatory environment that provides a timely return on a

substantial amount of planned capex over the next 5 years

substantial amount of planned capex over the next 5 years

Environmental Cost Recovery (ECR): ~$2.3 billion plan approved by the KPSC with a

10.1% ROE; ~$500 million remaining under prior plan at 10.63% ROE - virtually no

regulatory lag

10.1% ROE; ~$500 million remaining under prior plan at 10.63% ROE - virtually no

regulatory lag

Other supportive recovery mechanisms include Construction Work In Process, Fuel

Adjustment Clause, Gas Supply Clause Adjustment and Demand Side Management

recovery

Adjustment Clause, Gas Supply Clause Adjustment and Demand Side Management

recovery

Very competitive retail rates that attract energy-intensive businesses

©PPL Corporation 2012

6

Pennsylvania Regulated Segment

Investment Highlights

Investment Highlights

Significant growth in transmission portion of business which

earns a favorable rate of return on a near real-time basis

earns a favorable rate of return on a near real-time basis

CAGR of 22.3% in transmission rate base through 2016 driven by

initiatives to improve aging infrastructure and Susquehanna-Roseland

Project

initiatives to improve aging infrastructure and Susquehanna-Roseland

Project

ROE of 11.68% earned through FERC Formula Rate Mechanism

Susquehanna-Roseland Project earns an incentive 12.93% ROE and earns

a return on construction work-in-progress

a return on construction work-in-progress

Projected CAGR of 6.5% in distribution rate base through

2016 driven by initiatives to improve aging infrastructure

2016 driven by initiatives to improve aging infrastructure

Alternative ratemaking bill passed state legislature and

approved by the Governor

approved by the Governor

Intended to provide for more timely recovery of eligible distribution plant

costs that improve and maintain safety and reliability

costs that improve and maintain safety and reliability

©PPL Corporation 2012

7

Supply Segment

Investment Highlights

Investment Highlights

Very well-positioned competitive generation

PJM assets:

Low marginal cost nuclear and hydro facilities

Efficient supercritical coal units with fuel switching optionality

Attractive gas-fired assets that capture market opportunity and back-stop base load unit availability

Montana assets:

Low marginal cost coal and hydro units that are critical to infrastructure supporting load in the Northwest

Considerable upside from potential expansion of export capability to Alberta and the Dakotas in support of

rapidly growing unconventional oil production activities

rapidly growing unconventional oil production activities

Substantially in compliance with new emissions standards without further major

investments

investments

Generation fleet will benefit from multiple factors

Tightening reserve margins

Forced retirement of less efficient stations due to tightening emissions standards

Firming of demand driven by general economic recovery

General firming of natural gas prices

Among the strongest forward hedge profiles in industry

Wholesale generation increasingly augmented by growing competitive retail

activities across commercial, industrial and residential customer classes

activities across commercial, industrial and residential customer classes

©PPL Corporation 2012

8

$2.73

$/Share

Note: See Appendix for the reconciliation of earnings from ongoing operations to reported

earnings.

earnings.

$2.45

$2.15

Reaffirmed 2012 Ongoing Earnings Forecast

©PPL Corporation 2012

9

Dividend Profile

A significantly more rate-regulated business mix provides strong

support for current dividend and a platform for future growth

support for current dividend and a platform for future growth

(1) Ongoing EPS based on mid-point of forecast. Annualized dividend based on 1st quarter declaration. Actual dividends to be determined by Board of Directors.

((2) From only regulated segments.

$/Share

Annualized

(2)

(1)

©PPL Corporation 2012

10

Appendix

©PPL Corporation 2012

11

Midlands Integration - Improved

Network Performance

Network Performance

Customer Minutes Lost

Customer Interruptions (per 100 customers)

25.9%

Improvement

Improvement

39.7%

Improvement

Improvement

96%

Improvement

Improvement

21.6%

Improvement

Improvement

©PPL Corporation 2012

12

|

RIIO-ED1 Tentative Schedule

|

|

|

Provisional

Timing |

Milestone

|

|

September 2012

|

Publication of Strategy Consultation

|

|

February 2013

|

Publication of Strategy Decision

|

|

End May 2013

|

DNOs submit business plans

|

|

September 2013

|

Publication of Initial Assessment of companies business plans

|

|

November 2013

|

Publication of Fast Track Proposals (Initial Proposals)

|

|

March 2014

|

Publication of Fast Track Decision (Initial Proposals)

|

|

June 2014

|

Publication of Initial Proposals Consultation for non fast tracked

companies |

|

November 2014

|

Publication of Final Proposals for non fast tracked companies

|

|

December 2014

|

Issue statutory consultation on new license conditions

|

|

April 1, 2015

|

Price control commences

|

Source: Ofgem Press Release dated February 6, 2012

U.K. Electricity Distribution Price Control Review

©PPL Corporation 2012

13

PPL Electric Utilities Distribution Rate Case Facts

Distribution Revenue Increase Requested $104.6 million

Test Year 2012

Requested ROE 11.25%

2012 Distribution Rate Base $2.42 billion

2012 Common Equity Ratio 51.03%

1% Change in ROE = ~$23 million in revenue

Docket No. R-2012-2290597

Complete filing available at www.pplelectric.com/rateinfo

©PPL Corporation 2012

14

|

|

|

|

2012

|

|

2013

|

|

|

|

Baseload

|

|

|

|

|

|

|

|

|

Expected Generation(1) (Million MWhs)

|

|

|

51.5

|

|

53.1

|

|

|

|

East

|

|

|

43.5

|

|

44.8

|

|

|

|

West

|

|

|

8.0

|

|

8.3

|

|

|

|

Current Hedges (%)

|

|

|

94-98%

|

|

79-83%

|

|

|

|

East

|

|

|

96-100%

|

|

82-86%

|

|

|

|

West

|

|

|

82-86%

|

|

65-69%

|

|

|

|

Average Hedged Price (Energy Only) ($/MWh)(2) (3)

|

|

|

|

|

|

|

|

|

East

|

|

|

$54-55

|

|

$49-51

|

|

|

|

West

|

|

|

$50-52

|

|

$46-49

|

|

|

|

Current Coal Hedges (%)

|

|

|

100%

|

|

97%

|

|

|

|

East

|

|

|

100%

|

|

96%

|

|

|

|

West

|

|

|

100%

|

|

100%

|

|

|

|

Average Hedged Consumed Coal Price (Delivered $/Ton)

|

|

|

|

|

|

|

|

|

East

|

|

|

$76-79

|

|

$80-88

|

|

|

|

West

|

|

|

$23-28

|

|

$23-29

|

|

|

|

Intermediate/Peaking

|

|

|

|

|

|

|

|

|

Expected Generation(1) (Million MWhs)

|

|

|

7.6

|

|

7.0

|

|

|

|

Current Hedges (%)

|

|

|

58%

|

|

6%

|

|

|

Capacity revenues are expected to be $385 million and $590 million for 2012 and 2013, respectively.

As of March 31, 2012

(1) Represents expected sales of Supply segment based on current business plan assumptions.

(2) The 2012 average hedge energy prices are based on the fixed price swaps as of March 31, 2012; the prior collars have all been converted to fixed swaps.

(3) The 2013 ranges of average energy prices for existing hedges were estimated by determining the impact on the existing collars resulting from 2013 power prices at the 5th and 95th

percentile confidence levels.

percentile confidence levels.

Enhancing Value Through Active Hedging

©PPL Corporation 2012

15

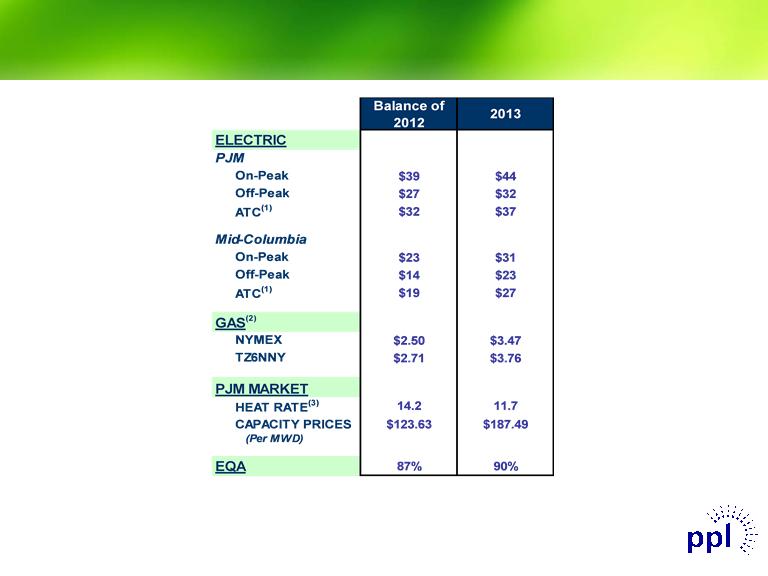

Market Prices

|

(1)

|

24-hour average.

|

|

(2)

|

NYMEX and TZ6NNY forward gas prices on 3/30/2012.

|

|

(3)

|

Market Heat Rate = PJM on-peak power price divided by TZ6NNY gas price.

|

Forward(1) Balance of 2012 2013 2014 ELECTRIC PJM On-Peak $39 $44 $45 Off-Peak $27 $32 $33 ATC(1) $32 $37 $39 Mid-Columbia On-Peak $23 $31 $36 Off-Peak $14 $23 $28 ATC(1) $19 $27 $32 GAS(2) NYMEX $2.50 $3.47 $3.95 TZ6NNY $2.71 $3.76 $4.19 PJM MARKET HEAT RATE(3) 14.2 11.7 10.8 CAPACITY PRICES $123.63 $187.49 $173.85 (Per MWD) EQA 87% 90% 91%

©PPL Corporation 2012

16

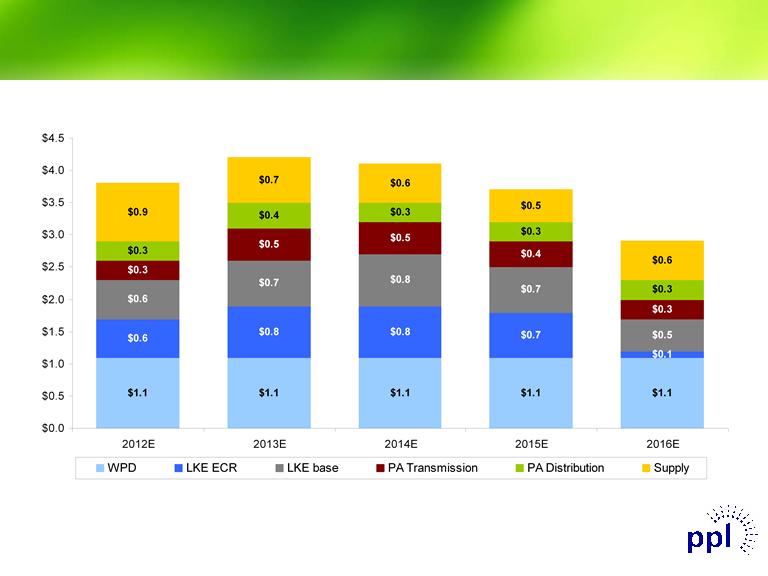

Capital Expenditures

($ in billions)

(1) Includes capex for WPD Midlands. Figures based on assumed exchange rate of $1.57 / GBP.

(2) Expect between 80% and 90% to receive timely returns via ECR mechanism based on historical experience and future projections.

(1)

(2)

$3.8

$4.2

$4.1

$3.7

$2.9

©PPL Corporation 2012

17

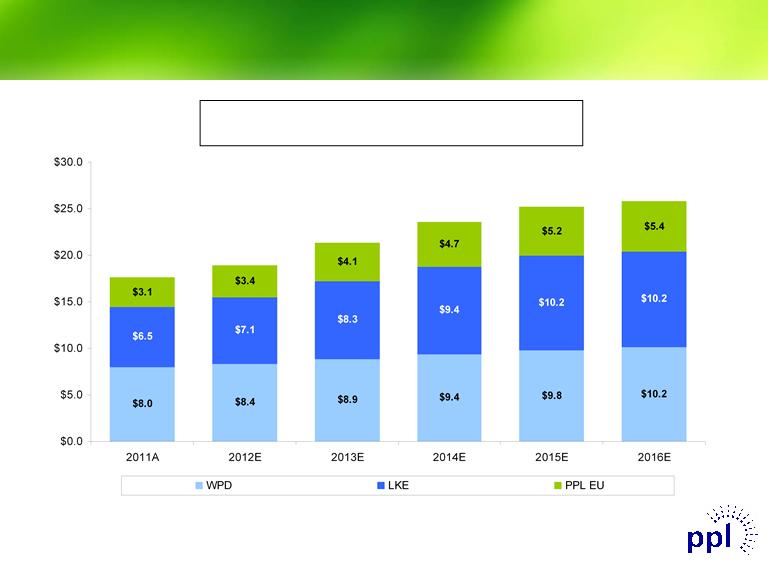

Projected Regulated Rate Base Growth

($ in billions)

(1) Represents capitalization for LKE, as LG&E and KU rate constructs are based on capitalization. Represents Regulatory Asset Value (RAV) for WPD.

(2) Includes RAV for WPD Midlands. Figures based on assumed exchange rate of $1.57 / GBP and are as of year-end December 31.

$18.9

$21.3

$23.5

$25.2

(2)

2012E - 2016E Regulatory Asset Base(1) CAGR: 7.9%

$17.6

$25.8

©PPL Corporation 2012

18

Free Cash Flow before

Dividends

Dividends

(Millions of Dollars)

(1) 2010 Free Cash Flow includes two months of the results of the Kentucky Regulated segment.

(1)

Reconciliation of Cash from

Operations to Free Cash Flow

before Dividends

Operations to Free Cash Flow

before Dividends

(Millions of dollars)

Free Cash Flow before Dividends

2010A 2011A 2012E 2013E Cash from Operations $ 2,034 $ 2,507 $ 2,800 Increase (Decrease) in cash due to: Capital Expenditures (1,644) (2,555) (3,840) Sale of Assets 161 381 Other Investing Activities - Net (20) (19) 30 (1) Free Cash Flow before Dividends $ 531 $ 314 $ (1,010) $ -

©PPL Corporation 2012

19

Note: As of March 31, 2012

(1) Excludes $1.15 billion of junior subordinated notes due 2018 that are a component of PPL’s 2010 Equity Units and

may be put back to PPL Capital Funding if the remarketing in 2013 is not successful.

may be put back to PPL Capital Funding if the remarketing in 2013 is not successful.

(2) Excludes $978 million of junior subordinated notes due 2019 that are a component of PPL’s 2011 Equity Units and

may be put back to PPL Capital Funding if the remarketing in 2014 is not successful.

may be put back to PPL Capital Funding if the remarketing in 2014 is not successful.

(3) Bonds defeased in substance in 2008 by depositing sufficient funds with the trustee.

(4) Represents REset Put Securities due 2035 that are required to be put by the holders in October 2015 either for (a)

purchase and remarketing by a remarketing dealer or (b) repurchase by PPL Energy Supply.

purchase and remarketing by a remarketing dealer or (b) repurchase by PPL Energy Supply.

Debt Maturities

(Millions) 2012 2013 2014 2015 2016 PPL Capital Funding $0 $0 (1) $0 (2) $0 $0 LG&E and KU Energy (Holding Co LKE) 0 0 0 400 0 Louisville Gas & Electric 0 0 0 250 0 Kentucky Utilities 0 0 0 250 0 PPL Electric Utilities 0 0 10 (3) 100 0 PPL Energy Supply 0 737 300 300 (4) 350 WPD 0 0 0 0 460 Total $0 $737 $310 $1,300 $810

©PPL Corporation 2012

20

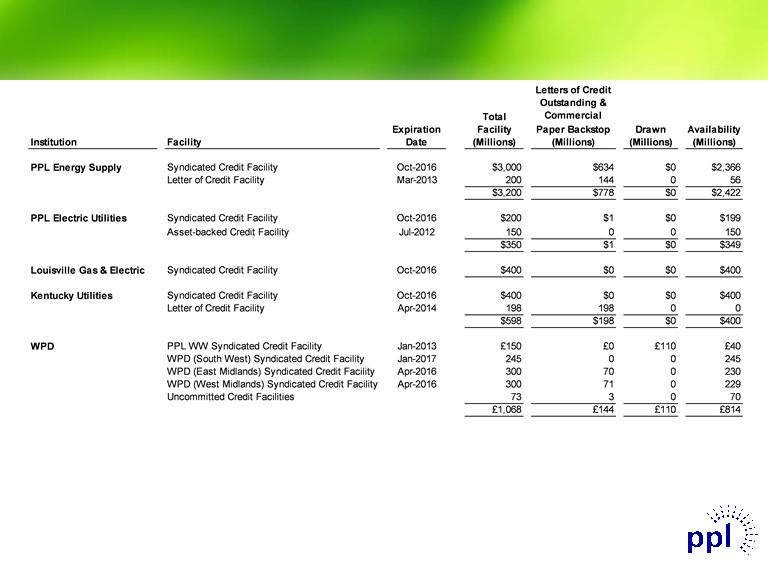

Note: As of March 31, 2012

• Credit facilities consist of a diverse bank group, with no bank and its affiliates providing an aggregate commitment of more than

9% of the total committed capacity for the domestic facilities and 17% of the total committed capacity for WPD’s facilities.

9% of the total committed capacity for the domestic facilities and 17% of the total committed capacity for WPD’s facilities.

(1) In April 2012, PPL Electric Utilities increased the capacity of its syndicated credit facility from $200 million to $300 million.

(1)

(1)

Liquidity Profile

Institution Facility Expiration Date Total Facility

(Millions) Letters of Credit Outstanding & Commercial Paper Backstop (Millions) Drawn (Millions) Availability (Millions) PPL Energy Supply Syndicated Credit Facility Oct-2016 $3,000 $634 $0 $2,366 Letter of Credit Facility Mar-2013 200 144 0 56 $3,200 $778 $0 $2,422 PPL Electric Utilities Syndicated Credit Facility Oct-2016 $200 $1 $0 $199 Asset-backed Credit Facility Jul-2012 150 0 0 150 $350 $1 $0 $349 Louisville Gas & Electric Syndicated Credit Facility Oct-2016 $400 $0 $0 $400 Kentucky Utilities Syndicated Credit Facility Oct-2016 $400 $0 $0 $400 Letter of Credit Facility Apr-2014 198 198 0 0 $598 $198 $0

©PPL Corporation 2012

21

Reconciliation of PPL’s Earnings from Ongoing

Operations to Reported Earnings

Operations to Reported Earnings

(Per Share - Diluted) Forecast Actual High Low 2012 2012 2011 2010 Earnings from Ongoing Operations $ 2.45 $ 2.15 $ 2.73 $ 3.13 Special Items: Adjusted energy-related economic activity, net 0.26 0.26 0.12 (0.27) Foreign currency-related economic hedges (0.02) (0.02) 0.01 Sales of assets: Maine hydroelectric generation business 0.03 Impairments: Emission allowances (0.02) Renewable energy credits (0.01) Acquisition-related adjustments: WPD Midlands: 2011 Bridge Facility costs (0.05) Foreign currency loss on 2011 Bridge Facility (0.07) Net hedge gains 0.07 Hedge ineffectiveness (0.02) U.K. stamp duty tax (0.04) Separation benefits (0.01) (0.01) (0.13) Other acquisition-related costs (0.10) LKE: Monetization of certain full-requirement sales contracts (0.29) Sale of certain non-core generation facilities (0.14) Discontinued cash flow hedges and ineffectiveness (0.06) Reduction of credit facility (0.01) 2010 Bridge Facility costs (0.12) Other acquisition-related costs (0.05) Net operating loss carryforward and other tax related adjustments 0.01 0.01 Other: Montana hydroelectric litigation 0.08 (0.08) Health care reform - tax impact (0.02) Litigation settlement - spent nuclear fuel storage 0.06 Change in U.K. tax rate 0.12 0.04 Windfall profits tax litigation (0.07) 0.03 Counterparty bankruptcy (0.01) (0.01) (0.01) Wholesale supply cost reimbursement 0.01 Total Special Items 0.23 0.23 (0.03) (0.96) Reported Earnings $ 2.68 $ 2.38 $ 2.70 $ 2.17

©PPL Corporation 2012

22

Statements contained in this presentation, including statements with respect to future earnings, cash flows, financing, regulation and

corporate strategy are "forward-looking statements" within the meaning of the federal securities laws. Although PPL Corporation

believes that the expectations and assumptions reflected in these forward-looking statements are reasonable, these statements are

subject to a number of risks and uncertainties, and actual results may differ materially from the results discussed in the statements.

The following are among the important factors that could cause actual results to differ materially from the forward-looking statements:

market demand and prices for energy, capacity and fuel; weather conditions affecting customer energy usage and operating costs;

competition in power markets; the effect of any business or industry restructuring; the profitability and liquidity of PPL Corporation, its

subsidiaries and customers; new accounting requirements or new interpretations or applications of existing requirements; operating

performance of plants and other facilities; the length of scheduled and unscheduled outages at our generating plants; environmental

conditions and requirements and the related costs of compliance, including environmental capital expenditures and emission

allowance and other expenses; system conditions and operating costs; development of new projects, markets and technologies;

performance of new ventures; asset or business acquisitions and dispositions, and PPL Corporation’s ability to realize the expected

benefits from acquired businesses, including the 2010 acquisition of Louisville Gas and Electric Company and Kentucky Utilities

Company and the 2011 acquisition of the Central Networks electricity distribution businesses in the U.K.; any impact of hurricanes or

other severe weather on our business, including any impact on fuel prices; receipt of necessary government permits, approvals, rate

relief and regulatory cost recovery; capital market conditions and decisions regarding capital structure; the impact of state, federal or

foreign investigations applicable to PPL Corporation and its subsidiaries; the outcome of litigation against PPL Corporation and its

subsidiaries; stock price performance; the market prices of equity securities and the impact on pension income and resultant cash

funding requirements for defined benefit pension plans; the securities and credit ratings of PPL Corporation and its subsidiaries;

political, regulatory or economic conditions in states, regions or countries where PPL Corporation or its subsidiaries conduct business,

including any potential effects of threatened or actual terrorism or war or other hostilities; foreign exchange rates; new state, federal or

foreign legislation, including new tax legislation; and the commitments and liabilities of PPL Corporation and its subsidiaries. Any such

forward-looking statements should be considered in light of such important factors and in conjunction with PPL Corporation's Form

10-K and other reports on file with the Securities and Exchange Commission.

corporate strategy are "forward-looking statements" within the meaning of the federal securities laws. Although PPL Corporation

believes that the expectations and assumptions reflected in these forward-looking statements are reasonable, these statements are

subject to a number of risks and uncertainties, and actual results may differ materially from the results discussed in the statements.

The following are among the important factors that could cause actual results to differ materially from the forward-looking statements:

market demand and prices for energy, capacity and fuel; weather conditions affecting customer energy usage and operating costs;

competition in power markets; the effect of any business or industry restructuring; the profitability and liquidity of PPL Corporation, its

subsidiaries and customers; new accounting requirements or new interpretations or applications of existing requirements; operating

performance of plants and other facilities; the length of scheduled and unscheduled outages at our generating plants; environmental

conditions and requirements and the related costs of compliance, including environmental capital expenditures and emission

allowance and other expenses; system conditions and operating costs; development of new projects, markets and technologies;

performance of new ventures; asset or business acquisitions and dispositions, and PPL Corporation’s ability to realize the expected

benefits from acquired businesses, including the 2010 acquisition of Louisville Gas and Electric Company and Kentucky Utilities

Company and the 2011 acquisition of the Central Networks electricity distribution businesses in the U.K.; any impact of hurricanes or

other severe weather on our business, including any impact on fuel prices; receipt of necessary government permits, approvals, rate

relief and regulatory cost recovery; capital market conditions and decisions regarding capital structure; the impact of state, federal or

foreign investigations applicable to PPL Corporation and its subsidiaries; the outcome of litigation against PPL Corporation and its

subsidiaries; stock price performance; the market prices of equity securities and the impact on pension income and resultant cash

funding requirements for defined benefit pension plans; the securities and credit ratings of PPL Corporation and its subsidiaries;

political, regulatory or economic conditions in states, regions or countries where PPL Corporation or its subsidiaries conduct business,

including any potential effects of threatened or actual terrorism or war or other hostilities; foreign exchange rates; new state, federal or

foreign legislation, including new tax legislation; and the commitments and liabilities of PPL Corporation and its subsidiaries. Any such

forward-looking statements should be considered in light of such important factors and in conjunction with PPL Corporation's Form

10-K and other reports on file with the Securities and Exchange Commission.

Forward-Looking Information Statement

©PPL Corporation 2012

23

“Earnings from ongoing operations” should not be considered as an alternative to reported earnings, or net income attributable to PPL, which is an

indicator of operating performance determined in accordance with generally accepted accounting principles (GAAP). PPL believes that “earnings from

ongoing operations,” although a non-GAAP financial measure, is also useful and meaningful to investors because it provides management’s view of

PPL’s fundamental earnings performance as another criterion in making investment decisions. PPL’s management also uses “earnings from ongoing

operations” in measuring certain corporate performance goals. Other companies may use different measures to present financial performance.

indicator of operating performance determined in accordance with generally accepted accounting principles (GAAP). PPL believes that “earnings from

ongoing operations,” although a non-GAAP financial measure, is also useful and meaningful to investors because it provides management’s view of

PPL’s fundamental earnings performance as another criterion in making investment decisions. PPL’s management also uses “earnings from ongoing

operations” in measuring certain corporate performance goals. Other companies may use different measures to present financial performance.

“Earnings from ongoing operations” is adjusted for the impact of special items. Special items include:

• Adjusted energy-related economic activity (as discussed below).

• Foreign currency-related economic hedges.

• Gains and losses on sales of assets not in the ordinary course of business.

• Impairment charges (including impairments of securities in the company’s nuclear decommissioning trust funds).

• Workforce reduction and other restructuring impacts.

• Acquisition-related adjustments.

• Other charges or credits that are, in management’s view, not reflective of the company’s ongoing operations.

Adjusted energy-related economic activity includes the changes in fair value of positions used economically to hedge a portion of the economic value

of PPL’s generation assets, full-requirement sales contracts and retail activities. This economic value is subject to changes in fair value due to market

price volatility of the input and output commodities (e.g., fuel and power) prior to the delivery period that was hedged. Also included in energy-related

economic activity is the ineffective portion of qualifying cash flow hedges, the monetization of certain full-requirement sales contracts and premium

amortization associated with options. This economic activity is deferred, with the exception of the full-requirement sales contracts that were

monetized, and included in earnings from ongoing operations over the delivery period of the item that was hedged or upon realization. Management

believes that adjusting for such amounts provides a better matching of earnings from ongoing operations to the actual amounts settled for PPL’s

underlying hedged assets. Please refer to the Notes to the Financial Statements and MD&A in PPL Corporation’s periodic filings with the Securities

and Exchange Commission for additional information on energy-related economic activity.

of PPL’s generation assets, full-requirement sales contracts and retail activities. This economic value is subject to changes in fair value due to market

price volatility of the input and output commodities (e.g., fuel and power) prior to the delivery period that was hedged. Also included in energy-related

economic activity is the ineffective portion of qualifying cash flow hedges, the monetization of certain full-requirement sales contracts and premium

amortization associated with options. This economic activity is deferred, with the exception of the full-requirement sales contracts that were

monetized, and included in earnings from ongoing operations over the delivery period of the item that was hedged or upon realization. Management

believes that adjusting for such amounts provides a better matching of earnings from ongoing operations to the actual amounts settled for PPL’s

underlying hedged assets. Please refer to the Notes to the Financial Statements and MD&A in PPL Corporation’s periodic filings with the Securities

and Exchange Commission for additional information on energy-related economic activity.

Free cash flow before dividends is derived by deducting capital expenditures and other investing activities-net, from cash flow from operations. Free

cash flow before dividends should not be considered as an alternative to cash flow from operations, which is determined in accordance with GAAP.

PPL believes that free cash flow before dividends, although a non-GAAP measure, is an important measure to both management and investors, as it

is an indicator of the company's ability to sustain operations and growth without additional outside financing beyond the requirement to fund maturing

debt obligations. Other companies may calculate free cash flow before dividends in a different manner.

cash flow before dividends should not be considered as an alternative to cash flow from operations, which is determined in accordance with GAAP.

PPL believes that free cash flow before dividends, although a non-GAAP measure, is an important measure to both management and investors, as it

is an indicator of the company's ability to sustain operations and growth without additional outside financing beyond the requirement to fund maturing

debt obligations. Other companies may calculate free cash flow before dividends in a different manner.

Definitions of Non-GAAP Financial Measures

©PPL Corporation 2012

24

"Kentucky Gross Margins" is a single financial performance measure of the Kentucky Regulated segment's electricity generation, transmission and

distribution operations as well as its distribution and sale of natural gas. In calculating this measure, utility revenues and expenses associated with

approved cost recovery tracking mechanisms are offset. Certain costs associated with these mechanisms, primarily ECR and DSM, are recorded as

"Other operation and maintenance" expense and the depreciation associated with ECR equipment is recorded as "Depreciation" expense. These

mechanisms allow for recovery of certain expenses, returns on capital investments and performance incentives. As a result, this measure

represents the net revenues from the Kentucky Regulated segment's operations.

distribution operations as well as its distribution and sale of natural gas. In calculating this measure, utility revenues and expenses associated with

approved cost recovery tracking mechanisms are offset. Certain costs associated with these mechanisms, primarily ECR and DSM, are recorded as

"Other operation and maintenance" expense and the depreciation associated with ECR equipment is recorded as "Depreciation" expense. These

mechanisms allow for recovery of certain expenses, returns on capital investments and performance incentives. As a result, this measure

represents the net revenues from the Kentucky Regulated segment's operations.

"Pennsylvania Gross Delivery Margins" is a single financial performance measure of the Pennsylvania Regulated segment's electric delivery

operations, which includes transmission and distribution activities. In calculating this measure, utility revenues and expenses associated with

approved recovery mechanisms, including energy provided as a PLR, are offset with minimal impact on earnings. Costs associated with these

mechanisms are recorded in "Energy purchases," "Other operation and maintenance-“ expense, which is primarily Act 129 costs, and in "Taxes,

other than income," which is primarily gross receipts tax. These mechanisms allow for recovery of certain expenses; therefore, certain expenses and

revenues offset with minimal impact on earnings. This performance measure includes PLR energy purchases by PPL Electric from PPL EnergyPlus,

which are reflected in “PLR intersegment utility revenue (expense).” As a result, this measure represents the net revenues from the Pennsylvania

Regulated segment's electric delivery operations.

operations, which includes transmission and distribution activities. In calculating this measure, utility revenues and expenses associated with

approved recovery mechanisms, including energy provided as a PLR, are offset with minimal impact on earnings. Costs associated with these

mechanisms are recorded in "Energy purchases," "Other operation and maintenance-“ expense, which is primarily Act 129 costs, and in "Taxes,

other than income," which is primarily gross receipts tax. These mechanisms allow for recovery of certain expenses; therefore, certain expenses and

revenues offset with minimal impact on earnings. This performance measure includes PLR energy purchases by PPL Electric from PPL EnergyPlus,

which are reflected in “PLR intersegment utility revenue (expense).” As a result, this measure represents the net revenues from the Pennsylvania

Regulated segment's electric delivery operations.

"Unregulated Gross Energy Margins" is a single financial performance measure of the Supply segment's competitive energy non-trading and trading

activities. In calculating this measure, the Supply segment's energy revenues, which include operating revenues associated with certain Supply

segment businesses that are classified as discontinued operations, are offset by the cost of fuel, energy purchases, certain other operation and

maintenance expenses, primarily ancillary charges, gross receipts tax, which is recorded in "Taxes, other than income," and operating expenses

associated with certain Supply segment businesses that are classified as discontinued operations. This performance measure is relevant to PPL

due to the volatility in the individual revenue and expense lines on the Statements of Income that comprise "Unregulated Gross Energy Margins."

This volatility stems from a number of factors, including the required netting of certain transactions with ISOs and significant swings in unrealized

gains and losses. Such factors could result in gains or losses being recorded in either "Wholesale energy marketing" or "Energy purchases" on the

Statements of Income. This performance measure includes PLR revenues from energy sales to PPL Electric by PPL EnergyPlus, which are

reflected in "PLR intersegment utility revenue (expense)." PPL excludes from "Unregulated Gross Energy Margins" the Supply segment's energy-

related economic activity, which includes the changes in fair value of positions used to economically hedge a portion of the economic value of PPL's

competitive generation assets, full-requirement sales contracts and retail activities. This economic value is subject to changes in fair value due to

market price volatility of the input and output commodities (e.g., fuel and power) prior to the delivery period that was hedged. Also included in this

energy-related economic activity is the ineffective portion of qualifying cash flow hedges, the monetization of certain full-requirement sales contracts

and premium amortization associated with options. This economic activity is deferred, with the exception of the full-requirement sales contracts that

were monetized, and included in unregulated gross energy margins over the delivery period that was hedged or upon realization.

activities. In calculating this measure, the Supply segment's energy revenues, which include operating revenues associated with certain Supply

segment businesses that are classified as discontinued operations, are offset by the cost of fuel, energy purchases, certain other operation and

maintenance expenses, primarily ancillary charges, gross receipts tax, which is recorded in "Taxes, other than income," and operating expenses

associated with certain Supply segment businesses that are classified as discontinued operations. This performance measure is relevant to PPL

due to the volatility in the individual revenue and expense lines on the Statements of Income that comprise "Unregulated Gross Energy Margins."

This volatility stems from a number of factors, including the required netting of certain transactions with ISOs and significant swings in unrealized

gains and losses. Such factors could result in gains or losses being recorded in either "Wholesale energy marketing" or "Energy purchases" on the

Statements of Income. This performance measure includes PLR revenues from energy sales to PPL Electric by PPL EnergyPlus, which are

reflected in "PLR intersegment utility revenue (expense)." PPL excludes from "Unregulated Gross Energy Margins" the Supply segment's energy-

related economic activity, which includes the changes in fair value of positions used to economically hedge a portion of the economic value of PPL's

competitive generation assets, full-requirement sales contracts and retail activities. This economic value is subject to changes in fair value due to

market price volatility of the input and output commodities (e.g., fuel and power) prior to the delivery period that was hedged. Also included in this

energy-related economic activity is the ineffective portion of qualifying cash flow hedges, the monetization of certain full-requirement sales contracts

and premium amortization associated with options. This economic activity is deferred, with the exception of the full-requirement sales contracts that

were monetized, and included in unregulated gross energy margins over the delivery period that was hedged or upon realization.

Definitions of Non-GAAP Financial Measures