Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bausch Health Companies Inc. | d361306d8k.htm |

Valeant Pharmaceuticals International, Inc.

Investor Presentation

May 2012

Exhibit 99.1 |

Special Notice Regarding Publicly Available

Information

THE BORROWER HAS REPRESENTED AND WARRANTED TO THE ARRANGER THAT THE INFORMATION

IN THIS DOCUMENT DOES NOT CONSTITUTE OR CONTAIN ANY MATERIAL NON-PUBLIC

INFORMATION WITH RESPECT TO THE BORROWER OR THE TARGET OR ANY PARTY RELATED

THERETO (COLLECTIVELY, “PARTIES”) OR THEIR RESPECTIVE SECURITIES

FOR PURPOSES OF UNITED STATES FEDERAL AND STATE SECURITIES LAWS.

2

Note 1: The guidance in this presentation is only effective as of the date

given, May 3, 2012, and will not be updated or affirmed unless and until

the Company publicly announces updated or affirmed guidance.

|

Forward-looking Statements

3

FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS MADE IN THIS PRESENTATION MAY CONSTITUTE FORWARD-LOOKING STATEMENTS, INCLUDING,

BUT NOT LIMITED TO, STATEMENTS REGARDING THE CLOSING OF PENDING TRANSACTIONS, EXPECTED REVENUE AND

SYNERGIES, PRODUCT APPROVALS AND LAUNCHES AND FINANCIAL GUIDANCE FOR 2012. FORWARD-LOOKING

STATEMENTS MAY BE IDENTIFIED BY THE USE OF THE WORDS “ANTICIPATES,” “EXPECTS,” “INTENDS,” “PLANS,” “COULD,” “SHOULD,”

“WOULD,

” “MAY,”

“WILL,”

“BELIEVES,”

“ESTIMATES,”

“POTENTIAL,” OR

“CONTINUE” AND VARIATIONS

OR SIMILAR EXPRESSIONS. THESE STATEMENTS ARE BASED UPON THE CURRENT EXPECTATIONS AND

BELIEFS OF MANAGEMENT AND ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES THAT COULD CAUSE

ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO, RISKS AND UNCERTAINTIES

DISCUSSED IN THE COMPANY'S MOST RECENT ANNUAL OR QUARTERLY REPORT FILED WITH THE SECURITIES AND

EXCHANGE COMMISSION ("SEC") AND OTHER RISKS AND UNCERTAINTIES DETAILED FROM TIME TO

TIME IN THE COMPANY'S FILINGS WITH THE SEC AND THE CANADIAN SECURITIES ADMINISTRATORS

("CSA"), WHICH FACTORS ARE INCORPORATED HEREIN BY REFERENCE. READERS ARE CAUTIONED NOT

TO PLACE UNDUE RELIANCE ON ANY OF THESE FORWARD-LOOKING STATEMENTS. THE COMPANY UNDERTAKES NO

OBLIGATION TO UPDATE ANY OF THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR

CIRCUMSTANCES AFTER THE DATE OF THIS PRESENTATION OR TO REFLECT ACTUAL OUTCOMES.

NON-GAAP INFORMATION

TO SUPPLEMENT THE FINANCIAL MEASURES PREPARED IN ACCORDANCE WITH GENERALLY ACCEPTED

ACCOUNTING PRINCIPLES (GAAP), THE COMPANY USES NON-GAAP FINANCIAL MEASURES THAT EXCLUDE

CERTAIN ITEMS, SUCH AS AMORTIZATION OF INVENTORY STEP-UP, STOCK-BASED COMPENSATION

STEP-UP, RESTRUCTURING AND ACQUISITION- RELATED COSTSTBD, ACQUIRED IN-PROCESS

RESEARCH AND DEVELOPMENT ("IPR&D"), LEGAL SETTLEMENTS, AMORTIZATION AND OTHER

NON-CASH CHARGES, AMORTIZATION OF DEFERRED FINANCING COSTS, DEBT DISCOUNTS AND ASC

470-20 (FSP APB 14-1) INTEREST, LOSS ON EXTINGUISHMENT OF DEBT, AND (GAIN) LOSS ON INVESTMENTS, NET, AND

ADJUSTS TAX EXPENSE TO CASH TAXES. MANAGEMENT USES NON-GAAP FINANCIAL MEASURES INTERNALLY FOR

STRATEGIC DECISION MAKING, FORECASTING FUTURE RESULTS AND EVALUATING CURRENT PERFORMANCE. BY

DISCLOSING NON-GAAP FINANCIAL MEASURES, MANAGEMENT INTENDS TO PROVIDE INVESTORS WITH A

MEANINGFUL, CONSISTENT COMPARISON OF THE COMPANY’S CORE OPERATING RESULTS AND TRENDS FOR THE PERIODS PRESENTED.

NON-GAAP FINANCIAL MEASURES ARE NOT PREPARED IN ACCORDANCE WITH GAAP; THEREFORE, THE INFORMATION

IS NOT NECESSARILY COMPARABLE TO OTHER COMPANIES AND SHOULD BE CONSIDERED AS A SUPPLEMENT TO,

NOT A 2012

FIRST

QUARTER

FINANCIAL

RESULTS

FOR

2012,

WHICH

CAN

BE

FOUND

AT

www.valeant.com. SUBSTITUTE FOR,

OR SUPERIOR TO, THE CORRESPONDING MEASURES CALCULATED IN ACCORDANCE WITH GAAP.

FURTHER RECONCILIATIONS ARE ALSO AVAILABLE IN THE COMPANY’S PRESS RELEASE DATED MAY 3, 2012, REPORTING ITS

|

Agenda

Executive Summary & Transaction Overview

Business Overview

Key Investment Considerations

Historical Financial Overview

Questions and Answers

4 |

Transaction Overview |

6

Transaction Overview

Valeant

Pharmaceuticals

International,

Inc.

(“Valeant”

or

the

“Company”)

is

a

multinational

specialty

pharmaceutical company with a diverse global product portfolio

Valeant has continued to demonstrate strong financial performance

For the LTM period ended March 31, 2012, the Company generated $2,755 million of

revenue and $1,876

million

of

adjusted

EBITDA

1

The

Company

expects

2012

revenue

of

$3.4

-

$3.6

billion

Low

effective

tax

rate

and

capex

resulted

in

free

cash

flow

of

$886

million

2

for

2011

and

$311

million

2

for the 3 months ended March 31, 2012

Valeant is planning to syndicate a new $500 million incremental Senior Secured

Term Loan B Facility (“Term Loan B”) to repay borrowings under

its revolving credit facility and for general corporate purposes, including

acquisitions This will allow Valeant to maintain adequate liquidity and

financial flexibility Pro

forma

senior

secured

leverage

will

be

1.7x

3

(synergy

adjusted)

and

total

leverage

will

be

3.9x

3

(synergy adjusted) based on LTM March 31, 2012 pro forma adjusted EBITDA of $1,876

million Shortly

after

the

funding

date

the

company

expects

to

complete

a

recently

commenced

restructuring of certain foreign subsidiary ownership.

Upon completion of the international

restructuring, substantially all of the IP rights will be held by newly-formed

Luxembourg, Ireland and Bermuda subsidiaries of VPII, each of which shall

become guarantors of the senior credit facilities and pledge all or

substantially all of their assets to secure those guarantees 6

¹

EBITDA adjusted for one-time items including acquired in-process R&D,

restructuring costs, legal settlements, acquisition-related costs, impairment costs, and other one-

time

items;

pro

forma

to

reflect

the

full

LTM,

synergized

impact

of

Elidel,

Dermik,

Sanitas,

Ortho

Dermatologics,

Afexa,

iNova,

Gerot

Lannach,

Probiotica,

Natur

Produkt,

University

Medical,

Atlantis,

Pedinol,

and

EyeTech

acquisitions.

Additional

details

on

pg.

37.

2

Not pro forma for the full LTM synergized impact of Elidel, Dermik, Sanitas, Ortho

Dermatologics, Afexa, iNova, Gerot Lannach, ProBiotica, Natur Produkt, University

Medical, Atlantis, Pedinol, and EyeTech acquisitions.

3

Net of $150 million in cash |

7

Sources and Uses

($ in millions)

Sources

Incremental Term Loan B

$500

Total Sources

$500

Uses

Cash to Balance sheet for General Corporate

Purposes, Including Acquisitions

$230

Revolver Repayment

70

Natur Produkt Acquisition

180

OID, Fees and Expenses

20

Total Uses

$500 |

8

¹

EBITDA adjusted for one-time items including acquired in-process R&D,

restructuring costs, legal settlements, acquisition-related costs, impairment costs, and other one-

time

items;

pro

forma

to

reflect

the

full

LTM,

synergized

impact

of

Elidel,

Dermik,

Sanitas,

Ortho

Dermatologics,

Afexa,

iNova,

Gerot

Lannach,

Probiotica,

Natur

Produkt,

University Medical, Atlantis, Pedinol, and EyeTech acquisitions.

2

Estimated cash balance as of May 2012 pro forma for the transaction.

3

Reflects repurchase activity between March 2012 and May 2012.

4

In the 3 month period ended March 31, 2012 the Company repurchased $1.1 million

principal amount of its 5.375% senior convertible notes due 2014 for a purchase price

of $4.0 million. Convertible debt balance inclusive of unamortized discount.

5

Based upon closing price on 22-May-2012.

Note: Leverage multiples are calculated based on total debt net of $150 million of

cash and cash equivalents per the credit agreement definition. Pro Forma

Capitalization ($ in millions)

03-31-2012

Amount

05-31-2012E

PF Amount

% of

Capitalization

x LTM

3/31/2012

PF EBITDA¹

Coupon

Maturity

Cash²

$330

$407

Revolver ($275 million)

0

0

L+275

April 20, 2016

Term Loan A

2,160

2,160

L+275

April 20, 2016

Term Loan B

591

591

L+275

February 13, 2019

New Term Loan B

500

TBD

February 13, 2019

Total Senior Secured Debt

$2,751

$3,251

15%

1.7x

6.500% Senior Unsecured Notes³

916

916

6.500%

2016

6.750% Senior Unsecured Notes

498

498

6.750%

2017

6.875% Senior Unsecured Notes³

939

939

6.875%

2018

7.000% Senior Unsecured Notes

686

686

7.000%

2020

6.750% Senior Unsecured Notes

650

650

6.750%

2021

7.250% Senior Unsecured Notes

541

541

7.250%

2022

5.375%

BVF

Convertible

Notes

18

18

5.375%

2014

Total Debt

$6,999

$7,498

34%

3.9x

Market

Capitalization

14,618

14,618

Total Capitalization

$21,614

$22,314

100%

3/31/2012 LTM Pro Forma Adjusted EBITDA¹

$1,876

4

5 |

9

Key Transaction Highlights

Focused

R&D

Spend

with

Strong

Pipeline

of

Future

Products

Capital Structure with Significant Equity Value &

Modest Leverage

Diversified Specialty Pharmaceutical Company

Strong Management Team

Significant Free Cash Flow Generation

9

Uniquely Positioned Product Portfolio

Favorable Industry Dynamics

Successful Integration Track Record |

Business Overview |

11

Overview of Valeant

Headquartered in Montreal, Quebec, Valeant is a multinational specialty

pharmaceutical company with a diverse global product portfolio

The Company has over 900 products and over 5,800 SKUs, with no product

contributing more than 10% of total revenue

In September 2010, Valeant Pharmaceuticals International underwent a

transformative merger

with

Biovail,

creating

a

“New

Valeant”

(the

“Company”)

with

expanded

scale

and

global presence

For the LTM period ended March 31, 2012, the Company generated $2,754 million of

revenue and $1,876 million of adjusted EBITDA

1

The Company’s specialty pharmaceutical, branded generics and OTC

products are divided into four main business lines

2

:

U.S. Dermatology –

Branded pharmaceutical and OTC dermatology products

U.S. Neurology and Other –

Branded neurology products and OTC products

Canada and Australia –

Branded and generic Pharmaceutical and OTC products

Emerging

Markets

–

Branded

generic

pharmaceutical

products

historically

sold

primarily in Europe (Poland, Serbia, Hungary, Croatia and Russia), Latin America

(Mexico, Brazil and exports out of Mexico), South East Asia and South

Africa 11

¹

EBITDA adjusted for one-time items including acquired in-process R&D,

restructuring costs, legal settlements, acquisition-related costs, impairment costs, and other one-

time

items;

pro

forma

to

reflect

the

full

LTM,

synergized

impact

of

Elidel,

Dermik,

Sanitas,

Ortho

Dermatologics,

Afexa,

iNova,

Gerot

Lannach,

Probiotica,

Natur

Produkt,

University

Medical,

Atlantis,

Pedinol,

and

EyeTech

acquisitions.

Please

see

schedule

on

page

37.

2

New segment reporting effective the first quarter of 2012

|

12

Valeant’s Operating Philosophy

Low cost operating structure

Minimal headquarters staff

All managers work in addition to manage, including CEO

True performance-based pay

Don’t bet on science,

bet on management

Avoid discovery

Litmus test all development efforts through partnering

Low cost, low risk programs –

singles and doubles, not home runs

Invest in branded, generic,

and OTC across select attractive

geographies

Not overly dependent on any one product or geography

Manage our risk -

avoid gambling on new chemical entities (NCEs)

Acquiring under managed companies with marketed products has

higher returns than traditional R&D

Avoid the big guys in the areas

where they are strong

Broad

indications

in

high

profile

therapeutics

areas

–

cardiovascular,

oncology, vaccines

Countries –

U.S., Western Europe, Japan, China

Primary care, building new diseases, blockbuster categories

Do not fall in love with your assets –

be willing to sell, partner, shut down

Big pharma overpays for scarce “strategic”

assets

Ultimate scorecard is shareholder return

If an asset is worth more to someone else, recognize it

12 |

13

Valeant’s Operating Philosophy (cont.)

Be prudent about investing

ahead of need –

curse of the industry

Spending on future indications before drug is approved

Building sales force—which is a commodity—ahead of demand

Infrastructure

–

either

geographic,

corporate

Business Development is a

CEO and line responsibility

Deployment of capital is most important decision for CEO and Board

Line management should be involved and select, negotiate, own and

be held accountable for deals

Change is good –

management

change quickly in underperforming

units

Reinforces

accountability

–

both

in

and

beyond

unit

New ideas, new energy

Speed and lack of bureaucracy is the

greatest advantage for a small

company

Clear accountabilities, clear strategy

Clear performance metrics

No excuses culture

Embrace fact-based decision-making

Positional power if not accompanied by open-mindedness, smarts,

and track record is dangerous

Facts trump opinion

Meritocratic culture

13 |

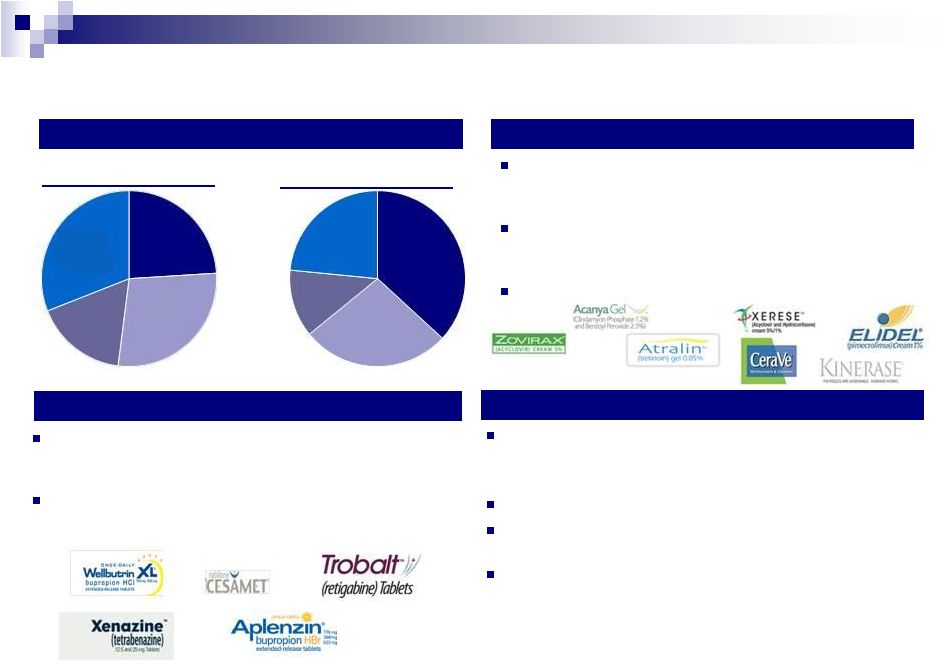

14

Valeant’s Key Marketed Products

Dermatology

14

Products focused on patients suffering from actinic

keratoses, skin cancer, acne, psoriasis, skin-aging

and pigmentation

Platform has grown through the acquisitions of Vital

Science, Dermik, Ortho Dermatologic, Elidel and

Zovirax over the past several years

24% organic product sales growth in Q1 2012

Neurology

Targets neurological diseases such as epilepsy,

migraines, depression, chronic pain, Huntington’s

disease, Parkinson’s disease and orphan diseases

6% organic product sales growth in Q1 2012

(excluding Welbutrin XL, Cardizem CD and Ultram

ER)

Branded Generics in Emerging Markets

Branded generics business develops, markets and

manufactures products that are equivalent to their brand

name counterparts

Robust pipeline of over 250 new product launches

Emerging markets area of high focus, with 12% organic

growth in Q1 2012

Platform has grown through recent acquisitions of Natur

Produkt and Gerot Lannach in Russia, as well as

Probiotica in Brazil

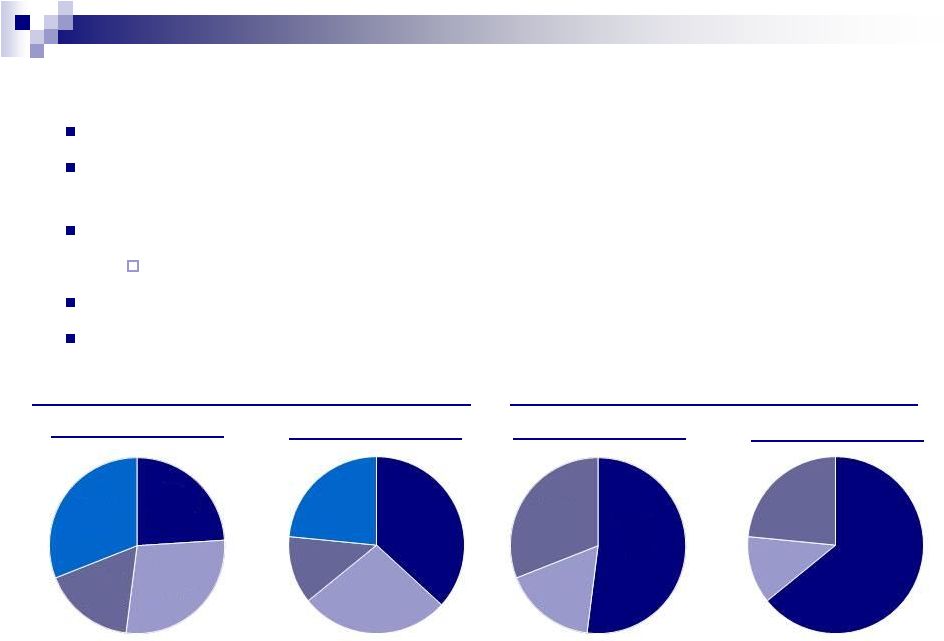

Product Sales by Segment

1

Q1 2012

Q1 2011

¹

Q1 2012 total revenue of $856 million and Q1 2011 revenue of $565 million. The

percentages exclude dermatology divestiture in Q1 2012 of $66m and $36m in Q1 2011.

Canada

and

Australia

17%

Emerging

Markets

31%

U.S.

Dermatology

28%

U.S.

Neurology

24%

U.S.

Neurology

38%

Emerging

Markets

23%

U.S.

Dermatology

27%

Canada

and

Australia

12% |

15

15

Geographic Diversity

Tailored Market Approach by Region

¹

Q1 2012 total revenue of $856 million and Q1 2011 revenue of $565 million. The

percentages exclude dermatology divestiture in Q1 2012 of $66m and $36m in

Q1 2011. Valeant Canada

Specialty Pharma

Valeant US

Specialty Pharma

Valeant Latin America

Branded Generics

Valeant Latin America

Branded Generics

Valeant South Africa

Specialty Pharma

Valeant Australia

Specialty Pharma

Valeant South East Asia

Specialty Pharma

Valeant Europe

Branded Generics |

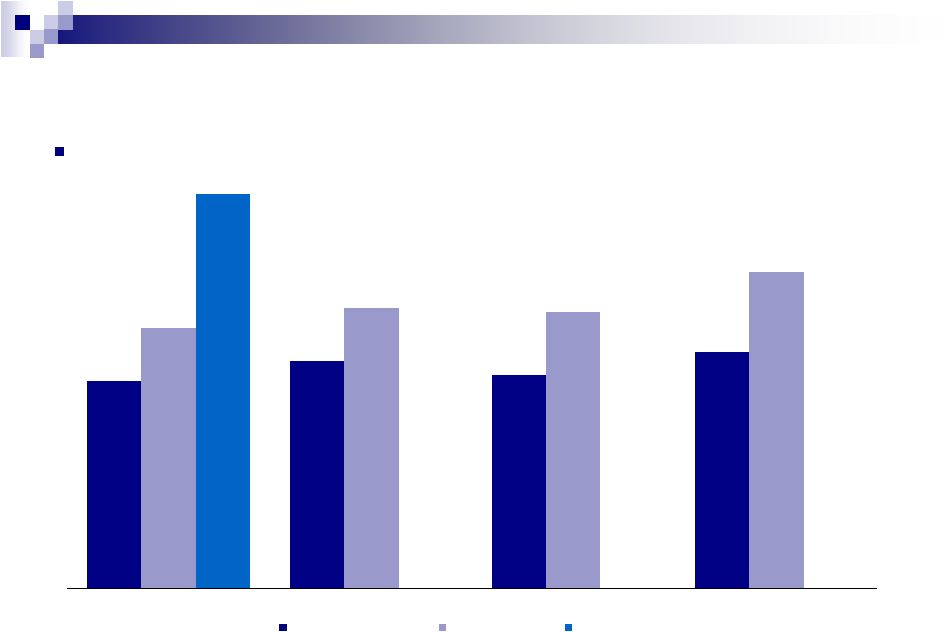

16

Consistent Financial Performance

($ in millions)

Note: Historical financials for Valeant exclude certain pro forma run rate

adjustments for completed acquisitions for which financials have not been made publicly available.

¹

EBITDA adjusted for one-time items including acquired in-process R&D,

restructuring costs, legal settlements, acquisition-related costs, impairment costs and other one-

2

Adjusted for one-time items and stock-based compensation expense included

in SG&A. 16

Q1 2012 organic product growth of 11%

Strong organic growth across key dermatology brands

$157

$143

$336

$1,125

$1,326

$1,535

$690

$657

$830

$1,928

$2,463

$2,755

FY 2007A

FY 2008A

FY 2009A

FY 2010A

FY 2011A

LTM 31-Mar-2012

EBITDA

Revenue

R&D (% of Revenue)

Feb-08: Mr. Michael Pearson hired

as CEO of Legacy Valeant

Sep-2010: Transformative merger

of Legacy Valeant with Biovail

time items.

SG&A

(%

of

Revenue)

EBITDA

Margin

1

2

58%

14%

42%

13%

42%

5%

31%

6%

23%

3%

23%

3%

22%

56%

54%

40%

22%

23% |

2012

YTD Achievements Successful acquisition agenda

Announced 9 transactions year to date

~$625 million in total purchase price; averaged <2.0x sales

Expanded growth platforms in Russia and Brazil

Multiple integrations completed and ongoing

Several underway: Europe, US Dermatology and Australia

R&D productivity and product launches

Late stage successes: IDP-108

Robust regional programs

100+ new OTC and Branded Generics products approved/launched in ex-US

markets Working Capital Improvement

Improved from 35% of LTM revenue in Q4 11 to 30% of LTM revenue in Q1 12

Inventory increased vs Q4 due to stock build related to tech transfers (Brazil,

U.S.)

Securities Repurchase Program

Repurchased over 5.26 million common shares for an aggregate purchase price

of $281 million; 316 million fully diluted share count as of March 31, 2012

17 |

New

Product Pipeline Geography

Key Pipeline Highlights

US/Global

•

IDP 108: Onychomychosis (PIII)

•

IDP 107: Oral acne (PII)

•

IDP 118: Psoriasis (PI)

•

Multiple life cycle management

Canada

•

Opana: Pain

•

Multiple OTC programs

Australia

•

Opana: Pain

•

Ziana: Acne

•

Multiple OTC programs

•

iNova pipeline: Rx, OTC, Branded Generics

Central and Eastern Europe

•

200+ Branded Gx and OTC products

•

25+ representation products

Latin America

•

50+ branded Generics and OTC products

South East Asia / South Africa

•

iNova pipeline: Rx, OTC, Branded Generics

18 |

Acquisition Updates

Announced YTD 2012

Swiss Herbal Remedies (Canada) –

(Expected to close by June)

Probiotica (Brazil) –

Closed

EyeTech (U.S.) –

Closed

Pele Nova (Brazil) –

Closed

Pedinol (U.S.) –

Closed

Natur Produkt (Russia) –

(Expected to close mid-year)

Gerot Lannach (Russia) –

Closed

Atlantis (Mexico) –

Closed

AcneFree (U.S.) –

Closed

Other Transactions

Divested Bioskin

Acquired assets –

Ortho Dermatologics –

Canada

Acquired assets –

Ortho Dermatologics –

Brazil

19

Total Purchase Price =

~$625 million

Expected 2012 Revenue Run Rate =

~$280 million

Sales Multiple Paid =

<2.0x

As part of our business strategy, we pursue acquisitions as opportunities arise.

We are actively evaluating and engaging in discussions concerning potential

acquisition targets, some of which could occur in the near term and/or could

be material |

Progress on 2012 Synergy Program

20

Run rate

expected by mid-

year

Run Rate

May 3, 2012

$200 million

$165 million

Run Rate

Feb 23, 2012

$135 million

Run rate

expected by Year-

end

$230+ million*

* Includes acquisitions announced and closed in 2012 |

Annual Financial Guidance for 2012

21

Previous Guidance

Revenue $3.1 -

$3.4 billion

$3.95 -

$4.20 Adjusted Cash

EPS

> $1.2 billion in Adjusted

Cash Flow from Operations

As of May 3, 2012*

Revenue > $3.4 -

3.6 billion

$4.45 -

$4.70 Adjusted Cash

EPS

> $1.4 billion in Adjusted

Cash Flow from Operations

*

Earnings

guidance

as

of

the

given

date

of

May

3

,

2012

only.

Please

see

Note

1.

rd |

Investment Considerations |

23

Key Transaction Highlights

Focused

R&D

Spend

with

Strong

Pipeline

of

Future

Products

Capital Structure with Significant Equity Value &

Modest Leverage

Diversified Specialty Pharmaceutical Company

Strong Management Team

Significant Free Cash Flow Generation

23

Uniquely Positioned Product Portfolio

Favorable Industry Dynamics

Successful Integration Track Record |

Q1

2011 Diversified Specialty Pharmaceutical Company

More than 900 products marketed with over 5,800 SKUs

Vast array of therapeutic categories including neurology, dermatology, and a broad

generics business

Highly diversified revenue stream

No product contributing more than 10% of total revenue

Limited near term patent and U.S. healthcare reform risk

Broad geographic distribution further enhanced by recent acquisitions

24

Product

Sales

by

Segment

1

Product

Sales

by

Geography

1

Q1 2012

Q1 2011

Q1 2012

¹

Q1 2012 total revenue of $856 million and Q1 2011 revenue of $565 million. The

percentages exclude dermatology divestiture in Q1 2012 of $66m and $36m in Q1

2011.

Canada

and

Australia

17%

Emerging

Markets

31%

U.S.

Dermatology

28%

U.S.

Neurology

24%

United

States

52%

Canada

and

Australia

17%

Emerging

Markets

31%

U.S.

Neurology

38%

Emerging

Markets

23%

U.S.

Dermatology

27%

Canada

and

Australia

12%

Emerging

Markets

23%

United

States

65%

Canada

and

Australia

12% |

Uniquely Positioned Product Portfolio

Product portfolio contains few products that necessitate large R&D or

promotional spend Existing marketed products and sizeable generics business

mitigate the risk of market share erosion due to generic competition

25

Product Segment

Comments

Emerging Markets

Central Europe

Latin America

South Africa

Southeast Asia

Highly diversified product mix with >500 products

No patent expiry risk

Robust pipeline of >250 new product launches

Dermatology

Zovirax

Topical cream and ointment for the treatment of herpes

Off

patent

since

1997

and

still

retains

a

majority

of

the

market

share

for

the

treatment

of

topical

herpes

As a topical, it is difficult to demonstrate bioequivalence, hindering the

development of a competing generic product Neurology

Wellbutrin XL

Antidepressant drug which has been off patent for several years yet still retains

strong market position in the U.S. Ability to stay ahead of the generic

erosion curve has been attributed in part to concerns about generics having potentially differing

efficacy to the branded version

Considerable brand loyalty among physicians has developed as it tends to be a

3rd/4th line treatment for depression Xenazine

Approved

in

the

U.S.

for

the

treatment

of

chorea

associated

with

Huntington’s

disease;

Only

approved

treatment

in

the

U.S.

-

commands premium pricing and extended IP leverage through its orphan drug

designation Sold in the U.S. through Lundbeck and in Canada (brand name

Nitoman, where it is also approved for other indications) OTC and Other

CeraVe

OTC skin care line continues to see significant growth; CeraVe grew 52% YoY in

2011 versus 2010 Frequently ranked as the most recommended skin care product

by dermatology nurses (over 70% of the time) 2012

2013

2014

2015

2016

Products

1) Benzaclin

None

1) Atralin

1) Xenazine

2) Acanya

1) Retin-A Micro

2) Elidel

Total 2011

Revenue

~$76 million

$0

~$25 million

~$140 million

~$150 million

US Patent Exposure |

26

Favorable Industry Dynamics

Large and growing market

2010 Global pharmaceutical market sales of $875 billion

Market

expected

to

grow

at

a

3

-

6%

compound

rate

to

~$1.1

trillion

by

2015

Aging demographics will continue to drive global healthcare spend

Near-term opportunities for generic and specialty pharmaceutical

companies Branded Generics / OTC

Global

generic

spend

is

expected

to

grow

at

a

13.1%

CAGR

through

2015,

driven

by

both

emerging

markets

and

developed

markets

working

to

reduce

healthcare expenditure

Selected Specialty Areas (ex. Dermatology, Oncology and Pain)

Emerging Markets

Pharmaceutical sales in key emerging markets are expected to nearly double

in sales, adding $150 billion by 2015

Limited patent risk

26

Source: IMS Health and Wall Street Research

1

Inclusive of anti-depressants and mood stabilizers.

|

27

Focused R&D Spend with Targeted Pipeline of

Future Products

Valeant’s

“Leveraged

R&D”

allows

the

company

to

progress

development

programs

while

limiting

R&D

spend

and

increasing

the

probability

of

success

and effectiveness

for the compounds in its pipeline

The Company strategically partners and in-licenses products, annual R&D

expenditure ~3% of sales

Valeant has a strong history of effective partnerships and in-licensing

Potiga / Trobalt

1

partnership with GSK

Licensing agreements with Meda on Elidel, Xerese, etc

¹

Trobalt is now referred to as Potiga in the United States; Trobalt remains the

brand name for territories outside the United States. 27

|

28

Successful

Integration Track

Record

Proven integration process drives significant synergies and improved

organic growth

The senior management team has significant experience managing

integrations, having completed ~30 product and / or company acquisitions of

various sizes over the past 4 years, including:

Most notably, Valeant’s merger with Biovail which closed in September

2010 demonstrated synergy realization well ahead of schedule

AcneFree

Atlantis

Aton Pharma

Delta

Biovail / Valeant Merger

Bunker

Coria Labs

Dermatech

Dermik Laboratories

Dow Pharmaceutical Sciences

EMO-FARM

EyeTech

Gerot Lannach

iNova

Laboratoire Dr. Renaud

Natur Produkt

Ortho Dermatologics

Pedinol

Pele Nova (minority stake)

PFI

PharmaSwiss

Probiotica

Sanitas

Swiss Herbal Assets

Tecnofarma

Vital Science

Zovirax

Nov-2010 Estimate

Jan-2011 Estimate

Current Estimate

Full Year Run Rate

$300 million

$300 million

$350 million

Time to Achieve

End of 2012

End of 2012

End of 2012

2011 P&L Impact

$200 million +

$250 million +

$300 million + |

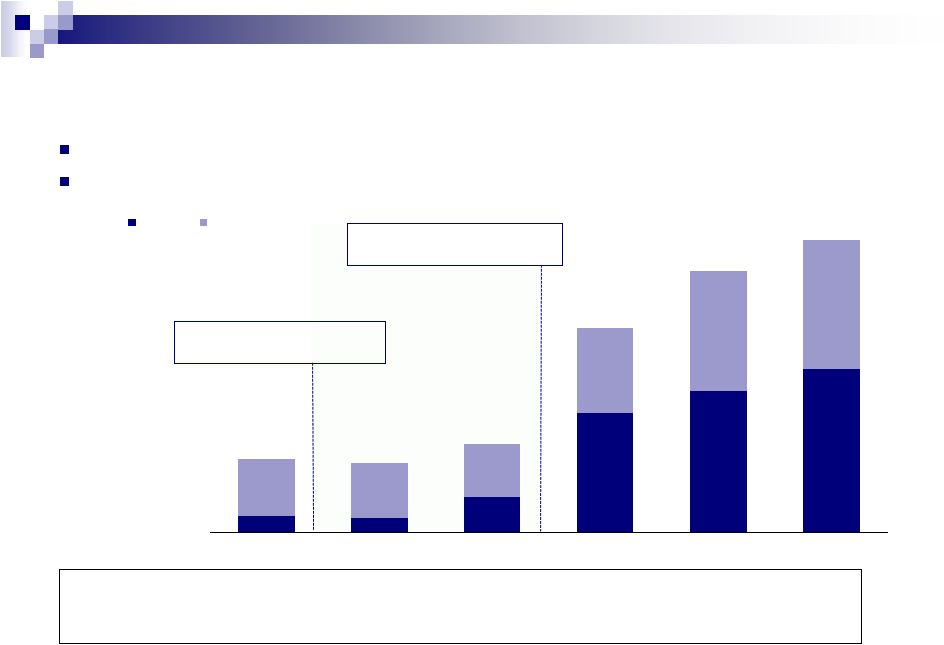

Significant Free Cash Flow Generation

Valeant’s top-line growth, high operating

margins, modest capital expenditures and

working capital requirements result in

significant free cash flow generation

2011 Free Cash Flow of $866 million

(excluding synergies)

Pro forma free cash flow supported by

efficient corporate structure (low corporate

cash tax rate < 10%)

Limited capital needs

2011 capital expenditures of ~$48

million

Note: Historical financials for Valeant exclude certain pro forma run rate

adjustments for completed acquisitions for which financials have not been made publicly available.

1

Free

Cash

Flow

defined

as

operating

cash

flow

less

capital

expenditures.

Not

pro

forma

for

the

full

LTM

synergized

impact

of

Elidel,

Dermik,

Sanitas,

Ortho

Dermatologics,

Afexa, iNova, Gerot Lannach, ProBiotica, Natur Produkt, University Medical,

Atlantis, Pedinol, and EyeTech acquisitions. 29

Ability to Generate Cash

Valeant’s ability to generate cash will enable it to pay down debt while

providing the financial flexibility to continue to invest in its

business $482

$434

$740

$1,103

$1,268

$1,487

$64

$39

$27

$22

$59

$48

FY 2007A

FY 2008A

FY 2009A

FY 2010A

FY 2011A

LTM 31-

Mar-

2012

EBITDA-CapEx

CapEx

1 |

$21,709

$3,251

$7,498

Enterprise Value

Debt

Secured Debt

Total Debt

Capital Structure with Significant Equity Value

and Modest Leverage

($ in millions)

Conservatively capitalized with total debt to capitalization of 34%

Pro Forma Senior Secured Leverage of 1.7x and Total Leverage of 3.9x

1

Market capitalization as of 22-May-2012.

2

Debt balances pro forma for proposed $500 million capital raise

30

Specialty Pharma Landscape

Significant Enterprise Value Coverage

~6.7x

Coverage

~2.9x

Coverage

$28,091

$16,624

$14,618

$9,404

$9,075

$8,768

$5,169

$4,073

Allergan

Shire

Valeant

Mylan

Watson

Forest

Warner

Chilcott

Endo

1

2 |

31

Experienced Management Team

31

Valeant has a strong management team with substantial industry experience

Valeant is led by Chairman and Chief Executive Officer J. Michael Pearson

Pearson previously served as Head of the Global Pharmaceutical Practice and head

of the Mid- Atlantic region of McKinsey & Company

Over

a

23-year

career,

he

has

worked

with

leading

Chief

Executive

Officers

and

was

an

integral

driver of major turnarounds, acquisitions and corporate strategy

J. Michael Pearson

Chairman of the Board and Chief

Executive Officer

Appointed Chairman and CEO of Legacy Valeant in February 2008

Prior to joining, Mr. Pearson was a Director at McKinsey & Company

Prior

McKinsey

positions

include:

McKinsey's

Board

of

Directors,

head

of

the

global

Pharmaceutical

Practice and head of McKinsey's mid-Atlantic region

Howard Schiller

Executive Vice President and Chief

Financial Officer

Mr. Schiller joined Valeant in December 2011

Prior to joining, Mr. Schiller was Chief Operating Officer for the Investment

Banking Division at Goldman Sachs, responsible for the management and

strategy of the business During his 24 years at Goldman Sachs, Howard

advised large multinational companies on strategic transactions,

financings, restructurings, and leveraged buyouts Rajiv De Silva

President and Chief Operating Officer of

Specialty Pharmaceuticals

Mr. De Silva joined Legacy Valeant in January 2009

Previously, Mr. De Silva held various leadership positions with Novartis AG

including President, Novartis Vaccines USA and Head, Vaccines of the

Americas Mr. De Silva was previously a partner at McKinsey, focused on the

pharmaceutical industry Robert Chai-Onn

Executive Vice President, General

Counsel & Corporate Secretary

Mr. Chai-Onn joined Legacy Valeant in 2004 as Vice President, Assistant

General Counsel Prior to joining Valeant, he was a corporate lawyer at the

law firm of Gibson, Dunn & Crutcher LLP Brian Stolz

Executive Vice President &

Chief Human Capital Officer

Mr. Stolz joined Valeant in July 2011

Prior to joining Valeant, he was a Principal at ghSMART and a consultant at

McKinsey & Co. |

Historical Financial Overview |

Adjusted

EBITDA

–

CAPEX

1

33

33

Pro Forma Financial Review

($ in millions)

Revenue

Adjusted EBITDA

1

Source: Public Company Filings

Note: Historical financials for Valeant exclude certain pro forma run rate

adjustments for completed acquisitions for which financials have not been made publicly available.

1

EBITDA adjusted for one-time items including acquired in-process R&D,

restructuring costs, legal settlements, acquisition-related costs, impairment costs, and other one-

time items; Not pro forma to reflect the full LTM, synergized impact of Elidel,

Dermik, Sanitas, Ortho Dermatologics, Afexa, iNova, Gerot Lannach, ProBiotica, Natur

Produkt, University Medical, Atlantis, Pedinol, and EyeTech acquisitions. $48

million of 3/31/2012 LTM Capital Expenditures. 2

Free

Cash

Flow

defined

as

operating

cash

flow

less

capital

expenditures,

excludes

expected

synergies.

Not

pro

forma

for

the

full

LTM

synergized

impact

of

Elidel,

Dermik,

Sanitas,

Ortho

Dermatologics,

Afexa,

iNova,

Gerot

Lannach,

ProBiotica,

Natur

Produkt,

University

Medical,

Atlantis,

Pedinol,

and

EyeTech

acquisitions.

Free

Cash

Flow

2

Valeant

Biovail

Synergies |

$452

$495

$464

$515

$565

609

$601

$688

$856

Q1

Q2

Q3

Q4

34

Quarterly Revenue Trends

($ in millions)

34

Note: Includes out-license of Cloderm in Q1’2011 and divestiture of

dermatology products in Q1’12 Consistent quarter over quarter

performance Pro Forma 2010

2011A

2012A |

First

Quarter Performance ($ in millions)

35

11% organic revenue growth in 1Q 2012 (excluding

the impact of foreign exchange and acquired sales)

Strong volume increases across all segments outside

of U.S. Neurology

74% gross profit margin in Q1 2012

$113 million spend in Q1 2012 under the new $1.5

billion securities repurchase program approved in

November 2011

~$172 million spend in Q2 2012, bringing total

program spend to $443 million since November 2011

$565

$856

1Q 2011

1Q 2012

Total Revenue

Adjusted Cash Flow from Operations

$204

$322

1Q 2011

1Q 2012

–

Increased Canada contract manufacturing

–

Product mix (U.S. & Europe)

–

Unfavorable exchange rates (Europe)

–

Delayed plant construction

—

Sequential increases in cost of goods sold: |

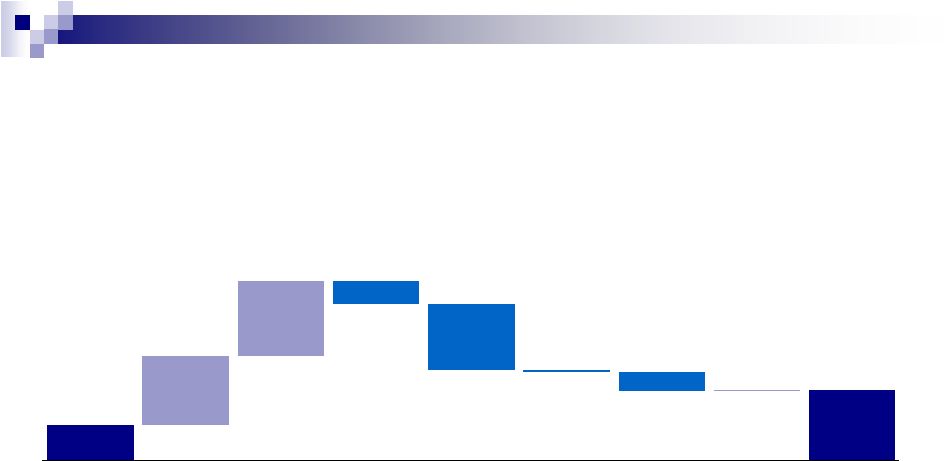

Q1

2012 Cash Flow Bridge ($ in millions)

36

$164

$322

$350

$113

$302

$11

$87

$8

$330

Cash

December

2011

Securities

Repurchases

Acquisitions

CapEx

Restructuring/

Integration/

Legal

Settlements

Other²

Cash

March

2012

Net Issuance

LT Debt

Net

Cash Flow

Generated¹

¹ Includes impact of divestiture of IDP-111 and 5FU 2

Includes payment of withholding tax upon vesting of share based awards, one-time

working capital adjustments, proceeds from the exercise of stock options and other

miscellaneous cash outflows |

37

Pro Forma EBITDA Reconciliation

37

March 31, 2012 LTM EBITDA ($ millions)

GAAP Operating Income

$287

+ Restructuring and Other Acquisition Related Costs¹

180

+ Acquired In-Process R&D

107

+ Legal Settlements

15

+ Purchase Price Step-Ups²

164

+ Stock-Based Compensation Expense

33

+ Depreciation and Amortization and Other Non-Cash Charges

701

+ Other one-time Adjustments³

48

LTM 31-March-2012 Adjusted EBITDA

$1,535

+ EBITDA

and

Synergy

Adjustments

for

Announced

and

Completed

Acquisitions

4

341

LTM 31-March-2012 Pro Forma Adjusted EBITDA

$1,876

1

Restructuring and other acquisition related costs include R&D cancellation and wind-down

costs, employee severance, accelerated equity compensation, facility closures, and

other restructuring costs. 2

Adjustments from purchase price step-ups from acquisitions including inventory, PP&E, and

stock-based compensation. 3

Includes one-time FX adjustments.

4

Includes LTM EBITDA and synergy contribution from completed acquisitions of Elidel, Sanitas, Dermik,

Ortho Dermatologics, Afexa, iNova, Gerot Lannach, Probiotica, University Medical,

Atlantis, Pedinol and EyeTech and LTM EBITDA and synergy contribution from announced but not yet completed acquisitions of Natur Produkt for

the twelve month period ended March 31, 2012.

|

Questions and Answers |