Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - RealD Inc. | Financial_Report.xls |

| EX-23.1 - EX-23.1 - RealD Inc. | a2209785zex-23_1.htm |

| EX-31.1 - EX-31.1 - RealD Inc. | a2209785zex-31_1.htm |

| EX-32.1 - EX-32.1 - RealD Inc. | a2209785zex-32_1.htm |

| EX-31.2 - EX-31.2 - RealD Inc. | a2209785zex-31_2.htm |

| EX-21.1 - EX-21.1 - RealD Inc. | a2209785zex-21_1.htm |

| EX-32.2 - EX-32.2 - RealD Inc. | a2209785zex-32_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial statements and supplementary data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED MARCH 23, 2012 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-34818

RealD Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

77-0620426 (I.R.S. Employer Identification No.) |

|

100 N. Crescent Drive, Suite 200 Beverly Hills, California 90210 (Address of Principal Executive Offices, Zip code) |

||

(310) 385-4000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common stock, par value $0.0001 per share |

New York Stock Exchange |

|

|---|---|---|

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No ý

The aggregate market value of the common stock held by non-affiliates of the registrant was $475,617,338.10 based on the last reported sale price of the registrant's common stock on September 23, 2011 (the last business day of the registrant's most recently completed second fiscal quarter) as reported by the New York Stock Exchange ($10.86 per share). As of May 29, 2012, there were 54,629,717 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant's Proxy Statement for its 2012 Annual Meeting of Stockholders, which is expected to be filed on or about June 15, 2012. With the exception of the sections of the registrant's 2012 Proxy Statement specifically incorporated herein by reference, the registrant's Proxy Statement for its 2012 Annual Meeting of Stockholders is not deemed to be filed as part of this Form 10-K.

RealD Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED

March 23, 2012

TABLE OF CONTENTS

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND

OTHER INDUSTRY DATA

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, about our future expectations, plans or prospects and our business. All statements contained in this Annual Report on Form 10-K, other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue" or the negative of these terms or other comparable terminology, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements include, among other things, statements concerning anticipated future financial and operating performance; our expectations regarding demand and acceptance for our technologies; RealD's ability to continue to derive substantial revenue from the licensing of RealD's 3D technologies for use in the motion picture industry, as well as our relationships with consumer electronics panel manufacturers and our ability to generate substantial revenue from the licensing of RealD's 3D technologies for use in 3D consumer electronics; 3D motion picture releases and conversions scheduled for fiscal 2013 ending March 2013 and beyond, their commercial success and consumer preferences; our ability to increase the number of RealD-enabled screens in domestic and international markets and market share; our ability to supply our solutions to our customers on a timely basis; our relationships with exhibitor and studio partners and the business model for 3D eyewear in North America; the progress, timing and amount of expenses associated with RealD's research and development activities; market and industry trends, including growth in 3D content; our plans, strategies and expected opportunities; the deployment of and demand for our products and products incorporating our technologies; and competitive pressures in domestic and international cinema markets impacting licensing and product revenues; and RealD's projected operating results.

Actual results may differ materially from those discussed in these forward-looking statements due to a number of factors, including the risks set forth in the section entitled "Risk factors" in Part I, Item 1A of this Annual Report on Form 10-K and elsewhere in this filing. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. We are under no duty to update any of the forward-looking statements after the date of this Annual Report on Form 10-K to conform our prior statements to actual results.

This Annual Report on Form 10-K also contains estimates and other information concerning our industry, including business segment and growth rates, that we obtained from industry publications, surveys and forecasts. Unless we otherwise specify, industry and market data is given on a calendar year basis and is current as of December 31, 2011. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. Although we believe the information in these industry publications, surveys and forecasts is reliable, we have not independently verified the accuracy or completeness of the information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled "Risk factors" in Part I, Item 1A of this Annual Report on Form 10-K.

RealD and the RealD logo are trademarks of RealD Inc. All other trademarks and service marks appearing in this Annual Report on Form 10-K are the property of their respective holders. All rights reserved. The absence of a trademark or service mark or logo from this Annual Report on Form 10-K does not constitute a waiver of trademark or other intellectual property rights of RealD Inc., its affiliates and/or licensors.

3

Overview

We are a leading global licensor of 3D technologies. Our extensive intellectual property portfolio is used in applications that enable a premium 3D viewing experience in the theater, the home and elsewhere. We license our RealD Cinema Systems to motion picture exhibitors that show 3D motion pictures and alternative 3D content. We also provide our RealD Display, active and passive eyewear and RealD Format technologies to consumer electronics manufacturers and content providers and distributors to enable the delivery and viewing of 3D content. Our cutting-edge 3D technologies have been used for applications such as piloting the Mars Rover.

Competitive strengths

Our competitive strengths include the following:

Innovative technology

Our technical expertise has allowed us to develop new and innovative technologies for viewing 3D content in the motion picture industry, the home and elsewhere. Working with Disney to release Chicken Little in 3D in 2005, we became the first company to commercially enable 3D theater screens using digital projection. Our patented RealD Cinema Systems deliver superior light output, providing for a high quality, brighter image and enabling display on larger theater screens than most competing technologies. Many of our licensees, including American Multi-Cinema, Inc., or AMC, Cinemark USA, Inc., or Cinemark, Regal Cinemas, Inc., or Regal, Carmike Cinemas, Inc., or Carmike, and Cineplex Theatres, or Cineplex, deploy our RealD Cinema Systems on their own premium-branded large-screen auditoriums. Our RealD Display, active and passive eyewear and RealD Format technologies provide our consumer electronics licensees the ability to display high quality 3D content that can be delivered through the current cable, satellite and broadcast infrastructure. We continually develop next generation 3D display technology for televisions, personal computers, laptops and mobile devices. Our extensive intellectual property portfolio, which is based on years of research and development, contains approximately 150 individual issued patents and approximately 264 pending patent applications in approximately 15 jurisdictions worldwide. Content producers use our technologies to enhance and accelerate their production of 3D content. Our research, development and engineering teams have expertise in many disciplines, including:

- •

- polarization control (the manipulation of light);

- •

- photonics (the application of electromagnetic energy, incorporating laser technology, electrical engineering, materials

science and information storage and processing);

- •

- optics (the branch of physics that deals with light and vision);

- •

- liquid crystal physics (the application of elements at the border between the solid and liquid phase to the creation of

nanoscale devices); and

- •

- digital image processing (the use of computer algorithms to perform image processing on digital images).

Global leader in 3D-enabled theater screens

As of March 23, 2012, our RealD Cinema Systems were deployed on approximately 20,200 theater screens in 68 countries, which we believe are more 3D screens than all of our competitors combined. 15 of the world's top 17 motion picture exhibition groups utilize RealD Cinema Systems in their

4

theaters, including Regal, AMC, Cinemark, Carmike, Cinepolis, Cineplex, ODEON, Cineworld and EuroPalaces. Our licensees include approximately 900 motion picture exhibitors. Domestic box office on RealD-enabled screens represented over 80% of total domestic 3D box office during our fiscal year ended March 23, 2012. As of March 23, 2012, we were working with our motion picture exhibitor licensees to deploy our RealD Cinema Systems on up to approximately 2,700 additional screens under our existing agreements with them, and we are actively engaged with other motion picture exhibitors regarding potential new license agreements.

Pioneer in emerging 3D consumer electronics technologies

We believe that the success of major 3D motion pictures is leading to the creation and distribution of 3D content and products for 3D consumer electronics. Although 3D consumer electronics technologies are new and developing, we have already entered into agreements to provide our RealD Display, active and passive eyewear and RealD Format technologies to leading consumer electronics manufacturers, including Victor Company of Japan, Limited, or JVC, Panasonic Corporation, or Panasonic, Samsung Electronics Company Limited, or Samsung, Sony Electronics, Inc., or Sony Electronics, Toshiba Corporation, or Toshiba and VIZIO, Inc., or VIZIO. Our licensees also include content distributors, including cable television services such as Cablevision Systems Corp., or Cablevision and satellite television services such as DirecTV Enterprises, LLC, or DirecTV.

Premium brand

We believe our brand is well-recognized among licensees and consumers as a result of motion picture studios and exhibitors co-branding with us and moviegoers having worn our branded RealD eyewear more than 725 million times. We believe the prominence of our brand in the motion picture industry will enhance our marketing efforts of 3D consumer electronics technologies.

Scalable licensing model

We license our 3D technologies under a highly scalable business model with recurring revenue from those licensees. As an example, our multi-year (typically five years or longer), generally exclusive agreements with motion picture exhibitors generate revenue on a per-admission, periodic fixed-fee or per-motion picture basis at limited incremental direct cost to us. We believe motion picture exhibitors prefer our licensing model, which includes technological upgrades and maintenance, because it reduces their capital expenditures and the risk they may purchase equipment that will become obsolete. We believe our motion picture exhibitor licensees also prefer our low-cost RealD eyewear because it requires less personnel (no active collecting or washing by motion picture exhibitors) and reduces motion picture exhibitors' loss from theft and breakage. Although we have not yet generated material revenue licensing 3D consumer electronics technologies, we anticipate that our relationships with consumer electronics manufacturers and others will generate future license fees on 3D consumer electronics technologies on a per unit basis.

Extensive industry relationships and strong technical expertise

Our experienced management team, including Michael V. Lewis, our Chairman and Chief Executive Officer, Joseph Peixoto, President of Worldwide Cinema, and Leo Bannon, Executive Vice President of Global Operations, have extensive, long-term relationships with content producers and distributors, major motion picture studios and exhibitors, and consumer electronics manufacturers that help us drive the proliferation of 3D content, delivery and viewing in theaters, the home and elsewhere. Our research and development team, based in Boulder, Colorado, is comprised of leaders in the invention, development and commercialization of innovative 3D technologies.

5

Strategy

Key elements of our strategy include:

Continue to innovate and develop new technologies

We continue to develop proprietary technologies to perfect the visual image and create additional revenue opportunities. We endeavor to improve our RealD Cinema Systems to deliver an even better and more immersive 3D viewing experience to consumers in theaters. For 3D consumer electronics, we are working to enhance our RealD Display, active and passive eyewear and RealD Format technologies to enable consumers to enjoy 3D at home and elsewhere. We have patented technologies that we believe will in the future enable consumers to enjoy 3D content without eyewear. We believe our licensing of 3D technologies for professional applications will continue to provide a strong foundation for our development of new 3D technologies for viewing 3D content at motion picture theaters, on consumer electronics and other applications. We also selectively pursue technology acquisitions to expand and enhance our intellectual property portfolio in areas that complement our existing and new market opportunities and to supplement our internal research and development efforts.

Increase our leading global share in 3D-enabled theater screens

We continue to work with our existing motion picture exhibitor licensees to deploy additional RealD Cinema Systems. We also plan to enter into agreements with new motion picture exhibitor licensees to increase the number of deployed RealD Cinema Systems worldwide. We believe there is a significant opportunity for us to continue to expand our business internationally and to license our 3D technologies to international motion picture exhibitors based on a licensing model that is similar to our domestic model.

Expand our emerging 3D consumer electronics business

We continue to work with consumer electronics manufacturers and content producers and distributors to enable a premium 3D viewing experience in the home and elsewhere using our technologies. We endeavor to incorporate our RealD Display, active and passive eyewear and RealD Format technologies in plasma and LCD televisions, set-top boxes, digital video recorders, interactive gaming consoles, laptop computers, desktop computers and mobile devices, and to enable the delivery of 3D content via cable, satellite, broadcast, packaged media and the Internet.

Build upon the strength of our RealD brand

It is our goal to make RealD the best known 3D technology brand in the world, associated with delivering the highest quality 3D viewing experience. We will further leverage the strength of our brand to generate stronger licensee and consumer preference for a RealD experience in 3D consumer electronics and other applications. We continue to actively encourage motion picture studios and exhibitors to prominently feature our brand in their motion picture advertising and marketing, at theater locations, online and on consumer electronics products and packaging. We will also continue our advertising efforts to strengthen our brand in the theatrical and consumer electronics industries. We plan to use our brand to drive the continued adoption of our 3D technologies in existing and new applications.

Industry

History of 3D

First used commercially in a public theater in 1922, 3D technology has been used by content producers in an effort to enhance the viewing experience. 3D imagery is created using stereoscopic

6

photography, which is a process that creates the illusion of 3D by using a pair of 2D images. Each image represents a different perspective of the same object, emulating the different perspectives that binocular vision captures. When the two images are viewed by each eye, the brain fuses the two images to form a single picture, creating the illusion of 3D. 3D technology has a wide range of applications including entertainment, research and development, scientific exploration and manufacturing.

Innovation in 3D technology has centered on optimizing the projection of stereoscopic images as well as the filtering of the image intended for each eye. Early 3D exhibition required the use of two projectors, one to project the reel for each eye to create the stereoscopic image, which required synchronization that was difficult to achieve due to the manual operation of projectors. To view a stereoscopic image, audiences utilized 3D eyewear that employed different filters that did not maintain the quality of a standard motion picture image and caused discomfort including eye strain and headaches.

Benefiting from the continuing adoption of digital projection, the newest wave of 3D projection uses digital technologies that address many of the limitations of previous methods of 3D projection. The use of high definition digital projectors, advances in the construction of silver screens and the use of polarization filters and polarized lenses have broadened the color spectrum, and reduced eyestrain and synchronization issues that caused headaches, which greatly improves the 3D viewing experience.

The launch of modern 3D digital projection for motion pictures was marked by the presentation of Chicken Little by Disney in November 2005, which debuted on approximately 100 RealD-enabled screens. Since the debut of Chicken Little in 2005 through March 23, 2012, more than 90 major 3D motion pictures have been released on RealD-enabled screens including six of the top 10 grossing films of all time. In addition, seven of the 10 highest grossing motion pictures released in 2011 were exhibited in RealD 3D.

Cutting-edge 3D technology has also been deployed in other applications including scientific research. For example, NASA has utilized 3D technology to analyze damage to the Space Shuttle and to navigate the Mars Rover. Industrial applications for 3D technology include the use of 3D visualization by biotech firms for the development of pharmaceuticals, by aircraft and motor vehicle manufacturers like McDonnell Douglas Corp., Caterpillar Inc. and Harley Davidson, Inc. for the design of new prototypes and by major energy companies such as Chevron that utilize 3D technology to reduce the cost and environmental impact of exploration by analyzing oil and gas fields in virtual 3D environments.

Market opportunity

Our 3D technologies can be used in many different applications and businesses, including entertainment, consumer electronics, education, aerospace, defense and healthcare. Our 3D technologies are primarily used in motion pictures, consumer electronics and professional applications.

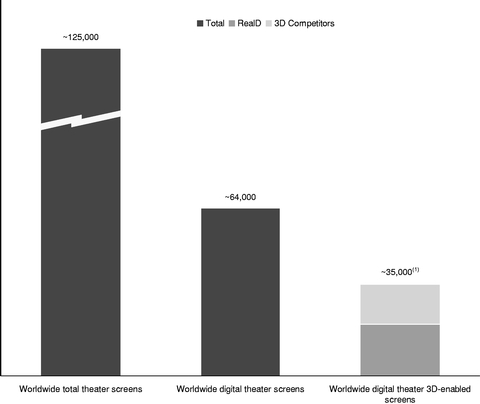

The shift in the motion picture industry from analog to digital over the past decade has created an opportunity for new and transformative 3D technologies. With the commercial success of recent 3D motion pictures, adoption of 3D digital cinema is positioned for continued growth as we believe many of the approximately 61,000 worldwide non-digital theater screens as of the end of December 31, 2011 may convert to digital projection. As of December 31, 2011, only approximately 64,000 digital theater screens were deployed worldwide, representing approximately 50% of the worldwide installed base. Certain major film studios have stated that they will stop making available analog versions of their motion pictures within the next few years, which should contribute to further migration of cinema screens with digital projectors. RealD's Cinema Systems function as an enhancement to digital projectors and, therefore, require cinemas to be equipped with a digital projector prior to installation.

7

The following chart illustrates, as of December 31, 2011, the approximate total number of theater screens worldwide, the approximate number of theater screens that have been converted to digital and the approximate number of digital theater screens that are 3D-enabled.

- (1)

- Of the estimated 35,000 worldwide digital theater 3D-enabled screens as of December 31, 2011 (per Screen Digest), 19,700 were RealD-enabled screens, representing a greater than 50% share. As of March 23, 2012, RealD had deployed approximately 20,200 screens worldwide.

The growth in 3D screens worldwide combined with growth in the number of 3D motion pictures has led to an increase in the worldwide box office generated by 3D screens in recent years. In 2011, 3D-enabled screens generated an estimated $6.9 billion in worldwide 3D box office (according to provisional figures from Screen Digest), representing 21% of the $32.6 billion in total worldwide box office in 2011. Seven of the top 10 grossing films worldwide in 2011 were exhibited in RealD 3D. We anticipate that continued growth in the number of 3D films and the number of 3D-enabled screens will lead to further growth in the worldwide 3D box office. We anticipate that approximately 37 3D motion pictures will be released worldwide in our fiscal year 2013, including sequels to successful major motion picture franchises, such as Men In Black, Madagascar, Spider-Man and Ice Age, as well as highly-anticipated original content such as The Avengers, Prometheus, Brave and The Hobbit.

In addition to creating original 3D motion pictures, content providers are converting classic 2D motion pictures to 3D in order to re-release films in theaters for display using 3D technologies. The 3D re-releases of the classic films The Lion King, Beauty and the Beast, Star Wars: The Phantom Menace, and Titanic have generated more than $650 million in global box office on a combined basis. Several additional 2D classic films are scheduled to be re-released in 3D in theaters including Star Wars, Jurassic Park, Finding Nemo, Monsters Inc., and The Little Mermaid.

8

The following table shows the major 3D motion pictures released or scheduled for release on 3D-enabled screens for the fiscal year 2013 ending on March 22, 2013, the motion picture studios and the release dates for those motion pictures (announced as of May 29, 2012).

Title

|

Motion Picture Studios | Release Date | ||

|---|---|---|---|---|

Wrath of the Titans |

Warner Bros. | 3/30/2012 | ||

Titanic 3D (re-release) |

Fox | 4/4/2012 | ||

The Pirates! Band of Misfits |

Sony / Aardman | 4/27/2012 | ||

The Avengers 3D |

Disney | 5/4/2012 | ||

Men in Black III |

Sony | 5/25/2012 | ||

Piranha 3DD |

Weinstein/Dimension | 6/1/2012 | ||

Madagascar 3: Europe's Most Wanted |

Dreamworks | 6/8/2012 | ||

Prometheus |

Fox | 6/8/2012 | ||

Brave |

Disney/Pixar | 6/22/2012 | ||

Abraham Lincoln: Vampire Hunter |

Fox | 6/22/2012 | ||

The Amazing Spider-Man |

Sony | 7/3/2012 | ||

Katy Perry: Part of Me |

Paramount | 7/5/2012 | ||

Ice Age: Continental Drift |

Fox | 7/13/2012 | ||

Step Up Revolution |

Summit | 7/27/2012 | ||

Nitro Circus the Movie 3D |

ARC | 8/10/2012 | ||

ParaNorman |

Focus/Laika | 8/17/2012 | ||

Resident Evil: Retribution |

Sony/Screen Gems | 9/14/2012 | ||

Finding Nemo (re-release) |

Disney/Pixar | 9/14/2012 | ||

Hotel Transylvania |

Sony | 9/21/2012 | ||

Dredd |

Lionsgate | 9/21/2012 | ||

Frankenweenie |

Disney | 10/5/2012 | ||

Silent Hill: Revelation 3D |

Open Road | 10/26/2012 | ||

Wreck-It Ralph |

Disney | 11/2/2012 | ||

Rise of the Guardians |

Paramount/Dreamworks | 11/21/2012 | ||

Life of Pi |

Fox | 11/21/2012 | ||

The Hobbit: An Unexpected Journey |

Warner Bros. | 12/14/2012 | ||

Cirque du Soleil: Worlds Away |

Paramount/Cameron-Pace | 12/21/2012 | ||

The Great Gatsby |

Warner Bros. | 12/25/2012 | ||

The Texas Chainsaw Massacre 3D |

Lionsgate | 1/4/2013 | ||

Hansel and Gretel: Witch Hunters |

MGM/Paramount | 1/11/2013 | ||

Monsters, Inc. (re-release) |

Disney/Pixar | 1/18/2013 | ||

Battle of the Year: The Dream Team |

Sony/Screen Gems | 1/25/2013 | ||

47 Ronin |

Universal | 2/8/2013 | ||

Escape from Planet Earth |

Weinstein | 2/14/2013 | ||

Oz: The Great & Powerful |

Disney | 3/8/2013 | ||

The Croods |

Dreamworks | 3/22/2013 | ||

Jack the Giant Killer |

Warner Bros. | 3/22/2013 |

We believe that more 3D-enabled theater screens will be needed in the future, particularly in international markets, to accommodate the expected growth in the number of 3D motion pictures being released and to provide the necessary capacity to fully capitalize on commercially successful 3D motion pictures.

We believe that the success of major 3D motion pictures will further stimulate the production and distribution of new and alternative 3D content for digital cinema. In particular, we anticipate that there will be more live broadcast events in 3D, including sporting events, concerts, cultural and other live events similar to a number of recent experiences. Live 3D events broadcast in RealD cinemas to date

9

have included Wimbledon tennis, FIFA World Cup soccer, Ultimate Fighting Championship (UFC) matches, and music concerts. In addition, in March 2012, we released Madam Butterfly 3D, a co-production with the Royal Opera House, to our participating exhibitor partners around the world.

We believe that the recent success of 3D motion pictures is also leading to the production and distribution of new 3D content for consumer electronics applications. There are currently a growing number of 3D channels available worldwide including linear broadcast channels and VOD systems on major broadcast services including DirecTV, Virgin Media, Sky, Foxtel and Comcast. 3D channels are currently being programmed from major content brands including ESPN (ESPN3D), British Sky Broadcasting (Sky 3D), and Discovery Communications (3net). Market researcher Insight Media expects the number of 3D TV channels worldwide to grow to more than 100 by 2014. Examples of major sporting events broadcast live in 3D include The Masters golf tournament, Premier League soccer, NCAA football, NCAA men's basketball Final Four games, the NBA Finals and boxing.

The proliferation of high definition televisions, laptops and other displays represents a new market opportunity for revenue arising from the release of 3D-enabled consumer electronics products. For example, market researcher DisplaySearch estimates that the number of 3D-enabled televisions shipped worldwide will more than double from an estimated 24 million in 2011 to approximately 50 million in 2012. We believe growth in the installed base of 3D-enabled TVs and other consumer displays gives film studios even more incentive to create a 3D version of their major film releases in order to take advantage of the downstream revenue opportunity to display the film's 3D version in the home.

Key applications

We believe that we possess innovative technology, a significant market presence, a premium brand and a scalable licensing model in our key applications.

Cinema

We design, manufacture, license and market our RealD Cinema Systems that enable digital cinema projectors to show 3D motion pictures and alternative 3D content to consumers wearing our RealD eyewear.

Technology. We believe our patented 3D digital projection technology delivers double the amount of light output compared to any other 3D digital projection technology on the market, which is the most significant factor in producing a high quality 3D image. We believe we are able to reach larger screens with our RealD digital projection technology than the majority of other 3D digital projection technology providers for use in motion picture theaters. For example, using a single digital DLP projector and the same lamp and lamp power as a 2D presentation, our RealD XL Cinema System, using our polarizing technology, can deliver crisp, clear 3D content to screens. Our RealD Cinema Systems:

- •

- are relatively inexpensive to deploy and include maintenance and free upgrades at no additional charge to the exhibitor;

- •

- produce full color, unlike stereoscopic/spectral 3D that relies on eyewear with red and green color filters that cause a

substantial loss of available colors;

- •

- reduce most "ghost images" caused by the left eye seeing a small portion of the right-eye frames and vice

versa;

- •

- can be viewed with our circular polarized passive RealD eyewear, which allow consumers to move around with reduced image distortion.

Market presence. Our RealD Cinema Systems are the world's most widely deployed digital 3D cinema technology based on the number of theater screens installed worldwide. As of March 23, 2012,

10

our RealD Cinema Systems were deployed on approximately 20,200 theater screens in 68 countries worldwide. We are working with our motion picture exhibitor licensees to deploy our RealD Cinema Systems on up to approximately 2,700 additional screens under our existing agreements with them, of which approximately 1,100 screens are domestic and approximately 1,600 are international. As of December 31, 2011, our RealD Cinema Systems accounted for over 80% of the estimated domestic 3D-enabled theater screens and over 50% of the 3D-enabled theater screens deployed worldwide. Domestic box office on RealD-enabled screens represented over 80% of total domestic 3D box office during our fiscal year ended March 23, 2012. We expect to continue to grow our cinema business based on an increasing number of theater screens becoming RealD-enabled and an increasing number of RealD-compatible 3D motion pictures being released.

The following chart illustrates the number of theater locations with RealD-enabled screens and the total number of RealD-enabled screens:

| |

Year ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

(approximate numbers)

|

March 23, 2012 |

March 25, 2011 |

March 26, 2010 |

|||||||

Number of RealD enabled screens (at period end) |

||||||||||

Total domestic RealD enabled screens |

11,700 | 8,700 | 3,400 | |||||||

Total international RealD enabled screens |

8,500 | 6,300 | 1,900 | |||||||

Total RealD enabled screens |

20,200 | 15,000 | 5,300 | |||||||

Number of locations with RealD enabled screens (at period end) |

||||||||||

Total domestic locations with RealD enabled screens |

2,600 | 2,300 | 1,800 | |||||||

Total international locations with RealD enabled screens |

2,500 | 2,200 | 1,200 | |||||||

Total locations with RealD enabled screens |

5,100 | 4,500 | 3,000 | |||||||

Number of 3D motion pictures (released during period) |

36 | 26 | 13 | |||||||

At most RealD theater locations, there are multiple RealD-enabled screens. We believe that having more RealD-enabled screens per location will allow us to accommodate the increasing number of 3D motion pictures being released simultaneously and provide the necessary capacity to fully capitalize on commercially successful 3D motion pictures. We believe the commercial success of 3D motion pictures will facilitate the conversion of theater screens to digital and 3D. After motion picture exhibitors convert their projectors to digital cinema, they must install a silver screen and our RealD Cinema Systems in order to display motion pictures in RealD 3D.

Content. The following table shows the major motion pictures released on RealD-enabled screens in fiscal year 2012, including the motion picture studios, the release dates, the domestic box office for those motion pictures on RealD-enabled screens, the RealD domestic box office as a percentage of

11

total domestic 3D box office, and the RealD domestic box office as a percentage of the total domestic 2D and 3D box office (all data through March 23, 2012).

Title

|

Motion Picture Studio | Release Date | Domestic Box Office on RealD-Enabled Screens |

RealD Percent of Domestic 3D Box Office |

RealD Percent of Total (2D+3D) Dom. Box Office |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Rio |

Fox | 4/15/2011 | $ | 58,977,206 | 91 | % | 44 | % | ||||||

Hoodwinked Too! Hood vs Evil |

The Weinstein Company | 4/29/2011 | $ | 5,119,946 | 90 | % | 59 | % | ||||||

Thor |

Paramount | 5/6/2011 | $ | 70,021,536 | 78 | % | 41 | % | ||||||

Priest |

Sony | 5/13/2011 | $ | 13,659,273 | 92 | % | 49 | % | ||||||

Pirates of the Caribbean: On Stranger Tides |

Disney | 5/20/2011 | $ | 70,269,762 | 73 | % | 30 | % | ||||||

Kung Fu Panda 2 |

Paramount | 5/26/2011 | $ | 55,745,016 | 88 | % | 35 | % | ||||||

Green Lantern |

Warner Bros | 6/17/2011 | $ | 41,191,082 | 89 | % | 37 | % | ||||||

Cars 2 |

Disney | 6/24/2011 | $ | 48,307,076 | 84 | % | 26 | % | ||||||

Transformers: Dark Of The Moon |

Paramount | 6/29/2011 | $ | 145,003,098 | 78 | % | 43 | % | ||||||

Harry Potter And The Deathly Hallows II |

Warner Bros | 7/15/2011 | $ | 96,530,758 | 64 | % | 26 | % | ||||||

Captain America: The First Avenger |

Paramount | 7/22/2011 | $ | 51,168,046 | 90 | % | 30 | % | ||||||

The Smurfs |

Sony | 7/29/2011 | $ | 46,663,040 | 93 | % | 34 | % | ||||||

Glee The 3D Concert Movie |

Fox | 8/12/2011 | $ | 10,592,165 | 92 | % | 92 | % | ||||||

Final Destination 5 |

Warner Bros | 8/12/2011 | $ | 24,189,940 | 81 | % | 62 | % | ||||||

Spy Kids: All The Time In The World |

The Weinstein Company | 8/19/2011 | $ | 15,548,279 | 95 | % | 43 | % | ||||||

Conan The Barbarian |

Lionsgate | 8/19/2011 | $ | 11,037,339 | 90 | % | 55 | % | ||||||

Fright Night |

Disney | 8/19/2011 | $ | 8,942,837 | 91 | % | 52 | % | ||||||

Shark Night 3D |

Relativity Media | 9/2/2011 | $ | 12,980,598 | 88 | % | 74 | % | ||||||

The Lion King 3D |

Disney | 9/16/2011 | $ | 75,243,499 | 89 | % | 83 | % | ||||||

Dolphin Tale |

Warner Bros | 9/23/2011 | $ | 24,963,188 | 84 | % | 36 | % | ||||||

The Three Musketeers |

Summit | 10/21/2011 | $ | 8,758,361 | 88 | % | 45 | % | ||||||

Puss In Boots |

Paramount | 10/28/2011 | $ | 46,954,170 | 76 | % | 33 | % | ||||||

A Very Harold & Kumar 3D Christmas |

Warner Bros | 11/4/2011 | $ | 27,525,095 | 91 | % | 82 | % | ||||||

Immortals |

Relativity Media | 11/11/2011 | $ | 46,758,674 | 93 | % | 58 | % | ||||||

Happy Feet 2 |

Warner Bros | 11/18/2011 | $ | 17,953,801 | 68 | % | 30 | % | ||||||

Hugo |

Paramount | 11/23/2011 | $ | 46,914,325 | 88 | % | 67 | % | ||||||

Arthur Christmas |

Sony | 11/23/2011 | $ | 14,940,856 | 88 | % | 33 | % | ||||||

The Adventures Of Tintin |

Paramount | 12/21/2011 | $ | 40,884,877 | 83 | % | 58 | % | ||||||

The Darkest Hour |

Summit | 12/25/2011 | $ | 12,023,748 | 90 | % | 58 | % | ||||||

Beauty And The Beast (3D) |

Disney | 1/13/2012 | $ | 38,886,857 | 90 | % | 86 | % | ||||||

Underworld Awakening |

Sony | 1/20/2012 | $ | 34,109,976 | 74 | % | 56 | % | ||||||

Journey 2: The Mysterious Island |

Warner Bros | 2/9/2012 | $ | 42,277,683 | 69 | % | 47 | % | ||||||

Star Wars: Episode I—Phantom Menace (in 3D) |

Fox | 2/10/2012 | $ | 36,853,913 | 88 | % | 88 | % | ||||||

Ghost Rider: Spirit of Vengeance |

Sony | 2/17/2012 | $ | 29,192,814 | 90 | % | 61 | % | ||||||

Dr. Seuss' The Lorax |

Universal | 3/2/2012 | $ | 56,986,747 | 80 | % | 37 | % | ||||||

John Carter |

Disney | 3/9/2012 | $ | 21,105,811 | 66 | % | 41 | % | ||||||

Note: As of March 23, 2012

Source: Rentrak

The number of 3D films exhibited on our RealD cinema systems has grown significantly in recent years, from 26 major motion pictures in our fiscal year 2011 to 36 major motion pictures in our fiscal year 2012. As of May 31, 2012, we expect approximately 37 3D motion pictures to be released during our fiscal year 2013 which ends on March 22, 2013, all of which we expect will be exhibited using our RealD Cinema Systems.

We believe that the recent success of major 3D motion pictures will drive the creation and theatrical distribution of more alternative content and live broadcast events in 3D. To facilitate the display of alternative content, we introduced RealD LIVE, which enables live event 3D broadcast

12

capabilities in theaters. RealD-enabled screens and the RealD Format have been used to exhibit other new and alternative 3D content, including sporting events, concerts, cultural and other live events. In addition, in March 2012, we released Madam Butterfly 3D, a co-production with London's Royal Opera House, to our participating exhibitor partners around the world.

Brand. Motion picture studios often co-brand RealD in motion picture marketing and advertising. Motion picture exhibitors display our brand at theaters, on-screen and online. Moviegoers have worn our branded RealD eyewear more than 725 million times. Our in-theater branding includes signage at the box office where tickets are purchased, signage in the lobby and in poster cases in and around the theater, branded recycling bins located at each auditorium entrance and exit, an on-screen animated 3D preview informing consumers when to put on their eyewear and reminding them to recycle their eyewear after the motion picture and a promotional trailer that plays immediately before the motion picture. Our brand also appears on major online ticketing websites aligned with show times at theaters equipped with our RealD technology. We believe our branded 3D experience will lead to increased admissions as consumers recognize our brand as the leading choice for 3D viewing, prompting motion picture exhibitors to select us as their 3D technology licensor.

Licensing model. We license our RealD Cinema Systems to motion picture exhibitors under multi-year (typically five years or longer) agreements that are generally exclusive and from which we generally receive license fees on a per-admission basis. We believe our agreements with motion picture exhibitors provide us with recurring revenue as 3D motion pictures are exhibited using our 3D technologies. Based on the number of deployed RealD-enabled screens, the number of additional RealD Cinema Systems that we will work with our existing motion picture exhibitor licensees to deploy, our market presence and the number of 3D motion pictures slated for future release, we believe our cinema business will continue to grow.

We license and market systems to motion picture exhibitors based on the type of digital projector installed and theater configuration: our RealD Cinema System, RealD XL Cinema System, RealD XLS Cinema System, and the RealD XLW Cinema System, which is designed specifically for premium large screen auditoriums with stadium seating configurations. Our RealD XL Cinema System can be displayed on screens of up to 82 feet wide, and our RealD Cinema Systems will be scalable to larger formats as projector technology evolves. The RealD XLW Cinema System, introduced in January 2011, can accommodate a throw ratio as wide as 1.0 (projection distance divided by screen width), and is designed for use in premium large screen motion picture auditoriums, theme parks and specialty theaters with stadium seating. We also recently introduced a RealD Cinema System for dual projector installations that is capable of delivering twice the light of other dual-projector 3D systems. Based on our actual experience, we believe we can upgrade almost any theater that has an existing digital cinema projector with our RealD Cinema Systems within a few hours. Under our agreements with motion picture exhibitors, we provide technological upgrades and maintenance on our RealD Cinema Systems at no additional charge to the exhibitor.

We believe our RealD Cinema Systems are a compelling and scalable technology for the motion picture industry. Motion picture producers can tell their stories in more creative and compelling ways through the use of 3D technology. As evidenced by the record-setting performance of The Avengers in May 2012, releasing content on RealD-enabled screens can result in increased ticket sales at premium prices, enhanced monetization of a motion picture's initial release and, as a result, can provide a more attractive return on investment to motion picture producers and distributors. Motion picture exhibitors share in the benefit of increased motion picture ticket sales at premium prices, and they can also generate new revenue opportunities through alternative 3D content, including 3D showings of sporting events, concerts, cultural and other live events. We also believe consumers benefit from a superior 3D entertainment experience.

13

Consumer electronics

We make our RealD Display, active and passive eyewear and RealD Format technologies available to consumer electronics manufacturers, content producers and content distributors to bring 3D to the home and elsewhere.

Technology. We continue our development efforts of next-generation 3D display technologies. The majority of 3D-enabled televisions sold today utilize active shuttering 3D eyewear. To address this opportunity, we have developed technology to create active 3D eyewear, which are compatible with 3D-enabled televisions from many major consumer electronics brands.

Our RealD Format is based on multiplexing technology (which packs two images in a single space) to deliver and display high definition 3D content via today's existing infrastructure for cable, satellite, broadcast, packaged media and the Internet. Our technology can grow with the content distribution infrastructure to deliver the highest quality, premium 3D viewing experience across a variety of distribution systems and consumer electronics products. Our 3D technologies can also be used for 3D-enabled interactive gaming by game developers and publishers. Our technologies for interactive gaming include those that adjust viewing angles in a game, assure 3D across depth of field and enable in-frame 3D effects.

We believe that 3D consumer electronics will continue to evolve towards an enhanced 3D entertainment experience and we intend to actively seek to have our technologies incorporated in new 3D-enabled consumer electronics products. We continue to develop, maintain, and strengthen our relationships within the broad spectrum of consumer electronics participants to guide the development of 3D in the home and elsewhere. We believe our active eyewear is adaptable to most consumer electronics applications and our patented high brightness, passive display could be used with high definition displays without significantly degrading image resolution.

In January 2011, together with Samsung Electronics LCD Business, we announced the joint development of a new 3D display technology called RDZ™ that offers full resolution high definition 3D video and is compatible with the same 3D eyewear used in RealD 3D-equipped motion picture theatres around the world. Unlike patterned retarder based 3D display technologies that cut resolution in half or diminish brightness, our RDZ™ 3D display technology is designed to deliver full resolution high definition 3D images by adopting active shutter technology on the display. Based on RealD technology used in many of the world's 3D-equipped motion picture theatres today, RDZ™ displays are also 2D compatible, resulting in no reduction of image quality in 2D mode. After having jointly announced with Samsung a license agreement in May 2011 which we had expected to lead to the incorporation of our RDZ™ 3D display technology into LCD panels manufactured by Samsung, Samsung's initiative to manufacture panels under the license agreement with us is no longer being pursued. We continue to explore other potential licensee relationships for our RDZ™ 3D display technology for LCD panels.

Competitive presence. Our 3D technologies can be deployed across the entire range of consumer electronics. We have recently made available our RealD Display, active and passive eyewear and RealD Format technologies to consumer electronics manufacturers, content producers and distributors to enable high definition televisions, laptops and other displays to be viewed in 3D in the home and elsewhere. Although we have not yet generated material revenue licensing our consumer electronics technologies, we have agreements in place with a wide range of leading consumer electronics manufacturers and content providers.

Content. Building on the recent success of major 3D motion pictures released in theaters, we believe consumers' desire for 3D consumer electronics will be stimulated with the creation and distribution of new motion pictures and other forms of 3D content. We anticipate that the demand for live broadcast events in 3D, including sporting events, concerts, cultural and other live events, for 3D

14

interactive games, as well as other new and alternative 3D content for the home and elsewhere, will further stimulate the demand for RealD-enabled consumer electronics products.

Brand. We believe the strength of our brand in the motion picture industry will assist us in the 3D consumer electronics space. We are working with our licensees to incorporate RealD branding in their consumer electronics product advertising, marketing and packaging and to have our brand featured prominently on our patented RealD eyewear used in the 3D consumer electronics application.

Licensing model. We have entered into multi-year licensing agreements with participants in the consumer electronics industry to further integrate our RealD Format and other technologies into their products. Although we have not yet generated material revenue from our current agreements in the consumer electronics industry, and may never generate material revenue from those agreements, we believe there will be future revenue opportunities for licensing our 3D technologies to consumer electronics manufacturers, component and accessories manufacturers, eyewear manufacturers, mobile device companies and others as the 3D consumer electronics opportunity continues to develop.

Professional

Our professional 3D technologies are utilized by Fortune 500 companies, government, academic institutions, and research and development organizations for applications such as piloting the Mars Rover. Our professional 3D technologies have also been used for theme park installations, including at LEGOLAND®.

Our history

RealD was founded in 2003 with the goal of bringing a premium 3D viewing experience to audiences everywhere. In 2005, we acquired Stereographics Corporation, or Stereographics, a company founded in 1980 and one of the largest providers of 3D technologies at the time of the acquisition. In 2007, we acquired ColorLink Inc., or ColorLink, a polarization control, photonics and optics company with an extensive patent portfolio. ColorLink, which was founded in 1995, had played an instrumental role collaborating with RealD to develop our first cinema system. In March 2005, we demonstrated our initial RealD Cinema System to motion picture exhibitors and studios. In November 2005, Disney released Chicken Little in 3D on approximately 100 RealD-enabled screens. In 2008, we established a RealD sales and operating presence in Europe and also entered 3D consumer electronics with a number of 3D technologies for the home and elsewhere. In December 2009, Fox released Avatar worldwide, including on approximately 4,200 RealD-enabled screens. In 2012, RealD surpassed 20,000 3D-equipped cinema screens worldwide.

Licensees

Cinema

In our cinema business, our primary licensees are motion picture exhibitors that use our RealD Cinema Systems, including 15 of the top 17 motion picture exhibition groups in the world. As of March 23, 2012, we had multi-year (typically five years or longer) agreements that are generally exclusive with our motion picture exhibitor licensees in both the domestic and international markets. However, our license agreements typically do not obligate motion picture exhibitors to deploy a specific number of our RealD Cinema Systems according to a specific timeline. License revenue from AMC, Cinemark and Regal together comprised approximately 24% of our gross license revenue in the year ended March 23, 2012, 23% in the year ended March 25, 2011 and 30% in the year ended March 26, 2010. No licensee accounted for more than 10% of our gross license revenue in fiscal 2012, 2011 or 2010.

15

Consumer electronics

In our consumer electronics business, our primary licensees are consumer electronics manufacturers, including JVC, Panasonic, Sony Electronics, Toshiba and Vizio. We currently have agreements in place with these consumer electronics manufacturers for the use of our 3D technologies in various consumer electronics products. Our customers also include content distributors, including cable providers, satellite television services company DirecTV and content producers. In May 2011, we announced the entry into a license agreement with Samsung Electronics LCD Business to make available to consumer electronics manufacturers panels featuring our RDZ™ 3D display technology, which delivers full resolution 3D images to each eye utilizing RealD 3D cinema glasses, Samsung's initiative to manufacture panels under the license agreement with us is no longer being pursued. We continue to explore other potential licensee relationships for our RDZ™ 3D display technology for LCD panels. Our customers also include content distributors, including cable providers, satellite television services company DirecTV, and content producers.

Professional

In our professional business, our primary customers are Fortune 500 companies, government agencies, academic institutions and research and development organizations.

Sales and marketing

We market and license our technologies throughout the 3D motion picture, 3D consumer electronics and professional industries through an internal sales team. We maintain sales offices in the United States, the United Kingdom, Japan, Hong Kong and China.

We focus our marketing efforts on motion picture studios and exhibitors, consumer electronics manufacturers, interactive game companies, content producers and content distributors. We reach these customers primarily through industry trade shows, public relations, our website and studio events.

Research and development

We believe we must continue to develop innovative technologies on a regular basis to maintain our competitive edge. We monitor trends in the 3D motion picture, 3D consumer electronics and professional industries to stay abreast of new developments. We further monitor relevant intellectual property and other public domain information. Our research and development is focused on building and testing licensed products that could potentially incorporate our 3D technologies. Once the proof of concepts are built and tested, our 3D technologies are licensed to motion picture exhibitors and consumer electronics manufacturers.

Our research and development expenses were $16.5 million for the year ended March 23, 2012, $15.6 million for the year ended March 25, 2011 and $11.0 million for the year ended March 26, 2010. In addition, we have made significant investments in intellectual property through acquisitions, including our acquisitions of Stereographics and ColorLink.

Manufacturing and supply

Cinema

RealD Cinema Systems. We purchase optical and mechanical components for our RealD Cinema Systems from multiple suppliers. We have also entered into a large number of license and deployment agreements with digital cinema projector and server companies that grant them a limited, royalty-free license related to the use of RealD technology into digital cinema projection systems.

16

RealD eyewear. Our RealD eyewear is an integral part of our RealD Cinema Systems. Our circular polarized passive RealD eyewear allows consumers to move around with reduced image distortion and is comfortable and sanitary, which we believe provides convenience to consumers. We have entered into non-exclusive agreements with several manufacturers to produce RealD eyewear. We manage worldwide manufacturing and distribution of RealD eyewear. Domestically, we operate a recycling program for our RealD eyewear. Domestically, we provide our RealD eyewear free of charge to motion picture exhibitors and then receive a fee from the motion picture studios for the usage of that RealD eyewear by the motion picture exhibitors' consumers. Most international motion picture exhibitors purchase RealD eyewear directly from us and sell them to consumers as part of their admission or as a concession item. As a result, we are one of the world's largest distributors of passive 3D eyewear. Our recyclable eyewear is designed to fit comfortably on most viewers from ages three and up and easily over prescription eyewear. We also make available kids size RealD 3D eyewear. With the growth of 3D motion picture productions and releases, we anticipate that a market for personal and customized RealD eyewear will emerge.

RealD installation, repair and maintenance services. We hire independent contractors to perform installation, repair and maintenance services related to our RealD Cinema Systems.

Consumer electronics

Our RealD Display, RealD Format, and technologies for use in high definition televisions, laptops and other displays, as well as our active and passive eyewear, are fully tested by our engineering team before they are delivered to consumer electronics manufacturers.

Professional

We use ColorLink Japan and other manufacturing suppliers for components of many of our professional products. We complete assembly, testing and inspection in our Boulder, Colorado facilities.

Competition

The market for 3D visual display technologies is highly competitive.

Our primary competitors for our RealD Cinema Systems include Dolby Laboratories, Inc., or Dolby, X6D Limited, or Xpand, MasterImage 3D, LLC, or MasterImage, Sony Electronics, or Sony, and IMAX Corporation, or IMAX. As of December 31, 2011, these and other competitors had enabled approximately 15,300 worldwide theater screens, collectively, as compared to our approximately 19,700 RealD-enabled worldwide theater screens (which subsequently increased to approximately 20,200 screens as of March 23, 2012). Consumers may be more familiar with some of our competitors' brands in the motion picture industry. However, we believe we differentiate ourselves from our competitors in the motion picture industry for reasons that include the following:

- •

- we provide premium 3D technologies that are highly regarded by licensees and others in the motion picture industry;

- •

- our RealD Cinema Systems deliver superior light output providing for a high quality image and enabling display on larger

theater screens with one projector than most competing technologies;

- •

- we offer motion picture exhibitors a licensing model that includes technological upgrades and maintenance at no additional

charge and reduces their capital expenditures and the risk that they may purchase equipment that will become obsolete;

- •

- compared to most of our competitors' eyewear in the motion picture industry, our circular polarized passive RealD eyewear allows consumers to move around with reduced image distortion; and

17

- •

- our RealD eyewear model requires less personnel (no active collecting or washing by motion picture exhibitors) and reduces motion picture exhibitors' loss from theft and breakage.

Our primary competitors in 3D consumer electronics technologies include those who are developing 3D displays, including LG and active 3D eyewear manufacturers including Xpand. While the 3D consumer electronics industry is new and rapidly developing, we must compete with companies that enjoy competitive advantages in the consumer electronics industry.

We believe that the principal competitive factors include some or all of the following:

- •

- quality and reliability of technologies;

- •

- technology performance, flexibility and range of application;

- •

- timeliness and relevance of new product introductions;

- •

- relationships with key participants in the motion picture and consumer electronics industries;

- •

- inclusion in explicit or de facto industry standards;

- •

- brand recognition and reputation;

- •

- availability of 3D compatible, high quality content; and

- •

- price.

We believe we compete favorably with respect to many of these factors.

Intellectual property

We have a substantial base of intellectual property assets, including patents, trademarks, copyrights, trade secrets and know-how.

We have multiple patents covering unique aspects and improvements for many of our technologies. As of March 23, 2012, we had over 216 patent families comprising approximately 150 individual issued patents and approximately 264 pending patent applications in approximately 15 jurisdictions worldwide. Our issued patents are scheduled to expire at various times between May 2012 and November 2036. Of these, four patents expired in 2011, two patents are scheduled to expire in 2012, six patents are scheduled to expire in 2013, and five patents are scheduled to expire in 2014. We believe the expiration of these patents will not adversely affect our business. Our patents are used in the areas of algorithms, autostereo, eyewear, projection, format, direct view, retarder stack filters, polarization switches, eyewear protection, color switching and other areas. We currently derive our license revenue principally from our RealD Cinema Systems. Patents relating to our RealD Cinema Systems generally expire between 2012 and 2036. We pursue a general practice of filing patent applications for our technology in the United States and outside of the United States where our licensees manufacture, distribute or sell licensed products and where our competitors manufacture, distribute or sell competing products. We actively pursue new applications to expand our patent portfolio to address new technology innovations.

We have approximately 42 trademark and service mark registrations and pending applications worldwide for a variety of word marks, logos and slogans. Our registered and common law trademarks are an integral part of our licensing program and licensees typically elect to place our trademarks on their products to inform consumers that their products incorporate our technology and meet our quality specifications.

Employees

As of March 23, 2012, we had 129 employees located in the United States, Canada, the United Kingdom, Japan, Hong Kong, and China. Approximately 30 are engaged in research and development, approximately 31 are in operations, and approximately 68 are in sales and general and administrative functions. None of our employees are represented by a labor union, and we consider our employee relations to be good.

18

The risks described below could have a material adverse impact on our financial position, results of operations, liquidity and cash flows. Although it is not possible to predict or identify all such risks and uncertainties, they may include, but are not limited to, the factors discussed below. Our business operations could also be affected by additional factors that are not presently known to us or that we currently consider not to be material to our operations. You should not consider this list to be a complete statement of all risks and uncertainties.

Risks relating to our business

If motion pictures that can be viewed with RealD Cinema Systems are not made or are not commercially successful, our revenue will decline.

Almost all of our revenue is currently dependent upon both the number of 3D motion pictures released and the commercial success of those 3D motion pictures. Although we have produced alternative content in 3D, such as the production of Carmen in 3D with London's Royal Opera House, we are not actively developing 3D motion pictures or our own 3D content, other than the current production of Madam Butterfly 3D, and therefore, we rely on motion picture studios producing and releasing 3D motion pictures compatible with our RealD Cinema Systems. There is no guarantee an increasing number of 3D motion pictures will be released or that motion picture studios will continue to produce 3D motion pictures at all. Motion picture studios may refrain from producing and releasing 3D motion pictures for any number of reasons, including their lack of commercial success, consumer preferences, the lower-cost to produce 2D motion pictures or the availability of other entertainment options. The commercial success of a 3D motion picture depends on a number of factors that are outside of our control, including whether it achieves critical acclaim, timing of the release, cost, marketing efforts and promotional support for the release. In the past, consumer interest in 3D motion pictures was episodic and motion picture studios tended to use 3D motion pictures as a gimmick rather than as an artistic tool to enhance the viewing experience. If consumers' recent renewed interest in the 3D viewing experience fails to grow or it declines for any reason, box office performance may suffer and motion picture studios may reduce the number of 3D motion pictures they produce. Poor box office performance of 3D motion pictures, disruption or reduction in 3D motion picture production or conversion of two-dimensional motion pictures into 3D motion pictures, changes in release schedules, cancellations of motion picture releases in 3D versions, a reduction in marketing efforts for 3D motion pictures by motion picture studios or a lack of consumer demand for 3D motion pictures could result in lower 3D motion picture attendance, which would substantially reduce our revenue. For example, the fact that Warner Brothers was unable to convert Harry Potter and the Deathly Hallows Part 1 from 2D into 3D in time for a 2010 release in 3D negatively impacted 3D motion picture attendance and, we believe, the box office for that motion picture and our revenue in the period in which that motion picture was released.

If motion picture exhibitors do not continue to use our RealD Cinema Systems or experience financial difficulties, our growth and results of operations could be adversely affected.

Our primary licensees in the motion picture industry are motion picture exhibitors. Our license agreements with motion picture exhibitors do not obligate these licensees to deploy a specific number of our RealD Cinema Systems. We cannot predict whether any of our existing motion picture exhibitor licensees will continue to perform under their license agreements with us, whether they will renew their license agreements with us at the end of their term or whether we may now or in the future be in breach of those agreements. If motion picture exhibitors reduce or eliminate the number of 3D motion pictures that are exhibited in theaters, then motion picture studios may not produce and release 3D motion pictures and our revenue could be materially and adversely affected.

19

In addition, license revenue from AMC, Cinemark and Regal together comprised approximately 24% of our gross license revenue in the year ended March 23, 2012, 23% in the year ended March 25, 2011 and 30% in the year ended March 26, 2010. Any inability or failure by motion picture exhibitors to pay us amounts due in a timely fashion or at all could substantially reduce our cash flow and could materially and adversely impact our financial condition and results of operations.

A deterioration in our relationships with the major motion picture studios could adversely affect our business.

The six major motion picture studios accounted for approximately 82% of domestic box office revenue and all 10 of the top 10 grossing 3D motion pictures in calendar year 2011. Such 3D motion pictures are also released internationally. In addition, for our domestic operations, these major motion picture studios pay us a per use fee for our RealD eyewear. To the extent that our relationship with any of these major motion picture studios deteriorates or any of these studios stop making motion pictures that can be viewed at RealD-enabled theater screens, refuse to co-brand with us, stop using or paying for the use of or reduce the amounts paid for our RealD eyewear in domestic markets, our costs could increase and our revenue could decline, which would adversely affect our business and results of operations. We understand that at least one motion picture studio is seeking a change to the 3D eyewear business model in North America to resemble the international model. While we support multiple business models for our RealD eyewear around the world, the uncertainty and any potential dispute with a motion picture studio over the domestic eyewear business model could adversely affect our results of operations, financial condition, business and prospects.

If motion picture exhibitors do not continue converting analog theaters to digital or the pace of conversions slows, our future prospects could be limited and our business could be adversely affected.

Our RealD Cinema Systems only work in theaters equipped with digital cinema projection systems, which enable 3D motion pictures to be delivered, stored and projected electronically, and our systems are not compatible with analog motion picture projectors. Motion picture exhibitors have been converting projectors to digital cinema over the last several years, giving us the opportunity to deploy our RealD Cinema Systems. After motion picture exhibitors convert their projectors to digital cinema, they must install a silver screen and our RealD Cinema System in order to display motion pictures in RealD 3D. The conversion by motion picture exhibitors of their projectors and screens from analog to digital cinema requires significant expense. As of December 31, 2011, approximately 65% of domestic theater screens had converted to digital and approximately 45% of the international theater screens had been converted. If the market for digital cinema develops more slowly than expected, or if the motion picture exhibitors we have agreements with delay or abandon the conversion of their theaters, our ability to grow our revenue and our business could be adversely affected. While DCIP and Cinedigm financing provided funding for the digital conversion of domestic theater screens operated by many of our licensees, there has not been a similar effort to organize digital conversion in certain geographies outside North America. If the pace of digital conversion outside of the United States does not follow that which occurred inside the United States, our revenue may not grow and our business could be adversely affected.

If the deployment of our RealD Cinema Systems is delayed or not realized, our future prospects could be limited and our business could be adversely affected.

We have license agreements with motion picture exhibitors that give us the right, subject to certain exceptions, to deploy our RealD Cinema Systems if a location under contract is already equipped with our systems and they choose to install additional 3D digital projector systems. As of March 23, 2012, we were working with our motion picture exhibitor licensees to deploy our RealD Cinema Systems on up to approximately 2,700 additional screens under our existing agreements with them. However, our license agreements do not obligate our licensees to deploy a specific number of our RealD Cinema

20

Systems. Numerous factors beyond our control could influence when and whether our RealD Cinema Systems will be deployed, including motion picture exhibitors' ability to fund capital expenditures, or their decision to delay or abandon the conversion of their theaters to digital projection or reduce the number of 3D motion pictures exhibited in their theaters, and our ability to secure adequate supplies of components comprising our RealD Cinema System in any given period. If motion picture exhibitors delay, postpone or decide not to deploy RealD Cinema Systems at the number of screens they have announced, or we are unable to deploy our RealD Cinema Systems in a timely manner, our future prospects could be limited and our business could be adversely affected.

Any inability to protect our intellectual property rights could reduce the value of our 3D technologies and brand, which could adversely affect our financial condition, results of operations and business.

Our business is dependent upon our patents, trademarks, trade secrets, copyrights and other intellectual property rights. Effective intellectual property rights protection, however, may not be available under the laws of every country in which we and our licensees operate, such as China. The efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. In addition, protecting our intellectual property rights is costly and time consuming. It may not be practicable or cost effective for us to fully protect our intellectual property rights in some countries or jurisdictions. If we are unable to successfully identify and stop unauthorized use of our intellectual property, we could lose potential revenue and experience increased operational and enforcement costs, which could adversely affect our financial condition, results of operations and business.

It is possible that some of our 3D technologies may not be protectable by patents. In addition, given the costs of obtaining patent protection, we may choose not to protect particular innovations that later turn out to be important. Even where we do have patent protection, the scope of such protection may be insufficient to prevent third parties from designing around our particular patent claims or otherwise avoiding infringement. Furthermore, there is always the possibility that an issued patent may later be found to be invalid or unenforceable, or a competitor may attempt to engineer around our issued patent. Additionally, patents only offer a limited term of protection. Moreover, the intellectual property we maintain as trade secrets could be compromised by third parties, or intentionally or accidentally by our employees, which would cause us to lose the competitive advantage resulting from them.

We may in the future be subject to intellectual property rights disputes that are costly to defend, could require us to pay damages and could limit our ability to use particular 3D technologies in the future.

We may be exposed to, or threatened with, future litigation or any other disputes by other parties alleging that our 3D technologies infringe their intellectual property rights. Any intellectual property disputes, regardless of their merit, could be time consuming, expensive to litigate or settle and could divert management resources and attention. An adverse determination in any intellectual property dispute could require us to pay damages and/or stop using our 3D technologies, trademarks, copyrighted works and other material found to be in violation of another party's rights and could prevent us from licensing our 3D technologies to others. In order to avoid these restrictions and resolve the dispute, we may have to pay for a license. This license may not be available on reasonable terms, could require us to pay significant license fees and may significantly increase our operating expenses. A license also may not be available to us at all. As a result, we may be required to use and/or develop non-infringing alternatives, which could require significant effort and expense, or which may not be possible. If we cannot obtain a license or develop alternatives for any infringing aspects of our business, we may be forced to limit our 3D technologies and may be unable to compete effectively. In certain instances, we have contractually agreed to provide indemnification to licensees relating to our

21

intellectual property. This may require us to defend or hold harmless motion picture exhibitors, consumer electronics manufacturers or other licensees. We have from time to time corresponded with one or more third parties regarding patent enforcement issues and in-bound and out-bound patent licensing opportunities. In addition, from time to time we may be engaged in disputes regarding the licensing of our intellectual property rights, including matters related to our license fee rates and other terms of our licensing arrangements. These types of disputes can be asserted by our licensees or prospective licensees or by other third parties as part of negotiations with us or in private actions seeking monetary damages or injunctive relief or in regulatory actions. Requests for monetary and injunctive remedies asserted in claims like these could be material and could have a significant impact on our business. Any disputes with our licensees, potential licensees or other third parties could materially and adversely affect our business, results of operations and prospects.

Our RealD Cinema Systems and other technologies are generally designed for use with third-party technologies and hardware, and if we are unable to maintain the ability of our RealD Cinema Systems and other technologies to work with these third-party technologies and hardware, our business and operating results could be adversely affected.