As filed with the Securities and Exchange Commission

on May

29, 2012

Registration Statement No. 333-168194

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________

Energizer Resources Inc.

(Exact name of Registrant as specified in its charter)

|

Minnesota

(State or other jurisdiction of incorporation or organization)

|

|

1040

(Primary Standard Industrial Classification Code Number)

|

|

20-0803515

(I.R.S. Employer Identification No.)

|

|

520 – 141 Adelaide Street West,

Toronto, Ontario M5H 3L5

(416) 364-4911

(Address, including zip code, and telephone number,

including area code, of Registrant's principal executive offices)

|

Richard E. Schler

Vice President and Chief Financial Officer

520 – 141 Adelaide Street West

Toronto, Ontario M5H 3L5

(416) 364-4911

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

__________________

Copy to:

| |

Kimberley R. Anderson

Dorsey & Whitney LLP

701 Fifth Avenue, Suite 6100

Seattle, WA 98104

(206) 903-8800

|

|

__________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of

"large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o |

Accelerated filer o |

| Non-accelerated filer (Do not check if a smaller reporting company) o |

Smaller reporting company x |

__________________

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

We originally registered the resale by the Selling Shareholders (as described below) of 46,373,334 common shares, including common shares underlying warrants, pursuant to a registration statement on Form S-1 declared effective by the Securities and Exchange Commission on November 10, 2010. This Post-Effective Amendment No. 1 to Form S-1 is being filed to update the registration statement on Form S-1 (File No. 333-168194) which was declared effective November 10, 2010. In addition, we are deregistering 696,000 common shares acquirable upon the exercise of Class A broker warrants at the exercise price of US$0.30 per share because such warrants expired unexercised on March 15, 2012.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 29, 2012

Preliminary Prospectus

Energizer Resources Inc.

45,677,334 Common Shares

This is an offering of up to 45,677,334 common shares, par value US$0.001 per share, of Energizer Resources Inc., ("we,"

"us," "our company" or the "Company"), by the selling shareholders listed beginning on page 13 of this prospectus. All of the common shares being offered, when sold, will be sold by selling shareholders. The common shares registered for resale under the registration statement of which this prospectus is part include:

| ● |

up to 22,740,667 common shares held by the selling shareholders described herein;

|

| ● |

up to 21,666,667 common shares acquirable upon the exercise of common share purchase warrants at the exercise price of US$0.50 per share for a period beginning July 15, 2010 and ending May 5, 2013, subject to earlier expiration in certain events;

|

| ● |

up to 870,000 common shares acquirable upon the exercise of Class B broker warrants at the exercise price of US$0.50 per share at any time after a corresponding number of Class A broker warrants have been exercised by the particular agent and on or before May 5, 2013; and

|

| ● |

up to 400,000 common shares acquirable upon the exercise of Class C broker warrants at the exercise price of US$0.30 per share until March 15, 2013.

|

On March 15, 2010, we sold 21,666,667 units at US$0.30 per unit for gross proceeds of US$6,500,000 in our brokered and non-brokered private placement offerings. Each unit consisted of one common share and one common share purchase warrant. Each common share purchase warrant entitles the holder to purchase one common share at an exercise price of US$0.50 for a period beginning July 15, 2010 and ending May 5, 2013, subject to earlier expiration in certain events. In connection with the brokered offerings, we issued 400,000 common shares, Class A broker warrants exercisable for up to 696,000 common shares and Class B broker warrants exercisable for up to 696,000 common shares to Clarus Securities Inc., and we issued Class A broker warrants exercisable for up to 174,000 common shares and Class B broker warrants exercisable for up to 174,000 common shares to Byron Securities Limited, as compensation for services rendered by Clarus and Byron in the brokered offerings. Byron has since acquired 174,000 common shares upon the exercise of the Class A broker warrants. The Class A broker warrants issued to Clarus expired unexercised on March 15, 2012. We also issued Class C broker warrants exercisable for up to 400,000 common shares and common share purchase warrants exercisable for up to 500,000 common shares to Clarus for advisory services. Clarus has since acquired 500,000 common shares upon the exercise of the common share purchase warrants. We will not receive any proceeds from the sale of the common shares by the selling shareholders. However, if the common share purchase warrants are exercised, or if the broker warrants are exercised on a cash basis, we will receive the exercise price of such warrants. We will pay the expenses of registering the common shares sold by the selling shareholders. See the section entitled

"selling shareholders" beginning on page 13 of this prospectus.

The common shares were registered to permit the selling shareholders to sell the common shares from time to time, in amounts and at prices and on terms determined at the time of the offering. The selling shareholders may sell the common shares in a number of different ways and at prevailing market prices or privately negotiated transactions. We provide more information about how the selling shareholders may sell the common shares in the section entitled

"Plan of Distribution" beginning on page 18 of this prospectus.

You should read this prospectus and any prospectus supplement carefully before you invest.

Our common shares are quoted on the OTC Bulletin Board (the

"OTCBB") and the OTCQB market tier of OTC Markets Group, Inc. (the "OTCQB") under the symbol

"ENZR", the Toronto Stock Exchange (the "TSX") under the symbol "EGZ" and the Frankfurt Stock Exchange under the symbol

"YE5". On May 24, 2012, the last reported sale price for our common shares on the OTCBB and the TSX was US$0.25 and CDN$0.25 per share, respectively.

Investing in our common shares involves a high degree of risk. See

"Risk Factors" beginning on page 4 of this prospectus. We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 25, 2012

TABLE OF CONTENTS

| |

Page

|

|

SUMMARY INFORMATION

|

2

|

|

RISK FACTORS

|

5

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

12

|

|

USE OF PROCEEDS

|

12

|

|

SELLING SHAREHOLDERS

|

12

|

|

PLAN OF DISTRIBUTION

|

18

|

|

DESCRIPTION OF SECURITIES TO BE REGISTERED

|

19

|

|

EXPERTS

|

20

|

|

DESCRIPTION OF BUSINESS

|

20

|

|

DESCRIPTION OF PROPERTY

|

21

|

|

LEGAL PROCEEDINGS

|

47

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

47

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

49

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

55

|

|

EXECUTIVE COMPENSATION

|

57

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

60

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

61

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

61

|

|

FINANCIAL STATEMENTS

|

63

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The distribution or possession of this prospectus in or from certain jurisdictions may be restricted by law. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares. Our business, financial condition, results of operations and prospects may have changed since that date.

SUMMARY INFORMATION

|

The Offering

|

This is an offering of up to 45,677,334 common shares by the selling shareholders.

|

|

Shares Offered By the Selling Shareholders

|

45,677,334 common shares, $0.001 par value per common share.(1)

|

|

Offering Price

|

Determined at the time of sale by the selling shareholders

|

|

Common Shares Outstanding

|

156,747,178 (2)

|

|

Use of Proceeds

|

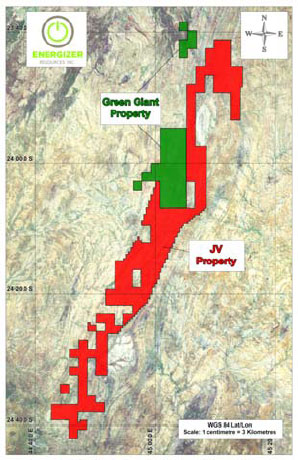

We will not receive any proceeds from the sale of the common shares by the selling shareholders. However, if the common share purchase warrants are exercised, or if the broker warrants are exercised on a cash basis, we will receive the exercise price of the common share purchase warrants and broker warrants. The common shares that will be resold under this prospectus were sold by us, or were issued upon the exercise of common share purchase warrants and broker warrants granted by us. The funds that we raised through the sale of those common shares are being used to further our exploration program on our Green Giant and joint venture ground graptite and vanadium project in Madagascar, including completion of a resource definition drill program and metallurgical testing, and for general corporate purposes.

|

|

Dividend Policy

|

We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends.

|

|

Trading Symbols

|

OTCBB: ENZR; OTCQB: ENZR; TSX: EGZ; Frankfurt Stock Exchange: YE5

|

|

(1)

|

In connection with the brokered and non-brokered offerings, we agreed to use commercially reasonable best efforts to file a registration statement with the Securities and Exchange Commission and cause it to become effective as soon as practicable after the closing of the brokered and non-brokered offerings, and to cause the registration statement to remain effective until the earlier of: (i) the date on which all the common shares issued in the brokered and non-brokered offerings and all of the common shares acquirable upon exercise of the common share purchase warrants issued in the brokered and non-brokered offerings have been sold pursuant to the registration statement or Rule 144 under the Securities Act of 1933, as amended; and (ii) the date on which all such common shares have ceased to be outstanding (whether as a result of the repurchase and cancellation, conversion or otherwise), provided that the selling shareholders furnish in writing to us all information within their possession or knowledge that we or our counsel may reasonably require or request (as needed) in order to keep the registration statement continuously effective.

|

|

(2)

|

Outstanding common shares excludes 23,690,000 common shares acquirable upon exercise of options at exercise prices ranging from US$0.20 to US$0.395 per share and 43,619,695 common shares acquirable upon exercise of common share purchase warrants at exercise prices ranging from US$0.15 to US$0.75.

|

Summary of Our Business

Energizer Resources Inc. is an exploration stage company engaged in the search for vanadium, graphite, uranium, gold and other minerals. We have an interest in properties located in the African country of Madagascar and Canada (Province of Québec). None of the properties in which we hold an interest have known mineral reserves of any kind at this time. As such, the work programs planned by us are exploratory in nature.

Our executive offices are currently located at 520–141 Adelaide Street West, Toronto, Ontario, Canada M5H 3L5. Our telephone number is (416) 364-4911. We maintain a website at www.energizerresources.com (which website is expressly not incorporated by reference into this filing).

The Offering

We are registering for resale common shares held or acquirable by the selling shareholders pursuant to the brokered and non-brokered private placement offerings.

On March 15, 2010, we completed brokered and non-brokered offerings consisting of 21,666,667 units at US$0.30 per unit for gross proceeds of US$6,500,000. We sold 14,500,000 units for gross proceeds of US$4,350,000 in the brokered offerings and 7,166,667 units for gross proceeds of US$2,150,000 in the non-brokered offerings. Each unit consisted of one common share and one common share purchase warrant. Each common share purchase warrant entitles the holder to purchase one common share at an exercise price of US$0.50 for a period beginning July 15, 2010 and ending May 5, 2013. We may accelerate the expiry of the common share purchase warrants if our common shares trade at a closing price greater than US$0.75 per common share for 21 consecutive days on the OTCBB or the TSX Venture Exchange (the

"TSX-V") (or such other stock exchange or quotation system on which the common shares may be listed and where a majority of the trading volume occurs) at any time after December 15, 2010, provided the registration statement has been declared and remains effective.

In connection with the brokered and non-brokered offerings, we agreed to use commercially reasonable best efforts to file a registration statement with the Securities and Exchange Commission and cause it to become effective as soon as practicable after the closing of the brokered and non-brokered offerings, and to cause the registration statement to remain effective until the earlier of: (i) the date on which all the common shares issued in the brokered and non-brokered offerings and all of the common shares acquirable upon the exercise of the common share purchase warrants issued in the brokered and non-brokered offerings have been sold pursuant to the registration statement or Rule 144 under the Securities Act of 1933, as amended (the

"Securities Act"); and (ii) the date on which all such common shares have ceased to be outstanding (whether as a result of the repurchase and cancellation, conversion or otherwise), provided that the selling shareholders furnish in writing to us all information within their possession or knowledge that we or our counsel may reasonably require in order to keep the registration statement continuously effective.

The units were issued together with listing rights and filing rights. If our common shares had not commenced trading on the TSX-V on or before June 15, 2010, each holder of a common share comprising a unit issued in the brokered and non-brokered offerings would have been entitled to be issued one-tenth of one common share beginning on June 15, 2010 and an additional one-tenth common share pursuant to such listing right on every six month anniversary thereafter in which our common shares did not commence trading on the TSX-V until June 15, 2012, such that the maximum number of common shares which would be issued pursuant to the listing rights is equal to 50% of the common shares comprising the units issued in the brokered and non-brokered offerings. As our common shares commenced trading on the TSX-V on May 5, 2010, all listing rights have expired and no common shares will be issued pursuant to such listing rights. Effective June 16, 2011, our common shares commenced trading on the TSX. If the registration statement had not been declared effective on or before December 15, 2010, each holder of a common share comprising a unit issued in the brokered and non-brokered offerings would have been entitled to be issued one-tenth of one common share beginning on December 15, 2010 and an additional one-tenth of one common share pursuant to such filing right on every six month anniversary thereafter in which the registration statement had not been declared effective until December 15, 2011, such that the maximum number of common shares which would be issued pursuant to the filing rights is equal to 30% of the common shares comprising the units issued in the brokered and non-brokered offerings. As the registration statement was originally declared effective on November 10, 2010, all filing rights have expired and no common shares will be issued pursuant to such filing rights.

In connection with the strategic investments by Dundee Corporation and Consolidated Thompson Iron Mines Limited (which was acquired by Cliffs Natural Resources Inc. pursuant to a court-approved plan of arrangement under the Canadian Business Corporations Act in May 2011, and is now known as Cliffs Quebec Iron Mining Limited), we granted Dundee and Consolidated Thompson with certain pre-emptive rights to participate in our future financings and the right to appoint one member to our board of directors. Dundee was granted the right to participate for up to 20% of all future financings of the Company until March 15, 2012, provided it held 10% of our issued and outstanding common shares. Upon the closing of the brokered offering, Dundee was also granted the right to immediately appoint one member to the Company's board of directors, and provided it held 10% of our issued and outstanding common shares, Dundee would have the right to nominate one person to the list of director nominees forwarded by management of the Company for election at the annual shareholders meeting. Dundee no longer has the right to nominate one person to the list of director nominees as it no longer holds 10% of our issued and outstanding common shares. Consolidated Thompson was granted the right to participate for up to 7% of all future financings of the Company until March 15, 2012, provided it held 5% of our issued and outstanding common shares. Upon the closing of the non-brokered offering, Consolidated Thompson was also granted the right to immediately appoint one member to the Company's board of directors, and provided it held 5% of our issued and outstanding common shares, Consolidated Thompson would have the right to nominate one person to the list of director nominees forwarded by management of the Company for election at the annual shareholders meeting. Consolidated Thompson no longer has the right to nominate one person to the list of director nominees as it no longer holds 5% of our issued and outstanding common shares

As consideration for their services in connection with the brokered offerings, Clarus Securities Inc. and Byron Securities Limited (together, the

"Agents") were (i) paid a cash commission of 6% of the gross proceeds of the brokered offerings, (ii) issued 870,000 Class A broker warrants, and (iii) issued 870,000 Class B broker warrants. Each Class A broker warrant entitled the holder to acquire one common share at an exercise price of US$0.30 until March 15, 2012. Each Class B broker warrant entitles the holder to acquire one common share at an exercise price of US$0.50 at any time after a corresponding number of Class A broker warrants have been exercised by the particular Agent and on or before May 5, 2013. Byron has since acquired 174,000 common shares upon the exercise of Class A broker warrants. The Class A broker warrants issued to Clarus expired unexercised on March 15, 2012. In addition, Clarus was issued 400,000 common shares and 400,000 Class C broker warrants as consideration for certain advisory services in connection with the brokered offerings. Each Class C broker warrant entitles the holder to acquire one common share at an exercise price of US$0.30 until March 15, 2013. We also agreed to pay the legal fees of Agents' counsel incurred in connection with the brokered offerings and the preparation and review of the registration statement. In July 2010, we issued 500,000 common share purchase warrants to Clarus for services it provided in connection with the listing of our common shares on the TSX-V. Each such warrant entitled the holder to acquire one common share at an exercise price of US$0.20 until July 2, 2012. Clarus has since acquired 500,000 common shares upon the exercise of such warrants.

The registration statement registers an aggregate of 45,677,334 common shares of which (i) 22,740,667 common shares are currently outstanding and (ii) 22,936,667 common shares are acquirable upon the exercise of the common share purchase warrants and broker warrants issued in connection with the brokered and non-brokered offerings at the exercise prices and exercise periods described above.

The net proceeds of the brokered and non-brokered offerings are being used to further our exploration program on our Green Giant and joint venture ground graphite and vanadium project in Madagascar, including completion of a resource definition drill program and metallurgical testing, and for general corporate purposes.

Summary Financial Information

The summary financial information set forth below should be read in conjunction with the section entitled

"Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and notes thereto appearing elsewhere in this prospectus. Our financial statements have been prepared in accordance with United States generally accepted accounting principles and are expressed in United States dollars.

The summary financial information for the fiscal years ended June 30, 2011 and 2010 and the nine month period ended March 31, 2012 (unaudited) has been derived from our financial statements included in this prospectus.

| |

As of

June 30, 2011

($)

|

As of

June 30, 2010

($)

|

As of

March 31, 2012

(unaudited)($)

|

|

Total Assets

|

12,761,886

|

2,863,223

|

5,418,416

|

|

Total Liabilities

|

702,476

|

413,121

|

749.102

|

| |

For the Fiscal Years Ended June 30,

|

|

|

2011

($)

|

2010

($)

|

For the period ended March 31, 2012 (unaudited) ($)

|

|

Operating Revenues

|

Nil

|

Nil

|

Nil

|

|

Operating Expenses

|

4,984,314

|

10,718,586

|

13,142,752

|

|

Loss from Continuing Operations

|

4,873,555

|

10,708,589

|

13,068,513

|

|

Loss per common share from Continuing Operations

|

(0.04)

|

(0.12)

|

(0.09)

|

|

Cash dividends declared and paid per common share

|

Nil

|

Nil

|

Nil

|

RISK FACTORS

Our business is subject to a variety of risks and uncertainties, including, but not limited to, the risks and uncertainties described below. If any of the risks described below, or elsewhere in this report on Form 10-Q, or our Company's other filings with the Securities and Exchange Commission (the "SEC"), were to occur, our financial condition and results of operations could suffer and the trading price of our common stock could decline. Additionally, if other risks not presently known to us, or that we do not currently believe to be significant, occur or become significant, our financial condition and results of operations could suffer and the trading price of our common stock could decline.

The report of our independent registered public accounting firm contains explanatory language that substantial doubt exists about our ability to continue as a going concern.

The independent auditor's report on our financial statements contains explanatory language that substantial doubt exists about our ability to continue as a going concern. Due to our lack of operating history and present inability to generate revenues, we have sustained operating losses since our inception. Since our inception, up to March 31, 2012, we had accumulated net losses of $65,142,353. If we are unable to obtain sufficient financing in the near term as required or achieve profitability, then we would, in all likelihood, experience severe liquidity problems and may have to curtail our operations. If we curtail our operations, we may be placed into bankruptcy or undergo liquidation, the result of which will adversely affect the value of our common shares.

Our common shares have been subject to penny stock regulation in the United States of America.

Our common shares have been subject to the provisions of Section 15(g) and Rule 15g-9 of the (US) Securities Exchange Act of 1934, as amended (the

"Exchange Act"), commonly referred to as the "penny stock" rule. Section 15(g) sets forth certain requirements for transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act. The Commission generally defines penny stock to be any equity security that has a market price less than US$5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is considered to be penny stock unless that security is: registered and traded on a national securities exchange meeting specified criteria set by the Commission; issued by a registered investment company; excluded from the definition on the basis of price (at least US$5.00 per share) or the registrant's net tangible assets; or exempted from the definition by the Commission. If our common shares are deemed to be

"penny stock", trading in common shares will be subject to additional sales practice requirements on broker/dealers who sell penny stock to persons other than established customers and accredited investors.

Financial Industry Regulatory Authority, Inc. ("FINRA") sales practice requirements may limit a shareholder's ability to buy and sell our common shares.

In addition to the

"penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We may not have access to sufficient capital to pursue our business and therefore would be unable to achieve our planned future growth.

We intend to pursue a growth strategy that includes development of our Company's business plan. Currently we have limited capital, which is insufficient to pursue our plans for development and growth. Our ability to implement our exploration plans will depend primarily on our ability to obtain additional private or public equity or debt financing. Such financing may not be available at all, or we may be unable to locate and secure additional capital on terms and conditions that are acceptable to us. Financing exploration plans through equity financing may have a dilutive effect on our common shares. Our failure to obtain additional capital will have a material adverse effect on our business.

Our primary exploration efforts are in the African country of Madagascar, where there is uncertainty with regard to its leader's commitment to democratic elections.

The timing of democratic elections in Madagascar remains uncertain. To date, our Company has not been placed under any constraints or experienced any disruptions in our exploration efforts due to the political situation in Madagascar. Depending on future actions taken by the transitional government in Madagascar, our Company and its business operations could be impacted.

A roadmap was signed by the various political factions on September 17, 2011, a government of national unity was formed in November and the transition parliament was re-structured to include opposition members. The African Union has endorsed this roadmap. This roadmap provides a path for democratic elections in Madagascar. However, at the date of this report, these elections have not taken place and are unlikely to take place until the latter stages of 2012, at the earliest.

As the roadmap has not been fully implemented, the EU has extended its suspension of development assistance to Madagascar (with the continuing exception for humanitarian aid). With UN assistance, the transition government introduced a law with respect to the independent elections commission which was adopted by the transition parliament in January 2012. Presently, other elections-related laws are being studied by the parliament. We are actively monitoring the political climate in Madagascar and continue to hold meetings with representatives of the government and the Ministry of Mines.

The granting, transformation or amendment of exploration and research mining permits within the country continues to be suspended. Our Company has continued to pay taxes and administrative fees in Madagascar with respect to all the mining permits we hold. These payments have been acknowledged and accepted by the Madagascar government.

Any adverse developments to the political situation in Madagascar could have a material effect on our Company's business, results of operations and financial condition.

As a public company we are subject to complex legal and accounting requirements that will require us to incur significant expenses and will expose us to risk of non-compliance.

As a public company, we are subject to numerous legal and accounting requirements that do not apply to private companies. The cost of compliance with many of these requirements is material, not only in absolute terms but, more importantly, in relation to the overall scope of the operations of a small company. Our relative inexperience with these requirements may increase the cost of compliance and may also increase the risk that we will fail to comply. Failure to comply with these requirements can have numerous adverse consequences including, but not limited to, our inability to file required periodic reports on a timely basis, loss of market confidence, delisting of our securities and/or governmental or private actions against us. We cannot assure you that we will be able to comply with all of these requirements or that the cost of such compliance will not prove to be a substantial competitive disadvantage vis-à-vis our privately held and larger public competitors.

Because we are quoted on the OTCQB instead of a national securities exchange in the United States, our U.S. investors may have more difficulty selling their stock or experience negative volatility on the market price of our stock in the United States.

In the United States, our common shares are currently quoted on the OTCQB. The OTCQB can be highly illiquid, in part because it does not have a national quotation system by which potential investors can follow the market price of shares except through information received and generated by a limited number of broker-dealers that make markets in particular stocks. There is a greater chance of volatility for securities that trade on the OTCQB as compared to a national securities exchange in the United States, such as the New York Stock Exchange, the NASDAQ Stock Market or the NYSE Amex. This volatility may be caused by a variety of factors, including the lack of readily available price quotations, the absence of consistent administrative supervision of bid and ask quotations, lower trading volume, and market conditions. U.S. investors in our common shares may experience high fluctuations in the market price and volume of the trading market for our securities. These fluctuations, when they occur, have a negative effect on the market price for our common shares. Accordingly, our U.S. shareholders may not be able to realize a fair price from their shares when they determine to sell them or may have to hold them for a substantial period of time until the market for our common shares improves.

In addition to being quoted on the OTCQB, on June 16, 2011, our common shares commenced trading on the Toronto Stock Exchange ("TSX"). The TSX is Canada's national stock exchange. Prior to this, from May 5, 2010 to June 15, 2011, our common shares traded on the TSX – Venture Exchange. Our common shares are also listed on the Frankfurt Exchange under the symbol YE5.

We do not intend to pay dividends.

We do not anticipate paying cash dividends on our common shares in the foreseeable future. We may not have sufficient funds to legally pay dividends. Even if funds are legally available to pay dividends, we may nevertheless decide in our sole discretion not to pay dividends. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors our board of directors may consider relevant. There is no assurance that we will pay any dividends in the future, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 (the

"Sarbanes-Oxley Act") could have a material adverse effect on our business & operating results.

If we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common shares.

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over financial reporting. In connection with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover

"material weaknesses" in our internal controls as defined in standards established by the Public Company Accounting Oversight Board, or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. The PCAOB defines

"significant deficiency" as a deficiency that results in more than a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected.

In the event that a material weakness is identified, we will employ qualified personnel and adopt and implement policies and procedures to address any material weaknesses that we identify. However, the process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that the measures we will take will remediate any material weaknesses that we may identify or that we will implement and maintain adequate controls over our financial process and reporting in the future.

Any failure to complete our assessment of our internal control over financial reporting, to remediate any material weaknesses that we may identify or to implement new controls, or difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements. Any such failure could also adversely affect the results of the periodic management evaluations of our internal controls. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common shares.

The price at which you purchase our common shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares at or above your purchase price, which may result in substantial losses to you. The market price for our common shares is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits which could lead to wide fluctuations in our share price.

The market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First our common shares are sporadically and thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or

"risky" investment due to our limited operating history, lack of profits to date and uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common shares, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common shares will be at any time, including as to whether our common shares will sustain their current market prices, or as to what effect that the sale of shares or the availability of common shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Volatility in our common share price may subject us to securities litigation, thereby diverting our resources that may have a material effect on our profitability and results of operations.

As discussed in the preceding risk factors, the market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources.

Should we lose the services of our key executives, our financial condition and proposed expansion may be negatively impacted.

We depend on the continued contributions of our executive officers to work effectively as a team, to execute our business strategy and to manage our business. The loss of key personnel, or their failure to work effectively, could have a material adverse effect on our business, financial condition, and results of operations. Specifically, we rely on J.A. Kirk McKinnon, our Chief Executive Officer, and Richard E. Schler, our Vice-President and Chief Financial Officer. We do not maintain key man life insurance on these individuals. Should we lose any or all of their services and we are unable to replace their services with equally competent and experienced personnel, our operational goals and strategies may be adversely affected, which will negatively affect our potential revenues.

Minnesota law and our articles of incorporation protect our directors from certain types of lawsuits, which could make it difficult for us to recover damages from them in the event of a lawsuit.

Minnesota law provides that our directors will not be liable to our Company or to our stockholders for monetary damages for all but certain types of conduct as directors. Our articles of incorporation require us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require our Company to use its assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

We have not identified any mineral reserves or resources and due to the speculative nature of mineral property exploration, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

Exploration for minerals is a speculative venture involving substantial risk. We cannot provide investors with any assurance that our claims and properties contain commercially exploitable reserves. The exploration work that we intend to conduct on our claims or properties may not result in the discovery of commercial quantities of vanadium, graphite, gold uranium, or other minerals. Problems such as unusual and unexpected rock formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

We are a mineral exploration company with a limited operating history and expect to incur operating losses for the foreseeable future.

We are a mineral exploration company. We have not earned any revenues and we have not been profitable. Prior to completing exploration on our claims, we may incur increased operating expenses without realizing any revenues from those claims. There are numerous difficulties normally encountered by mineral exploration companies, and these companies experience a high rate of failure. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. We have no history upon which to base any assumption as to the likelihood that our business will prove successful, and we can provide no assurance to investors that we will generate any operating revenues or ever achieve profitable operations.

Because of the speculative nature of mineral property exploration, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

Exploration for minerals is a speculative venture involving substantial risk. We cannot provide investors with any assurance that our claims and properties contain commercially exploitable reserves. The exploration work that we intend to conduct on our claims or properties may not result in the discovery of commercial quantities of vanadium, graphite, gold, uranium or other minerals. Problems such as unusual and unexpected rock formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot, or may elect not, to insure against. We currently have no such insurance, but our management intends to periodically review the availability of commercially reasonable insurance coverage. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets.

If we confirm commercial concentrations of vanadium, graphite, gold, uranium or other minerals on our claims and interests, we can provide no assurance that we will be able to successfully bring those claims or interests into commercial production.

If our exploration programs are successful in confirming deposits of commercial tonnage and grade, we will require significant additional funds in order to place the claims and interests into commercial production. This may occur for a number of reasons, including because of regulatory or permitting difficulties, because we are unable to obtain any adequate funds or because we cannot obtain such funds on terms that we consider economically feasible.

Because access to most of our properties is often restricted by inclement weather or proper infrastructure, our exploration programs are likely to experience delays.

Access to most of the properties underlying our claims and interests is restricted due to their remote locations and because of weather conditions. Most of these properties are only accessible by air. As a result, any attempts to visit, test, or explore the property are generally limited to those periods when weather permits such activities. These limitations can result in significant delays in exploration efforts, as well as mining and production efforts in the event that commercial amounts of minerals are found. This could cause our business to fail.

As we undertake exploration of our claims and interests, we will be subject to the compliance of government regulation that may increase the anticipated time and cost of our exploration program.

There are several governmental regulations that materially restrict the exploration of minerals. We will be subject to the mining laws and regulations in force in the jurisdictions where our claims are located, and these laws and regulations may change over time. In order to comply with these regulations, we may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to land. While our planned budget for exploration programs includes a contingency for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program, or that the budgeted amounts are inadequate.

Our operations are subject to strict environmental regulations, which result in added costs of operations and operational delays.

Our operations are subject to environmental regulations, which could result in additional costs and operational delays. All phases of our operations are subject to environmental regulation. Environmental legislation is evolving in some countries and jurisdictions in a manner that may require stricter standards, and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors, and employees. There is no assurance that any future changes in environmental regulation will not negatively affect our projects.

We have no insurance for environmental problems.

Insurance against environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production, has not been available generally in the mining industry. We have no insurance coverage for most environmental risks. In the event of a problem, the payment of environmental liabilities and costs would reduce the funds available to us for future operations. If we are unable to fund fully the cost of remedying an environmental problem, we might be required to enter into an interim compliance measure pending completion of the required remedy.

Due to external market factors in the mining business, we may not be able to market any minerals that may be found.

The mining industry, in general, is intensely competitive. Even if commercial quantities of minerals are discovered, we can provide no assurance to investors that a ready market will exist for the sale of these minerals. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of markets and processing equipment, and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, mineral importing and exporting and environmental protection. The exact effect of these factors cannot be accurately predicted, but any combination of these factors may result in our not receiving an adequate return on invested capital.

Our performance may be subject to fluctuations in market prices of vanadium, graphite, gold, uranium, and other minerals.

The profitability of a mineral exploration project could be significantly affected by changes in the market price of the relevant minerals. Recently, the price of vanadium has increased due to the markets in China as well as the expanded uses including large-scale power storage application. With respect to the market prices of graphite, its price has increased over the past several months. The price of gold, while recently reaching record highs has decreased over the past few months. Demand for gold can also be influenced by economic conditions, attractiveness as an investment vehicle and the relative strength of the U.S. dollar and local investment currencies. The market price of uranium has increased due in large measure to projections as to the number of new nuclear energy plants that will be constructed in China, the United States and other jurisdictions. A number of other factors affect the market prices for other minerals. The aggregate effect of the factors affecting the prices of various minerals is impossible to predict with accuracy. Fluctuations in mineral prices may adversely affect the value of any mineral discoveries made on the properties with which we are involved, which may in turn affect the market price and liquidity of our common shares and our ability to pursue and implement our business plan. In addition, the price of vanadium has in the past fluctuated significantly on a month-to-month and year-to-year basis.

Because from time to time we hold a significant portion of our cash reserves in Canadian dollars, we may experience losses due to foreign exchange translations.

From time to time we hold a significant portion of our cash reserves in Canadian dollars. Due to foreign exchange rate fluctuations, the value of these Canadian dollar reserves can result in translation gains or losses in U.S. dollar terms. If there was a significant decline in the Canadian dollar versus the U.S. dollar, our converted Canadian dollar cash balances presented in U.S. dollars on our balance sheet would significantly decline. If the US dollar significantly declines relative to the Canadian dollar our quoted US dollar cash position would significantly decline as it would be more expensive in US dollar terms to pay Canadian dollar expenses. We have not entered into derivative instruments to offset the impact of foreign exchange fluctuations. Such foreign exchange declines could cause us to experience losses.

Our Company's business is impacted by any instability and fluctuations in global financial systems.

The recent credit crisis and related instability in the global financial system, although somewhat abated, has had, and may continue to have, an impact on our Company's business and our Company's financial condition. Our Company may face significant challenges if conditions in the financial markets do not continue to improve. Our Company's ability to access the capital markets may be severely restricted at a time when our Company wishes or needs to access such markets, which could have a materially adverse impact on our Company's flexibility to react to changing economic and business conditions or carry on our operations.

Until we can validate otherwise, the properties described below have no known mineral reserves of any kind and we are planning programs that are exploratory in nature.

Further details regarding our Company's properties, although not incorporated by reference, including the comprehensive geological report prepared in compliance with Canada's National Instrument 43-101 on the Sagar Property in Northern Québec and on the Green Giant Property in Madagascar, have been filed within our Company's filings on Sedar at http://www.sedar.com (which website is expressly not incorporated by reference into this filing).

Climate change and related regulatory responses may impact our business.

Climate change as a result of emissions of greenhouse gases is a significant topic of discussion and may generate government regulatory responses in the near future. It is impracticable to predict with any certainty the impact of climate change on our business or the regulatory responses to it, although we recognize that they could be significant. However, it is too soon for us to predict with any certainty the ultimate impact, either directionally or quantitatively, of climate change and related regulatory responses.

To the extent that climate change increases the risk of natural disasters or other disruptive events in the areas in which we operate, we could be harmed. While we maintain rudimentary business recovery plans that are intended to allow us to recover from natural disasters or other events that can be disruptive to our business, our plans may not fully protect us from all such disasters or events.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and pose challenges for our management.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations promulgated thereunder, the Sarbanes-Oxley Act and SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the U.S. public markets. Our management team will need to devote significant time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

We are an

"emerging growth company" and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an

"emerging growth company," as defined in the Jumpstart our Business Startups Act of 2012 or JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not

"emerging growth companies" including not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. In addition, Section 107 of the JOBS Act also provides that an

"emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An

"emerging growth company" can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We will incur increased costs and demands upon management as a result of complying with the laws and regulations that affect public companies, which could materially adversely affect our results of operations, financial condition, business and prospects.

As a public company and particularly after we cease to be an

"emerging growth company," we will incur significant legal, accounting and other expenses that we have not incurred to date, including increased costs associated with public company reporting and corporate governance requirements. These requirements include compliance with Section 404 and other provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, as well as rules implemented by the SEC. The increased costs associated with operating as a public company will decrease our net income or increase our net loss, and may require us to reduce costs in other areas of our business. Additionally, if these requirements divert our management's attention from other business concerns, they could have a material adverse effect on our results of operations, financial condition, business and prospects. However, for as long as we remain an

"emerging growth company" as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not

"emerging growth companies" including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an

"emerging growth company." If the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30, we would cease to be an

"emerging growth company" as of the following June 30, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an

"emerging growth company" immediately.

SHOULD ONE OR MORE OF THE FOREGOING RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD THE UNDERLYING ASSUMPTIONS OF OUR BUSINESS PROVE INCORRECT, ACTUAL RESULTS MAY DIFFER SIGNIFICANTLY FROM THOSE ANTICIPATED, BELIEVED, ESTIMATED, EXPECTED, INTENDED OR PLANNED.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements regarding management's plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated risks set forth in this prospectus include or relate to, among other things, (a) our growth strategies, (b) anticipated trends in the mining industry, (c) our ability to obtain and retain sufficient capital for future operations, and (d) our anticipated needs for working capital. These statements may be found under

"Management's Discussion and Analysis of Financial Condition and Results of Operations" and

"Description of Business," as well as in this prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under

"Risk Factors" and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur.

The forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results contemplated in forward-looking statements will be realized. In addition, as disclosed elsewhere in the

"Risk Factors" section of this prospectus, there are a number of other risks inherent in our business and operations which could cause our operating results to vary markedly and adversely from prior results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking information included in this prospectus, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

Any statement in this prospectus that is not a statement of an historical fact constitutes a

"forward-looking statement". Further, when we use the words "may", "expect", "anticipate",

"plan", "believe", "seek", "estimate", "internal", and similar words, we intend to identify statements and expressions that may be forward- looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions that could cause our future results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability to control or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important factors that may cause our actual results to differ from such forward-looking statements include, but are not limited to, the risks outlined under

"Risk Factors" herein. The reader is cautioned that our company does not have a policy of updating or revising forward-looking statements and thus the reader should not assume that silence by management of our company over time means that actual events are bearing out as estimated in such forward-looking statements.

All references to

"dollars", "$" or "US$" are to United States dollars and all references to "CDN$" are to Canadian dollars. United States dollar equivalents of Canadian dollar figures are based on the noon exchange rate as reported by the Bank of Canada on the applicable date.

USE OF PROCEEDS

We will not receive any proceeds from the sale of common shares by the selling shareholders. The selling shareholders will receive all of the net proceeds from the sale of common shares offered by them under this prospectus. If the common share purchase warrants and broker warrants are exercised by the selling shareholders, the proceeds from the common share purchase warrants and broker warrants (if the broker warrants are exercised on a cash basis) will be used to further our exploration and development efforts on graphite and vanadium in Madagascar on both the 100% owned ground and the 75% joint venture owned ground and for general corporate purposes.

SELLING SHAREHOLDERS

This prospectus covers the offering of up to 45,677,334 common shares by the selling shareholders. We will not receive any proceeds from the sale of common shares by selling shareholders.

The common shares issued to the selling shareholders are

"restricted securities" under applicable federal and state securities laws and are being registered to give the selling shareholders the opportunity to sell their common shares. The registration of such common shares does not necessarily mean, however, that any of these common shares will be offered or sold by the selling shareholders. The selling shareholders may from time to time offer and sell all or a portion of their common shares in the over-the-counter market, in negotiated transactions, or otherwise, at market prices prevailing at the time of sale or at negotiated prices.

The registered common shares may be sold directly or through brokers or dealers, or in a distribution by one or more underwriters on a firm commitment or best efforts basis. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any particular offer will be set forth in an accompanying prospectus supplement. See

"Plan of Distribution" beginning on page [INSERT PAGE NUMBER] of this prospectus. Each of the selling shareholders reserves the sole right to accept or reject, in whole or in part, any proposed purchase of the registered common shares to be made directly or through agents. The selling shareholders and any agents or broker-dealers that participate with the selling shareholders in the distribution of their registered common shares may be deemed to be

"underwriters" within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the registered common shares may be deemed to be underwriting commissions or discounts under the Securities Act.

We will receive no proceeds from the sale of the registered common shares, and we have agreed to bear the expenses of registration of the common shares, other than commissions and discounts of agents or broker-dealers and transfer taxes, if any.

Selling Shareholders Information

The following table sets forth the number of common shares beneficially owned by the selling shareholders as of the closing date of the financing, the number of common shares covered by this prospectus on behalf of the selling shareholders and the number of common shares that the selling shareholders beneficially own as of the closing date of the financing. This table assumes that the selling shareholders offer for sale all of the common shares covered by this prospectus. At May 25, 2012, we had 156,747,178 common shares issued and outstanding.

The common shares may be offered under this prospectus from time to time by the selling shareholders, or by any of their respective pledgees, donees, assignees or other successors-in-interest. The amounts set forth below are based upon information provided to us by the selling shareholders, or on our records, and are accurate to the best of our knowledge. It is possible, however, that the selling shareholders may have acquired additional common shares or disposed of common shares after the closing date of the financing.

The selling shareholders will pay any underwriting discounts and commissions and expenses incurred by the selling shareholder for brokerage, accounting, tax or legal services or any other expenses incurred by the selling shareholder in disposing of the common shares. We will bear other costs, fees and expenses incurred in effecting the registration of the common shares covered by this prospectus, including, without limitation, fees and expenses of our counsel and our accountants.

|

|

Before Offering

|

After Offering

|

|

Name

|

Total Number of

Shares

Beneficially

Owned

|

Percentage

of Shares

Owned (1)

|

Number of

Shares Offered

|

Total Number of Shares Beneficially Owned (2)

|

Percentage

of Shares

Owned (1)

|

|

John Bailey (3)

|

120,000

|

*

|

120,000

|

-

|

-

|

|

Beggar Pacific Holding Corp (4)

|

160,000

|

*

|

160,000

|

-

|

-

|

|

Dave Blore (5)

|

533,333

|

*

|

200,000

|

333,333

|

*

|

|

Patricia Blore (6)

|

100,000

|

*

|

100,000

|

-

|

-

|

|

Byron Securities Limited.(7)

|

348,000

|

*

|

348,000

|

-

|

-

|

|

Canamerica Capital Corp. (8)

|

1,000,000

|

*

|

1,000,000

|

-

|

-

|

|

Daniel Wilbert Chapman (9)

|

80,000

|

*

|

80,000

|

-

|

-

|

|

Clarus Securities Inc. (10)

|

1,996,000

|

*

|

1,996,000

|

-

|

-

|

|

Consolidated Thompson Iron Mines Limited (11)

|

13,333,334

|

8.5%

|

13,333,334

|

-

|

-

|

|

Barry Cummings (12)

|

40,000

|

*

|

40,000

|

-

|

-

|

|

Dundee Corporation (13)

|

20,000,000

|

12.6%

|

20,000,000

|

-

|

-

|

|

Extreme Growth Fund Resources SICAV SIF (14)

|

1,750,000

|

*

|

1,000,000

|

750,000

|

*

|

|

Falcon Trading Co. Inc. (15)

|

200,000

|

*

|

200,000

|

-

|

-

|

|

Gerry Franco (16)

|

200,000

|

*

|

200,000

|

-

|

-

|

|

Vern Friesen (17)

|

200,000

|

*

|

200,000

|

-

|

-

|

|

Max Fugman (18)

|

40,000

|

*

|

40,000

|

-

|

-

|

|

Salim Ghafari (19)

|

60,000

|

*

|

60,000

|

-

|

-

|

|

Jindy Gill (20)

|

20,000

|

*

|

20,000

|

-

|

-

|

|

Glen Allen Graham Harrison (21)

|

40,000

|

*

|

40,000

|

-

|

-

|

|

Thomas James (22)

|

30,000

|

*

|

30,000

|

-

|

-

|

|

Larry Thomas Johnston (23)

|

20,000

|

*

|

20,000

|

-

|

-

|

|

Bernard John Jones (24)

|

30,000

|

*

|

30,000

|

-

|

-

|

|

Dr. M. Kalairajah (25)

|

216,000

|

*

|

36,000

|

180,000

|

*

|

|

Efstathe (Steve) Krembenios (26)

|

20,000

|

*

|

20,000

|

-

|

-

|

|

Wolfgang Horst Kyser (27)

|

790,000

|

*

|

350,000

|

440,000

|

*

|

|

Brian Lind-Petersen (28)

|

100,000

|

*

|

100,000

|

-

|

-

|

|

Borge Lind-Petersen (29)

|

400,000

|

*

|

400,000

|

-

|

-

|

|

Ian MacPherson (30)

|

30,000

|

*

|

30,000

|

-

|

-

|

|

Donna Martin (31)

|

40,000

|

*

|

40,000

|

-

|

-

|

|

Raymond Martin (32)

|

200,000

|

*

|

200,000

|

-

|

-

|

|

Douglas L. Mason (33)

|

150,000

|

*

|

150,000

|

-

|

-

|

|

Margaret C. McGroarty (34)

|

30,000

|

*

|

30,000

|

-

|

-

|

|

Norman David Moretto (35)

|

40,000

|

*

|

40,000

|

-

|

-

|

|

Edward Antoni Mucha (36)

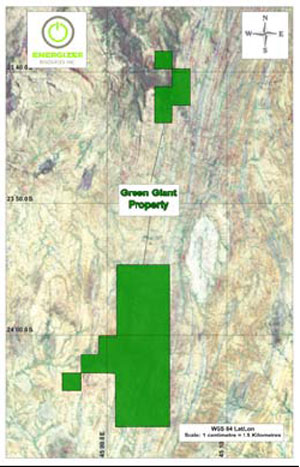

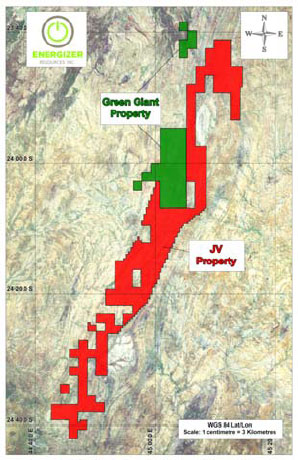

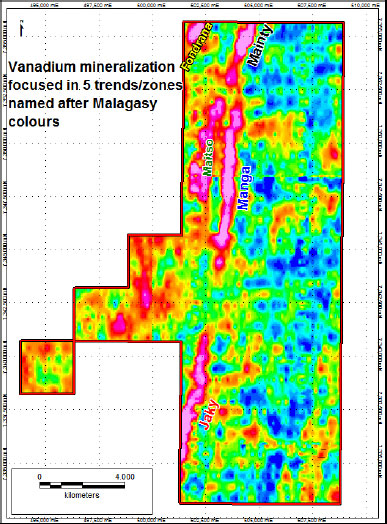

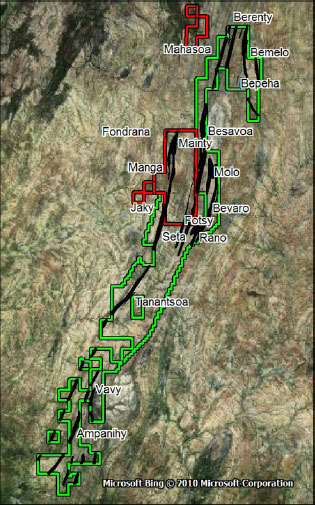

|