Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PSS WORLD MEDICAL INC | d357787d8k.htm |

PSS WORLD

MEDICAL INVESTOR DAY 2012

May 24, 2012

InterContinental Hotel -

Times Square

New York, NY

EXHIBIT 99.1 |

FORWARD-LOOKING

STATEMENTS During this meeting and its replay, we may make a number of forward-looking

statements regarding revenue, gross margin, operating expenses, operating margins,

earnings per share and other matters that are not historical facts. Additionally, we may

include statements regarding the plans, strategies and objectives of management for

future operations, including execution of our restructuring plans, and the additional

investment in, and disposition of, certain business operations; statements or projections of

cost savings, growth rates, profitability, investment levels or other financial items;

statements regarding anticipated operational results and management’s estimate of

pro forma financial results, and any statements of assumptions underlying any of the

foregoing. Those statements involve a number of risks and uncertainties that could cause

actual results to differ materially from what is expressed or forecasted. For a list and

descriptions of certain of these risks and uncertainties, we refer you to the

forward-looking statement disclosure and other information provided in our most

recent Form 10-K and other SEC filings, copies of which are available from the SEC,

from the investor relations section of our website, or requested from us in investor

relations. The Company wishes to caution listeners of the conference and its replay and/or

participants in this meeting not to place undue reliance on any such forward-looking

statements, which statements are made pursuant to the Private Securities Litigation

Reform Act of 1995 and, as such, speak only as of the date made. The Company also wishes

to caution listeners and participants that it undertakes no duty or is under no

obligation to update or revise any forward-looking statements, except as may be

required by law.

We may reference certain non-GAAP financial measures in an effort to provide additional

information to investors. All non-GAAP measures have been reconciled to the related

GAAP measures in accordance with SEC rules. You'll find reconciliation charts in this

presentation and in the Financial Supplement on our website, at www.pssworldmedical.com.

2 |

AGENDA

3

INDUSTRY OVERVIEW AND

STRATEGIC TRANSFORMATION

FINANCIAL TRANSFORMATION

GO TO MARKET STRATEGIES

OPERATIONS OVERVIEW

SUMMARY

QUESTIONS AND ANSWERS

Gary Corless, President & CEO

David Bronson, EVP & CFO

Eddie Dienes, President, PSS

Brad Hilton, Chief Service Officer

Gary Corless, President & CEO |

INDUSTRY OVERVIEW

AND STRATEGIC TRANSFORMATION

4

Gary Corless, President & CEO |

5

Healthcare Costs as % of U.S. GDP

Source: Centers for Medicare & Medicaid Services

16%

17%

18%

20%

2005

2010

2015

2020

THE HEALTHCARE INDUSTRY MUST CHANGE |

Time

Reimbursement

Pressures

Healthcare

Reform

Consolidation

Economic

Environment

Unemployment

Lower Utilization

RAPID CHANGE REQUIRES BOLD ACTION

6 |

OUR VISION FOR

MOVING FORWARD 7

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform

1 |

RATIONALE FOR FOUR

VERTICALS 8

Payer & Patient Preferred

Higher Growth

Demonstrated Core Competency

Higher Profitability |

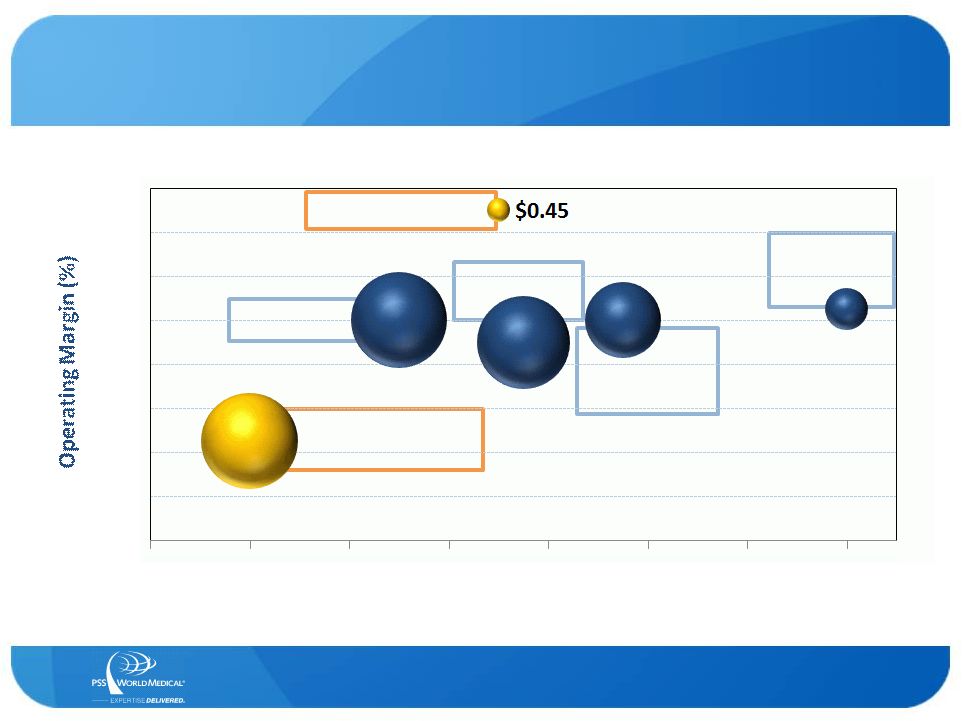

FOCUSED ON GROWTH

AND MARGIN 9

Market Growth Rate (%)

$ in Billions

2

0

2

4

6

8

10

12

-

$8

$8

Physician

Laboratory

In-Office

Dispensing

Skilled Nursing

Facilities

Home Care

& Hospice

$8

$5

$1.5

16

14

12

10

8

6

4

2

0

Specialty Dental |

FOCUSED STRUCTURE

FOR GROWTH Physician

Business

Extended

Care

10

POST-TRANSFORMATION

Skilled

Nursing

Specialty

Dental

PRE-TRANSFORMATION |

TARGET

MARKET

OPPORTUNITY

11

STRATEGIC

OBJECTIVE

•

Size: $7-9 Billion

•

Historic growth

rate: 2-4%

•

Number of sites:

>200,000

•

Current market

share: 15%

Accelerate revenue growth through innovative and

differentiated solutions that strengthen primary care and front

line specialists in a range of practices including health systems

COMPETITIVE

ADVANTAGES

•

Large, well-trained

sales force

•

Differentiated

service model

•

Industry-leading

private label

offering

PHYSICIAN

5 Year Market Share Goal: 25% |

TARGET

MARKET

OPPORTUNITY

12

STRATEGIC

OBJECTIVE

•

Size: $6-9 Billion

•

Historic growth

rate: 5-6%

•

Number of sites:

100,000 physician

office laboratories

•

Current market

share: 6-8%

Market-leading distributor of laboratory products and services

to physician offices, independent clinical labs & small hospitals

COMPETITIVE

ADVANTAGES

•

Laboratory

expertise

•

Breadth of offering

•

Size and knowledge

of sales force

LABORATORY

5 Year Market Share Goal: 15% |

TARGET

MARKET

OPPORTUNITY

13

STRATEGIC

OBJECTIVE

•

Size: $1-2 Billion

•

Historic growth

rate: 10-15%

•

Number of sites:

40,000

•

Current market

share: 6-8%

Market leader for in-office dispensing solutions for physician

offices, urgent care, work-site clinics and community health

centers

COMPETITIVE

ADVANTAGES

•

Industry-leading

customer technology

platform

•

Full service turnkey

dispensing solutions

•

Size and knowledge

of sales force

DISPENSING

5 Year Market Share Goal: 20-25% |

TARGET

MARKET

OPPORTUNITY

14

STRATEGIC

OBJECTIVE

•

Size: $1-5 Billion

•

Historic growth

rate: 7-8%

•

Number of sites:

12,000 agencies and

3,500 hospice sites

•

Current market

share: 10%

Market leader for innovative products and services for home

care agencies and hospice providers

COMPETITIVE

ADVANTAGES

•

Broad product and

service offering

•

Differentiated

service model

•

Customer

technology

solutions

HOME CARE & HOSPICE

5 Year Market Share Goal: 10-15% |

5 YEAR VISION

15

2X

Revenues

10%

Operating Margin |

FOCUSED FOR

GROWTH 16

“External opportunities met with

internal competencies in a unique way.” |

FINANCIAL

TRANSFORMATION 17

David Bronson, EVP & CFO |

2011 INVESTOR DAY

REPORT CARD 18

FY12 Goal

FY12 Actual

Revenue Growth

7-9%

3.3%

EPS

$1.46-1.50

$1.38

Operating Cash Flow

$115-120 million

$128.4 million |

TRANSFORMING FOR

GROWTH 19

Focused

Growth

Leadership Team

Experience

Strong Financial Base |

($ in

millions) Revenue

Gross Profit

Gross Percentage

SG&A

Operating Income

Operating Percentage

Interest/Other

Pre-tax

Taxes

Net Income

EPS

EBITDA

FY12

PRO

FORMA

CARVE-OUT

INCOME

STATEMENT

20

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. Skilled

Nursing

$ 485

137

28.3%

120

17

3.6%

-

17

6

11

$ 0.21

$ 23

FY12

(As Reported)

Consolidated

$ 2,102

674

32.1%

541

133

6.3%

18

115

41

74

$ 1.38

$ 171

FY12

Pro Forma

$ 1,571

522

33.2%

413

109

6.9%

18

91

32

59

$ 1.08

$ 141

Specialty

Dental

$ 46

15

33.0%

8

7

15.8%

-

7

3

4

$ 0.09

$ 7 |

FY11-12 PRO

FORMA INCOME STATEMENT 21

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. ($ in millions)

FY12

Pro Forma

FY11

Pro Forma

Percent

Change

Revenue

$ 1,571

$ 1,485

5.8%

Gross Profit

522

478

Gross Percentage

33.2%

32.2%

98 bp

SG&A

413

379

Operating Income

109

99

9.5%

Operating Percentage

6.9%

6.7%

23 bp

Interest/Other

18

15

Pre-tax

91

84

Taxes

32

31

Net Income

59

53

EPS

$ 1.08

$ 0.94

15.6%

EBITDA

$ 141

$ 127 |

GROWTH EXPECTATIONS

BY VERTICAL 22

* Baseline is estimated FY12 pro forma financial information adjusted for recent acquisitions.

Physician

$ 1,030

12-13%

3-5%

9-10%

Total

$ 1,700

13-15%

5-7%

10%

($ in millions)

BASELINE

Revenue

5 YEAR TARGET

Revenue CAGR

% Revenue Growth from M&A

Operating Margin

Laboratory

$ 460

15-16%

5-10%

10-12%

Dispensing

$ 110

25-30%

5-10%

10-12%

Home Care

& Hospice

$ 100

18-20%

10-12%

8-10% |

OPERATING MARGIN

EXPANSION 23

* Base is FY12 Pro Forma income statement operating margin. Pro forma financial information

excludes Skilled Nursing and Specialty Dental businesses and represents

management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. |

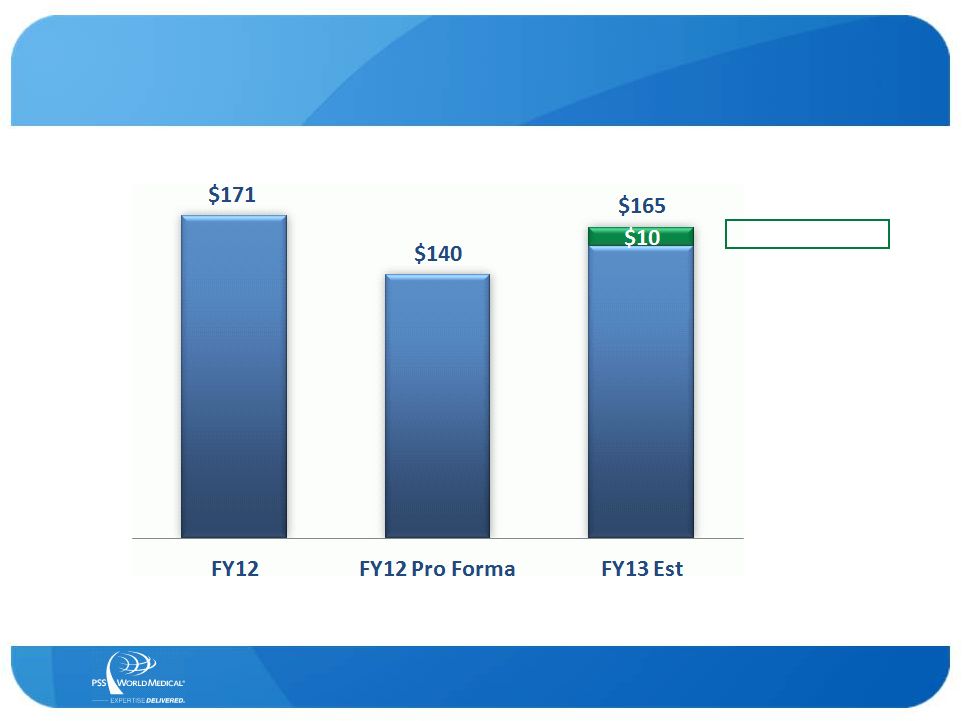

EBITDA

ANALYSIS 24

$ in millions

FY13 M&A to Date

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. |

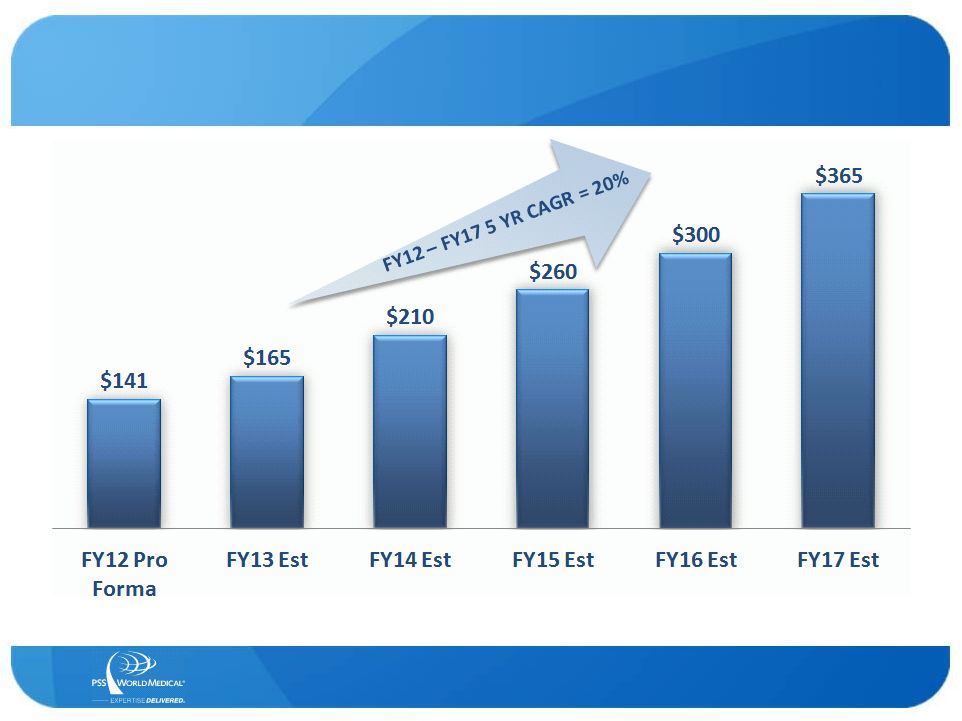

EBITDA

LONG-TERM OUTLOOK 25

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. |

FINANCIAL RESOURCES

26

($ in millions)

FY13 Est

FY14 Est

FY15 Est

FY16 Est

FY17 Est

Operating Cash Flow

$ 105

$ 125

$ 150

$ 185

$ 220

Capital Expenditures

(25)

(27)

(30)

(33)

(37)

Free Cash Flow

80

98

120

152

183

Debt

Gross

465

475

250

250

250

Net

120

210

260

215

155

Leverage

Gross

2.8x

2.3x

1.0x

0.8x

0.7x

Net

0.7x

1.0x

1.0x

0.7x

0.4x

•

Includes estimated divestiture proceeds, M&A activity, share repurchases to offset annual

dilution and convertible debt repayment in 2014. This represents management’s best

estimate as of the date of this presentation which may differ materially from actual results. |

Skilled

Nursing Goldman Sachs

$480 million

$30 million

6 –

9x

6 –

9 months

Strategic or Financial

DIVESTITURE PROCESS

Advisor

Revenues

Adjusted EBITDA*

Expected multiple

Expected timing

Expected buyer

27

Use of Proceeds:

M&A strategy

Share repurchases

Pay down debt

* Information represents management’s best estimate as of the date of this presentation

and may differ materially from actual results. Adjusted EBITDA includes estimated stand

alone business synergies. Specialty Dental

William Blair

$47 million

$7 –

8 million

8 –

10x

3 –

6 months

Strategic or Financial |

FY13 FINANCIAL

GUIDANCE 28

10-12%

Consolidated

Revenue

Growth From FY12

Pro Forma

$1.11-1.15

EPS From Continuing

Operations

$100-110 mm

Consolidated

Operating

Cash Flow |

GO TO MARKET

STRATEGIES 29

Eddie Dienes, President, PSS |

OUR VISION FOR

MOVING FORWARD 30

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform

1 |

GO TO MARKET

STRATEGY 31

PSS Generalist Sales Force

PSS Home

Care &

Hospice

Sales Force

PSS Specialist

Health Systems

PSS Specialist

Laboratory

Consultant

PSS Specialist

Dispensing

Solutions

Manufacturer’s

Specialist

Manufacturer’s

Specialist

Manufacturer’s

Specialist |

2013 SALES FORCE

FOCUS Improve Caregivers

Efficiencies

REACH

OUR HEALTH

STRENGTHEN

SALES FORCE

PRODUCTIVITY

HEALTH SYSTEMS

Online Penetration

Programs

Sales Force Expansion

Workflow

Improvements

Total Customer

Solutions

Online Sales Growth

Increase Caregivers

Revenues

Reduce Caregivers

Expenses

Margin Expansion

Compensation Plan

Our Brands

Strategic Partnerships

Efficiency Programs

Reach

Programs

Business

Conversations

Our Brands

Reach Programs

Defined Rep And

Leader Roles

M & A

Lower the Cost to

Serve

Dramatically

increase and

penetrate the

number of

caregivers we

Significantly

increase sales

representatives

selling time

Dramatically

increase our

share of Health

Systems

Maximize our

profitability through

strategic products,

pricing, a lower cost

to serve and a fully

aligned comp plan

Strengthen the clinical

success & financial

health of our caregivers

by improving their

financial performance

by 20%

serve

32 |

•

Consultative selling

•

Account penetration

•

Expanding sales force

•

Increased national

account expertise

33

KEYS TO SUCCESS

•

Build a focused leadership team

•

Align compensation programs

•

Continue growth of Our Brands

•

Complete expansion of our

health systems resources

FY13 MILESTONES

PHYSICIAN

33 |

HEALTH SYSTEMS:

IMPACT OF CONSOLIDATION 34

Ownership

Caregiver

Locations

34 |

LARGE AND GROWING

CUSTOMER BASE 35

35

PSS Serves a

Broad Range of

Health Systems |

HEALTH SYSTEM

COMPETITIVE ADVANTAGES •

High Level Service Model of Distribution

–

Ease of ordering & returns; late cut off times

–

Next day delivery by PSS Delivery Professionals

•

Product & Pricing Standardization

–

Product formularies

–

GPO relationships

•

Breadth of Products

–

Our Brands

•

Large, Well Trained Sales Force

–

Generalists & Specialists

36 |

FOCUSED INVESTMENT

IN HEALTH SYSTEMS 37

FY12

FY13

Strategic Account Executives

6

12

Strategic Account Managers

0

4

GPO Directors

1

3

Health System Analysts

0

2

Dedicated Marketing Managers

0

2

Total

7

23 |

SUPERIOR LEVEL OF

SERVICE 38

LISA BOYD

Account Representative

Health System with 55,000 employees,

including several thousand physicians;

PSS ships to more than 400 locations in

12 states in the South and Midwest

“The reason I prefer PSS is

simple. It is the level of

service we receive from your

support staff…

With these

individuals in place as well as

many others, I have a

confidence level with PSS that

no other company has been

able to match.” |

“Baptist

Health System cemented a partnership with PSS to streamline

and standardize the supply

acquisition process in our clinics.

PSS turned out to be the perfect

partner to bring the necessary

resources to help BHS make changes

to be successful.

From electronic

ordering to standardizing product to

utilizing generic products, the

program was solid.”

39

MICHAEL LOUVIERE

Vice President, Supply Chain

Health System with 85 physicians;

PSS ships to more than 45 locations

in Alabama

OUR BRANDS PROVIDE ATTRACTIVE SOLUTION |

“CFMG chose

PSS as a service provider because of their

quality medical products and

outstanding customer service.

Our physician’s network

benefits tremendously from

the size of their medical

services inventory and

participating manufacturers.”

BREADTH OF INVENTORY

40

LENDA TOWNSEND-WILLIAMS, MBA

Chief Operating Officer

Health System with 500 physicians;

PSS ships to more than 60 locations

in the greater Oakland, CA, area |

“For the

nurses dealing with the PSS drivers –

in-stock

items, next-day delivery of

orders placed by 8:00 pm, a

reliable delivery fleet and a

promise to understand each

physician customer –

made

the difference.”

EASY TO DO BUSINESS WITH

41

MICHAEL REICH

Director for Lab & Medical Sourcing

Health System with 1,200 physicians;

PSS ships to more than 60 locations

in the New York region |

“Private

Practice Doctors and PSS share the vision

of preserving high quality

patient care through

private practice

medicine. PPD is thrilled

to be working with PSS.”

FOCUS ON SUPPORTING CAREGIVERS

42

ALEXANDRA BROUSSEAU, PHD

PPD Membership

Management Services Organization

with 180 physicians;

PSS ships to more than 60 locations

in the greater Los Angeles area |

OUR VISION FOR

MOVING FORWARD 43

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform

1 |

44

LABORATORY

•

Laboratory expertise

•

Competency in complex

capital equipment sales

•

Differentiated offering

•

Sourcing and Our Brands

•

Build a focused leadership team

•

Define and realign roles for

sales force

•

Expand product offering

•

Establish key GPO relationships

•

Integrate acquired businesses

KEYS TO SUCCESS

FY13 MILESTONES |

45

DISPENSING

•

Turnkey installation and

solution management

•

Claims processing

expertise

•

Repackaging and

fulfillment capabilities

•

Leveraging generalist

sales force

•

Build a focused leadership team

•

Integrate acquired businesses

•

Implement branding of offering

•

Train and engage sales reps

•

Expand customer reach

FY13 MILESTONES

KEYS TO SUCCESS |

46

EASY TO USE SOLUTION |

•

Dedicated, experienced

sales force

•

Logistics expertise

•

Differentiated service

model

•

Navigation of

reimbursement and

competitive bidding

47

KEYS TO SUCCESS

•

Build a focused leadership team

•

Transition to separate sales

team split from Skilled Nursing

Facilities business

•

Integrate operations and

distribution

•

Realign and brand the offering

FY13 MILESTONES

HOME CARE & HOSPICE |

SUPERIOR

COMBINATION OF SERVICES 48

BONNIE ALKEMA

Executive Director

Hospice Agency based in Miami, FL

with 4 branches servicing 600+ patients;

Supplies are shipped to more than 700,000

patient’s homes across the country each year

“We are very excited to have

chosen your Company as our

supplier for our Hospice

program. Your combination of

better Service, Online

Technology, Patient Home

Delivery and Cost Savings

versus your competition drove

us to you. We choose our

partners carefully and you are

now one of them.” |

ROBUST TECHNOLOGY

INTEGRATION 49

BARRY DAVIS

Chief Operation Officer

Home Health and Hospice Agency based

in Jackson, MS with 35 branches

“Sta-Home chose your

Company because of the cost

containment program, sales

rep support and most

importantly, because you were

fully interfaced with our Point-

of-Care software system,

Homecare Homebase. Being

able to interface to our Home

Care software system is critical

for our Operational Efficiency.” |

OUR VISION FOR

MOVING FORWARD 50

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform

1 |

OPERATIONS

OVERVIEW 51

Brad Hilton, Chief Service Officer |

OUR VISION FOR

MOVING FORWARD 52

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform

1 |

53

Customer Solutions

Professional Delivery

Order Fulfillment

ONE COMMON DISTRIBUTION INFRASTRUCTURE |

ONE WORLD-CLASS

SHARED SERVICES TEAM 54

Customer Service

Supplier Services

Team Member Services

Financial

Legal & Compliance

Information Technology |

ONE INFORMATION

TECHNOLOGY PLATFORM 55

Customer Experience Systems

Order Processing Systems

IT Infrastructure

Business Information & Reporting Systems |

OUR VISION FOR

MOVING FORWARD 56

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform |

SUMMARY

57

Gary Corless, President & CEO |

EXPERIENCED TEAM

REDUCES RISK 2003 Strategic Transformation:

•

Divested imaging business

•

Consolidated distribution infrastructure,

rationalizing half of existing locations

•

Implemented standardized ERP system

•

Launched global sourcing effort

58

Then

Now

Revenues

$1.1 bn

$2.1 bn

Margins

2%

6%

ROCC

7%

35%

Fiscal year end stock price

$9.80

$25.34

RESULTS

•

Designed shared service approach

for back office

•

Instituted long-term strategic

planning process

•

Implemented long-term incentive

programs |

TRANSFORMATION

DRIVEN BY OUR PURPOSE AND MISSION 59

PURPOSE

Strengthen the clinical

success and financial health

of caregivers by solving

their biggest problems.

MISSION

Improve caregivers’

financial performance

by 20%. |

OUR VISION FOR

MOVING FORWARD 60

Common Distribution Infrastructure

World-Class Shared Services Team

Information Technology Platform

1 |

PSS WORLD

MEDICAL INVESTOR DAY 2012

May 24, 2012

InterContinental Hotel -

Times Square

New York, NY |

APPENDIX

62 |

63

FY11 PRO FORMA

CONTINUING OPERATIONS RECONCILIATION

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. ($ in millions)

FY11

(As Reported)

Consolidated

Skilled

Nursing

Specialty

Dental

FY11

Pro Forma

Continuing

Operations

Revenue

$ 2,035

$ 506

$ 44

$ 1,485

Gross Profit

636

144

14

478

Gross Margin

31.2%

28.4%

31.0%

32.2%

SG&A

502

116

7

379

Operating Income

134

28

7

99

Operating Margin

6.6%

5.5%

14.4%

6.7%

Interest/Other

15

-

-

15

Pre-tax

119

28

7

84

Taxes

44

11

2

31

Net Income

$ 75

$ 17

$ 5

$ 53

EPS

$ 1.32

$ 0.31

$ 0.07

$ 0.94

EBITDA

$ 168

$ 34

$ 7

$ 127 |

64

($ in millions)

FY12

FY11

Revenues

$ 531

$ 550

Gross Profit

152

158

Gross Percentage

28.7%

28.6%

SG&A

128

123

Operating Income

24

35

Operating Percentage

4.6%

6.2%

Net Income

15

22

EPS

$ 0.30

$ 0.38

EBITDA

$ 30

$ 41

FY11-12 PRO FORMA SKILLED NURSING & SPECIALTY DENTAL

* Pro forma financial information for Skilled Nursing and Specialty Dental businesses

which represents management’s best estimate as of the date of this

presentation and may differ materially from actual pro forma financial results. |

FY12 EBITDA

CALCULATION ($ in millions)

FY12

(as reported)

Skilled

Nursing

Specialty

Dental

FY12

Pro Forma

NET INCOME

$ 74

$ 11

$ 4

$ 59

Plus: Interest expense

20

-

-

20

Less: Interest and investment income

-

-

-

-

Plus: Provision for income taxes

41

6

3

32

Plus: Depreciation

27

5

-

22

9

1

-

8

EBITDA

$ 171

$ 23

$ 7

$ 141

65

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. Plus: Amortization of

intangible assets |

FY11 EBITDA

CALCULATION ($ in millions)

FY11

(as reported)

Skilled

Nursing

Specialty

Dental

FY11

Pro Forma

NET INCOME

$ 75

$ 17

$ 5

$ 53

Plus: Interest expense

17

-

-

17

Less: Interest and investment income

-

-

-

-

Plus: Provision for income taxes

44

11

2

31

Plus: Depreciation

25

4

-

21

7

2

-

5

EBITDA

66

* Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and

represents management’s best estimate as of the date of this presentation and may

differ materially from actual pro forma financial results. Plus: Amortization of

intangible assets $ 168

$ 34

$ 7

$ 127 |