Attached files

| file | filename |

|---|---|

| 8-K - DELPHI AUTOMOTIVE PLC 8-K - Aptiv PLC | may2012-8xk.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE DATED MAY 24, 2012 - Aptiv PLC | exhibit991pressreleasedate.htm |

For internal use only Offer to Acquire FCI’s Motorized Vehicles Division May 24, 2012 Exhibit 99.2

For internal use only 2 This presentation, as well as other statements made by Delphi Automotive (“Delphi” or the “Company”), contain forward-looking statements that reflect, when made, the Company’s current views with respect to current events and financial performance. Such forward-looking statements are subject to many risks, uncertainties and factors relating to the Company’s operations and business environment, which may cause the actual results of the Company to be materially different from any future results, express or implied, by such forward-looking statements. All statements that address future operating, financial or business performance or the Company’s strategies or expectations are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “outlook” or “continue,” and other comparable terminology. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, the following: global economic conditions, including conditions affecting the credit market, the cyclical nature of automotive sales and production; the potential disruptions in the supply of and changes in the competitive environment for raw material integral to our products; the Company’s ability to maintain contracts that are critical to its operations; the ability of the Company to attract, motivate and/or retain key executives; the ability of the Company to avoid or continue to operate during a strike, or partial work stoppage or slow down by any of its unionized employees or those of its principal customers, and the ability of the Company to attract and retain customers. Additional factors are discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s filings with the Securities and Exchange Commission. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect the Company. It should be remembered that the price of the ordinary shares and any income from them can go down as well as up. Delphi disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events and/or otherwise, except as may be required by law. Forward-Looking Statements 2

For internal use only Rodney O’Neal

For internal use only Delphi to Acquire FCI MVL Delphi has entered into exclusive negotiations with FCI, a portfolio company of Bain Capital, and made a binding offer for the acquisition of FCI’s Motorized Vehicles division (MVL) – All-cash deal valued at €765M on a debt/cash free basis – Will be accretive to EPS in 2013 4 Note: MVL revenue reported on an International Financial Reporting Standards (IFRS) basis MVL at a Glance Leading global manufacturer of automotive interconnect products with a focus on high value, leading technology applications 2011 revenue of €692M

For internal use only Strategic Rationale 5 Strengthens and broadens leading position in the high growth and high margin global automotive connectors market Significantly diversifies customer base, enhances position with high growth customers Expands footprint and capabilities in fast growing Asia market Significant revenue synergies and operating efficiencies Accretive to margins and earnings per share in 2013 Results in attractive return on investment Accelerates revenue and earnings growth

For internal use only Airbags interconnect & cable assemblies Retainers Seatbelt pre-tensioner Braking and stability control Airbag ECU Engine control systems Transmission connections Hybrid/EV interconnect Charge plugs Data connectivity Device Electrical distribution Full interconnect solutions Power-actuated applications Enhances Portfolio of Automotive Connectors 6 Connection Systems Accelerates Revenue Growth Combined Indicates portfolio position/strength MVL

For internal use only Kevin Clark

For internal use only Transaction Purchase 100% of the stock of the Motorized Vehicles Division “MVL” of FCI Purchase Price €765M on a cash free, debt free basis (~$972M) Financing ~60% balance sheet cash / ~40% existing credit lines Accretion 2013E EPS accretion of $0.24/share, excluding one-time items Timing Expected to close by year-end 2012, subject to acceptance of the offer Offer Summary 8 Note: Purchase price assumes foreign exchange spot rate of 1.27 USD to EUR. Accretion assumes 2013 USD to EUR conversion exchange rate of 1.30 Delphi’s binding offer is subject to customary regulatory approvals including consultation by FCI with the Works Council, which is required by French law

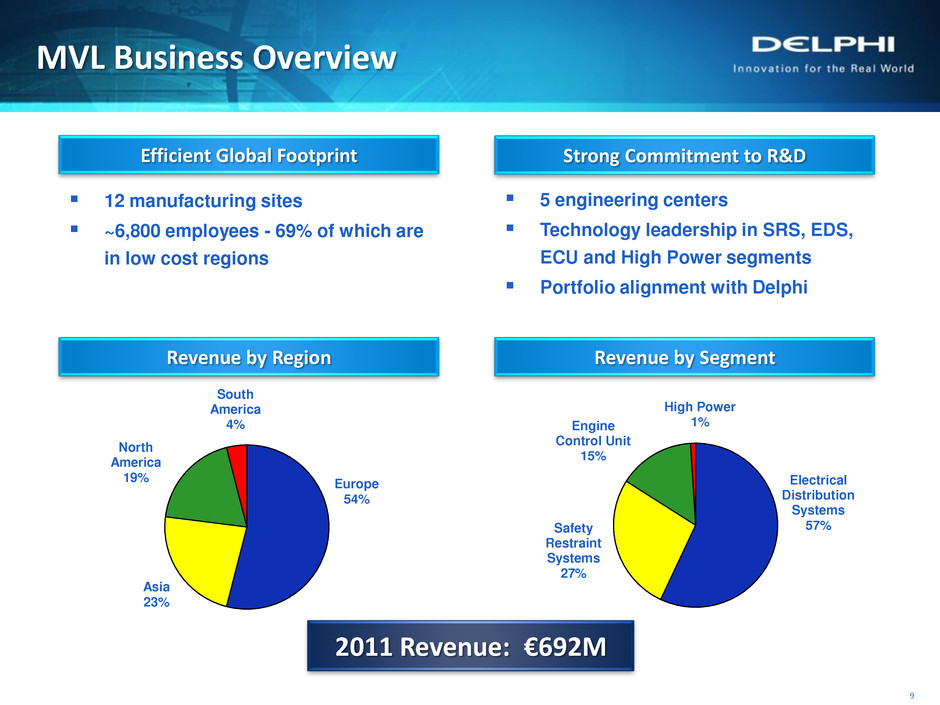

For internal use only MVL Business Overview 9 Strong Commitment to R&D 5 engineering centers Technology leadership in SRS, EDS, ECU and High Power segments Portfolio alignment with Delphi 12 manufacturing sites ~6,800 employees - 69% of which are in low cost regions Revenue by Region Revenue by Segment Efficient Global Footprint Electrical Distribution Systems 57% Safety Restraint Systems 27% Engine Control Unit 15% High Power 1% Europe 54% Asia 23% North America 19% South America 4% 2011 Revenue: €692M

For internal use only MVL Product Portfolio 10 Leadership on harsh environment powertrain interconnect Applications Full interconnect solutions – Powertrain, braking and cockpit Power-actuated applications Electrical Distribution (EDS) Global leader in higher growth SRS market Applications Airbags interconnect & cable assemblies Retainers Seatbelt pre-tensioner Safety Restraint Systems (SRS) High-end product offering and strong position with key systems providers Applications Engine control systems Braking and stability control systems Airbag ECU Engine Control Unit (ECU) End-to-end product capabilities protected with 18 global patents Applications EV Interconnect and Charge Plugs High Power

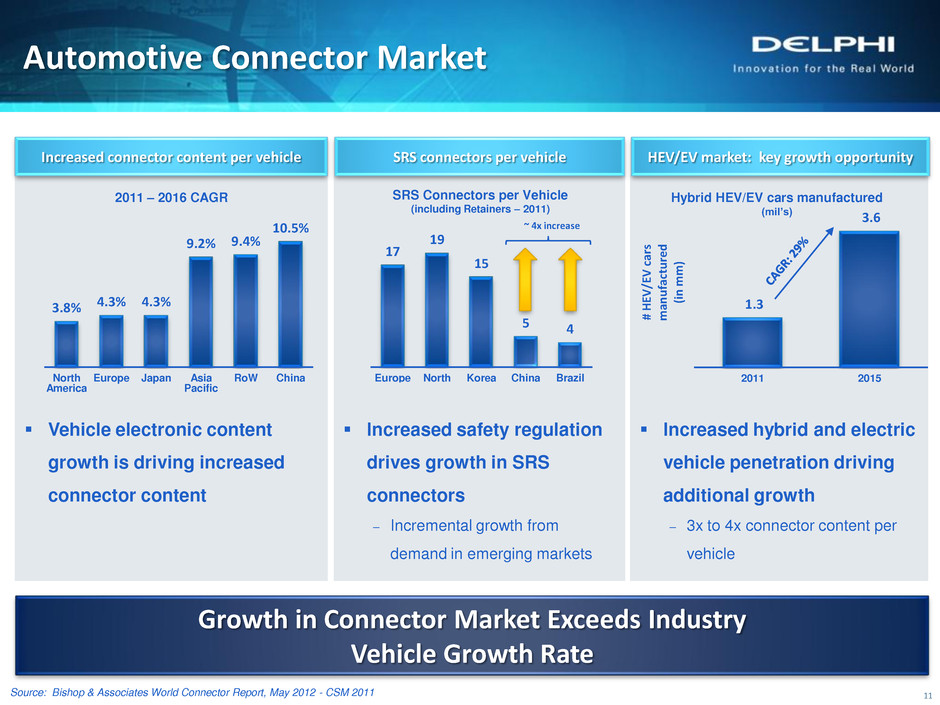

For internal use only 17 19 15 5 4 Europe North America Korea China Brazil Automotive Connector Market 11 HEV/EV market: key growth opportunity Increased connector content per vehicle Increased hybrid and electric vehicle penetration driving additional growth – 3x to 4x connector content per vehicle Vehicle electronic content growth is driving increased connector content Source: Bishop & Associates World Connector Report, May 2012 - CSM 2011 SRS connectors per vehicle ~ 4x increase 1.3 3.6 2011 2015 # H EV /E V c ar s m an u fac tu re d (i n m m ) 3.8% 4.3% 4.3% 9.2% 9.4% 10.5% North America Europe Japan Asia Pacific RoW China Growth in Connector Market Exceeds Industry Vehicle Growth Rate 2011 – 2016 CAGR SRS Connectors per Vehicle (including Retainers – 2011) Hybrid HEV/EV cars manufactured (mil’s) Increased safety regulation drives growth in SRS connectors – Incremental growth from demand in emerging markets

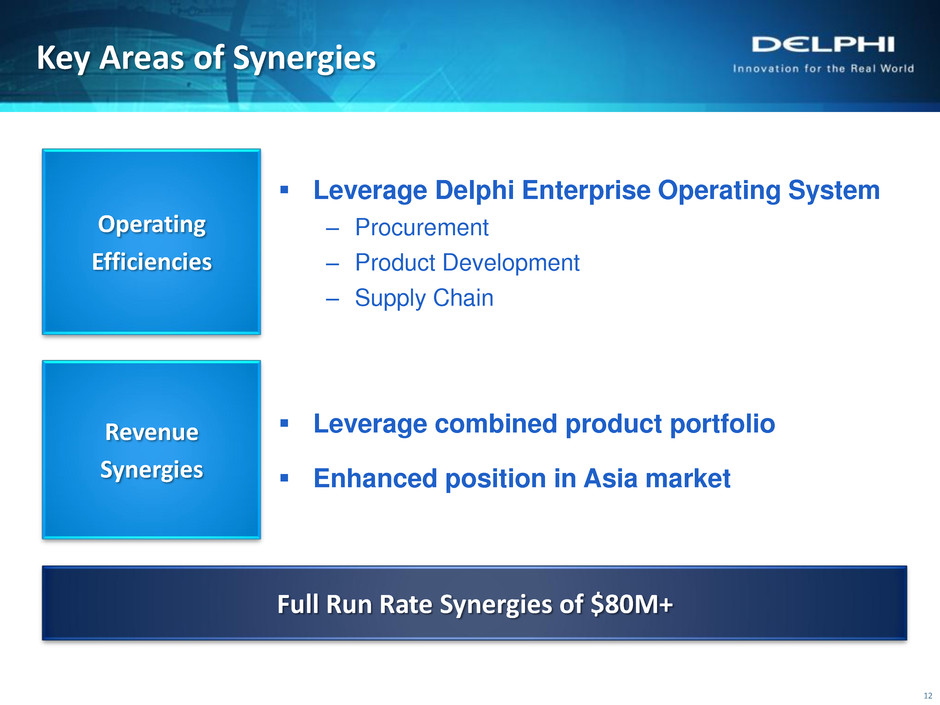

For internal use only Key Areas of Synergies Operating Efficiencies Revenue Synergies Leverage Delphi Enterprise Operating System – Procurement – Product Development – Supply Chain Leverage combined product portfolio Enhanced position in Asia market 12 Full Run Rate Synergies of $80M+

For internal use only Strategic Rationale 13 Strengthens and broadens leading position in the high growth and high margin global automotive connectors market Significantly diversifies customer base, enhances position with high growth customers Expands footprint and capabilities in fast growing Asia market Significant revenue synergies and operating efficiencies Accretive to margins and earnings per share in 2013 Results in attractive return on investment Accelerates revenue and earnings growth

For internal use only 14