Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONAGRA BRANDS INC. | d355026d8k.htm |

1

Citi 2012

Global

Consumer

Conference

Exhibit 99.1 |

Note

on

forward-looking

statements

2

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are based on management’s

current views and assumptions of future events and financial performance and are subject

to uncertainty and changes in circumstances. The company undertakes no responsibility

for updating these statements. Readers of this presentation should understand that these

statements are not guarantees of performance or results. Many factors could affect the

company’s actual financial results and cause them to vary materially from the expectations

contained in the forward-looking statements. These factors include, among other things:

availability and prices of raw materials, including any negative effects caused by inflation;

the effectiveness of the company’s product pricing, including any pricing actions and

promotional changes; future economic circumstances; industry conditions; the company’s

ability to execute its operating and restructuring plans; the success of the company’s

innovation, marketing, and cost-saving initiatives; the competitive environment and related

market conditions; operating efficiencies; the ultimate impact of any product recalls; the

company’s success in efficiently and effectively integrating the company’s

acquisitions; access to capital; actions of governments and regulatory factors affecting the

company’s businesses, including the Patient Protection and Affordable Care Act; the amount

and timing of repurchases of the company’s common stock, if any; and other risks described

in the company’s reports filed with the Securities and Exchange Commission. The

company’s cautions readers not to place undue reliance on any forward-looking

statements included in this presentation, which speak only as of the date made. |

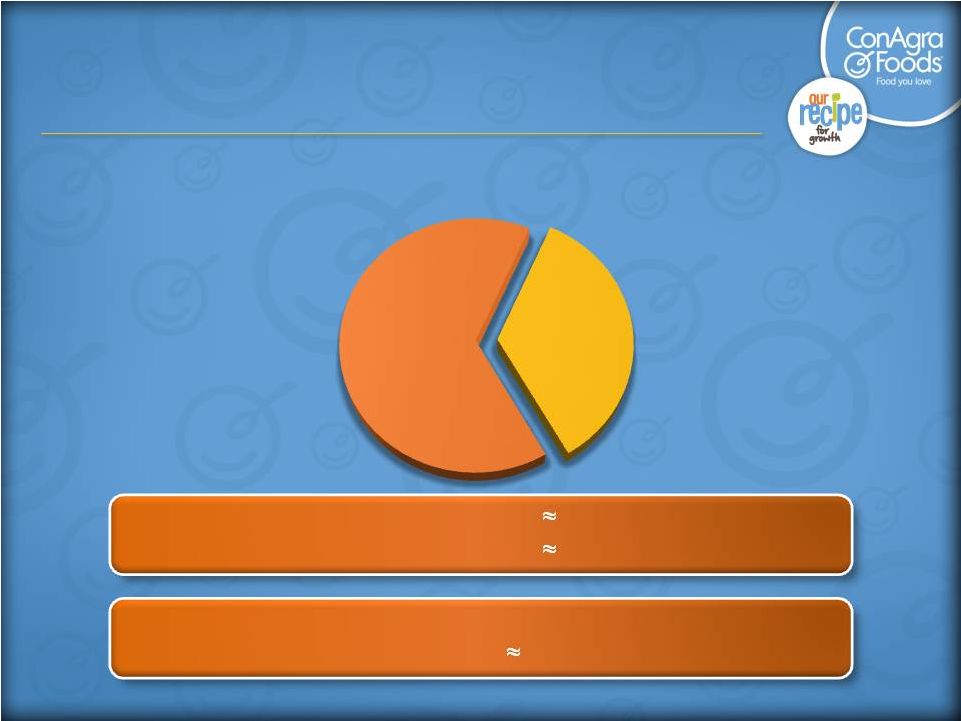

Company overview

3

FY12 Operating Cash Flow

FY12 Debt/EBITDA**

$1.3 billion* (est.)

2X (est.)

Current Annualized Dividend: $0.96 / share

Current Dividend Yield: 3.5%

35%

65%

Consumer Foods

Commercial Foods

Fiscal 2012 sales: Approaching $13 billion (est.)

*Excludes any FY12 discretionary pension contributions

**The

inability

to

predict

the

amount

and

timing

of

future

items

makes

a

detailed

reconciliation

of

projections

impracticable. |

Our

journey: entering phase 2 •

Phase 1

–

Operational progress

•

Organizational wiring

•

Culture

•

Cost structure

•

Marketing and innovation

•

Balance sheet

•

Portfolio

•

Phase 2

–

Leverage strong foundation

–

Our Recipe for Growth

4 |

5 |

•

Adopting best-in-class pricing and trade practices

•

Driving category growth

•

Developing win-win multi-year joint business plans

•

Presenting ONE ConAgra Foods voice

Customer Connect

•

Establishing customer P&Ls as key measurement

6 |

Financial priorities

1.

Strong earnings and cash flows

2.

Healthy balance sheet and strong liquidity

3.

High-return capital allocation with

top-tier dividend

7 |

Capital allocation:

M&A process guidelines

Category upside / position within category

Customer need / relationships

Potential for ConAgra Foods to improve through:

–

Innovation

–

Supply chain

–

Distribution

Operating leverage/scale

Organic sales growth potential

Margin structure

EPS contribution

ROIC

Strategic fit

Financial fit

Acquisitions

Right assets / Right growth potential / Right price

8 |

Long-term goals

•

Sales

growth

of

3%

annually

•

EPS* growth of 6-8% annually

Margin improvement

Operating leverage

Capital allocation

•

ROIC* of 13-14%

*EPS and ROIC guidance discussed in this presentation has been adjusted for items

impacting comparability. EPS guidance is based

on

diluted

EPS,

adjusted

for

items

impacting

comparability.

The

inability

to

predict

the

timing

and

amount

of

future

items

impacting comparability makes a detailed reconciliation of projections

impracticable. 9

Confirming expectations for modest comparable EPS growth in

Fiscal 2012 Q4 |

10

Citi 2012

Global

Consumer

Conference |