Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ONCOR ELECTRIC DELIVERY CO LLC | d357465d8k.htm |

Exhibit 99.1

First Quarter 2012 Investor Call

May 23, 2012

Oncor Electric Delivery

Forward Looking Statements

This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor Electric Delivery Company LLC (Oncor) with the Securities and Exchange Commission (SEC). Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. In addition to the risks and uncertainties set forth in Oncor’s SEC filings, the forward-looking statements in this presentation could be affected by, among other things: prevailing governmental policies and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; weather conditions and other natural phenomena; acts of sabotage, wars or terrorist or cyber security threats or activities; economic conditions, including the impact of a recessionary environment; unanticipated population growth or decline, or changes in market demand and demographic patterns; changes in business strategy, development plans or vendor relationships; unanticipated changes in interest rates or rates of inflation; unanticipated changes in operating expenses, liquidity needs and capital expenditures; inability of various counterparties to meet their financial obligations to Oncor, including failure of counterparties to perform under agreements; general industry trends; hazards customary to the industry and the possibility that Oncor may not have adequate insurance to cover losses resulting from such hazards; changes in technology used by and services offered by Oncor; significant changes in Oncor’s relationship with its employees; changes in assumptions used to estimate costs of providing employee benefits, including pension and other post-retirement employee benefits, and future funding requirements related thereto; significant changes in critical accounting policies material to Oncor; commercial bank and financial market conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds in the capital markets and the potential impact of disruptions in US credit markets; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; financial restrictions under Oncor’s revolving credit facility and indentures governing its debt instruments; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; actions by credit rating agencies; and Oncor’s ability to effectively execute its operational strategy. Any forward-looking statement speaks only as of the date on which it is made, and Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events.

Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measures is included in this presentation, which is available on Oncor’s website, www.oncor.com, under the ‘News’ tab in the Investor Information section, and also filed with the SEC.

Oncor Electric Delivery

| 1 |

|

1st Quarter 2012 Investor Call Agenda

Financial Overview

Operational Review

Q&A

David Davis

Chief Financial Officer

Bob Shapard

Chairman and CEO

Oncor Electric Delivery

2

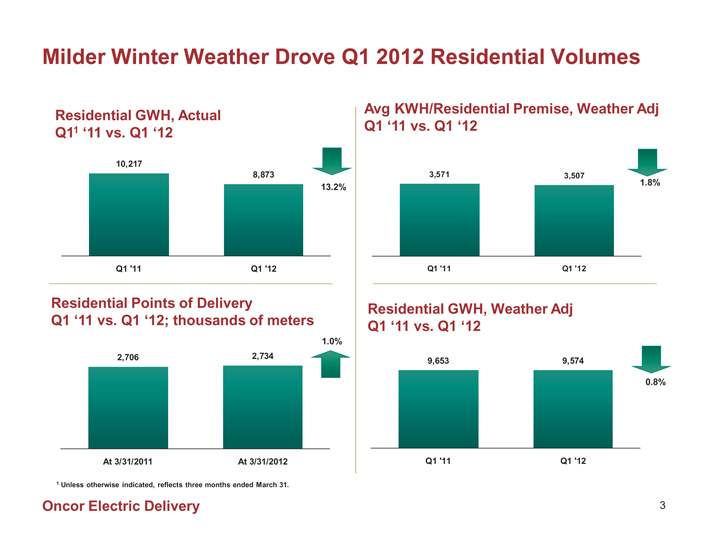

Milder Winter Weather Drove Q1 2012 Residential Volumes

Residential GWH, Actual Q11 ‘11 vs. Q1 ‘12

10,217

Q1 ‘11

8,873

Q1 ‘12

13.2%

Avg KWH/Residential Premise, Weather Adj Q1 ‘11 vs. Q1 ‘12

3,571

Q1 ‘11

3,507

Q1 ‘12

1.8%

Residential Points of Delivery

Q1 ‘11 vs. Q1 ‘12; thousands of meters

2,706

At 3/31/2011

2,734

At 3/31/2012

1.0%

Residential GWH, Weather Adj Q1 ‘11 vs. Q1 ‘12

9,653

Q1 ‘11

9,574

Q1 ‘12

0.8%

1 Unless otherwise indicated, reflects three months ended March 31.

Oncor Electric Delivery

3

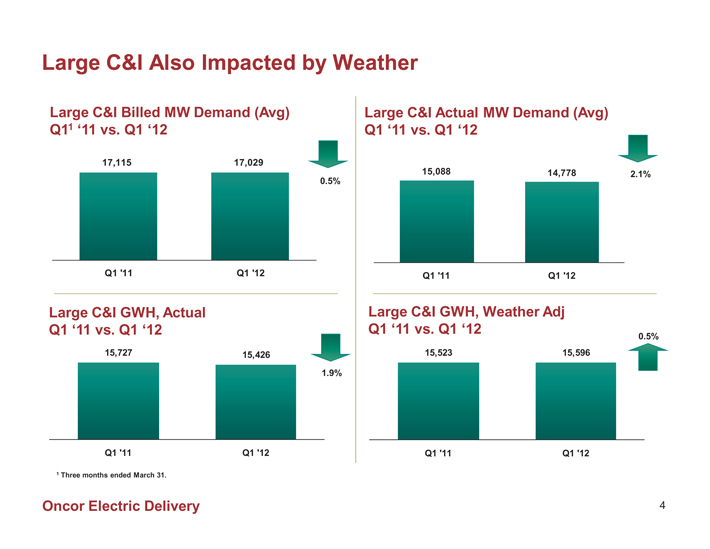

Large C&I Also Impacted by Weather

Large C&I Billed MW Demand (Avg) Q11 ‘11 vs. Q1 ‘12

17,115

Q1 ‘11

17,029

Q1 ‘12

0.5%

Large C&I Actual MW Demand (Avg) Q1 ‘11 vs. Q1 ‘12

15,088

Q1 ‘11

14,778

Q1 ‘12

2.1%

Large C&I GWH, Actual Q1 ‘11 vs. Q1 ‘12

15,727

Q1 ‘11

15,426

Q1 ‘12

1.9%

1 Three months ended March 31.

Oncor Electric Delivery

4

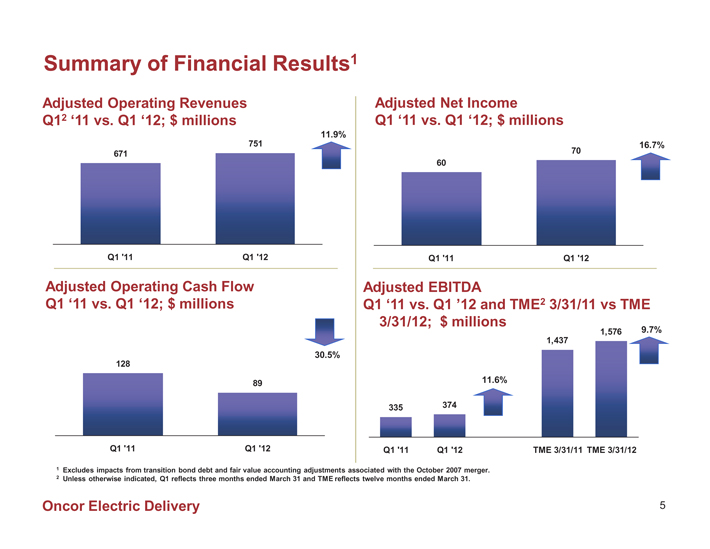

Summary of Financial Results1

Adjusted Operating Revenues Q12 ‘11 vs. Q1 ‘12; $ millions

671

Q1 ‘11

751

Q1 ‘12

11.9%

Adjusted Operating Cash Flow Q1 ‘11 vs. Q1 ‘12; $ millions

128

Q1 ‘11

89

Q1 ‘12

30.5%

Adjusted Net Income

Q1 ‘11 vs. Q1 ‘12; $ millions

60

Q1 ‘11

70

Q1 ‘12

16.7%

Adjusted EBITDA

Q1 ‘11 vs. Q1 ‘12 and TME2 3/31/11 vs TME 3/31/12; $ millions

335

Q1 ‘11

374

Q1 ‘12

11.6%

1,437

1,576

9.7%

TME 3/31/11 TME 3/31/12

1 Excludes impacts from transition bond debt and fair value accounting adjustments associated with the October 2007 merger.

2 Unless otherwise indicated, Q1 reflects three months ended March 31 and TME reflects twelve months ended March 31.

Oncor Electric Delivery

5

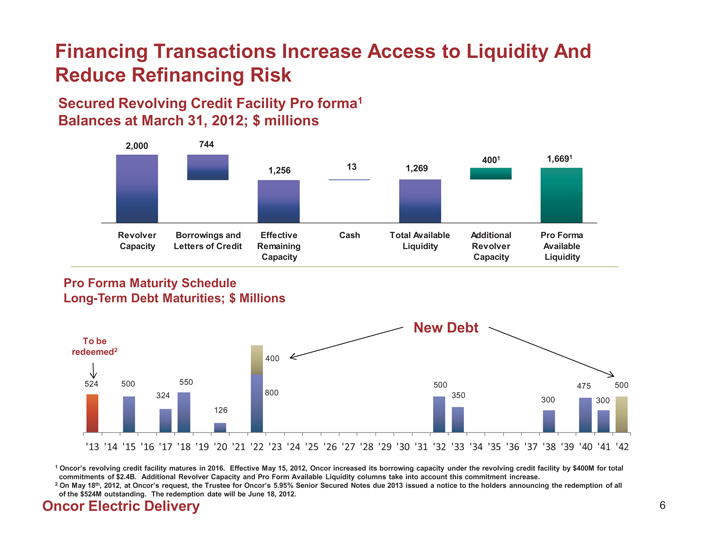

Financing Transactions Increase Access to Liquidity And Reduce Refinancing Risk

Secured Revolving Credit Facility Pro forma1 Balances at March 31, 2012; $ millions

2,000 744

400 1 1,669 1

13 1,269 1,256

Revolver Borrowings and Effective Cash Total Available Additional Pro Forma Capacity Letters of Credit Remaining Liquidity Revolver Available Capacity Capacity Liquidity

Pro Forma Maturity Schedule

Long-Term Debt Maturities; $ Millions

To be redeemed2

524 500 550 324

126

400

800

500 475 500 350 300 300

1 Oncor’s revolving credit facility matures in 2016. Effective May 15, 2012, Oncor increased its borrowing capacity under the revolving credit facility by $400M for total commitments of $2.4B. Additional Revolver Capacity and Pro Form Available Liquidity columns take into account this commitment increase.

2 On May 18th, 2012, at Oncor’s request, the Trustee for Oncor’s 5.95% Senior Secured Notes due 2013 issued a notice to the holders announcing the redemption of all of the $524M outstanding. The redemption date will be June 18, 2012.

Oncor Electric Delivery

6

1st Quarter 2012 Investor Call Agenda

Financial Overview

Operational Review

Q&A

David Davis

Chief Financial Officer

Bob Shapard

Chairman and CEO

Oncor Electric Delivery

7

Appendix -

Regulation G Reconciliations and Supplemental Data

Oncor Electric Delivery

8

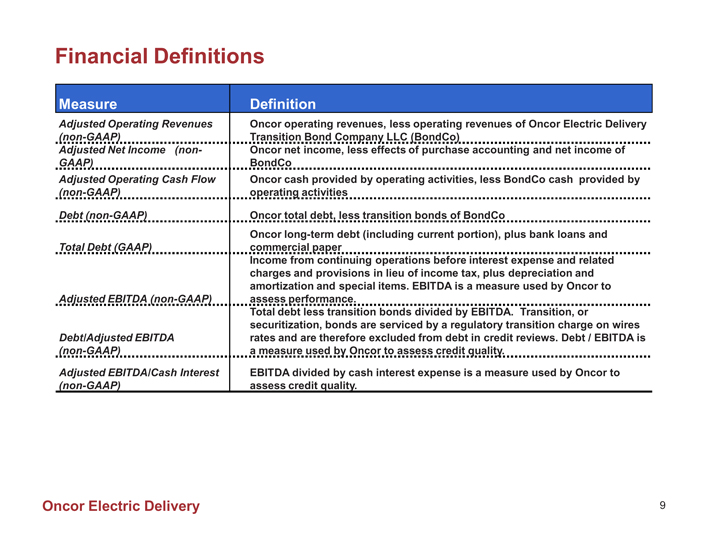

Financial Definitions

Measure Definition

Adjusted Operating Revenues

(non-GAAP) Oncor operating revenues, less operating revenues of Oncor Electric Delivery Transition Bond Company LLC (BondCo)

Adjusted Net Income (non-GAAP) Oncor net income, less effects of purchase accounting and net income of BondCo

Adjusted Operating Cash Flow (non-GAAP) Oncor cash provided by operating activities, less BondCo cash provided by operating activities

Debt (non-GAAP) Oncor total debt, less transition bonds of BondCo

Total Debt (GAAP) Oncor long-term debt (including current portion), plus bank loans and commercial paper

Adjusted EBITDA (non-GAAP) Income from continuing operations before interest expense and related charges and provisions in lieu of income tax, plus depreciation and amortization and special items. EBITDA is a measure used by Oncor to assess performance.

Debt/Adjusted EBITDA

(non-GAAP) Total debt less transition bonds divided by EBITDA. Transition, or securitization, bonds are serviced by a regulatory transition charge on wires rates and are therefore excluded from debt in credit reviews. Debt / EBITDA is a measure used by Oncor to assess credit quality.

Adjusted EBITDA/Cash Interest

(non-GAAP) EBITDA divided by cash interest expense is a measure used by Oncor to assess credit quality.

Oncor Electric Delivery

9

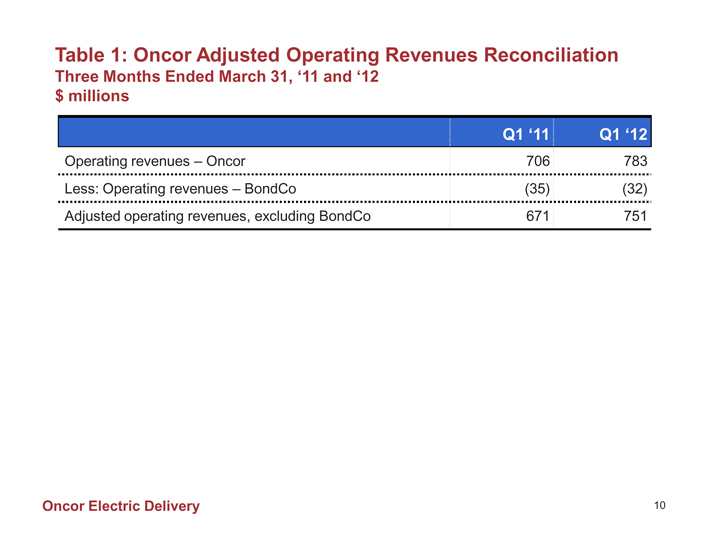

Table 1: Oncor Adjusted Operating Revenues Reconciliation

Three Months Ended March 31, ‘11 and ‘12 $ millions

Q1 ‘11 Q1 ‘12

Operating revenues – Oncor 706 783 Less: Operating revenues – BondCo (35) (32) Adjusted operating revenues, excluding BondCo 671 751

Oncor Electric Delivery

10

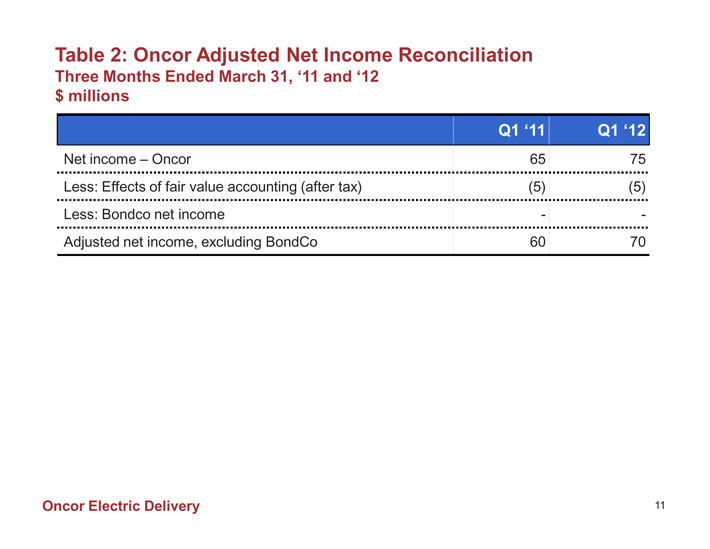

Table 2: Oncor Adjusted Net Income Reconciliation

Three Months Ended March 31, ‘11 and ‘12 $ millions

Q1 ‘11 Q1 ‘12

Net income – Oncor 65 75

Less: Effects of fair value accounting (after tax) (5) (5)

Less: Bondco net income — -

Adjusted net income, excluding BondCo 60 70

Oncor Electric Delivery

11

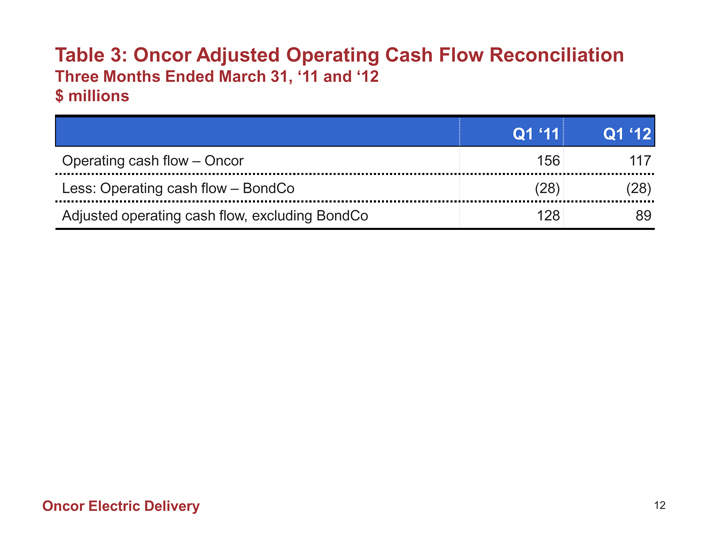

Table 3: Oncor Adjusted Operating Cash Flow Reconciliation

Three Months Ended March 31, ‘11 and ‘12 $ millions

Q1 ‘11 Q1 ‘12

Operating cash flow – Oncor 156 117

Less: Operating cash flow – BondCo (28) (28)

Adjusted operating cash flow, excluding BondCo 128 89

Oncor Electric Delivery

12

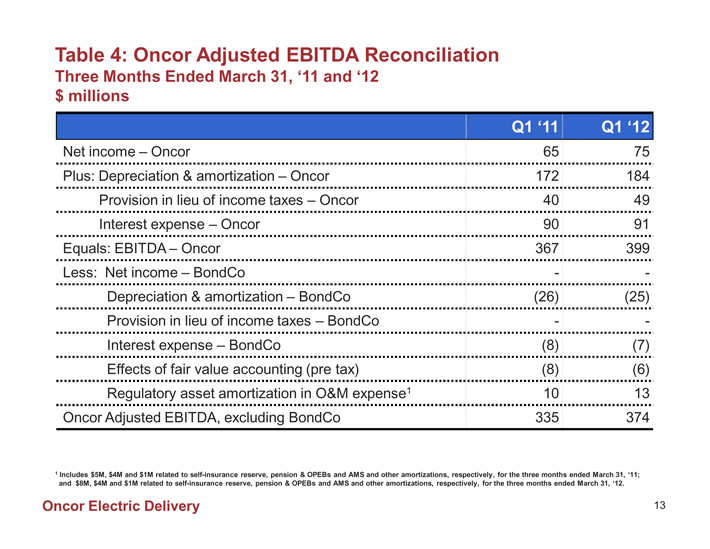

Table 4: Oncor Adjusted EBITDA Reconciliation

Three Months Ended March 31, ‘11 and ‘12 $ millions

Q1 ‘11 Q1 ‘12

Net income – Oncor 65 75

Plus: Depreciation & amortization – Oncor 172 184

Provision in lieu of income taxes – Oncor 40 49

Interest expense – Oncor 90 91

Equals: EBITDA – Oncor 367 399

Less: Net income – BondCo — -

Depreciation & amortization – BondCo (26) (25)

Provision in lieu of income taxes – BondCo — -

Interest expense – BondCo (8) (7)

Effects of fair value accounting (pre tax) (8) (6)

Regulatory asset amortization in O&M expense1 10 13

Oncor Adjusted EBITDA, excluding BondCo 335 374

1 Includes $5M, $4M and $1M related to self-insurance reserve, pension & OPEBs and AMS and other amortizations, respectively, for the three months ended March 31, ‘11; and $8M, $4M and $1M related to self-insurance reserve, pension & OPEBs and AMS and other amortizations, respectively, for the three months ended March 31, ‘12.

Oncor Electric Delivery

13

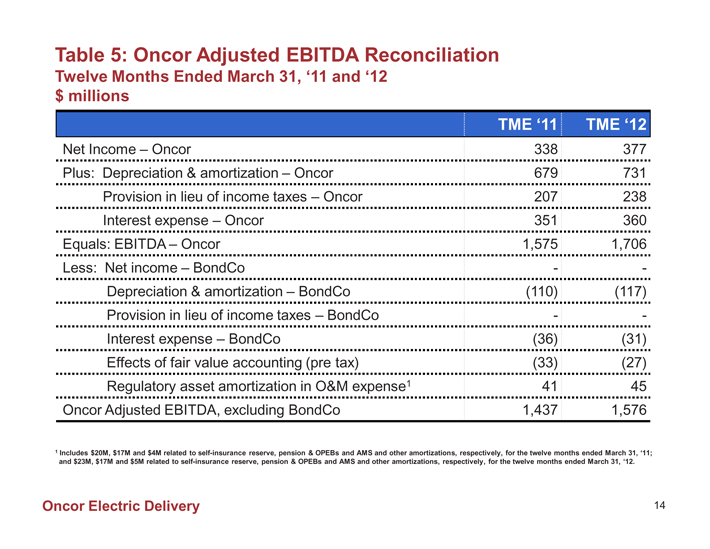

Table 5: Oncor Adjusted EBITDA Reconciliation

Twelve Months Ended March 31, ‘11 and ‘12 $ millions

TME ‘11 TME ‘12

Net Income – Oncor 338 377

Plus: Depreciation & amortization – Oncor 679 731

Provision in lieu of income taxes – Oncor 207 238

Interest expense – Oncor 351 360

Equals: EBITDA – Oncor 1,575 1,706

Less: Net income – BondCo—-

Depreciation & amortization – BondCo (110) (117)

Provision in lieu of income taxes – BondCo—-

Interest expense – BondCo (36) (31)

Effects of fair value accounting (pre tax) (33) (27)

Regulatory asset amortization in O&M expense1 41 45

Oncor Adjusted EBITDA, excluding BondCo 1,437 1,576

1 Includes $20M, $17M and $4M related to self-insurance reserve, pension & OPEBs and AMS and other amortizations, respectively, for the twelve months ended March 31, ‘11; and $23M, $17M and $5M related to self-insurance reserve, pension & OPEBs and AMS and other amortizations, respectively, for the twelve months ended March 31, ‘12.

Oncor Electric Delivery

14

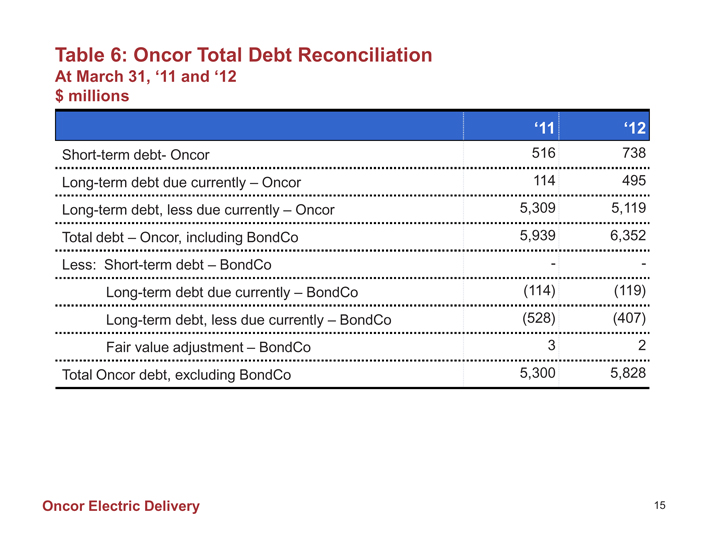

Table 6: Oncor Total Debt Reconciliation

At March 31, ‘11 and ‘12 $ millions

‘11 ‘12

Short-term debt- Oncor 516 738

Long-term debt due currently – Oncor 114 495

Long-term debt, less due currently – Oncor 5,309 5,119

Total debt – Oncor, including BondCo 5,939 6,352

Less: Short-term debt – BondCo—-

Long-term debt due currently – BondCo (114) (119)

Long-term debt, less due currently – BondCo (528) (407)

Fair value adjustment – BondCo 3 2

Total Oncor debt, excluding BondCo 5,300 5,828

Oncor Electric Delivery

15

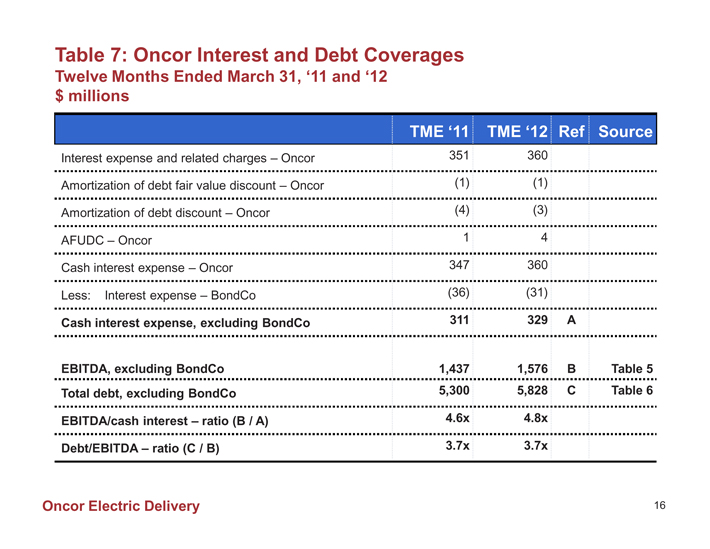

Table 7: Oncor Interest and Debt Coverages

Twelve Months Ended March 31, ‘11 and ‘12 $ millions

TME ‘11 TME ‘12 Ref Source

Interest expense and related charges – Oncor 351 360 Amortization of debt fair value discount – Oncor (1) (1) Amortization of debt discount – Oncor (4) (3) AFUDC – Oncor 1 4 Cash interest expense – Oncor 347 360 Less: Interest expense – BondCo (36) (31)

Cash interest expense, excluding BondCo 311 329 A

EBITDA, excluding BondCo 1,437 1,576 B Table 5 Total debt, excluding BondCo 5,300 5,828 C Table 6 EBITDA/cash interest – ratio (B / A) 4.6x 4.8x Debt/EBITDA – ratio (C / B) 3.7x 3.7x

Oncor Electric Delivery

16