Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BlackRock Inc. | d356891d8k.htm |

| EX-1.2 - UNDERWRITING AGREEMENT - BlackRock Inc. | d356891dex12.htm |

| EX-1.1 - UNDERWRITING AGREEMENT - BlackRock Inc. | d356891dex11.htm |

| EX-10.1 - STOCK REPURCHASE AGREEMENT - BlackRock Inc. | d356891dex101.htm |

| EX-10.2 - EXCHANGE AGREEMENT - BlackRock Inc. | d356891dex102.htm |

Exhibit 10.3

Execution Copy

EXCHANGE AGREEMENT

BY AND BETWEEN

PNC BANCORP, INC.

THE PNC FINANCIAL SERVICES GROUP, INC.

AND

BLACKROCK, INC.

Dated as of May 21, 2012

EXCHANGE AGREEMENT

THIS EXCHANGE AGREEMENT (this “Agreement”) is made and entered into as of May 21, 2012 by and among PNC Bancorp, Inc., a Delaware corporation (“PNC”) and the PNC Financial Services Group, Inc., a Pennsylvania corporation (“PNC Parent”), and BlackRock, Inc., a Delaware corporation (“BlackRock”).

WHEREAS, BlackRock and PNC Parent are parties to an Amended and Restated Implementation and Stockholder Agreement, dated as of February 27, 2009, as amended by Amendment No. 1, dated as of June 11, 2009, to the Amended and Restated Implementation and Stockholder Agreement (as so amended, the “PNC Stockholder Agreement”);

WHEREAS, one of the Selling Stockholders (as defined below) proposes to sell through an underwritten public offering (the “Secondary Offering”) shares of BlackRock’s common stock, par value $0.01 per share (the “Common Stock”), including shares of Common Stock issuable upon the conversion of an equal number of shares of BlackRock’s Series B non-voting convertible participating preferred stock, par value $0.01 per share (“Series B Preferred Stock”);

WHEREAS, BlackRock and Barclays Bank PLC (“Barclays”) propose to enter into a transaction (the “Repurchase Transaction”) whereby certain subsidiaries of Barclays (each, a “Selling Stockholder” and, collectively, the “Selling Stockholders”) shall sell to BlackRock, and BlackRock shall purchase from such Selling Stockholders, certain shares of Series B Preferred Stock and Common Stock, as set forth in the Stock Repurchase Agreement, dated as of May 21, 2012, by and between BlackRock and Barclays;

WHEREAS, concurrently with the closing of the Secondary Offering and the Repurchase Transaction, BlackRock and Barclays propose to consummate an exchange transaction whereby one or more affiliates of Barclays will exchange shares of Common Stock for a like number of shares of Series B Preferred Stock, in an amount to be determined as provided therein, if, immediately following the consummation of the Secondary Offering and the Repurchase Transaction, Barclays and its affiliates collectively own more than 1% of the outstanding Common Stock (together with the Secondary Offering and the Repurchase Transaction, the “Barclays Transactions”); and

WHEREAS, concurrently with the closing of the Secondary Offering and the Repurchase Transaction, PNC will exchange a portion of the shares of Series B Preferred Stock owned by it or its subsidiaries for an equal number of shares of Common Stock (the “PNC Exchange”);

NOW, THEREFORE, in consideration of the foregoing, of the mutual promises herein set forth, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, it is hereby agreed as follows:

ARTICLE I

EXCHANGE

Section 1.1 Exchange of PNC Class B Exchange Shares. Under the terms and subject to the conditions hereof and in reliance upon the representations, warranties and agreements contained herein, at the Closing (as defined herein), PNC shall exchange or cause to be exchanged such number of shares of Series B Preferred Stock, owned by PNC and its subsidiaries (the “PNC Class B Exchange Shares”) equal to the lesser of (a) such number of PNC Class B Exchange Shares that, upon exchange thereof for shares of Common Stock, would result in PNC’s percentage beneficial ownership of Common Stock equaling 23.75% of the outstanding Common Stock (such percentage calculated taking into account the Barclays Transactions occurring concurrently on the Closing Date, but not any option to purchase additional shares exercised thereafter) and (b) two million shares of Series B Preferred Stock, for an equal number of shares of Common Stock (the “Exchange Shares”), as appropriately adjusted for any stock split, combination, reorganization, recapitalization, reclassification, stock dividend, stock distribution or similar event declared or effected prior to the Closing (as defined herein).

Section 1.2 Closing. The closing (the “Closing”) of the exchange of the PNC Class B Exchange Shares for the Exchange Shares shall be held at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, Four Times Square, New York, New York, immediately subsequent to the satisfaction or waiver of the conditions set forth in Articles V and VI herein, or at such other time, date or place as PNC and BlackRock may agree in writing. The date on which the Closing occurs is hereinafter referred to as the “Closing Date.”

Section 1.3 Deliveries.

(a) At the Closing, PNC shall deliver or cause to be delivered to BlackRock (the “PNC Closing Deliveries”) transfer authorization evidencing the transfer of the PNC Class B Exchange Shares from PNC or its subsidiaries to BlackRock in the form attached hereto as Exhibit A free and clear of any Lien (as defined below).

(b) At the Closing, BlackRock shall deliver to PNC certificates registered or evidence of book-entry credits, in PNC’s name (or the name(s) of one or more subsidiaries of PNC that it shall so designate in writing) representing the Exchange Shares (the “BlackRock Closing Deliveries”).

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF PNC

PNC represents and warrants to BlackRock, as follows:

2

Section 2.1 Title to PNC Class B Exchange Shares. As of the Closing, PNC will own, directly or indirectly, and deliver the PNC Class B Exchange Shares free and clear of any and all option, call, contract, commitment, mortgage, pledge, security interest, encumbrance, lien, tax, claim or charge of any kind or right of others of whatever nature (collectively, a “Lien”) of any kind.

Section 2.2 Authority Relative to this Agreement. PNC has the requisite corporate power and authority to execute and deliver this Agreement, and to consummate the transactions contemplated hereby. The execution and delivery of this Agreement by PNC, and the consummation by PNC of the transactions contemplated hereby has been duly authorized, and no other corporate or stockholder proceedings on the part of PNC are necessary to authorize this Agreement or for PNC to consummate the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by PNC and, assuming the due authorization, execution and delivery thereof by BlackRock, constitutes the valid and binding obligation of PNC, enforceable against it in accordance with its terms, except as may be limited by bankruptcy, insolvency or other equitable remedies.

Section 2.3 Governmental Approvals. No material consent, approval, authorization or order of, or registration, qualification or filing with, any court, regulatory authority, governmental body or any other third party is required to be obtained or made by PNC for the execution, delivery or performance by PNC of this Agreement or the consummation by PNC of the transactions contemplated hereby.

Section 2.4 Receipt of Information. PNC has received all the information it considers necessary or appropriate to decide whether to acquire the Exchange Shares in exchange for the PNC Class B Exchange Shares. PNC has had an opportunity to ask questions and receive answers from BlackRock regarding the terms and conditions of the offering of the Exchange Shares and the business and financial condition of BlackRock and to obtain additional information necessary to verify the accuracy of any information furnished to it or to which it had access. PNC has not received, and is not relying on, any representations or warranties from BlackRock, other than as provided herein.

Section 2.5 Restricted Securities. PNC understands that the Exchange Shares may not be sold, transferred or otherwise disposed of without registration under the Securities Act of 1933, as amended (the “Securities Act”), or an exemption therefrom, and that in the absence of an effective registration statement covering the Exchange Shares or an available exemption from registration under the Securities Act, the Exchange Shares must be held indefinitely. In particular, PNC is aware that the Exchange Shares may not be sold pursuant to Rule 144 promulgated under the Securities Act unless all of the conditions of the rule are met.

Section 2.6 Legends. It is understood that, in addition to the legend required by the PNC Stockholder Agreement, the certificates evidencing the Exchange Shares will bear the following legend:

“THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF A REGISTRATION STATEMENT IN EFFECT WITH RESPECT TO THE SECURITIES UNDER SUCH ACT OR AN OPINION OF COUNSEL SATISFACTORY TO BLACKROCK, INC. THAT SUCH REGISTRATION IS NOT REQUIRED.”

3

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF BLACKROCK

Section 3.1 Exchange Shares. The Exchange Shares have been duly and validly authorized, and, when issued upon the terms hereof, will be fully paid, nonassessable and free of statutory preemptive rights and contractual stockholder preemptive rights, with no personal liability attaching to the ownership thereof.

Section 3.2 Authority Relative to this Agreement. BlackRock has the requisite corporate power and authority to execute and deliver this Agreement and the requisite corporate power and authority to consummate the transactions contemplated hereby. The execution and delivery of this Agreement and the consummation by BlackRock of the transactions contemplated hereby has been duly authorized by BlackRock’s board of directors (including a majority of BlackRock’s Independent Directors (as defined in the PNC Stockholder Agreement)), and no other corporate or stockholder proceedings on the part of BlackRock are necessary to authorize this Agreement or to consummate the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by BlackRock and, assuming the due authorization, execution and delivery thereof by PNC, constitutes the valid and binding obligation of BlackRock, enforceable against BlackRock in accordance with its terms, except as may be limited by bankruptcy, insolvency or other equitable remedies.

Section 3.3 Governmental Approvals. No material consent, approval, authorization or order of, or registration, qualification or filing with, any court, regulatory authority, governmental body or any other third party is required to be obtained or made by BlackRock for the execution, delivery or performance by BlackRock of this Agreement or the consummation by BlackRock of the transactions contemplated thereby, except those contemplated hereby.

ARTICLE IV

ADDITIONAL AGREEMENTS

Section 4.1 Compliance with PNC Stockholder Agreement and Related Agreements. The parties intend that this Agreement and the transactions contemplated hereby be consistent with the conditions and restrictions applicable to the parties and/or their affiliates pursuant to the PNC Stockholder Agreement. BlackRock and PNC shall take all commercially reasonable actions, and deliver any necessary consent or waiver to comply with the provisions of the PNC Stockholder Agreement relating to the exchange of the PNC Class B Exchange Shares for the Exchange Shares pursuant hereto.

4

Section 4.2 Commercially Reasonable Efforts. The parties shall each cooperate with each other and use (and shall cause their respective subsidiaries to use) their respective commercially reasonable efforts to promptly take or cause to be taken all necessary actions, and do or cause to be done all things, necessary, proper or advisable under this Agreement and applicable laws to consummate and make effective all the transactions contemplated by this Agreement as soon as practicable.

Section 4.3 Public Announcements. Except as may be required by applicable law, neither party hereto shall make any public announcements or otherwise communicate with any news media with respect to this Agreement or any of the transactions contemplated hereby, without prior consultation with the other party as to the timing and contents of any such announcement or communications; provided, however, that nothing contained herein shall prevent any party from promptly making all filings with any governmental entity or disclosures with the stock exchange, if any, on which such party’s capital stock is listed, as may, in its judgment, be required in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated hereby.

ARTICLE V

CONDITIONS TO CLOSING OF BLACKROCK

The obligation of BlackRock to acquire the PNC Class B Exchange Shares from PNC and to issue the Exchange Shares to PNC at the Closing is subject to the fulfillment to BlackRock’s satisfaction on or prior to the Closing Date of each of the following conditions:

Section 5.1 Representations and Warranties. Each representation and warranty made by PNC in Article II above shall be true and correct on and as of the Closing Date as though made as of the Closing Date.

Section 5.2 Performance. All covenants, agreements and conditions contained in this Agreement to be performed or complied with by PNC on or prior to the Closing Date shall have been performed or complied with by PNC in all respects.

Section 5.3 Certificates and Documents. PNC shall have delivered at or prior to the Closing to BlackRock or its designee the PNC Closing Deliveries.

Section 5.4 Completion of Barclays Transactions. The Barclays Transactions shall have been completed. For greater certainty the completion of the Secondary Offering does not require the exercise of any option granted to the underwriters for such offering.

5

ARTICLE VI

CONDITIONS TO CLOSING OF PNC

The obligation of PNC to acquire the Exchange Shares from BlackRock, and to transfer the PNC Class B Exchange Shares to BlackRock, at the Closing is subject to the fulfillment to PNC’s satisfaction on or prior to the Closing Date of each of the following conditions:

Section 6.1 Representations and Warranties. Each representation and warranty made by BlackRock in Article III above shall be true and correct in all material respects on and as of the Closing Date as though made as of the Closing Date.

Section 6.2 Performance. All covenants, agreements and conditions contained in this Agreement to be performed or complied with by BlackRock on or prior to the Closing Date shall have been performed or complied with by BlackRock in all respects.

Section 6.3 Certificates and Documents. BlackRock shall have delivered at or prior to the Closing to PNC the BlackRock Closing Deliveries.

Section 6.4 Completion of Barclays Transactions. The Barclays Transactions shall have been completed. For greater certainty the completion of the Secondary Offering does not require the exercise of any option granted to the underwriters for such offering.

ARTICLE VII

MISCELLANEOUS

Section 7.1 Termination. This Agreement may be terminated prior to the Closing as follows: (i) at any time on or prior to the Closing Date, by mutual written consent of PNC and BlackRock; or (ii) at the election of PNC or BlackRock by written notice to the other party hereto after 5:00 p.m., New York time, on the date upon which the Offering is terminated prior to consummation or, if sooner, June 15, 2012, if the Closing shall not have occurred, unless such date is extended by the mutual written consent of PNC and BlackRock; provided, however, that the right to terminate this Agreement pursuant to this clause (ii) shall not be available to a party whose failure or whose affiliate’s failure to perform or observe in any material respect any of its obligations under this Agreement in any manner shall have been the principal cause of or resulted in the failure of the Closing to occur on or before such date.

Section 7.2 Savings Clause. No provision of this Agreement shall be construed to require any party or its affiliates to take any action that would violate any applicable law (whether statutory or common), rule or regulation.

Section 7.3 Amendment and Waiver. Except as otherwise provided herein, this Agreement may not be amended except by an instrument in writing signed on behalf of each of the parties hereto. The failure of any party to enforce any of the provisions of this Agreement shall in no way be construed as a waiver of such provisions and shall not affect the right of such party thereafter to enforce each and every provision of this Agreement in accordance with its terms.

6

Section 7.4 Severability. If any provision of this Agreement shall be declared by any court of competent jurisdiction to be illegal, void or unenforceable, all other provisions of this Agreement shall not be affected and shall remain in full force and effect.

Section 7.5 Entire Agreement. Except as otherwise expressly set forth herein, this Agreement, together with the several agreements and other documents and instruments referred to herein or therein or annexed hereto, embody the complete agreement and understanding among the parties hereto with respect to the subject matter hereof and supersede and preempt any prior understandings, agreements or representations by or among the parties, written or oral, that may have related to the subject matter hereof in any way. Without limiting the generality of the foregoing, to the extent that any of the terms hereof are inconsistent with the rights or obligations of PNC under any other agreement with BlackRock, the terms of this Agreement shall govern.

Section 7.6 Successors and Assigns. Neither this Agreement nor any of the rights or obligations of any party under this Agreement shall be assigned, in whole or in part by any party without the prior written consent of the other parties.

Section 7.7 Counterparts. This Agreement may be executed in separate counterparts each of which shall be an original and all of which taken together shall constitute one and the same agreement.

Section 7.8 Remedies.

(a) Each party hereto acknowledges that monetary damages would not be an adequate remedy in the event that each and every one of the covenants or agreements in this Agreement are not performed in accordance with their terms, and it is therefore agreed that, in addition to and without limiting any other remedy or right it may have, the non-breaching party will have the right to an injunction, temporary restraining order or other equitable relief in any court of competent jurisdiction enjoining any such breach and enforcing specifically each and every one of the terms and provisions hereof. Each party hereto agrees not to oppose the granting of such relief in the event a court determines that such a breach has occurred, and to waive any requirement for the securing or posting of any bond in connection with such remedy.

(b) All rights, powers and remedies provided under this Agreement or otherwise available in respect hereof at law or in equity shall be cumulative and not alternative, and the exercise or beginning of the exercise of any thereof by any party shall not preclude the simultaneous or later exercise of any other such right, power or remedy by such party.

Section 7.9 Notices. All notices and other communications hereunder shall be in writing and shall be deemed given if delivered personally, sent by electronic mail, telecopied (upon telephonic confirmation of receipt), on the first business day following the date of dispatch if delivered by a recognized next day courier service, or on the third business day following the date of mailing if delivered by registered or certified mail, return receipt requested, postage prepaid. All notices hereunder shall be delivered as set forth below, or pursuant to such other instructions as may be designated in writing by the party to receive such notice.

7

If to BlackRock:

c/o BlackRock, Inc.

55 East 52nd Street

New York, NY 10055

Facsimile: 212-810-8760

Attn: Susan L. Wagner

and

40 East 52nd Street

New York, NY 10022

Facsimile: 212-810-3744

Attn: General Counsel

with a copy (which shall not constitute notice) to:

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, NY 10036

Facsimile: 212-735-2000

Attention: Stacy J. Kanter, Esq.

If to PNC:

The PNC Financial Services Group, Inc.

One PNC Plaza

Pittsburgh, PA 15222

Facsimile: 412-762-2875

Attention: General Counsel

with a copy (which shall not constitute notice) to:

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, NY 10019

Facsimile: 212-403-2000

Attention: Nicholas G. Demmo, Esq.

Section 7.10 Governing Law; Consent to Jurisdiction.

(a) This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware without giving effect to the principles of conflicts of law. Each of the parties hereto hereby irrevocably and unconditionally consents to submit to the exclusive

8

jurisdiction in the Court of Chancery of the State of Delaware or any court of the United States located in the State of Delaware, for any action, proceeding or investigation in any court or before any governmental authority (“Litigation”) arising out of or relating to this Agreement and the transactions contemplated hereby. Each of the parties hereto hereby irrevocably and unconditionally waives, and agrees not to assert, by way of motion, as a defense, counterclaim or otherwise, in any such Litigation, the defense of sovereign immunity, any claim that it is not personally subject to the jurisdiction of the aforesaid courts for any reason other than the failure to serve process in accordance with this Section 7.10, that it or its property is exempt or immune from jurisdiction of any such court or from any legal process commenced in such courts (whether through service of notice, attachment prior to judgment, attachment in aid of execution of judgment, execution of judgment or otherwise), and to the fullest extent permitted by applicable law, that the Litigation in any such court is brought in an inconvenient forum, that the venue of such Litigation is improper, or that this Agreement, or the subject matter hereof, may not be enforced in or by such courts and further irrevocably waives, to the fullest extent permitted by applicable law, the benefit of any defense that would hinder, fetter or delay the levy, execution or collection of any amount to which the party is entitled pursuant to the final judgment of any court having jurisdiction. Each of the parties irrevocably and unconditionally waives, to the fullest extent permitted by applicable law, any and all rights to trial by jury in connection with any Litigation arising out of or relating to this Agreement or the transactions contemplated hereby.

(b) Each of the parties expressly acknowledges that the foregoing waiver is intended to be irrevocable under the laws of the State of Delaware and of the United States of America; provided that consent by PNC and BlackRock to jurisdiction and service contained in this Section 7.10 is solely for the purpose referred to in this Section 7.10 and shall not be deemed to be a general submission to said courts or in the State of Delaware other than for such purpose.

Section 7.11 Interpretation. The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. Whenever the words “include”, “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation”.

[Signature Pages Follow]

9

IN WITNESS WHEREOF, the parties hereto have caused this Exchange Agreement to be duly executed and delivered as of the date first above written.

| THE PNC FINANCIAL SERVICES GROUP, INC. | ||||

| By: | /s/ David J. Williams | |||

| Name: | David J. Williams | |||

| Title: | Senior Vice President | |||

| PNC BANCORP, INC. | ||||

| By: | /s/ George P. Long, III | |||

| Name: | George P. Long, III | |||

| Title: | Assistant Secretary | |||

| BLACKROCK, INC. | ||||

| By: | /s/ Daniel Waltcher | |||

| Name: | Daniel Waltcher | |||

| Title: | Managing Director, Deputy General Counsel and Assistant Secretary | |||

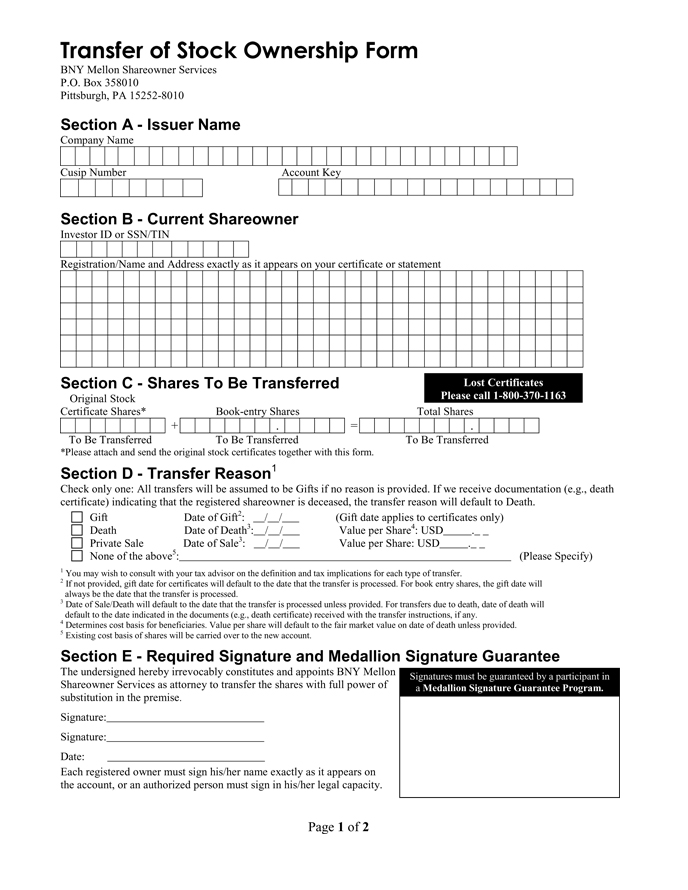

Exhibit A

Transfer of Stock Ownership Form BNY Mellon Shareowner Services P.O. Box 358010 Pittsburgh, PA 15252-8010 Section A - Issuer Name Company Name Cusip Number Account Key Section B - Current Shareowner Investor ID or SSN/TIN Registration/Name and Address exactly as it appears on your certificate or statement Section C - Shares To Be Transferred Original Stock Certificate Shares* Book-entry Shares Total Shares To Be Transferred To Be Transferred To Be Transferred *Please attach and send the original stock certificates together with this form. Section D - Transfer Reason1 Lost Certificates Lost Certificates Please call 1-800-370-1163 Check only one: All transfers will be assumed to be Gifts if no reason is provided. If we receive documentation (e.g., death certificate) indicating that the registered shareowner is deceased, the transfer reason will default to Death. Gift Date of Gift2: __/__/___ (Gift date applies to certificates only) Death Date of Death3:__/__/___ Value per Share4: USD_____._ _ Private Sale Date of Sale3: __/__/___ Value per Share: USD_____._ _ None of the above5:___________________________________________________________ (Please Specify) 1 You may wish to consult with your tax advisor on the definition and tax implications for each type of transfer. 2 If not provided, gift date for certificates will default to the date that the transfer is processed. For book entry shares, the gift date will always be the date that the transfer is processed. 3 Date of Sale/Death will default to the date that the transfer is processed unless provided. For transfers due to death, date of death will default to the date indicated in the documents (e.g., death certificate) received with the transfer instructions, if any. 4 Determines cost basis for beneficiaries. Value per share will default to the fair market value on date of death unless provided. 5 Existing cost basis of shares will be carried over to the new account. Section E - Required Signature and Medallion Signature Guarantee The undersigned hereby irrevocably constitutes and appoints BNY Mellon Shareowner Services as attorney to transfer the shares with full power of substitution in the premise. Signature:____________________________ Signature:____________________________ Date: ____________________________ Signatures must be guaranteed by a participant in a Medallion Signature Guarantee Program. Each registered owner must sign his/her name exactly as it appears on the account, or an authorized person must sign in his/her legal capacity. Page 1 of 2

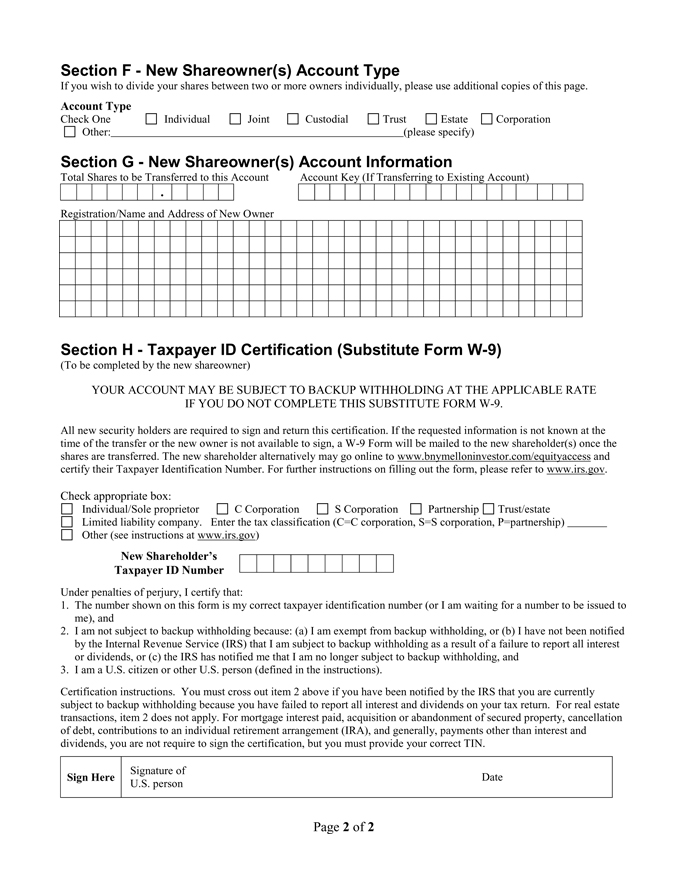

Section F - New Shareowner(s) Account Type If you wish to divide your shares between two or more owners individually, please use additional copies of this page. Account Type Check One Individual Joint Custodial Trust Estate Corporation Other: (please specify) Section G - New Shareowner(s) Account Information Total Shares to be Transferred to this Account Account Key (If Transferring to Existing Account) Registration/Name and Address of New Owner Section H - Taxpayer ID Certification (Substitute Form W-9) (To be completed by the new shareowner) YOUR ACCOUNT MAY BE SUBJECT TO BACKUP WITHHOLDING AT THE APPLICABLE RATE IF YOU DO NOT COMPLETE THIS SUBSTITUTE FORM W-9. All new security holders are required to sign and return this certification. If the requested information is not known at the time of the transfer or the new owner is not available to sign, a W-9 Form will be mailed to the new shareholder(s) once the shares are transferred. The new shareholder alternatively may go online to www.bnymelloninvestor.com/equityaccess and certify their Taxpayer Identification Number. For further instructions on filling out the form, please refer to www.irs.gov. Check appropriate box: Individual/Sole proprietor C Corporation S Corporation Partnership Trust/estate Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=partnership) Other (see instructions at www.irs.gov) New Shareholder’s Taxpayer ID Number Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (defined in the instructions). Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not require to sign the certification, but you must provide your correct TIN. Sign Here Signature of U.S. person Date