Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARRIS GROUP INC | d354881d8k.htm |

May 23, 2012

Dave Potts, CFO

Barclay’s Capital

Global Technology,

Media and Telecommunications

Conference

Exhibit 99.1 |

Safe

Harbor Statements in this presentation including those related to expected

sales levels, acceptance of new ARRIS products (including the

Moxi® Gateway and the E6000 Converged Edge Router),

growth in Internet video traffic and the expanded use of IP MSO infrastructure, the

general market outlook, the impact of the acquisition of BigBand, the timing

and impact of new growth opportunities and industry trends, are

forward-looking statements. These statements involve risks and

uncertainties that may cause actual results to differ materially from those set forth in

these statements. Among other things, projected results are based on

preliminary estimates, assumptions and projections that management believes

to be reasonable at this time, but are beyond management’s control;

ARRIS is dependent upon customer decisions to purchase the Company’s

products -- these decisions can be deferred and customers also may

select competitor’s products; the BigBand acquisition has the

integration and other risks attendant to all acquisitions; and because the

market in which ARRIS operates is volatile, actions taken and

contemplated may not achieve the desired impact. Other factors that could

cause results to differ from current expectations include: the uncertain

current economic climate and financial markets, and their impact on our

customers’ plans and access to capital; the impact of rapidly

changing technologies; the impact of competition on product development and

pricing; the ability of ARRIS to react to changes in general industry and

market conditions; rights to intellectual property and the current trend

toward increasing patent litigation, market trends and the adoption of

industry standards; possible acquisitions and dispositions; and consolidations

within the telecommunications industry of both the customer and supplier

base. These factors are not intended to be an all-encompassing

list of risks and uncertainties that may affect the Company’s business.

Additional information regarding these and other factors can be found in

ARRIS’

reports filed with the Securities and Exchange Commission, including its Form

10-Q for the quarter ended March 31, 2012. In providing

forward-looking statements, the Company expressly disclaims any

obligation to update publicly or otherwise these statements, whether as a

result of new information, future events or otherwise. 2

Barclay's Capital Conference

May 23, 2012 |

Barclay's Capital Conference

May 23, 2012

Company Overview

3 |

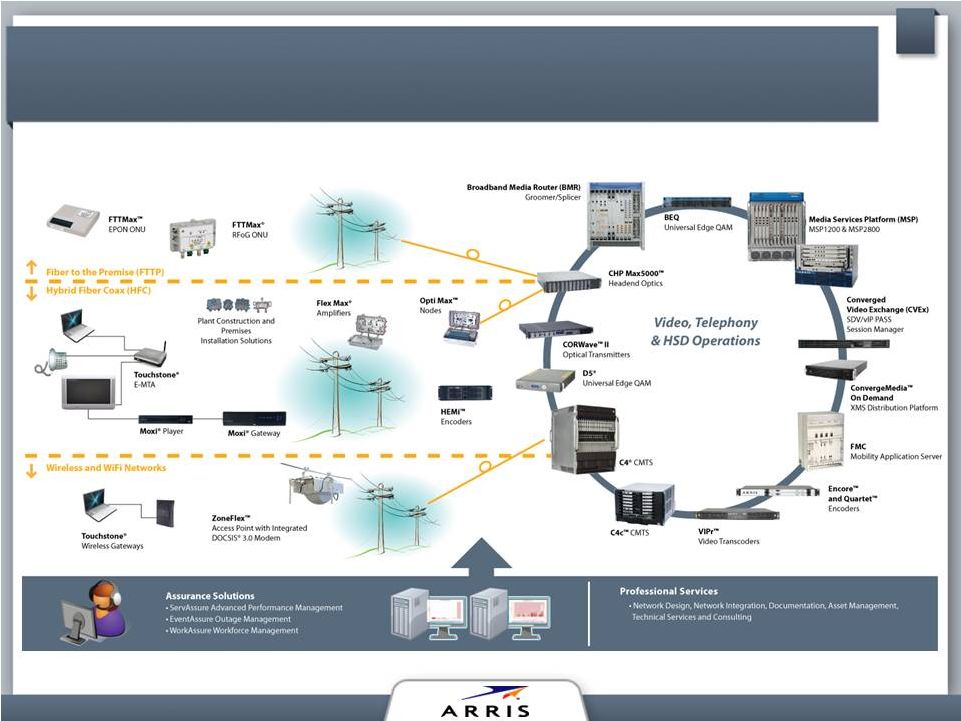

ARRIS Company Overview

High tech, pure play provider of voice, high-speed data, and

video solutions to the global broadband industry

4

Barclay's Capital Conference

May 23, 2012

Note:

1.Based on closing share price of $12.93 on 4/30/2012

Direct presence in 21

countries

Channel presence in 30

countries

Headquartered in

Suwanee, Georgia

~2,117 employees

Customers Worldwide

Market Cap ~1.5 billion

1 |

ARRIS Company Highlights

Profitable business with solid cash generation

Product roadmap, R&D, and acquisition strategy focused

on enabling convergence of cable services on a unified IP

platform

Significant market share of major product areas

-

~45% worldwide installed base of VoIP enabled high speed modems

•

#1 Worldwide Market Share*

-

~31% worldwide installed base of cable edge routers (CMTS)

•

#2 Worldwide Revenue Market Share*

5

* Infonetics 4Q11

May 23, 2012

Barclay's Capital Conference |

ARRIS Portfolio Across the Network

May 23, 2012

Barclay's Capital Conference

6 |

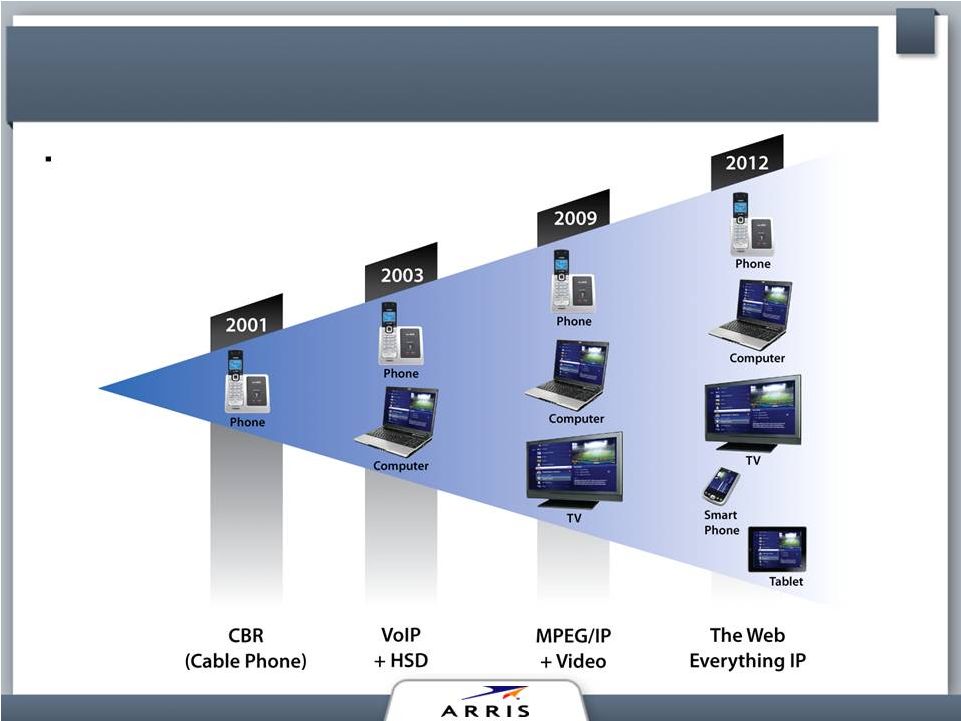

Our

Vision Continues to Expand 7

Barclay's Capital Conference

May 23, 2012

Our Path to Growth

-

“Everything IP, Everywhere”

-

In the Home and on the Go! |

Q1

2012 Results & Highlights Revenue $302.9M

-

Up 8% vs. Q4 2011, 13% vs. Q1 2011

Record bookings and order backlog

Gross Margin 36.0%

Non-GAAP EPS $0.19

75% Domestic, 25% International

Strong cash flow

$335.1M Net cash position

Stock repurchase program continued

BigBand integration complete (acquired 11/2011)

8

Barclay's Capital Conference

May 23, 2012

1

See reconciliation of GAAP to Non-GAAP measures.

Off to a great start

1 |

Q1

2012 Results & Highlights Record CMTS downstream port shipments

109,744 C4™downstreams, 10% more than previous high

Shipped >1.6 million CPE units in the quarter

-

Up 35% vs. Q4 2011

-

60% of CPE units were DOCSIS 3.0

-

Wi-Fi Gateways, data modem business

Moxi®

Gateway

-

Successful launch at WOW

-

Buckeye beginning commercial deployments

-

Additional operators in line for commercial deployments

New Gateway Platform Programs

-

3rd party middleware software integrations launched

BigBand

-

Product/feature execution improving

-

MSP deployments underway

9

Barclay's Capital Conference

May 23, 2012 |

Barclay's Capital Conference

May 23, 2012

Business Drivers

10 |

Online Video Drives Bandwidth Growth

11

84% of the total U.S. Internet

audience viewed online video

89% of the total Brazil Internet

audience viewed online Video

4.7 B

2.7 B

30 B

43 B

Videos Viewed

Grows +45% in

Past Year

May 23, 2012

Barclay's Capital Conference

* Based on video content sites: excludes video server networks. Online Video includes both

streaming and progressive download video, total U.S.- Home/Work/University

Locations |

DOCSIS 3.0 Technology Upgrade Cycle Accelerating

Our guarantee is our promise to you.

Find out more at comcast.com.

Important

information

regarding

your

XFINITY®

Service.

To ensure that your modem

can take advantage of all

that XFINITY Internet has to

offer, you will need to

replace your current

modem with a DOCSIS 3.0

modem.

May 23, 2012

Barclay's Capital Conference

12

Valued Comcast Customer

Alpharetta, GA

Subject: Important Service Announcement Regarding Your Cable Modem

Dear Valued Comcast Customer:

Our records indicate that the cable modem which you currently use for

your XFINITY®

Internet service may not be able to receive the full range of

speeds available with XFINITY Internet.

To ensure that your modem can take advantage of all that XFINITY

Internet has to offer, you will need to replace your current modem with

a DOCSIS 3.0 modem.

There are several convenient modem replacement options available

to you:

To protect our environment, please dispose of your older modem properly.

Instead of disposing with household trash, you can return it to the front

counter of any Comcast Payment Center or you can check with your

local municipality to learn about its recycling days.

Sincerely,

Comcast

•

Visit a retailer to purchase a new cable modem. You may visit

http://mydeviceinfo.comcast.net/ for a list of modems certified to

work on our network.

•

Arrange to lease a cable modem by calling 1-800-XFINITY. You may

have a leased modem sent to you with a self-installation kit. If

you do so, no installation charges apply and there will be no shipping or

handling charge. Standard installation fees apply for professional

installation. Applicable equipment charges apply when leasing a

modem from Comcast. |

Ramped R&D Investment in Response to

Emerging Growth Opportunities

Barclay's Capital Conference

May 23, 2012

13

~$155 Million of R&D past twelve months

While Remaining Solidly Profitable

ARRIS R&D Quarterly Investment ($M)

*

Includes Bigband |

Increased R&D Investment

Bearing Fruit in 2012 and Beyond…

Moxi®

Gateway

–

supports

a

new

generation

of

devices

-

Whole Home Solution

-

Hybrid legacy/IPTV

Entirely

refreshed

C4

product

line

–

world

class

density

-

Double the density

•

32D Downstream Card (Software upgradeable)

•

24U Upstream Card

-

Two new software releases

•

IP V6

•

Upstream Channel Bonding

E6000

Converged

Edge

Router

–

the

IPTV

solution

-

Radical new concept in high density edge routers

-

Platform for the next decade

Completely revamped CPE product line

-

Voice enabled

-

Wi-Fi enabled

-

Embedded routing

Ethernet

Passive

Optical

Network

(EPON)

-

Fiber

to

the

Home

New Assurance software suite

14

Barclay's Capital Conference

May 23, 2012 |

…While Growing a Valuable Patent Portfolio

US

Foreign

Total

Patents Granted

444

167

611

Applications Pending

268

107

375

TOTAL

712

274

986

2010

2011

2012 YTD

Patents Granted

28

36

20

Applications Filed

81

92

22

May 23, 2012

Barclay's Capital Conference

15 |

Excellent Opportunities for Growth

Goals:

-

10%+ Revenue CAGR

-

High Teens Non-GAAP EBITDA %

16

Barclay's Capital Conference

May 23, 2012

Growth Will Drive Operating Leverage

and EPS Expansion

32D &

24U

MOXI

®

Gateway

E6000™

Edge Router

MSP

Multiple

Screens

International expansion

CPE

Wi-Fi

Non

GAAP

EBITDA

%

=

(GAAP

EBITDA

+

Equity

Compensation

Expense

+

Other

Non-GAAP

Adjustments)

/

Sales

2011

2013 |

Q2

2012 Guidance Revenue $330M -

$350M

-

Entering quarter with good momentum

-

Center of guidance represents 28% growth vs. Q2 2011

Adjusted(Non-GAAP)EPS $0.20 -

$0.24

(1)

/GAAP $.10 -

$.14

-

Mix expected to shift towards CPE and CMTS hardware

~34% tax rate assumed

-

Versus 26.9% for Q2 2011

116.0M diluted shares assumed

-

Versus 123.7M for Q2 2011

17

Barclay's Capital Conference

May 23, 2012

(1) See reconciliation of GAAP to Adjusted Non-GAAP EPS Guidance

reconciliation Optimistic about the year as a whole

|

Executing on our Strategy

-

Strategic

acquisitions

–

Fortify

IP

Video

offering

and

patent

portfolio

•

Digeo

•

BigBand

-

Deep

IP

Product

Portfolio

–

Positions

ARRIS

for

growth

•

Moxi Whole Home Solution

•

Wireless

•

DOCSIS 3.0

•

CCAP

-

Strong Balance Sheet

•

Cash generation

•

Share buyback

•

Acquisition strategy

-

Shareholder value increasing as we remain focused on achieving 10%

revenue growth and high teens Non-GAAP EBITDA margin

18

Barclay's Capital Conference

May 23, 2012 |

Questions? |

GAAP EPS/Adjusted EPS Reconciliation Q1 2012

(Preliminary & Unaudited)

Barclay's Capital Conference

20

May 23, 2012

See the Notes to GAAP / Adjusted Non-GAAP Financial Measures slide

Per Diluted

Per Diluted

Per Diluted

Amount

Share

Amount

Share

Amount

Share

Net income (loss)

11,564

$

0.09

$

(59,629)

$

(0.51)

$

5,799

$

0.05

$

Highlighted items:

Impacting gross margin:

Purchase accounting impacts of deferred revenue

-

-

3,126

0.03

1,258

0.01

Stock compensation expense

437

-

521

-

750

0.01

Impacting operating expenses:

Acquisition costs

-

-

2,730

0.02

607

0.01

Restructuring

-

-

3,391

0.03

5,203

0.04

Amortization of intangible assets

8,944

0.07

6,817

0.06

7,379

0.06

Goodwill and intangibles impairment

-

-

88,633

0.74

-

-

Loss of sale of product line

-

-

-

-

337

-

Stock compensation expense

4,847

0.04

4,586

0.04

5,899

0.05

Impacting other (income) / expense:

Non-cash interest expense

2,832

0.02

2,941

0.02

2,999

0.03

Impairment of investment

-

-

3,000

0.03

-

-

Impacting income tax expense:

Adjustments of income tax valuation allowances and other

(3,583)

(0.03)

3,032

0.03

-

-

Tax impact related to goodwill and intangibles impairment

-

-

(25,584)

(0.21)

-

-

Tax related to highlighted items above

(5,024)

(0.04)

(8,553)

(0.07)

(8,121)

(0.07)

Total highlighted items

8,453

0.07

84,640

0.71

16,311

0.14

Net income excluding highlighted items

20,017

$

0.16

$

25,011

$

0.21

$

22,110

$

0.19

$

Weighted average common shares -

basic

117,316

(1)

Weighted average common shares -

diluted

125,732

119,609

(2)

117,597

(1) Basic shares used for Q4 2011 as losses were reported for those periods and the

inclusion of dilutive shares would be antidilutive (2) Non-GAAP net

income for Q4 2011 is positive and , therefore, the diluted shares used in this calculation include the effect of options

Q1 2012

Q4 2011

Q1 2011 |

GAAP EBITDA/Adjusted EBITDA Reconciliation

(Preliminary & Unaudited)

Barclay's Capital Conference

21

May 23, 2012

See the Notes to GAAP / Adjusted Non-GAAP Financial Measures slide

(in thousands)

Q1 2011

Q4 2011

Q1 2012

Earnings (loss) before tax

11,325

(78,341)

8,686

Depreciation

5,855

6,589

7,195

Amortization of intangibles

8,944

6,817

7,379

Goodwill & intangible impairment

-

88,633

-

Interest expense

4,225

4,258

4,350

Interest income

(778)

(715)

(755)

GAAP EBITDA

29,571

27,241

26,855

GAAP EBITDA - % of Sales

11.1%

9.7%

8.9%

Highlighted items:

Purchase accounting impact of def revenue

-

3,126

1,258

Stock compensation expense

5,284

5,108

6,649

Acquisition costs

-

2,730

607

Restructuring

-

3,391

5,203

Impairment on investments

-

3,000

-

Loss of sale of product line

-

-

337

Total highlighted items

5,284

17,355

14,054

Adjusted Non-GAAP EBITDA

34,855

44,596

40,909

Adjusted Non GAAP EBITDA - % of Adjusted Non GAAP Sales

13.0%

15.6%

13.4% |

GAAP to Adjusted Non-GAAP

EPS Guidance Reconciliation

Barclay's Capital Conference

22

May 23, 2012

See the Notes to GAAP / Adjusted Non-GAAP Financial Measures slide

See the Notes to GAAP / Adjusted Non-GAAP Financial Measures slide

Q2 2012 EPS

Guidance

Estimated GAAP EPS

$0.10 -

$0.14

Reconciling Items:

Amortization of Intangibles (after tax)

$0.04

Stock Compensation Expense (after tax)

$0.04

Non-Cash Interest -

Convertible Debt (after tax)

$0.02

Subtotal

$0.10

Estimated Adjusted (Non-GAAP) EPS

$0.20 -$ 0.24 |

Notes to GAAP/Adjusted Non-GAAP Financial Measures

(Preliminary & Unaudited)

Barclay's Capital Conference

23

May 23, 2012

The Company reports its financial results in accordance with accounting principles generally accepted

in the United States (“GAAP” or referred to herein as “reported”). However,

management believes that certain non-GAAP financial measures provide management and other users

with additional meaningful financial information that should be considered when assessing our

ongoing performance. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and

make operating decisions. These non-GAAP measures are among the factors management uses in

planning for and forecasting future periods. Non-GAAP financial measures should be

viewed in addition to, and not as an alternative to, the Company’s reported results prepared in

accordance with GAAP. Our non-GAAP financial measures reflect adjustments based on the

following items, as well as the related income tax effects:

Purchase Accounting Impacts Related to Deferred Revenue: In connection with our acquisition of

BigBand, business combination rules require us to account for the fair values of arrangements

for which acceptance has not been obtained, and post contract support in our purchase accounting. The non-GAAP adjustment to our sales and cost of sales is intended to

include the full amounts of such revenues. We believe the adjustment to these revenues is useful

as a measure of the ongoing performance of our business. We have historically experienced

high renewal rates related to our support agreements and our objective is to increase the renewal rates on acquired post contract support agreements; however, we cannot be

certain that our customers will renew our contracts.

Stock-Based Compensation Expense: We have excluded the effect of stock-based compensation

expenses in calculating our non-GAAP operating expenses and net income measures. Although

stock-based compensation is a key incentive offered to our employees, we continue to evaluate our business performance excluding stock-based compensation expenses. We

record non-cash compensation expense related to grants of options and restricted stock. Depending

upon the size, timing and the terms of the grants, the non-cash compensation expense may

vary significantly but will recur in future periods. Acquisition Costs: We have

excluded the effect of acquisition related and other expenses and the effect of restructuring expenses in calculating our non-GAAP operating expenses and net

income measures. We incurred significant expenses in connection with our recent acquisition of

BigBand, which we generally would not have otherwise incurred in the periods presented as part

of our continuing operations. Acquisition related expenses consist of transaction costs, costs for transitional employees, other acquired employee related costs, and integration related

outside services. We believe it is useful to understand the effects of these items on our total

operating expenses. Restructuring Costs: We have excluded the effect of

restructuring charges in calculating our non-GAAP operating expenses and net income measures. Restructuring expenses consist of

employee severance, abandoned facilities, and other exit costs. We believe it is useful to understand

the effects of these items on our total operating expenses. Amortization of

Intangible Assets: We have excluded the effect of amortization of intangible assets in calculating our non-GAAP operating expenses and net income measures. Amortization

of intangible assets is non-cash, and is inconsistent in amount and frequency and is significantly

affected by the timing and size of our acquisitions. Investors should note that the use of

intangible assets contributed to our revenues earned during the periods presented and will contribute

to our future period revenues as well. Amortization of intangible assets will recur in future

periods. Impairment of Goodwill and Intangibles: We have excluded the effect of the

estimated impairment of goodwill and intangible assets in calculating our non-GAAP operating expenses and

net income (loss) measures. Although an impairment does not directly impact the Company’s current

cash position, such expense represents the declining value of the technology and other

intangibles assets that were acquired. We exclude these impairments when significant and they are not reflective of ongoing business and operating results.

Loss on Sale of Product Line: We have excluded the effect of a loss on the sale of a product

line in calculating our non-GAAP operating expenses and net income measures. We believe it

is useful to understand the effects of these items on our total operating expenses.

Non-Cash Interest on Convertible Debt: We have excluded the effect of non-cash interest in

calculating our non-GAAP operating expenses and net income measures. We record the

accretion of the debt discount related to the equity component non-cash interest expense. We

believe it is useful to understand the component of interest expense that will not be paid out in

cash.

Impairment of Investment: We have excluded the effect of an other-than-temporary impairment of

a cost method investment in calculating our non-GAAP financial measures. We believe it is

useful to understand the effect of this non-cash item in our other expense (income).

Income Tax Expense: We have excluded the tax effect of the non-GAAP items mentioned above.

Additionally, we have excluded the effects of certain tax adjustments related to state

valuation allowances, research and development tax credits and provision to return

differences. |