Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Global Vision Holdings, Inc. | Financial_Report.xls |

| EX-21 - LIST OF SUBSIDIARIES - Global Vision Holdings, Inc. | versant_s1-ex21.htm |

| EX-10.3 - SUBSCRIPTION AGREEMENT - Global Vision Holdings, Inc. | versant_s1-ex1003.htm |

| EX-23.1 - CONSENT - Global Vision Holdings, Inc. | versant_s1-ex2301.htm |

Registration No. _______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

VERSANT INTERNATIONAL, INC.

(Exact name of registrant in its charter)

|

Nevada

|

2000

|

27-2553082

|

||

|

(State or other Jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

Incorporation or Organization)

|

Classification Code Number)

|

Identification No.)

|

VERSANT INTERNATIONAL, INC.

19200 Von Karman Avenue, 4th Floor

Irvine, California 92612

(949) 281-6438

(Address and telephone number of principal executive offices and principal place of business)

Glen Carnes, Chief Executive Officer

19200 Von Karman Avenue, 4th Floor

Irvine, California 92612

(949) 281-6438

(Name, address and telephone number of agent for service)

With a copy to

Manderson, Schafer & McKinlay, LLP

Attention: Lance McKinlay

4675 MacArthur Court, Suite 1200, Newport Beach, CA 92660

Approximate date of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-accelerated Filer o

|

Smaller Reporting Company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

To Be Registered

|

Amount To

Be Registered

|

Proposed

Maximum

Offering Price

Per Share (2)

|

Proposed Maximum

Aggregate Offering

Price

|

Amount Of

Registration

Fee (3)

|

||||||||||||

|

Class B Common Stock, $0.001 par value per share(1)

|

25,500,000

|

$0.10

|

|

$2,550,000

|

|

$292.23

|

||||||||||

|

(1)

|

Pursuant to Rule 416 of the Securities Act, this registration statement also registers such additional shares of common stock as may become issuable to prevent dilution as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated in accordance with Rule 457 of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee. Our Class B common stock is not traded on any national exchange and the offering price is based on the price at which shares of the registrant’s Class B common stock were sold to investors in private transactions, which does not necessarily bear a relationship to the registrant's book value, assets, past operating results, or financial condition. If and when our Class B common stock is quoted on the OTC Electronic Bulletin Board, the shares may be sold at prevailing market prices or at privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Electronic Bulletin Board, that such an application for quotation will be approved or that our Class B common stock ever will trade. The registrant makes no representation as to the price at which its common stock may trade if quoted on the OTC Bulletin Board.

|

|

(3)

|

Calculated in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any statewhere the sale is not permitted.

SUBJECT TO COMPLETION, DATED May 22, 2012

VERSANT INTERNATIONAL, INC.

PROSPECTUS

This prospectus relates to the resale of up to 25,500,000 shares of outstanding Class B common stock, $.001 par value per share, of Versant International, Inc. that may be sold from time to time by the selling stockholders identified in this prospectus. These selling stockholders, together with their transferees, are referred to throughout this prospectus as “selling stockholders.” We are not selling any shares of our common stock in this offering and therefore will not receive any proceeds from this offering.

Our Class B common stock does not presently trade on any exchange or electronic medium.We have not applied for listing to trade on any public market nor has a market maker applied to have our Class B common stock admitted to quotation on the OTC Bulletin Board. We will seek to identify a market maker to file an application to have our Class B common stock admitted to quotation on the OTC Bulletin Board; however, we cannot assure you that our Class B common stock ever will be quoted on the OTC Bulletin Board or trade on any other public market or electronic medium.

We will pay all of the expenses incident to the registration of the shares offered under this prospectus, except for sales commissions and other expenses of selling stockholders applicable to the sales of their shares.

The shares may be offered for sale from time to time by the selling stockholders acting as principal for their own accounts or in brokerage transactions at prevailing market prices or in transactions at negotiated prices. No representation is made that any shares will or will not be offered for sale. It is not possible at the present time to determine the price to the public in any sale of the shares by the selling stockholders and the selling stockholders reserve the right to accept or reject, in whole or in part, any proposed purchase of shares. Accordingly, the public offering price and the amount of any applicable underwriting discounts and commissions will be determined at the time of such sale by the selling stockholders. See “Selling Stockholders” and “Plan of Distribution” in this prospectus.

An investment in our common stock is speculative and involves a high degree of risk. Investors should carefully consider the risk factors and other uncertainties described in this prospectus before purchasing our common stock. See “Risk Factors”beginning on page 7.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL, ACCURATE, OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2012

TABLE OF CONTENTS

Page No.

|

3

|

|

|

Prospectus Summary

|

4

|

|

Risk Factors

|

7

|

|

Market and Other Data

|

12

|

|

Use of Proceeds

|

12

|

|

Determination of Offering Price

|

12

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

13

|

|

Our Business

|

16

|

|

Description of Properties

|

28

|

|

Legal Proceedings

|

28

|

|

Market For Our Common Stock and Other Related Stockholder Matters

|

28

|

|

Management

|

28

|

|

Executive Compensation

|

30

|

|

Transactions With Related Persons

|

32

|

|

Security Ownership of Certain Beneficial Owners and Management

|

33

|

|

Selling Stockholders

|

34

|

|

Plan of Distribution

|

38

|

|

Description of Securities

|

39

|

|

Shares Eligible For Future Sale

|

42

|

|

Legal Matters

|

43

|

|

Experts

|

43

|

|

44

|

|

|

Index to Financial Statements

|

44

|

AVAILABLE INFORMATION

This prospectus constitutes a part of a registration statement on Form S-1 (together with all amendments and exhibits thereto, the “Registration Statement”) filed by us with the SEC under the Securities Act of 1933, as amended (the “Securities Act”). As permitted by the rules and regulations of the SEC, this prospectus omits certain information contained in the Registration Statement, and reference is made to the Registration Statement and related exhibits for further information with respect to Versant International, Inc. and the securities offered hereby. Any statements contained herein concerning the provisions of any document filed as an exhibit to the Registration Statement or otherwise filed with the SEC are not necessarily complete, and in each instance reference is made to the copy of such document so filed. Each such statement is qualified in its entirety by such reference.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred to you. We and the selling stockholders have not, and the underwriters have not, authorized anyone to provide you with additional or different information from that contained in this prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this prospectus includes certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included or incorporated by reference in this report, including, without limitation, statements regarding our future financial position and capital needs, business strategy, projected product development, budgets, projected revenues, projected costs and plans and objectives of management for future operations, are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “project,” “estimate,” “anticipate,” or “believe” or the negative thereof or any variation thereon or similar terminology.

Such forward-looking statements are made based on management's beliefs, as well as assumptions made by, and information currently available to, management pursuant to the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to have been correct. Such statements are not guarantees of future performance or events and are subject to known and unknown risks and uncertainties that could cause the Company's actual results, events or financial positions to differ materially from those included within the forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to:

|

●

|

future financial and operating results, including projections of sales, revenue, income, expenditures, liquidity, and other financial items

|

|

|

●

|

our ability to develop relationships with new customers and maintain or improve existing customer relationships;

|

|

|

●

|

development of new products, brands and marketing strategies;

|

|

|

●

|

distribution channels, product sales and performance and timing of product shipments;

|

|

|

●

|

inventories and the adequacy and intended use of our facilities;

|

|

|

●

|

current or future customer orders;

|

|

|

●

|

management’s goals and plans for future operations;

|

|

|

●

|

our ability to improve operational efficiencies, manage costs and business risks and improve or maintain profitability;

|

|

|

●

|

growth, expansion, diversification and acquisition strategies, the success of such strategies, and the benefits we believe can be derived from such strategies;

|

|

|

●

|

personnel;

|

|

|

●

|

the outcome of regulatory, tax and litigation matters;

|

|

|

●

|

sources and availability of raw materials;

|

|

|

●

|

overall industry and market performance;

|

|

|

●

|

effects of competition; and

|

|

|

●

|

other assumptions described in this report or underlying or relating to any forward looking statements.

|

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements. Except as required by law, we undertake no obligation to disclose any revision to these forward-looking statements to reflect events or circumstances after the date made, changes in internal estimates or expectations, or the occurrence of unanticipated events.

3

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Unless the context otherwise requires, any reference to “the Company,” “we,” “us,” or, “our” refers to Versant International, Inc., a Nevada corporation, together with its wholly-owned subsidiary, Mamma’s Best, LLC, a California limited liability company, which we refer to as “Mamma’s Best.”

VERSANT INTERNATIONAL, INC.

One of our principal business objectives is to create shareholder value through acquisitions or investments in environmentally responsible growth companies. Our investment and acquisition team specializes in proprietary fundamental research, used to identify and model reliable growth companies. We completed our first acquisition in March 2012 with the purchase of Mamma’s Best, a foods products company selling products at well-known organic and natural food retail outlets primarily in Southern California. We anticipate that our acquisition efforts may result in approximately two to three acquisitions per year, though the actual number of acquisitions we complete remains subject to many factors, some of which are outside our control, and is thus uncertain.

Corporate History

Versant International, Inc. (formerly Shang Hide Consultants, Ltd.) was incorporated in the State of Nevada on May 5, 2010. Initially, we were engaged in organizational efforts and obtaining initial financing. Upon a change in management around the beginning of 2012, we increased our efforts to identify a possible business combination. Prior to our first acquisition in March 2012 as further described below, we were considered a “shell company” under SEC Rule 12b-2 of the Securities Exchange Act of 1934, because we had nominal assets consisting of cash and no or nominal operations.

Acquisition of Mamma’s Best

On March 12, 2012, Versant International, Inc. acquired Mamma’s Best, LLC, a Delaware limited liability company,through entering into a Share Exchange Agreement with Mamma’s Bestand the selling members of Mamma’s Best. Under the share exchange agreement, the selling members received Ten Million (10,000,000) shares of Class B common stock of Versant International, Inc. for 100% ownership of Mamma’s Best. Mamma’s Best is a food products company. For accounting purposes, the share exchange transaction was treated an acquisition.

Upon the closing of the Share Exchange, the management of Mamma’s Best was constituted as follows:

|

Name

|

Title

|

|

Glen W. Carnes

|

Chief Executive Officer

|

|

Lyda Corey

|

President, Chief Financial Officer

|

|

Elizabeth Aphessetche

|

Chief Operating Officer, Secretary

|

Our Business

As a result of the closing of the Company’s acquisition of Mamma’s Best, our operations are now focused on the all-natural and organic food market.

Through our wholly-owned subsidiary, Mamma’s Best, we sell unique, all natural food products based on family recipes of the subsidiaries’ founders. Mamma’s Best was created by three sisters: Lyda, Nancy and Elizabeth, who, inspired by their mother’s talent for cooking, developed a unique, all natural, food product line based on family recipes that blended two distinct ethnic-style backgrounds.Through the date of this prospectus all of our sales have derived from a total of four sauces and marinades available at approximately 140 natural and organic food outlets in Southern California.

4

We are currently in the process of expanding our food line to include additional sauces and marinades, jams, soups, and salad dressings. We are also seeking to expand our geographical presence throughout the Western United States as well as increase the number of retailers carrying our products.

Grocer’s Direct

In May 2012, we formed a wholly owned subsidiary, Grocer’s Direct, LLC, to provide food branding and distribution brokerage services focused on the natural foods industry. As this food brokerage arm develops, part of our strategy will be to facilitate efficiencies in the distribution of Mamma’s Best products.

Our Key Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively and to capitalize on the growth of the market that includes our products:

|

|

●

|

the uniqueness our food product recipes, which feature a homemade taste;

|

|

|

●

|

overall product quality and utilization of all natural ingredients; and

|

|

|

●

|

the seasoned experience and abilities of our management team.

|

Our Growth Strategy

We are committed to enhancing financial performance and cash flows through:

|

|

●

|

improving our market position in the food products business through expanding product lines;

|

|

|

●

|

seeking access to an increased customer base for our food products by broadening distribution channels; and

|

|

|

●

|

identifying, and as appropriate, capitalizing on additional acquisitions opportunities through comprehensive research, due diligenceand well thought out and verifiable marker criteria for targeted businesses that are environmentally responsible.

|

Principal Executive Offices

Our headquarters is located in Irvine, California, where we maintain our corporate and administrative offices. Our telephone number is (949) 281-6438. We maintain a website at www.VersantInternational.com, which contains information about our Company, but that information is not part of this prospectus.

The Offering

This prospectus relates to an aggregate of 25,500,000 shares of Class B common stock of Versant International, Inc. that may be offered for sale by the persons named in this prospectus under the heading “Selling Stockholders.” A substantial majority of the selling stockholders are third party investors who acquired shares in private placements of our Class B common stock; the remaining selling stockholders acquired shares in connection with providing services to the Company as officers, directors, employees and consultants. We have no contractual obligation to register any of the shares offered hereunder.

We appreciate the support of our investors, and would like to do our part as a socially responsible company to help create potential liquidity opportunities for our investors in the future. We believe that the registration of shares hereunder will be of benefit to, and appreciated by, our investors and employees.

During the first quarter of 2012, we issued an aggregate of 2,475,000 shares of Class B common stock for total cash consideration of $79,500. During April 2012 we issued an aggregate of 555,000 shares of Class B common stock for total cash consideration of $30,500. During May 2012 prior to the date of this prospectus, we issued an aggregate of 770,000 shares of Class B common stock for total cash consideration of $42,000.

5

In April and May 2012, we issued a total of 1,625,000 shares of Class B common stock to six different consultants, each of whom is identified in this prospectus under the heading “Selling Stockholders.”

Accordingly, in the spirit of recognizing our third party investors, we determined to register for resale all of the shares currently held by our third party investors. We also determined to register for resale all of the shares held by our employees and consultants, with the following exceptions. In the case of our managing executives Glen Carnes and Michael Young, we are registering approximately only 25% of the outstanding Class B shares each of them holds. Similarly, only a small percentage of shares held by an investor who is also a family member of one of our affiliates is being registered hereby.

Finally, with respect to the founders and former owners of our wholly owned subsidiary Mamma’s Best, each of these founders entered into a lock up agreement upon our acquisition of Mamma’s Best, whereby each founder agreed not to sell the shares of our Class B common stock obtained in the acquisition for a period of one following the acquisition. Accordingly, each of these founders will maintain a significant number of shares of our Class B common stock assuming all shares registered hereby are sold.

Offering Summary

|

Class B Common Stock Offered

|

25,500,000 shares of Class B common stock, all of which are being offered for resale by selling stockholders, including shares issued to our officers, employeesand consultants; and shares issued to third party investors.

|

|

Common Stock Outstanding

|

Seventy Million (70,000,000) shares of Class A Common Stock and Seventy Million Four Hundred Thirty-Five Thousand (70,425,000) shares of Class B Common Stock.

|

|

Offering Price

|

The shares may be offered and sold from time to time by the selling stockholders and/or their registered representatives at prevailing market prices or privately negotiated prices. Currently, the Company’s Class B common stock is not admitted to quotation on the OTC Bulletin Board or another exchange or electronic medium.

|

|

Use of Proceeds

|

We will not receive any proceeds from sales of the shares offered by the selling stockholders.

|

|

Dividend Policy

|

We intend to retain all available funds and any future earnings, if any, for use in our business operations. Accordingly, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

|

|

Fees and Expenses

|

We will pay all expenses incident to the registration of such shares, except for sales commissions and other expenses of selling stockholders.

|

|

Market Information

|

Our Class B common stock is not currently listed on any national securities exchange and is not quoted on any over-the-counter market. We will seek to identify a market maker to file an application with the Financial Industry Regulatory Authority, Inc. for our Class B common stock to be admitted for quotation on the OTC Bulletin Board after the effective date of this Registration Statement. We have not yet identified a market maker that has agreed to file such application. We cannot assure you that a public market for our Class B common stock will develop in the future.

|

|

Risk Factors

|

An investment in our common stock is highly speculative and involves a high degree of risk. Investors should carefully consider the risk factors and other uncertainties described in this prospectus before purchasing our common stock. See “Risk Factors” beginning on page 7.

|

6

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors in addition to other information in this prospectus, including the financial statements and the related notes thereto, and in our other filings with the SEC before purchasing our Class B common stock. The risks and uncertainties described below are those that are currently deemed to be material and specific to our Company and industry. If any of these risks actually occur, our business may be adversely affected, and you may lose all or part of your investment.

Risks Associated With Our Business

We have a limited operating history.

We have a limited operating history, a limited number of customers, and have experienced operating losses since our inception. The Company is subject to substantially all the risks inherent in the creation of a new business. As a result of its small size and capitalization and limited operating history, the Company is particularly susceptible to adverse effects of changing economic conditions and consumer tastes, competition, and other contingencies or events beyond the control of the Company. It may be more difficult for the Company to prepare for and respond to these types of risks and the risks described elsewhere than for a company with an established business and operating cash flow. Historically, we had no significant assets or financial resources. We will, in all likelihood over at least the next twelve months, sustain operating expenses that exceed our corresponding revenues. This operating deficiency will likely result in the incurrence of net operating losses until we can increase the reach of our distribution channel, our brand recognition and our customer base. There is no assurance we will be successful in increasing our business operations and achieving profitability.

We recently entered into a new business and may not be successful in executing our business plan.

We have recently entered into the natural and organic food development, distribution, and sales industry. We face significant competition from national and international food producer and distributors that possess significant brand recognition advantages. Even though our management believes our products are positioned to increase our market share, our limited operating history and financial resources make it difficult to penetrate our targeted market. If we are unable to increase our brand recognition we may not achieve profitability.

We may likely need to raise additional funds in the future to fund our on-going operations and growth strategy. If such funds are not available we may not be able to continue as a going concern.

Our cash from operations may not be sufficient to meet our working capital needs and/or to implement our business strategies. As a result, we may need to raise additional capital or obtain additional financing. Accordingly, we expect that we will have to raise additional capital in the future to help fund our operations and growth strategy or to fund unforeseen capital requirements or other events and uncertainties. If we cannot raise funds on acceptable terms, we may not be able to increase or market share, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements. This may prevent us from achieving profitability or continue as a going concern.

In addition, it may be difficult for us to raise capital due to a variety of factors, some of which may be outside of our control, including a tightening of credit markets, overall poor performance of stock markets, and/or an economic slowdown in the United States or other countries. Thus, there is no assurance we would be able to raise additional capital if needed. To the extent we do raise additional capital, the ownership position of existing stockholders could be diluted. Similarly, there can be no assurance that additional financing will be available if needed or that it will be available on favorable terms.

7

Our industry is highly competitive and we may be unable to compete effectively. Increased competition could adversely affect our financial condition.

The market for our products is highly competitive. Many of our competitors are substantially larger and have greater financial resources and broader name recognition than we do. Some of the well-established companies with which we compete include: Trader Joe’s brand, Soy Vay and Jim Beam. Our larger competitors may be able to devote greater resources to research and development, marketing and other activities that could provide them with a competitive advantage. Our market has relatively low entry barriers and is highly sensitive to the introduction of new products that may rapidly capture a significant market share. Increased competition could result in price reductions, reduced gross profit margins or loss of market share, any of which could have a material adverse effect on our financial condition and results of operations. There can be no assurance that we will be able to compete in this intensely competitive environment.

The failure of our suppliers to supply quality materials in sufficient quantities, at a favorable price, and in a timely fashion could adversely affect the results of our operations.

Our products are currently supplied from one vendor. The loss of this vendor or significant increases in their pricing structure, would adversely affect our business operations. Although we believe that we could establish alternate sources for our products, any delay in locating and establishing relationships with other sources could result in product shortages, with a resulting loss of sales and customers.

A shortage of raw materials or an unexpected interruption of supply could also result in higher prices for materials used in the production of our products. Although we may be able to raise our prices in response to significant increases in the cost of these materials, we may not be able to raise prices sufficiently or quickly enough to offset the negative effects of the cost increases on our results of operations.

There can be no assurance that our current or future suppliers will provide the quality materials needed by us in the quantities requested or at a price we are willing to pay. Because we do not control the actual production of our sauces and marinades, we are also subject to delays caused by interruption in production of materials based on conditions outside of our control, including weather, transportation interruptions, strikes and natural disasters or other catastrophic events.

We could be exposed to product liability claims or other litigation, which may be costly and could materially adversely affect our operations.

Any general, commercial and/or service liability claims will have a material adverse effect on our financial condition. We could face financial liability due to product liability claims if the use of our products results in significant loss or injury. Additionally, the manufacture and sale of our products involves the risk of injury to consumers from tampering by unauthorized third parties or product contamination. We could be exposed to future product liability claims that, among others: our products contain contaminants; we provide consumers with inadequate instructions about product use; or we provide inadequate warning about side effects or interactions of our products with other substances.

Our products and manufacturing activities are subject to extensive government regulation, which could limit or prevent the sale of our products in some markets and could increase our costs.

The manufacturing, packaging, labeling, advertising, promotion, distribution, and sale of our products are subject to regulation by numerous national and local governmental agencies in the United States. Failure to comply with governmental regulations may result in, among other things, injunctions, product withdrawals, recalls, product seizures, fines, and criminal prosecutions. Any action of this type by a governmental agency could materially adversely affect our ability to successfully market our products. In addition, if the governmental agency has reason to believe the law is being violated (for example, if it believes we do not possess adequate substantiation for product claims), it can initiate an enforcement action. Governmental agency enforcement could result in orders requiring, among other things, limits on advertising, consumer redress, divestiture of assets, rescission of contracts, and such other relief as may be deemed necessary. Violation of these orders could result in substantial financial or other penalties. Any action by the governmental agency could materially adversely affect our ability and our customers’ ability to successfully market those products.

8

We cannot predict the nature of any future laws, regulations, interpretations, or applications, nor can we determine what effect additional governmental regulations, when and if adopted, would have on our business. They could include requirements for the reformulation of certain products to meet new standards, the recall or discontinuance of certain products, additional record keeping, expanded or different labeling, and additional scientific substantiation. Any or all of these requirements could have a material adverse effect on our operations.

Our manufacturing and fulfillment activities are subject to certain risks.

Our products are manufactured for us in Huntington Park, CA. As a result, we are dependent on the uninterrupted and efficient operation of this facility. Our supplier’s manufacturing and fulfillment operations are subject to power failures, blackouts, the breakdown, failure or substandard performance of equipment, the improper installation or operation of equipment, natural or other disasters, and the need to comply with the requirements or directives of governmental agencies, including the FDA. While we believe our supplier has implemented various emergency, contingency and disaster recovery plans, there can be no assurance that the occurrence of these or any other operational problems at our supplier’s facility would not have a material adverse effect on our business, financial condition and results of operations. Furthermore, there can be no assurance that their contingency plans will prove to be adequate or successful if needed.

Changes in our relationships with significant distributors could adversely affect us.

Since inception, our three largest distributors, which purchase our products and then re-sell them, accounted for approximately 86% of our net revenues. There can be no assurance that all significant distributors will continue to purchase our products in the same quantities or on the same terms as in the past, particularly as consumers continue to demand lower pricing and increased value. The loss of a significant distributor or a material reduction in sales to a significant customer could materially and adversely affect our product sales, financial condition and results of operations.

We may be unable to adequately protect our product branding or may inadvertently infringe on the intellectual property rights of others.

Our products and recipes are not legally protected by trademarks or patents that are registered with the U.S. Patent and Trademark Office, or by contractual licenses. There can be no assurance that we will be able to protect our brand name and underlying products from infringement.

In addition, infringement may be alleged against us by our competitors. In the event we are required to defend our products in litigation, even if successful, substantial costs and diversion of resources could have a material adverse effect on our business, results of operation and financial condition. If any such claims are asserted against us, we may seek to obtain a license under the third party’s intellectual property rights. There can be no assurance, however, that a license would be available on terms acceptable or favorable to us, if at all.

We must leverage our value proposition to compete against retailer brands and other economy brands.

Retailers are increasingly offering retailer and other economy brands that compete with some of our products. Our products must provide higher value and/or quality to our consumers than less expensive alternatives, particularly during periods of economic uncertainty such as those we continue to experience. Consumers may not buy our products if the difference in value or quality between our products and retailer or other economy brands narrows or if consumers perceive a narrowing. If consumers prefer retailer or other economy brands, then we could lose market share or sales volumes or shift our product mix to lower margin offerings. The impact could materially and adversely affect our financial condition and results of operations.

9

We are dependent on our officers and other product development and marketing employees. Loss of any of these key employees may adversely impact our ability to execute our business plan.

For the foreseeable future, our success will depend largely on the services of all of current employees due to their product development expertise. Our officers and key employees provide industry knowledge, marketing skills and relationships with major customers. We are also dependent on these employees to both manage our current operations, and attract and obtain additional financing. The loss of any of these employees or our inability to replace them effectively could seriously harm our business, financial condition or results of operations and our ability to execute our business plan.

Our marketing costs could materially increase which could have a material adverse effect on our earnings.

We incur marketing costs relating to the advertising and promotion of our products. For instance, our marketing costs may materially increase. Any increase in our marketing costs without an offsetting increase in our revenues could have a material adverse impact on our earnings.

In addition to our current operations, we pursue other acquisitions in unrelated industries. In this regard, we are not obligated to follow any particular criteria for evaluating new acquisition targets.

Even though we believe our officers and directors possess the appropriate expertise and ability to identify suitable acquisition targets, there is no guarantee the acquisition will be successful. Additionally, we may incur substantial expenses related to these activities that may be unrecoverable. We will target companies which we believe will provide the best potential long-term financial return for our stockholders and we will determine the terms of the relationship accordingly.

Our acquisition and strategic alliance strategies include numerous risks, including identifying acquisition candidates, execution risks, significant acquisition costs, the management of a larger enterprise, and the diversion of management’s attention that could cause our overall business operations to suffer.

We may seek to acquire companies that complement our business. Our inability to complete acquisitions and successfully integrate acquired companies may render us less competitive. We may evaluate acquisitions at any time. We cannot assure you that we will be able to identify acquisition candidates and complete acquisitions on commercially reasonable terms or at all. If we make acquisitions, we also cannot be sure that any benefits anticipated from the acquisitions will actually be realized. Additionally, we cannot be sure that we will be able to obtain financing for acquisitions.

The process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial, operational and managerial resources that would otherwise be available for the ongoing development or expansion of our existing business. The integration of acquired businesses may also lead to the loss of key employees of the acquired companies and diversion of management’s attention from ongoing business concerns. To the extent that we have miscalculated our ability to integrate and operate the business to be acquired, we may have difficulty in achieving our operating and strategic objectives. The diversion of management attention may affect our results of operations. Future acquisitions could result in the incurrence of debt and related interest expense, contingent liabilities and accelerated amortization expenses related to acquisition premiums paid, which could have a materially adverse effect on our financial condition, operating results and cash flow.

Risks Related to Our Stock

There is currently no trading market for our Class B Common Stock, and liquidity of shares of our Class B Common Stock is limited.

Currently there is no public trading market for our Common Stock. Further, no public trading market is expected to develop in the foreseeable future unless and until we obtain effectiveness of a registration statement under the Securities Act of 1933, as amended, which we refer to as the Securities Act. Therefore, as a threshold matter, outstanding shares of Common Stock cannot be offered, sold, pledged or otherwise transferred unless subsequently registered pursuant to, or exempt from registration under, the Securities Act and any other applicable federal or state securities laws or regulations. Compliance with the criteria for securing exemptions under federal securities laws and the securities laws of the various states is extremely complex, especially in respect of those exemptions affording flexibility and the elimination of trading restrictions in respect of securities received in exempt transactions and subsequently disposed of without registration under the SecuritiesAct or state securities laws.

10

Applicable SEC Rules governing the trading of “penny stocks” limits the trading and liquidity of our common stock which may affect the trading price of our common stock.

We plan to file the necessary regulatory applications to enable our common stock to be eligible for trading on the OTC Bulletin Board. To the extent our common stock becomes eligible for trading, and it trades below $5.00 per share, our common stock will be considered a “penny stock” and will be subject to SEC rules and regulations that impose limitations upon the manner in which our shares can be publicly traded. These regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure document explaining the penny stock market and the associated risks. Under these regulations, brokers who recommend penny stocks to persons other than established customers or certain accredited investors must make a special written suitability determination for the purchaser and receive the purchaser's written agreement to a transaction prior to sale. These regulations may have the effect of limiting the trading activity of our common stock and reducing the liquidity of an investment in our common stock.

We intend to raise additional capital in the future, and such additional capital may be dilutive to stockholders or impose operational restrictions.

We intend to raise additional capital in the future to help fund our operations and acquisition strategy through sales of shares of our common stock, securities convertible into shares of our common stock, or issuances of debt. Additional convertible debt or equity financing may be dilutive to our stockholders and debt financing, if available, may involve restrictive covenants that may limit our operating flexibility. If additional capital is raised through the issuance of shares of our common stock or securities convertible into shares of our common stock, the percentage ownership of our stockholders will be reduced. These stockholders may experience additional dilution in net book value per share and any additional equity securities may have rights, preferences and privileges senior to those of the holders of our common stock.

If our executive officers, directors and principal stockholders collectively have the power to control our management and operations, and have a significant majority in voting power on all matters submitted to the stockholders of the company.

Management and affiliates of our management currently beneficially own 100% of the outstanding Class A common stock which has a 10:1 voting ratio to Class B common stock. Generally, Class A common stock and Class B common stock vote together on all matters submitted for vote to the stockholders of the Company, including the election of directors. Consequently, management has the ability to influence control of the operations of the Company and, acting together, will have the ability to influence or control substantially all matters submitted to stockholders for approval, including:

|

●

|

Election of our board of directors (the “Board of Directors”);

|

|

|

●

|

Removal of directors;

|

|

●

|

Amendment to the Company’s Articles of Incorporation or Bylaws; and

|

|

|

●

|

Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination.

|

These stockholders have complete control over our affairs. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the Common Stock.

The trading price of our common stock is likely to be highly volatile.

The trading price of our shares, assuming they become eligible to trade, may from time to time fluctuate widely. The trading price may be affected by a number of factors including events described in the risk factors set forth in this report as well as our operating results, financial condition, announcements regarding our business, general economic conditions and other events or factors. In addition, the stock market has experienced significant price and volume fluctuations that have particularly affected the price of many small capitalization companies and that often have been unrelated or disproportionate to the operating performance of these companies. Market fluctuations such as these may seriously harm the market price of our common stock. Further, securities class action suits have been filed against companies following periods of market volatility in the price of their securities. If such an action is instituted against us, we may incur substantial costs and a diversion of management attention and resources, which would seriously harm our business, financial condition and results of operations.

11

We do not intend to pay dividends in the foreseeable future.

We have never declared or paid a cash dividend on our common stock. Accordingly, we do not anticipate paying any dividends in the foreseeable future and investors seeking dividend income should not purchase our common stock.

We may issue Preferred Stock, which could have the effect of delaying or preventing a change in control of the Company.

Our Amended and Restated Articles of Incorporation authorizes the issuance of up to 25,000,000 shares of Preferred Stock. In the event Preferred Stock is issued, it could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. This is because each share of Preferred Stock would be convertible into ten thousand (10,000) shares of Class A common stock, and each share of Class A common stock, in turn, would be convertible into two (2) shares of Class B common stock. Thus, holders of Preferred Stock could exert significant influence on matters that would require the approval of stockholders, including a proposed merger of the Company into another corporate entity, or a different kind of sale of the Company. Although we have no present plans to issue any shares of our authorized Preferred Stock, there can be no assurance that the Company will not do so in the future.

MARKET AND OTHER DATA

The industry and market data contained in this prospectus are based on independent industry publications, reports by market research firms or other published independent sources and, in each case, are believed by us to be reliable and accurate. However, industry and market data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. In addition, consumption patterns and customer preferences can and do change. The industry and market data sources upon which we relied are publicly available and were not prepared for our benefit or paid for by us.

USE OF PROCEEDS

The shares of common stock offered by this prospectus are being registered for the account of the selling stockholders named in this prospectus. We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling stockholders. We will pay all of the expenses incident to the registration of the shares except for sales commissions and other expenses of selling stockholders.

DETERMINATION OF OFFERING PRICE

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was based upon the price at which shares were most recently sold to our shareholders in a recent private placement of Class B common stock and does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value.

12

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following discussion and analysis provides information which the Company's management believes to be relevant to an assessment and understanding of the Company's results of operations and financial condition. This discussion should be read together with the Company's financial statements and the notes to financial statements, which are included in this prospectus.

Overview

On March 12, 2012, we completed an acquisition of Mamma’s Best, a food products company. In April 2012 we formed a food brokerage subsidiary, Grocer’s Direct, LLC, with a strategy to facilitate food brokerage and distribution to achieve greater efficiencies.

We continue to investigate and, if such investigation warrants, acquire additional companies or business which may or may not be in the same industry as our wholly-owned subsidiary, Mamma’s Best, LLC. Our on-going principal business objective for the next 12 months and beyond will be to achieve long-term growth potential through additional business combinations and the operation and growth of Mamma’s Best, rather than immediate, short-term earnings.

The analysis of new business opportunities will be undertaken by or under the supervision of Glen W. Carnes, our Chief Executive Officer and Chairman; Michael D. Young, our President and Chief Operating Officer; and Stanley L. Teeple, our Interim Chief Financial Officer. Messrs. Carnes, Young, and Teeple possess significant investment banking and acquisition experience to enhance our ability to identify acquisition targets. Our officers and directors have over 50 years of combined experience and involvement with these types of transactions across a wide array of industries. Correspondingly, we believe the contacts obtained along with the experience in analyzing and accounting for these types of transactions is significantly beneficial in identifying potential acquisition targets.

Through our wholly-owned subsidiary, Mamma’s Best, LLC we sell unique, all natural food products based on family recipes of the subsidiaries’ founders. Through the date of this report all of our sales were from a total of four sauces and marinades available at approximately 140 natural and organic food outlets in Southern California.

We are currently in the process of expanding our food line to include additional sauces and marinades, jams, soups, and salad dressings. We are also seeking to expand our geographical presence throughout the Western United States as well as increase the number of retailers carrying our products .We market and sell organic and natural food products. As of the date of this report, our product line consists of four varieties of sauces and marinades. Our products are available in retail grocery outlets that specialize in organic and natural food distribution and sales, some of which are nationally recognized.

Key Performance Indicators

Our key performance indicators are the number of units sold of each product, as well as our total revenues.

We recognize revenue when orders are shipped, at which time ownership and the risk of loss is transferred to the buyer. Increasing our revenues will require us to enhance our brand recognition, increase our number of customers, expand our product offerings, and extend our geographical presence.

We also monitor product returns, of which there have been none to date.

Results of Operations

Prior to the acquisition of Mamma’s Best, which includes the periods from May 2010 through March 12, 2012, Versant did not have any operations and correspondingly did not generate revenue. The following is a discussion and analysis of the results of operations of Versant as if the acquisition of Mamma’s Best (surviving accounting entity) were completed as of the beginning of the first period presented in the accompanying financial statements (year ended December 31, 2010).

13

The following discussion and analysis should be read in conjunction with the accompanying financial statements for the years ended December 31, 2011 and 2010 and for the three month period ended March 31, 2012.

Comparison of the Years Ended December 31, 2011 and 2010

Revenues

Revenues for both periods consist of sales of our four sauces and marinades. We increased our revenue by approximately 7% to $18,769 in 2011 from the same period in 2010 primarily related to increased product orders from one of our major distributors. We expect our revenues from our existing product line to continue to increase throughout 2012 related to our expected increase in brand recognition, additional promotional efforts, and the development and distribution of new products in mid to late 2012.

Cost of Goods Sold

Our cost of goods sold increased slightly disproportionate to our increase in revenue resulting in a decrease of 5% in gross margin for the year ended December 31, 2011 as compared to the period ended December 31, 2010. The decrease in our gross margin from 29% in 2010 to 24% in 2011 was the result of price increases implemented by our primary product supplier while we did not increase our corresponding pricing structure in an attempt to expand our market share and customer base. Until we achieve sufficient brand recognition we expect our gross margin to remain at their current levels.

Operating Expenses

To date, our operating expenses consist primarily of sales and marketing expenses related to increasing our brand recognition and other general administrative expenses.

Sales and Marketing. Our sales and marketing expenditures increased approximately 171% in 2011 to $11,581 from the same period in 2010. This increase was primarily due to increasing the activity of the Company as a whole and continuing to focus additional resources on expanding our market share and brand recognition. We expect these expenditures to increase in future periods as we roll out new products and product lines.

General, Administrative and Related Expenses. General, administrative and related expenses consist of costs related to meals and entertainment including travel, insurance, utilities, and professional fees. Our general and administrative expenses increased significantly from a total of $1,433 for the year ended December 31, 2010 to $9,114 for the year ended December 31, 2011. The increase was primarily a result of our founding members devoting more time and effort to the Company’s operations. We expect increases in these types of expenses as we continue to execute our growth plans.

Comparison for Quarters Ended March 31, 2012 and 2011

For the three months ended March 31, 2012 our revenues from sauce and marinade sales increased approximately 59% to $4,472. The increase was primarily due to increases in retail outlets carrying our food products as well as increased brand recognition. Historically, we have seen a relative even mix of sales amongst our four current product offerings. We anticipate our sales to increase as we intend to devote additional time resources developing broker relationships; expand our product offerings; increase our geographical reach; and implementation of promotional programs.

Our cost of goods sold increased to approximately $3,600 in-line with the increased revenue during the period ended March 31, 2012. Our gross margin and cost of goods sold, as a percentage of revenue, remained relatively flat as compared to the three months ended March 31, 2011 since we did not increase our product price nor did our production vendor. We expect to maintain our current sales margins and we closely monitor the costs of our underlying ingredients. As our product lines increase our exposure to rapid price changes in raw materials such as fruits will also increase. We believe our relationship with our production vendor is good which provides us timely information to making corresponding price adjustments to our finished goods.

14

During the three months ended March 31, 2012 our sales and marketing expenditures declined 72% to approximately $900 due to the decreased need to provide demos and samples. During 2012 and beyond we expect our sales and marketing expenses to increase as we roll out new products and attempt to extend our geographical reach.

Our officer compensation (stock based) of $2,569,697; professional fees of $86,571; and other general and administrative expenses of $11,725 all increased significantly during the three months ended March 31, 2012. Most of the increases were non-recurring items related to due diligence and increased SEC filings for the acquisition of Mamma’s Best which was completed on March 12, 2012. We expect these items to decrease throughout the remainder of 2012 unless we acquire another operating business or exceed our current growth expectations for Mamma’s Best.

Liquidity and Capital Resources

Our current working capital and liquidity needs are provided by the operations of Mamma’s Best; working capital advances from our officers; and private placements of our common stock. We have historically been able to meet our obligations from liquidity provided by our operations enhanced by advances from our officers. Our current obligations primarily consist of amounts due to our professional service providers related to the acquisition of Mamma’s Best.

We purchase inventory on a just in time basis, which helps provide cash to meet our recurring obligations. Additionally, our officers have agreed to defer payment of their outstanding obligations until such time as the Company obtains the appropriate level of operating resources or may accept equity settlements in the future.

In order to execute our Mamma’s Best growth strategy and acquire other businesses we will need to raise additional capital. In May 2012, we raised $42,000 in private placements of our Class B common stock. We currently have limited liquidity and capital and resources. Our cash flows from operations alone are not sufficient to meet our current working capital requirements. In order to execute our plans for growth we will be required to raise additional funds through either debt or equity financing.

As of March 31, 2012, we had cash and cash equivalents of approximately $37,897. Cash used in operations during the three months ended March 31, 2012 totaled $77,449.

As of December 31, 2011, we had cash and cash equivalents of approximately $2,900. Cash used in operations during the year ending December 31, 2011 totaled $17,428 as compared to $9,682 in 2010, primarily related to increased inventory and overall commercial activities.

For the year’s ending December 31, 2011 and 2010 we incurred a net loss of $16,224 and $713, respectfully. During the initial years as a startup company, we focused on product development, brand identity, packaging, and sampling product to consumers while working to establish distribution for sales. These efforts resulted in costs exceeding revenues.

In order to execute our Mamma’s Best growth strategy and acquire other businesses we will need to raise additional capital. We intend to raise funds via private placements of our common stock, however, there are no firm future funding commitments by stockholders, management, or other third party investors.

We believe that our current resources are sufficient to meet our on-going operations, at their current levels, for at least the next twelve months. Since we cannot accurately predict the timing of new food product launch or when we will acquire additional business, if any, we are currently unable to estimate our liquidity needs beyond the next twelve months.

15

Plan of Operations

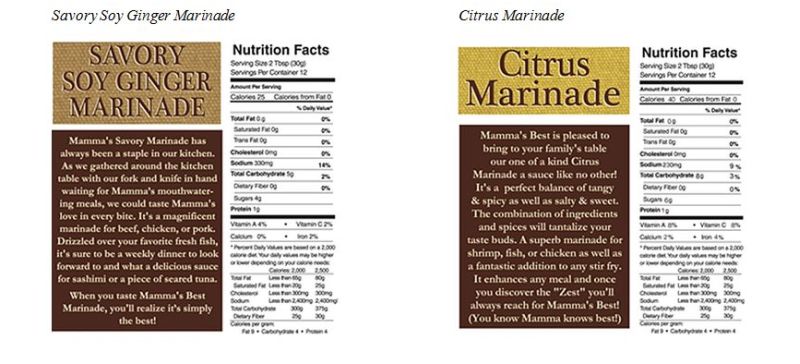

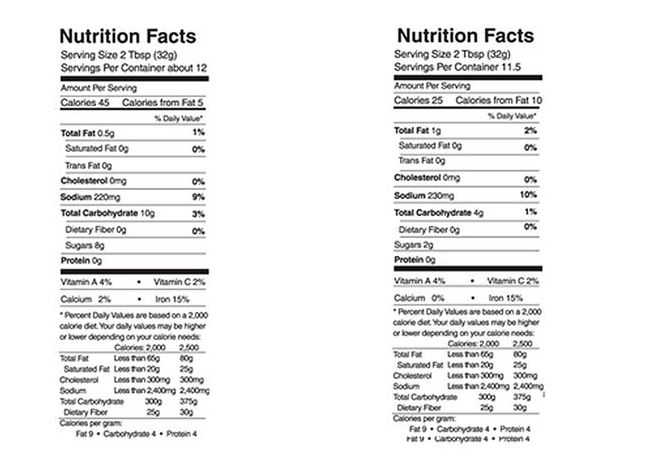

We operate in the natural and organic food industry. Our four current sauce and marinade product offerings: Backyard BBQ”, “Sweet and Spicy BBQ”, “Savory Soy Ginger Marinade”, and “Citrus Marinade” appear to be gaining sales momentum in our initial Southern California markets.

We expect to build on this momentum by expanding our local customer base for these products by increasing the number of customers and distributors that offer our products. In order to execute this strategy our employees are devoting more time to sales and marketing efforts, including setting up more product demonstrations and other market awareness generation activities. Additionally, we are making efforts to establish relationships with larger national grocery chains with the assistance of consultants familiar with the industry. We expect these efforts to further expand our markets geographically.

We have also increased our efforts to sell our products directly to consumers via our website and are continuing to explore ways to make our products more visible to a greater range of customers.

In addition to the increased marketing of our existing brands of sauces and marinades, we intend to roll out several new product lines over the next twelve months and beyond, including jams, soups and salad dressings. The Company intends to roll out approximately 16 new product offerings in these three additional product lines, contingent on the timely receipt of additional financing that will be needed to support the product offerings. Please see "Business – Future Products" below for more information.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

BUSINESS

Corporate History

Versant International, Inc. (formerly Shang Hide Consultants, Ltd.) was incorporated in the State of Nevada on May 5, 2010. Initially, we were engaged in organizational efforts and obtaining initial financing. Upon a change in management around the beginning of 2012, we increased our efforts to identify a possible business combination. Prior to our first acquisition in March 12, 2012 as further described below, we were considered a “shell company” under SEC Rule 12b-2 of the Securities Exchange Act of 1934, because we nominal assets consisting of cash and no or nominal operations.

Acquisition of Mamma’s Best

On March 12, 2012, Versant International, Inc. entered into a Share Exchange Agreement with Mamma’s Best, LLC, a Delaware limited liability company, and the selling members of Mamma’s Best. Under the share exchange agreement, the selling members received Ten Million (10,000,000) shares of Class B common stock of Versant International, Inc. for 100% ownership of Mamma’s Best. Mamma’s Best is a food products company. For accounting purposes, the share exchange transaction was treated an acquisition.

Our Business

As a result of the closing of the Company’s acquisition of Mamma’s Best, our operations are now focused on the all-natural and organic food market.

Through our wholly-owned subsidiary, Mamma’s Best, we sell unique, all natural food products based on family recipes of the subsidiaries’ founders. Mamma’s Best was created by three sisters: Lyda, Nancy and Elizabeth, who, inspired by their mother’s talent for cooking, developed a unique, all natural, food product line based on family recipes that blended two distinct ethnic-style backgrounds. Through the date of this prospectus all of our sales have derived from a total of four sauces and marinades available at approximately 140 natural and organic food outlets in Southern California.

16

We are currently in the process of expanding our food line to include additional sauces and marinades, jams, soups, and salad dressings. We are also seeking to expand our geographical presence throughout the Western United States as well as increase the number of retailers carrying our products .

Our Products

To date, our products have been available through natural and organic food retailers located in Southern California, specifically the greater Los Angeles and Orange County locales. Our products are also available directly via our website, (www.mammasbest.com). Our natural food product line currently being sold consists of the following:

Marinades/ Sauces:

|

·

|

Backyard BBQ

|

Mamma makes the best ribs in town and the secret is in the sauce. Our family’s BBQ sauce has been around for over 25 years, and because it’s so popular, we decided to make it available to you. It is not your typical sweet sauce that tends to burn on the grill but a combination of tomato, vinegar and a unique blend of spices that give it a kick!

|

·

|

Sweet and Spicy BBQ

|

Want to add some spice to your meals but be sweet about it? Try Mamma’s Best Sweet & Spicy BBQ sauce for a taste above the rest. The perfect blend of sweet and spicy will make your meatloaf or pork chops that family favorite again. Try it on some chicken and let those magic spices so their thing. If shrimp or fish is your choice, bake with this unique mixture of sweet & spicy flavors to share with your loved ones.

17

Future Products

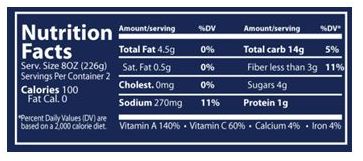

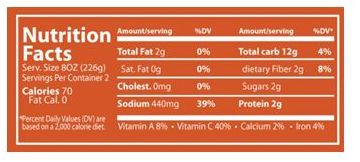

We intend to roll out several new products and product lines over the next twelve months and beyond. Initially we expect these products to comprise new product areas of: (1) soup offerings, (2) salad dressings, and (3) jams, all based on the on-going use of nutritious, all natural ingredients. We have already developed the recipes for the following new product offerings, which are being manufactured currently:

Soups:

|

·

|

Tuscan Fagioli

|

Enjoy the taste of Tuscany in every bowl. With each spoonful you will taste the hearty combination of potatoes and white beans mixed with our secret “trito” blend. Adding a finishing touch of rosemary will make you feel like you are sitting in the Village Ristorante ~ Buon Appetito!

18

|

·

|

Oven Roasted Vegetable

|

Roasting vegetables is the best cooking method to bring out their natural flavors. Fill your home with the aroma of a home cooked meal, roasting in your oven. Our delicious blend of carrots, sweet potatoes, butternut squash, onions, bell peppers and a dash of thyme and sage are the perfect combination to make you feel like you made it from scratch.

|

·

|

Thai Soup

|

Travel to the Far East from your dinner table. Enjoy the exotic tastes of Thailand in our special shrimp stock, flavored with garlic, kaffir lime leaves, lemon grass, shallots, tamarind and red chili peppers. For that authentic entrée, add some tofu and chicken.

19

|

·

|

County Curried Vegetable

|

Let the exotic aroma in your kitchen warm your tummy with our Country Curry Soup. Yukon potatoes, carrots, onions, sweet potatoes and yellow bell peppers merry slowly with the finest spices such as madras curry powder, turmeric, and mustard powder. The finishing touch of coconut milk and the soup simmers to perfection.

|

·

|

Soup de Soleil

|

Transport your senses to the sun-drench coastlines of the Mediterranean. Roasted poblano peppers, smoky black beans, carrots, roasted corn kernels, cilantro, garlic and roasted chilis make this soup flavorful beyond belief. Add a cup of cooked rice and chicken, serve with warm tortillas and you’ve got your new afternoon favorite.

|

·

|

Wholesome Bliss Veggie Broth

|

Jams:

|

·

|

Grape Homestyle Fruit Spread

|

Packed with real grapes, our homestyle grape jam elevates the flavors from the California sun.

20

|

·

|

Peach Raspberry Homestyle Fruit Spread

|

A blend of fresh sweet peaches & plump ruby red raspberries can make your summertime year round.

|

·

|

Mango Habanero Homestyle Fruit Spread

|

A tropical twist with habanero spices bursting with mango flavor.

|

·

|

Acai Blueberry Homestyle Fruit Spread

|

A combination of the two highest antioxidant fruits packed with delicious flavor.

21

|

·

|

Blackberry Pear Homestyle Fruit Spread

|

A delicious blend of sun-ripened berries with juicy sweet pears.

22

|

·

|

Strawberry Homestyle Fruit Spread

|

With plump, ripe strawberries you get that just-picked flavor.

Thus, the Company intends to roll out approximately 16 new product offerings in 3 additional product lines within the next 6 months, contingent on the timely receipt of additional financing that will be needed to support the product offerings.

In addition, the Company is working on creating additional product lines, including:

Salad Dressings:

|

●

|

Asian Cilantro & Sesame

|

|

|

●

|

Mediterranean Balsamic & Herb

|

|

●

|

Roasted Garlic & Lemon

|

|

|

●

|

Classic Vinaigrette

|

Salsa:

|

●

|

Red (Roma tomatoes, garlic, chilis, cilantro and green onions)

|

|

|

●

|

Green (tomatillos, onion and cilantro)

|

|

●

|

Chipotle (smoky flavor with a hint of spice)

|

|

|

●

|

Black bean/roasted corn

|

23

Pasta Sauce:

|

·

|

Marinara - traditional red pasta sauce

|

|

|

·

|

Basillico - red sauce with a touch of cream

|

|

·

|

Arrabiata - spicy red pasta sauce

|

|

|

·

|

Bolognese - meat sauce

|

Chimichurri:

|

·

|

Red - a blend of parsley, garlic, oregano, apple cider vinegar, balsamic, and spices

|

|

|

·

|

Green - a combination of fresh herbs and balsamic with roasted garlic

|

General Description of the Market

According to Organic Monitor estimates, global organic sales reached $54.9 billion in 2009, up from, $50.9 billion in 2008.1The countries with the largest markets are the United States, Germany, and France.2 In the United States, sales of organic food and beverages have grown from $1 billion in 1990 to $26.7 billion in 2010, with sales in 2010 representing 7.7% growth over 2009 sales.3 Organic food and beverage sales represented approximately 4% of overall food and beverage sales in 2010.4 Mass market retailers (mainstream supermarkets, club/warehouse stores, and mass merchandisers) in 2010 sold 54% of organic food. Natural retailers were next, selling 39% of total organic food sales. Other sales occur via export, the Internet, farmers’ markets/ Community Supported Agriculture, mail order, and boutique and specialty stores.5

The Natural and Organic Opportunity

Over the last couple of years, natural and organic food has been one of the fasting growing segments in the food sales and distribution industry. The trend toward healthier, more natural ingredients in food items is unmistakable. According to WholeFoods Magazine:

“Sharp food retailers have recognized that 1) consumers want to eat healthier and that 2) no major national food brand has yet fully captured the “natural” identity in consumers’ minds. In the absence of a dominant national “natural” brand, these first-mover retailers have seized the opportunity to “own” the natural category, and have begun to shift the balance of power away from manufacturers and toward retail stores.” 6

Walmart, which sells about 25% of the nation’s food, announced in January 2011 a major five-year plan to convert thousands of its private label food items to healthier recipes. In addition, Walmart is encouraging its major suppliers such as Kraft Foods, Pepsi, Coca-Cola, Unilever, Nestle, and Procter and Gamble to follow suit.7 Retail Insights estimates that the reformulations to better-for-you ingredients across all these brands will account for well over half of all food-store sales within the next 10 to 15 years.8

While more established companies are reformulating toward healthier ingredients, we are entering the market with a fresh start, emphasizing all natural and organic ingredients in all of our tasty product lines. We believe this is a competitive advantage in a market segment that still has a long way to grow.

1The World of Organic Agriculture: Statistics & Emerging Trends 2011.

3Organic Trade Association’s 2011 Organic Industry Survey.

5Id.

7Id.

8Id.

24

Sub-markets

Within the natural and organic food market, we are initially targeting submarkets for sauces, marinades, soups, and jams. Other potential product lines that the Company is considering include salad dressings, chimichurri, baked goods, soup starters, pasta sauces, beef jerky, and frozen foods.

|

●

|

BBQ sauces/marinades. Considering that 73% of all Americans own or have access to grills and consumers continue to embrace an “outdoor living lifestyle” that facilitates backyard getaways, we believe the BBQ market has solid growth potential. This belief is bolstered by a trend of increased emphasis on entertaining at home and dining out less.

|

|

|

●

|

Soups. We believe soup is a staple in most American households. In particular, the ready-to-serve variety of soup has seen sales increase by 16% in recent years, which translates into a $3.8 billion dollar market.

|

|

●

|