Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MACOM Technology Solutions Holdings, Inc. | d356928d8k.htm |

M/A-COM Technology Solutions

Holdings

May 22, 2012

Exhibit 99.1 |

2

Forward-Looking Statement Safe Harbor and Use of Non-GAAP

Financial Measures

This presentation will include forward-looking statements by us within the

meaning of the Private Securities Litigation Reform Act of 1995, and any

related Q&A discussion may include such statements as well.

Forward-looking statements are statements about future results or events. These statements may

relate to, among other things, our future growth, net revenue, gross margin,

operating margin, earnings, cash flow, capital expenditures, working capital

and other financial items, or our target operating model, business strategy,

goals and expectations concerning our market position, future operations or other

topics. We may use the words "anticipate", "believe",

"could", "estimate", "expect", "intend", "may", "plan",

"predict",

"project",

"will”,

“forecast”,

“guidance”,

“target

model”

and

similar

terms

and

phrases

when

making forward-looking statements.

Our forward-looking statements are subject to assumptions, risks and

uncertainties, and are not guarantees of future results. Actual

results may differ materially from the outcomes stated or implied by our

forward-looking statements based on any assumptions and risk factors we may mention today or

otherwise,

and

based

on

the

risk

factors

set

forth

in

our

Quarterly

Report

on

Form

10-Q

filed

with

the

SEC

on May 10, 2012, which is publicly-available on the SEC's EDGAR database.

We undertake no obligation to update any information contained in these

statements at a later date. Any

references

we

make

to

our

projected

future

financial

results

“announced

as

of

May

8,

2012”

are

not

intended to update, revise or reaffirm that projection as of today.

We will make references in this presentation to certain financial information

calculated on a basis other than

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

(GAAP),

including

certain gross margin and operating margin figures calculated to exclude

amortization, non-cash compensation expense, accretion of contingent

consideration and/or restructuring charges required to be included by

GAAP. An appendix at the end of this presentation includes a reconciliation of each non-

GAAP

figure

presented

herein

to

the

most

comparable

GAAP

figure.

Our

fiscal

year

end

is

the

Friday

closest

to

September

30

.

th |

3

•

60-year heritage of innovation

•

$310M of FY 2011 revenue

•

2,700+ products across 38 product lines

•

6,000+ customers worldwide

•

Global, multi-channel sales strategy

•

Differentiated “Fab-Lite”

model

Provider of high-performance analog semiconductor solutions for use in wireless

and wireline applications across the RF, microwave & millimeterwave

spectrum M/A-COM Tech Snapshot

Broad

End-Markets /

Applications

Strong

Product

Portfolio

Global

Presence

Diverse

Customer

Base

3 |

Large

and Growing End Markets CATV / Broadband

Wireless Backhaul

VSAT Terminals

Fiber Optics

Military Communications

Electronic warfare

Space & Hi-Rel

Industrial & Medical

Radar –

Air, Ground & Sea

Test & Measurement

Mobile Devices

Automotive

•

Numerous applications in each primary market

•

>$30

B

market

opportunity

with

projected

14%

CAGR

(1)

A&D –

36%

Multi-market –

39%

Networks –

25%

Note: Percent of Q2 FY 2012 revenue shown for primary markets.

1. Source: Frost & Sullivan, 2010-2017

4 |

5

Broad & Innovative Product Portfolio

Integrated

Circuits

Power Pallets

& Transistors

Passive

Components

Switch Limiters,

Switches, Diodes

Active

Components

Multi-Chip

Modules

1 MHz

Radio Frequency

6 GHz

Microwave

20 GHz

110 GHz

Millimeter Wave

Industrial

Broad-

band

Wireless Data,

Toll Tags

GPS,

Avionic,

Radar

Cellular

DVB,

Satellite

Radio

WiMAX, WLAN,

Access Points

Test

Equipment

Microwave

Radio Links

DBS,

Industrial

Imaging

Satellite Payload

Communications

Industrial

VSAT

Millimeter

Wave Radio

Links

UAV

Datalink

SATCOM

Terminal

Communication

Tracking and

Jamming

Adaptive

Cruise

Control

Scientific

Imaging and

Measurement

Radar

Communications

Broadcast

•

Over 2,700 products across 38 product lines

•

High performance analog products up to 100 GHz

•

Long

product

lifecycles

ranging

from

5

–

10

years

Diverse

Array

of

Products

and

Form

Factors

Serving

a

Broad

Frequency

Spectrum

5 |

6

Growth Strategy with Multiple Drivers

NEW PRODUCTS /

PRODUCT LINES

OPPORTUNISTIC

ACQUISITIONS

NEW ADJACENT

MARKETS

INTEGRATED

SOLUTIONS

GaN Transistors

& Smart Pallets

40G / 100G

Optoelectronics

38 GHz SmartSet |

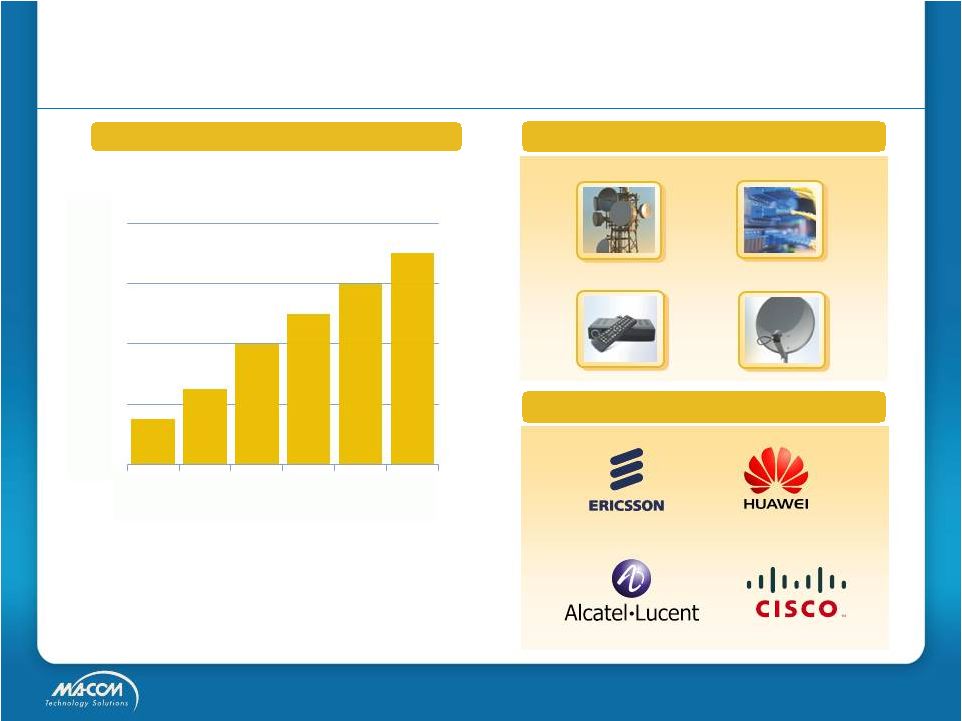

MARKET OVERVIEW |

Networks Overview

1.

2010 Cisco Visual Networking index.

Wireless Backhaul

Satellite Internet

CATV / Broadband

Fiber Optics

•

Proliferation of smartphones, tablets,

video on demand services

•

Infrastructure expansion & upgrades for

greater capacity and faster speeds

Exabytes

8

0

20

40

60

80

2010

2011

2012

2013

2014

2015

8

Applications

By 2015 Total Internet Traffic will be

4X

Larger

than

2010

(1)

Market Drivers

Key Customers |

9

•

Multiple design wins for modulator driver

and TIA products for 100G

•

Ramp in production with 100G long haul

customer

•

At OFC, our EML driver used in customer

demonstration of 100GbE CFP2

•

Ovum forecasts double digit CAGR for

100G ramping in late CY 2012 thru 2013

Networks Product Highlight: Optoelectronics |

10

Aerospace & Defense Overview

1.

The Teal Group.

•

UAV

market

to

double

over

next

decade

(1)

•

Electronic

content

growth

in

A&D

–

phased

array radars with 1000s of T/R modules

Radar

Electronic Warfare

Military Communications

Space & Hi-Rel

Market Drivers

World Unmanned Aerial Vehicle

Forecast

(1)

Applications

Key Customers

0

3

6

9

12

2011

2012

2013

2014

2015

2016

($ Billions) |

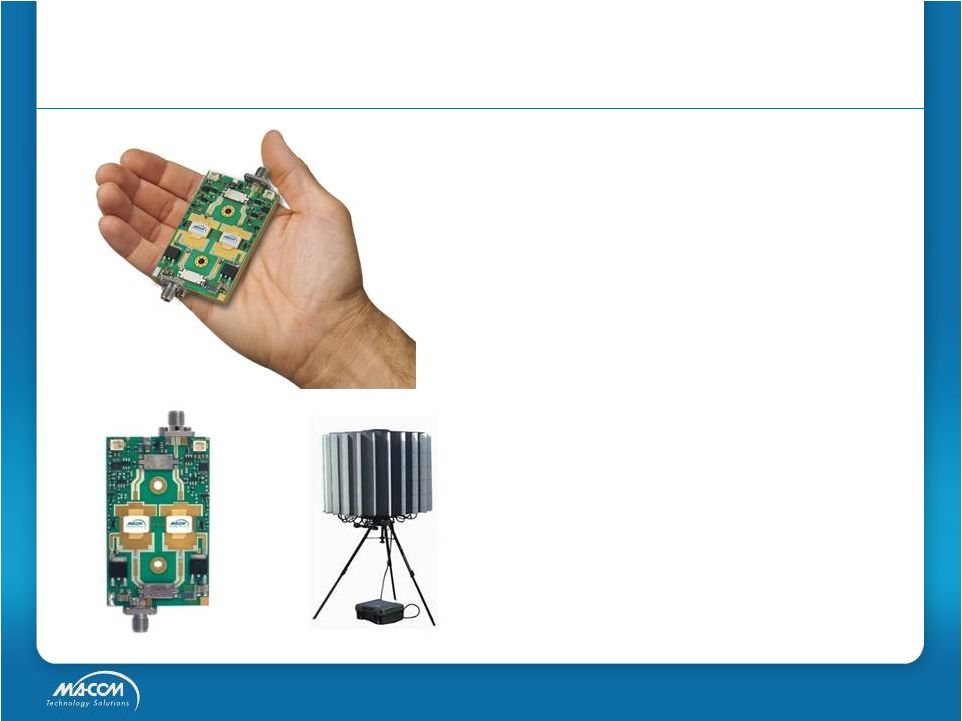

11

•

GaN Smart Pallet incorporates hybrid PA

technologies & intelligent bias circuitry

•

Compact module optimizes performance,

reliability and cost for customer

•

Sole source design win with US Defense

customer for mortar locating radar

•

20 units to be delivered this year with full

rate production slated for CY 2014

A&D Product Highlight: GaN Smart Pallet |

12

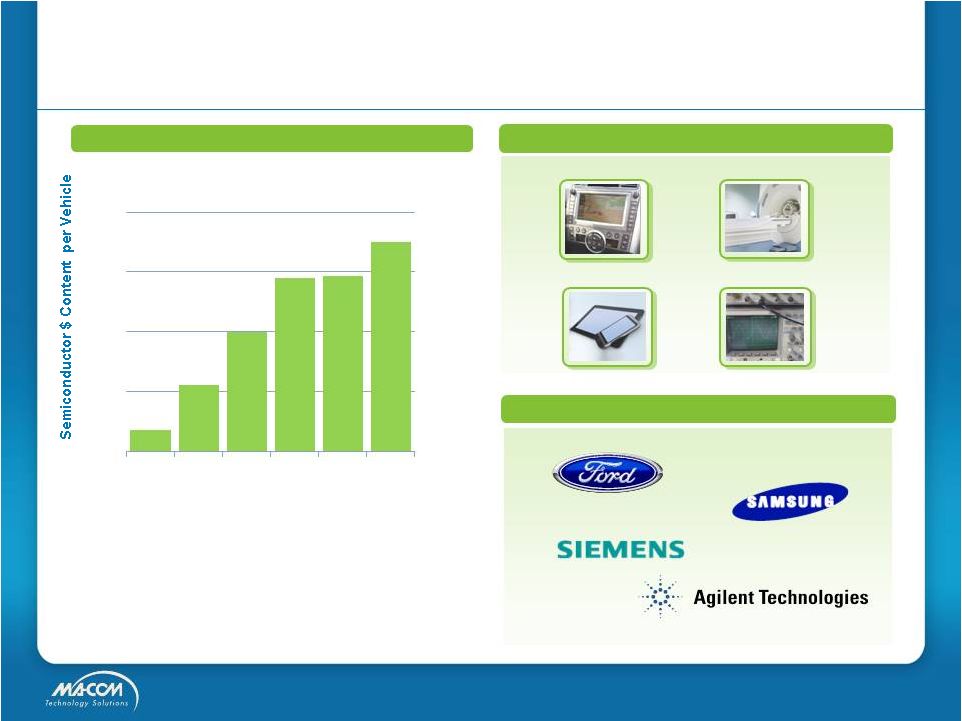

Multi-market Overview

1.

IC Insights. 9% CAGR from 2010-2014.

•

Increasing semiconductor content per

automobile

–

9%

CAGR

(1)

•

Solutions for medical imaging, life

sciences, and test & measurement

•

Broad portfolio of catalog products

Automotive

Mobile Devices

Test & Measurement

Industrial & Medical

Market Drivers

Applications

Avg. Semiconductor Content in

Automobiles

(1)

Key Customers

250

300

350

400

450

2009

2010

2011

2012

2013

2014 |

13

•

Ford is only >10% customer for patented

GPS “Sync”

Module

•

Module enables dead reckoning feature &

eliminates need for antenna fin

•

Marketing ADAS prototype with NAVTEQ

for energy efficiency & enhanced safety

•

Other automotive applications include

sensor products for short range radar

Multi-market Highlight: Automotive

ADAS Prototype with NAVTEQ Maps

Ford “Sync”

GPS Module |

COMPETITIVE ADVANTAGE |

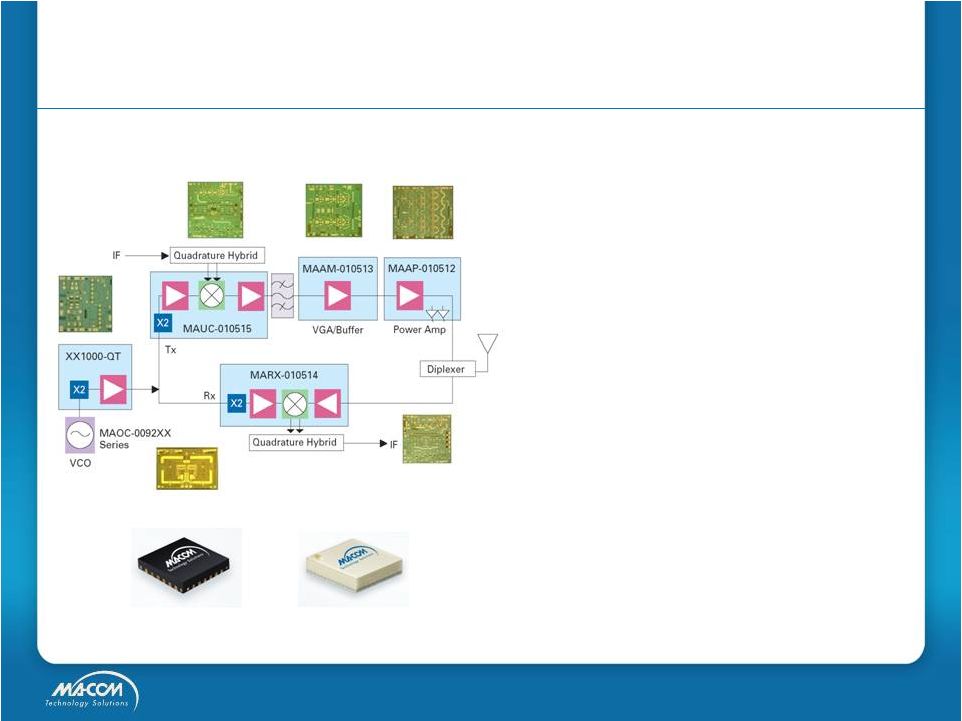

Advanced R&D Capabilities

•

System level approach to solutions that

enable fast time to market for customer

•

Combines unique modeling, IC design,

integration & packaging capabilities

•

A leader in RF front end architecture for

wireless

backhaul

with

“SmartSet”

solution

•

Innovation in surface mount packaging

allows use of high volume manufacturing

42 GHz SmartSet for Wireless Backhaul

QFN Packages

Laminate Packages

15 |

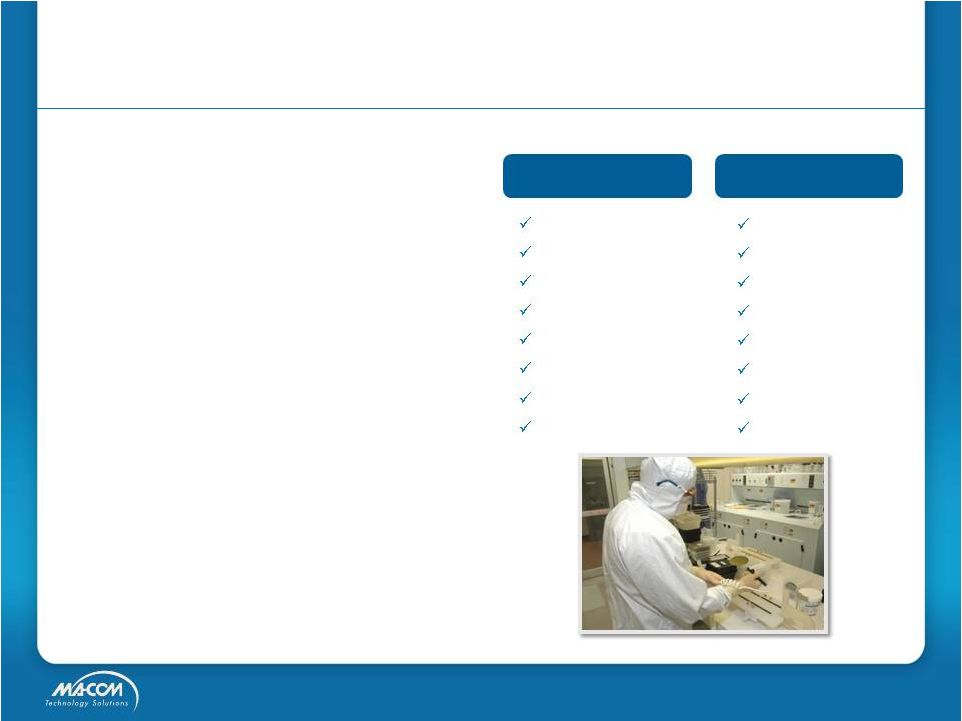

AlGaAs Diodes

GaAs MESFET

GaAs pHEMT

HMIC Technology

Silicon Bipolar

Silicon Diodes

Silicon LDMOS

Silicon MOSFET

GaAs HBT

GaAs HFET

GaAs MESFET

GaAs pHEMT

GaN on SiC

InP HBT

RF CMOS

SiGe

•

Owning a fab is a competitive advantage

–

Proprietary process technologies

–

Assurance of supply

–

Control over quality

–

Strategic for US A&D customers

•

Outsourcing enhances attractiveness of

financial model

–

Variable cost structure

–

Outsourcing of excess demand

–

Low capital expenditures

Differentiated “Fab-Lite”

Model

Internal Process

Technologies

External Process

Technologies

16 |

FINANCIAL OVERVIEW |

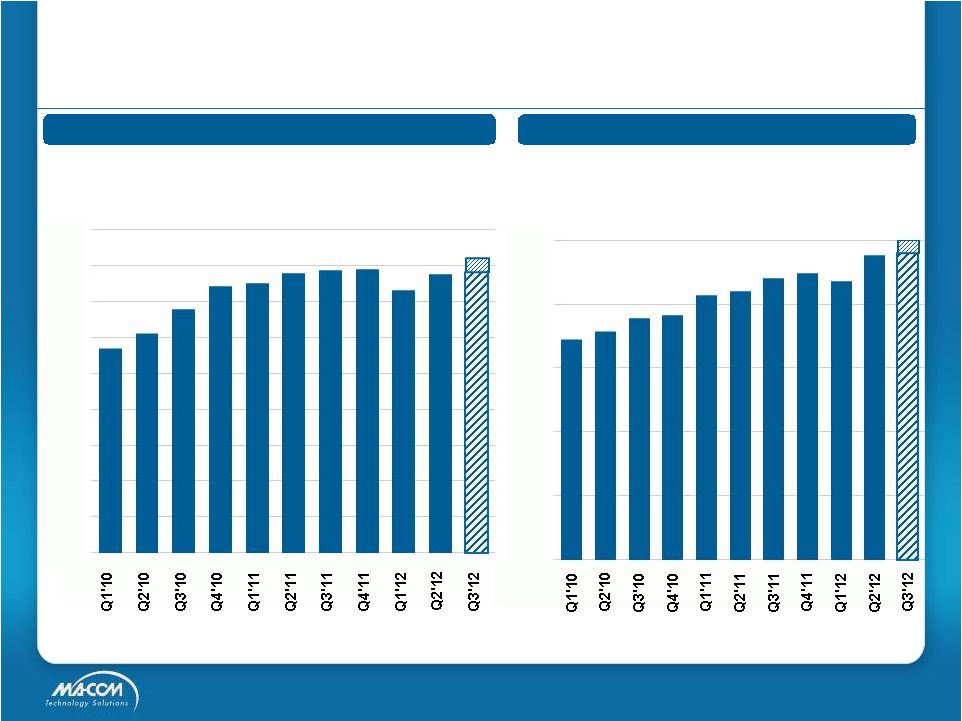

Revenue by Fiscal Quarter

($ in millions)

Gross Margin** by Fiscal Quarter

Revenue and Gross Margin Expansion

* Q3 FY 2012 guidance announced as of May 8, 2012

** Non-GAAP: Excludes amortization and

non-cash compensation expenses. $78-82*

48-50%*

$57

$61

$68

$74

$75

$78

$79

$79

$73

$77

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

34%

36%

38%

38%

41%

42%

44%

45%

44%

48%

0%

10%

20%

30%

40%

50%

18 |

19

2-Year Target Operating Model

($ in millions / % of revenue)

Revenue

$260

$310

$77

Above

Market

Growth

Gross Margin

(1)

37%

43%

48%

55% –

60%

Operating

Margin

(1)(2)

10%

17%

23%

30% –

35%

1.

Non-GAAP: Excludes amortization and non-cash compensation expenses.

2. Non-GAAP: Also excludes accretion of contingent

consideration and restructuring charges. FY 2010

FY 2011

Q2 FY 2012

Target

Model |

20

Annual Operating Cash Flow

Strong Cash Flow & Balance Sheet

First Half FY’12 Operating

Cash Flow -

$18.2

Cash & Equivalents -

$74.7

Working Capital -

$130.6

Debt Free

Unused and Available

Line of Credit -

$125.0

As of March 30, 2012

($ in millions)

$20.7

$32.8

$

-

$10

$20

$30

$40

FY 2010

FY 2011 |

Appendix |

22

Reconciliation of GAAP to Non-GAAP Results

($ in thousands)

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

FY 2010

FY 2011

Revenue

$57,405

$61,014

$67,705

$74,173

$74,909

$77,884

$78,700

$78,802

$73,035

$77,480

$260,297

$310,295

GAAP Gross Profit

$19,419

$21,315

$25,126

$27,883

$30,614

$32,245

$34,118

$34,883

$31,415

$36,549

$93,743

$131,860

GAAP Gross Margin

34%

35%

37%

38%

41%

41%

43%

44%

43%

47%

36%

42%

Amortization expense

399

397

398

400

382

382

443

381

382

382

1,594

1,588

Non-cash compensation expense

(16)

54

101

55

54

102

134

45

36

42

194

335

Non-GAAP Gross Profit

$19,802

$21,766

$25,625

$28,338

$31,050

$32,729

$34,695

$35,309

$31,833

$36,973

$95,531

$133,783

Non-GAAP Gross Margin

34%

36%

38%

38%

41%

42%

44%

45%

44%

48%

37%

43%

GAAP Operating Profit

$17,983

$17,854

$45,927

GAAP Operating Margin

23%

7%

15%

COGS Amortization expense

382

1,594

1,588

COGS Non-cash compensation expense

42

194

335

R&D Non-cash compensation expense

118

208

258

SG&A Amortization expense

257

1,095

1,069

SG&A Non-cash compensation expense

303

1,143

964

Accretion of contingent consideration

(1,247)

2,000

210

Restructuring charges

-

2,234

1,499

Non-GAAP Operating Profit

$17,838

$26,322

$51,850

Non-GAAP Operating Margin

23%

10%

17% |