Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): May 15, 2012

X-FACTOR COMMUNICATIONS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-54341

|

45-1545032

|

||

|

(State or other jurisdiction of incorporation

or organization)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

3 Empire Blvd.

5th Floor

South Hackensack, NJ 07606

|

(Address of principal executive offices)

|

201-518-1925

|

(Registrant’s telephone number, including area code)

Organic Spice Imports, Inc.

7910 Ivanhoe Ave. #414

|

La Jolla, California 92037

|

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SPECIAL NOTE ABOUT FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K and other reports filed by X-Factor Communications Holdings, Inc. from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain forward looking statements and information that are based upon beliefs of, and information currently available to, the registrant’s management, as well as estimates and assumptions made by the registrant’s management. When used in the Filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to the registrant or the registrant’s management identify forward looking statements. Such statements reflect the current view of the registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to the registrant’s industry, operations and results of operations and any businesses that may be acquired by the registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

| Item 1.01. Entry into a MaterialDefinitive Agreement. |

The following discussion provides only a brief description of the documents described below. The discussion is qualified in its entirety by the full text of the agreements, copies of which are included as Exhibits to this report.

Agreement and Plan of Merger

On March 5, 2012, X-Factor Communications Holdings, Inc. (formerly, Organic Spice Imports, Inc.) entered into an Agreement and Plan of Merger (the "Merger Agreement") with X-Factor Acquisition Corp., a Delaware corporation and wholly-owned subsidiary of Organic Spice (“Acquisition Corp”), and X-Factor Communications, LLC, a New York limited liability company (“X-Factor”). On May 15, 2012, pursuant to the terms and conditions of the Merger Agreement, Acquisition Corp merged with and into X-Factor (the "Merger") and X-Factor survived the Merger and became a wholly-owned subsidiary of Organic Spice. On May 16, 2012, Organic Spice Imports, Inc. changed its name to X-Factor Communications Holdings, Inc. References herein to the “Company”, the “registrant”, “we”, “us” or “our” refer to X-Factor Communications Holdings, Inc. References herein to “Organic Spice” refer to the registrant prior to its name change.

On May 15, 2012, at the “Effective Time”, which was defined in the Merger Agreement as the satisfaction of certain conditions, in particular the receipt of subscriptions for a minimum amount of $1,500,000 (the “Minimum Amount”) of our Common Stock (including the $295,000 paid by the three individuals (the “Controlling Stockholders”) who acquired control of Organic Spice on February 10, 2012 as described in Item 2.01 below under the heading “History”) in connection with a private placement offering (the “Offering”) of up to 6,666,667 shares ($5,000,000) of our Common Stock (the “Maximum Amount”), which includes an over-allotment option in the amount of 2,666,667 share ($2,000,000) (the “Over Allotment Option”):

(a) Each holder of X-Factor Membership Interests received such number of shares of our fully paid and nonassessable Common Stock equal to one multiplied by the Exchange Ratio, defined as 5.286767 shares of our Common Stock for each X-Factor Membership Interest issued and outstanding, rounded to the nearest whole share.

(b) Each holder of X-Factor Preferred Membership Interests received the Preferred Consideration Amount, defined as 1.190229 shares of our Common Stock for each $1.00 of the purchase price paid by a holder of Preferred Membership Interests in the purchase of such Preferred Membership Interests, rounded to the nearest whole share.

(c) All shares of Acquisition Corp common stock issued and outstanding immediately prior to the Effective Time were converted into and became one validly issued, fully paid and nonassessable X-Factor Common Membership Interest.

(d) We assumed the rights and obligations under each outstanding convertible debt security (each, a “Convertible Security”), if any, issued by X-Factor that is convertible into X-Factor Membership Interests. Each Convertible Security evidences the right to receive, upon conversion, a number of shares of our Common Stock (in either event, rounded to the nearest whole share) equal to the number of X-Factor Membership Interests into which the Convertible Security was convertible immediately prior to the Effective Time multiplied by the Exchange Ratio. The new conversion price applicable to each such Convertible Security shall be determined by dividing the conversion price immediately prior to the Effective Time by the Exchange Ratio.

(e) We assumed the rights and obligations under X-Factor’s outstanding warrants (the “Warrants”), if any, to purchase X-Factor Membership Interests. The Warrants were assumed in accordance with their terms and conditions. Each Warrant evidences the right to purchase a number of shares of our Common Stock (rounded to the nearest whole share) equal to the number of X-Factor Membership Interests into which such Warrant is exercisable immediately prior to the Effective Time multiplied by Exchange Ratio. The new exercise price of the Warrants shall be determined by dividing the exercise price of the Warrants immediately prior to the Effective Time by the Exchange Ratio. In addition to the foregoing, the one holder of a warrant to purchase X-Factor Preferred Membership Interests received an additional warrant to purchase, for a period of 10 years from the Effective Time, a number of shares of our Common Stock equal to the aggregate exercise price of such preferred warrant, which is $125,137, multiplied by the Preferred Consideration Amount, provided that such additional warrant shall be for the purchase of no less than the number of shares of our Common Stock equal to 27,500 multiplied by the Exchange Ratio, and the exercise price of such additional warrant shall be the quotient of the exercise price of such preferred warrant, which is $4.33 per X-Factor Preferred Membership Interest, divided by the Exchange Ratio.

2

(f) We assumed all of X-Factor’s rights and obligations under the options to purchase X-Factor Membership Interests, pursuant to X-Factor’s 2006 Long-Term Equity Incentive Plan and 2010 Long Term Incentive Plan, that were outstanding immediately prior to the Effective Time and have not prior to the Effective Time been exercised, cancelled or terminated nor expired.

If, upon the final completion or termination of the Offering, the Company has raised gross proceeds less than $4,705,000, then after the final closing of the Offering, the Exchange Ratio shall be proportionately adjusted in favor of the former members of X-Factor. In such case, the number of shares underlying options, warrants and convertible securities included within the Merger Consideration, and the exercise or conversion prices thereof, as applicable, shall be adjusted in accordance with such adjusted Exchange Ratio.

From and after the Effective Time, we became the sole member of X-Factor. From and after the Effective Time, we increased the size of our Board of Directors to three persons and we elected new officers and directors, as described in Item 2.01 below.

Offering

On May 15, 2012, at the Effective Time and in connection with the Offering, we also issued an aggregate of 1,648,333 shares of our common stock at a price of $0.75 per share, for gross proceeds of $1,236,250 pursuant to the terms and conditions of a Subscription Agreement by and between the Company and 11 accredited investors. In addition, we issued an aggregate of 970,733 shares of our common stock at a price of $0.75 per share, in exchange for the conversion of $728,049 of X-Factor’s convertible promissory notes. Please see Item 3.02 of this report for additional information relating to the private offering.

Cancellation Agreement

As an inducement for X-Factor to consummate the transactions contemplated by the Merger Agreement, on May 15, 2012, the Company cancelled 10,000,000 shares of common stock and warrants to purchase up to 5,000,000 shares of common stock owned of record by the Controlling Stockholders immediately prior to the Effective Time.

| Item 2.01. Completion of Acquisition or Disposition of Assets. |

Information in response to this Item 2.01 below is keyed to the item numbers of Form 10 (General Form For Registration of Securities Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934).

Part I.

| Item 1. Description of Business. |

In the discussion below, when we refer to “X-Factor”, the “Company”, “we”, “us” and “our”, we also mean our wholly-owned operating subsidiary, X-Factor Communications, LLC, as may be applicable.

History

Organic Spice Imports, Inc. ("Organic Spice") was incorporated in the State of Delaware on December 31, 2010 and was established as part of the Chapter 11 reorganization of Spicy Gourmet Organics, Inc., a California corporation ("SGO"). SGO was incorporated in the State of California in 2006 and was formed to import specialty organic spices from South Asia and sell them in the United States. SGO was under capitalized and sales of its spice products were slow to develop. As a result, SGO lacked sufficient cash flow to meet its current obligations and on October 1, 2010, SGO filed a voluntary petition for bankruptcy under Chapter 11 in the U.S. Bankruptcy Court for the Central District of California. SGO's Plan of Reorganization (the "Plan") was confirmed by the U.S. Bankruptcy Court for the Central District of California on November 19, 2010.

3

The Plan provided, among other things, for the incorporation of Organic Spice, the spin off of SGO's importing business to Organic Spice, and the distribution of Organic Spice shares to the bankruptcy creditors. Organic Spice lacked the resources required to effectively develop an import business and therefore engaged in a search for a strategic business partner or a merger or acquisition partner with the resources to establish a business and provide greater value to its stockholders.

On February 10, 2012, a change in control occurred as a result of the sale by the former majority stockholders of Organic Spice of 11,050,000 shares of common stock to Peter Quigley, Randle Kenilworth and Donald J. Wright. In connection with the change in control, Organic Spice entered into a General Assignment and Assumption Agreement dated February 10, 2012 ("Effective Date") pursuant to which it sold, assigned and transferred to Retail Spicy Gourmet, Inc. ("RSG"), a Delaware corporation, all rights and interests it may have to sell spices and related products (the "Business") as set forth in the Plan in exchange for RSG's assumption of any and all liabilities of Organic Spice preceding the Effective Date, including without limitation, Organic Spice's obligation under the Plan to distribute 25% of its gross profits derived from all sales of spices and related products to certain creditors as set forth in the Plan.

On May 15, 2012, Organic Spice completed a reverse merger transaction (as described in Item 1.01, herein), pursuant to which it (i) became the parent of X-Factor by virtue of its acquisition of all of the X-Factor membership units; (ii) assumed the operations of X-Factor; and (iii) changed its name from “Organic Spice Imports, Inc.” to “X-Factor Communications Holdings, Inc.”

Overview of X-Factor Business

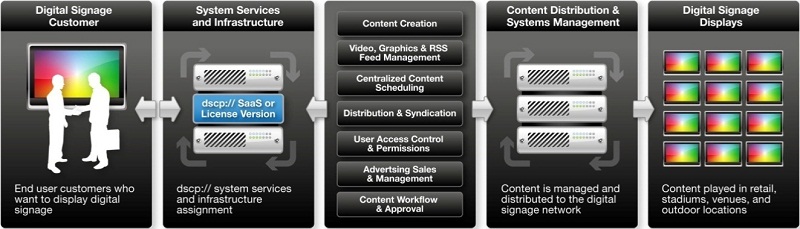

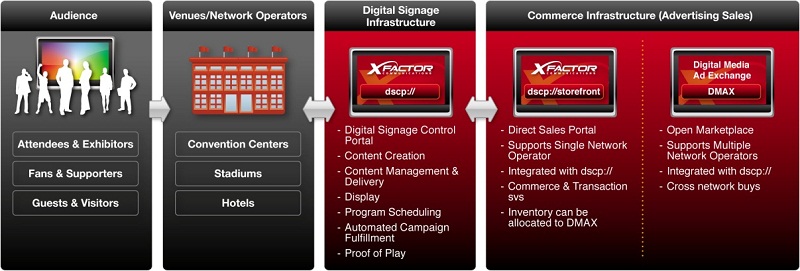

X-Factor is a New York limited liability company originally formed on May 31, 2005. X-Factor is a provider of interactive digital media network software and services. The X-Factor Digital Media Network Platform (the “X-Factor Platform”), our cloud-based digital signage, Web and mobile solution, is delivered as a software-as-a-service ("SaaS") and under software license model. The X-Factor Platform enables our customers to build simple yet scalable marketing, advertising and corporate digital media networks.

The X-Factor Platform empowers customers with a set of comprehensive digital media tools to integrate digital signs, premium content, social networks and mobile applications with live video broadcasts, advertising sales, and marketing programs addressing the rapidly expanding digital media needs of our brand, corporate, public venue, education and government sector customers.

Our clients use the X-Factor Platform services for end-consumer and audience focused live and on-demand digital media programs, as well as internal corporate communications. We have aligned our products and services to the needs and requirements of our three key major customer segments - brands, corporations and public venues. These customer segments use the X-Factor Platform and associated services to create, manage and deliver comprehensive digital media programs using interactive digital signage, mobile and Web services and applications. These integrated digital media network platform services and applications are optimized for the following specific audience environments:

|

●

|

Public Places. These include stadiums, arenas, convention centers, hotels, college campuses, restaurants and outdoor advertising billboard locations. The X-Factor Platform provides an interactive digital signage solution that is used for awareness and advertising campaigns, way finding, emergency messaging, commerce, and as “a call to action” driving targeted engagements via personal devices. The X-Factor Platform’s mobile and Web solutions are used for these targeted personal engagements both in and outside of the public venue.

|

4

|

●

|

Personal Devices. By leveraging the worldwide adoption of personal mobile devices such as mobile phones, tablets and laptops, driven by social media and Web applications for consumers and corporate users, the X-Factor Platform allows its customers to easily create, manage and deploy targeted digital media programming and applications to enhance audience participation anywhere, driving brand engagement, marketing, advertising and employee communications.

|

|

●

|

Workplace. Our corporate clients use the X-Factor Platform in the corporate setting on equipment such as desktops and mobile devices and in conference rooms, common areas, cafeterias and elevators throughout the enterprise for communications, human resources, training, emergency messaging and security with extensions into the personal environment using Web and mobile applications.

|

Our Services and Products

The X-Factor Digital Media Network Platform and Component Solutions

Unique to X-Factor, users of the X-Factor Platform are provided with advanced digital media services and an advertising focused e-commerce system that supports public and private advertising sales, campaign creation, order fulfillment and billing that is integrated with content creation, content management and delivery. The X-Factor Platform components that can be sold individually or as a comprehensive turnkey solution are as follows:

|

●

|

dscp:// - Digital Signage Control Portal. This is our innovative, patent pending, anchor product. dscp:// is a digital signage software application that allows users to deploy and manage digital signage services quickly and easily.

|

|

●

|

DMAX (Digital Media Advertising Exchange) & Storefront Advertising Portals. These are our integrated and branded e-commerce portals that support public (DMAX) and private (Storefront) advertising sales, campaign creation, order fulfillment and billing. Through our ongoing integration of dscp://, we believe we are the only vendor in the marketplace that provides advertising sales support with content creation, management and delivery.

|

|

●

|

dmcp:// - Digital Media Control Portal & Webcasting. This is our globally available, live and on-demand multimedia distribution product that delivers rich media content, desktop signage and emergency messaging to mobile and Web devices.

|

|

●

|

Media Service Bureau & Creative Services. This is our full suite of professional grade digital media services including digital media application development, content creation and management services.

|

Over the past three and a half years we have conceptualized, developed and sold our patent-pending signage software to several customers directly and through resellers, including the U.S. Postal Service, the Phoenix Convention Center and the New York Jets. We created the initial Digital Signage Control Portal (dscp://) software to complement the product offered by Cisco Systems, Inc.

We believe that our Web 2.0 based software application is unique in the industry specifically because it addresses the “ease of use” needs for content creation, updates, and content workflow by non-technical digital signage system operators as well as the scalability issues that have prevented effective large scale digital signage deployments. Early in the product development cycle, we realized that the target user of the software would not be a corporate information technology organization so we focused on creating a software application which could be mastered by a non-technical user. With a Web browser based and highly graphical user interface, dscp:// is designed to be intuitive and flexible. We trademarked the term “Simple Signage” and this continues to be the goal throughout the evolution of this product line.

5

Currently dscp:// is available through a traditional licensing agreement or through our scalable, high availability software as a service (SaaS) hosting infrastructure for those organizations that prefer an outsourced service model that minimizes initial capital expenditures.

The dscp:// product addresses three large and growing market segments:

|

●

|

Software as a service (SaaS) opportunity with Cisco Systems, Inc.'s global resellers and other strategic digital media hardware companies;

|

|

●

|

“Stand-alone” turnkey enterprise and small to medium sized business (SMB) market; and

|

|

●

|

a digital signage advertising exchange that builds on the dscp:// platform to facilitate the sale and purchase of advertising on digital media networks.

|

These market opportunities and the dscp:// software are supported further by X-Factor’s cost-effective creative services department for those firms that need assistance with their initial and ongoing digital signage content needs.

Key dscp:// Software Differentiators. Our scalable, open digital signage control platform (dscp://) was designed to be integrated with our advertising sales portals, DMAX and dscp://Storefront.

|

●

|

Scalability. Our dscp:// platform is field tested on large networks including over 550 active locations currently deployed in the United States Postal Service (USPS) network. This is a large content contributor digital signage network with over 100 content publishers contributing content to the network.

|

|

●

|

Open Platform Approach. Unlike most digital signage platforms, dscp:// is not bundled with a proprietary media player. Using a Web 2.0 based approach, dscp:// interoperates with any device capable of supporting a Web browser which includes small form factor PCs and set top box style media players. We are currently exploring the manufacturing of a low cost player that will accelerate large client opportunities.

|

|

●

|

Ease of Use. From X-Factor's inception, we designed dscp:// with the end user in mind. The product is graphics based and requires no programming expertise. If end users can use MS PowerPoint, they can use dscp://.

|

|

●

|

Programming Control. X-Factor incorporated user roles and permissions based architecture in the design of dscp://. This allows an administrator the option to keep either centralized or distributed control over who can create and distribute content over the network.

|

|

●

|

Syndication Hierarchy. To manage content distribution over large networks, we incorporated the concept of hierarchical control. This allows users to precisely direct content to specific locations (national, regional, local, single location) and assign prioritization of content.

|

6

|

●

|

Play Live. We have given dscp:// users the unique ability to easily take a live video feed and broadcast an event over their digital signage network as well as to Web and mobile devices.

|

|

●

|

Advertising Sales Portal Support. We have designed our dscp:// software to be complementary with DMAX and dscp://Storefront advertising platforms.

|

|

●

|

Mobile and Web Support. Our dscp:// and dscp://storefront products support a full array of interactive mobile and Web advertising, marketing and distribution functions.

|

DMAX and Storefront Advertising Sales Portals

We have developed two adjunct advertising sales portal applications, dscp://Storefront and the Digital Media Advertising Exchange (DMAX). We believe that both software products are capable of accelerating the return on investment ("ROI") for digital signage and other media network owners such as mobile and Web operators. These platforms enable advertisers and media buyers to electronically purchase advertising time from digital signage network owners, such as retail chains, stadiums or convention centers. DMAX supports multiple public network owners while dscp://Storefront is a customer branded sales portal that supports a private single digital signage network owner.

During the 2010 and 2011 professional baseball seasons, we collaborated with Cisco Systems, Inc. to successfully deploy a customized version of its dscp://Storefront advertising sales portal at the Kansas City Royals Kaufman Stadium. Following this deployment, we are now focused on delivering the dscp://Storefront advertising sales portal to a variety of customer networks.

Web & Mobile

dmcp:// digital media control portal. Leveraging our digital signage products and services, we have developed the first release of the dmcp://digital media control portal. dmcp:// is a digital media publishing and distribution application service for content publishers, brands and corporate users supporting desktop signage, emergency messaging, live, on-demand and programmed content channels in a single Web portal application for Web and mobile devices.

dmcp:// digital media control portal - Highlights

|

●

|

Player: Easily design and deploy custom branded media players and screen savers

|

7

|

●

|

Video support: Live, on-demand and programmed channels

|

|

●

|

Content Management and Creation: Easily manage and create video, graphics and text content. The built-in review feature allows you to manage, approve and monitor all published content

|

|

●

|

Viral Distribution: Enable sharing and distribution with the top social networks, twitter, blogs

|

|

●

|

Advertising: Full advertising management functions including the creation of advertising offers, buying portal, campaign fulfillment and billing/reporting functions

|

|

●

|

E-Commerce: Support for donations, pay per view, Web storefronts/merchandise sales, and subscription models

|

|

●

|

Access control: Password-protected Web Access/User Registration

|

|

●

|

Content Syndication: Provides multiple levels of content distribution with partner Websites

|

|

●

|

Scheduling: Schedule content to display at a certain time and date and also schedule recurring events.

|

|

●

|

Web Linkage: Link to any Website or mobile content

|

|

●

|

Multi-Channel and Device Distribution: Distribute to Web and mobile devices

|

|

●

|

Live Events: Supports live events through video broadcast, real-time chat and Q&A

|

|

●

|

Interactive Digital Signage: Using the X-Factor Platform and our mobile synchronization capabilities, marketing and promotion campaigns can be easily deployed to engage audiences through unique in-venue interactivity via mobile IVR, text and QR code integrated marketing solutions. Our customers use our digital signage solution as the call to action mechanism driving in-venue behavior as well as enabling an ongoing engagement with the audience.

|

Webcasting

A globally available, live and on-demand multimedia distribution service that delivers rich media content cost-effectively, supporting corporate communications, events, marketing, e-commerce and information distribution. Clients use our Webcasting services in many ways, including product announcements, press releases, multimedia-enabled reports, interactive town halls utilizing Q&A and polling features, employee communications, and sales and marketing meetings.

By using the X-Factor Platform, streaming rich media technology, IP (Internet Protocol) over the Internet or corporate Intranets to broadcast live or on-demand audio or video, we can create compelling rich media environments for use by our clients. Coupled with our content development and Digital Asset Management (DAM) services, clients not only have cost-effective access to state of the art technology, but can use this technology more effectively by developing and using compelling content as part of their Webcasting initiatives.

While most Webcasting providers focus on external events (over the public Internet), we also provide Webcasting solutions for enterprise Webcasting (behind a company’s firewall). We believe we can successfully infiltrate the marketplace by operating as a full-service provider and offering consulting services to clients looking to develop their own in-house Webcast solutions.

Many Fortune 1000 companies use live and on-demand streaming technology. Companies that recognize the value and efficiencies of these forms of communications are demanding richer and timelier interactive content. Media applications must assist with many tasks, including broadcasting video, streaming to mobile devices, synchronizing slides and graphics, and providing audience notification, Q&A and feedback mechanisms, searchable archives, and robust usage reports and viewer statistics.

8

Our targeted markets include:

|

●

|

corporate communications, including town hall meetings, human resources updates, sales training, internal executive communications and external corporate meetings;

|

|

●

|

venues such as live events;

|

|

●

|

government uses, such as public hearings, local, state and national branches of government;

|

|

●

|

public relations applications, such as product launches, press events and special events; and

|

|

●

|

financial sector applications, such as stockholder meetings and quarterly earnings updates.

|

Industry and Market Overview

Market Opportunity

As a result of our early success in providing high quality global Webcasting, fully interactive live events and related services (including digital asset management, content development, and design/consulting), we have been called upon by our clients and resellers to provide a growing array of multimedia communication services.

Chief among these is digital signage, which has become our product development focus. We believe that digital signage, and the related sector of mobile advertising, provides large, lucrative and growing market opportunities. We are responding to the needs of these growing markets with innovative applications, software and technology through the X-Factor Digital Media Network Platform.

The three areas that we believe we are poised to exploit are Digital Out-of-Home Advertising (DOOH), Digital Signage Software and Mobile Advertising.

DOOH

Digital Out-of-Home Advertising refers to media distributed across placed-based networks in public venues such as cafes, bars, restaurants, health clubs, colleges, arenas, gas stations and other public spaces. DOOH networks typically feature screens, kiosks, jukeboxes and/or jumbotrons. DOOH media benefits location owners and advertisers alike in being able to engage customers and/or audiences and extend the reach and effectiveness of marketing messages. The entire Digital Out-of-Home Advertising sector is currently estimated to generate approximately $1 billion in business each year. As more ad networks look to leverage digital solutions, the total amount spent on DOOH is expected to increase. We believe we are well-positioned as a pioneer in DOOH content management and advertising solutions. It is our goal to capture a substantial portion of this market through large resellers and strategic relationships.

Digital Signage Software

An increasing number of companies are using digital signage networks to communicate with their employees and customers. As a result, a solution that meets the needs of each vertical sector of a company along with those of various segments within an industry is extremely desirable. We believe that our products and services are capable of meeting that need. With paper and print giving way to digital menu displays, we intend to capitalize on tapping the increasing display budgets by providing strategic consulting, software implementation, digital continuing education and training, marketing assistance and advertising revenue from a single digital platform. It has been estimated by Global Industry Analysts Inc. that the market for digital signage will reach approximately $13.8 billion by 2017.

9

Mobile Advertising

We participate in the mobile advertising industry, which is crowded and fractured, by enabling efficient digital media advertising solutions that empower consumers with Digital Out of Home and Mobile synchronization. Progressive brands are increasingly looking to create campaigns using the three screens (signage, Web and mobile). Our experience in the Digital Out of Home sector has established X-Factor as a viable integrator and platform to service these brands.

DOOH and Digital Signage Industry Research

|

●

|

A new market research report from Global Industry Analysts Inc. states “With several advantages like higher viewer recall and retention of digitally displayed messages stacked in its favor, digital signage systems are forecast to witness sturdy gains in the upcoming years, reaching $13.8 billion by 2017.”

|

|

●

|

According to a survey conducted by DigitalSignageToday.com, survey respondents revealed that the primary reason they invest in digital signage is “customer experience”, “branding” was second and “ad revenue” was third. We understand that it is not enough for companies to merely sell products and services but they must engage their customers on both intellectual and emotional levels. Digital signage can accomplish both goals.

|

|

●

|

The Digital Place-based Advertising Association (DPAA) states that advertising revenue in the digital place-based sector is estimated to be in excess of $1 billion today. “This industry is coming together and increasingly advertisers are embracing the ability to engage consumers on the go, where they work, shop, dine, travel and play, closer to the point of purchase than the sofa in their living rooms,” said Mike DiFranza, DPAA chairman. He further states, “This sector enables advertisers to replace TV impressions lost to DVRs as well as engage light TV viewers with content relevant to their activities outside the home.”

|

|

●

|

Arbitron Inc. measures the Digital Signage sector annually with its Digital Place-based Video Study. According to its 2010 study:

|

|

●

|

Reach: The availability of digital place-based video has reached a critical mass. Seventy percent of U.S. residents aged 12 or older have seen a digital video display in a public venue in the past month; 52 percent recall seeing one in the past week.

|

|

●

|

Comparison to other media. Digital video in public venues reaches more Americans each month (70 percent) than video over the Internet (43 percent) or Facebook (41 percent).

|

|

●

|

Top venues for overall viewers. The top five places to reach consumers with digital video are grocery stores (28 percent of the U.S. population aged 12 or older), shopping malls (27 percent), large retail or department stores (20 percent), medical offices (20 percent) and movie theaters (19 percent).

|

|

●

|

Advertising engagement. Viewers are engaged with the content; nearly half (47 percent) of those who have seen a digital place-based video in the past month specifically recall seeing an ad.

|

|

|

Effect on purchase patterns. Nearly one in five (19 percent) of those who have seen a digital video ad say they have made an unplanned purchase after seeing an item featured on the screen.

|

10

Mobile Advertising Industry Research

|

●

|

Millennial Media’s Q1 2011 network data also indicates there are more than 13 million mobile users accessing retail content on their mobile device each month, with 2.2 million accessing this content almost every day. It has become imperative for retail brands to commit to a mobile strategy to connect with these consumers where they are currently researching, comparing, and purchasing products.

|

|

●

|

A market research report conducted by the mobile advertising technology company Smaato states, “The US is the second largest market globally in terms of mobile advertising spending behind Japan. It will close the gap next year with a forecast of $1.24 billion and will grow up to $5 billion in 2015.”

|

|

●

|

According to Juniper Research, worldwide mobile ad spending is forecasted to grow from $3.1 billion in 2010 to $11 billion in 2015 (Juniper Research, Dec 2010) – a 2.5X increase.

|

|

●

|

Data from eMarketer estimates that nearly 20 million US adults will redeem a mobile coupon this year, including coupons or codes received via SMS, applications and mobile Web browsers; quick response codes for redemption online or offline; and group buying coupons purchased via mobile. By 2013, the number using such coupons is expected to nearly double, and 16.5% of all U.S. adult mobile phone users are expected to redeem a coupon that year.

|

Sales & Marketing

We sell our integrated digital media network platform to end users and customers through a direct sales force as well as through a growing network of partner resellers. Thus far, we have implemented the portion of our business plan that included developing an initial release of our digital media network platform, acquiring large customers, reseller channel relationships and building brand awareness within our targeted markets. In order to increase our market share of the digital media industry we intend to:

|

●

|

increase our sales opportunities through the hiring of addition sales personnel;

|

|

●

|

pursue additional channel reseller relationships and enhance our existing relationships with Cisco Systems, Inc., LGE, iBAHN and others;

|

|

●

|

cultivate and grow our direct brand and advertising offerings in the signage, mobile and social media areas; and

|

|

●

|

increase our technological differentiation through the addition of development resources.

|

We are actively cultivating and pursuing customers in the following areas to gain market share and drive revenue growth:

Advertising. Our unique combination of simple to use digital signage solutions tied to our dscp://Storefront and DMAX advertising management systems allows digital signage network operators to display and sell their advertising inventory and buyers to order and execute digital signage, mobile and Web advertising buys. This enables our customers to benefit from the ROI produced by easily allowing them to monetize their investment in digital signage and digital media through advertising revenues. We believe that we have a growing advertising driven opportunity and sales funnel with many potential clients in the retail, hospitality, stadium and convention center markets.

Retail. We provide retailers with a turnkey digital media solution incorporating digital signage, mobile and Web components. Currently, several large retailers are evaluating this integrated digital media network solution for deployment.

Hotels, Arenas, Stadiums and Convention Centers. Building on our success at the Kansas City Royals’ stadium along with our newly formalized contractual reseller relationship with iBAHN for Webcasting services and their current customer base of hotels, and convention centers. We are focused on growing this market through relationships with established service providers, management companies and owners of these facilities.

11

Expansion of Strategic Reseller Network. We are seeking to establish additional relationships with other hardware and software providers that benefit from our software offerings, driving sales of their products as well as our software and SaaS services (e.g. Dell, HP, IBM, Sony, Samsung, Panasonic, Sharp, LG and Advantek).

Marketing Strategy

Our sales and marketing strategy involves two focus areas: (1) forming strategic partner programs with companies who we expect to resell our products, services and technology to their end clients and (2) marketing directly to end clients, utilizing our reseller network for implementation when possible.

We plan to focus our marketing and sales efforts on our three primary target customer types in each line of business as follows.

|

·

|

Public Venue. This includes retail, healthcare institutions, convention centers, sporting arenas, hotels and education venues.

|

|

·

|

Corporate & Enterprise. Investor relations, public relations, advertising agencies, and healthcare businesses.

|

|

·

|

Brands. Advertising and marketing programs for brands of all sizes.

|

We expect implementation and execution of our sales and marketing strategy will include the following.

Direct Sales Staff. We plan to staff our sales and marketing organization with professionals who have proven track records in selling digital media solutions to one or more of our three primary customer types (Public Venues, Corporate and Brands).

Product Managers. We plan to make product managers responsible for the growth and development of our products and function as subject matter experts. These experts will also function as a sales overlay to provide expert sales support to the sales team. As we gain market share in each category of business, we expect that our sales and product management team will evolve into areas of specialization where there will be a sales specialist within each product category.

Channel Managers. We plan to make channel managers responsible for the support and performance of their assigned channel resellers. We expect that our marketing staff will work with these channel managers to develop and implement channel partner programs for strategic partner resellers in the digital media sector. We expect that each program will equip our resellers with:

|

●

|

access to a channel program manager who oversees the overall relationship;

|

|

●

|

industry-specific promotional materials;

|

|

●

|

on-demand promo Webcasts launched from our resellers’ Websites;

|

|

●

|

educational Webinars to their clients and “training” days; and

|

|

●

|

access to product experts supporting the channel sales process.

|

We expect to develop a specialized digital media network platform channel program for each of our primary customer types (Public Venues, Corporate and Brands). We expect these programs will equip our contracted channel resellers with:

|

●

|

promotional material, pricing information, PowerPoint presentations;

|

12

|

●

|

training on dscp:// software, features, functions and benefits;

|

|

●

|

training on how best to perform sales presentations and software demonstrations; and

|

|

●

|

an X-Factor on-line reseller portal.

|

Webcasting Training and Education Program. We understand the importance of using our own Webcasting and Digital Media Network Platform as a powerful tool to market our services by delivering video training, marketing and educational Webcasts to all of our contracted resellers and prospects across all business lines.

We expect that our customers and prospects will participate in on-demand Webcast training sessions to educate them on how our products and services operate and the benefits they provide. We expect that specific Webcasts will be conducted for our strategic contracted resellers to train them on reselling our services.

We plan to make all of our on-demand Webcasts equipped with on-line registration in order to gather key information from the invitee that we can use to build a sales lead and management database.

Database Marketing & Lead Generation. We plan to store the leads generated across our platforms and through the on-line registration feature of our Webcasts in our internal sales database. We plan to use this internal sales database for direct phone campaigns and email and direct mail campaigns. In addition, we plan to equip our Website with an industry specific Special Reports or White Papers tab which customers will need to opt into in order to receive. Once a person’s name, company name and email address are captured, we plan to enter that data into our database and turn it over to a member of our sales team for follow-up.

Advertising and Promotional Vehicles. On our own and in conjunction with our large channel relationships, we plan to aggressively cultivate our search engine advertising through search engine optimization and advertising in industry specific print publications. We believe additional promotional vehicles that will create brand awareness and drive sales will include:

|

●

|

advertising in targeted print online publications;

|

|

●

|

exhibiting at trade shows;

|

|

●

|

developing collateral materials, brochures and direct mail pieces;

|

|

●

|

networking through professional associations;

|

|

●

|

sponsoring industry-specific events; and

|

|

●

|

social media such as Facebook, LinkedIn, Twitter and YouTube.

|

Differentiation. A key tenet of our marketing plan is the promotion of our differentiation in the marketplace. We believe that our Digital Media Network Platform is unique to the marketplace in that it ties together digital signage with Web and mobile solutions that are cloud-based, providing customers with the ability to implement scalable marketing, branding and advertising initiatives all from one provider. In addition, we believe we are the only digital signage solution provider that provides consolidated content delivery and advertising monetization in one easy-to-use platform. The X-Factor platform empowers customers with a set of comprehensive digital media tools to integrate digital signs, premium content, social networks and mobile applications with live video broadcasts, advertising and marketing programs.

Key Differentiating Marketplace Factors

Prominent Customer Base and Channel Partners. Our clients include a notable list of public and private sector enterprise and government organizations who we believe recognize the value of our product offerings.

Ease of use. Our products and solutions enable creators of digital media to easily create, manage and distribute content. Our trademark “Simple Signage” highlights this concept.

ROI. Our advertising driven DOOH platform enables users to monetize their investment.

13

Multiple Media Channels. Our products and solutions provide corporate communications and advertising related Digital Out-of-Home, Mobile and Web based solutions.

Large and Growing Market Opportunity. The corporate and advertising marketplace is growing rapidly.

Attractive Business Model. Our solutions are sold as a software sale or a hosted SaaS offering, providing a flexible and affordable business model.

Experienced Management: Our senior management team consists of repeat entrepreneurs with startup and Fortune 100 experience.

Our Digital Media Network Platform

Digital Signage Control Portal (dscp://) Software. This proprietary and unique software that we developed is patent-pending under the trademark “Simple Signage”. We developed dscp:// as the result of studying the market and responding to the needs of customers for the simplest means possible to update and manage content over their digital signage networks.

Because dscp:// is a Web 2.0 application, the programming code is extremely efficient and progressive, providing an advantage over older technology platforms. In comparison to older technology platforms, dscp:// is more easily customizable and the overall architecture is less expensive to deploy, giving us considerable pricing and speed to market advantages. We also provide customers with the choice of obtaining the dscp:// product through a software license or as a software as a service (SaaS) offering.

Strategic Partners and Business Relationships

Our primary business development efforts are focused on exploiting the broad reach of our strategic partners and business relationships. We have established key strategic global business relationships with Cisco Systems, Inc., iBAHN, LGE, NEC and Verizon Business which we believe position X-Factor for rapid sales growth. We continue to make an increasing number of customer presentations and proposals for digital media and signage services as our opportunities for strategic alignments with large industry participants grow.

Chief among these partners is Cisco Systems, Inc., which has committed significant resources to exploiting the growth opportunities it has identified in the digital signage space. Cisco Systems, Inc., our other strategic partners and those with whom we have business relationships continue to expand the number and scale of the opportunities that we are working on together.

Cisco Systems, Inc. ("Cisco"). We have earned the designation Cisco Digital Media System (DMS) Ecosystem Partner. We believe this designation coupled with a successful track record of joint Cisco and X-Factor customer deployments may result in the promotion of X-Factor’s business through Cisco's marketing and sales channels. These channels consist of over 30,000 Cisco resellers that are focused on providing Cisco products and DMS solutions to its clients. X-Factor's software products and support services assist Cisco in generating sales for its products and services. In addition, Cisco has offered to refer some of its DOOH advertising opportunities to X-Factor’s Digital Media Advertising Exchange DMAX software platform.

LG Electronics, Inc. ("LGE"). LGE and X-Factor are exploring ways to leverage X-Factor’s solutions for its worldwide digital signage solution integration suite for resellers and possible co-marketing.

14

NEC Corporation ("NEC"). NEC, is one of the largest resellers of Cisco products globally. X-Factor has had a reseller contract in place with NEC since 2009. NEC facilitated the development of our partnership with Cisco through its involvement in the United States Postal Service project. In that instance, NEC provided displays and system integration services alongside Cisco’s media players with our software, providing the customer interface and ongoing content creation, distribution and management.

Verizon. Given its broad relationships with enterprise customers and their communications needs, Verizon also acts as a systems integrator for digital signage network deployments. We have a successful business relationship with Verizon, servicing the United States Postal Service account. We expect to continue to expand this relationship in 2012.

iBAHN. We signed an agreement to provide Webcasting services to iBAHN and its 70 Platinum hotel customers. These high-end hotels will be offering the Webcasting services to their corporate and conference clients. iBAHN provides digital information, entertainment and Internet solutions to the hospitality and meeting industries. Annually, more than 21 million travelers and meeting attendees at over 3,000 hotels, conference centers and meeting spaces in 41 countries worldwide use iBAHN services. In addition, over 40% of the Fortune 100 use iBAHN’s services.

We plan to continue to leverage these and other developing relationships and we expect these relationships will enable us to broaden our access to potential customers and accelerate our growth.

X-Factor Intellectual Property

Trademarks

We have two trademarks registered with the United States Patent and Trademark Office, namely dscp:// and Simple Signage.

Patents

We have filed one patent application with the United States Patent and Trademark Office for our Dynamic Digital Signage, Customer Content Control Portal and Management System, which provides access to software applications and Websites for others hosted on computer servers accessible through a global computer network; editing, modification and customization of software applications accessible via a global computer network (Application #12/326,034).

Competition

We compete in several large and diverse markets. Due to the varied nature of the products that comprise our Digital Media Network Platform, we compete across a number of markets spanning advertising supported digital signage, mobile and Web marketing, and corporate communications. We believe that our software is competitive in a wide array of areas including hardware feature integration, usability, architecture, and pricing.

Digital Signage Architecture

We believe our use of Web 2.0 methodologies, combined with state-of-the-art coding and application frameworks, provides a solid and efficient foundation for the incremental development of client-requested features. We compete with digital signage software providers such as Broadsign, Cisco, Harris, Scala, and Symon, which have substantially greater name recognition and financial and other resources then we have. However, we believe that our easy to use powerful and flexible platform competes favorably with the products provided by these vendors. Our dscp:// product line has an "open architecture" with respect to hardware and can be deployed using off-the-shelf hardware solutions with Microsoft Windows-based or Linux-based operating systems, providing greater deployment possibilities and significant price advantages as compared to competitive company product offerings.

15

Usability

Usability is the foundation of our current and future product and solution offerings. Larger competitors such as Scala and Harris have been focused on the development of hardware that can be mired in complex functions and may require heavy reliance on IT support. We believe, however, that creators and managers want a simple, powerful content management system. Therefore, we are focused on developing the software for a broad spectrum of users. Furthermore, we provide a wide range of digital signage services from consulting to software implementation to training and content creation, uniquely positioning us to respond to many diverse proposals or leads. From simple corporate communications to complex system wayfinding integration, we believe we provide a solution that will not intimidate new users and will accommodate the power user.

Pricing

We believe that many of our competitors have in place rigid pricing and fee structures, creating a high barrier for potential customers. We believe our product pricing plans that are in place greatly benefit the customer while maintaining scale and profitability. We are extremely flexible in building the pricing structures to accommodate the needs of a wide array of customers. Whether fulfilling a SaaS or license model software deployment, providing professional services or incorporating third party vendors, competitive pricing flexibility drives a large amount of digital signage opportunities. SMB and enterprise customers can select from the features and pricing that meet their needs.

Advertising Sales Platform

We believe that the development of our Digital Media Ad Sales Platform, which was done in tandem with actual users, answers the diverse needs of the advertising community and we believe this positions our product and solution offerings for rapid growth in the marketplace. We believe that our DMAX and Storefront application platforms are competitive in many areas, but most importantly in flexibility, workflow, pricing and scalability.

Flexibility

Our platform achieves a balance of addressing the needs of multiple market verticals, as well as sophisticated and hyper-local advertisers, while our competitors have focused on the larger Digital Out of Home Market. As a result, larger networks may be burdened by increasing overhead and the struggle to reach critical mass. By providing an agnostic platform that supports specific customer and re-seller needs, we believe that our products will provide an attractive alternative to hardware resellers, brands and venues.

Work-Flow

Negotiating the advertising sales world can be daunting for a new digital signage network with no requisite experience in selling media. The DMAX and dscp://Storefront platforms have a sophisticated workflow that is hidden in an easy to use interface. The workflow engine supports the creation of sales opportunities, advertising offers, the synchronization of creative media, and the fulfillment of offers. A process to negotiate, review and approve creative, bill, remit, and make good, are all powerfully packaged in an engaging user interface.

Scalability

The DMAX platform is built around digital media and is built to scale in multiple areas of digital and non-digital media assets. As such, digital signage, placed based banners and signs, mobile and Web advertising sales and integration, through in-house or third party vendors, is a cornerstone of our system architecture and development road map.

16

Employees

As a result of the Merger we have 9 employees, 6 of which are full time, 1 part-time and 2 consultants.

| Item 1A. Risk Factors. |

As a smaller reporting company we are not required to provide this information.

| Item 2. Financial Information. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited balance sheets as of December 31, 2011 and 2010 and the related statements of operations and members’ deficit and cash flows for the years ended December 31, 2011 and 2010 and the notes attached thereto and the unaudited balance sheet as of March 31, 2012 and the related unaudited statements of operations and members’ deficit and cash flows for the three months ended March 31, 2012 and 2011 and the notes attached thereto. Such financial statements exclude the effects of the Merger and the related reorganization. This interim financial information reflects, in the opinion of management, all adjustments necessary (consisting only of normal recurring adjustments and changes in estimates, where appropriate) to present fairly the results for the interim periods. The results of operations and cash flows for such interim periods are not necessarily indicative of the results for the full year.

All statements contained herein that are not historical facts, including, but not limited to, statements regarding anticipated future capital requirements, our future development plans, our ability to obtain debt, equity or other financing, and our ability to generate cash from operations, are based on current expectations. The discussion of results, causes and trends should not be construed to imply any conclusion that such results or trends will necessarily continue in the future. The Company operates in one segment and therefore segment information is not presented.

The statements contained herein, other than historical information, are or may be deemed to be forward-looking statements and involve factors, risks and uncertainties that may cause our actual results in future periods to differ materially from such statements. These factors, risks and uncertainties are discussed below and include market acceptance and availability of digital media communication services, rapid technological change affecting demand for our services, competition from other digital media communication service providers, deteriorating economic conditions, the availability of sufficient financial resources to enable us to pay our existing obligations and expand our operations, lack of clearly established set of internal controls, being an early stage software development company as well as other risks and uncertainties that may be detailed from time to time in our filings with the Securities and Exchange Commission.

Overview

The Company, through its wholly-owned subsidiary X-Factor Communications, LLC, a New York limited liability company, located in South Hackensack, New Jersey, provides interactive digital media network software and services. The X-Factor Digital Media Network Platform, our cloud-based digital signage, web and mobile solution, is delivered as a software-as-a-service and under a software license model, enabling our customers to build simple yet scalable advertising and corporate digital media networks. The Company’s webcasting solution, a live and on-demand multimedia distribution product delivers rich media content, desktop signage and emergency messaging to mobile and Web devices. The Company’s solutions address the rapidly expanding digital media needs of its corporate, public venue, education and government sector customers. The Company sells its software and services throughout the United States. The Company has limited its staffing and marketing efforts, expenditures and expenses to date. Over the past 2 years the Company has benefited from limited direct sales efforts and sales referrals from Cisco and some of the larger integrators/reseller sales channels in the marketplace. The Company believes it is now positioned to implement an aggressive marketing campaign to increase the sales volume through these sales channels. In addition, the Company has introduced stand-alone solutions to the marketplace that it plans to market along with its partner oriented product portfolio.

17

Liquidity and Capital Resources

At December 31, 2011 the Company had a members' deficit of $1,294,187, a working capital deficiency of $441,953 and incurred a net loss of $1,502,638 for the year then ended. In addition, there was a decrease in revenue of $929,797 in 2011 when compared to 2010 levels.

At March 31, 2012 the Company had a members' deficit of $2,444,615, a working capital deficiency of $1,125,381 and incurred a net loss of $1,191,043 for the three months then ended. In addition, there was a decrease in revenue of $18,002 during the three months ended March 31, 2012 when compared to the same period in 2011. There can be no assurance that: (1) existing stockholders of the Company will continue to support the operational and financial requirements of the Company, (2) that the Company will be able to raise sufficient equity or (3) that the Company will continue to be able to comply with existing covenants with creditors in future periods. While X-Factor has been successful in raising funds through loans and sales of membership units prior to the Merger, and the Company has been successful in raising funds through the sale of common stock pursuant to the Offering concurrent with the Merger, the Company does not currently have any sources of committed funding available. During 2012 and 2011, the Company received an aggregate $75,000 (net) and $850,000, respectively, in cash proceeds from the sale of promissory notes. In addition, on May 15, 2012, X-Factor closed the Merger, pursuant to which it became the wholly owned subsidiary of the registrant. Upon the closing of the Merger, the registrant raised cash proceeds of $1,236,250. As the Company does not have any committed sources of financing, these factors raise substantial doubt about the Company's ability to continue as a going concern. The financial statements do not include any adjustments to the carrying value of assets and liabilities that might result from the outcome of these uncertainties.

The Company believes that the proceeds from the sale of the securities in the Offering, together with conversion of certain promissory notes upon the closing of the Merger, along with management’s expectation for greater financing opportunities as a result of the Merger, will provide sufficient operating capital to fund its operations for the next year. There are no assurances, however, that the Company will be able to raise additional capital as may be needed, or increase revenue levels and profitability. Further, if the current economic climate negatively impacts the Company, as it may, and the Company is unable to raise additional capital on acceptable terms it could have a material adverse effect on the Company's financial condition and future operations.

Critical Accounting Policies

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are uncollateralized, non interest bearing, customer obligations due under normal trade terms and are stated at the amount billed to the customer. Payments of accounts receivable are allocated to the specific invoices identified on the customer's remittance advice or, if unspecified, are applied to the earliest unpaid invoices.

The carrying amount of the Company's accounts receivable may, at times, be reduced by a valuation allowance that reflects management's best estimate of the amounts that will not be collected. Management individually reviews all accounts receivable balances periodically and based on an assessment of the current creditworthiness, estimates the portion, if any, of the balance that will not be collected.

Equipment and Leasehold Improvements

Equipment and leasehold improvements are recorded at cost. Depreciation on equipment is recorded over the estimated useful lives of the assets (five years) using the straight-line method. Leasehold improvements are depreciated using the straight-line method over the shorter of the estimated useful life of the asset (seven years) or the expected term of the occupancy. Included in equipment are fixed assets subject to capital leases which are depreciated over the life of the respective asset. Maintenance and repair costs are charged to expense as incurred. Upon sale or retirement, the cost and related accumulated depreciation are eliminated from the respective accounts and any resulting gain or loss will be reported in results of operations.

18

Long-Lived Assets

The Company periodically evaluates the net realizable value of long-lived assets, principally equipment and leasehold improvements, relying on a number of factors including operating results, business plans, economic projections and anticipated future cash flows. Impairment in the carrying value of an asset is recognized whenever anticipated future undiscounted cash flows from an asset are estimated to be less than its carrying value. The amount of the impairment recognized is the difference between the carrying value of the asset and its fair value. There were no impairment losses recognized in the years ended December 31, 2011 and 2010 or in the three month periods ended March 31, 2012 and 2011.

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is reasonably assured. The Company has certain arrangements where it is obligated to deliver multiple products and/or services (multiple elements). In these arrangements, the Company allocates the total revenue among the elements based on the sales price of each element when sold separately using vendor-specific objective evidence. Revenue from multi-year licensing arrangements are accounted for as subscriptions, with billings recorded as unearned revenue and recognized as revenue ratably over the billing coverage period. Unearned revenue also consists of future maintenance and upgrade services that will be provided by the Company in future periods under terms of a non-refundable service contract.

Derivative Financial Instruments

The Company's objectives in using debt-related derivative financial instruments are to obtain the lowest cash cost source of funds. Derivatives are recognized in the balance sheet at fair value based on the criteria specified in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification ("ASC") Topic 815, "Derivatives and Hedging." Under ASC Topic 815, the estimated fair value of the derivative liabilities is revalued at each balance sheet date with the changes in value, if any, recorded in the interest and other expense section of the accompanying Statements of Operations and Members' Deficit.

Equity-Based Compensation

Equity-based awards for membership common units have been appropriately accounted for as required by ASC Topic 718, “Compensation – Stock Compensation” (“ASC Topic 718”). Under ASC Topic 718, equity-based awards are valued at fair value on the date of grant and that fair value is recognized over the requisite service period. The Company values its equity-based awards using the Black-Scholes option valuation model. The fair value of the units used in these valuation models is based on the most recent sale of a membership common unit of the Company.

Prior to the Merger, X-Factor periodically granted options for membership common units to employees and consultants in accordance with the provisions of X-Factor’s stock option plans, with the exercise price of the options established at the price of a recent sale of a membership common unit of X-Factor.

The fair value of warrants for membership common units issued to consultants or employees are recognized over the requisite service period with a corresponding decrease to members' deficit. Warrants issued to consultants are valued at the fair value of the common membership units related to the warrants. Warrants for membership common units issued to equity investors have no effect on members' deficit; that is, the fair value of the warrants granted to investors and charged to members' deficit are entirely offset by a corresponding adjustment to members' deficit.

19

Income Taxes

X-Factor has elected to be taxed as a limited liability company under the applicable provisions of the Internal Revenue Code and State of New Jersey tax laws. In lieu of X-Factor incurring a tax liability, the former members, prior to the Merger, were taxed individually on their proportionate share of X-Factor’s taxable income or loss. Accordingly, X-Factor has not recorded a benefit for income taxes or any deferred tax assets or liabilities for Federal or state tax purposes. There were no interest or penalties related to income taxes that have been accrued or recognized as of and for the years ended December 31, 2011 and 2010 or in the three month periods ended March 31, 2012 and 2011.

The Company, through X-Factor following the Merger, conducts business domestically and, as a result, files Federal and state income tax returns. In the normal course of business, the Company is subject to examination by taxing authorities. X-Factor has no open tax years prior to its 2008 tax return.

Accounting Standards Update (“ASU”) 2009-06, which is included as part of ASC Topic 740 –“Income Taxes”. This section of the ASC clarifies the accounting for uncertainty in income taxes recognized in an entity’s financial statements and prescribes a recognition threshold of more-likely-than-not to be sustained upon examination. Measurement of the tax uncertainty occurs if the recognition threshold has been met. The standard also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition requirements. Because X-Factor is a limited liability company and Federal and state taxes were passed through to its members prior to the Merger and will be passed through to the Company following the Merger, so too would the assessments from any tax examinations. There are no ongoing or pending examinations by Federal or state tax agencies. The Company has evaluated the tax positions of X-Factor for all currently open tax years, 2008 through 2011, and has concluded that there are no significant uncertain tax positions for either Federal or state purposes.

Results of Operations

Year ended December 31, 2011 (the “2011 Year”) compared to year ended December 31, 2010 (the “2010 Year”)

Revenues - Revenues decreased $929,797, or 52.3%, in the 2011 Year to $849,096 from $1,778,893 in the 2010 Year. The primary reason for the decrease in revenues in 2011 was that X-Factor provided significant digital signage and advertising software development services and licenses to Cisco Systems Inc. which were completed in 2010 and a decrease in public relations related webcasting due to a harsher 2011 economic recession climate. The following are the changes in the components of X-Factor’s revenue:

|

Favorable

|

||||||||||||

|

Year Ended December 31

|

(Unfavorable)

|

|||||||||||

|

2011

|

2010

|

Change

|

||||||||||

|

Digital signage software and services

|

$ | 549,988 | $ | 1,329,844 | $ | (779,856 | ) | |||||

|

Webcasting

|

299,108 | 449,049 | (149,941 | ) | ||||||||

|

Total revenues

|

$ | 849,096 | $ | 1,778,893 | $ | (929,797 | ) | |||||

Cost of revenues – Cost of revenues decreased $430,133, or 64.3% in the 2011 Year to $238,578 from $668,711 in the 2010 Year. Cost of revenues, as a percentage of revenues, were 28.1% in the 2011 Year and 37.6% in the 2010 Year. The decline in cost of revenues and cost of revenues as a percentage of revenues was directly related to the decrease in revenues and the cessation of the Cisco projects in 2010.

Gross Profit – Gross profit decreased $499,664, or 45% in the 2011 Year to $610,518 from $1,110,182 in the 2010 Year. Gross profit, as a percentage of revenues, was 71.9% in the 2011 Year and 62.4% in the 2010 Year. The primary reason for the increase in gross margin is the decrease in the costs incurred in 2010 for the Cisco projects and the higher profit margin digital signage software and services revenues.

Salaries and fringe benefits expenses – Compensation costs decreased $636,511, or 58.2% in the 2011 Year to $457,820 from $1,094,331 in the 2010 Year. Compensation costs, as a percentage of revenue, were 53.9% in the 2011 Year and 61.5% in the 2010 Year. The reason for the decrease in costs during the 2011 Year was X-Factor’s decision during the fourth quarter of the 2010 Year to reduce staff headcount and freeze salaries. While this significantly reduced compensation costs in the 2011 Year, X-Factor’s reduction in revenues in the 2011 Year caused only a slight decrease in the compensation costs as a percentage of revenues.

20

General and administrative expenses - General and administrative expenses increased $410,888, or 55.8% in the 2011 Year to $1,146,611 from $735,723 in the 2010 Year. General and administrative expenses, as a percentage of revenue, were 135.0% in the 2011 Year and 41.4% in the 2010 Year. Due to cash limitations, X-Factor utilized equity-based compensation to pay for various consulting services. The following are the changes in the components of X-Factor’s general and administrative expenses:

|

Favorable

|

||||||||||||

|

Year ended December 31

|

(Unfavorable)

|

|||||||||||

|

2011

|

2010

|

Change

|

||||||||||

|

Professional and consulting fees, equity-based

|

$ | 527,387 | $ | 78,005 | $ | (449,382 | ) | |||||

|

Professional and consulting fees

|

355,536 | 403,297 | 47,761 | |||||||||

|

Communication costs

|

52,820 | 69,594 | 16,774 | |||||||||

|

Travel

|

78,250 | 92,181 | 13,931 | |||||||||

|

Settlement of customer dispute

|

26,000 | -- | (26,000 | ) | ||||||||

|

Computer repairs and maintenance costs

|

25,389 | 41,316 | 15,927 | |||||||||

|

Bad debts

|

25,000 | 900 | (24,100 | ) | ||||||||

|

Rent

|

19,500 | 25,200 | 5,700 | |||||||||

|

Other expenses

|

36,729 | 25,230 | (11,499 | ) | ||||||||

|

Total general and administrative expenses

|

$ | 1,146,611 | $ | 735,723 | $ | (410,888 | ) | |||||

Depreciation and amortization – Depreciation and amortization expenses decreased $20,076, or 23%, in the 2011 Year to $67,081 from $87,157 in the 2010 Year. The decrease was due to certain assets being fully depreciated, retirements and a lower level of equipment and leasehold improvement additions in all years and periods.

Loss from operations – Loss from operations increased by $253,965, or 31.5% in the 2011 Year to $1,060,994 from $807,029 in the 2010 Year.

In the 2011 Year, X-Factor’s loss from operations increased due to the reduction in digital signage software and services revenues and increases in professional and consulting fees to prepare for the Merger and private offering of our common stock which were partially offset by the reduction in compensation costs. In the 2010 Year, X-Factor’s loss from operations was favorably impacted by the increases in the higher margin digital signage software and services revenues partially offset by the increase in salaries and fringe benefits for staffing increases necessary for increased marketing and sales efforts. X-Factor’s reduction in force in the fourth quarter of the 2010 Year and the winding down of the third-party development costs for X-Factor’s digital signage software is expected to benefit future periods.

21

Other expense – Other expense increased by $338,929, or 330.0% in the 2011 Year to $441,644 from $102,715 in the 2010 Year. The following are the changes in the components of X-Factor’s other expenses:

|

Favorable

|

||||||||||||

|

Year ended December 31

|

(Unfavorable)

|

|||||||||||

|

2011

|

2010

|

Change

|

||||||||||

|

Amortization of discount for Bridge Notes

|

$ | 218,979 | $ | -- | $ | (218,979 | ) | |||||

|

Amortization of financing costs for Bridge Notes

|

23,277 | -- | (23,277 | ) | ||||||||

|

Interest for Bridge Notes

|

13,962 | -- | (13,962 | ) | ||||||||

|

All other interest

|

117,707 | 97,374 | (20,333 | ) | ||||||||

|

Professional fees related to proposed Merger

|

62,188 | -- | (62,188 | ) | ||||||||

|

Change in the fair value of derivative financial instruments for insiders

|

-- | (1,429 | ) | (1,429 | ) | |||||||

|

Other expenses

|

5,531 | 6,770 | 1,239 | |||||||||

|

Total other expenses

|

$ | 441,644 | $ | 102,715 | $ | (338,929 | ) | |||||