Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EATON CORP | d356808d8k.htm |

| EX-99.1 - EX-99.1 - EATON CORP | d356808dex991.htm |

©

2012 Eaton Corporation. All rights reserved.

Acquisition of Cooper Industries plc

Eaton Corporation

Sandy Cutler

May 21, 2012

Exhibit 99.2 |

2

©

2012 Eaton Corporation. All rights reserved.

This

communication

is

not

intended

to

and

does

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to

subscribe

for

or

buy

or

an

invitation

to

purchase

or

subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant

to the acquisition or otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

A registration statement on Form S-4 will be filed that will include the Joint Proxy Statement of

Eaton Corporation (“Eaton”) and Cooper Industries plc (“Cooper”) that

also

constitutes

a

Prospectus

of

Eaton

Global

Corporation

Plc

(1)

(“Eaton

Global

Plc”).

Eaton

and

Cooper

plan

to

mail

to

their

respective

shareholders

(and

to Cooper Equity Award Holders for information only) the Joint Proxy Statement/Prospectus (including

the Scheme) in connection with the transactions. Investors and shareholders are urged to read the

Joint Proxy Statement/Prospectus (including the Scheme) and other relevant documents filed or to

be filed with the SEC carefully when they become available because they will contain important

information about Eaton, Cooper, Eaton Global Plc, the

transactions

and

related

matters.

Investors

and

security

holders

will

be

able

to

obtain

free

copies

of

the

Joint

Proxy

Statement/Prospectus

(including

the

Scheme)

and

other

documents

filed

with

the

SEC

by

Eaton

Global

Plc,

Eaton

and

Cooper

through

the

website

maintained

by

the

SEC

at

www.sec.gov.

In

addition,

investors

and

shareholders

will

be

able

to

obtain

free

copies

of

the

Joint

Proxy

Statement/Prospectus

(including

the

Scheme)

and

other

documents

filed

by Eaton and Eaton Global Plc with the SEC by contacting Don Bullock from Eaton by calling (216)

523-5127, and will be able to obtain free copies of the Joint Proxy

Statement/Prospectus

(including

the

Scheme)

and

other

documents

filed

by

Cooper

by

contacting

Cooper

Investor

Relations

at

c/o

Cooper

US,

Inc.,

P.O.

Box 4466, Houston, Texas 77210 or by calling (713) 209-8400.

Cooper,

Eaton

and

Eaton

Global

Plc

and

their

respective

directors

and

executive

officers

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

the

respective

shareholders

of

Cooper

and

Eaton

in

respect

of

the

transactions

contemplated

by

the

Joint

Proxy

Statement/Prospectus.

Information

regarding

the

persons

who

may,

under

the

rules

of

the

SEC,

be

deemed

participants

in

the

solicitation

of

the

respective

shareholders

of

Cooper

and

Eaton

in

connection

with

the proposed transactions, including a description of their director or indirect interests, by

security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus

when

it

is

filed

with

the

SEC.

Information

regarding

Cooper's

directors

and

executive

officers

is

contained

in

Cooper's

Annual

Report

on

Form 10-K for the year ended December 31, 2011 and its Proxy Statement on Schedule 14A, dated

March 13, 2012, which are filed with the SEC. Information regarding Eaton's directors and

executive officers is contained in Eaton's Annual Report on Form 10-K for the year ended December 31, 2011 and its Proxy

Statement

on

Schedule

14A,

dated

March

16,

2012,

which

are

filed

with

the

SEC.

(1)

Expected name, or a variant thereof

The

directors

of

Eaton

Corporation

accept

responsibility

for

the

information

contained

in

this

communication.

To

the

best

knowledge

and

belief

of

the

directors

of Eaton Corporation (who have taken all reasonable care to ensure such is the case), the information

contained in this communication is in accordance with the

facts

and

does

not

omit

anything

likely

to

affect

the

import

of

such

information. |

3

©

2012 Eaton Corporation. All rights reserved.

Forward Looking Statements

This presentation may contain forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 concerning Eaton, Eaton Global Plc, the acquisition

and other transactions contemplated by the Transaction Agreement, our acquisition financing,

our long-term credit rating and our revenues and operating earnings. These statements or disclosures may discuss goals,

intentions and expectations as to future trends, plans, events, results of operations or financial

condition, or state other information relating to Eaton or Eaton Global Plc, based on current

beliefs of management as well as assumptions made by, and information currently available to,

management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,”

“estimate,” “expect,” “forecast,” “guidance,”

“intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or

expressions. These forward-looking statements are subject to various risks and uncertainties, many

of which are outside of our control. Therefore, you should not place undue reliance on such

statements. Factors that could cause actual results to differ materially from those in

the forward-looking statements include adverse regulatory decisions; failure to satisfy other closing conditions with respect to the

Acquisition; the risks that the new businesses will not be integrated successfully or that we will not

realize estimated cost savings and synergies; our ability to refinance the bridge loan on

favorable terms and maintain our current long-term credit rating; unanticipated changes in

the markets for our business segments; unanticipated downturns in business relationships with customers or their purchases

from Eaton; competitive pressures on our sales and pricing; increases in the cost of material, energy

and other production costs, or unexpected costs that cannot be recouped in product pricing; the

introduction of competing technologies; unexpected technical or marketing difficulties;

unexpected claims, charges, litigation or dispute resolutions; new laws and governmental regulations. The foregoing

list of factors is not exhaustive. You should carefully consider the foregoing factors and the

other risks and uncertainties that affect our business described in our Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other

documents filed from time to time with the SEC. We do not assume any obligation to update these

forward-looking statements.

No statement in this presentation is intended to constitute a profit forecast for any period, nor

should any statements be interpreted to mean that earnings or earnings per share will

necessarily be greater or lesser than those for the relevant preceding financial periods for Eaton. |

4

©

2012 Eaton Corporation. All rights reserved.

Eaton’s acquisition of Cooper results in…

•

A combination of two leading industrial companies with

complementary electrical businesses

•

$21.5B combined 2011 sales

•

$3.1B combined 2011 EBITDA

•

An enterprise increasingly well positioned for growth through

addressing global power management needs

•

Significant synergies

•

Win-win for both companies’

shareholders

•

29% premium for Cooper with significant cash component

•

Accretion

to

earnings

benefits

both

companies’

shareholders

as the continuing owners of Eaton Global Plc |

5

©

2012 Eaton Corporation. All rights reserved.

Transaction overview

Combined

company

•

Premier power management company with 2011 sales of $21.5B

•

Under the leadership of Eaton management

•

Named Eaton Global Plc and will continue to trade on NYSE as ETN

•

Incorporated in Ireland

Consideration

•

Cooper shareholders will receive $39.15 in cash and 0.77479 ETN Plc

shares, reflecting a 29% equity premium to the closing price on May 18

•

Eaton shareholders will receive 1 ETN Plc share

Financing

•

Fully committed bridge financing in place

Financial

benefits

•

$375M operating synergies, with >80% realized by year 3, and $160M

global

cash

management

and

resultant

tax

benefits

in

the

mature

year

(1)

•

Significantly accretive to Eaton’s earnings

Timing

•

Expect closing in the fall of 2012

•

Conditional on customary regulatory and shareholder approvals

(1)

The financial benefits statements have been reported on in accordance with the Irish Takeover

Code. Please see the offer announcement dated May 21,

2012 for further details. |

6

©

2012 Eaton Corporation. All rights reserved.

Benefits to Cooper shareholders

•

Recommended bid with the full support of Cooper’s Board of

Directors

•

Bid reflects full value for the company

•

29% equity premium to the closing price on May 18, 2012

•

Attractive EV/EBITDA

ltm

multiple of 12.9x

(1)

, significantly above the multiple at

closing on May 18, 2012 of 10.0x

•

Consideration provides certainty of value given the high cash

component

•

Equity component provides upside to shareholders

•

Strategically compelling combination

(1)

Assumes the purchase of all outstanding Cooper stock options for cash and share consideration |

7

©

2012 Eaton Corporation. All rights reserved.

Eaton’s strategy remains consistent

•

A premier

power

management

enterprise

run

as

an

integrated

operating company

serving customers globally

•

Provide innovative, safe, reliable, and efficient electrical,

hydraulic, and mechanical solutions across diverse end markets

•

Focus upon one of the most important challenges of our

time…reducing the rising cost and increasing environmental

impact of the world’s growing energy needs

•

Maintain balance across geographies, the economic cycle, and

our business mix

•

Build on our leadership positions through acquisitions in our

Electrical, Hydraulics, and Aerospace businesses |

8

©

2012 Eaton Corporation. All rights reserved.

Corporate goals for 2015

Returns

Performance

Growth

Note:

Segment Margin excludes acquisition integration charges

16%

segment

margin

12-14%

sales

growth

9% free

cash flow

margin

30% of

sales from

emerging

markets

2015

Goals

20%

earnings

growth

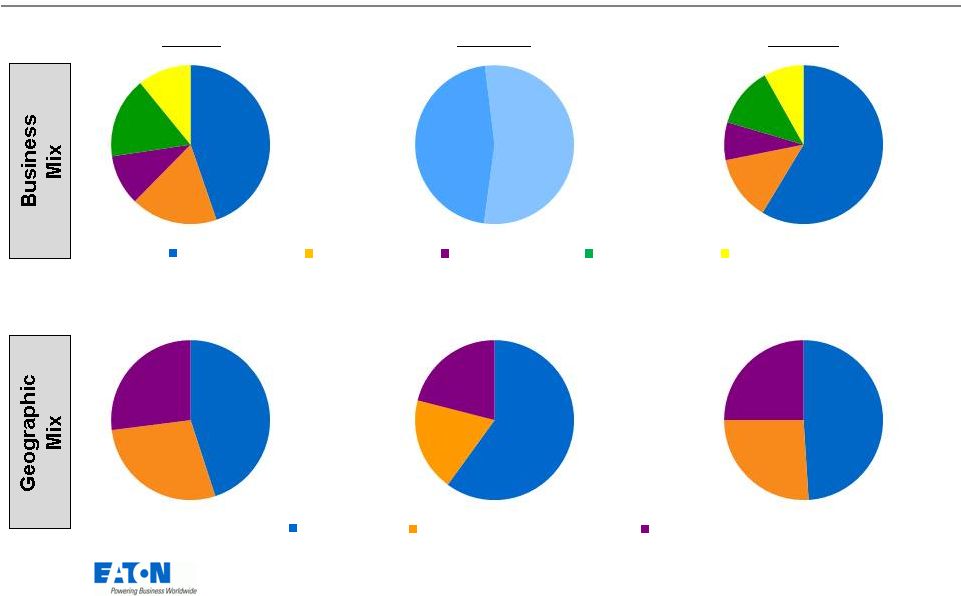

15% ROIC |

9

©

2012 Eaton Corporation. All rights reserved.

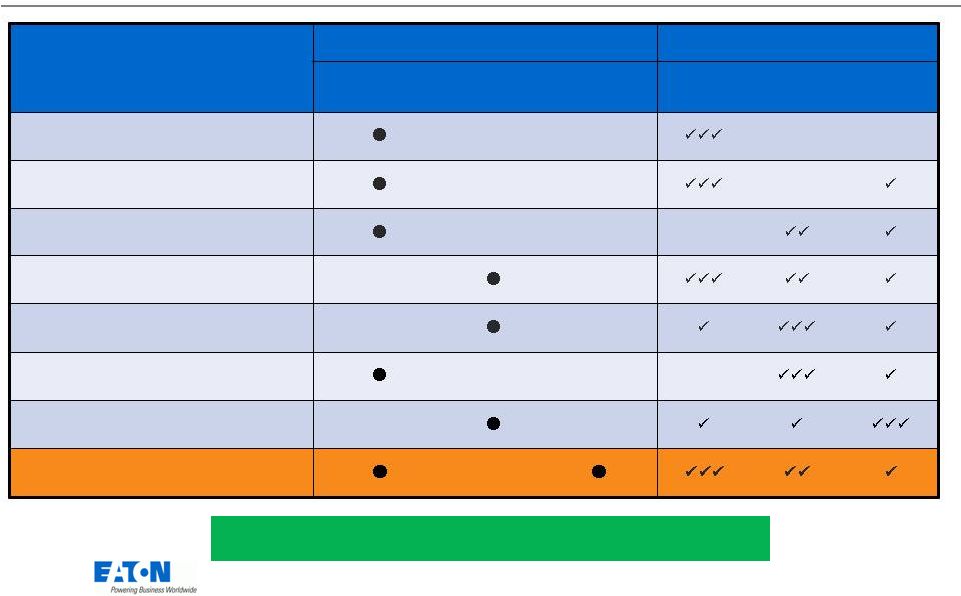

Acquisitions have played a large role in growing

our electrical business

Electrical Group

Acquisitions

Year

Acq’d

Sales

Market Participation

Regional Strength

Power Control

& Distribution

Power

Quality

Lighting &

Safety

Americas

EMEA

Asia-

Pacific

Cutler Hammer

1978

$0.6B

Westinghouse DCBU

1994

$1.0 B

Delta Electrical

2003

$0.3 B

Powerware

2004

$0.8 B

MGE Small Systems

2007

$0.2 B

Moeller

2008

$1.5 B

Phoenixtec

2008

$0.5 B

Cooper

2012

$5.4 B

28 other Electrical acquisitions since 1990

|

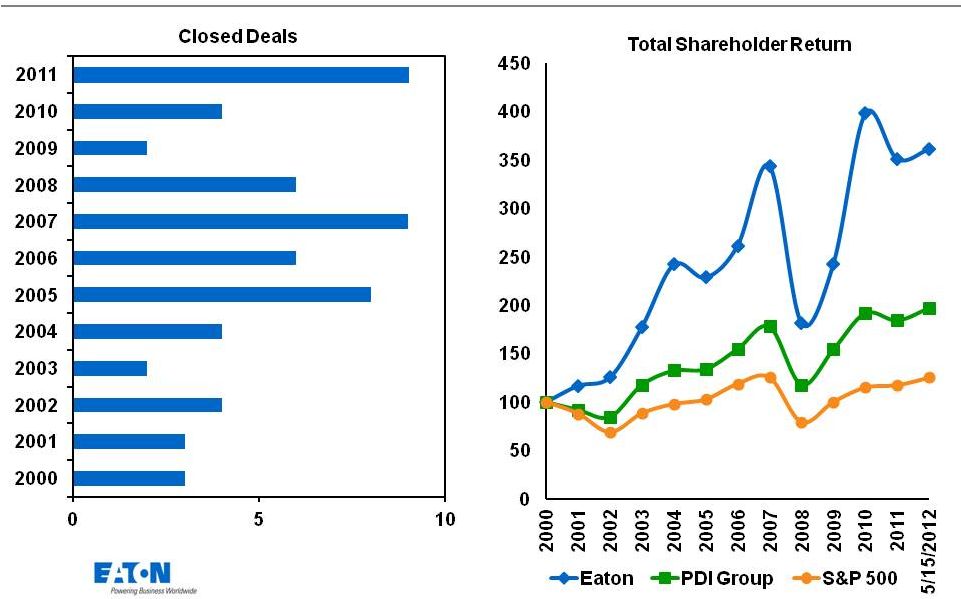

Our

acquisition program has helped drive strong shareholder returns

|

11

©

2012 Eaton Corporation. All rights reserved.

Cooper is an electrical industry leader

•

Leading and innovative manufacturer of electrical equipment with

$5.4B sales and 14.0% operating margin in 2011

•

Wide range of electrical products

•

100+ year reputation in industrial, utility, and commercial markets with leading

brands •

Serves global customers with a suite of electrical products enhancing

energy efficiency and safety across varied end markets

•

Strong U.S. presence (60% of sales), with growing international focus (40% of

sales) •

Sales presence in over 100 countries

•

Manufacturing in 23 countries

•

26,000 employees worldwide

•

Driving growth organically through:

•

Expanding into emerging markets

•

Targeting high-growth industry verticals such as oil & gas, mining,

utilities •

Innovative new products with 29% of sales from new products

•

Customer centric sales organization and sales processes

|

12

Cooper has a wide range of complementary

electrical businesses

•

Cooper Power Systems

•

$1.3 B sales

•

Market leader in

distribution grid

protection

•

Crouse-Hinds

•

$1.0 B sales

•

Global leader in electrical

solutions for harsh and

hazardous environments

•

Safety

•

$600 M sales

•

Leading European

provider of emergency

lighting and video

security

Energy and Safety Solutions ($2.9 B sales)

12

Electrical Products ($2.5 B sales)

•

Lighting

•

$1.1 B sales

•

Strong LED

platform

driving growth

•

Bussmann:

•

$650 M sales

•

Global leader

in

circuit protection

•

B-Line Support structures

•

$400 M sales

•

Global provider

of

structural systems and

wire

management solutions

•

Wiring devices

•

$350 M sales

•

Electrical devices

for

commercial and residential power distribution |

13

©

2012 Eaton Corporation. All rights reserved.

•

Broad portfolio of complementary products

•

Market segment expansion:

•

Upstream into power solutions encompassing primary and

secondary distribution, grid automation, and smart grid

•

Downstream into lighting, lighting controls, and wiring devices

•

Expands our solutions with all channels

•

Well positioned to address long-term global requirements

•

Aging grid

•

Increased spending on energy & infrastructure

•

Protecting people, equipment and data

The strategic rationale for this acquisition is

compelling -

I |

14

©

2012 Eaton Corporation. All rights reserved.

•

Aligns with our customer segment focus in oil & gas, mining,

energy efficiency and alternative energy

•

Adds breadth to our global geographic exposure

•

Attractive business in EMEA

•

Strong oil & gas industry positioning globally

•

Complementary component and utility business in APAC

•

Offers improved cash management flexibility for the

corporation

The strategic rationale for this acquisition is

compelling -

II |

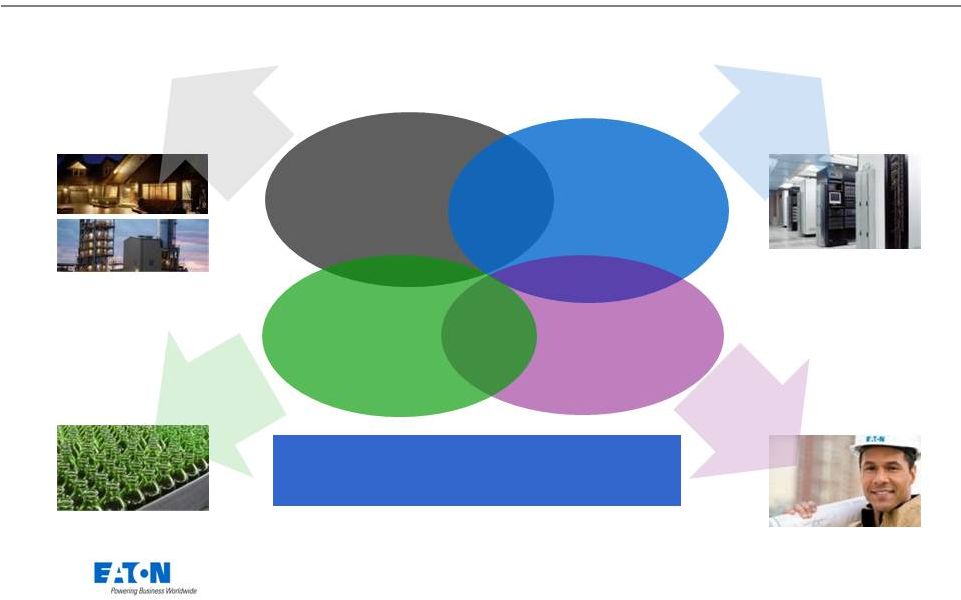

Eaton’s present electrical solutions are focused

upon four broad sets of capabilities

POWER

DISTRIBUTION

POWER

QUALITY

SERVICE

CONTROL

Eaton Power Expertise…

…

accessible and applied

Access to:

Residential, non residential

construction and utilities

Access to:

Data Center

and IT markets

Access to:

Machine builders

and the factory floor

Access to:

Energy efficiency,

infrastructure &

maintenance

Leading products capture attention…

…broad capabilities deliver solutions

©

2012 Eaton Corporation. All rights reserved.

15 |

©

2012 Eaton Corporation. All rights reserved.

|

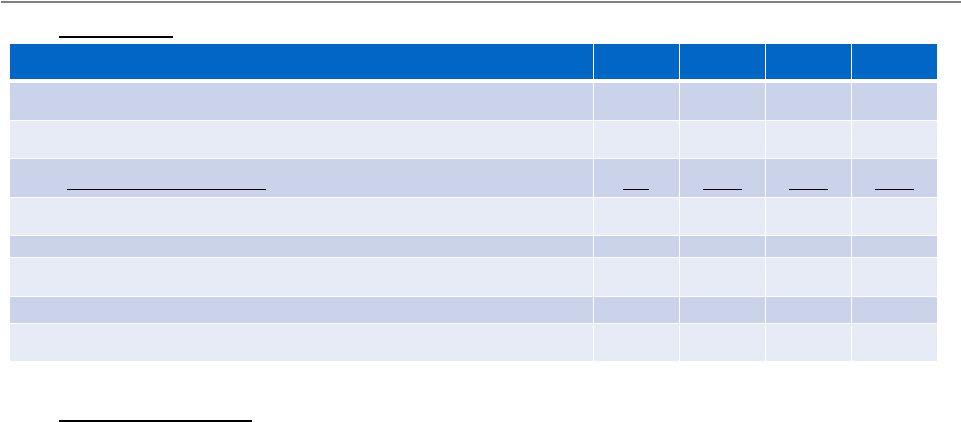

17

Our integrated operating company capabilities

(EBS) will drive significant synergies

(1)

($M)

2013

2014

2015

2016

Pre-tax operating synergies

Sales synergies

10

35

70

115

Cost-out synergies

65

140

240

260

Total operating synergies

75

175

310

375

Global cash management and resultant tax benefits

160

160

160

160

Acquisition integration costs, pre-tax

90

75

35

-

•

$260M in cost out synergies with over 90% complete by 2015

•

$200M in acquisition integration charges with ~80% incurred through 2014

Integration plans

Synergies

(1)

The financial benefits statements have been reported on in accordance with the

Irish Takeover Code. Please see the offer announcement dated May 21,

2012 for further details. |

18

©

2012 Eaton Corporation. All rights reserved.

The acquisition is accretive to earnings

(1)

($)

2013

2014

2015

2016

Operating EPS Accretion

(1)

(0.10)

0.35

0.45

0.55

Cash Operating EPS Accretion

(1,2)

0.40

0.65

0.75

0.85

Accretion

(1)

EPS accretion numbers do not represent a profit forecast as defined in the Irish

Takeover Code (2)

Cash Operating EPS excludes incremental amortization of intangibles arising from

purchase accounting |

19

©

2012 Eaton Corporation. All rights reserved.

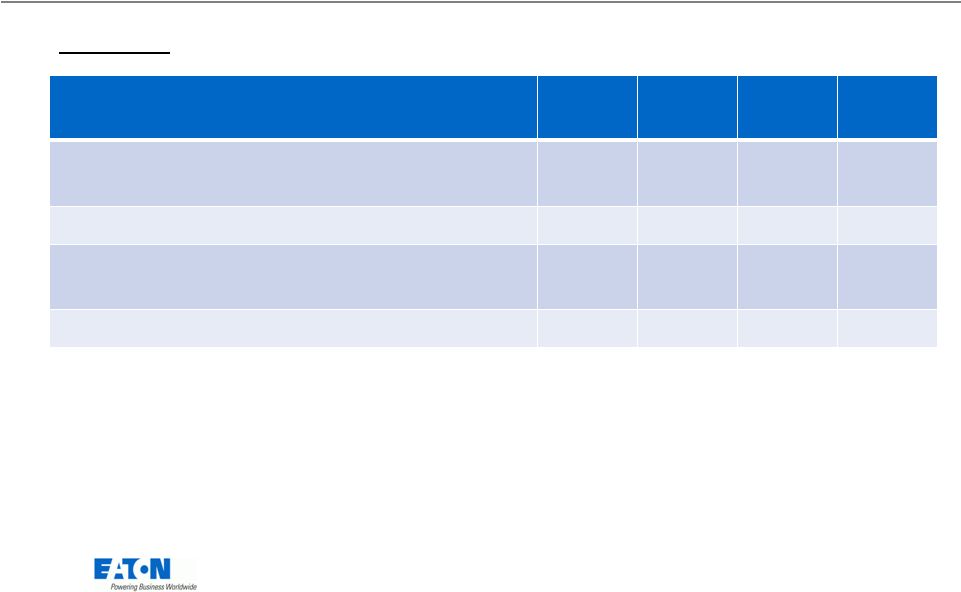

Cooper enhances Eaton’s revenue mix

Electrical

Hydraulics

Aerospace

Truck

Automotive

Eaton

Cooper

NewCo

100% Electrical

U.S.

International Developed

Emerging

Note: Based on 2011 sales

100% Electrical

11%

45%

16%

10%

18%

EPG

46%

E&SS

54%

8%

12%

8%

13%

59%

45%

27%

28%

21%

19%

60%

25%

26%

49%

0% |

20

©

2012 Eaton Corporation. All rights reserved.

Financing plan for transaction

•

Bridge loan and cash on hand to fund cash

component of the consideration

•

Plan to replace bridge loan with approximately

$5.1B of term debt in several tranches with varied

tenors

•

In the medium term, we are targeting a return to an

A credit rating for our long term debt

Note: At the closing of the acquisition, Eaton Global Plc will be assuming and

guaranteeing the outstanding debt of Cooper Industries plc

|

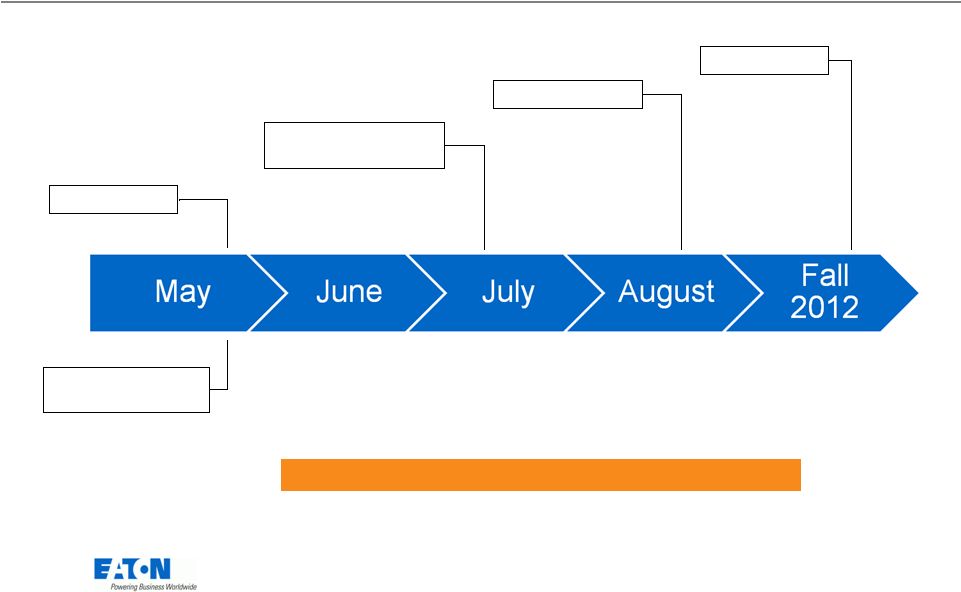

21

©

2012 Eaton Corporation. All rights reserved.

We expect the transaction to close this fall

Announcement

Shareholder votes

Post proxy statement

and scheme document

Regulatory filings

Expected close

Bridge financing

commitment in place |

22

©

2012 Eaton Corporation. All rights reserved.

Eaton’s acquisition of Cooper results in…

•

A combination of two leading industrial companies with

complementary electrical businesses

•

$21.5B combined 2011 sales

•

$3.1B combined 2011 EBITDA

•

An enterprise increasingly well positioned for growth through

addressing global power management needs

•

Significant synergies

•

Win-win for both companies’

shareholders

•

29% premium for Cooper with significant cash component

•

Accretion

to

earnings

benefits

both

companies’

shareholders

as the continuing owners of Eaton Global Plc |

|