Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SITO MOBILE, LTD. | Financial_Report.xls |

| EX-32.1 - SINGLE TOUCH SYSTEMS 10Q, CERTIFICATION 906, CEO - SITO MOBILE, LTD. | singletouchexh32_1.htm |

| EX-31.2 - SINGLE TOUCH SYSTEMS 10Q, CERTIFICATION 302, CFO - SITO MOBILE, LTD. | singletouchexh31_2.htm |

| EX-32.2 - SINGLE TOUCH SYSTEMS 10Q, CERTIFICATION 906, CFO - SITO MOBILE, LTD. | singletouchexh32_2.htm |

| EX-31.1 - SINGLE TOUCH SYSTEMS 10Q, CERTIFICATION 302, CEO - SITO MOBILE, LTD. | singletouchexh31_1.htm |

| EX-10.1 - SINGLE TOUCH SYSTEMS 10Q, SETTLEMENT AGREEMENT AND MUTUAL GENERAL RELEASE - SITO MOBILE, LTD. | singletouchexh10_1.htm |

| EX-10.3 - SINGLE TOUCH SYSTEMS 10Q, CONSULTING AGREEMENT, SIBER - SITO MOBILE, LTD. | singletouchexh10_3.htm |

| EX-10.1.1 - SINGLE TOUCH SYSTEMS 10Q, PERPETUAL EXCLUSIVE LICENSE AGREEMENT - SITO MOBILE, LTD. | singletouchexh10_11.htm |

| EX-10.2 - SINGLE TOUCH SYSTEMS 10Q, FORM OF WARRANT REPLACING STOCK OPTION - SITO MOBILE, LTD. | singletouchexh10_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2012

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ____________ to ____________

Commission file number: 000-53744

Single Touch Systems Inc.

(Exact name of small business issuer as specified in its charter)

|

Delaware

|

13-4122844

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

100 Town Square Place, Suite 204

Jersey City, NJ

(Address of principal executive offices)

(201) 275-0555

(Registrants telephone number, including area code)

_____________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company; as defined within Rule 12b-2 of the Exchange Act.

|

o

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

Non-accelerated filer

|

x

|

Smaller reporting company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The number of shares outstanding of each of the issuer's classes of common equity as of April 30, 2012: 131,082,392 shares of common stock

Contents

|

Page

|

||

|

Number

|

||

PART I - FINANCIAL INFORMATION

Item 1 - Interim Financial Statements March 31, 2012

|

SINGLE TOUCH SYSTEMS, INC

|

|||||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|||||||||

|

March 31,

|

September 30,

|

||||||||

|

2012

|

2011

|

||||||||

|

(Unaudited)

|

|||||||||

|

Assets

|

|||||||||

|

Current assets

|

|||||||||

|

Cash and cash equivalents

|

$ | 1,053,158 | $ | 523,801 | |||||

|

Accounts receivable - trade, net of allowance

|

1,067,659 | 907,275 | |||||||

|

Prepaid expenses

|

86,860 | 93,872 | |||||||

|

Other current asset

|

155,000 | 155,000 | |||||||

|

Total current assets

|

2,362,677 | 1,679,948 | |||||||

|

Property and equipment, net

|

279,068 | 303,214 | |||||||

|

Other assets

|

|||||||||

|

Capitalized software development costs, net of amortization

|

401,002 | 395,188 | |||||||

|

Intangible assets:

|

|||||||||

|

Patents

|

673,257 | 714,623 | |||||||

|

Patent applications cost

|

592,113 | 544,240 | |||||||

|

Software license

|

76,000 | - | |||||||

|

Deposits and other assets

|

104,280 | 99,481 | |||||||

|

Total other assets

|

1,846,652 | 1,753,532 | |||||||

|

Total assets

|

$ | 4,488,397 | $ | 3,736,694 | |||||

See accompanying notes.

|

SINGLE TOUCH SYSTEMS, INC

|

||||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS - continued

|

||||||||

|

March 31,

|

September 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

(Unaudited)

|

||||||||

|

Liabilities and Stockholders' Equity

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable

|

$ | 928,242 | $ | 1,178,057 | ||||

|

Accrued expenses

|

139,417 | 176,232 | ||||||

|

Accrued compensation - related party

|

74,986 | 36,410 | ||||||

|

License fee payable

|

30,000 | - | ||||||

|

Current obligation on patent acquisitions

|

84,934 | 163,680 | ||||||

|

Convertible debentures- unrelated parties, including accrued interest,

|

||||||||

|

net of discounts of $273,091

|

1,270,224 | - | ||||||

|

Convertible debentures - related party, including accrued interest,

|

||||||||

|

net of discounts of $62,970

|

455,934 | - | ||||||

|

Total current liabilities

|

2,983,737 | 1,554,379 | ||||||

|

Long-term liabilities

|

- | - | ||||||

|

Total liabilities

|

2,983,737 | 1,554,379 | ||||||

|

Stockholders' Equity

|

||||||||

|

Preferred stock, $.0001 par value, 5,000,000 shares authorized;

|

||||||||

|

none outstanding

|

||||||||

|

Common stock, $.001 par value; 200,000,000 shares authorized,

|

||||||||

|

130,882,392 shares issued and outstanding as of December 31, 2011

|

||||||||

|

and as of September 30, 2011

|

130,882 | 130,182 | ||||||

|

Additional paid-in capital

|

124,062,576 | 123,446,398 | ||||||

|

Accumulated deficit

|

(122,688,798 | ) | (121,394,265 | ) | ||||

|

Common stock subscriptions receivable

|

- | - | ||||||

|

Total stockholders' equity

|

1,504,660 | 2,182,315 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 4,488,397 | $ | 3,736,694 | ||||

See accompanying notes.

|

SINGLE TOUCH SYSTEMS, INC

|

||||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

|

||||||||||||||||

|

For the Three Months Ended

|

For the Six Months Ended

|

|||||||||||||||

|

March 31,

|

March 31,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

Revenue

|

||||||||||||||||

|

Wireless applications

|

$ | 1,554,823 | $ | 1,031,585 | $ | 3,144,496 | $ | 2,045,433 | ||||||||

|

Operating Expenses

|

||||||||||||||||

|

Royalties and application costs

|

654,310 | 450,790 | 1,417,631 | 959,355 | ||||||||||||

|

Research and development

|

16,050 | 9,533 | 53,250 | 32,872 | ||||||||||||

|

Compensation expense (including stock based

|

||||||||||||||||

| compensation of $0, $0, $9,960, and $3,182,508 *) | 679,961 | 326,839 | 1,373,784 | 4,321,237 | ||||||||||||

|

Depreciation and amortization

|

163,604 | 157,294 | 319,075 | 294,580 | ||||||||||||

|

General and administrative (including stock based

|

||||||||||||||||

| compensation of $68,606, $0, $89,753, and $421,200 *) | 577,778 | 506,497 | 1,108,448 | 1,090,343 | ||||||||||||

| 2,091,703 | 1,450,953 | 4,272,188 | 6,698,387 | |||||||||||||

|

Loss from operations

|

(536,880 | ) | (419,368 | ) | (1,127,692 | ) | (4,652,954 | ) | ||||||||

|

Other Income (Expenses)

|

||||||||||||||||

|

Net (loss) on settlement of indebtedness

|

- | - | - | (651,315 | ) | |||||||||||

|

Interest income

|

11 | - | 36 | - | ||||||||||||

|

Interest expense

|

(128,468 | ) | (12,420 | ) | (166,077 | ) | (26,042 | ) | ||||||||

|

Net (loss) before income taxes

|

(665,337 | ) | (431,788 | ) | (1,293,733 | ) | (5,330,311 | ) | ||||||||

|

Provision for income taxes

|

- | - | (800 | ) | (800 | ) | ||||||||||

|

Net income (loss)

|

$ | (665,337 | ) | $ | (431,788 | ) | $ | (1,294,533 | ) | $ | (5,331,111 | ) | ||||

|

Basic and diluted loss per share

|

$ | (0.01 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.04 | ) | ||||

|

Weighted average shares outstanding

|

130,182,392 | 128,071,629 | 130,316,818 | 126,388,312 | ||||||||||||

|

* For the quarters ended March 31, 2012 and 2011 and for the six months ended March 31, 2012 and 2011, respectively.

|

||||||||||||||||

See accompanying notes.

|

SINGLE TOUCH SYSTEMS, INC

|

||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

||||||||

|

For the Six Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Cash Flows from Operating Activities

|

||||||||

|

Net loss

|

$ | (1,294,533 | ) | $ | (5,331,111 | ) | ||

|

Adjustments to reconcile net loss to net cash

|

||||||||

|

used in operating activities:

|

||||||||

|

Depreciation expense

|

53,515 | 46,537 | ||||||

|

Amortization expense - software development costs

|

201,254 | 185,327 | ||||||

|

Amortization expense - patents

|

64,306 | 62,716 | ||||||

|

Amortization expense - discount of convertible debt

|

95,103 | - | ||||||

|

Stock based compensation

|

99,713 | 3,603,708 | ||||||

|

Loss on settlement of debt

|

- | 651,315 | ||||||

|

(Increase) decrease in assets

|

||||||||

|

(Increase) decrease in accounts receivable

|

(160,384 | ) | (181,442 | ) | ||||

|

(Increase) decrease in prepaid expenses

|

7,011 | 69,143 | ||||||

|

(Increase) decrease in deposits and other assets

|

(4,799 | ) | (1,204 | ) | ||||

|

Increase (decrease) in liabilities

|

||||||||

|

Increase (decrease) in accounts payable

|

(249,816 | ) | (3,810 | ) | ||||

|

Increase (decrease) in accrued expenses

|

1,763 | 31,425 | ||||||

|

Increase (decrease) in accrued interest

|

70,974 | 14,184 | ||||||

|

Net cash used in operating activities

|

(1,115,893 | ) | (853,212 | ) | ||||

|

Cash Flows from Investing Activities

|

||||||||

|

Patents and patent applications costs

|

(70,812 | ) | (23,005 | ) | ||||

|

Purchase of property and equipment

|

(29,370 | ) | (91,850 | ) | ||||

|

Capitalized software development costs

|

(207,068 | ) | (292,219 | ) | ||||

|

Net cash used in investing activities

|

$ | (307,250 | ) | $ | (407,074 | ) | ||

See accompanying notes.

|

SINGLE TOUCH SYSTEMS, INC

|

||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) - Continued

|

||||||||

|

For the Six Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Cash Flows from Financing Activities

|

||||||||

|

Proceeds from issuance of common stock

|

40,000 | 1,000 | ||||||

|

Proceeds from issuance of convertible debt - unrelated parties

|

1,500,000 | (175,000 | ) | |||||

|

Proceeds from issuance of convertible debt - related parties

|

500,000 | - | ||||||

|

Loan advances received from related parties

|

- | 17,685 | ||||||

|

Fees paid pursuant to warrant settlement

|

- | (30,000 | ) | |||||

|

Repayments on related party loans

|

- | (320,000 | ) | |||||

|

Principal reduction in obligation on patent purchases

|

(87,500 | ) | ||||||

|

Net cash provided by financing activities

|

1,952,500 | (506,315 | ) | |||||

|

Net increase (decrease) in cash

|

529,357 | (1,766,601 | ) | |||||

|

Beginning balance - cash

|

523,801 | 4,040,169 | ||||||

|

Ending balance - cash

|

$ | 1,053,158 | $ | 2,273,568 | ||||

|

Supplemental Information:

|

||||||||

|

Interest expense paid

|

$ | - | $ | - | ||||

|

Income taxes paid

|

$ | 800 | $ | 800 | ||||

|

Non-cash investing and financing activities:

|

|

|

For the six-months ended March 31, 2012

|

|

|

During the six months ended March 31, 2012, the Company received $2,000,000 through the issuance of

|

|

|

convertible debt including common stock warrants to purchase 4,000,000 shares of the Company's common

|

|

|

stock at $0.25 per share. The Company recognized discounts against the principal amounts due totaling $464,252

|

|

|

with an offsetting amount charged to equity. The discount is being amortized over the one year term of the

|

|

|

respective debt instrument. The discounts consist of the relative fair value of the warrants totaling $412,736

|

|

|

and the relative fair value of beneficial conversion features totaling $51,516.

|

|

|

During the six-months ended March 31 2012, the Company agreed to modify the terms of warrants granted

|

|

|

to a consultant under a new agreement replacing a prior agreement in June 2011 to purchase 1,000,000 shares

|

|

|

of the Company's common stock. Under the modified terms, the exercise price was reduced from $0.80 per share

|

|

|

to $0.40 per share and the expiration date of the warrants was extended from June 14, 2014 to December 14, 2014.

|

|

|

The Company recognized compensation expense during the period of $53,600 on the modification.

|

|

|

During the six-months ended March 31, 2012, the Company was granted a perpetual license to utilize the

|

|

|

Anywhere software. In consideration for the license, the Company agreed to pay $30,000 and issue 200,000

|

|

|

shares of its common stock. The license was valued at $76,000 (See Note 6). The $30,000 was paid in April 2012.

|

|

|

During the six-months ended March 31, 2012, the Company recognized stock based compensation of

|

|

|

$46,113 on the vesting of 1,000,000 options.

|

|

See accompanying notes.

|

SINGLE TOUCH SYSTEMS, INC

|

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) - Continued

|

||||||

|

For the six-months ended March 31, 2011

|

|

|

During the six months ended March 31, 2011, the Company issued 722,094 shares of its common

|

|

|

stock through the cashless exercise of 800,000 warrants.

|

|

|

During the six months ended March 31, 2011, the Company issued 723,684 shares of its common stock

|

|

|

through a settlement with a former Note holder as to the number of shares he was entitled to in the original

|

|

|

conversion of his note. The Company recognized a loss of $651,315 on the issuance of the 723,684 shares.

|

|

|

During the six months ended March 31, 2011, the Company issued 3,000,000 shares of its common stock

|

|

|

to its President as compensation. The shares were valued at $2,700,000 and charged to operations as

|

|

|

compensation expense.

|

|

|

During the six months ended March 31, 2011, the Company charged $465,214 to equity relating to

|

|

|

the amortization of discounts on related party convertible debt.

|

See accompanying notes.

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2012

(Unaudited)

1. Organization, History and Business

Single Touch Systems, Inc. (“the Company”) was incorporated in Delaware on May 31, 2000, under its original name, Hosting Site Network, Inc. On May 12, 2008, the Company changed its name to Single Touch Systems, Inc.

The Company offers its patented technologies via a modular, adaptable platform and multi-channel messaging gateway to its customers enabling them to reach consumers on all types of connected devices.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements contain all adjustments (consisting only of normal recurring adjustments) which, in the opinion of management, are necessary to present fairly the financial position of the Company as of March 31, 2012, and the results of its operations and cash flows for the three months and six months ended March 31, 2012 and 2011. Certain information and footnote disclosures normally included in financial statements have been condensed or omitted pursuant to rules and regulations of the U.S. Securities and Exchange Commission (“the Commission”). The Company believes that the disclosures in the unaudited condensed consolidated financial statements are adequate to ensure the information presented is not misleading. However, the unaudited condensed consolidated financial statements included herein should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2011 filed with the Commission on December 30, 2011.

The accompanying consolidated financial statements are prepared using the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America.

2. Summary of Significant Accounting Policies

Reclassification

Certain reclassifications have been made to conform the 2011 amounts to 2012 classifications for comparative purposes.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Single Touch Systems, Inc. and it’s wholly- owned subsidiaries, Single Touch Interactive, Inc., and HSN, Inc. (an inactive company formed in New Jersey on August 21, 2001). Intercompany transactions and balances have been eliminated in consolidation.

Revenue Recognition

Revenue is derived on a per message/notification basis through the Company’s patented technologies and a modular, adaptable platform designed to create multi-channel messaging gateways for all types of connected devices. Revenue is recognized in accordance with Staff Accounting Bulletin (“SAB”) No. 101, “Revenue Recognition in Financial Statements,” as revised by SAB No. 104. As such, the Company recognizes revenue when persuasive evidence of an arrangement exists, title transfer has occurred, the price is fixed or readily determinable and collectability is probable. Sales are recorded net of sales discounts.

Accounts Receivable

Accounts receivable is reported at the customers’ outstanding balances, less any allowance for doubtful accounts. Interest is not accrued on overdue accounts receivable.

Allowance for Doubtful Accounts

An allowance for doubtful accounts on accounts receivable is charged to operations in amounts sufficient to maintain the allowance for uncollectible accounts at a level management believes is adequate to cover any probable losses. Management determines the adequacy of the allowance based on historical write-off percentages and information collected from individual customers. Accounts receivable are charged off against the allowance when collectability is determined to be permanently impaired.

Property and Equipment

Property and equipment are stated at cost. Major renewals and improvements are charged to the asset accounts while replacements, maintenance and repairs that do not improve or extend the lives of the respective assets are expensed. At the time property and equipment are retired or otherwise disposed of, the asset and related accumulated depreciation accounts are relieved of the applicable amounts. Gains or losses from retirements or sales are credited or charged to income.

Depreciation is computed on the straight-line and accelerated methods for financial reporting and income tax reporting purposes based upon the following estimated useful lives:

|

Software development

|

2- 3 years

|

|

Equipment

|

5 years

|

|

Computer hardware

|

5 years

|

|

Office furniture

|

7 years

|

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Long-Lived Assets

The Company accounts for its long-lived assets in accordance with Accounting Standards Codification (“ASC”) Topic 360-10-05, “Accounting for the Impairment or Disposal of Long-Lived Assets.” ASC Topic 360-10-05 requires that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the historical cost carrying value of an asset may no longer be appropriate. The Company assesses recoverability of the carrying value of an asset by estimating the future net cash flows expected to result from the asset, including eventual disposition. If the future net cash flows are less than the carrying value of the asset, an impairment loss is recorded equal to the difference between the asset’s carrying value and fair value or disposable value. The Company determined that none of its long-term assets at March 31, 2012 were impaired.

Prepaid Royalties

The Company’s agreements with licensors and developers generally provide it with exclusive publishing rights and require it to make advance royalty payments that are recouped against royalties due to the licensor or developer based on product sales. Prepaid royalties are amortized on a software application-by-application basis, based on the greater of the proportion of current year sales to total current and estimated future sales or the contractual royalty rate based on actual net product sales. The Company continually evaluates the recoverability of prepaid royalties, and charges to operations the amount that management determines is probable that will not be recouped at the contractual royalty rate in the period in which such determination is made or at the time the Company determines that it will cancel a development project. Prepaid royalties are classified as current and non-current assets based upon estimated net product sales within the next year.

Capitalized Software Development Costs

The Company capitalizes internal software development costs subsequent to establishing technological feasibility of a software application. Capitalized software development costs represent the costs associated with the internal development of the Company’s software applications. Amortization of such costs is recorded on a software application-by-application basis, based on the greater of the proportion of current year sales to total of current and estimated future sales for the applications or the straight-line method over the remaining estimated useful life of the software application. The Company continually evaluates the recoverability of capitalized software costs and will charge to operations amounts that are deemed unrecoverable for projects it abandons.

Issuances Involving Non-cash Consideration

All issuances of the Company’s stock for non-cash consideration have been assigned a dollar amount equaling the market value of the shares issued on the date the shares were issued for such services and property. The non-cash consideration paid pertains to consulting services and the acquisition of a software license (See Note 6).

Stock Based Compensation

The Company accounts for stock-based compensation under ASC Topic 505-50, formerly Statement of Financial Accounting Standards (“SFAS”) No. 123R, "Share-Based Payment” and SFAS No. 148, "Accounting for Stock-Based Compensation - Transition and Disclosure - An amendment to SFAS No. 123.” These standards define a fair-value-based method of accounting for stock-based compensation. In accordance with SFAS Nos. 123R and 148, the cost of stock-based compensation is measured at the grant date based on the value of the award and is recognized over the vesting period. The value of the stock-based award is determined using the Binomial or Black-Scholes option-pricing models, whereby compensation cost is the excess of the fair value of the award as determined by the pricing model at the grant date or other measurement date over the amount that must be paid to acquire the stock. The resulting amount is charged to expense on the straight-line basis over the period in which the Company expects to receive the benefit, which is generally the vesting period. During the six months ended March 31, 2012, the Company recognized stock-based compensation expense totaling $99,713, of which $46,113 was recognized through the vesting of 1,000,000 common stock options and $53,600 was recognized as compensation on the modification of 1,000,000 warrants granted to a consultant under a new agreement replacing a prior agreement (See Note 12). During the six months ended March 31, 2011, the Company recognized stock-based compensation expense of $2,700,000 through the issuance of 3,000,000 shares of its common stock to its executive chairman and $903,708 through the granting of options to management and employees to purchase 9,655,000 shares of the Company’s common stock at $0.90 per share (See Note 12).

Loss per Share

The Company reports earnings (loss) per share in accordance with ASC Topic 260-10, "Earnings per Share." Basic earnings (loss) per share is computed by dividing income (loss) available to common shareholders by the weighted average number of common shares available. Diluted earnings (loss) per share is computed similar to basic earnings (loss) per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. Diluted earnings (loss) per share has not been presented since the effect of the assumed conversion of warrants and debt to purchase common shares would have an anti-dilutive effect. Potential common shares as of March 31, 2012 that have been excluded from the computation of diluted net loss per share amounted to 57,124,613 shares and include 20,020,175 warrants, 32,980,000 options and $2,062,219 of debt and accrued interest convertible into 4,124,438 shares of the Company’s common stock. Potential common shares as of March 31, 2011 that have been excluded from the computation of diluted net loss per share total 57,434,880 shares and include 37,836,820 warrants, 18,330,000 options, and $469,182 of debt convertible into 1,268,060 shares of the Company’s common stock.

Cash and Cash Equivalents

For purpose of the statements of cash flows, the Company considers cash and cash equivalents to include all stable, highly liquid investments with maturities of three months or less.

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Concentration of Credit Risk

The Company primarily transacts its business with one financial institution. The amount on deposit in that one institution may from time to time exceed the federally-insured limit.

Of the Company’s revenue earned during the three months ended March 31, 2012, approximately 99% was generated from contracts with eight customers covered under the Company’s master services agreement with AT&T. Of the Company’s revenue earned during the three months ended March 31, 2011, approximately 93% was generated from contracts with eight customers covered under the Company’s master services agreement with AT&T.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Convertible Debentures

If the conversion features of conventional convertible debt provides for a rate of conversion that is below market value at issuance, this feature is characterized as a beneficial conversion feature (“BCF”). A BCF is recorded by the Company as a debt discount pursuant to ASC Topic 470-20 “Debt with Conversion and Other Options.” In those circumstances, the convertible debt is recorded net of the discount related to the BCF, and the Company amortizes the discount to interest expense or equity (if the debt is due to a related party), over the life of the debt using the effective interest method.

Income Taxes

The Company accounts for its income taxes under the provisions of ASC Topic 740, “Income Taxes.” The method of accounting for income taxes under ASC 740 is an asset and liability method. The asset and liability method requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between tax bases and financial reporting bases of other assets and liabilities.

Recent Accounting Pronouncements

The Company continually assesses any new accounting pronouncements to determine their applicability to the Company. Where it is determined that a new accounting pronouncement affects the Company’s financial reporting, the Company undertakes a study to determine the consequence of the change to its financial statements and assures that there are proper controls in place to ascertain that the Company’s financials properly reflect the change.

3. Accounts Receivable

Accounts receivable consists of the following:

|

March 31,

|

September 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

Due from customers

|

$ | 1,148,103 | $ | 987,719 | ||||

|

Less allowance for bad debts

|

(80,444 | ) | (80,444 | ) | ||||

|

Net Carrying Value

|

$ | 1,067,659 | $ | 907,275 | ||||

4. Property and Equipment

The following is a summary of property and equipment:

|

March 31,

|

September 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

Computer hardware

|

$ | 706,001 | $ | 709,891 | ||||

|

Equipment

|

46,731 | 46,731 | ||||||

|

Office furniture

|

127,669 | 94,410 | ||||||

|

Total Cost

|

880,401 | 851,032 | ||||||

|

Less accumulated depreciation

|

(601,333 | ) | (547,818 | ) | ||||

|

Net Book Value

|

$ | 279,068 | $ | 303,214 | ||||

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Depreciation expense for the three months ended March 31, 2012 and 2011 was $23,874 and $24,287, respectively. Depreciation expense for the six months ended March 31, 2012 and 2011 was $53,515 and $46,537, respectively.

5. Capitalized Software Development Costs

The following is a summary of the net book value of capitalized software development costs:

|

March 31,

|

September 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

Beginning Balance

|

$ | 395,188 | $ | 305,710 | ||||

|

Additions

|

207,068 | 502,110 | ||||||

|

Amortization

|

(201,254 | ) | (412,632 | ) | ||||

|

Ending Balance

|

$ | 401,002 | $ | 395,188 | ||||

Amortization expense for the three months ended March 31, 2012 and 2011 was $107,500 and $125,568, respectively. Amortization expense for the six ended March 31, 2012 and 2011 was $201,254 and $185,327, respectively.

Amortization expense for the remaining estimated lives of these costs are as follows:

|

Period Ending March 31,

|

||||

|

2013

|

$ | 245,757 | ||

|

2014

|

155,245 | |||

| $ | 401,002 | |||

6. Intangible Assets

Patents

The following is a summary of the net book value of capitalized patent costs:

|

March 31,

|

September 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

Beginning Balance

|

$ | 939,534 | $ | 916,594 | ||||

|

Less: amortization

|

(266,277 | ) | (201,971 | ) | ||||

|

Ending Balance

|

$ | 673,257 | $ | 714,623 | ||||

Amortization charged to operations for the three months ended March 31, 2012 and 2011 totaled $32,230 and $33,438, respectively. Amortization charged to operations for the six months ended March 31, 2012 and 2011 totaled $64,306 and $62,716, respectively.

A schedule of amortization expense over the estimated life of the patents is as follows:

|

Period Ending March 31,

|

||||

|

2013

|

$ | 132,392 | ||

|

2014

|

132,392 | |||

|

2015

|

132,392 | |||

|

2016

|

132,392 | |||

|

2017

|

121,500 | |||

|

Thereafter

|

22,189 | |||

| $ | 673,257 | |||

In January 2011, the Company was issued US Patent 7,865,181 “Searching for mobile content” and US Patent 7,865,182 “Over the air provisioning of mobile device settings.” The costs associated with these patents, totaling $29,254 are included above and are being amortized over the patent’s estimated useful life of 7 years.

In September 2011, the Company was issued US Patent 8,015,307 “System and method for streaming media.” The costs associated with the patent totaling $8,115 are included above and are being amortized over the patent’s estimated useful life of 7 years.

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In October 2011, the Company was issued US Patent 8,041,341 “System of providing information to a telephony subscriber.” The costs associated with this patents totaling $22,940 are included above and are being amortized over the patent’s estimated useful life of 7 years.

Software license

On March 30, 2012, the Company was granted a perpetual license to utilize the “Anywhere” software and related source code from Soap Box Mobile, Inc. (“Soapbox”). Under the terms of the underlying agreement, the Company issued 200,000 shares of its common stock to Soapbox and paid $30,000 in April 2012. All of the consideration paid was distributed to eight individuals comprising all of the common shareholders of Soapbox pursuant to instruction from Soapbox. The Company valued the license at $76,000, comprising of the fair value of the 200,000 shares on date of grant ($46,000) and the $30,000 of cash. The license, by its terms, has an indefinite life and is therefore not subject to amortization. The Company’s executive chairman owns a majority preferred interest in Soapbox and received no portion of the consideration paid.

7. Income Taxes

As of March 31, 2012, the Company has a net operating loss carryover of approximately $37,160,000 available to offset future income for income tax reporting purposes, which will expire in various years through 2032, if not previously utilized. However, the Company’s ability to use the carryover net operating loss may be substantially limited or eliminated pursuant to Internal Revenue Code Section 382.

The Company adopted the provisions of ASC 740-10-50, formerly FIN 48, “Accounting for Uncertainty in Income Taxes”. The Company had no material unrecognized income tax assets or liabilities for the six months ended March 31, 2012 or for the six months ended March 31, 2011.

The Company’s policy regarding interest and penalties on income tax is to expense those items as general and administrative expense but to identify them for tax purposes. During the six months ended March 31, 2012 and 2011, there were no income tax or related interest and penalty items in the income statement or liability on the balance sheet. The Company files income tax returns in the U.S. federal jurisdiction and various state jurisdictions. The Company is no longer subject to U.S. federal or state income tax examination by tax authorities for years before 2007. The Company is not currently involved in any income tax examinations.

The provisions for income tax expense for the six months ended March 31, 2012 and 2011 are as follows:

|

2012

|

2011

|

|||||||

|

Current

|

||||||||

|

Federal

|

$ | - | $ | - | ||||

|

State

|

800 | 800 | ||||||

|

Total income tax expense

|

$ | 800 | $ | 800 | ||||

8. Obligation on Patent Acquisitions

On March 15, 2010, the Company purchased six patents and three patent applications from an unrelated third party (the “Seller”) for $900,000 of which $550,000 was paid on the execution of the purchase agreement. Pursuant to the initial agreement, $175,000 was due on or before March 15, 2011, which was paid, and the final installment of $175,000 was due on or before March 15, 2012. The terms of the agreement were modified on March 1, 2012 whereby the remaining $175,000 is payable in two installments. Under the modified terms, an installment of $87,500 became due on or before March 15, 2012 and was paid. The fourth and final installment of $87,500 is now due on or before September 15, 2012.

As the original and modified agreements do not provide for any stated interest on the payments, the Company was required to impute interest on the payment stream. The Company present valued the payments at $831,394 using an effective interest rate of 15% in its computation. Of the $831,394, $706,685 was allocated to the purchased patents, and $124,709 was allocated to the patent applications. The patents are being amortized over 7 years. The value assigned to the patent applications is not being amortized. Upon the issuance of a patent, its respective cost will be amortized over the patent’s estimated useful life. Costs associated with abandoned applications are charged to operations. The Company granted the Seller a license to utilize all acquired patents over their respective lives on a worldwide basis for no consideration. In addition, the Company is required to reserve for the Seller ten abbreviated dialing codes for a five-year period. The patents have been pledged as collateral against the remaining balance due.

As of March 31, 2012, $812,500 of the $900,000 has been paid. The remaining payment of $87,500 is due in September 2012. Interest accrued and charged to operations for the three months ended March 31, 2012 and 2011 totaled $2,566 and $12,338, respectively. Interest accrued and charged to operations for the six months ended March 31, 2012 and 2011 totaled $8,754 and $22,024, respectively.

Following is the maturity of this obligation at March 31, 2012:

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

Due September 15, 2012

|

$ | 87,500 | ||

|

Less imputed interest

|

(2,566 | ) | ||

|

Net Carrying Value

|

$ | 84,934 |

9. Convertible Debt

During the months of November and December 2011, the Company received a total of $1,800,000 in consideration for issuing convertible notes and warrants to purchase 3,600,000 shares of the Company’s common stock to seven investors including a Company director. In February 2012, the Company received from two investors an additional $200,000 in consideration for issuing convertible notes and warrants to purchase 400,000 shares of the Company’s common stock. One of the investors participated in the earlier issuance. The notes bear interest at a rate of 10% per annum. Principal and accrued interest are fully due one year from the respective date of each loan but may be extended by mutual consent of the holder and the Company. Outstanding principal and the first year’s accrued interest are convertible into shares of the Company’s common stock at a conversion rate of $0.50 per share. Interest accrued on the notes during the three months and six months ended March 31, 2012 and charged to operations amounted to $46,575 and $62,219, respectively.

The warrants are exercisable into common shares commencing on the date of each loan at a price of $0.25 per share and expire three years from each respective date of grant.

Pursuant to ASC Topic 470-20, “Debt with Conversion and Other Options,” the convertible notes were recorded net of discounts that include the relative fair value of the warrants’ and the notes’ beneficial conversion features totaling $414,425. The discounts are being amortized to either interest expense or equity (if the debt is due to a related party) over the one-year term of the various notes using the effective interest method. The initial value of the warrants of $412,736 was calculated using the Binomial Option model with a risk-free interest rates ranging from 0.39% to 0.43%, volatility ranging from 100.79% to 103.00%, and trading prices ranging from $0.22 to $0.35 per share. The beneficial conversion feature of $51,516 was calculated pursuant to ASC Topic 470-20 using trading prices ranging from $0.26 to $0.35 per share and an effective conversion price $0.0322 per share.

Amortization of the discounts for the three months ended March 31, 2012 totaled $108,226 of which $79,326 was charged to interest expense and $28,900 was charged to equity. Amortization of the discounts for the six months ended March 31, 2012 totaled $128,191 of which $95,103 was charged to interest expense and $33,088 was charged to equity.

The summary of convertible notes is as follows:

|

March 31,

|

||||

|

2012

|

||||

|

Principal balance

|

$ | 2,000,000 | ||

|

Accrued interest

|

62,219 | |||

|

Gross Amount Due

|

2,062,219 | |||

|

Less:

|

||||

|

Debt discounts

|

(336,061 | ) | ||

|

Net Carrying Value

|

$ | 1,726,158 | ||

10. Related Party Transactions

Acquisition option

On June 30, 2011, the Company entered into an agreement with its executive chairman whereby the Company was granted an option to acquire his preferred stock holdings in Soapbox Mobile, Inc. Pursuant to the terms of the agreement, the Company paid a deposit of $155,000 to the executive chairman which is fully refundable in the event the acquisition does not close. Under the original option agreement the term was six months, during which both parties would perform due diligence necessary to determine the value of his majority interest and perform other actions necessary to complete the acquisition. The option has been extended to June 30, 2012.

Convertible promissory note

On November 14, 2011, the Company issued a Convertible Promissory Note to one of its directors in the amount of $500,000 in connection with is debt offering discussed in Note 9. The note bears interest at a rate of 10% per annum, is unsecured and matures on November 14, 2012. In addition, the unpaid principal together with accrued interest is convertible at the election of the holder and at a conversion rate of $0.50 per share. As additional consideration, the Company granted a warrant to purchase up to 1,000,000 shares of the Company’s common stock for a period of three years at an exercise price of $0.25 per share. In accordance with ASC 470-20, the note was recorded net of a discount totaling $96,058, which represents the relative fair value of the warrants received. The discount will be amortized over the one-year term to equity using the effective interest method. The initial value of the warrants of $96,058 was calculated using the Binomial Option model with a risk-free interest rate of 0.39%, volatility of 100.79%, and a trading price of $0.25 per share.

11. Fair Value

The Company’s financial instruments at March 31 2012 consist principally of notes payable and convertible debentures. Notes payable and convertible debentures are financial liabilities with carrying values that approximate fair value. The Company determines the fair value of notes payable and convertible debentures based on the effective yields of similar obligations.

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company believes all of the financial instruments’ recorded values approximate fair market value because of their nature and respective durations.

The Company complies with the provisions of ASC No. 820-10 (“ASC 820-10”), “Fair Value Measurements and Disclosures.” ASC 820-10 relates to financial assets and financial liabilities. ASC 820-10 defines fair value, establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (GAAP), and expands disclosures about fair value measurements. The provisions of this standard apply to other accounting pronouncements that require or permit fair value measurements and are to be applied prospectively with limited exceptions.

ASC 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820-10 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions, about market participant assumptions, which are developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under ASC 820-10 are described below:

Level 1. Valuations based on quoted prices in active markets for identical assets or liabilities that an entity has the ability to access.

Level 2. Valuations based on quoted prices for similar assets or liabilities, quoted prices for identical assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable data for substantially the full term of the assets or liabilities.

Level 3. Valuations based on inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The Company utilizes the best available information in measuring fair value. The following table summarizes, by level within the fair value hierarchy, the financial assets and liabilities recorded at fair value on a recurring basis as follows:

|

Level 1

|

Level 2

|

Level 3

|

Fair Value

|

|||||||||||||

|

March 31, 2012

|

||||||||||||||||

|

Liabilities:

|

||||||||||||||||

|

Obligation on patent acquisitions

|

$ | - | $ | 84,934 | $ | - | $ | 84,934 | ||||||||

|

Convertible debentures

|

- | 2,062,219 | - | 2,062,619 | ||||||||||||

| $ | - | $ | 2,147,153 | $ | - | $ | 2,147,153 | |||||||||

12. Stockholders’ Equity

Common Stock

The holders of the Company's common stock are entitled to one vote per share of common stock held.

During the three months ended March 31 2012, the Company issued 200,000 shares of its common stock for the acquisition of the Anywhere software license as discussed in Note 6. The 200,000 shares were valued at their respective market value on the date of issuance totaling $46,000.

During the three months ended March 31 2012, 500,000 shares of the Company’s common stock were issued through the exercise of 500,000 common stock warrants. The Company received $40,000 through the exercise.

During the three months ended March 31, 2011, the Company issued 456,119 shares of its common stock of which 356,119 shares were issued in the cashless exercises of 400,000 warrants and 100,000 shares of common stock were issued through an exercise by a Director of 100,000 warrants at a price of $0.01 per share.

Warrants

As indicated in Note 9, the Company issued warrants to eight investors to purchase a total of 4,000,000 shares of the Company’s common stock at a price of $0.25 per share. The warrants expire at various dates through February 2015.

In March 2012, the Company agreed to modify the terms of warrants granted to a consultant under a new agreement that replaced a prior agreement in June 2011 to purchase 1,000,000 shares of the Company's common stock. Under the modified terms, the exercise price was reduced from $0.80 per share to $0.40 per share and the expiration date of the warrants was extended from June 14, 2014 to December 14, 2014. The Company recognized consultant’s compensation expense during the period of $53,600 on the modification.

SINGLE TOUCH SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Options

During the six months ended March 31, 2012, the Company granted options to a director to purchase 200,000 shares of the Company’s common stock at $0.225 per share. The Company valued the options at $6,410 using a Binomial Option model based upon an expected life of 5 years, risk free interest rate of 0.90%, and expected volatility of 102.42%. At the date of grant, the Company’s common stock had a trading price of $0.22 per share. The Company is charging the $6,410 to operations as compensation expense based upon the vesting of the respective options.

During the six months ended March 31, 2012, the Company recognized stock based compensation of $46,112 on the vesting of 1,000,000 options including the 200,000 options issued to the above indicated director.

A summary of outstanding stock warrants and options is as follows:

|

Weighted

|

||||||||

|

Number of

|

Average

|

|||||||

|

Shares

|

Exercise Price

|

|||||||

|

Outstanding - October 1, 2011

|

49,810,986 | $ | 0.81 | |||||

|

Granted

|

4,200,000 | 0.25 | ||||||

|

Exercised

|

(500,000 | ) | 0.08 | |||||

|

Forfeited

|

(510,811 | ) | (0.08 | ) | ||||

|

Outstanding – March 31, 2012

|

53,000,175 | $ | 0.77 | |||||

|

Exercisable – March 31, 2012

|

37,350,175 | $ | 0.77 | |||||

In addition, at March 31, 2012, the Company has $2,062,219 of debt and accrued interest outstanding that is convertible into 4,124,438 shares of the Company’s common stock.

13. Commitments and Contingency

Operating Leases

The Company leases office space in Encinitas, California; Rogers, Arkansas; Jersey City, New Jersey; and Boise, Idaho. The Encinitas lease expires on May 31, 2013. The Rogers office is leased for a term of five years, effective January 1, 2012. The Boise lease expires on October 14, 2012. The Jersey City lease expires on June 30, 2016 and the Company has the option to lease the Jersey City offices for an additional five years. In addition to paying rent, the Company is also required to pay its pro rata share of the property’s operating expenses. Rent expense for the three months ended March 31 2012 and 2011 was $53,145 and $28,286, respectively. Rent expense for the six months ended March 31 2012 and 2011 was $98,436 and $57,989, respectively. Minimum future rental payments under non-cancellable operating leases with terms in excess of one year for the next five years and in the aggregate are:

|

Year Ending March 31,

|

||||

|

2013

|

$ | 152,190 | ||

|

2014

|

154,209 | |||

|

2015

|

156,889 | |||

|

2016

|

159,591 | |||

|

2017

|

63,398 | |||

| $ | 686,277 | |||

Licensing Fee Obligations

The Company has entered into various licensing agreements that require the Company to pay fees to the licensors on revenues earned by the Company utilizing the related license. The amounts paid on each license vary depending on the terms of the related license.

14. Subsequent Events

In April 2012, a consultant exercised 200,000 warrants for $16,000 in cash.

In May 2012, an investor exercised 1,000,000 warrants for $250,000 in cash.

Item 2 - Management's Discussion and Analysis of Financial Condition and Results of Operations

The following Management's Discussion and Analysis should be read in conjunction with Single Touch's financial statements and the related notes thereto. The Management's Discussion and Analysis contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements in this Report on Form 10-Q. The Company’s actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors. The Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this Report on Form 10-Q.

The following discussion should be read in conjunction with our unaudited consolidated financial statements and related notes and other financial data included elsewhere in this report. See also the notes to our consolidated financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in our Annual Report on Form 10-K for the year ended September 30, 2011.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. We have identified the following accounting policies that we believe are key to an understanding of our financial statements. These are important accounting policies that require management’s most difficult, subjective judgments.

Revenue Recognition

Revenue is recognized in accordance with Staff Accounting Bulletin (“SAB”) No. 101, Revenue Recognition in Financial Statements, as revised by SAB No. 104. As such, the Company recognizes revenue when persuasive evidence of an arrangement exists, title transfer has occurred, the price is fixed or readily determinable and collectability is probable. Sales are recorded net of sales discounts.

Non-monetary Consideration Issued for Services

We value all services rendered and property exchanged for our common stock at the quoted price of the shares issued at date of issuance or at the fair value of the services rendered or property, whichever is more readily determinable. All other services or property provided in exchange for other non-monetary consideration are valued at either the fair value of the services or property received or the fair value of the consideration relinquished, whichever is more readily determinable.

Our accounting policy for equity instruments issued to consultants and vendors in exchange for goods and services follows the provisions of Accounting Standards Codification (“ASC’) Topic 505-50, “Equity Based Payments to Non Employees.” The measurement date for the fair value of the equity instruments issued is determined at the earlier of (i) the date at which a commitment for performance by the consultant or vendor is reached or (ii) the date at which the consultant or vendor’s performance is complete. In the case of equity instruments issued to consultants, the fair value of the equity instrument is recognized over the term of the consulting agreement. In accordance with ASC Topic 505, an asset acquired in exchange for the issuance of fully-vested, non-forfeitable equity instruments should not be presented or classified as an offset to equity on the grantor’s balance sheet once the equity instrument is granted for accounting purposes. Accordingly, we record the fair value of non-forfeitable common stock issued for future consulting services as prepaid services in our consolidated balance sheet.

Conventional Convertible Debt

When the convertible feature of the conventional convertible debt provides for a rate of conversion that is below market value at issuance, this feature is characterized as a beneficial conversion feature (“BCF”). We record a BCF as a debt discount pursuant to ASC Topic 470-20, “Debt with Conversion and Other Options.” In those circumstances, the convertible debt will be recorded net of the discount related to the BCF. We amortize the discount to interest expense or equity (if the debt is due to a related party) over the life of the debt using the effective interest method.

Software Development Costs

We account for our software development costs in accordance with ASC Topic 985-20, “Cost of Software to be Sold, Leased, or Otherwise Marketed.” Under ASC Topic 985-20, we expense software development costs as incurred until we determine that the software is technologically feasible. Once we determine that the software is technologically feasible, we amortize the costs capitalized over the expected useful life of the software.

Fair Value Measurement

The Company complies with the provisions of ASC No. 820-10, “Fair Value Measurements and Disclosures.” ASC 820-10 relates to financial assets and financial liabilities. ASC 820-10 defines fair value, establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (“GAAP”), and expands disclosures about fair value measurements. The provisions of this standard apply to other accounting pronouncements that require or permit fair value measurements and are to be applied prospectively with limited exceptions.

ASC 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820-10 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions, about market participant assumptions, that are developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under ASC 820-10 are described below:

Level 1. Valuations based on quoted prices in active markets for identical assets or liabilities that an entity has the ability to access.

Level 2. Valuations based on quoted prices for similar assets or liabilities, quoted prices for identical assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable data for substantially the full term of the assets or liabilities.

Level 3. Valuations based on inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Overview

Single Touch Systems Inc. is an innovative mobile media solutions provider serving retailers, advertisers and brands. Through patented technologies and a modular, adaptable platform, our multi-channel messaging gateway enables marketers to reach consumers on all types of connected devices, with information that engages interest, drives transactions and strengthens relationships and loyalty.

Our solution is designed to drive return on investment for high-volume clients and/or customized branded advertisers. Our platform and tools are designed to enable large brands or anyone with substantial reach to utilize the mobile device as a new means to communicate. Communication might be in the form of a reminder message, a coupon, an advertisement or a voice call. Regardless of the form, our platform can drive value and cost savings for companies large and small, and we provide the ability to drive contextually relevant advertising messages to the right audience.

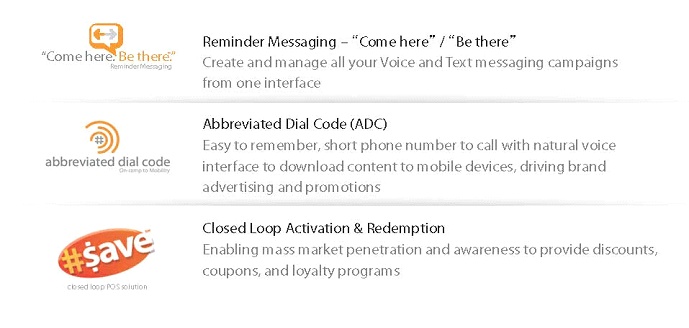

Our business has focused on leveraging our solution in the areas of messaging/notifications and Abbreviated Dial Codes. These solutions are to be enhanced by our deployment of imbedded advertisements, sponsorship and couponing.

“The vast mobile messaging industry worldwide, currently generating revenues in excess of USD 150 billion, and set to continue growing to more than USD 233 billion by 2014.” (1)

“Short Messaging Service, simply known as SMS, has established itself as the simplest, easiest and most economical means of personalized one-to-one communication – with SMS volume growth statistics attesting to its popularity.” (1)

“The performance of SMS over the last five years has been staggering and remains so mainly because it is cheap, easy to use, convenient, discreet and universally acceptable to some 4 billion consumers worldwide. SMS continues to grow in all markets.” (1) “In 2011 worldwide SMS traffic topped 8 trillion messages” (2)

|

(1)

|

Source: Portio Research Mobile Factbook 2011

|

|

(2)

|

Source: GSM Associates

|

We have developed and are deploying advertisements, sponsorships and couponing within our product offerings. This development is significant in that our per-message revenue increases significantly for each message that includes an advertisement or sponsorship. We see these expanded offerings, including those not based directly on messaging volume, as important steps in our continued program to creating both consumer and advertiser demand for our mobile media platform, accessing mobile notifications, advertisements, sponsorships, coupons and commerce transactions from the mobile phone.

Currently, over 90% of our revenues are paid to us through AT&T Services, Inc., and the bulk of that revenue comes from notifications sent on behalf of Walmart. These programs and related services continue to develop nationwide, and we continue to experience increasing activity in these programs that have caused our AT&T revenues to grow.

We have a portfolio of intellectual property relevant to our industry related to mobile search, commerce, advertising and streaming media. This portfolio represents our many years innovation in the wireless industry through patented technology developed by us as well as patented technology we purchased from Microsoft and others.

We have law firms engaged to protect our patented technology against unauthorized users and infringers. We have sent letters of notification to several companies making them aware of our patent portfolio and have commenced litigation. We will continue to identify, notify, and, where circumstances warrant, prosecute companies we believe may be infringing on the intellectual property protected by our growing patent portfolio.

As we expand operational activities, we may continue to experience operating losses and/or negative cash flows from operations and may be required to obtain additional financing to fund operations.

Throughout our history our operations have been constrained by our ability to raise funds, and our liquidity has been an ongoing issue. We have received debt and equity investments both from insiders and from private investors. We have always had negative cash flows from operations and net operating losses, although the size of the net operating losses has been magnified by a variety of non-cash accounting charges. As we expand operational activities, we may continue to experience operating losses and/or negative cash flows from operations and may be required to obtain additional financing to fund operations.

Our operating history makes predictions of future operating results difficult to ascertain. Our revenue is concentrated with a single customer. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in our stage of development. Such risks include, but are not limited to, an evolving business model and the management of growth. To address these risks we must, among other things, diversify our customer base, implement and successfully execute our business and marketing strategy, continue to develop and upgrade technology and products, respond to competitive developments, and attract, retain and motivate qualified personnel. There can be no assurance that we will be successful in addressing such risks, and the failure to do so can have a material adverse effect on our business prospects, financial condition and results of operations.

Results of Operations

Results of Operations for the Three Months Ended March 31, 2012 and March 31, 2011

During the three-month period ended March 31, 2012, the Company had an increase in revenue of approximately 51% over revenue generated during the same three-month period in the previous year ($1,554,823 in 2012 compared to $1,031,585 in 2011). The growth, all of which is organic, is attributable to continuing mobile adoption, new programs for existing and new client relationships. The Company’s net loss for the three months ended March 31, 2012 was $665,337. This is higher than the net loss incurred during three months ended March 31, 2011 of $431,788. The net loss of $665,337 incurred in 2012 included stock-based compensation of $68,606 for Consulting expense, part of General and Administrative expenses, and $163,604 of depreciation and amortization. The net loss of $431,788 incurred in 2011 included no stock-based compensation but did include $157,294 of depreciation and amortization. Net loss, excluding stock-based compensation and depreciation and amortization, was $433,127 in 2012 as compared to $274,494 in 2011. The increased loss reflects higher fixed costs in our second fiscal quarter within the fiscal year ending September 30, 2012 necessary to support the larger annual revenues.

We define Adjusted EBITDA as consolidated operating income before depreciation, amortization of intangible assets, stock-based compensation, and special charges. We use Adjusted EBITDA to evaluate the underlying performance of our business, and a summary of Adjusted EBITDA, reconciling GAAP amounts (i.e., items reported in accordance with U.S. Generally Accepted Accounting Principles) to Adjusted EBITDA amounts (i.e., items included within Adjusted EBITDA as defined directly above) for the three months ended March 31, 2012 and 2011 follows:

|

For the Three Months March 31,

|

||||||||||||||||||||||||||||||||||||||||

|

2012

|

2011

|

GAAP

|

Adjusted EBITDA

|

|||||||||||||||||||||||||||||||||||||

|

Adjust-

|

Adjusted

|

Adjust-

|

Adjusted

|

Change

|

Change

|

|||||||||||||||||||||||||||||||||||

|

GAAP

|

ments

|

EBITDA

|

GAAP

|

ments

|

EBITDA

|

$ | % | $ | % | |||||||||||||||||||||||||||||||

|

Revenue

|

||||||||||||||||||||||||||||||||||||||||

|

Wireless Applications

|

$ | 1,554,823 | $ | 1,554,823 | $ | 1,031,585 | $ | 1,031,585 | $ | 523,238 | 51 | % | $ | 523,238 | 51 | % | ||||||||||||||||||||||||

|

Operating Expenses

|

||||||||||||||||||||||||||||||||||||||||

|

Royalties and Application Costs

|

$ | 654,310 | $ | 654,310 | $ | 450,790 | $ | 450,790 | $ | 203,520 | 45 | % | $ | 203,520 | 45 | % | ||||||||||||||||||||||||

|

Research and Development

|

$ | 16,050 | $ | 16,050 | $ | 9,533 | $ | 9,533 | $ | 6,517 | 68 | % | $ | 6,517 | 68 | % | ||||||||||||||||||||||||

|

Compensation expense (including

|

||||||||||||||||||||||||||||||||||||||||

|

stock-based compensation)

|

$ | 679,961 | $ | 679,961 | $ | 326,839 | $ | 326,839 | $ | 353,122 | 108 | % | $ | 353,122 | 108 | % | ||||||||||||||||||||||||

|

Depreciation and amortization

|

$ | 163,604 | $ | (163,604 | ) | $ | - | $ | 157,294 | $ | (157,294 | ) | $ | - | $ | 6,310 | 4 | % | ||||||||||||||||||||||

|

General and administrative (including

|

||||||||||||||||||||||||||||||||||||||||

|

stock-based compensation)

|

$ | 577,778 | $ | (68,606 | ) | $ | 509,172 | $ | 506,497 | $ | 506,497 | $ | 71,281 | 14 | % | $ | 2,675 | 1 | % | |||||||||||||||||||||

| $ | 2,091,703 | $ | (232,210 | ) | $ | 1,859,493 | $ | 1,450,953 | $ | (157,294 | ) | $ | 1,293,659 | $ | 640,750 | 44 | % | $ | 565,834 | 44 | % | |||||||||||||||||||

|

Loss from Operations/Adjusted EBITDA

|

$ | (536,880 | ) | $ | 232,210 | $ | (304,670 | ) | $ | (419,368 | ) | $ | 157,294 | $ | (262,074 | ) | $ | (117,512 | ) | 28 | % | $ | (42,596 | ) | 16 | % | ||||||||||||||

Royalties and Application Costs represent the direct out-of-pocket costs associated with revenue. Royalties and Application Costs vary substantially in line with revenue and totaled $654,310 in 2012, compared to $450,790 in 2011, an increase of 45%. Because a portion of Royalties and Application Costs are fixed and all such costs are being monitored and reduced wherever possible, they grew at a lesser percentage than revenue.

Research and development expenses grew from $9,533 in 2011 to $16,050 in 2012, and compensation expense grew from $326,839 to $679,961. The former reflects the growing investment in technologies that we anticipate will generate revenues for years to come while the latter reflects the increased headcount necessary to support our expanding business.

General and Administrative expenses for the three months ended March 31, 2012 and 2011 both on a GAAP and on an Adjusted EBITDA basis, consist of the following:

|

For the Three Months Ended March 31,

|

|||||||||||||||||||||||||||||||||||||

|

2012

|

2011

|

GAAP

|

Adjusted EBITDA

|

||||||||||||||||||||||||||||||||||

|

Adjust-

|

Adjusted

|

Adjust-

|

Adjusted

|

Change

|

Change

|

||||||||||||||||||||||||||||||||

|

GAAP

|

ments

|

EBITDA

|

GAAP

|

ments

|

EBITDA

|

$ | % | $ | % | ||||||||||||||||||||||||||||

|

Professional Fees

|

$ | 181,818 | $ | (15,006 | ) | $ | 166,812 | $ | 171,197 | $ | 171,197 | $ | 10,621 | 6 | % | $ | (4,385 | ) | -3 | % | |||||||||||||||||

|

Travel

|

$ | 80,386 | $ | 80,386 | $ | 89,155 | $ | 89,155 | $ | (8,769 | ) | -10 | % | $ | (8,769 | ) | -10 | % | |||||||||||||||||||

|

Consulting expense

|

$ | 166,895 | $ | (53,600 | ) | $ | 113,295 | $ | 154,595 | $ | 154,595 | $ | 12,300 | 8 | % | $ | (41,300 | ) | -27 | % | |||||||||||||||||

|

Office rent

|

$ | 53,145 | $ | 53,145 | $ | 28,286 | $ | 28,286 | $ | 24,859 | 88 | % | $ | 24,859 | 88 | % | |||||||||||||||||||||

|

Insurance expense

|

$ | 31,894 | $ | 31,894 | $ | 19,854 | $ | 19,854 | $ | 12,040 | 61 | % | $ | 12,040 | 61 | % | |||||||||||||||||||||

|

Equipment lease

|

$ | - | $ | 22,500 | $ | 22,500 | $ | (22,500 | ) | -100 | % | $ | (22,500 | ) | -100 | % | |||||||||||||||||||||

|

Trade shows

|

$ | 3,995 | $ | 3,995 | $ | - | $ | 3,995 | $ | 3,995 | |||||||||||||||||||||||||||

|

Telephone

|

$ | 19,419 | $ | 19,419 | $ | 9,444 | $ | 9,444 | $ | 9,975 | 106 | % | $ | 9,975 | 106 | % | |||||||||||||||||||||

|

Office expense

|

$ | 9,862 | $ | 9,862 | $ | 846 | $ | 846 | $ | 9,016 | 1066 | % | $ | 9,016 | 1066 | % | |||||||||||||||||||||

|

Other

|

$ | 30,364 | $ | 30,364 | $ | 10,620 | $ | 10,620 | $ | 19,744 | 186 | % | $ | 19,744 | 186 | % | |||||||||||||||||||||

|

Total General and Administrative Expenses

|

$ | 577,778 | $ | (68,606 | ) | $ | 509,172 | $ | 506,497 |

$ -

|

$ | 506,497 | $ | 71,281 | 14 | % | $ | 2,675 | 1 | % | |||||||||||||||||

The diminution in Consulting expense on an Adjusted EBITDA basis, from $154,595 in 2011 to $113,295 in 2012, reflects management performing certain services previously outsourced. The elimination of the $22,500 Equipment Lease expense in 2011 reflects its being supplanted by the license in perpetuity as part of the Anywhere purchase from Soapbox Mobile, Inc. (Exhibit 10.1.1). The increases in Telephone, Office, and Other expenses reflect the additional headcount and office space necessary to support that headcount necessary for servicing and expanding our business.

Results of Operations for the Six Months Ended March 31, 2012 and March 31, 2011

Our revenues grew 54%, from $2,045,533 in 2011 to $3,144,496 in 2012. At the same time Royalties and Application Costs rose only 48%, from $959,355 to $1,417,631, over the same period. Scale economies, absorption of fixed-cost capacity, cost controls, and more premium revenue are translated into margin betterment.

|

For the Six Months Ended March 31,

|

||||||||||||||||||||||||||||||||||||||||

|

2012

|

2011

|

GAAP

|

Adjusted EBITDA

|

|||||||||||||||||||||||||||||||||||||

|

Adjust-

|

Adjusted

|

Adjust-

|

Adjusted

|

Change

|

Change

|

|||||||||||||||||||||||||||||||||||

|

GAAP

|

ments

|

EBITDA

|

GAAP

|

ments

|

EBITDA

|

$ | % | $ | % | |||||||||||||||||||||||||||||||

|

Revenue

|

||||||||||||||||||||||||||||||||||||||||

|

Wireless Applications

|

$ | 3,144,496 | $ | - | $ | 3,144,496 | $ | 2,045,433 | $ | - | $ | 2,045,433 | $ | 1,099,063 | 54 | % | $ | 1,099,063 | 54 | % | ||||||||||||||||||||

|

Operating Expenses

|

||||||||||||||||||||||||||||||||||||||||

|

Royalties and Application Costs

|