Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMEGA PROTEIN CORP | d355870d8k.htm |

1

Exhibit 99.1

Investor Presentation

May 2012 |

Forward Looking Statements

2

The statements contained in this presentation that are not historical facts are

forward-looking statements that involve a number

of

risks

and

uncertainties.

Forward-looking

information

may

be

based

on

projections,

predictions

and

estimates.

Some

statements

in

this

presentation

may

be

forward-looking

and

use

words

like

“may,”

“may

not,”

“believes,”

“do

not

believe,”

“expects,”

“do not expect,”

“anticipates,”

“do not anticipate,”

“see,”

“do not see,”

or other similar expressions.

The actual results of future events described in any of these forward-looking statements

could differ materially from those stated in the forward-looking statements.

Important factors that could cause actual results to be materially different from those

forward-looking statements include, among others: (1) the Company’s ability to meet its raw material requirements

through its annual menhaden harvest, which is subject to fluctuations due to natural

conditions over which the Company has no control, such as varying fish population, fish

oil yields, adverse weather conditions, natural and other disasters and disease; (2)

the impact of laws and regulations that may be enacted that may restrict the Company’s operations or the sale

of the Company’s products; (3) the impact of worldwide supply and demand relationships on

prices for the Company’s products; (4) the Company’s expectations regarding

demand and pricing for its products proving to be incorrect; (5) fluctuations in the

Company’s quarterly operating results due to the seasonality of the Company’s business and its deferral

of inventory sales based on worldwide prices for competing products; (6) the long-term

effect of the Deepwater Horizon oil spill on the Company’s business, operations

and fish catch; (7) the business, operations, potential or prospects for the

Company’s

subsidiaries,

Cyvex

Nutrition,

Inc.

and

InCon

Processing,

LLC,

the

dietary

supplement

market

or

the

human

health and wellness segment generally; and (8) the cost of compliance with existing and future

government regulations. Other factors are described in further detail in the

Company’s filings with the Securities and Exchange Commission, including its

reports on Form 10-K, Form 10-Q and Form 8-K. Some of the information presented is derived from third-party

sources. While we believe this information to be reliable, we have made no independent

investigation of these third-party sources or attempted to verify the veracity of

the third-party data in any way. |

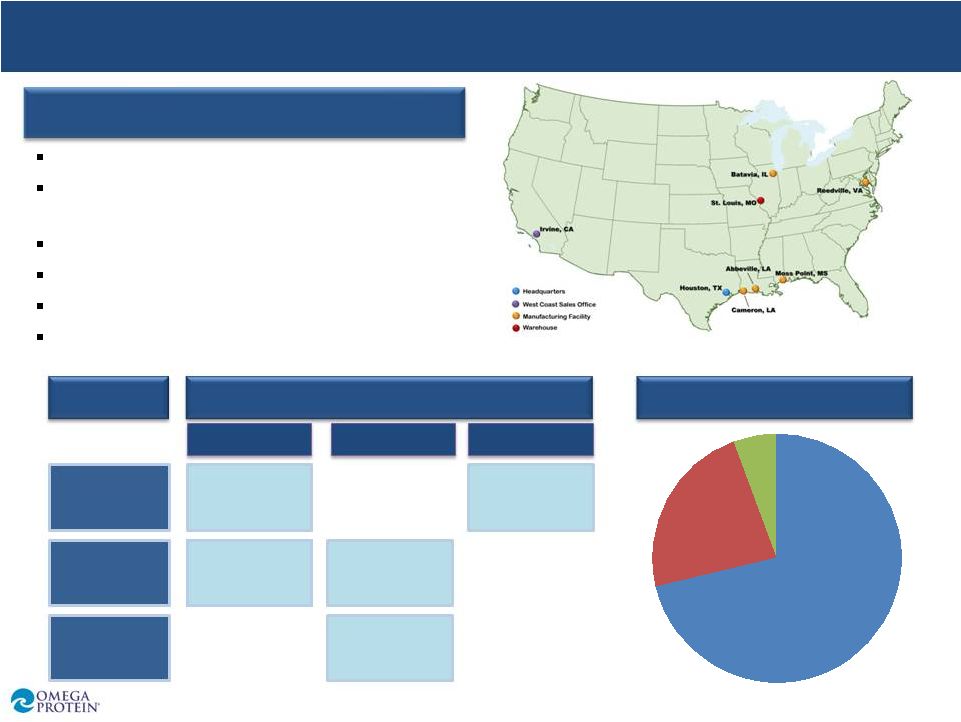

3

Nutritional Ingredient Company

USA’s leading vertically integrated producer

of Omega-3 and fish meal products

5 manufacturing facilities & 40+ vessels

$235mm Revenues (‘11)

23.2% Gross Margin (‘11)

NYSE: OME; Russell 3000 member

Key Facts

Animal

Human

Plant

Nutritional Market Segments

Dietary

Supplement

Ingredients

2011 Revenues

Fish Oil

Fish Oil

Fish Meal

Fish

Solubles

Products

Protein

Lipids

Other

Protein

71%

Lipids

23%

Other

6%

Company Overview |

Blue

Chip Customer Base 4 |

Global Distribution Network

5

Source: Omega Protein

Canada = 6%

U.S. = 34%

Latin America = 2%

Europe = 12%

Asia = 46%

2011 exports= 66% of sales

Percent of Sales |

Animal

Nutrition |

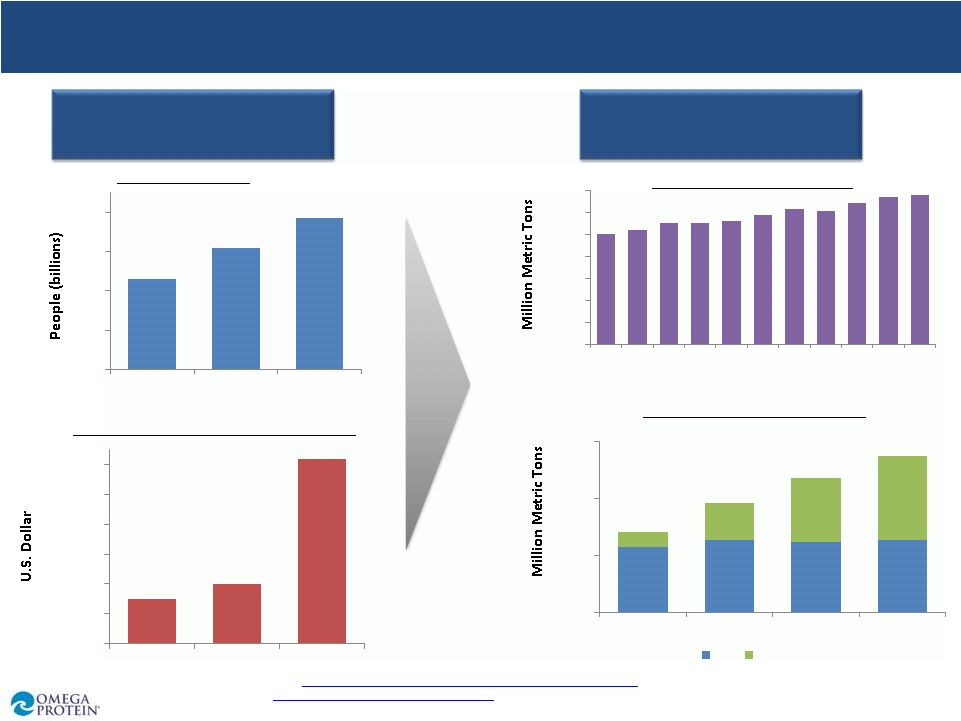

7

Growing Demand for Animal Nutrition

5.3

6.1

6.8

3.0

4.0

5.0

6.0

7.0

1990

2000

2010

World Population

$1,500

$2,000

$6,200

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

1990

2000

2010

40

50

60

70

80

90

100

110

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

World Pigmeat Production

0

50

100

150

1990

2000

2010

2020e

Fish Consumption & Sourcing

Wild

Aquaculture

Increasing Populations &

Standards of Living

Increasing Demand for

Pork and Aquaculture

Source: World Population- World Bank, 2011.

http://search.worldbank.org/data?qterm=population&language=EN&format=html;

Standards of Living- World Bank, 2011

http://data.worldbank.org/indicator/NY.GDP.PCAP.CD ; World Pigmeat and Fish Consumption- OECD-FAO Agricultural Outlook 2011-2020,

http://stats.oecd.org/OECDStat_Metadata/ShowMetadata.ashx?Dataset=HIGH_AGLINK_2011&ShowOnWeb=true&Lang=en

Developing Countries GDP per

Capita |

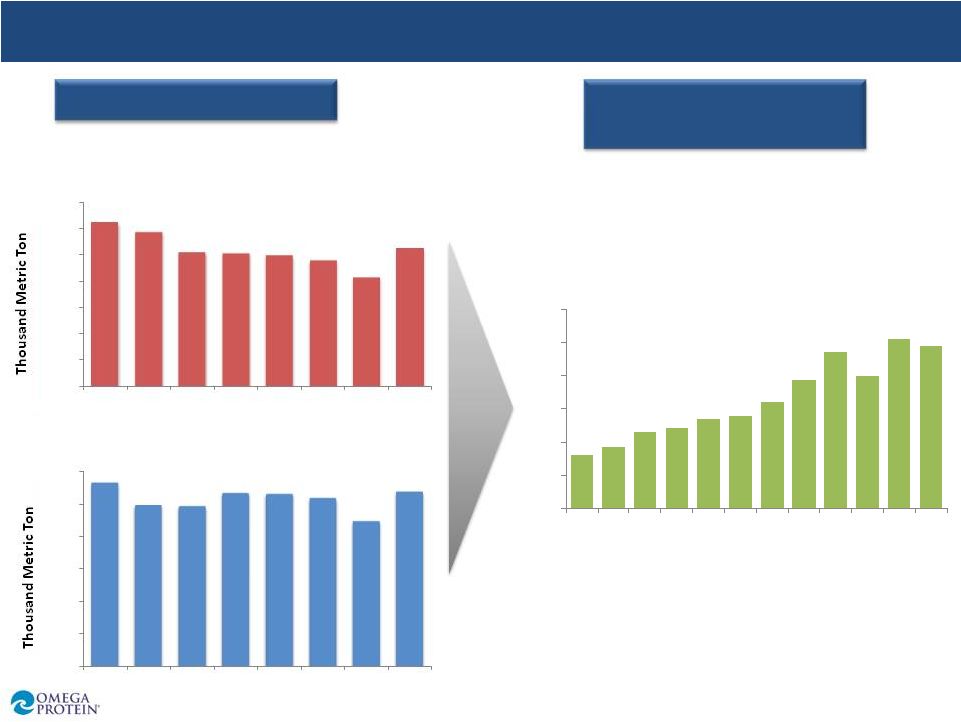

8

Supply not Keeping Pace with Demand

Global Fish Meal Production

Supply is Flat

$324

$373

$462

$488

$536

$559

$648

$778

$943

$801

$1,027

$979

$0

$200

$400

$600

$800

$1,000

$1,200

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Omega Protein Revenue per Ton* (U.S. Dollars) Source:

“Yearbook of Statistics 2011”, IFFO * Excludes human revenues.

Rising Demand + Flat

Supply = Rising Prices

6,226

5,868

5,092

5,052

4,972

4,775

4,134

5,207

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2004

2005

2006

2007

2008

2009

2010

2011

1,129

988

983

1,061

1,056

1,031

889

1,072

0

200

400

600

800

1,000

1,200

2004

2005

2006

2007

2008

2009

2010

2011

Global Fish Oil Production |

9

Animal Nutrition: Fish Meal

2011 End Use Of Fish Meal

Description

Protein ingredient for

animal feed

Considered a premium

protein source due to

digestibility and amino

acid profile

Customers

Aquaculture

Livestock

(primarily pigs)

Drivers

Aquaculture

43%

Dairy

6%

Pet

13%

Swine

37%

Other

1%

Growing demand for

seafood and pork

Global supply of fish meal

Price of alternate

proteins |

10

Animal Nutrition: Fish Oil

Description

Fat components of an

animal’s diet

Source of Omega-3s

Customers

Aquaculture is the

largest market

(primarily for salmon feed)

Drivers

Increasing demand for

seafood

Global supply of fish oil &

other cost-effective

Omega-3s

2011 End Usage of OME Fish Oil

Aquaculture

75%

Beef

6%

Industrial

1%

Pet

16%

Other

2% |

Human

Nutrition |

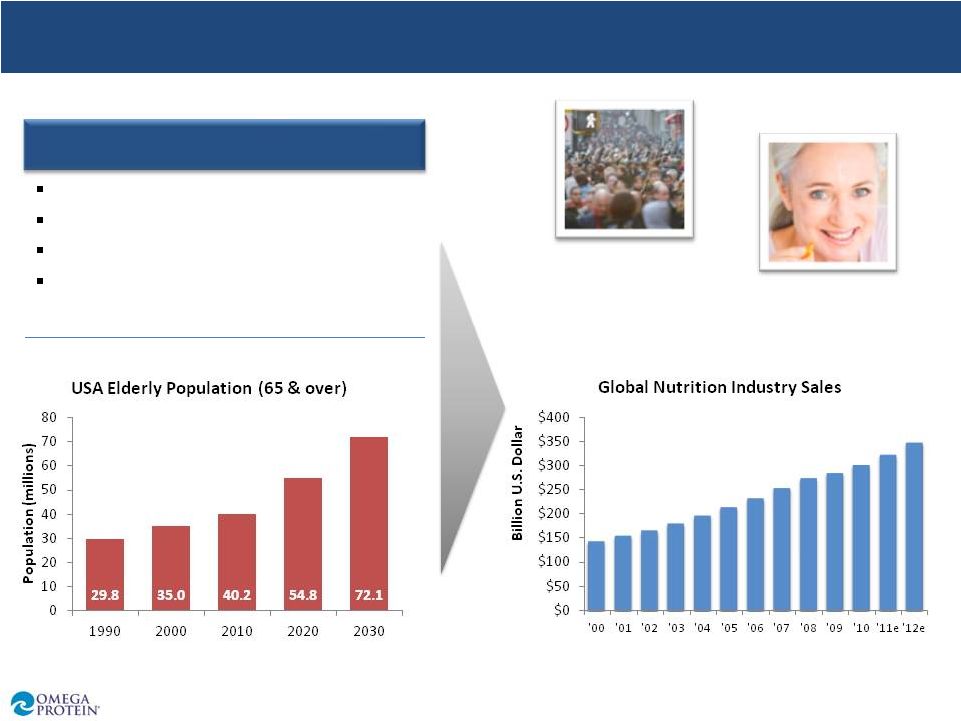

Source: U.S. Census

Bureau, Robert W. Baird & Co.. 12

Growing Demand for Human Nutrition

Growing populations

Increasing standards of living

Aging

Rising health care costs

Key Trends |

13

Human Nutrition: Nutraceuticals

Diverse set of dietary

supplement ingredients

Categories include

antioxidants, anti-aging,

cognitive health

Supplement

Manufacturers

Contract Manufacturers

Functional Food Markets

Interest in preventative

health

Focus on diet & nutrition

Awareness of nutritional

product benefits

Source: Nutrition Business Journal

Description

Customers

Drivers

U.S. Supplement Sales |

14

Human Nutrition: Fish Oil

Fish oil for dietary

supplements &

functional foods

Available in a variety of

specifications

Supplement

Manufacturers

Contract Manufacturers

Interest in preventative

health

Focus on diet & nutrition

Awareness of nutritional

product benefits

Source: “2010

Strategic

Analysis

of

the

Global

EPA

&

DHA

Omega-3

Ingredients

Market.”

Frost

&

Sullivan.

January

2011

Global Omega-3 Ingredient Sales

Description

Customers

Drivers |

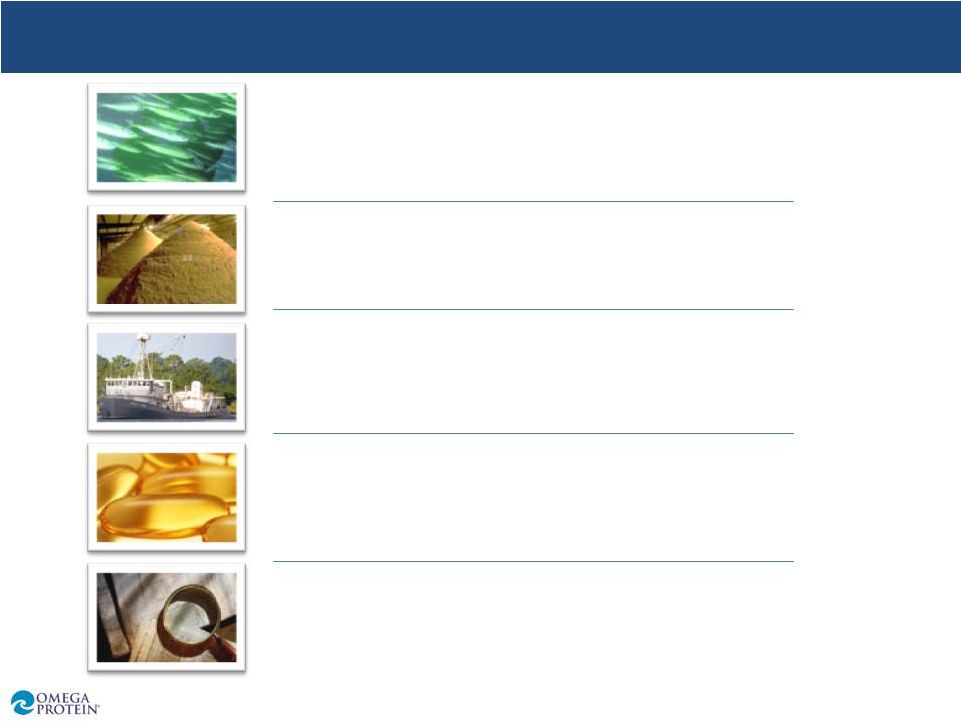

Uniquely Positioned in Omega-3 Supplements

15

Sustainable Fishery

49 vessels &

34 spotter planes

4 Manufacturing

Facilities

Refinery and

Molecular Distillation

Sales and Distribution:

Top Manufacturers

•

Traceable

supply

provides

additional

quality

assurance

–

USA’s only

vertically integrated supplier, and one of only a few in the world

•

Well-positioned to provide long-term supply arrangements

•

Ability to make “Made in the USA”

marketing claims

Omega Protein’s Value Proposition

Vertically Integrated: From Catch to Market

Acquired 2011

Acquired 2010

Legacy Business |

Growth & Financial

Growth & Financial |

17

Growth Initiatives

Strategic growth around existing core platform

Additional

Product

Lines

for existing

products

New customers

in existing

markets

Leverage

Customer

Relationships

Research &

Development

Production process

innovation &

efficiencies

•

Improve

benefits of

end products

•

Develop novel

new products

OME CORE

Knowledge of animal

and human nutrition

Expertise in proteins

& lipids

Distribution channels

& customer

relationships

New markets |

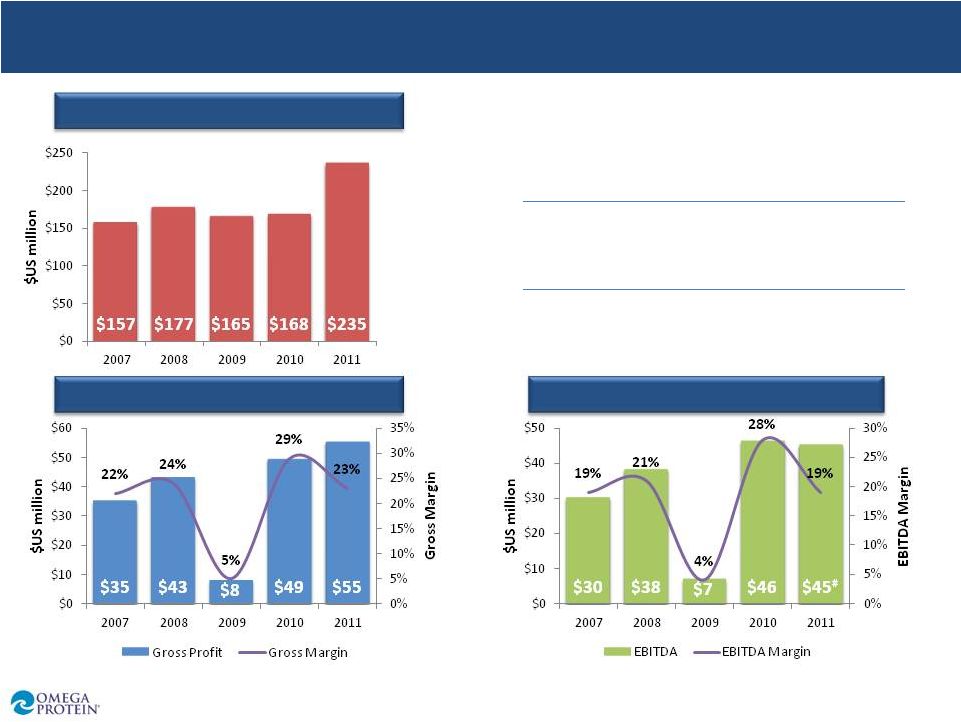

Income Statement Financial Highlights

18

Source: Omega Protein

* See Appendix 1 for a reconciliation for EBITDA to net income

# Excludes $26mm settlement related to Gulf of Mexico oil spill.

•

Strong industry fundamentals yield

healthy margins over time

•

Seasonal factors can create short-

term volatility

•

Strong cash flow generation

Gross Margin 2007-2011

Revenue 2007-2011

EBITDA 2007-2011* |

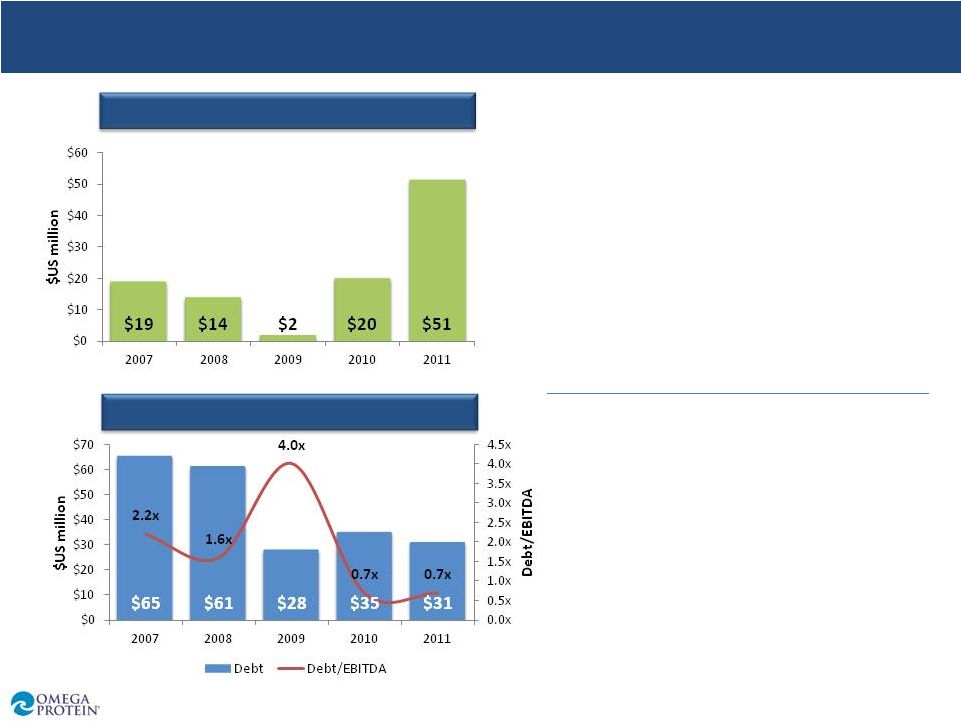

Balance Sheet Highlights

19

Source: Omega Protein

•

Strong balance sheet and ample

liquidity provide financial flexibility

•

Solid free cash flows generate

rising cash balances

Debt Balance 2007-2011

Cash Balance 2007-2011 |

OME

Investment Summary 20

Pure play on omega-3 fatty acids and high quality protein

ingredients

Benefits from increasing demand for nutritional ingredients

and stable global supply of fish meal and fish oil

Vertically integrated operations with significant barriers to

entry

Human nutrition-driven growth from expanded product

offerings and prudent acquisitions

Strong balance sheet with focus on creating shareholder

value |

Appendix I

21

2007

2008

2009

2010

2011

Net Income (loss)

12

13

(6)

18

34

Reconciling items:

Interest expense

5

4

4

2

2

Income tax provision (benefit)

7

7

(3)

10

18

Depreciation and amortization

13

13

13

15

16

Debt refinancing costs

3

-

-

-

-

Net loss on disposal of assets

-

1

1

1

2

GCCF, 2008 and 2005

hurricane settlements

(10)

-

(2)

-

(27)

Adjusted EBITDA

30

38

7

46

45

The following table provides a reconciliation of Adjusted EBITDA*, a non-GAAP (Generally

Accepted Accounting Principles) financial measure, to net income, the most directly

comparable financial measure calculated and presented in accordance with GAAP, for

fiscal years ended December 31, 2007, 2008, 2009, 2010 and 2011: |

Appendix I

22

*Adjusted EBITDA represents net income before interest expense, income tax, depreciation and

amortization, debt financing costs, net loss on disposal of assets, and the GCCF and

2008 and 2005 hurricane litigation settlements. The Company has reported Adjusted EBITDA because it

believes Adjusted EBITDA is a measure commonly reported and widely used by investors as an

indicator of a company's operating performance. The Company believes Adjusted EBITDA

assists such investors in comparing a company's performance on a consistent basis. Adjusted EBITDA is

not a calculation based on GAAP and should not be considered an alternative to net income in

measuring our performance or used as an exclusive measure of cash flow because it does

not consider the impact of working capital growth, capital expenditures, debt principal

reductions and other sources and uses of cash which are disclosed in our consolidated

statements of cash flows. Investors should carefully consider the specific items

included in our computation of Adjusted EBITDA. While Adjusted EBITDA has been disclosed herein to permit a more

complete comparative analysis of our operating performance relative to other companies,

investors should be cautioned that Adjusted EBITDA as reported by us may not be

comparable in all instances to Adjusted EBITDA as reported by other companies. Adjusted EBITDA amounts may

not be fully available for management's discretionary use, due to certain requirements to

conserve funds for capital expenditures, debt service and other commitments, and

therefore management relies primarily on our GAAP results. Adjusted EBITDA is not intended to represent net

income as defined by GAAP and such information should not be considered as an alternative to

net income, cash flow from operations or any other measure of performance prescribed by

GAAP in the United States. |