Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REPUBLIC AIRWAYS HOLDINGS INC | v313761_8k.htm |

Bank of America 2012 Global Transportation Conference May 17, 2012

Disclaimer Forward Looking Statements Statements in this presentation, as well as oral statements that may be made by officers or directors of Republic Airways Holdings Inc . , its advisors, affiliates or subsidiaries (collectively or separately the “Company”), that are not historical fact constitute “forward - looking statements” . Such forward - looking statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from historical results or from any results expressed or implied by the forward - looking statements . Such risks and uncertainties are outlined in the Company’s Annual Report on Form 10 - K, most recent Quarterly Report and other documents filed with the SEC from time to time . The Company cautions users of this presentation not to place undue reliance on forward - looking statements, which may be based on assumptions and anticipated events that do not materialize . 2

RJET Highlights 3 ▪ Competitive unit costs and stable operating margins on Republic’s fixed - fee business with predictable, long - term income stream on EJet aircraft and lower proportional exposure to 50 - seat aircraft ▪ Chautauqua restructuring program in 2012 targeting reductions in aircraft ownership and maintenance costs and putting grounded aircraft back to work in order to allow for long - term stability ▪ Successfully restructured Frontier leads to profitability in DEN and point - to - point opportunities for a transformed ULCC ▪ 2012 Financial results improving despite increase in fuel prices due to Frontier restructuring and mitigation of pro - rate losses ▪ Frontier separation transaction should provide some recovery on our investment and return both business segments to their core operations ▪ Competitor disruptions create growth opportunities for RJET ▪ Potential mainline scope changes also create new growth opportunities for Regional sector

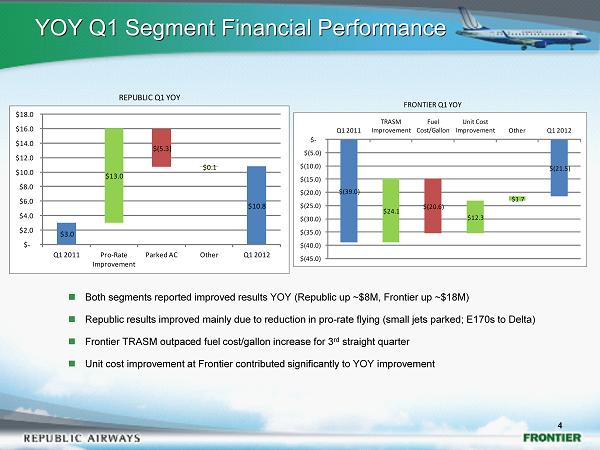

YOY Q1 Segment Financial Performance 4 Both segments reported improved results YOY (Republic up ~$8M, Frontier up ~$18M) Republic results improved mainly due to reduction in pro - rate flying (small jets parked; E170s to Delta) Frontier TRASM outpaced fuel cost/gallon increase for 3 rd straight quarter Unit cost improvement at Frontier contributed significantly to YOY improvement FRONTIER Q1 YOY $(39.0) $(21.5) $24.1 $(20.6) $12.3 $1.7 $(45.0) $(40.0) $(35.0) $(30.0) $(25.0) $(20.0) $(15.0) $(10.0) $(5.0) $ - Q1 2011 TRASM Improvement Fuel Cost/Gallon Unit Cost Improvement Other Q1 2012 REPUBLIC Q1 YOY $3.0 $10.8 $13.0 $(5.3) $0.1 $ - $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q1 2011 Pro - Rate Improvement Parked AC Other Q1 2012

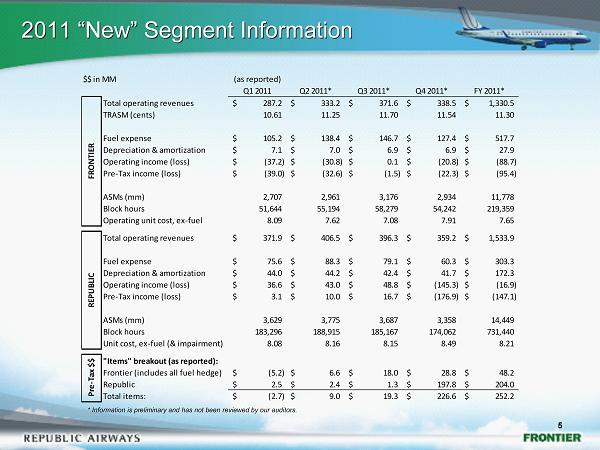

2011 “New” Segment Information 5 $$ in MM (as reported) Q1 2011 Q2 2011* Q3 2011* Q4 2011* FY 2011* Total operating revenues 287.2$ 333.2$ 371.6$ 338.5$ 1,330.5$ TRASM (cents) 10.61 11.25 11.70 11.54 11.30 Fuel expense 105.2$ 138.4$ 146.7$ 127.4$ 517.7$ Depreciation & amortization 7.1$ 7.0$ 6.9$ 6.9$ 27.9$ Operating income (loss) (37.2)$ (30.8)$ 0.1$ (20.8)$ (88.7)$ Pre-Tax income (loss) (39.0)$ (32.6)$ (1.5)$ (22.3)$ (95.4)$ ASMs (mm) 2,707 2,961 3,176 2,934 11,778 Block hours 51,644 55,194 58,279 54,242 219,359 Operating unit cost, ex-fuel 8.09 7.62 7.08 7.91 7.65 Total operating revenues 371.9$ 406.5$ 396.3$ 359.2$ 1,533.9$ Fuel expense 75.6$ 88.3$ 79.1$ 60.3$ 303.3$ Depreciation & amortization 44.0$ 44.2$ 42.4$ 41.7$ 172.3$ Operating income (loss) 36.6$ 43.0$ 48.8$ (145.3)$ (16.9)$ Pre-Tax income (loss) 3.1$ 10.0$ 16.7$ (176.9)$ (147.1)$ ASMs (mm) 3,629 3,775 3,687 3,358 14,449 Block hours 183,296 188,915 185,167 174,062 731,440 Unit cost, ex-fuel (& impairment) 8.08 8.16 8.15 8.49 8.21 "Items" breakout (as reported): Frontier (includes all fuel hedge) (5.2)$ 6.6$ 18.0$ 28.8$ 48.2$ Republic 2.5$ 2.4$ 1.3$ 197.8$ 204.0$ Total items: (2.7)$ 9.0$ 19.3$ 226.6$ 252.2$ FRONTIER REPUBLIC Pre-Tax $$ * Information is preliminary and has not been reviewed by our auditors.

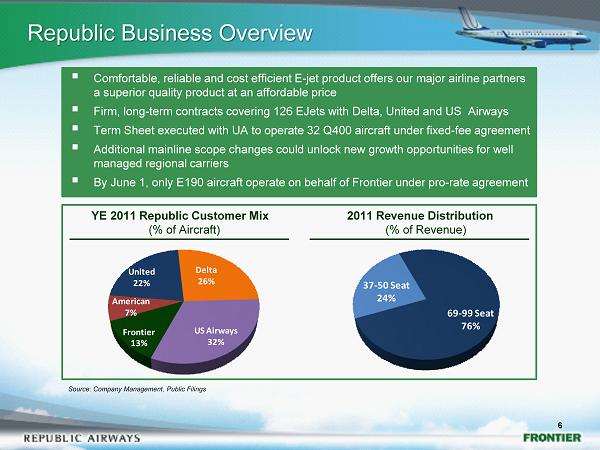

6 YE 2011 Republic Customer Mix (% of Aircraft) 2011 Revenue Distribution (% of Revenue) ▪ Comfortable, reliable and cost efficient E - jet product offers our major airline partners a superior quality product at an affordable price ▪ Firm, long - term contracts covering 126 EJets with Delta, United and US Airways ▪ Term Sheet executed with UA to operate 32 Q400 aircraft under fixed - fee agreement ▪ Additional mainline scope changes could unlock new growth opportunities for well managed regional carriers ▪ By June 1, only E190 aircraft operate on behalf of Frontier under pro - rate agreement Source: Company Management, Public Filings Republic Business Overview American 7% United 22% Delta 26% US Airways 32% Frontier 13% 37 - 50 Seat 24% 69 - 99 Seat 76%

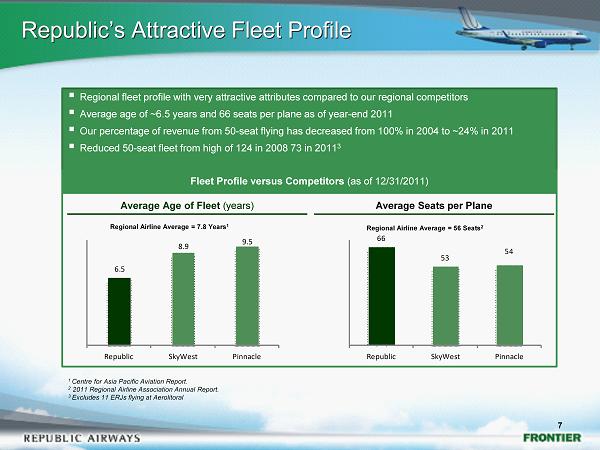

Republic’s Attractive Fleet Profile 7 Average Seats per Plane Fleet Profile versus Competitors (as of 12/31/2011) Average Age of Fleet (years) ▪ Regional fleet profile with very attractive attributes compared to our regional competitors ▪ Average age of ~6.5 years and 66 seats per plane as of year - end 2011 ▪ Our percentage of revenue from 50 - seat flying has decreased from 100% in 2004 to ~24% i n 2011 ▪ Reduced 50 - seat fleet from high of 124 in 2008 73 in 2011 3 1 Centre for Asia Pacific Aviation Report. 2 2011 Regional Airline Association Annual Report. 3 Excludes 11 ERJs flying at Aerolitoral Regional Airline Average = 7.8 Years 1 Regional Airline Average = 56 Seats 2 6.5 8.9 9.5 Republic SkyWest Pinnacle 66 53 54 Republic SkyWest Pinnacle

Regional Airline Pressures 8 ▪ Fixed - Fee agreement profitability has come under pressure in recent years due to increases in labor, healthcare and maintenance costs coupled with benign CPI - related rate adjustments ▪ Republic’s profitability has been consistently among the best in the regional airline segment; however, future Republic financial results may be negatively impacted by: » Costs associated with parking surplus ERJ aircraft » Prorate operations with Frontier Airlines » Costs associated with a new pilot labor agreement ▪ Republic and other regional carriers must develop new strategies to improve profitability and sustainability over the long - term ▪ Regional carriers still provide a value - added service to legacy carriers and fill a real need for domestic hub services to small and medium domestic markets Regional Airline Profits Have Come Under Pressure in Recent Years, However, Republic Remains Solidly Profitable

Mitigation of Under - Utilized Assets 9 ▪ During April we closed on subleases for 3 E170s to Aerolitoral » Represents the final 3 unassigned E170 aircraft removed from Frontier service » 2 Aircraft will be delivered in June and the 3rd in September ▪ Four Q400 Aircraft at Republic scheduled to be placed into fixed - fee agreement with UA in late 2012 ▪ Ongoing efforts to place 37 - 50 seat aircraft into replacement flying agreements to mitigate aircraft ownership costs and lease tail risk ▪ Success of this effort will be closely aligned to our success in restructuring our Chautauqua operating subsidiary

Chautauqua Restructuring Effort 10 ▪ As part of the Frontier restructuring, several 50 - seat aircraft were removed from service ▪ The ERJ aircraft are no longer producing positive cash flow; we took an impairment charge of $191 million in the 4th quarter of 2011 mainly to write - down the values on our 42 owned ERJ aircraft ▪ Aircraft obligations on our 84 ERJ aircraft have a remaining duration ranging from 2012 to 2020 ▪ CPA contract terms do not currently provide adequate coverage of these obligations ▪ As of March 31, we had 14 ERJ aircraft parked » 3 more ERJ aircraft will be removed from Frontier pro - rate by Jun 2012 » 8 CO ERJ aircraft scheduled to come out of service by Sep 2012 » 15 AA ERJ aircraft currently under agreement through Feb 2013 ▪ We have targeted $40 - $60 million of annual improvements in order to place small jets back into service with our legacy partners to cover the lease tail and debt obligations of the ERJ aircraft » Our restructuring efforts are underway and we believe our key stakeholders are fully engaged in the process

UA Q400 Term Sheet ▪ The Company has executed a term sheet with United to operate 32 Q400 aircraft (including 4 aircraft currently owned by Republic flying in pro - rate service with Frontier) over an average eight year period beginning in August 2012 » Capacity Purchase (“Fixed - Fee”) Agreement with industry standard pass - through costs (Fuel, AC ownership, Airport Costs, Insurance, etc…) » Aircraft would operate on the Republic Airline certificate and be reported in the Republic business segment » Term of aircraft leases coincide with term of CPA agreement (no tail risk) » Contingent upon execution of several key agreements, including certain maintenance contracts for expenses that are passed through to United » Aircraft are already financed; hence limited capital investment cost in this undertaking » We expect results to be accretive to earnings in Q4 2012 11

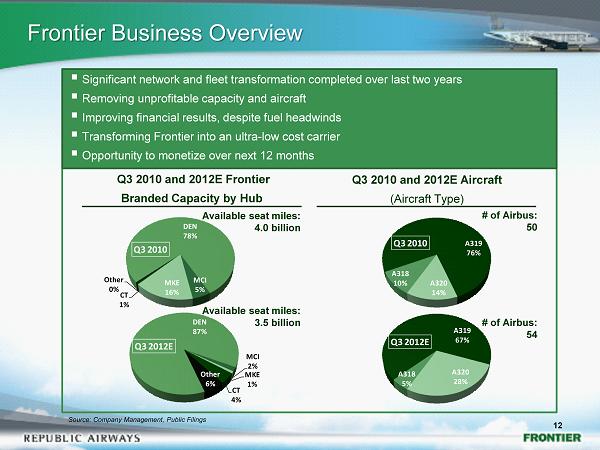

12 Q3 2010 and 2012E Frontier Branded Capacity by Hub Q3 2010 and 2012E Aircraft (Aircraft Type) ▪ Significant n etwork and fleet transformation completed over last two years ▪ Removing unprofitable capacity and aircraft ▪ Improving financial results, despite fuel headwinds ▪ Transforming Frontier into an ultra - low cost carrier ▪ O pportunity to monetize over next 12 months Source: Company Management, Public Filings Frontier Business Overview DEN 78% MCI 5% MKE 16% CT 1% Other 0% Q3 2010 DEN 87% MCI 2% MKE 1% CT 4% Other 6% Q3 2012E A318 5% A319 67% A320 28% Q3 2012E A318 10% A319 76% A320 14% Q3 2010 Available seat miles: 4.0 billion Available seat miles: 3.5 billion # of Airbus: 54 # of Airbus: 50

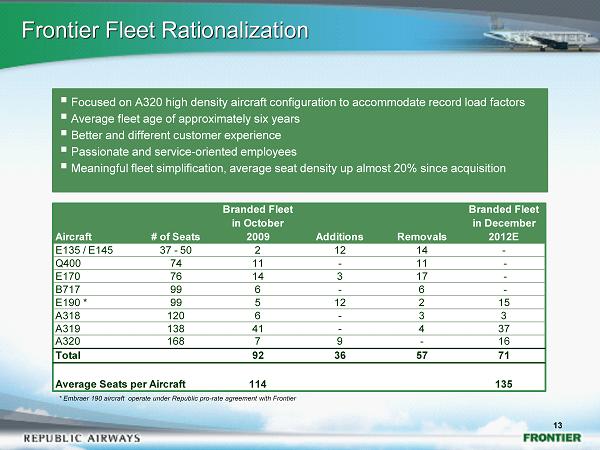

Frontier Fleet Rationalization 13 ▪ Focused on A320 high density aircraft configuration to accommodate record load factors ▪ Average fleet age of approximately six years ▪ Better and different customer experience ▪ Passionate and service - oriented employees ▪ Meaningful fleet simplification, average seat density up almost 20% since acquisition E135 / E145 37 - 50 2 12 14 - Q400 74 11 - 11 - E170 76 14 3 17 - B717 99 6 - 6 - E190 * 99 5 12 2 15 A318 120 6 - 3 3 A319 138 41 - 4 37 A320 168 7 9 - 16 Total 92 36 57 71 114 135 Branded Fleet in December 2012E Branded Fleet in October 2009 Average Seats per Aircraft Additions RemovalsAircraft # of Seats * Embraer 190 aircraft operate under Republic pro - rate agreement with Frontier

Frontier Separation Process 14 ▪ The Company has selected Barclays Capital as its advisor ▪ New executive management team in place, headed by former US Airways CEO, David Siegel ▪ The Company has made no determination as to the type of transaction (sale, partial sale, spin, etc…) ▪ The Company expects to have interest from a select group of private equity firms and/or strategic industry participants ▪ Agreements are in place between Republic and Frontier for pro - rate operations and administrative services ▪ Continuing restructuring work to push Frontier into the ultra - low cost carrier segment ▪ The Company has been actively hedging its remaining 2012 fuel consumption over the last several weeks with the recent dip in oil prices

Frontier Fleet News and Updates 15 ▪ Attractive fleet additions for future of Frontier » Well priced » First mover advantage » Limited financing risk » Low PDP requirements in the near term » Efficient engine maintenance secured ▪ Frontier A320 fleet to undergo seat modifications to add six seats to each aircraft by end of May 2012 » Lower CASM a benefit of modification to aircraft » Extra seats should produce close to $10M in additional revenue in 2012 ▪ Evaluating slimline seat purchase to enable an additional six seats to fleet in 2013: » A320 from 168 to 174 » A319 from 138 to 144 » A318s removed from fleet in 2013 80 NEO aircraft positions, starting in 2016

RJET Highlights 16 ▪ Competitive unit costs and stable operating margins on Republic’s fixed - fee business with predictable, long - term income stream on EJet aircraft and lower proportional exposure to 50 - seat aircraft ▪ Chautauqua restructuring program in 2012 targeting reductions in aircraft ownership and maintenance costs and putting grounded aircraft back to work in order to allow for long - term stability ▪ Successfully restructured Frontier leads to profitability in DEN and point - to - point opportunities for a transformed ULCC ▪ 2012 Financial results improving despite increase in fuel prices due to Frontier restructuring and mitigation of pro - rate losses ▪ Frontier separation transaction should provide some recovery on our investment and return both business segments to their core operations ▪ Competitor disruptions create growth opportunities for RJET ▪ Potential mainline scope changes also create new growth opportunities for Regional sector