Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - BPZ RESOURCES, INC. | a12-12471_18k.htm |

Exhibit 99.1

|

|

Boston & New York City Investor Meetings May 17 & 18, 2012 |

|

|

1 Forward Looking Statements www.bpzenergy.com NYSE & BVL: BPZ This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.These forward looking statements are based on our current expectations about our company, our properties, our estimates of required capital expenditures and our industry. You can identify these forward-looking statements when you see us using words such as "expect”, "will", "anticipate," "indicate," "estimate," "believes," "plans" and other similar expressions. These forward-looking statements involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward looking statements. Such uncertainties include the success of our project financing efforts, accuracy of well test results, well refurbishment efforts, successful production of indicated reserves, satisfaction of well test period requirements, successful installation of required permanent processing facilities, receipt of all required permits, results of seismic date acquisition efforts, and the successful management of our capital expenditures, the successful completion of a new drilling platform for the Corvina Field, and other normal business risks. We undertake no obligation to publicly update any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. We caution you not to place undue reliance on those statements. The U.S. Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only “reserves” that a company anticipates to be economically producible by application of development projects to known accumulations, and there exists or is a reasonable expectation there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project. We are prohibited from disclosing estimates of oil and gas resources that do not constitute such “reserves” in our SEC filings. We may use certain terms in this presentation such as “contingent” and “prospective” resources which imply the existence of quantities of resources which the SEC guidelines strictly prohibit U.S. publicly registered companies from including in reported reserves in their filings with the SEC. With respect to possible and probable reserves we are required to disclose the relative uncertainty of such classifications of reserves when they are included in our SEC filings, and investors are urged to consider closely the disclosure in our SEC filings, available from us at 580 Westlake Park Blvd., Suite 525, Houston, Texas 77079; Telephone: (281) 556-6200. These filings can also be obtained from the SEC via the internet at www.sec.gov. The definitions of Contingent and Prospective Resources have been excerpted from the Petroleum Resources Management System approved by the Society of Petroleum Engineers (SPE) Board of Directors, March 2007. Proved, Probable and Possible Reserves are denoted by P1, P2 and P3, respectively. Prospective resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective resources have both an associated chance of discovery and a chance of development. Prospective resources are further subdivided in accordance with the level of certainty associated with recoverable estimates assuming their discovery and development and may be sub-classified based on project maturity. Contingent resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations, but the applied project(s) are not yet considered mature enough for commercial development due to one or more contingencies. Contingent Resources may include, for example, projects for which there are currently no viable markets, or where commercial recovery is dependent on technology under development, or where evaluation of the accumulation is insufficient to clearly assess commerciality. Contingent Resources are further categorized in accordance with the level of certainty associated with the estimates and may be sub classified based on project maturity and/or characterized by their economic status. The volume and parameters associated with low, best and high estimates scenarios of contingent resources are referred to as 1C, 2C and 3C, respectively. The Company is aware that certain information concerning its operations and production is available from time to time from Perupetro, an instrumentality of the Peruvian government, and the Ministry of Energy and Mines (“MEM”), a ministry of the government of Peru. This information is available from the websites of Perupetro and MEM and may be available from other official sources of which the Company is unaware. This information is published by Perupetro and MEM outside the control of the Company and may be published in a format different from the format used by the Company to disclose such information, in compliance with SEC and other U.S. regulatory requirements. The Company provides such information in the format required, and at the times required, by the SEC and as determined to be both material and relevant by management of the Company. The Company urges interested investors and third parties to review the Company’s filing with the SEC before making an investment decision. Information obtained from other sources may not comply with the requirements of the SEC or management of the Company. Nothing herein shall be deemed to constitute an offer to sell, or the solicitation of an offer to buy, any securities of the Company. |

|

|

2 BPZ Energy in Peru www.bpzenergy.com NYSE & BVL: BPZ Focus Oil & Gas Four Blocks Working interests: Block Z-1: 51% * Onshore: 100% Acreage 2.2 million gross acres Current Production Corvina & Albacora ** Oil Fields Offshore Exploration Multiple Plays * JV partnership signed in April 2012, subject to Peruvian government approvals * * Albacora production achieved during testing |

|

|

3 More About Us www.bpzenergy.com NYSE & BVL: BPZ NYSE & BVL Ticker BPZ Market Capitalization (1) $ 390 MM Shares Outstanding 116 MM 2011 Proved Oil Reserves (2) 35 MMBO 2011 Avg. Daily Production (3) 3,775 BOPD gross 1Q 2012 Avg. Daily Production 3,880 BOPD gross 2012 Capital & Exploratory Budget $ 130 MM Full Year 2011: Revenues $ 144 MM Operating Loss $ 12 MM EBITDAX (4) $ 52 MM Share Ownership: Insider 12% Institutional 70% Notes: (1) Approximate as of May 9, 2012. (2) Estimates are for 100% of Block Z-1 reserves as of 12/31/11 based on Netherland Sewell & Associates (NSAI) report. (3) Production numbers are for 100% of Block Z-1 production during 2011 and 2012. (4) EBITDAX is a non-GAAP measure. The Appendix slide to this presentation contains a reconciliation of EBITDAX to the Company’s net income (loss), which is the most directly comparable financial measure calculated in accordance with Generally Accepted Accounting Principles (GAAP) in the United States of America. |

|

|

4 Strengthening the Foundation www.bpzenergy.com NYSE & BVL: BPZ Installed reinjection equipment on the Albacora platform Implemented gas cap reinjection at Corvina with positive results Artificial lift programs in both fields Fabrication of the new CX-15 platform underway Completed seismic interpretation of new data on Blocks XXII & XXIII Acquisition of 3-D seismic survey in Block Z-1 Obtained $115 million of financings Listed common shares on the Bolsa de Valores in Lima Continued team transformation with new Chief Financial Officer Appointed two new independent Board Directors Finalized the strategic partnering process on offshore Block Z-1 |

|

|

5 Oil Reserve History www.bpzenergy.com NYSE & BVL: BPZ Note: Represent 100% of Block Z-1 Proved, Probable and Possible reserves for 2009-2011. On December 31, 2008, the SEC adopted the final rules regarding amendments to current Oil and Gas reporting requirements. The amendments were designed to modernize and update the oil and gas disclosure requirements to align them with current practices and changes in technology and included enabling companies to additionally disclose their probable and possible reserves. MMBO |

|

|

6 2012 Key Initiatives www.bpzenergy.com NYSE & BVL: BPZ Achieving commerciality at Albacora oil field Optimizing oil production via reservoir management and artificial lift Developing 23 MMBO of Corvina PUDs from new CX-15 platform Exploring onshore and offshore Unlocking asset value |

|

|

7 Achieving Commerciality at Albacora www.bpzenergy.com NYSE & BVL: BPZ Steps to Commerciality Equipment placed on platform Installation and tie-ins complete Testing complete Extension of flaring permits received Final permit to commission equipment |

|

|

Optimizing Oil Production 8 www.bpzenergy.com NYSE & BVL: BPZ Corvina Field Gas cap reinjection underway Reservoir performance shows marked improvement Continue artificial lift program Albacora Field A-14XD well producing oil naturally Continue artificial lift program |

|

|

The New CX-15 Platform 9 www.bpzenergy.com NYSE & BVL: BPZ First Buoyant Tower in Peru $77 MM project cost 24 slots Production and reinjection equipment already included CX-15 and CX-11 platforms connected via 4 subsea pipelines Anticipated drilling every 6-8 weeks $10 MM-$12 MM drill costs per well 1,000 -1,500 bopd average range projected for initial production rates Gas reinjection wells for pressure maintenance |

|

|

Developing Corvina’s 23 MMBO of PUDs 10 www.bpzenergy.com NYSE & BVL: BPZ The New CX-15 Platform Contracts for fabrication signed and work underway Transport and install new platform in 3Q 2012 Commence New CX-15 drilling campaign 4Q 2012 Hull Top Section Cellar Deck Production Deck |

|

|

Exploring Onshore Blocks 11 Blocks XIX & XXIII Mancora Gas, Heath & Eocene Oil 3D Seismic EIA for Block XIX Conduct 3-D seismic on Block XIX 2-D and 3-D seismic interpretations completed on Block XXIII Drilling EIA approval for Block XXIII Drill exploration commitments Launch Partnering Process Block XXII Adjacent to Existing Oil Fields 2-D seismic completed Interpretation completed Drilling EIA approval Drill exploration commitment www.bpzenergy.com NYSE & BVL: BPZ |

|

|

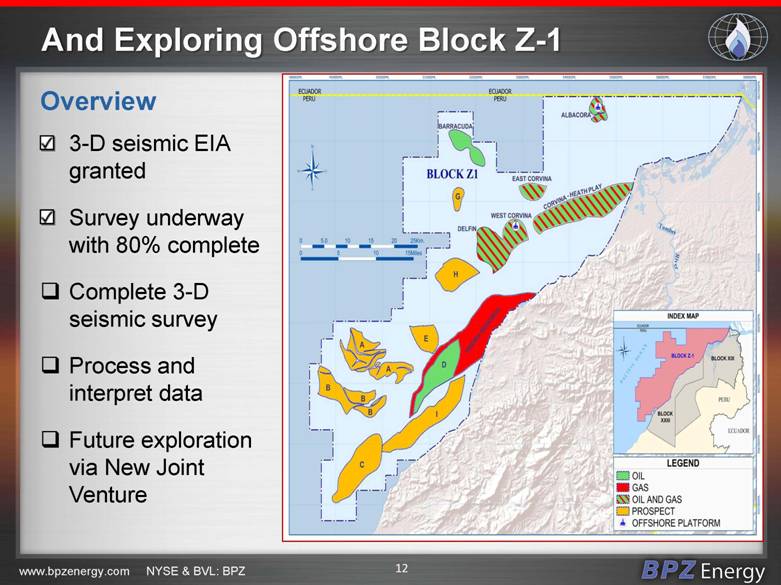

And Exploring Offshore Block Z-1 Overview 3-D seismic EIA granted Survey underway with 80% complete Complete 3-D seismic survey Process and interpret data Future exploration via New Joint Venture 12 www.bpzenergy.com NYSE & BVL: BPZ |

|

|

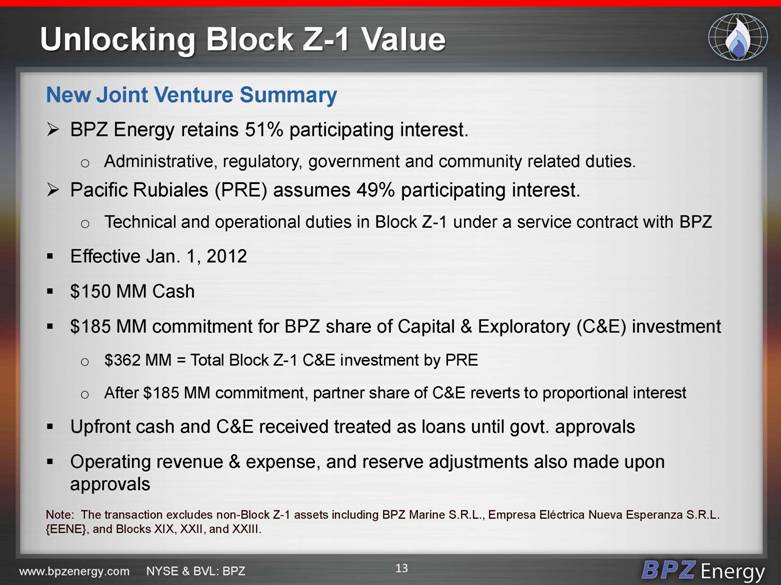

Unlocking Block Z-1 Value 13 www.bpzenergy.com NYSE & BVL: BPZ New Joint Venture Summary BPZ Energy retains 51% participating interest. Administrative, regulatory, government and community related duties. Pacific Rubiales (PRE) assumes 49% participating interest. Technical and operational duties in Block Z-1 under a service contract with BPZ Effective Jan. 1, 2012 $150 MM Cash $185 MM commitment for BPZ share of Capital & Exploratory (C&E) investment $362 MM = Total Block Z-1 C&E investment by PRE After $185 MM commitment, partner share of C&E reverts to proportional interest Upfront cash and C&E received treated as loans until govt. approvals Operating revenue & expense, and reserve adjustments also made upon approvals Note: The transaction excludes non-Block Z-1 assets including BPZ Marine S.R.L., Empresa Eléctrica Nueva Esperanza S.R.L. {EENE}, and Blocks XIX, XXII, and XXIII. |

|

|

JV = Catalyst for Value Creation 14 www.bpzenergy.com NYSE & BVL: BPZ Current and Future Benefits Partnership with PRE already underway! Enhanced operational, technical and financial support Cash advances to BPZ ongoing before government approvals BPZ share of 2012, 2013, and some, if not all of 2014 Block Z-1 capital and exploratory investments expected to be funded Partnership helps accelerate exploration & development of Block Z-1 35 MM Proved Oil Reserves; New CX-15 Platform to develop 23 MM PUD Reserves in Block Z-1 59 MM Probable Oil Reserves and 55 MM of Possible Oil Reserves New 3D seismic data on several prospects and leads |

|

|

Corporate & Social Responsibility 15 www.bpzenergy.com NYSE & BVL: BPZ Investing with Social Inclusion |

|

|

Catalysts for Growth 16 www.bpzenergy.com NYSE & BVL: BPZ |

|

|

Conclusion 17 The BPZ team will be recognized for excellence in exploring, developing and producing oil and gas in the Americas. For additional information please contact: A. Pierre Dubois Investor Relations & Corporate Communications BPZ Energy 580 Westlake Park Blvd., Suite 525 Houston, Texas 77079 (281) 752-1240 pierre_dubois@bpzenergy.com www.bpzenergy.com NYSE & BVL: BPZ Manolo Zúñiga President & CEO BPZ Energy |

|

|

Appendix – GAAP Reconciliation 18 Reconciliation of non-GAAP measure The table below represents a reconciliation of EBITDAX to the Company’s net income (loss), which is the most directly comparable financial measure calculated in accordance with generally accepted accounting principles in the United States of America. Earnings before interest, income taxes, depletion, depreciation and amortization, exploration expense and certain non-cash charges (“EBITDAX”) is a non-GAAP financial measure, as it excludes amounts or is subject to adjustments that effectively exclude amounts, included in the most directly comparable measure calculated and presented in accordance with GAAP in financial statements. “GAAP” refers to generally accepted accounting principles in the United States of America. Non-GAAP financial measures disclosed by management are provided as additional information to investors in order to provide them with an alternative method for assessing the Company’s financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Pursuant to the requirements of Regulation G, whenever the Company refers to a non-GAAP financial measure, it also presents the most directly comparable financial measure presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure and such comparable GAAP financial measure. Management believes that EBITDAX may provide additional helpful information with respect to the Company’s performance or ability to meet its debt service and working capital requirements. www.bpzenergy.com NYSE & BVL: BPZ $ 38,768 $ 51,767 EBITDAX - 2,046 Loss on derivatives 12,889 - Other expense 32,778 13,082 Dry hole costs 19,107 9,315 Geological, geophysical and engineering expense 33,755 38,944 Depreciation, depletion and amortization expense (11,608) 2,435 Income tax expense (benefit) 11,618 19,772 Interest expense $ (59,771) $ (33,827) Net loss (in thousands) 2010 2011 Twelve Months Ended December 31, |

|

|

Appendix - JV Approval Process 19 www.bpzenergy.com NYSE & BVL: BPZ Approval Up to 12 month process expected Review by Perupetro, Ministry of Energy and Mines, Ministry of Economy and Finance as well as President of Peru. Non-approval If BPZ existing Bank Loans are not fully repaid by the termination date, BPZ repays PRE based on: Quarterly repayment schedule to PRE of $4 MM plus accrued interest Interest Rate at Libor + 9%, Earliest first repayment date Oct. 2013 After Bank Loans are fully repaid: Quarterly repayment schedule to PRE of $10 MM plus accrued interest Plus payments of 49% of cash flow for preceding quarter minus $10 MM (49% of cash flow if BPZ would still have a minimum cash balance of $40 MM) Payments continue until all amounts due have been repaid Note: Please also refer to all documents filed with the SEC in association with the joint venture transaction. |