Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BOYD GAMING CORP | d355494d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - BOYD GAMING CORP | d355494dex21.htm |

| EX-99.3 - RECONCILIATIONS - BOYD GAMING CORP | d355494dex993.htm |

| EX-99.1 - PRESS RELEASE - BOYD GAMING CORP | d355494dex991.htm |

| EX-10.1 - COMMITMENT LETTER - BOYD GAMING CORP | d355494dex101.htm |

| EX-10.2 - COMMITMENT LETTER - BOYD GAMING CORP | d355494dex102.htm |

Boyd

Gaming’s Acquisition of Peninsula Gaming

Delivering Growth and Financial Strength

May 16, 2012

1

Exhibit 99.2 |

Transformative

Transaction 2

•

High quality assets with significant growth potential

•

Attractive purchase multiple of ~7.0x

•

Accretive to EPS and cash flow in first year

•

Increases scale and strengthens financial profile

•

Attractive markets located in strongest region in domestic gaming industry

•

Limited competition, stable tax and regulatory environments, resulting in high EBITDA

margins

Expands Scale, Diversifies Company, Strengthens Financial Profile

|

Acquisition

Overview 3

Acquisition:

•

Peninsula Gaming (SEC Publicly Registered Company)

•

Owner and operator of five locals-oriented gaming properties in Iowa

(2),

Louisiana (2) and Kansas (1)

•

Recently opened the Kansas Star Casino in Mulvane, KS (December 2011)

Transaction

Value:

•

Total purchase price: $1.45 billion

•

Acquisition multiple of ~7.0x based on consolidated EBITDA of $206 million (including

Peninsula’s corporate expense)

•

LTM property EBITDA (excl. Kansas) of $109 million, plus annualized Q1 2012

Kansas EBITDA of $107 million

(1)

, less $10 million of corporate expenses

Purchase

Consideration:

•

Of the total $1.45 billion purchase price, the total cash consideration paid by Boyd is

$200 million

•

The remaining consideration comes in the form of:

•

Approximately $1.1 billion of net debt at Peninsula

•

Approximately $144 million Seller Note provided by Peninsula

Expected

Closing:

•

Q3 / Q4 2012

1)

Annualized Kansas Star EBITDA of $107 million calculated as Q1 2012 EBITDA of $26.8

million multiplied by four quarters of pro forma operations.

|

4

1)

Industry peers include ASCA, PENN and PNK.

Strategic Rationale

High Quality

Assets

in

Protected

Markets

•

Acquiring a high margin and high return business

•

Peninsula LTM EBITDA margin of 33.4% is well above its industry peers average of 26.7%

(1)

•

Peninsula operates in low promotional and gaming tax environments resulting in high EBITDA

margins with modest capital expenditure requirements

Further

Jurisdictional

Diversification

•

Upon closing, Boyd will expand into two new jurisdictions with gaming operations in eight

states •

Increases relative importance of the Midwest and South regions, providing stability to earnings

while maintaining upside potential in a Las Vegas recovery

Near-Term

Identified

Growth Catalyst

•

The Kansas Star Casino is a near and long-term growth opportunity

•

Generated property EBITDA of $26.8 million in Q1 2012

Attractive

Valuation

•

Pure-play Midwest and regional gaming comparables currently trade at a multiple of

roughly

7.0 to 8.0x versus the acquisition multiple of ~7.0x

High

Free Cash Flow

•

The acquisition has the potential to significantly increase free

cash flow by over $70 million, which

increases return on equity, strengthens the balance sheet and will accelerate

deleveraging Revenue

Opportunities

•

Additional

revenue

opportunities

through

expanding

the

“B

Connected”

loyalty

program

to

Peninsula’s

customers |

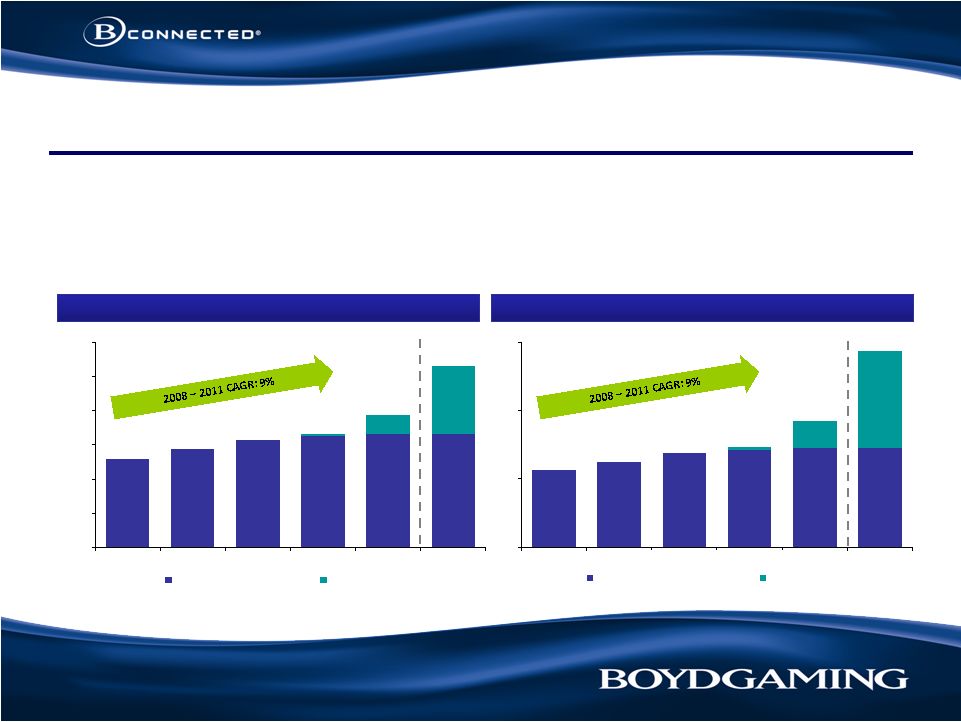

$84

$107

$109

$109

$30

$107

$84

$94

$103

$110

$139

$216

$94

$103

$3

0

75

150

$225

2008

2009

2010

2011

LTM 3/31/12

Annualized

Property EBITDA (excl. Kansas)

Kansas EBITDA

$259

$326

$330

$330

$56

$201

$259

$286

$315

$332

$387

$531

$286

$315

$6

0

100

200

300

400

500

$600

2008

2009

2010

2011

LTM 3/31/12

Annualized

Net Revenue (excl. Kansas)

Kansas Net Revenue

Peninsula Gaming Overview

5

Source: Public filings.

1)

Excludes corporate expenses.

2)

Represents Q1 2012 Kansas Star results annualized for a full year of operations plus

LTM 3/31/12 results of Peninsula’s other properties.

•

Locals-oriented gaming company with five properties in Iowa, Louisiana and Kansas

•

Leading market positions with high operating margins

•

Newly opened Kansas Star Casino (December 2011) provides growth potential

Net Revenues ($ in millions)

Property EBITDA ($ in millions)

(1)

(2)

(2) |

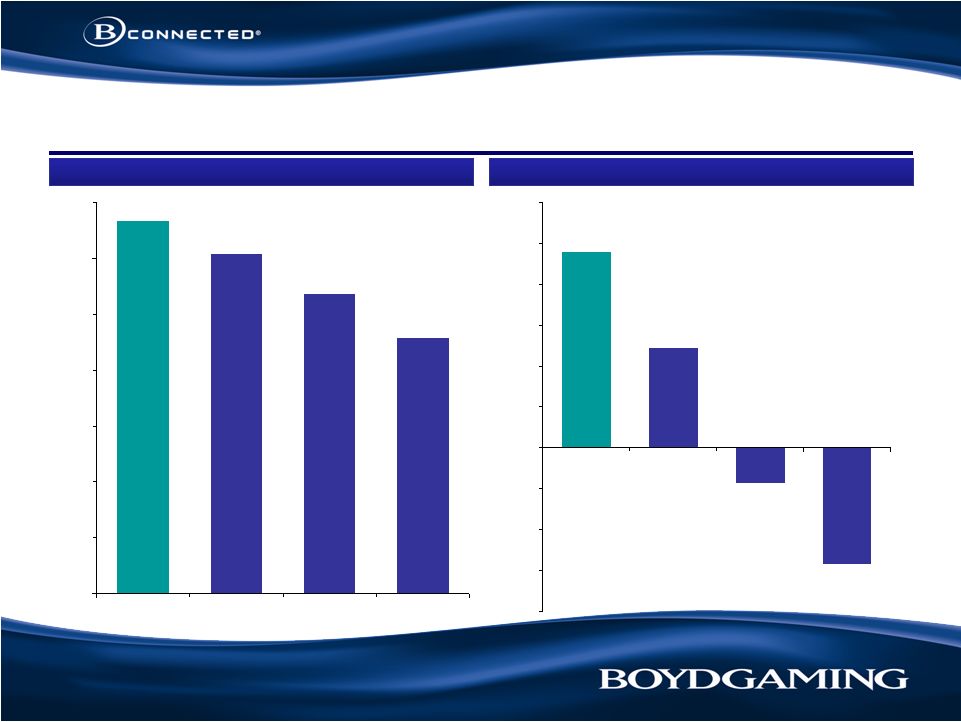

Attractive, Top

Performing Regional Gaming Assets 6

Source: Public filings.

1)

Based on company reported consolidated EBITDA and net revenues as of LTM 3/31/2012. Includes

corporate expenses. 2)

Peninsula excludes results from Amelia Belle and Kansas Star. Penn National excludes results

from Hollywood Casino Perryville, M Resort, and Beulah Park and annualized as

appropriate due to limited disclosure post June 30, 2011 quarter. Pinnacle excludes

results from St. Louis operations (including Lumiere and River City), River Downs, Boomtown Reno, Casino

Magic Argentina and President Casino.

2.4%

1.2%

(0.4%)

(1.4%)

(2.0%)

(1.5%)

(1.0%)

(0.5%)

–

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

Peninsula

Penn National

Pinnacle

Ameristar

LTM EBITDA Margins

(1)

Same Store Net Revenue CAGR (2008 to 2011)

(2)

33.4%

30.4%

26.8%

22.9%

–

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

Peninsula

Ameristar

Penn National

Pinnacle |

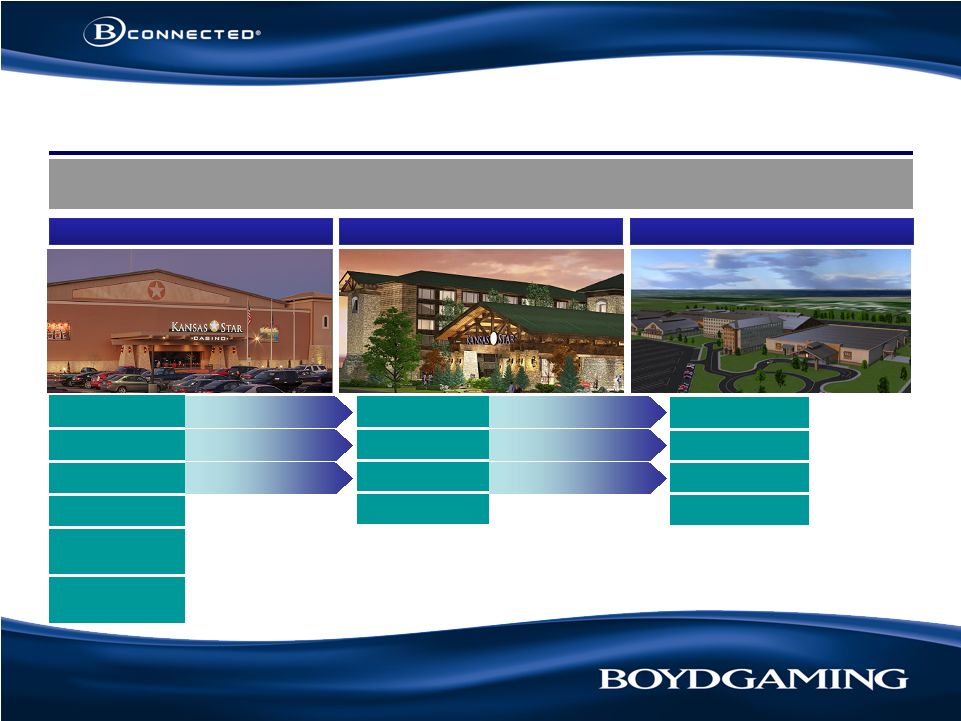

Location: Northwood, IA

Gaming Tax Rate: 21%

LTM EBITDA: $40 million

EBITDA Margin: 41.5%

Location: Dubuque, IA

Gaming Tax Rate: 21%

LTM EBITDA: $24 million

EBITDA Margin: 34.7%

Location: Mulvane, KS

Gaming Tax Rate: 27%-31%

Q1’12 EBITDA: $27 million

EBITDA Margin: 53.3%

Location: Opelousas, LA

Gaming Tax Rate: 36.5%

LTM EBITDA: $30 million

EBITDA Margin: 26.0%

Note:

LTM EBITDA figures are as of March 31, 2012, except for Kansas Star which represents Q1 2012

results. Peninsula Gaming Property Overviews

7

Location: Amelia, LA

Gaming Tax Rate: 21.5%

LTM EBITDA: $14 million

EBITDA Margin: 30.0%

Existing Boyd Properties

Peninsula Properties |

Significant

Growth Potential in Kansas Star 8

Slots:

1,411

Table Games:

35

Hotel Rooms

(1)

:

0

Budget

(2)

:

$179 million

Q1 2012

Net Revenue:

$50 million

Q1 2012

Property EBITDA:

$27 million

Slots:

1,836

Table Games:

45

Hotel Rooms

(1)

:

150

Budget

(2)

:

$83 million

Source: Public filings.

1)

To be developed and operated by a third-party.

2)

Development costs do not incorporate hotel development costs by a third-party.

December 2011 (Interim Facility)

January 2013 (Permanent Facility)

+ 425

+ 10

+ 150

At

opening

of

the

permanent

facility,

approximately

$260

million

will

be

invested

in the premier gaming property in Kansas

Slots:

2,000

Table Games:

55

Hotel Rooms

(1)

:

300

Budget

(2)

:

$28 million

January 2015 (Phase II)

+ 164

+ 10

+ 150 |

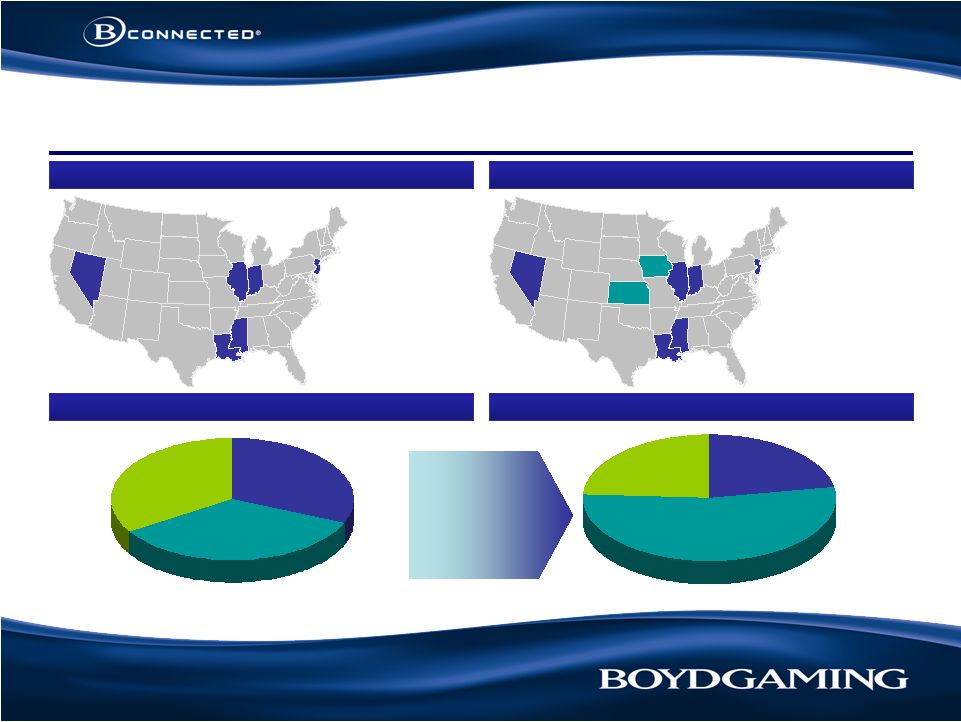

Las Vegas

24%

Atlantic City

22%

Midwest and South

54%

Atlantic City

31%

Las Vegas

34%

Midwest and South

35%

Gaming

Operations in

6 Jurisdictions

Gaming

Operations in

8 Jurisdictions

(2)

Expands Geographic & Operating Diversification

9

Note: Borgata results are presented to reflect full consolidation of the property, consistent

on a GAAP basis. 1)

Excludes corporate expenses.

2)

Includes $109 million of Peninsula LTM 3/31/12 property EBITDA (excluding Kansas) and $107

million of annualized Q1 2012 Kansas EBITDA.

Current Geographical Diversification

Pro Forma Geographical Diversification

Boyd LTM 3/31/12 EBITDA Diversification

(1)

Pro Forma EBITDA Diversification

(1) |

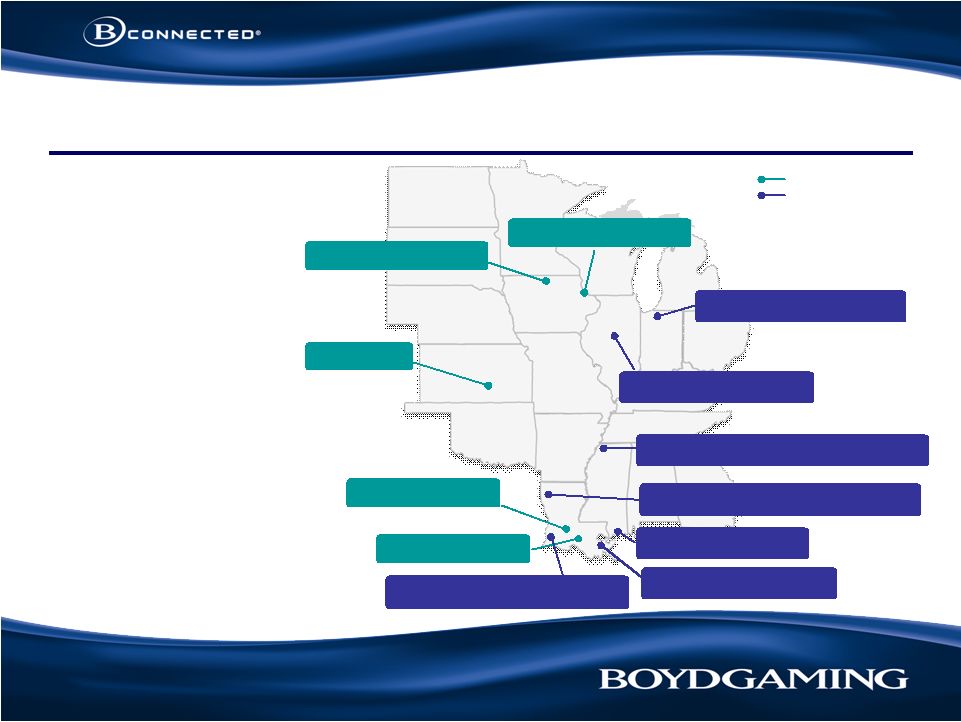

Diversification

into Resilient Markets in Midwest/South 10

Kansas Star

Diamond Jo Worth

Diamond Jo Dubuque

Blue Chip Casino Hotel Spa

Par-A-Dice Hotel Casino

Evangeline Downs

Amelia Belle

Delta Downs Racetrack Casino Hotel

Treasure Chest Casino

IP Casino Resort Spa

Sam’s Town Hotel and Casino Shreveport

Sam’s Town Hotel and Gambling Hall Tunica

Boyd Gaming’s Properties

Peninsula’s Properties

•

Markets with limited

supply

•

Stable tax rates and

regulatory

environments

•

Strong, economically

resilient markets |

$318

$170

$488

$694

$318

$170

$206

0

200

400

600

$800

Boyd Consolidated LTM 3/31/12

Pro Forma Consolidated

Las Vegas & Atlantic City

Midwest and South

Peninsula

Pro Forma Operating Performance

11

Note: Borgata results are presented to reflect full consolidation of the property, consistent

on a GAAP basis. 1)

Includes proportional amount of corporate expenses.

2)

Includes $109 million of Peninsula LTM 3/31/12 property EBITDA (excluding Kansas),

$107

million

of

annualized

Q1

2012

Kansas

EBITDA

and

$10

million

of

corporate

expenses.

Pro Forma Adjusted EBITDA ($ in millions)

(1)

(2)

(1) |

Improves Boyd

Gaming’s Scale and Competitive Position 12

1)

Includes corporate expenses.

2)

Includes $109 million of Peninsula LTM 3/31/12 property EBITDA (excluding Kansas), $107

million of annualized Q1 2012 Kansas EBITDA and $10 million of corporate

expenses. 3)

Borgata results are presented to reflect full consolidation of the property, consistent on a

GAAP basis. Annualized Pro Forma EBITDA versus LTM Public Comparables ($

in millions) (1)

$753

$694

$488

$371

$264

$181

0

200

400

600

$800

Penn National

Boyd + Peninsula

Boyd

Ameristar

Pinnacle

Isle of Capri

(2)

(3) |

Strengthens

Financial Profile Source: SEC Filings.

1)

Includes 50% of Borgata debt and EBITDA (Boyd’s ownership interest).

2)

Free cash flow calculated as Boyd wholly-owned EBITDA less interest expense,

maintenance capital expenditures and taxes. 13

Increases Free Cash Flow Generation ($ in millions)

(2)

Leads to Stronger Balance Sheet and Growth in Earnings

•

Post this acquisition and associated

financings, Boyd remains leverage

neutral at 7.3x

(1)

•

Increases free cash flow generation;

accelerating future leverage

reduction

•

Adds over $70 million in free

cash flow; total annual free

cash flow increased to

approximately $185 million

$109

$185

$0

$50

$100

$150

$200

As of LTM March 31, 2012

Pro Forma |

Financing

Overview 14

Peninsula Debt

New

debt

of

$1.2

billion

will

be

raised

at

Peninsula,

with

proceeds

used

to

refinance

existing

debt

of

approximately $700 million, fund an additional cash consideration to the seller and pay

transaction related fees and expenses, including debt breakage costs

Pro forma total leverage at Peninsula will be below 6.0x (excluding Seller Note

financing) New debt financing will mainly consist of prepayable bank debt

Debt financing already in place and committed by banks

Seller Note

Peninsula has agreed to provide an approximately $144 million Seller Note

Cash Consideration Paid by Boyd

To be funded through borrowings under our credit facility

Total Purchase Price

$1.45 billion

Less: Peninsula Net Debt

$1.1 billion

Less: Seller Note

~$144 million

Cash Consideration Paid by Boyd

$200 million |

Transformative

& Value Building Transaction •

Generates meaningful value for shareholders

•

High quality assets with growth potential in attractive new markets

•

Strengthens financial profile

•

Increases free cash flow and earnings per share

•

Increases scale and geographic diversity

•

Directly aligns with the Company’s growth strategy

15 |

APPENDIX

16 |

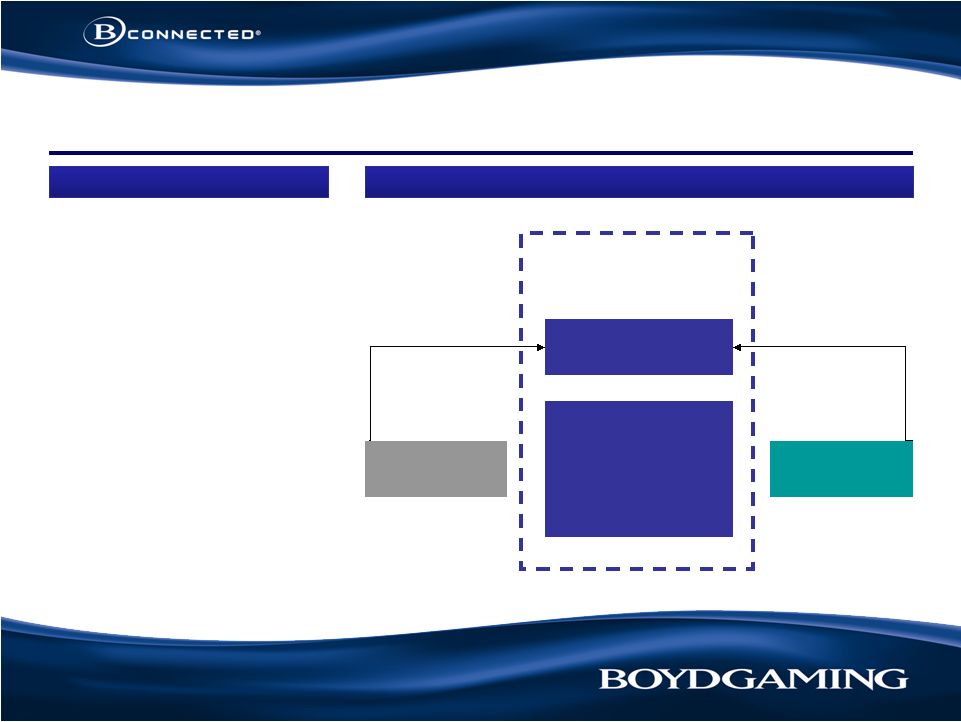

Structure

Overview 17

Structure Overview

Transaction Structure

Restricted

Group

Boyd Gaming

Wholly Owned

Properties

Unrestricted

Subsidiary

Peninsula

100% Interest

Borgata

50% Interest

Management Fee

Distributions:

Taxes & Dividends

Unrestricted

Subsidiary

•

Peninsula debt will be held in a

unrestricted subsidiary

•

Peninsula’s debt and EBITDA

excluded for purposes of our

covenant calculations (with

exception of a management fee);

will be consolidated into our

results

•

Upon refinancing of the

Peninsula credit, Peninsula will

be a Restricted Subsidiary, which

will provide significant

deleveraging from a covenant

perspective

17 |

Seller Note

Financing 18

Summary of Terms

Approximate Amount:

$144 million

Tenor:

6 years

Non-Call Period:

Prepayable at all times

Coupon:

Year 1: 0%

Year 2: 6%

Year 3: 8%

Thereafter: 10%

Interest Payment:

PIK

•

As part of the purchase, Boyd has negotiated approximately $144 million in Seller Note

financing

•

The Seller Note will be held by Peninsula |

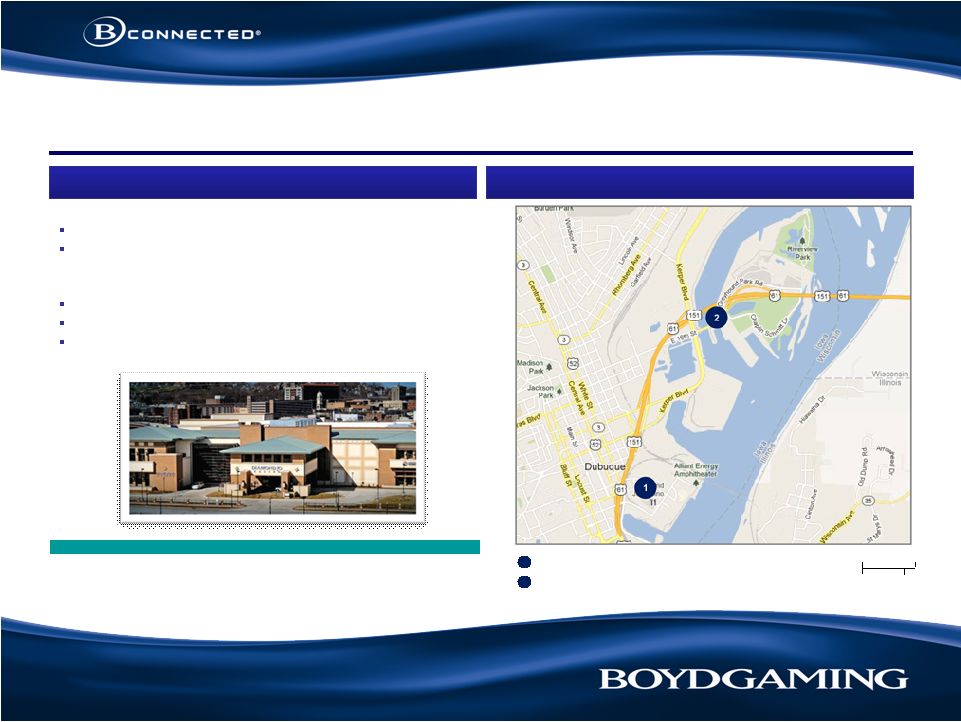

Diamond Jo

Dubuque 19

Location

Dubuque, Iowa

Located within the $400 million America’s River Project and next to the

Grand Harbor Resort and Waterpark

Property Description

New land-based complex opened in December 2008

987 slot machines and 19 table games

Other amenities include state-of-the-art bowling center, 33,000 sq. ft.

event center and five dining outlets

Source: SEC filings.

1

Diamond Jo Dubuque

2

Mystique Casino Dubuque

2000 ft

500 m

$ in millions

2008

2009

2010

2011

LTM 3/31/12

Net Revenue

$42.4

$71.9

$67.8

$68.9

$69.8

Adjusted EBITDA

12.9

23.8

22.7

23.9

24.2

% Margin

30.5%

33.1%

33.4%

34.7%

34.7%

Property Overview

Market Map |

Diamond Jo

Worth 20

Location

Northwood, Iowa –

located equal distance between Minneapolis,

Minnesota and Des Moines, Iowa

Property Description

972 slot machines and 22 table games

Other amenities include a 5,200 sq. ft. event center, several dining

options and a 100-room hotel adjacent to the casino, which is owned

and operated by a third party

1

Diamond Jo Worth

$ in millions

2008

2009

2010

2011

LTM 3/31/12

Net Revenue

$84.6

$83.9

$86.6

$93.9

$96.3

Adjusted EBITDA

32.6

33.6

35.5

38.7

40.0

% Margin

38.5%

40.0%

41.1%

41.2%

41.5%

Property Overview

Market Map

10 miles

Source: SEC filings. |

Evangeline

Downs 21

Location

Opelousas, Louisiana –

20 miles from Lafayette

Property Description

1,424 slot machines and 23,000 square foot event center

Dining venues include a 353-seat buffet, a 140-seat fine-dining

restaurant, a 90-seat Café

and a 120-seat Mojo’s sports bar

The racino includes a one-mile dirt track, a 7/8 mile turf track, stables

for 980 horses, a grandstand and clubhouse seating for 1,295 patrons

1

Evangeline Downs

2

Coushatta Casino

3

Paragon Casino

4

Hollywood Casino Baton Rouge

$ in millions

2008

2009

2010

2011

LTM 3/31/12

Net Revenue

$132.2

$122.8

$113.0

$115.4

$116.9

Adjusted EBITDA

38.9

34.4

29.8

30.1

30.4

% Margin

29.5%

28.0%

26.4%

26.1%

26.0%

Property Overview

Market Map

50 miles

5

Belle of Baton Rouge

7

Cypress Bayou Casino

8

Amelia Belle Casino

Source: SEC filings.

6

L’Auberge Baton Rouge (In Development) |

Amelia Belle

Casino 22

Location

Amelia, Louisiana –

80 miles from New Orleans

Closest competitor approximately 40 miles away

Property Description

838 slot machines and 17 table games

The third deck of the riverboat includes a 119-seat buffet and a

banquet room

$ in millions

2009

2010

2011

LTM 3/31/12

$7.7

$48.0

$48.0

$47.4

1.9

15.1

14.3

14.2

25.1%

31.6%

29.9%

30.0%

Net Revenue

Adjusted EBITDA

% Margin

Property Overview

Market Map

8

Evangeline Downs

2

Coushatta Casino

3

Paragon Casino

4

Hollywood Casino Baton Rouge

6

L’Auberge Baton Rouge (In Development)

50 miles

5

Belle of Baton Rouge

7

Cypress Bayou Casino

1

Amelia Belle Casino

Source: SEC filings.

Note:

Amelia Belle was acquired on October 22, 2009. |

Kansas Star

23

Property Overview

Location

Mulvane, Kansas –

20 miles south of Wichita

Property Description

Opened in December 2011 and currently offers 1,411 slot machines

and 35 table games

Casino will expand to 2,000 slot machines and 55 table games when

fully built out in 2015

Other amenities include an equine complex with multiple arenas and

barn facilities and a third-party owned 300-room hotel

Market Map

1

Kansas Star

$ in millions

2011

LTM 3/31/12

Annualized

(1)

$6.0

$201.1

3.3

107.1

55.1%

53.3%

53.5%

Net Revenue

Adjusted EBITDA

% Margin

$56.3

30.1

Source: SEC filings.

Note:

Kansas Star began casino gaming operations on December 20, 2011.

(1)

Represents Q1 2012 Kansas Star results annualized for a full year of

operations. (2)

Kansas City gaming market includes: Hollywood Casino, Argosy Casino Riverside,

Harrah’s North Kansas City, Ameristar Kansas City, Isle of Capri Kansas

City and Seventh Street Casino. 2

Kansas City Market

(2)

10 miles |

Forward Looking

Statements Important Information Regarding Forward-Looking Statements.

This presentation contains, or may contain, “forward-looking statements”

concerning Boyd and Peninsula, which are subject to the safe harbor provisions created by the

Private Securities Litigation Reform Act of 1995. Generally, the words

“believe,” “anticipate,”

“expect,”

“may,”

“should,”

“could,”

and other future-oriented terms identify forward-

looking statements. Forward-looking statements include, but are not limited to, statements

relating to the following: (i) the expected benefits of the merger, the expected

accretive effect of the merger on Boyd’s financial results and profile, expected cost,

revenue, EBITDA, margin, and synergies, the expected impact for customers and

employees, future capital expenditures, expenses, revenues, earnings, economic

performance, financial condition, losses and future prospects; (ii) the anticipated benefits of geographic

diversity that would result from the merger; the expected results of Peninsula’s gaming

properties, including, without limitation, Kansas Star; (iii) future industry

developments and trends; (iv) the anticipated completion of the proposed merger, and

the anticipated financing of the merger; and (vi) assumptions underlying any of the foregoing

statements.

These forward-looking statements are based upon the current beliefs and expectations

of management and involve risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking statements. Many of these

risks and uncertainties relate to factors that are beyond Boyd’s ability to

control or estimate precisely and include, without limitation: the ability to obtain

governmental or gaming approvals of the merger and the transactions contemplated by the

merger agreement, or to satisfy other conditions to the merger on the proposed terms

and timeframe; the possibility that the merger does not close when expected or at all, or that

the companies may be required to modify aspects of the merger to

achieve regulatory approval; the ability to realize the expected synergies or other benefits

from the transaction in the amounts or in the timeframe anticipated; the ability to

integrate Peninsula in a timely and cost-efficient manner with Boyd; uncertainties in the global

economy and credit markets; and rates of change in, margins, market share, capital

expenditures, revenue and operating expenses generally; volatility in quarterly results and

in the stock price of Boyd; access to capital markets; the ability to manage and grow the

Boyd’s cash position following the merger; the sufficiency of Boyd’s financial resources

to support future business activities (including but not limited

to operations, investments, debt service requirements and capital expenditures); the impact

of legal proceedings; and other risks and uncertainties, including those detailed

from time to time in Boyd’s periodic reports (whether under the caption Risk

Factors or Forward Looking Statements or elsewhere). Boyd can give no assurances

that such forward-looking statements will prove to have been correct. The reader is cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this announcement. Neither

Boyd nor any other person undertakes any obligation to update or revise publicly any of

the forward-looking statements set out herein, whether as a result of new information, future events or otherwise, except to the extent legally required. Nothing

contained herein shall be deemed to be a forecast, projection or

estimate of the future financial performance of Boyd following the implementation of the

merger or otherwise. No statement in this announcement should be interpreted to mean

that the earnings per share, profits, margins or cash flows of Boyd for the current or future financial years

would necessarily match or exceed the historical published figures.

Non-GAAP Financial Measures

Regulation G, "Conditions for Use of Non-GAAP Financial Measures," prescribes the

conditions for use of non-GAAP financial information in public disclosures. We believe that

our presentations of the non-GAAP financial measures used in this presentation are

important supplemental measures of operating performance to investors. Reconciliations

of non-GAAP financial measures to GAAP can be found at

http://boydgaming.investorroom.com/ We do not provide a reconciliation of

forward-looking non-GAAP financial measures due to our inability to project special charges and certain expenses.

24 |

25 |