Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - METLIFE INC | d348552d8k.htm |

| EX-99.1 - PRESS RELEASE - METLIFE INC | d348552dex991.htm |

| EX-10.1 - EMPLOYMENT AGREEMENT BETWEEN CHRISTOPHER G. TOWNSEND AND METLIFE ASIA PACIFIC - METLIFE INC | d348552dex101.htm |

METROPOLITAN LIFE INSURANCE COMPANY OF

HONG KONG LIMITED

HEALTHCARE PLAN

MEMBER’S EXPLANATORY HANDBOOK

Prepared by:

JLT

| Contents |

Page | |||||

| Foreword |

||||||

| 1. |

General Information |

2 | ||||

| 2. |

Healthcare Benefits |

4 | ||||

| 3. |

Direct Settlement of Medical Expenses |

6 | ||||

| 4. |

Reimbursement of Medical Expenses |

8 | ||||

| 5. |

Emergency Assistance |

11 | ||||

| 6. |

Exclusions |

13 | ||||

Appendix

Prior Agreement Application — Hospitalization

Prior Agreement Application — Series of Procedures / Medical Prosthetic Devices

Prior Agreement Application — Dental Treatments

FOREWORD

This booklet summarises the Care & Health Corporate Healthcare Plan (the Plan), which consists of four major components covering: -

| • | medical expenses arising from sickness or injury; |

| • | maternity related expenses; |

| • | dental expenses; |

| • | emergency assistance, including evacuation and repatriation. |

The Plan is insured by the AXA Group (the insurer) based in France and the claims are administered by a dedicated division of GMC Services (GMC) based in Singapore. The emergency assistance programme is supported by International SOS (ISOS), a specialist in this field.

In Hong Kong, Jardine Lloyd Thompson Limited (JLT) is an appointed distributor and co-ordinator. Their contact details are as follows:-

Jardine Lloyd Thompson Limited

28/F., DCH Commercial Centre 25

Westlands Road, Quarry Bay

Hong Kong

Telephone 2864 5527 or 2864 5335

Facsimile 2529 5333

Whilst every effort has been made to ensure accuracy of this document, it must be clearly understood that, should there be any discrepancy between this booklet and the provisions of the Insurer’s policy wording, then the latter shall prevail.

| 1. | GENERAL INFORMATION |

| 1.1 | Coverage |

The Plan covers medical treatment provided by registered medical practitioners and medical practices that are recognized by the World Health Organisation. Chinese Herbalist and Bonesetters who are Registered Chinese medicine practitioners under the Chinese Medicine Ordinance of the Hong Kong SAR or duly qualified practitioner of Chinese Medicine registered as such under the laws of the country you receive such treatment are also covered.

The Plan provides 24-hour worldwide coverage and gives you the flexibility to choose in which country within your geographical zone, hospital and clinic to have your treatment. Medical expenses resulting from an accident or unforeseeable illness occurring during travel in excluded countries (if applicable) are covered. In respect of hospitalisation, you must follow the procedures set out in section 2.2. The emergency assistance coverage is only applicable to overseas trips that do not exceed 90 days per trip.

| 1.2 | Enrolment |

You are required to submit the following details for each person to be covered:-

| a) | full name; |

| b) | date of birth; |

| c) | sex; |

| d) | nationality; |

| e) | employee’s bank details, i.e. bank name, bank address, account number, account holder’s name, swift code and currency (for reimbursement of claims); |

| f) | employee’s personal correspondence address; |

| g) | employee’s email address |

Unless the total number of employees covered in your group is greater than 10, each employee member is required to complete a health declaration form (details of each eligible dependant will also need to be declared in the same form), which is then submitted to the Insurer for assessment. Cover will not commence until the application has been accepted by the Insurer. Depending on an individual’s medical history, acceptance may include additional exclusions.

2

Each member will receive a Plan membership card which lists out important contact and membership numbers. You should, therefore, carry this card at all times in case you suddenly require medical treatment. These cards must be returned to Jardine Lloyd Thompson Limited (JLT) when you leave service. If you should lose a card, you must report it to JLT at the earliest opportunity. There will be a charge for a replacement card.

| 1.3 | Dependant’s Coverage |

Provided it has been agreed with your employer, the Plan will cover your spouse and any unmarried children from birth up to the age of 20 years or 25 if they are still in full-time education (proof of full-time education will be required for those over the age of 20).

After you have joined the Plan, it is your responsibility to notify JLT (via your employer) of any additional eligible dependants.

| 1.4 | Maximum Insured Age |

You must be under the age of 65 when you first join the Plan. Once a member, cover is renewable until the age of 64.

| 1.5 | Termination of Benefits |

All expenses incurred after one of the following will not be covered:-

| a) | cessation of membership in the Plan; |

| b) | the termination of your employment; |

| c) | the eve of your 65th birthday; |

| d) | the termination of the insurance policy by your employer; |

| e) | in respect of a dependent child, the eve of his/her 21st birthday or 26th birthday if still in full-time education. |

3

| 2. | HEALTHCARE BENEFITS |

| 2.1 | Outpatient Benefits |

Subject to the policy exclusions (see section 6.1) and claim procedures, all reasonable and customary outpatient medical expenses will be covered by the Plan without cash limits. However, all eligible outpatient medical expenses shall be reimbursed on a 90% basis.

| 2.2 | Hospitalisation Benefits |

Subject to the policy exclusions (see section 6.1), all reasonable and customary hospitalisation expenses will be covered up to the amounts which are commensurate with a standard private room. Additional charges resulting from the use of a deluxe or VIP room will, however, not be covered.

Hospitalisation must be for at least 24 hours. If confinement is less than 24 hours, treatment and services provided will be deemed as outpatient, unless surgery has been involved. You should also note that an admission to hospital which is primarily for diagnostic scanning, X-ray examination, physical therapy and the like will also be deemed as outpatient treatment.

For a child under the age of 12, the Plan will also cover the cost (up to US$40 per day for a maximum of 30 days per year) of an additional bed for an accompanying parent.

| 2.3 | Ambulance Costs |

Reimbursement of ambulance costs is subject to a maximum of US$300 per year per person.

| 2.4 | Maternity Benefit |

Subject only to the policy exclusions, all maternity related expenses incurred after 9 months’ membership (waived if your membership group consists of more than 10 employees) will be covered by the Plan up to a limit of US$12,000 per pregnancy.

In addition, up to three fertility treatments (per lifetime under the Plan) by way of in vitro fertilisation or artificial insemination will be covered at US$750 per fertilisation/ insemination. “Prior Agreement” from the Insurer is required (see section 4.1).

All eligible expenses shall be reimbursed on a 90% basis.

4

| 2.5 | Dental Benefits |

Dental prostheses and orthodontic expenses incurred after 6 months’ membership (waived if your membership group consists of more than 10 employees) will be reimbursed at a rate of 90% by the Plan up to the following cash limits:-

| a) | General treatment (consultations, conservative care, surgery, routine care, cleaning, fillings, extractions, etc) - up to US$1,500 per person per year. |

| b) | Dental prosthesis (crowns, pinned teeth, inlays, on lays, fixed or removable dentures, implants, except temporary) - limited to US$700 per tooth (up to an annual maximum of US$3,500 per person). “Prior Agreement” from the Insurer is required (see section 4.1). |

| c) | Orthodontics (for children only) - up to US$1,800 per year for a maximum of 2 years. Treatment must be before the child’s 16th birthday and “Prior Agreement” from the Insurer is required (see section 4.1). |

| 2.6 | Other Prostheses |

After 6 months’ membership (waived if your membership group consists of more than 10 employees), medical prostheses (hearing aids, orthopedic prostheses, non-orthopedic prostheses) and durable medical equipment are covered at a rate of 90% up to a maximum of US$4,200 per year. “Prior Agreement” from the Insurer is required (see section 4.1).

5

| 3. | DIRECT SETTLEMENT OF MEDICAL EXPENSES |

| 3.1 | Outpatient |

GMC has a designated global network of clinics that will bill GMC directly for general and specialist consultations. These are listed on the GMC website — www.henner.com and marked with ¨. To access to this facility, you (as the employee member) need to download a “Direct Settlement document” from the said website by following these procedures:-

| a) | Connect to www.henner.com and go to “International Medical Network” —> “Access the Network”. |

| b) | Identify yourself by entering your GMC number (as it appears on your GMC Card) and password (which will be your date of birth for the first time login — dd/mm/yyyy) and a city of your choice. |

| c) | Download GMC Direct Settlement document which can be folded into a more convenient size for carriage. |

| d) | If your dependants are also covered, their names will appear on the document. You may download additional documents for your covered dependants to use. |

| e) | Each document carries a six-month validity period from the issuance date, but you can download a new document before the expiry of the old document. |

On arrival at one of the participating clinics, simply present the practitioner with your valid downloaded Direct Settlement document as well as your GMC Card. The benefit section of your direct settlement document lists all the services included. For services rendered that are not listed, but are covered under your policy, you will need to pay for the service and claim reimbursement afterwards.

Since outpatient is set at 90% reimbursement, you are responsible to pay 10% co-payment for each visit at network clinics.

| 3.2 | Hospitalisation — Planned Admission |

For any planned confinement, including for childbirth, you must notify the Insurer by asking your attending doctor to promptly complete and return a ‘Prior Agreement Application - Hospitalisation’. This should be done at least 10 days before your admission date. This

6

procedure enables the insurer to assess whether the charges to be incurred are within the reasonable and customary range. At the same time, GMC will arrange for the hospital to send bills directly to the Insurer for settlement.

A photocopy of the enclosed specimen form can be used. The completed form should be faxed to GMC on Singapore (65) 6849 4092 during office hours. For assistance, you may contact JLT on Hong Kong (852) 2864 5527 or 2864 5335 (facsimile Hong Kong (852) 2529 5333)

| 3.3 | Hospitalisation – Emergency Admission |

If you are being admitted in an emergency and it is to a designated hospital marked with

on the list in the GMC website, the hospital will bill GMC directly if you are able to show the hospital your downloaded Direct Settlement document as detailed in Section 3.1.

on the list in the GMC website, the hospital will bill GMC directly if you are able to show the hospital your downloaded Direct Settlement document as detailed in Section 3.1.

However, if the emergency admission is to any other hospital, you should notify the Insurer as soon as possible and before you are discharged by calling one of the appropriate contact numbers on the back of your GMC Card and. If the length of your stay turns out to be too short to give sufficient time for GMC to arrange a direct settlement, you will need to settle the bill upon discharge and claim reimbursement afterwards by following the procedures set out in Section 4.3. For reference, the emergency contact numbers that appear on the back of your GMC Card are as follows:-

| Hospitalisation in Asia Pacific |

Hong Kong: (852) 800 96 5656 or Singapore: (65) 6887 2488 | |

| Hospitalisation in the USA and Canada | Toll free: 1 866 936 1225 or From outside the USA and Canada: +1 305 459 4856 | |

| Elsewhere in the World | Singapore: (65) 6887 2488 |

7

| 4. | REIMBURSEMENT OF MEDICAL EXPENSES |

The need to make a reimbursement claim should only arise in two situations. One is for outpatient expenses when the direct settlement facility cannot be or has not been used and the other is for emergency hospital admissions when the Direct Settlement document has not been used.

A claim for reimbursement must be made within 12 months of incurring the expense. Beyond this period, a claim will be rejected. Unlike most insurance claims, there is no claim form to complete. The documents needed to support the different types of medical claims are listed below. You should consider accumulating small claims before submitting them in batches for reimbursement.

All claims should be sent to:

GMC Services

20 Cecil Street

#05-05 Equity Plaza

Singapore 049705

Telephone: (65) 6887 2488

Facsimile: (65) 6849 4092

Email: gmcg.ug32@henner.com

Be sure to retain a copy of all documentation which you submit.

Claims reimbursement will be credited into your bank account. A settlement statement detailing the expenses incurred and amount reimbursed will be sent directly to your email address.

The Insurer reserves the right to request further supporting information if the documents submitted prove to be insufficient.

| 4.1 | Prior Agreement |

You MUST seek ‘Prior Agreement’ from the Insurer for

| • | Protracted forms of medical treatment, which requires more than one session, such as Physiotherapy, Chiropractors, Chemotherapy, Radiotherapy, Dialysis, Electrotherapy, Kinesitherapy, Speech Therapy, Nursing Care or Psychiatric Treatment, etc |

| • | Fertility treatment |

8

| • | Dental prosthesis and orthodontic treatment |

| • | Medical prostheses and durable medical equipment |

This is a necessary procedure which also helps you to ensure that charges to be incurred will be within the reasonable and customary range. It must be noted that failure to comply with this requirement will result in your claim being rejected.

The attending doctor/specialist must complete the appropriate ‘Prior Agreement Application — Series of Procedures / Medical Prosthetic’ or ‘Prior Agreement Application — Dental Treatments’ form (a photocopy of the enclosed specimen can be used) together with a medical prescription detailing the diagnosis, treatments planned and cost breakdown.

The completed form and medical prescription should be faxed to GMC on Singapore (65) 6849 4082 during office hours. Once processed, you will receive by email an approval letter. A copy of this letter must accompany your claim for reimbursement of the related expenses.

In planning your treatment around the “Prior Agreement” you should, where practicable, allow at least 15 days for the Insurer to give its response. However, the Insurer will permit the completed form to be submitted after the commencement of treatment when urgent treatment is required. For assistance, you may contact JLT on Hong Kong (852) 2864 5527 or (852) 2864 5335 (facsimile Hong Kong (852) 2529 5333).

| 4.2 | Outpatient Expenses (including Pre and Post Natal) |

| a) | Always obtain an original official receipt from your doctor/hospital for the expenses incurred. |

| b) | The receipt must include the following information:- |

| • | Date of consultation |

| • | Full name of the patient (as shown on the GMC Card) |

| • | Breakdown of charges incurred |

| • | Diagnosis/disability |

You should write on the back of the receipt (a) the name of your company, (b) name of the patient and (c) the patient’s ‘Identification Number’ as it appears on patient’s GMC Card or attach a photocopy of the patient’s card.

9

| c) | No claim form is required. Simply submit the original discharge summary and receipt, making sure the information set out in (b) above is complete. |

| 4.3 | Hospitalisation Expenses |

| a) | Always obtain an original official receipt, discharge summary and medical report from your doctor/hospital for the expenses incurred. |

| b) | The receipt must include the following information:- |

| • | Date of admission, discharge and (if applicable) surgery |

| • | Full name of the patient (as shown on the GMC Card) |

| • | Breakdown of charges incurred |

| • | Diagnosis/disability |

You should write on the back of the receipt (a) the name of your company, (b) name of the patient and (c) the patient’s ‘Identification Number’ as it appears on patient’s GMC Card or attach a photocopy of the patient’s card.

| c) | No claim form is required. Simply submit the original discharge summary and receipt, making sure the information set out in (b) above is complete. |

10

| 5. | EMERGENCY ASSISTANCE |

Whenever emergency assistance is required, necessitated by accident or illness occurring when you are residing outside your home country (the country of your declared nationality) or when you are travelling outside your country of employment, you should call (65) 6887 2488 which shown on your GMC Card.

Cover is provided by International SOS (ISOS), a specialist organisation in this field. You should take note that when transportation costs are involved, tickets must be arranged by ISOS for it to be covered by the Plan. At the same time, you are required to surrender any unused portion of a prepaid ticket. Any transportation which involves air travel will be on economy class unless it is deemed medically inappropriate.

| 5.1 | Telephone Medical Advice |

ISOS will arrange to provide medical advice to you over the telephone.

| 5.2 | Emergency Medical Evacuation for reasons of Health |

Once notified, ISOS will arrange the necessary contacts between their medical team, the local doctor and the family doctor, if appropriate.

When deemed necessary and approved by ISOS’ medical department, having taken full account of your condition, ISOS will arrange and pay for the expense of transporting you by the most appropriate means to the nearest hospital most appropriate for your condition.

| 5.3 | Return to Country of Employment |

If an emergency medical evacuation takes you to a third country, ISOS will arrange and pay the cost of economy class airfare by scheduled flight for returning you to your country of employment or home country.

| 5.4 | Return of Unaccompanied Children |

ISOS will arrange and pay the cost of the return home to the country of employment or the home country (or to the home of a member of your family) of your children under 18 years of age travelling with you, if you cannot take care of them because of injury or sickness during the trip.

11

| 5.5 | Compassionate Visit |

If you are hospitalised for over seven days outside your country of employment or home country without an adult companion, ISOS will supply and pay a round-trip ticket economy class air fare by scheduled flight for one of your family members to visit you.

| 5.6 | Return of Bodily Remains |

In the event of death, ISOS will pay the cost of transporting the mortal remains from the place of death to the deceased’s home country. The cost of the coffin is limited to US$1,900.

| 5.7 | Transmission of Urgent Messages |

ISOS will transmit your urgent messages to your family members in the event of evacuation/hospitalisation.

| 5.8 | Advance of Bail |

When you are in a foreign country, ISOS will advance bail to you up to US$13,600. This sum is only an advance and so, you are required to repay the total amount within 45 days after receipt of an ISOS invoice.

This coverage does not apply to any situation resulting from traffic or narcotic offences or from your participation in any political demonstration.

| 5.9 | Lawyer’s Fees |

ISOS will reimburse you for lawyer’s fees up to US$1,700 if proceedings are taken against you for involuntary violation of the laws of a foreign country.

12

| 6. | EXCLUSIONS |

| 6.1 | For the whole Plan |

The following are not covered by the Plan: -

| a) | Additional expenses that are a consequence of using a deluxe or VIP room. |

| b) | Treatment by any person other than a registered medical practitioner; medical practices that are not recognized by the World Health Organisation. |

| c) | Non-medicinal everyday-use products such as absorbent cotton, alcohol, sun creams, toothpaste, bandages, shampoo, etc. |

| d) | Stays in convalescent homes, rest homes (or similar facilities), establishments for alcoholics or drug addicts (or related facilities) during the first two years of membership. After two years membership cover will be limited to 30 days per person per year. |

| e) | Expenses relating to health comfort items (e.g. orthopaedic shoes, inhalators, massage devices, sun lamps, heating pads, etc.) |

| f) | Stays in geriatric facilities under partial or permanent supervision. |

| g) | Care that presents no direct medical necessity for the treatment of illness, especially cosmetic procedures and the results thereof. |

| h) | Preventive medical care and health check-ups. |

| i) | Treatments for mental disorders such as nervous disorders or mental illness, psychoanalysis, psychotherapy. |

| j) | Thermal cures and spa |

| k) | Occupational rehabilitation. |

| 1) | Non-medical expenses such as for telephone calls, alcoholic beverages and guests’ meals. |

| m) | Expenses resulting from intentional acts including suicide and self inflicted injuries; war, riots, brawls, acts of terrorism in which you have played an active role; sports practised as a professional activity; deliberate exposure of extreme danger. |

13

| 6.2 | Additional Exclusions applicable to Emergency Assistance Benefits (as defined in Section 5):- |

| a) | Any repatriation or emergency transportation or other expenses not approved in writing by ISOS and/or under the auspices of ISOS. |

| b) | Any expenses incurred against medical advice or when the condition is not serious. |

| c) | Medical examinations or surgical procedures scheduled prior to the request for assistance and not of an emergency nature or intended to protect life or prevent substantial worsening of the condition. |

| d) | Injuries or illnesses due to the practice of hazardous sports such as microlight flying, hang-gliding, paragliding, mountain climbing, rock climbing, contact sports and martial arts, caving, sledge, skiing, ski jumping, bobsleighing, bungee-jumping, gliding, rafting or the operation of personal watercraft. |

| e) | Injuries or illnesses directly or indirectly arising from civil or foreign war, insurrections, riots, rebellions or popular uprising, whenever the member is in breach of existing laws by taking part although cases of legitimate self-defence and assistance to persons in danger are covered. |

| f) | Self-inflicted injuries or illnesses including suicide, attempted suicide and self-mutilation. |

| g) | Injures or illnesses resulting from or occurring in conjunction with competitive sports other than those in which the member participates purely as an amateur. |

| h) | Flying unless as a passenger in an aircraft that has a valid flying certificate and is flown by a licensed pilot. |

| i) | Injuries or illnesses incurred prior to the effective date of coverage and not declared to the Insurer. |

| j) | Participation in brawls, other than in self-defence or to the rescue of a third party. |

| k) | Injuries or illnesses resulting directly or indirectly from radioactivity. |

14

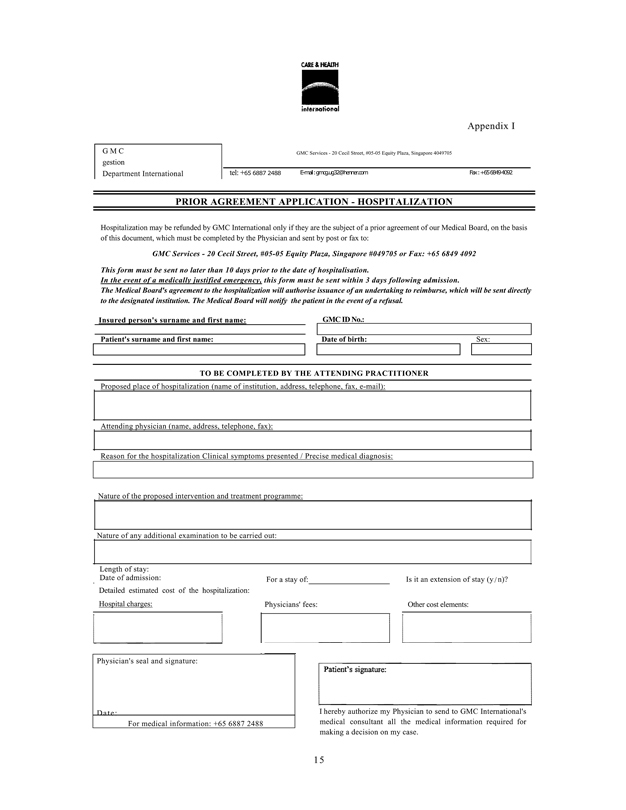

Appendix I

G M C gestion

Department International

GMC Services - 20 Cecil Street, #05-05 Equity Plaza, Singapore 4049705

tel: +65 6887 2488

E-mail : gmcg.ug32@henner.com Fax : +65 6849 4092

PRIOR AGREEMENT APPLICATION - HOSPITALIZATION

Hospitalization may be refunded by GMC International only if they are the subject of a prior agreement of our Medical Board, on the basis of this document, which must be completed by the Physician and sent by post or fax to:

GMC Services - 20 Cecil Street, #05-05 Equity Plaza, Singapore #049705 or Fax: +65 6849 4092

This form must be sent no later than 10 days prior to the date of hospitalisation.

In the event of a medically justified emergency, this form must be sent within 3 days following admission.

The Medical Board’s agreement to the hospitalization will authorise issuance of an undertaking to reimburse, which will be sent directly to the designated institution. The Medical Board will notify the patient in the event of a refusal.

Insured person’s surname and first name:

GMC ID No.:

Patient’s surname and first name:

Date of birth:

Sex:

TO BE COMPLETED BY THE ATTENDING PRACTITIONER

Proposed place of hospitalization (name of institution, address, telephone, fax, e-mail):

Attending physician (name, address, telephone, fax):

Reason for the hospitalization Clinical symptoms presented / Precise medical diagnosis:

Detailed estimated cost of the hospitalization:

Physicians’ fees:

Other cost elements:

Nature of the proposed intervention and treatment programme:

Nature of any additional examination to be carried out:

Length of stay: Date of admission:

For a stay of:

Is it an extension of stay (yin)?

Hospital charges:

Physician’s seal and signature:

Date:

For medical information: +65 6887 2488

Patient’s signature

hereby authorize my Physician to send to GMC International’s medical consultant all the medical information required for making a decision on my case.

15

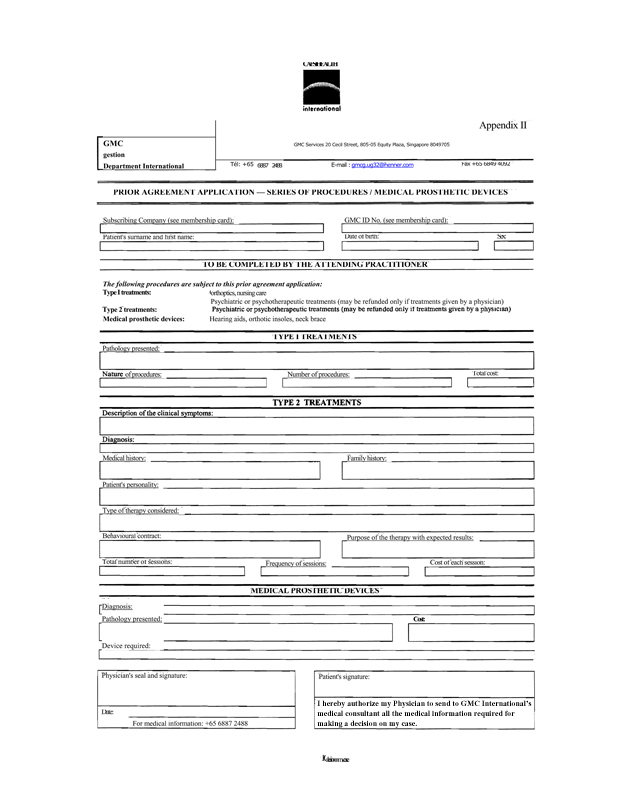

Appendix II

GMC gestion

Department International

Tél: +65 6887 2488

GMC Services 20 Cecil Street, 805-05 Equity Plaza, Singapore 8049705

E-mail : gmcg.ug32@henner.com

Fax +65 6849 4092

PRIOR AGREEMENT APPLICATION — SERIES OF PROCEDURES / MEDICAL PROSTHETIC DEVICES

Subscribing Company (see membership card):

GMC ID No. (see membership card):

Patient’s surname and first name:

Date of birth:

Sex:

TO BE COMPLETED BY THE ATTENDING PRACTITIONER

The following procedures are subject to this prior agreement application:

Type I treatments:

orthoptics, nursing care

Psychiatric or psychotherapeutic treatments (may be refunded only if treatments given by a physician)

Type 2 treatments:

Psychiatric or psychotherapeutic treatments (may be refunded only if treatments given by a physician)

Medical prosthetic devices:

Hearing aids, orthotic insoles, neck brace

TYPE I TREATMENTS

Pathology presented:

Nature of procedures:

Number of procedures:

Total cost:

TYPE 2 TREATMENTS

Description of the clinical symptoms:

Diagnosis

Medical history:

Family history:

Patient’s personality:

Type of therapy considered:

Behavioural contract:

Purpose of the therapy with expected results:

Total number of sessions:

Frequency of sessions:

Cost of each session:

MEDICAL PROSTHETIC DEVICES

Diagnosis:

Pathology presented:

Device required:

Cost:

Physician’s seal and signature:

Date:

For medical information: +65 6887 2488

Patient’s signature:

decision on my case.

16

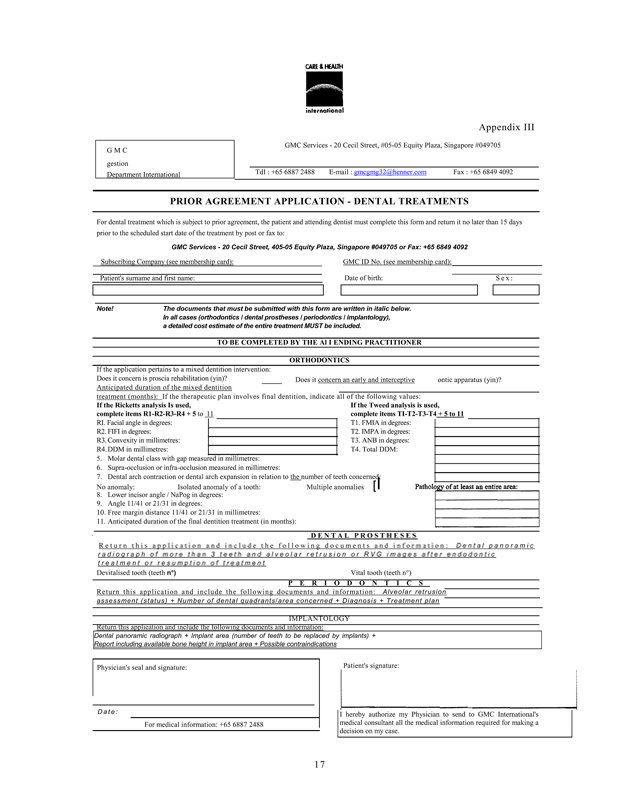

Appendix III

GMC

gestion

Department International

GMC Services - 20 Cecil Street, #05-05 Equity Plaza, Singapore #049705

Tel : +65 6887 2488 E-mail : gmcgmg32@henner.com Fax : +65 6849 4092

PRIOR AGREEMENT APPLICATION - DENTAL TREATMENTS

For dental treatment which is subject to prior agreement, the patient and attending dentist must complete this form and return it no later than 15 days prior to the scheduled start date of the treatment by post or fax to:

GMC Services - 20 Cecil Street, 405-05 Equity Plaza, Singapore #049705 or Fax: +65 6849 4092

Subscribing Company (see membership card): GMC ID No. (see membership card):

Patient’s surname and first name: Date of birth: Sex:

Note! The documents that must be submitted with this form are written in italic below.

In all cases (orthodontics / dental prostheses / periodontics / implantology), a detailed cost estimate of the entire treatment MUST be included.

TO BE COMPLETED BY THE Al I ENDING PRACTITIONER

ORTHODONTICS

If the application pertains to a mixed dentition intervention:

Does it concern is proscia rehabilitation (yin)?

Does it concern an early and interceptive

ontic apparatus (yin)?

Anticipated duration of the mixed dentition treatment (months): If the therapeutic plan involves final dentition, indicate all of the following values:

If the Ricketts analysis Is used, complete items R1-R2-R3-R4 + 5 to 11

If the Tweed analysis is used, complete items TI-T2-T3-T4 + 5 to 11

RI. Facial angle in degrees:

R2. FIFI in degrees:

R3. Convexity in millimetres:

R4. DDM in millimetres:

5. Molar dental class with gap measured in millimetres:

6. Supra-occlusion or infra-occlusion measured in millimetres:

7. Dental arch contraction or dental arch expansion in relation to the number of teeth concerned:

No anomaly: Isolated anomaly of a tooth: Multiple anomalies [|

8. Lower incisor angle / NaPog in degrees:

9. Angle 11/41 or 21/31 in degrees:

10. Free margin distance 11/41 or 21/31 in millimetres:

11. Anticipated duration of the final dentition treatment (in months):

T1. FMIA in degrees:

T2. IMPA in degrees:

T3. ANB in degrees:

T4. Total DDM:

Pathology of at least an entire area:

PROSTHESES Return this application and include the following documents and information: Dental panoramic radiograph of more than 3 teeth and alveolar retrusion or RVG images after endodontic treatment or resumption of treatment

Devitalised tooth (teeth n°) Vital tooth (teeth n°)

PERIODONTICS

Return this application and include the following documents and information: Alveolar retrusion assessment (status) + Number of dental quadrants/area concerned + Diagnosis + Treatment plan

IMPLANTOLOGY

Return this application and include the following documents and information:

Dental panoramic radiograph + Implant area (number of teeth to be replaced by implants) + Report including available bone height in implant area + Possible contraindications

Physician’s seal and signature:

Patient’s signature:

Date:

For medical information: +65 6887 2488

I hereby authorize my Physician to send to GMC International’s medical consultant all the medical information required for making a decision on my case.