Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUKE REALTY CORP | d353894d8k.htm |

RELIABLE. ANSWERS.

2012 UBS Industrial Real Estate Summit

May 16

Exhibit 99.1 |

RELIABLE. ANSWERS.

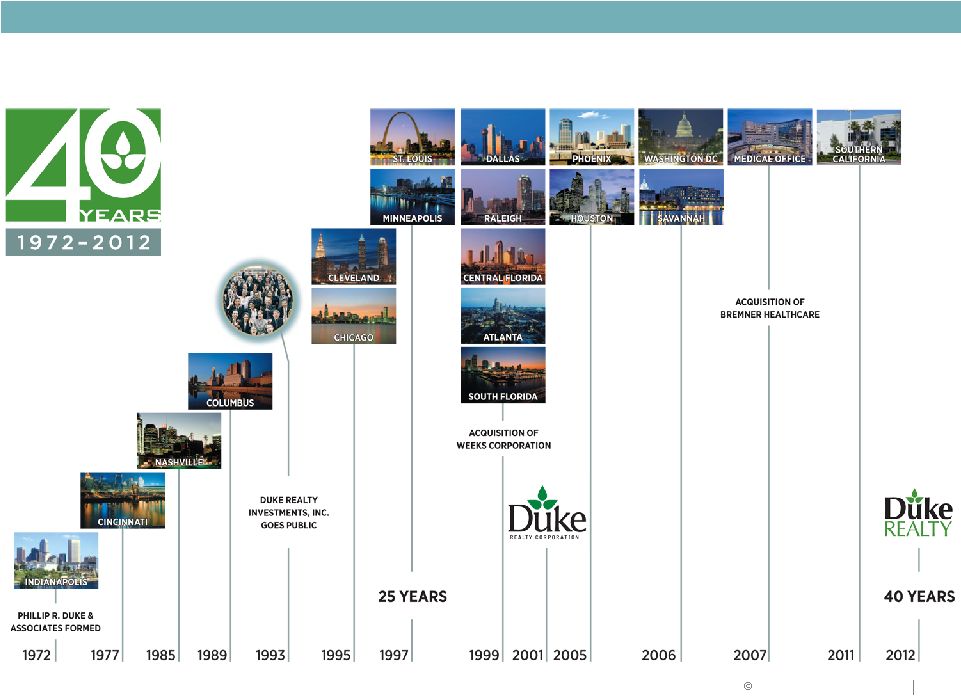

2012 Duke Realty Corporation

40 Years Timeline

2 |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

3

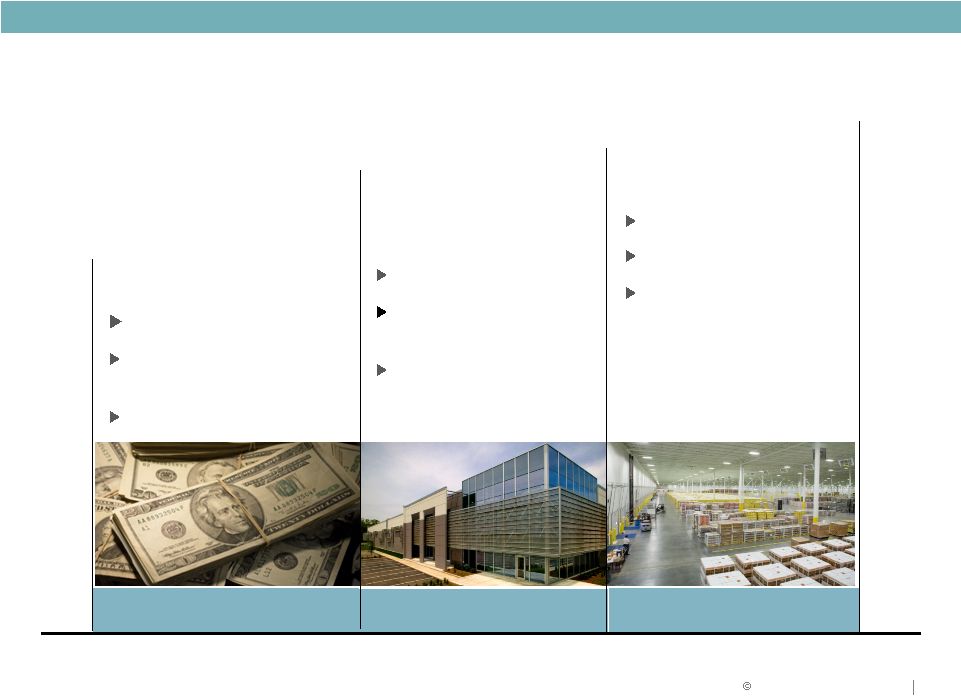

2009

2010 and 2011

FOCUS:

Liquidity

More than $1.5 billion

capital raised

Strategy refined

FOCUS:

Strategy execution

Operating

fundamentals

Balance sheet

strength

FOCUS:

Asset quality

Cash flow growth

Shareholder return

Where we’ve been and where we’re going…

2012 and beyond |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

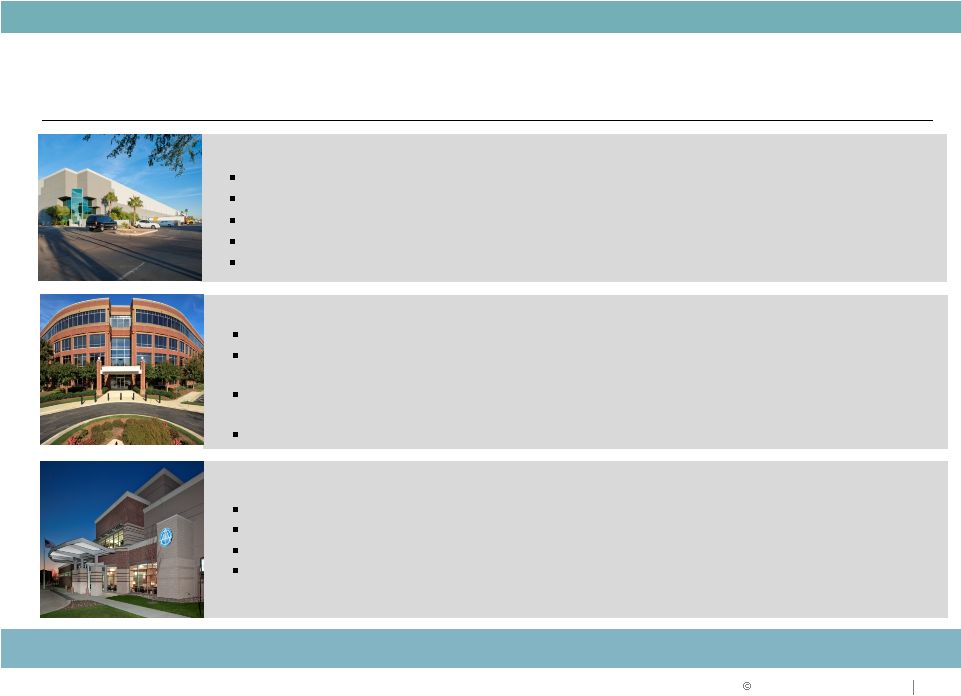

Suburban Office Market Still Challenging

Economic and federal budget uncertainty limiting business investment and expansion

decisions Recovery is very slow, with Q1 overall vacancy declining to 12.7%,

down 50 bps from prior year, with class A only space vacancy declining 90

bps from prior year Absorption for 2011 at 35 million SF, with Q1 about same

pace with 10 million SF of absorption; supply ticking up, but at about

one-third of peak 2007/2008 levels Re-leasing capital expenditures

remain elevated Medical Office Traction Remains

Operators now making expansion decisions after two year pause

Relationships are a key driver of on campus MOB business

Demographics and economics positive growth drivers

Medical office development and acquisition activity continues

4

Market Outlook

Still challenging, but trends improving in all product types

Industrial Market Continues Slow Recovery

Net absorption in U.S. for Q1 positive for the 8th consecutive quarter, class A

vacancy at 10.7% Strong

demand

for

large,

modern

product

remains,

class

A

vacancy

down

240bps

over

prior

year

Rents beginning to improve, occupancy levels getting closer to equilibrium and

limited new supply ISM index has been slowly climbing after a moderate

trough in mid-2011 Manufacturing sector, wholesale trade and

transportation realizing a majority of recent job growth Source: PPR and

Duke Realty |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Industrial Sector Peer Set Drill Down

5

•

RMZ outperformed S&P 500 in 2011, but has lagged slightly below the S&P 500

in 2012

•

Industrial

Sector

Comps

have

rallied

recently

.

.

.

Improving

key

trading

metrics

and

relative valuations

•

Duke Realty has outperformed, although still undervalued by most levered and

NAV metrics to its Industrial Comps …

but improving

Better than comparative Peer set and Industrial Comps since 2010

Better than comparative Peer set, Industrial Comps and major indexes since

Blackstone disposition

•

Most Industrial Comps AFFO Growth from 2010 to 2012 estimates, are flat to

declining

.

.

.

Duke

Realty

steady

to

slightly

positive

although

we

are

repositioning

and de-levering

•

Duke

Realty

dividend

yield

higher

than

Industrial

Comp

set

average

…

4.8%

versus

3.5% average

Industrial Sector Outperforming Sector YTD | Duke Outperforming

Peers |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

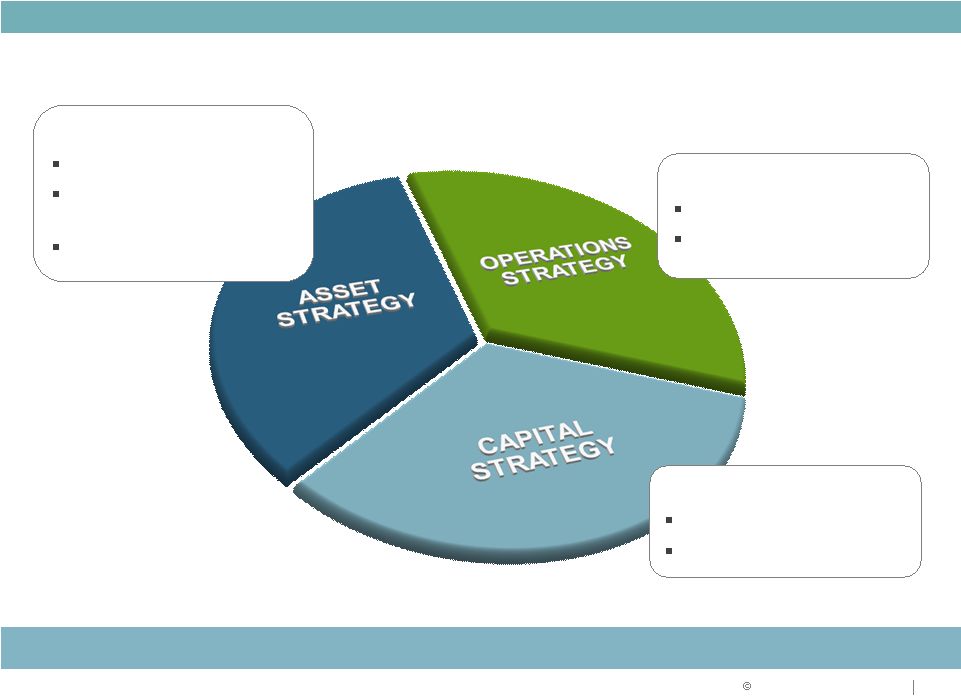

Focus on:

Increasing cash flow

Maximizing return on

assets

6

Strategy for Success

Focus on:

Improving coverage ratios

Improving ratings

Focus on:

Portfolio repositioning

Strategic acquisitions &

dispositions

Development opportunities

Strategies for delivering shareholder value |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Strategic Focus

2012 Goals and Objectives

Q1 2012 Update

•

Lease-up portfolio, manage cap ex; reach

positive same property income growth

•

Balance execution with capital strategy relative

to level and quality of cash flow and same

property NOI

•

Development starts of $150 to $250 million

focus on medical office and build-to-suit

•

Total portfolio occupancy as of quarter end 92.1%, up 1.4% from

year-end; industrial portfolio at 93.6%; medical office at 90.1%

•

Approximately 8.7 million square feet of leases completed

•

Debt to EBITDA @ 6.6x (7.38x excl. Blackstone); 4.7% Same

Property NOI growth

•

$120.8MM development starts. Two 100% leased bulk industrial

projects (at 6.9% stabilized yield) and one 100% leased medical

office (at 7.4% stabilized yield)

•

Continue strong momentum from 2011 on

repositioning of portfolio

•

Pursue acquisitions of medical and industrial

assets

•

Continue pruning suburban office primarily in

Midwest

•

Closed on over $157MM of acquisitions during the quarter,

weighted 45% in medical office and 55% in industrial

•

$63.7MM in dispositions of non-core assets

•

Opportunistically access capital markets . . .

push out maturity schedule further

•

Continue improving coverage ratios

•

Maintain minimal balance on line of credit

•

Fixed charge ratio of 1.81x

•

Issued $150MM of equity through ATM program

•

Redeemed Series M Preferred shares of $168MM

•

Zero credit facility balance and $15MM of cash at quarter end

Asset

Strategy

Operations

Strategy

Capital

Strategy

7

Solid

Q1

start

and

executing

across

all

three

aspects

of

our

strategy |

2012 Duke Realty Corporation

OPERATIONS STRATEGY

8 |

9

Focus on Fundamentals

LEASING OF

PORTFOLIO

STRATEGIC

NEW DEVELOPMENT

AND LAND DISPOSITION

AFFO PAYOUT

OPERATIONS STRATEGY

Maximize return on assets

2012 Duke Realty Corporation |

2012 Duke Realty Corporation

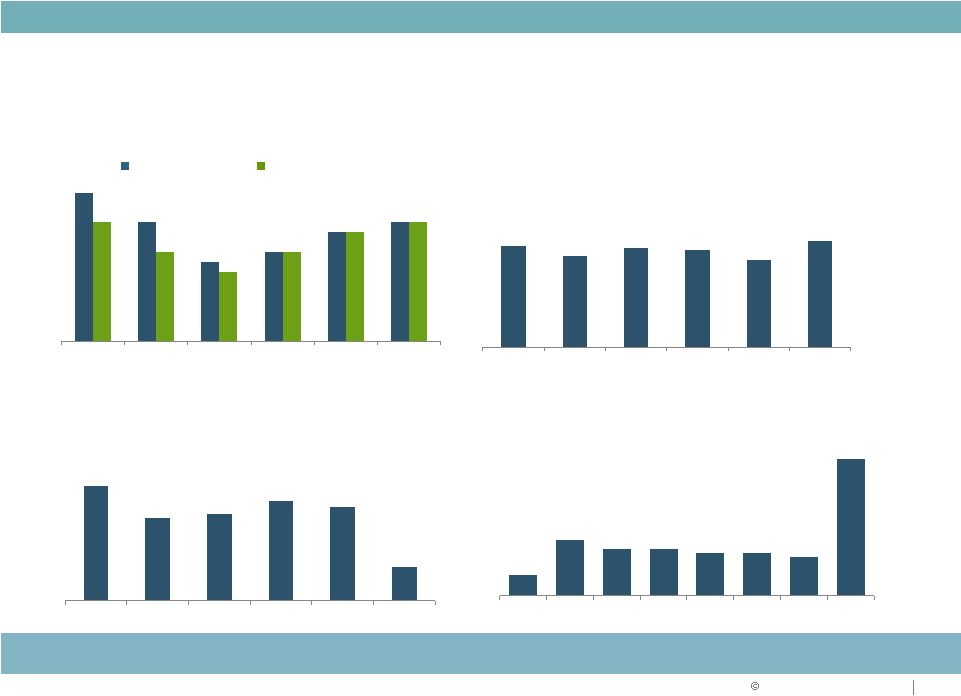

Consistent Operating Performance

Stabilized Occupancy (%)

Strong

historical

stabilized

occupancy

–

fundamentals

improving

Lease Renewals (%)

Strong lease renewal percentages

Stabilized occupancy

In-service occupancy

Leasing Activity

New

Leases

and

Renewals

–

Consistent

Execution

(in

millions

of

square feet)

Lease Maturity Schedule

Lease maturities are well balanced with no one year accounting for

more than 12%

Demonstrated ability to

maintain consistency through economic cycles

95%

92%

92%

89%

88%

91%

91%

89%

89%

87%

10

OPERATIONS STRATEGY

92%

92%

72%

79%

77%

69%

84%

21.4

22.7

25.9

24.5

8.7

2007

2008

2009

2010

2011

2012 YTD

5%

13%

11%

11%

10%

10%

9%

32%

2012

2013

2014

2015

2016

2017

2018

2019+

2007

2008

2009

2010

2011

2012 YTD

80%

2007

2008

2009

2010

2011

2012 YTD

29.9 |

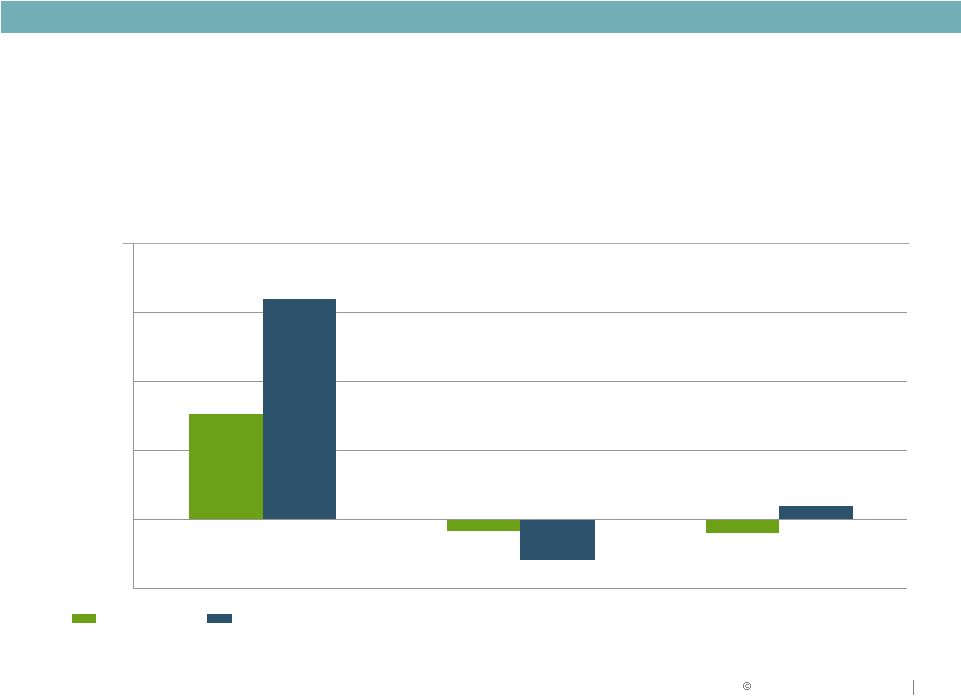

2012 Duke Realty Corporation

Notes

1.

Based

on

simple

average

of

year-over-year

annual

same-property

cash

NOI

growth,

includes

2007

-

2011

2.

Suburban Office Peers include BDN, CLI, HIW, LRY and PKY; weighted by historical

market cap 3.

Industrial includes DCT, EGP, FR, FPO, PSB, AMB and PLD; weighted by historical

market cap 1.5%

(0.2%)

(0.2%)

3.2%

(0.6%)

0.2%

(1.0%)

0.0%

1.0%

2.0%

3.0%

4.0%

Suburban Office Peers

Industrial Peers

5-Year Avg.

1-Year Avg.

Annual Same-Store

NOI Growth

(1)

%, y-y

Sources SNL and company filings

Duke Realty

Suburban Office Peers

(2)

Industrial Peers (3)

Consistent NOI Growth Outperformance

Relative Performance vs. Peers

OPERATIONS STRATEGY

11 |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

12

Positioned for NAV Growth

KEY NAV GROWTH DRIVERS

Source: PPR, Green Street and Duke Realty

Lease up

existing

vacancy

Increase Rents/

Reduced

Capex

Increased

management &

service fees

Accretive future

development

Accretive

future

acquisitions

Portfolio occupancy of 92.1%

Strong leasing pipeline

Demonstrated track record of 69-80% renewal rate

Rent roll downs burning off and positive same property NOI performance

Research forecasts market wide average annual rent growth of 3.2% from

2013-16 Will benefit from uptick in third party and JV partners

development and construction activity

Property

management

and

leasing

fees

-

will

trend

higher

as

occupancy

improves

Current pipeline of 686K SF of medical office, 344K SF of suburban office

2012 estimated development starts of $200 to $300 million

Land for 44 million SF of new development, 70% industrial

Acquisitions focused on asset strategy

Industrial and medical office assets

Higher rental rate growth markets |

2012 Duke Realty Corporation

13

Land and Development Capabilities

OPERATIONS STRATEGY

$498

million

HELD FOR DEVELOPMENT

Industrial

Office Midwest

26.3

2.8

Indianapolis, Chicago,

Cincinnati, Columbus,

Minneapolis, and

St. Louis major

positions

East

3.8

2.1

New Jersey,

Baltimore,

Washington D.C., and

Raleigh

Southeast

8.5

1.3

Atlanta, Central

Florida, and, South

Florida

Southwest

5.8

0.7

Phoenix, Dallas, and

Houston

Total

44.4 million SF

6.9 million SF

Attractive positions contribute to future development and value

Development –

Amounts in million SF

Office

30%

Industrial

70% |

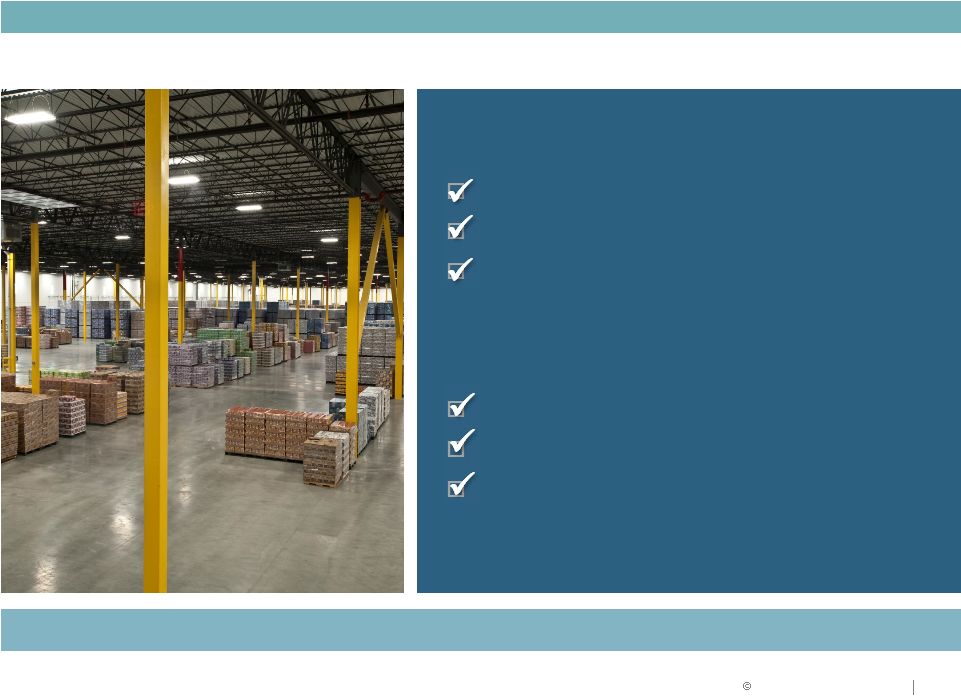

2012 Duke Realty Corporation

14

Indianapolis –

Industrial

OPERATIONS STRATEGY

Expand Industrial

•

Regal Beloit build-to-suit bulk distribution facility

•

376,000 square feet, ten year lease term to growing global manufacturing

company •

50/50 joint venture with Browning

•

Monetizes

26

acres

of

land

at

our

960

acre

AllPoints

Midwest

bulk

distribution

park

•

$15 million project |

2012 Duke Realty Corporation

15

Northeast U.S. –

Bulk Industrial Build-to-Suit

OPERATIONS STRATEGY

Repeat business new development with growing tenant

•

Regional distribution center build-to-suit in Delaware for Amazon

•

1,015,000 square feet

•

Twelve year lease term

•

$82 million project

•

“A”

rated credit |

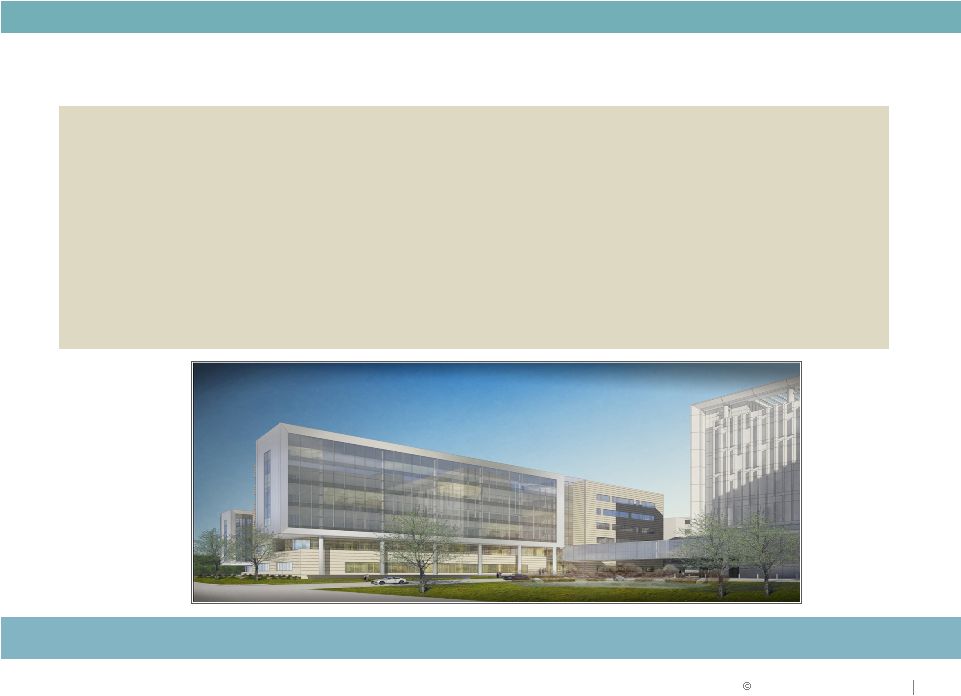

2012 Duke Realty Corporation

16

Indianapolis –

Medical Office

OPERATIONS STRATEGY

Grow Medical Office

•

Wishard Faculty Office Building

•

Aa2 rated system sponsored by Marion County

•

275,000 square feet

•

Thirty year lease term

•

50/50 Joint Venture with Hospital System

•

On campus of new hospital to open in 2013

•

$90 million project |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

17

Tampa –

Medical Office

•

VA Primary Care Annex at Tampa

•

Leased to Department of Veterans Affairs

•

120,000 square feet

•

20 year lease term

•

$41 million project

Grow Medical Office |

2012 Duke Realty Corporation

18

2011 PERFORMANCE

Total portfolio occupancy of 90.7%

Industrial at 91.9% occupancy

Over 24.5 million SF leases

2012 PERFORMANCE YTD:

Total occupancy of 92.1%

Industrial at 93.6% occupancy

Approximately 8.7 million SF leases

Quality,

well-positioned

assets

to

drive

performance

OPERATIONS STRATEGY |

2012 Duke Realty Corporation

ASSET STRATEGY

19 |

2012 Duke Realty Corporation

$1 Billion

20

Repositioning Track Record

$1 Billion

2005

2006

2007

2009

2010

2011

Proven ability to execute

ASSET STRATEGY

Flex disposition

Washington DC

Savannah

Healthcare

Asset Strategy

Premier

CBRERT

Dugan

Suburban

Office

Disposition |

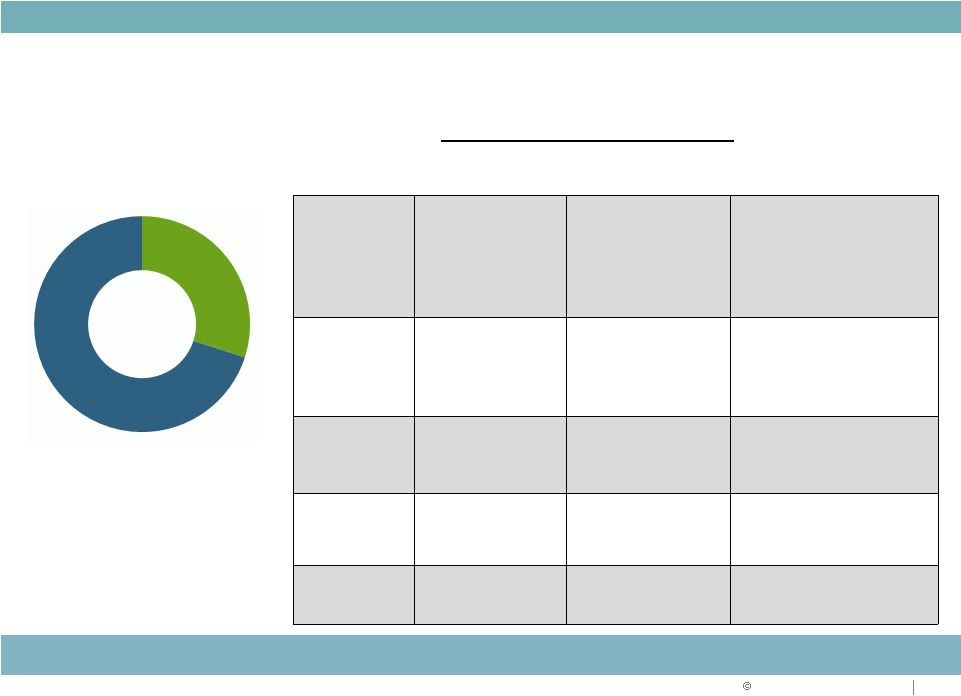

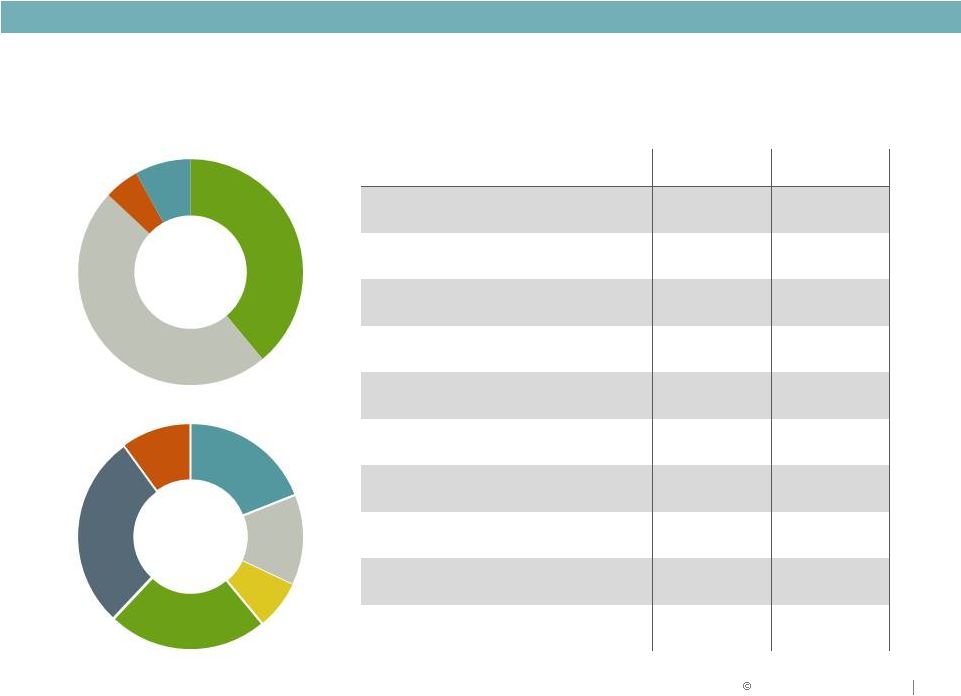

2012 Duke Realty Corporation

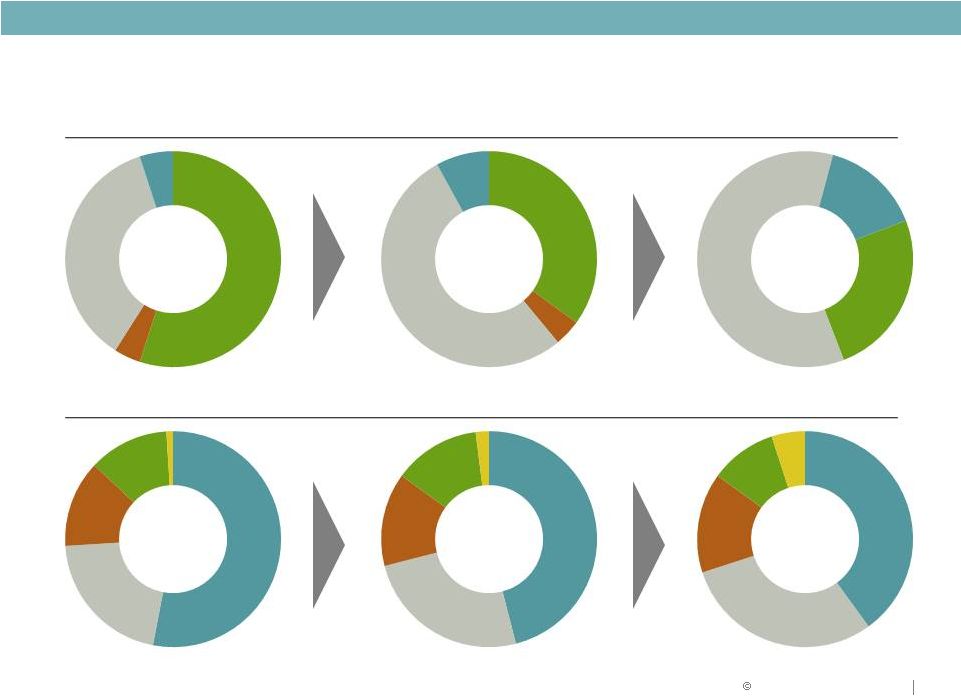

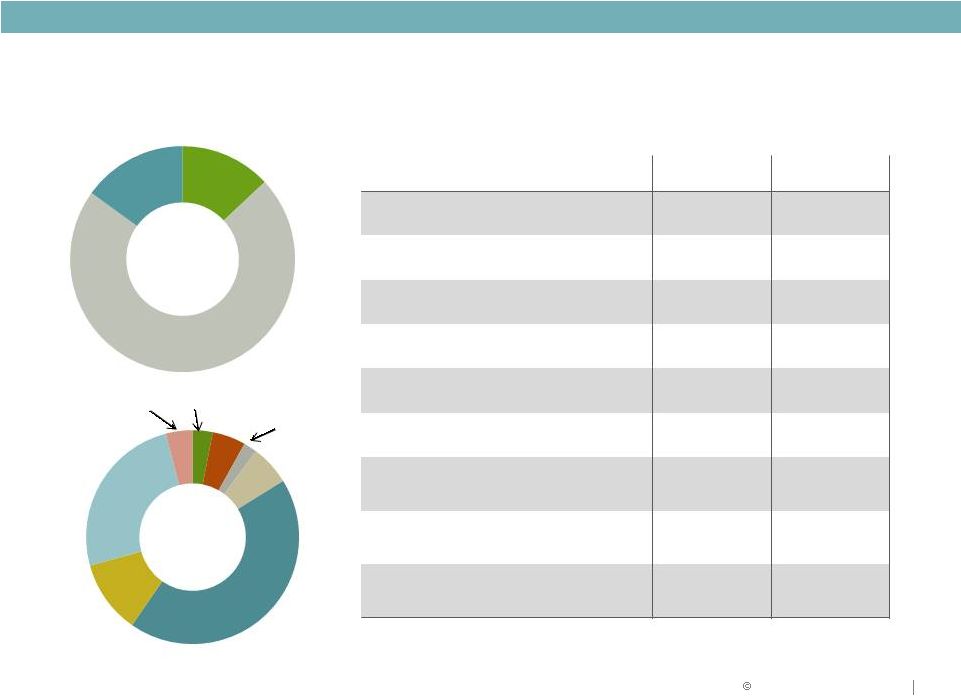

21

Asset Strategy

March 31, 2012

BY PRODUCT

2009

2013

BY GEOGRAPHY

ASSET STRATEGY

2009

2013

2012

Southeast

21%

Southeast

24%

Southeast

30%

2012

Office

55%

Retail

4%

Industrial

36%

Medical

Office

5%

Office

32%

Retail

4%

Industrial

53%

Medical

Office

11%

Office

25%

Industrial

60%

Medical

Office

15%

Midwest

53%

East

13%

South

12%

West

1%

Midwest

40%

East

15%

South

10%

West

5%

Midwest

46%

East

14%

South

14%

West

2% |

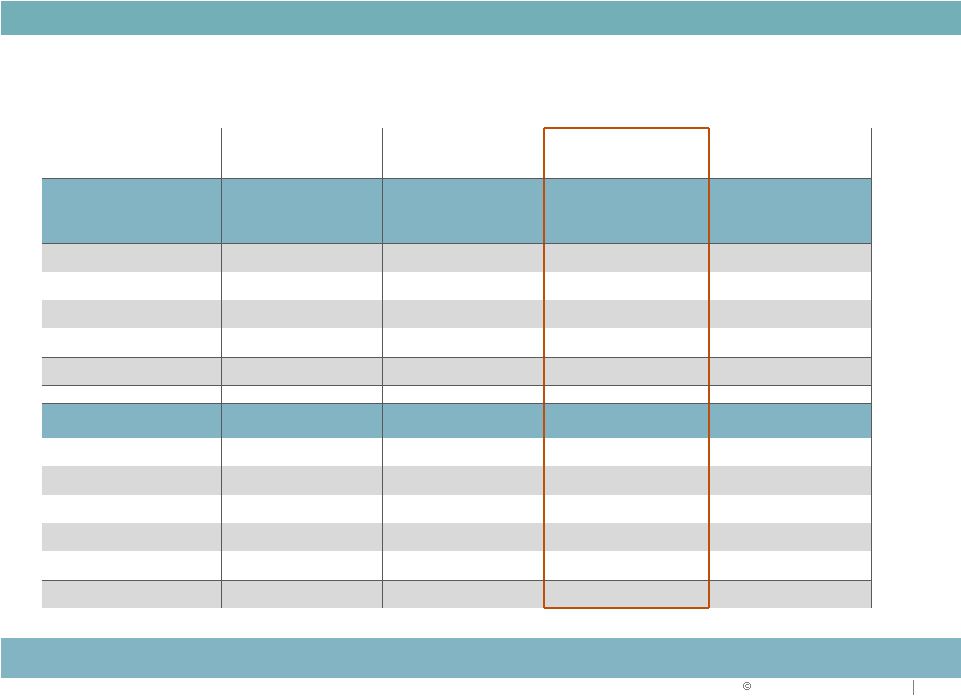

2012 Duke Realty Corporation

22

Asset Strategy: Road Map

($ in millions)

Investment

12/31/10

Investment

3/31/12

ACTION PLAN

Investment

2013

PRODUCT TYPE

Amount

%

Amount

%

Acquisitions /

Developments /

Repositioning

Amount

%

Industrial

$3,645

45%

$4,264

53%

$656

$4,920

60%

Office

3,770

46%

2,529

32%

(479)

2,050

25%

Medical Office

515

6%

840

11%

390

1,230

15%

Retail

280

3%

305

4%

(305)

0

0%

$8,210

100%

$7,938

100%

$262

$8,200

100 %

REGION

Midwest

$3,970

48%

$3,710

46%

($430)

$3,280

40%

Southeast

2,270

28%

1,884

24%

526

2,460

30%

East

955

11%

1,089

14%

141

1,230

15%

South

950

12%

1,092

14%

(272)

820

10%

West

65

1%

163

2%

247

410

5%

$8,210

100%

$7,938

100%

$262

$8,200

100%

Portfolio sale accelerates suburban office repositioning

ASSET STRATEGY |

2012 Duke Realty Corporation

23

ASSET STRATEGY

Asset Strategy: Progress To Date

BUILDING ACQUISITIONS

BUILDING DISPOSITIONS

Q4 2009

15

Q4 2009

144

2010

919

2010

499

2011

747

2011

1,634

Q1 2012

157

64

Total

$1,838

Total

$2,341

NO

DILUTION

TO AFFO

Matching acquisitions with dispositions . . . limiting earnings impact

($ in millions)

PROGRESS TO DATE

TOTAL

VALUE

ASSUMED

DEBT

NET

Dispositions

$2,341

($0)

$2,341

Acquisitions

$1,838

($669)

$1,169

Excess Cash

$1,172 |

2012 Duke Realty Corporation

24

New, High Quality Portfolio with Long-term Leases

Premier portfolio of assets

Portfolio average

Bulk

Industrial

Suburban Office

Medical

Office

Property age

10.4 years

13.1 years

4.2 years

Property size

221,000 SF

117,000 SF

82,000 SF

Lease term

7.1 years

7.3 years

11.7 years

Tenant size

76,000 SF

12,000 SF

10,000 SF

ASSET STRATEGY |

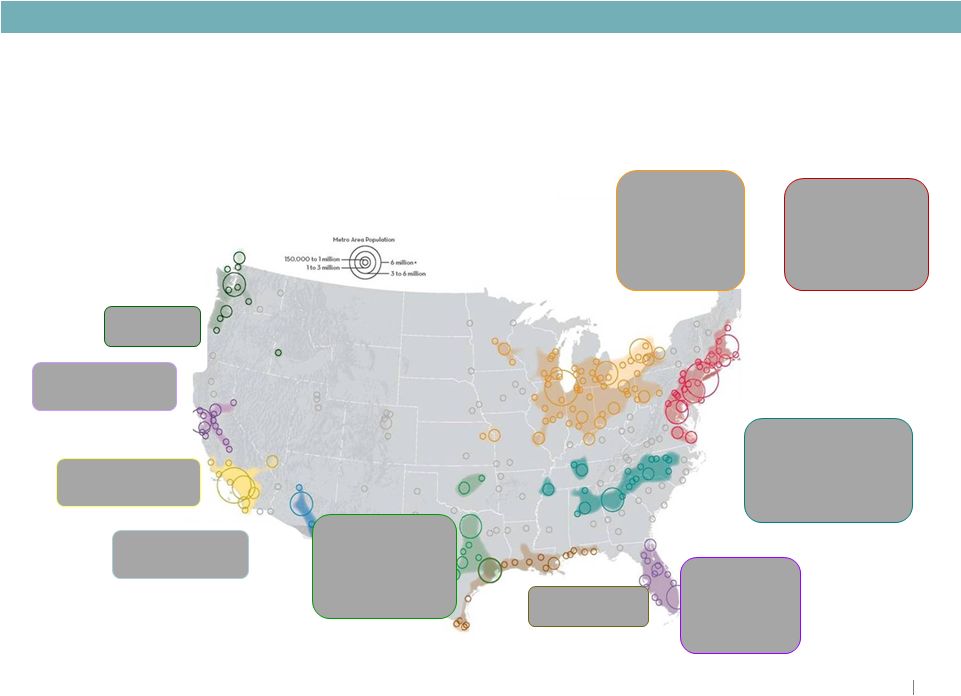

RELIABLE. ANSWERS.

U.S. Rail and Highway Logistics Routes & Corridors

Duke Realty’s 17 Primary Markets Strategically Placed in Key Distribution

Corridors Note:

Duke Realty Primary

Industrial Markets in Blue |

RELIABLE. ANSWERS.

Market Size

(MM SF)

(Dec. 2011)

Population

(MM People)

(Dec. 2011)

Fore. Pop. Growth

(Fore. 2011-2016)

Pop. w/in 500 miles

(as of 2005)

Fore. Demand Growth

(Fore. 2011-2016)

Fore. Vacancy Rates

(Fore. Dec. 2016)

Atlanta

489.7

5.4

1.8%

25.2%

2.2%

10.4%

Baltimore

149.0

2.7

0.5%

36.7%

0.9%

9.1%

Chicago

794.0

9.6

0.5%

27.8%

1.0%

10.6%

Cincinnati

206.6

2.2

0.6%

39.0%

1.5%

7.4%

Columbus OH

219.1

1.9

0.8%

45.0%

1.3%

10.1%

Dallas - Fort Worth

546.5

6.6

2.1%

14.3%

2.0%

10.0%

Fort Lauderdale

102.8

1.8

1.8%

6.5%

1.6%

5.4%

Houston

396.6

6.2

1.9%

12.2%

1.5%

5.0%

Indianapolis

179.6

1.8

1.3%

35.1%

2.2%

5.5%

Inland Empire

390.4

4.3

1.0%

14.4%

2.8%

9.3%

Los Angeles

682.8

10.0

1.0%

14.3%

0.9%

3.0%

Miami

194.4

2.5

1.2%

6.2%

1.1%

5.6%

Minneapolis

146.9

3.3

1.0%

14.6%

1.1%

6.3%

Nashville

133.0

1.6

1.0%

34.4%

1.4%

8.9%

Norfolk

67.8

1.7

0.7%

35.0%

1.6%

8.1%

Orlando

107.2

2.2

2.6%

12.7%

1.6%

10.6%

Phoenix

205.2

4.3

2.6%

11.4%

2.4%

10.6%

Raleigh

42.4

1.2

3.6%

36.0%

1.8%

7.3%

Saint Louis

203.1

2.9

0.4%

31.1%

0.6%

9.3%

Tampa

128.5

2.8

1.4%

12.0%

1.6%

6.2%

Washington - NoVA - MD

145.7

5.7

1.1%

37.7%

1.4%

8.3%

Austin

52.3

1.8

2.6%

11.2%

1.2%

10.4%

Boston

167.3

4.6

0.2%

23.0%

0.4%

8.6%

Charlotte

152.4

1.8

2.3%

30.7%

1.4%

8.0%

Cleveland

189.6

2.1

-0.3%

43.1%

0.4%

7.9%

Denver

146.6

2.6

1.1%

5.3%

0.9%

7.0%

Detroit

334.6

4.3

0.0%

38.8%

1.0%

9.7%

East Bay

173.1

2.6

1.0%

13.4%

0.9%

5.6%

Hartford

50.6

1.2

0.2%

25.4%

1.3%

9.1%

Honolulu

37.1

1.0

0.5%

0.4%

1.0%

2.7%

Jacksonville

96.7

1.4

1.6%

16.6%

2.2%

9.3%

Kansas City

183.3

2.1

1.0%

21.1%

0.8%

7.0%

Las Vegas

84.4

2.0

2.9%

15.7%

1.9%

11.1%

Long Island

130.3

2.9

0.1%

27.4%

0.4%

3.8%

Memphis

182.7

1.3

0.8%

28.7%

2.0%

10.8%

Milwaukee

93.6

1.6

0.4%

25.0%

0.7%

9.3%

New Orleans

55.5

1.2

0.3%

17.1%

0.5%

8.8%

New York

393.4

11.6

0.2%

29.3%

0.0%

5.6%

Northern New Jersey

150.6

2.2

0.3%

31.3%

0.8%

7.3%

Oklahoma City

58.5

1.3

1.1%

15.4%

1.3%

5.4%

Orange County

161.6

3.1

1.0%

14.3%

0.7%

3.7%

Palm Beach County

41.7

1.4

2.7%

7.3%

1.3%

8.4%

Philadelphia

360.2

6.0

0.4%

33.1%

0.8%

7.8%

Pittsburgh

103.6

2.4

-0.1%

44.5%

0.5%

7.7%

Portland, OR

148.2

2.3

1.8%

5.2%

2.0%

5.9%

Richmond

71.9

1.3

1.0%

38.1%

1.8%

8.3%

Sacramento

131.6

2.2

1.2%

14.2%

0.6%

12.1%

Salt Lake City

82.2

1.2

1.5%

5.3%

1.3%

5.9%

San Antonio

71.9

2.2

2.0%

9.9%

1.8%

8.4%

San Diego

91.9

3.2

1.5%

13.9%

0.7%

7.6%

San Francisco

62.7

1.8

0.8%

13.1%

0.1%

2.8%

San Jose

74.5

1.9

0.8%

13.1%

0.3%

3.7%

Seattle

194.7

3.5

1.1%

3.8%

1.7%

6.7%

Stamford

26.1

0.9

0.3%

26.6%

1.9%

7.0%

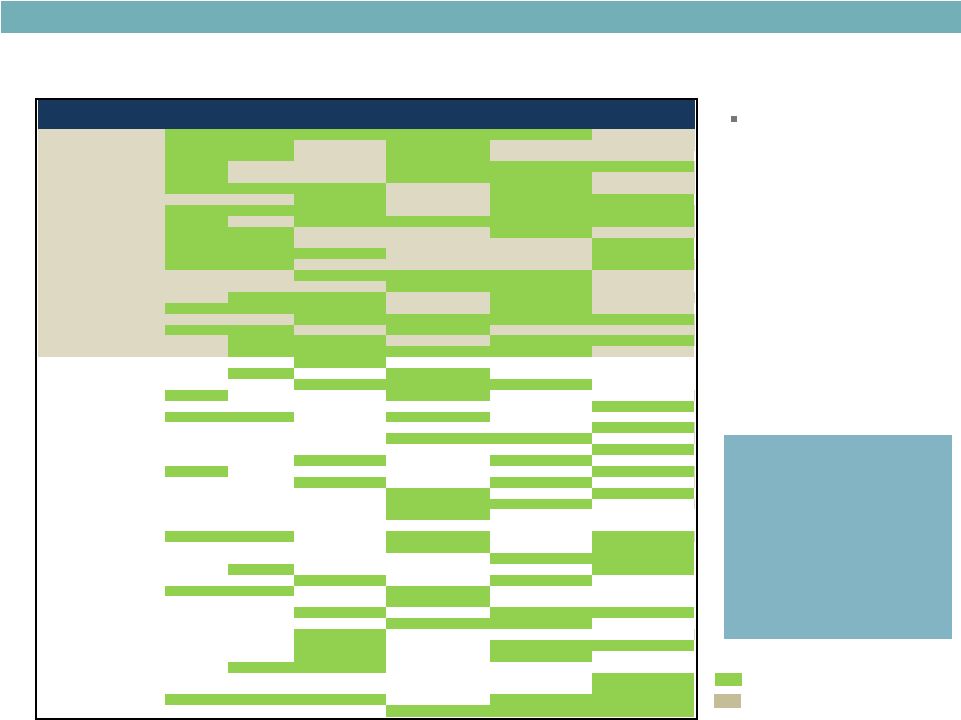

Duke Realty’s

industrial portfolio is

diversified across top

ranked markets by

square footage,

population,

population growth,

population within 500

miles, forecast

demand growth and

forecast vacancy

rates

Rankings of “PPR 54”

Top Industrial Markets

= Top

50%

Ranking

per

“PPR

54”

Data

Located in

Strategic

Distribution

Markets

Consistent with

Asset Strategy

= Crossover market with Duke portfolio

Source: PPR, Q4 2011 |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

27

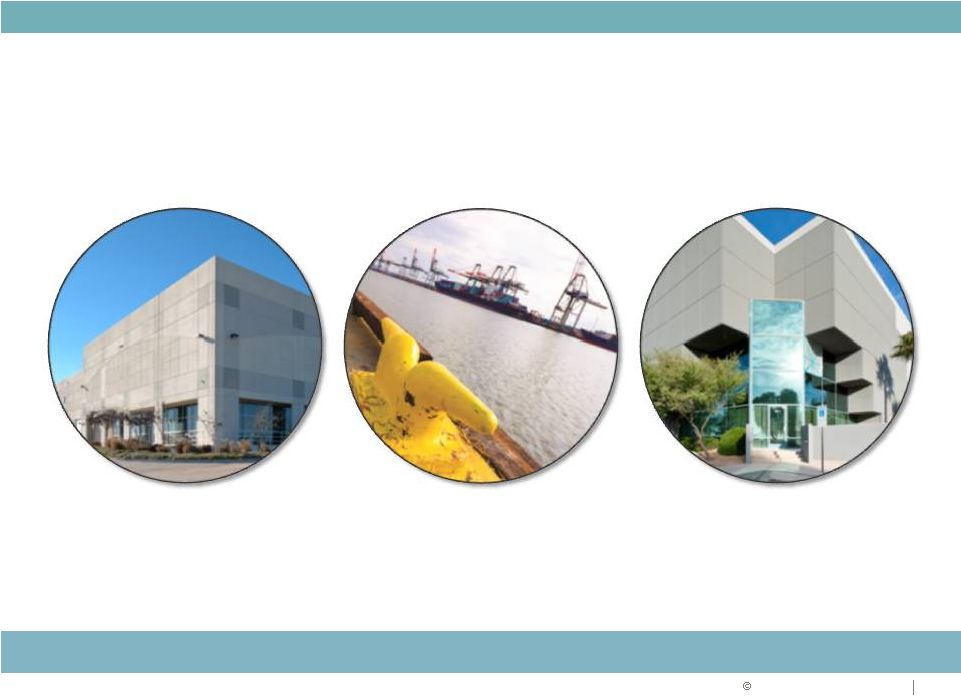

Industrial Market Expansion in 2011

Century Distribution Center

Los Angeles, CA

323,000 SF, 100% leased

Pioneer 161 Solo

Dallas, TX

603,000 SF, 100% leased

Lakeside Ranch Industrial

Dallas, TX

749,000 SF, 100% leased

Premier Portfolio Industrial

Pompano, FL

1,163,000 SF, 90% leased

Premier Portfolio Office

Pompano, FL

389,000 SF, 87%, leased

Seefried Industrial

Chicago, IL

353,000 SF, 100% leased

Seefried Industrial

Dallas, TX

324,000 SF, 100% leased |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Strategy for Industrial Markets

Focus

industrial

expansion

in

core

markets:

–

South Florida

$597

–

Chicago

318

–

Houston

83

–

Dallas

78

–

Southern

California

68

Develop in markets where we have land and competitive positions

Goal: Increase Shareholder Value

Develop in markets where we have land and competitive positions

$ Invested ($ in millions)

|

2012 Duke Realty Corporation

29

$1.6 billion of dispositions

$747 million of acquisitions

Over $200 million of development starts

Made significant progress on strategic plan

2012 PERFORMANCE YTD:

$64 million of dispositions

$157 million of acquisitions

$121 million of development starts

Continue making progress on strategic plan

Quality portfolio further improving with asset strategy

ASSET STRATEGY

2011 PERFORMANCE |

2012 Duke Realty Corporation

CAPITAL STRATEGY AND 2012 GUIDANCE

30 |

2012 Duke Realty Corporation

CAPITAL STRATEGY

Capital Strategy Focus

31

Reducing leverage

Increasing coverage ratios

Maintaining size and quality of unencumbered asset base

Executing portfolio repositioning in alignment with capital strategy

objectives

Further improve balance sheet strength and ratings

1

1

2

2

3

3

4

4 |

2012 Duke Realty Corporation

CAPITAL STRATEGY

32

Key Metrics & Goals

2009

Actual

2010

Actual

2011

Actual

2012

1Q

Actual

Goal

Debt to Gross Assets

44.5%

46.3%

46.8%

47.3

45.0%

Debt + Preferred to Gross

Assets

54.9%

55.5%

55.6%

54.3

50.0%

Fixed Charge Coverage

Ratio

1.79 : 1

1.79 : 1

1.82 : 1

1.81:1

2.00 : 1

Debt/EBITDA

6.65

7.31

6.02*

6.56**

< 6.00

Debt + Preferred/EBITDA

8.47

8.88

7.34*

7.64**

< 7.75

Progressing toward strategic plan goals

*Timing of Blackstone transaction. Including adjustments to TTM EBITDA for Blackstone transaction

results in recast 2011 Debt to EBITDA of 7.03x and Debt+Preferred/EBITDA of 8.58x . **

For 1Q 2012, recast Debt to EBITDA of 7.38x and Debt+Preferred/EBITDA of 8.59x

|

2012 Duke Realty Corporation

CAPITAL STRATEGY

33

Continue to execute on capital strategy objectives

CAPITAL SOURCE

2007

2008

2009

2010

2011

2012

YTD

TOTAL

Common Stock

$230

-

$575

$311

-

$150

$1,216

Preferred Stock

-

$300

-

-

-

-

$300

Unsecured Debt

$300

$325

$500

$250

-

-

$1,375

Secured Debt

-

-

$270

-

-

-

$270

Asset Dispositions

$785

$475

$300

$533

$1,650

$65

$3,808

TOTAL

$1,315

$1,100

$1,645

$1,094

$1,650

$215

$7,019

•

Investment grade rated debt for over 15 years

•

Proven access to multiple capital sources

•

Available line of credit -

$850 million capacity

•

Dividend covered by AFFO

Continue to strengthen balance sheet

($ in millions) |

RELIABLE. ANSWERS.

Bond Market Indicative Pricing

Credit Markets Responding favorably to Execution of Asset and

Capital Strategies

Source: Wells Fargo, 5/11/2012

Tenor

5 years

10 years

Assumed Ratings

Baa2/BBB-

Baa2/BBB-

Benchmark

5 year UST

10 year UST

Benchmark Yield

0.78%

1.88%

Reoffer Spread

220.0 bps

240.0 bps

Reoffer Yield

2.98% area

4.28% area

Underwriting Fee (%)

0.600%

0.650%

All-In Cost (Yield)

3.11% area

4.36% area |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

The RMZ outperformed S&P 500 in 2011,

but has lagged slightly below the S&P 500 in 2012

35

Source: J.P. Morgan, Bloomberg, FactSet as of 05/10/12

1

Based upon 342 total trading days

85%

90%

95%

100%

105%

110%

115%

120%

Jan-11

Jan-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Level

# trading days

above

%

above¹

900

4

1%

Current (896)

7

2%

850

60

17%

800

175

51%

750

303

89%

Performance

RMZ

S&P 500

FY 2011

4.7%

0.0%

YTD 2012

12.5%

8.0%

$9

$10

$11

$12

$13

$14

$15

$16

Jan-11

Jan-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Level

# trading days

above

%

above¹

$15.00

9

3%

Current ($14.76)

27

8%

$14.50

45

13%

$13.50

186

54%

$13.00

221

65%

Protests in Middle East turn violent and

Japanese earthquake and tsunami result

in crisis at nuclear plant

Market expectations for a solution to the European debt crisis grow

and DRE announces sale of over $1 billion office portfolio (10/20)

Heightened fears over

European debt crisis and

S&P downgrade of U.S. AAA

credit rating

U.S. economic data consistently beats

expectations and the European Central

Bank takes aggressive action to relieve

funding pressures on European banks

DRE

$14.76

Feb-11

RMZ price performance (2011 –

2012YTD)

DRE price performance (2011 –

2012YTD) |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

36

Relative Performance of Duke Realty versus

Industrial Comps only

Notes

1.

Comparables include DCT, EGP, FR, and PLD; PLD and AMB are included historically,

total return for comparable companies figures are calculated on a market cap weighted basis

2.

DRE stock price as of end of trading 5/11/12, @ $14.68

3.

DRE performance since 10/20 announcement of $1.1Bn office divestiture. Based upon

10/20/11 close of $10.68 Strong Recent Performance Reflective of Executing

Aligned Operating, Asset Repositioning and Capital Strategies

% Total Return(1):

Ind Comps

-4.0%

S&P 400

-1.7%

FY 2011

YTD

2012

(2)

Since -

10/20

(3)

RMS

+25.2%

Ind Comps

+34.7%

DRE

+2.1%

Ind Comps

+21.6%

DRE

+23.3%

S&P 500

+8.4%

RMS

+14.1%

S&P 400

+10.2%

DRE

+41.2%

S&P 400

+15.4%

S&P 500

+12.7%

RMS

+8.7%

S&P 500

+2.1% |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

37

Notes

1.

As of April 30, 2012

2.

Includes LRY, HIW, CLI, BDN, and OFC

3.

DCT’s beta only available since its IPO. Barra began tracking DCT’s

beta in Dec 2006 4.

Includes PLD, FR, EGP, DCT, and LRY

Duke Realty and Peers Barra Beta Analysis

Beta Trends are Slowly Improving Consistent with Asset and Capital

Strategy….Working on Further Lowering Beta

Barra Beta Analysis

2002-2012

1 Year

5 Year

10 Year

Avg

Avg

Avg

DRE

Office Comps

(2)

Industrial Comps

(3)(4)

1.34

1.45

1.54

Current

(1)

1.09

1.21

1.25

1.35

1.00

1.23

1.25

1.41

0.95 |

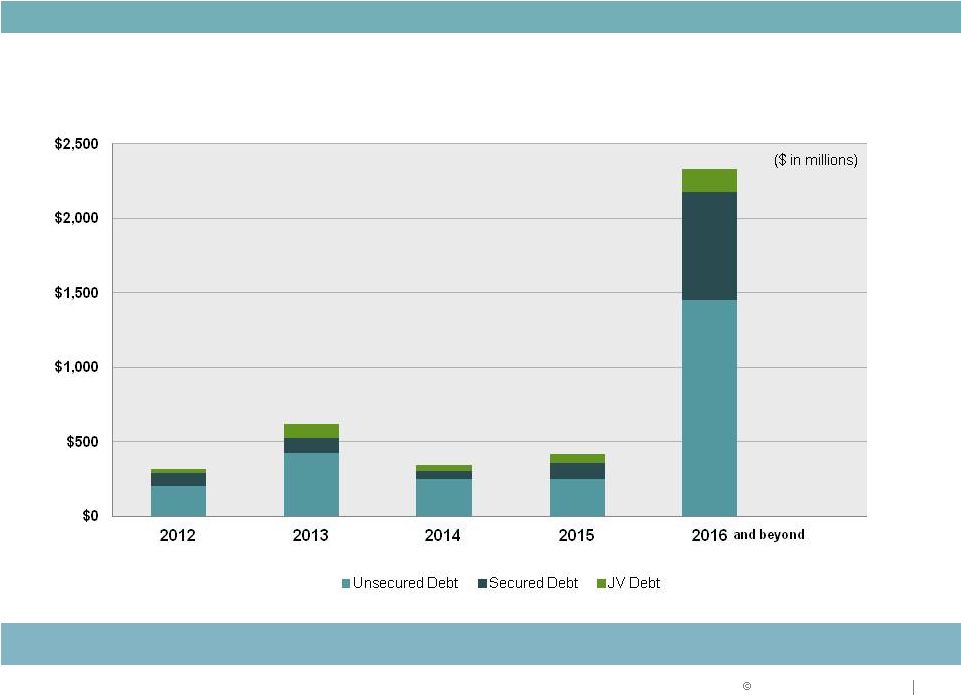

2012 Duke Realty Corporation

38

Liquidity Position

CAPITAL STRATEGY

Manageable debt maturities |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

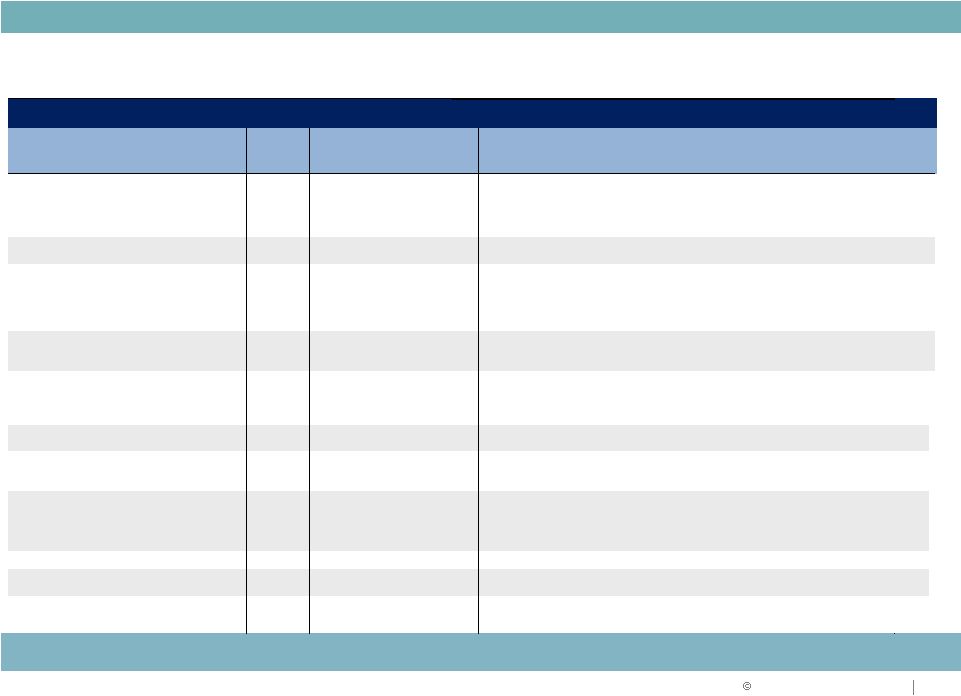

2012 Range of Estimates

($ in millions)

Leasing Actions Combined with Modest Rental Rate Increases Drive

Upside

39

Metrics

2011

Actual

Q1 2012

Actual

Pessimistic

Optimistic

Key 2012 Assumptions

Core FFO per share

$1.15

$0.24

$0.94

$1.06

-

Blackstone/repositioning dilution $.10 -

$.12

-

Lower service operations income

-

Partially offset by improvement in occupancy of core portfolio

AFFO Payout Ratio

87%

85%

96%

80%

-

Annual dividend maintained at $0.68 per share

Avg Occupancy -

In-Service

89.7%

91.3%

89.5%

92.5%

-

Positive

momentum

anticipated

given

Industrial

and

medical

office

performance

-

Lower expirations than 2011 (7% vs. 10%)

-

Upside to guidance driven by lease-up of portfolio

Same Property NOI Growth

3.2%

3.6%

(1.5%)

2.5%

-

Occupancy increase lower than 2011

-

Rental rate pressure remains

Building Acquisitions

$747

$157

$300

$500

-

Remain selective regarding property type and location in alignment with

long-term strategy

-

Focus on industrial and medical office

Building Dispositions

$1,634

$64

$200

$300

-

Continue to prune remaining non-core office portfolio

Land Sale Proceeds

$12

$2

$20

$30

-

Selling 10% to 20% of identified non-strategic parcels

-

Demand still sluggish

$489

$138

$300

$500

-

Comprised of medical office and industrial starts

-

Development of $200 to $300 million

-

Third party of $100 to $200 million

Construction Volume

$727

$107

$400

$600

-

Wind down of BRAC project partially offset by development volume

Service Operations Income

$46

$6

$20

$25

-

Reduced fees from BRAC project

General & Admin expense

$40

$12

$43

$38

-

In line with 2011

2012 Range of Estimates

Construction and

Development Starts |

2012 Duke Realty Corporation

40

$1.6 billion of capital raised through asset

dispositions

Retired $333 million of unsecured bonds

Redeemed $109 million of preferred equity

Fixed charge ratio of 1.82x and

debt to EBITDA of 6.02x*

Opportunistically tapped ATM raising $147 million

Continue improving coverage ratios

Maintaining minimal balance on line of credit

CAPITAL STRATEGY

Strong

balance

sheet

…

executing

according

to

strategy

* Timing of Blackstone transaction; Including adjustments to EBITDA for

Blackstone transaction results in recast Debt to EBITDA of 7.03x

2011 PERFORMANCE

2012 PERFORMANCE YTD: |

2012 Duke Realty Corporation

MIDWEST OVERVIEW

Performance Update

41 |

2012 Duke Realty Corporation

RECENT TRANSACTIONS

42

Midwest

New Lease -

Industrial

World Park Union Center

Cincinnati

191,000 SF

Tenant: Ashland

Term 6 years

Renewal -

Industrial

Park 100 Bldg 131

Indianapolis

419,000 SF

Tenant: Hewlett Packard

Term: 1.25 years

Strong distribution base: Over 30% of U.S.

population within one day’s drive

74 Fortune 500 headquarters

High growth and return opportunities, particularly

in Chicago, Columbus, and Indianapolis

Duke Realty’s roots and a position of strength

Original

location

–

since

1972

Low basis product

Dominant market position

46% of our total investment

Acquisition -

Industrial

1860 W. Jefferson

Chicago

827,000 SF, 100% leased

Tenant: Crate & Barrel

MIDWEST OVERVIEW

Development Industrial

Regal Beloit BTS

Allpoints Midwest Bldg 4

Indianapolis

376,000 SF

100% leased

Committed to Midwest because we perform…

Midwest remains a key component to our strategy

MARKET OVERVIEW & KEY POINTS |

2012 Duke Realty Corporation

43

Midwest Overview

Location

Product

Type

Industrial

Office

Average Age

11.8 years

16.2 years

Average Building Size

248,000 SF

125,000 SF

Total Square Footage

57 million

12.4 million

Current Occupancy

94.8%

83.8%

Indianapolis

96.4%

92.6%

Chicago

98.0%

88.4%

Cincinnati

93.1%

83.4%

St. Louis

88.1%

76.8%

Columbus

96.5%

84.0%

Minneapolis

84.5%

100%

MIDWEST OVERVIEW |

2012 Duke Realty Corporation

44

Midwest Focus

DOMINANT POSITION

BULK INDUSTRIAL

REDUCE OFFICE

CONCENTRATION

MIDWEST OVERVIEW

Enhancing dominant industrial position in Midwest |

2012 Duke Realty Corporation

EAST & SOUTHEAST OVERVIEW

Performance Update

45 |

2012 Duke Realty Corporation

46

East & Southeast Overview

New Deal –

Industrial

625 Braselton

Atlanta

William Carter Co.

1,061,663 SF

Term:11.5 years

New/Renewal -

Office

Liberty Center II

Washington, D.C.

Scitor Corp

159,000 SF

Term: 10 years

EAST & SOUTHEAST OVERVIEW

Disposition –

Office

Raleigh –

6 Bldgs

427,000 SF

87% leased

New Lease/Dev Start –

Industrial

Delaware

560 Merrimac Ave

Tenant: Amazon

1,015,000 SF

Term: 12 years

RECENT TRANSACTIONS

Strong presence: entered Southeast in 1999 (Weeks

merger) and East in 2006 (acquisition of Winkler portfolio) 15 Fortune 500 headquarters

East and Southeast cities among top growth markets

in country… strong in-migration

Diversified economies; Government, healthcare,

finance and education

Eastern cities maintained highest employment rate

through downturn

Atlanta and Northeast corridor strong in bulk

industrial

38% of our total investment

MARKET OVERVIEW & KEY POINTS

|

2012 Duke Realty Corporation

47

East & Southeast Overview

Industrial

Office

Average Age

9.5 years

9.9 years

Average Building Size

161,000 SF

110,000 SF

Total Square Footage

29.3 million

9.5 million

Current Occupancy

91.6%

86.6%

Atlanta

90.1%

81.7%

South Florida

84.3%

85.7%

Raleigh

98.9%

89.4%

Washington D.C./Baltimore

94.1%

87.1%

Central Florida

93.6%

84.4%

Savannah

93.2%

NA

EAST & SOUTHEAST OVERVIEW

Location

Product

Type

Office

37%

Industrial

48%

Medical

Office

7%

Retail

8%

Atlanta

18%

D.C./

Baltimore

16%

Central

9%

Raleigh

21%

South

27%

Savannah

9%

Florida

Florida |

2012 Duke Realty Corporation

48

East & Southeast Focus

BULK INDUSTRIAL/PORTS

LEASE UP AND RENT GROWTH

ACQUISITIONS & DEVELOPMENT

EAST & SOUTHEAST OVERVIEW

Maximize assets and market position |

2012 Duke Realty Corporation

49

SOUTHWEST OVERVIEW

Performance Update |

2012 Duke Realty Corporation

RECENT TRANSACTIONS

50

Southwest

New Lease-

Industrial

Kingsley Dist. Center

Service Lighting & Electrical

132, 000 SF

Term: 5.5 years

New Lease-

Industrial

Freeport VI

VMP Nutrition

114,000 SF

Term: 5 years

Duke Realty one of top 3 owner/developers in

Dallas/Ft.Worth

Duke Realty presence since 1999 (Weeks merger)

52 Fortune 500 headquarters

Demographic drivers: modern transportation and

infrastructure, population and job growth

Strong industrial demand expected post-recovery

Port, inland port and logistics key for bulk

distribution markets

16% of our total investment

Expand industrial presence by pursuing select

acquisition opportunities in Houston, Phoenix and

Southern California

Renewal-

Office

Aspen Grove Office Center II

Mars Petcare

122,000 SF

Term: 5 years

MARKET OVERVIEW & KEY POINTS

SOUTHWEST

OVERVIEW |

2012 Duke Realty Corporation

51

Southwest Overview

Location

Product

Type

SOUTHWEST OVERVIEW

Seattle

2%

Austin

3%

Southern CA

5%

Dallas

43%

Phoenix

6%

Houston

12%

Nashville

25%

San Antonio

4%

Office

11%

Industrial

68%

Medical

Office

21%

Industrial

Office

Average Age

8.3 years

7.3 years

Average

Building

Size

272,000 SF

106,700 SF

Total

Square

Footage

23.4 million

1.6 million

Current Occupancy

93.2%

95.5%

Dallas

92.2%

100%

Nashville

95.6%

93.9%

Houston

92.6%

100%

Phoenix

94.4%

N/A

Southern California

100%

N/A |

2012 Duke Realty Corporation

52

Southwest Focus

DALLAS LEASE-UP

HOUSTON INDUSTRIAL PORT

DALLAS INLAND PORT

SOUTHERN CALIFORNIA

EXPANSION

SOUTHWEST OVERVIEW

Grow |

2012 Duke Realty Corporation

53

MEDICAL OFFICE STRATEGY &

Performance Update |

2012 Duke Realty Corporation

Medical Office Portfolio at March 31, 2012

54

In-Service

Under

Development

Total

Properties

44

6

50

Investment $

$695 M

$145 M

$840 M

Square Feet

3.59 M

685 K

4.28 M

Occupancy

91%

86%

90%

Local

15%

Regional

55%

National

30%

Specialty

Hospital

7%

MOB On-

Campus

86%

MOB

Off-Campus

7%

Portfolio investment by product type

Portfolio investment by

hospital system

MEDICAL OFFICE STRATEGY |

major cities that produce more than $100 billion in goods and

services. Mega-regions will drive need for healthcare,

transportation infrastructure and jobs through 2050

Duke Realty Markets: Demographic Focus

*

Duke Realty market

Map Source: ATLANTA REGIONAL COMMISSION MEGAREGIONS REPORT

MEDICAL OFFICE STRATEGY

55

CASCADIA

NORTHERN

CALIFORNIA

SOUTHERN

CALIFORNIA

ARIZONA SUN

CORRIDOR

TEXAS TRIANGLE

GULF COAST

FLORIDA

Jacksonville

Miami

Orlando*

Tampa*

PIEDMONT ATLANTIC

Atlanta*

Birmingham

Charlotte

Nashville*

Raleigh*

NORTHEAST

Baltimore*

Boston

Philadelphia

Richmond

Washington, D.C.*

GREAT LAKES

Chicago*

Columbus*

Indianapolis*

Louisville

Minneapolis*

St. Louis*

Austin*

Dallas*

Houston*

San Antonio

Megaregions by 2050:

Populations in contiguous regions with |

2012 Duke Realty Corporation

56

Healthcare Data Points

The nation’s largest industry

•

Represents more than 17% of GDP, predicted to exceed 23%

by 2020

•

Americans spend more than 5% of pre-tax income on

healthcare. Lower income brackets pay 15% or more ($7,800

per capita health expenditures in 2008/2009)

Reform

•

Increased number of people insured expected to increase by

30 to 50 million –

increased demand for care

•

Number of physicians will increase –

more space demand

•

Hospitals expect margin pressure and need to increase

market share –

Hospitals seeking capital partners for

“non-core assets”

•

May reduce reimbursements –

real estate efficiency a

priority –

larger deals and floor plates

Healthcare systems growing and physician employment changing

MEDICAL OFFICE STRATEGY |

2012 Duke Realty Corporation

57

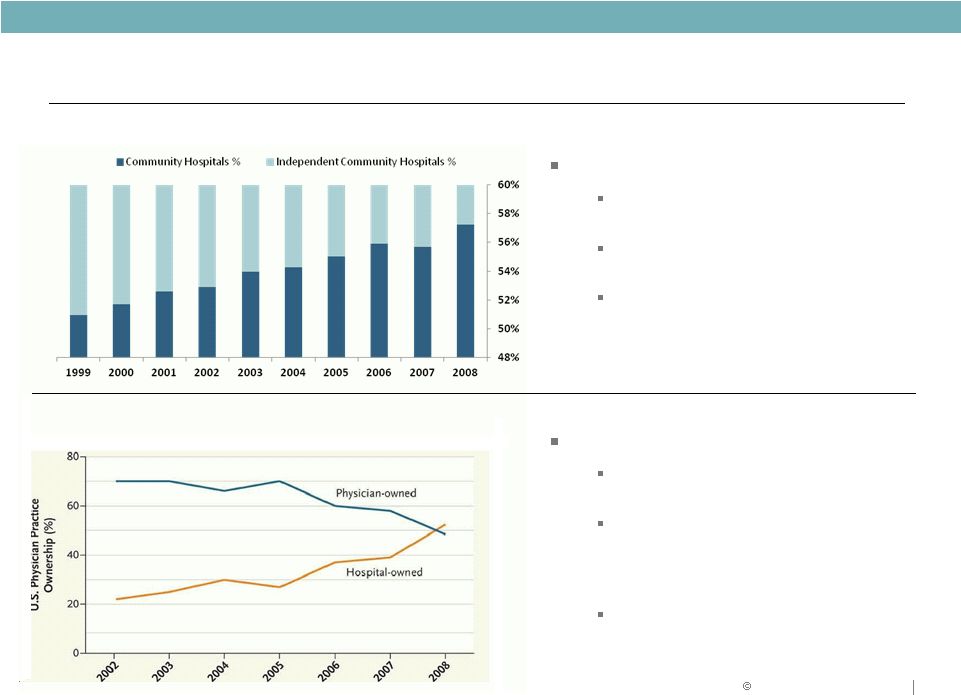

Healthcare Systems

Consolidation of hospitals into systems

continues

Hospitals need capital and must grow

market share

Healthcare systems are drivers for more

strategically located outpatient facilities

Employment of Physicians

More physicians are being employed by

hospitals

Hospitals and physicians are forming

multi-specialty practices to prepare for

improved quality and reduced

reimbursement

Hospitals are driving more medical office

space needs for physicians

Fewer Independent Community Hospitals

More Physician’s Aligning with Hospitals

Demand Drivers

#

Hospitals

5,000

MEDICAL OFFICE STRATEGY

Source: Robert Kocher, MD and Nikhil R. Sahni, B.S., “Hospitals’ Race to Employ

Physicians – The Logic behind a Money-Losing Proposition.”The New

England Journal of Medicine.;364:1790-1793.

12 May 2011. Physician Compensation and Production Survey, Medical Group Mgt Assoc,

2003-2009. |

2012 Duke Realty Corporation

58

Development Focus

ACTION PLAN

National brand awareness

Be “Experts”

–

Speak at national conferences (ASHE, BOMA)

–

Third party references

National system relationships

–

Ascension

–

Tenet

–

HCA

–

Adventist

Regional system relationships

–

Baylor Health

–

Rex Healthcare

–

Carolina Healthcare Systems

–

Advocate

System

Focus

MEDICAL OFFICE STRATEGY

Local

10%

National

30%

Regional

60% |

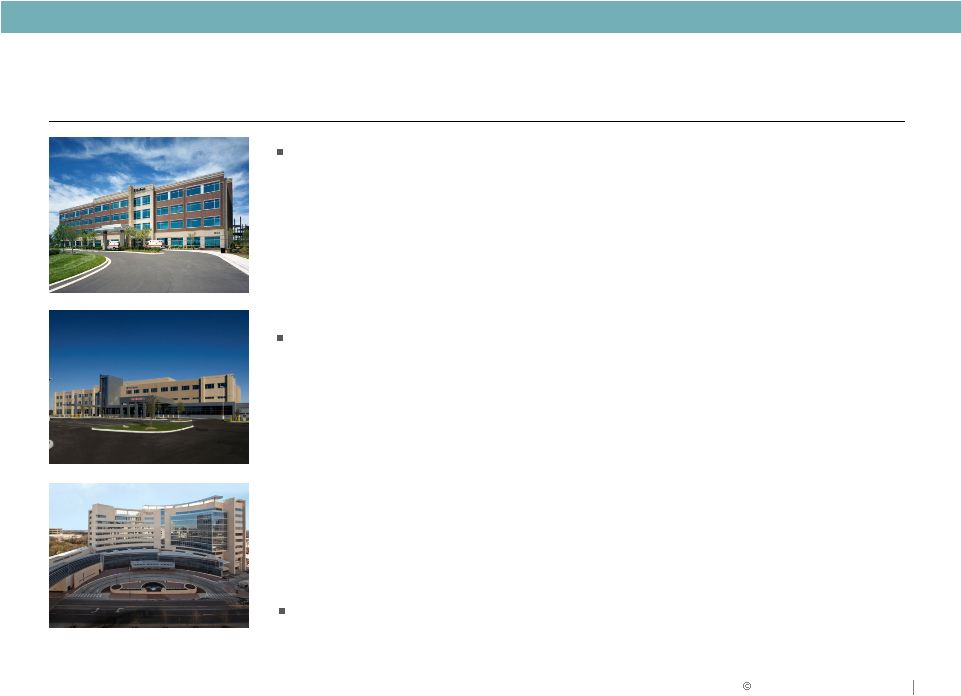

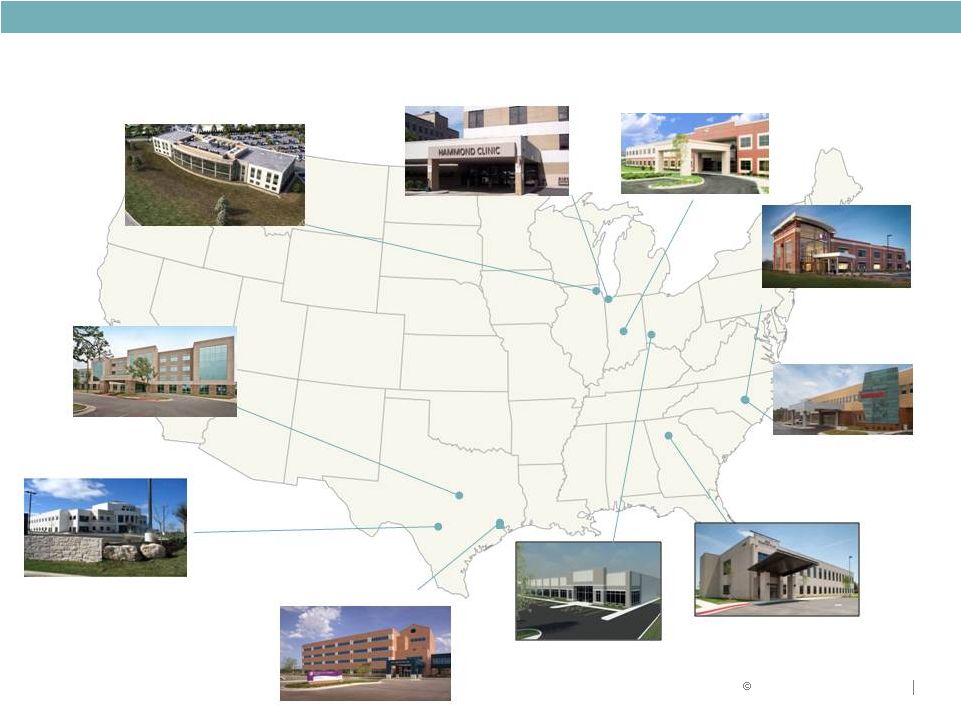

59

Healthcare Projects Delivered/Acquired in 2011/2012

Rex Holly Springs MOB

Raleigh, NC

30,000 SF, 100% leased

Christus St. Catherine

Houston, TX

169,000 SF, 96% leased

WakeMed Brier Creek

Healthplex

Raleigh, NC

48,000 SF, 79% leased

Butler County Medical

Cincinnati, OH

109, 000 SF, 100% leased

Christus Santa Rosa

San Antonio, TX

111,000 SF, 100% leased

Max Simon MOB

Indianapolis, IN

85,000 SF, 100% leased

Franciscan Alliance

Chicago area (Hammond, IN)

195,000 SF, 100% leased

MEDICAL OFFICE STRATEGY

Burr Ridge Medical

Chicago, IL

105,000 SF, 100% leased

2012 Duke Realty Corporation

New Hampton Place

Snellville, GA

40,000 SF, 66% leased |

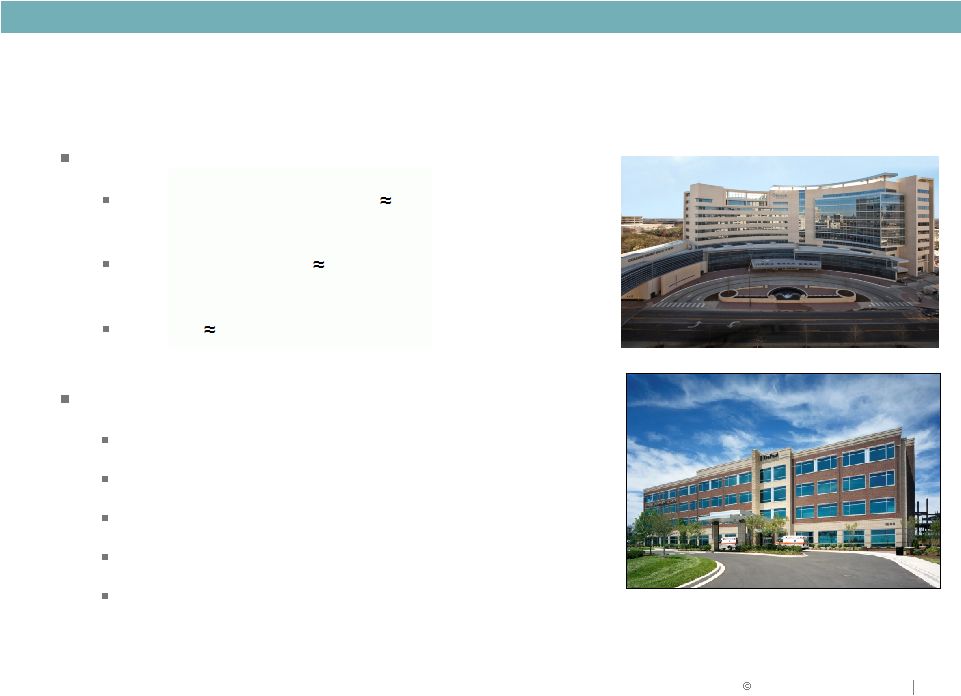

60

Healthcare Projects Under Development at March 31, 2012

Baylor McKinney MOB I

McKinney, TX

114,000 SF, 69% preleased

WakeMed Raleigh

Medical Park

Raleigh, NC

86,000 SF, 58% preleased

Marquette General Hospital MOB

Escanaba, MI

43,000 SF, 100% preleased

North Fulton MOB

Atlanta, GA

52,000 SF, 52% preleased

Wishard Faculty Office

Building

Indianapolis, IN

275,000 SF, 100% preleased

MEDICAL OFFICE STRATEGY

VA Tampa

Tampa, FL

117,000 SF, 100% preleased

Scott and White

Marble Falls, TX

67,000 SF, 100% preleased |

2012 Duke Realty Corporation

Our Plan

Existing

healthcare

assets

$840

Million

by

3/31/12

New

developments

$200

Million

in

2012

and

2013

Acquire

$200-$250

Million

in

2012

and

2013

Our Focus

Goal: Grow Medical Office to $1.23 Billion by 2013

61

MEDICAL OFFICE STRATEGY

Growth regions (Southeast, South)

Health system relationships

On-campus assets

Class

A

product

(50,000

–

400,000

+

square

feet)

National industry expert |

2012 Duke Realty Corporation

62

WHY DUKE REALTY?

Quality portfolio improving with asset strategy

Solid balance sheet improving with capital strategy

Unmatched ability to execute on daily operations

Development capabilities in place with existing land bank

Talent and leadership depth to execute

Delivering on what we say we will do

MEDICAL OFFICE STRATEGY |

2012 Duke Realty Corporation

Vision Road Map –

Future Duke Realty

Low leverage industrial and office REIT in high growth markets

and product segments

63

MEDICAL OFFICE STRATEGY

What We Will Be

•

Low leveraged

•

Move from 54% to 45% leverage

•

Product focused

•

Become bulk industrial focused

Industrial: Increase from 35% to > 60%

Office: Decrease from 55% to < 25%

Medical: Grow from 5% to 15%+

•

Concentrated in high growth

markets

•

Align investment and resources to high

growth markets; dispose/exit non-

strategic

areas

Differentiated asset strategy within

tighter geographic focus

Action Plan

Non-Strategic property and land sales |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Forward-Looking Statement

This slide presentation contains statements that constitute “forward-looking

statements” within the

meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 as

amended by the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, among others, our statements regarding

(1) strategic initiatives with respect to our assets, operations and capital and (2) the

assumptions underlying our expectations. Prospective investors are cautioned

that any such forward- looking statements are not guarantees of future

performance and involve risks and uncertainties, and that actual results may

differ materially from those contemplated by such forward-looking statements. A

number of important factors could cause actual results to differ

materially from those contemplated by

forward-looking statements in this slide presentation. Many of these

factors are beyond our ability to control or predict. Factors that could

cause actual results to differ materially from those contemplated in this

slide presentation include the factors set forth in our filings with the Securities and Exchange

Commission, including our annual report on Form10-K, quarterly reports on Form

10-Q and current reports on Form 8-K. We believe these

forward-looking statements are reasonable, however, undue reliance should

not be placed on any forward-looking statements, which are based on current expectations. We

do

not assume any obligation to update any forward-looking statements as a result of

new information or future developments or otherwise.

Certain of the financial measures appearing in this slide presentation are or may be

considered to be non- GAAP financial measures. Management believes that

these non-GAAP financial measures provide additional appropriate measures

of our operating results. While we believe these non-GAAP financial

measures are useful in evaluating our company, the information should be considered

supplemental in nature and not a substitute for the information prepared in

accordance with GAAP. We have provided for

your reference supplemental financial disclosure for these measures, including the

most directly comparable GAAP measure and an associated reconciliation in our

most recent quarter supplemental report, which is available on our website at

www.dukerealty.com. Our most recent quarter supplemental report also

includes the information necessary to recalculate certain operational ratios and ratios of

financial position. The calculation of these non-GAAP measures may differ

from the methodology used by other REITs, and therefore, may not be

comparable. 64 |