Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nationstar Mortgage LLC | d353475d8k.htm |

| EX-99.2 - TRANSCRIPT OF THE EARNINGS CALL OF NATIONSTAR MORTGAGE HOLDINGS INC. - Nationstar Mortgage LLC | d353475dex992.htm |

| EX-99.1 - TEXT OF PRESS RELEASE OF NATIONSTAR MORTGAGE HOLDINGS, INC. - Nationstar Mortgage LLC | d353475dex991.htm |

Q1 2012

Earnings Presentation Three Months Ended March 31, 2012

May 15, 2012

Exhibit 99.3 |

Forward

Looking Statements 1

Any statements in this presentation that are not historical or current facts are

forward-looking statements. Forward-looking statements include,

without limitation, statements concerning plans, objectives, goals, projections,

strategies, future events or performance, and underlying assumptions and other

statements, which are not statements of historical facts. Forward-looking statements convey the Company’s current expectations or

forecasts of future events. When used in this presentation, the words

“anticipate,” “appears,” “foresee,” “intend,” “should,” “expect,” “estimate,”

“target,” “project,” “plan,” “may,”

“could,” “will,” “are likely” and similar expressions are intended to identify forward-looking statements. These

statements involve predictions of our future financial condition, performance, plans

and strategies, and are thus dependent on a number of factors including, without

limitation, assumptions and data that may be imprecise or incorrect. Specific factors that may impact performance or other

predictions of future actions have, in many but not all cases, been identified in

connection with specific forward-looking statements. Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may

cause the Company’s actual results, performance or achievements to be

materially different from any future results, performances or achievements expressed or implied by the forward-looking

statements. Certain of these risks and uncertainties are described in the “Risk

Factors” section of Nationstar Mortgage LLC’s Annual Report on Form

10-K for the year ended December 31, 2011, and other required reports, as filed with the SEC, which are available at the SEC’s website at

http://www.sec.gov. We caution you not to place undue reliance on these

forward-looking statements that speak only as of the date they were made.

Unless required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statements to reflect

circumstances or events after the date of this presentation. |

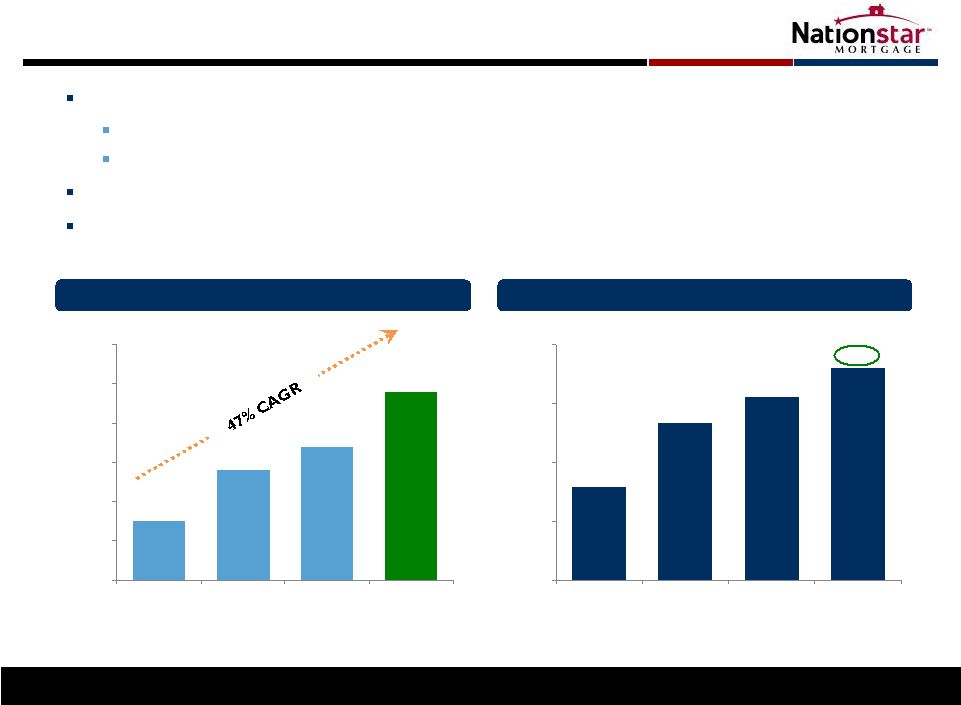

$22

$46

$65

$136

Q1

$77

$300

0

50

100

150

200

250

300

350

2008

2009

2010

2011

2012

Estimate

Q1 2012 Highlights

AEBITDA up 63% to $77 million; Net Income up 237% to $50 million

Servicing

book

grew

by

nearly

$60

billion

of

UPB

–

committed

to

purchase

Aurora

Bank

(1)

Strongest

quarter

for

loan

originations

in

history

–

originated

$1.2

billion

of

loans

$516 million raised through IPO and post-Q1 debt offering provides ample liquidity

for growth 1)

Pro forma for Aurora acquisition expected to close in May’12

2)

Please see endnotes for AEBITDA reconciliation

$21

$34

$64

$107

$166

0

40

80

120

160

200

2008

2009

2010

2011

Q1 2012

Pro-Forma

2

Servicing Growth

(1)

($bn of UPB)

AEBITDA Growth

(2)

Strong first quarter as a public company –

momentum going forward

($mm) |

Fee-Based Business Model with Strong Cash Flow

1)

Pro forma for Aurora acquisition assuming $63 billion of UPB

3

$166 billion of UPB

(1)

GSEs / Government

Financial Institutions

Private Investors

Service +1 million customers

Majority are current (85%+)

Borrowers

Mortgage Owners

Originations

Servicing

Adjacent Svcs.

Earn stable contractual fee for servicing residential customers

Make money based on volume and effectiveness

Originate

or

refinance

loans

–

predominantly

based

on

existing

relationships

Addressable Market:

$10+ trillion in servicing UPB

60 million customers |

Servicing: Performance Drives Earnings

Primary

driver

of

profitability

is

servicing

performance

–

ability

to

drive

down

defaults

and

delinquencies

Best-in-class in delinquencies and roll rates

Our heritage is servicing credit-challenged loans and preserving home

ownership Track record of making loans affordable

1)

Loan

Performance,

Subprime,

2004-

2007

origination

years.

Data

as

of

4/25/12

4

Delinquency Rate

(1)

Positive Roll Rates

(1)

(60+ DQ as % of UPB)

(% of delinquent UPB that improve) |

Announced

March

6

th

agreement

to

purchase

$63

billion

(1)

in

servicing

assets

from

Aurora

Bank

Total equity investment of $286 million from Nationstar with an internally projected

IRR of 20%+ Expect the transaction to close in the second quarter

Proceeding with all regulatory approvals and integration plan

Capacity additions to ensure portfolio continuity

Aurora Transaction

5

Summary of Aurora Transaction

Servicing Locations

1)

Estimated Q2 2012 balances; 75% non-agency, 25% agency

Receive base servicing

fees + 35% interest in

Excess MSRs

Purchase 65% interest

in Excess MSRs

Nationstar

Aurora

$63 billion of servicing assets

284,625 loans

25% Agency & 75% Non-Agency |

ResCap

Transaction 6

Announced

May

14

th

agreement

to

purchase

$374

billion

in

servicing

assets

through

363

(“stalking

horse”)

bid

$201 billion in primary servicing rights

$173 billion in sub-servicing contracts

Pro

forma

$550

billion

UPB

–

would

make

Nationstar

largest

non-bank

mortgage

servicer

Anticipate closing in late 2012, subject to auction process as well as court and

other regulatory approvals Entitled to breakup fee of $72 million and up to $10

million of expense reimbursement $374 billion of servicing assets

2.4 million customers

68% Agency & 32% Non-Agency

Summary of Rescap Transaction

Receive base servicing

fees + 35% interest in

Excess MSRs

Purchase up to 65%

interest in Excess

MSRs alongside

Fortress affiliates

Servicing Locations

ResCap

Nationstar

Aurora |

Approximately

$350

billion

has

transferred

from

banks

to

non-banks

over

the

past

2

years

(1)

Limited number of qualified buyers / subservicers

High barriers to entry

Must have strong agency relationships

Transformational shift

Basel III capital requirements

Regulatory and headline risk

Focus on core customer wallet share

Servicing: Strong Pipeline of Growth Opportunities

1)

Bank transactions June 2010 through April 2012. Ocwen 8-K, September 2010; National

Mortgage News, November 2010; Bloomberg, June 2011; Bloomberg, October 2011; SEC S-4/A Filing, filed by Nationstar Mortgage LLC,

June 2011; Wall Street Journal, August 2011; Nationstar, 2011; National Mortgage News,

November 2011; Reverse Mortgage Daily, December 2011; 8-K Filing, filed by Nationstar Mortgage LLC, March 2012

7

Favorable Supply -

Demand Dynamics |

28%

33%

36%

38%

20%

25%

30%

35%

40%

Q2 '11

Q3 '11

Q4 '11

Q1 '12

$1.5

$2.8

$3.4

$4.8

$-

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

2009

2010

2011

Q1 '12 Ann.

Originations: Enhances Core Servicing Platform

8

Origination Volume

Recapture Rate

($bn of UPB)

Originations supplements core servicing operations

Most cost effective way to create servicing

Extends life of servicing cash flows

Enables refinancing as loss mitigation tool

Cash flow positive and profitable |

$60

million in total cash / near-cash revenue Originations: Cash-Driven

Economics 1)

Includes mark to market on loans held for sale and derivative/hedges

2)

As of 4-30-12.

($mm)

Cash

–

Points,

Fees,

Gain

on

Sale

$43.9

Pipeline

Value

(1)

(Converts to cash in 90 days)

16.5

Subtotal Cash / Near Cash Revenue

$60.4

Servicing Asset

(Cash value realized over time)

13.0

Other

(2.9)

Total Originations Revenue

$70.5

Originations Volume

$1,190

Application

Pipeline

(2)

$1,937

Q1 2012 Unit Economics

9

Cash / near cash is

86% of total revenue |

Originations: Creating New Customer Relationships with KB

10

1)

Source: Housing Zone

2)

Source: February 2012 KB Home Investor Presentation

On

March

12

th

,

KB

Home

named

Nationstar

as

its

preferred

mortgage

lender

KB Home is the 5

largest homebuilder in US

(1)

Nearly

$1.6

billion

in

home

sales

in

2011

(1)

Less interest rate-sensitive profile

Loan originations expected to begin this month (May’12)

$125 million application pipeline expected

Hired approximately 150 dedicated employees

KB Home Geographic Footprint

KB Home Buyer Mix

(2)

(2)

th |

Consolidated Performance

1)

Adjusted

EBITDA,

refer

to

Endnotes

disclaimer

and

reconciliation

to

net

income

slide

2)

Includes Legacy Segment

11

Operating Segment Revenue of $161.6 million and Operating Segment

AEBITDA of $77.2 million Total GAAP Net Income of $50.2 million

Operating Segment AEBITDA per share of $1.04 and Total GAAP EPS of $0.67

Q4'11

($ millions except where noted)

Servicing

Originations

Operating

Total

(2)

Total

Revenue

$91.1

$70.5

$161.6

$161.7

$119.4

Expense

$59.2

$28.5

$87.7

$96.6

$86.5

AEBITDA

(1)

$34.8

$42.4

$69.8

$39.7

margin%

38%

60%

48%

Pre-Tax Income

$61.4

$53.3

$14.9

Net Income -

GAAP

$50.2

$14.9

Per Share Data:

AEBITDA

$0.47

$0.57

$0.94

$0.57

Pre-Tax Income

$0.83

$0.72

$0.21

Net Income -

GAAP

$0.67

$0.21

Q1 '12

$1.04

$77.2 |

Balance

Sheet 12

Significant cash for investment with the proceeds from the IPO

Strong operating cash flow for the quarter

1)

Includes receivables from affiliates

2)

Includes mortgage loans for sale and mortgage loans held for investment subject to

nonrecourse debt (legacy assets) 3)

Notes payable includes servicing advance facilities and origination warehouse

facilities $ millions

Q1 '12

Q4 '11

$ millions

Q1 '12

Q4 '11

Assets:

Liabilities:

Cash and cash equivalents

$356

$62

Notes payable

(3)

$768

$873

Restricted cash

109

71

Senior unsecured notes

281

280

Accounts receivable

(1)

535

567

Payables and accrued liabilities

241

184

Mortgage loans held for sale

(2)

620

702

Nonrecourse debt -

Legacy assets

110

112

Mortgage servicing rights -

fair value

266

251

Excess spread financing at fair value

47

45

Property and equipment, net

25

24

Participating interest financing

114

-

Other assets

268

111

Other liabilities

25

13

Total Liabilities

$1,586

$1,507

Shareholders Equity

$593

$281

Total Assets

$2,179

$1,788

Total Liabilities and Shareholders Equity

$2,179

$1,788 |

Appendix

13 |

AEBITDA

Reconciliation 14

For Quarter Ended March 31, 2012

For Quarter Ended December 31, 2011

$ Millions

Servicing

Originations

Operating

Legacy

Total

Adjusted EBITDA

$34.8

$42.4

$77.2

($7.5)

$69.8

Interest expense on corporate notes

(8.5)

-

(8.5)

-

(8.5)

MSR valuation adjustment

0.5

-

0.5

-

0.5

Excess spread adjustment

(4.9)

-

(4.9)

-

(4.9)

Amortization of mort. serv. obligations

0.6

-

0.6

-

0.6

Depreciation & amortization

(0.9)

(0.4)

(1.2)

(0.3)

(1.5)

Stock-based compensation

(2.2)

(0.2)

(2.4)

-

(2.4)

Fair value adjustment for derivatives

0.0

-

0.0

(0.3)

(0.3)

Pre-Tax Income

$19.6

$41.8

$61.4

($8.0)

$53.3

Income taxes

(3.1)

Net Income

$50.2

AEBITDA per Share

(1)

$0.47

$0.57

$1.04

($0.10)

$0.94

$ Millions

Servicing

Originations

Operating

Legacy

Total

Adjusted EBITDA

$35.6

$11.7

$47.3

($7.6)

$39.7

Interest expense on corporate notes

(7.8)

-

(7.8)

-

(7.8)

MSR valuation adjustment

(8.2)

-

(8.2)

-

(8.2)

Excess spread adjustment

(3.1)

-

(3.1)

-

(3.1)

Amortization of mort. serv. obligations

-

-

-

-

-

Depreciation & amortization

(0.8)

(0.4)

(1.2)

(0.3)

(1.5)

Restructuring charges

-

(1.8)

(1.8)

-

(1.8)

Stock-based compensation

(2.4)

(0.3)

(2.7)

-

(2.7)

Fair value adjustment for derivatives

0.3

-

0.3

-

0.3

Net Income

$13.6

$9.2

$22.8

($7.9)

$14.9

AEBITDA per Share

(2)

$0.51

$0.17

$0.68

($0.11)

$0.57

1)

Calculated using a fully diluted average share count of 74.561 million shares

2)

Calculated using a fully diluted average share count of 70.000 million shares

|

AEBITDA

Reconciliation (continued) 15

For Quarter Ended March 31, 2011

1)

Calculated using a fully diluted average share count of 70.000 million shares

$ Millions

Servicing

Originations

Operating

Legacy

Total

Adjusted EBITDA

$23.7

$4.3

$28.0

($4.1)

$23.8

Interest expense on corporate notes

(7.5)

(0.1)

(7.5)

-

(7.5)

MSR valuation adjustment

(3.8)

-

(3.8)

-

(3.8)

Excess spread adjustment

-

-

-

-

-

Amortization of mort. serv. obligations

-

-

-

-

-

Depreciation & amortization

(0.4)

(0.3)

(0.6)

(0.1)

(0.8)

Stock-based compensation

(4.7)

(0.5)

(5.2)

(0.0)

(5.3)

Fair value adjustment for derivatives

0.9

-

0.9

-

0.9

Net Income

$8.2

$3.4

$11.6

($4.3)

$7.4

AEBITDA per Share

(1)

$0.34

$0.06

$0.40

($0.06)

$0.34 |

AEBITDA

Reconciliation (continued) 16

1)

Calculated using a fully diluted average share count of 70.000 million shares

FY 2008

FY 2009

FY 2010

FY 2011

Net income (loss)

(157,610)

$

(80,877)

$

(9,914)

$

20,887

$

Adjust for:

Net loss from Legacy Portfolio and Other

164,738

97,263

24,806

24,892

Interest expense from unsecured senior notes

–

–

24,628

30,464

Depreciation and amortization

1,172

1,542

1,873

3,395

Change in fair value of MSRs

11,701

27,915

6,043

39,000

Fair

value

changes

on

excess

spread

financing

–

–

–

3,060

Share-based compensation

1,633

579

8,999

14,764

Exit costs

–

–

–

1,836

Fair value changes on interest rate swaps

–

–

9,801

(298)

Ineffective portion of cash flow hedge

–

–

(930)

(2,032)

Adjusted EBITDA

(1)

21,634

$

46,422

$

65,306

$

135,968

$ |

Endnote

Adjusted EBITDA (“AEBITDA”)

17

This disclaimer applies to

every usage of “Adjusted EBITDA” or “AEBITDA” in this presentation. Adjusted EBITDA

is a key performance metric used by management in evaluating the performance of our

segments. Adjusted EBITDA represents our Operating Segments' income

(loss), and excludes income and expenses that relate to the financing of our senior notes, depreciable (or amortizable) asset base of

the business, income taxes (if any), exit costs from our restructuring and certain

non-cash items. Adjusted EBITDA also excludes results from our legacy asset

portfolio and certain securitization trusts that were consolidated upon adoption of the new accounting guidance eliminating the concept of a

qualifying special purpose entity ("QSPE“).

|