Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Lumos Networks Corp. | d353087d8k.htm |

Company Presentation

May 2012

Exhibit 99.1 |

| 1

Use of Non-GAAP Financial Measures

Special Note Regarding Forward-Looking Statements

Any

statements

contained

in

this

presentation

that

are

not

statements

of

historical

fact,

including

statements

about

our

beliefs

and

expectations,

are

forward-looking

statements

and

should

be

evaluated

as

such.

The

words

“anticipates,”

“believes,”

“expects,”

“intends,”

“plans,”

“estimates,”

“targets,”

“projects,”

“should,”

“may,”

“will”

and similar words and expressions are intended to identify forward-looking statements.

Such forward-looking statements reflect, among other things, our current

expectations, plans and strategies, and anticipated financial results, all of which are subject to known

and unknown risks, uncertainties and factors that may cause our actual results to differ

materially from those expressed or implied by these forward- looking statements.

Many of these risks are beyond our ability to control or predict. Because of these risks, uncertainties and assumptions, you should not

place undue reliance on these forward-looking statements. Furthermore, forward-looking

statements speak only as of the date they are made. We do not undertake any obligation

to update or review any forward-looking information, whether as a result of new information, future events or otherwise.

Important factors with respect to any such forward-looking statements, including certain

risks and uncertainties that could cause actual results to differ from those contained

in the forward-looking statements, include, but are not limited to: rapid development and intense competition in the

telecommunications industry; our ability to achieve benefits from our separation from NTELOS

Holdings Corp.; our ability to successfully increase revenues and

manage

churn

in

the

recently

acquired

FiberNet

business;

our

ability

to

offset

expected

revenue

declines

in

our

RLEC

business

related

to

the

recent

regulatory developments and carriers grooming their networks; adverse economic conditions;

operating and financial restrictions imposed by our senior credit facility; our cash

and capital requirements; declining prices for our services; the potential to experience a high rate of customer turnover; federal

and state regulatory fees, requirements and developments; our reliance on certain suppliers

and vendors; and other unforeseen difficulties that may occur. These risks and

uncertainties are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read

in conjunction with the more detailed cautionary statements and risk factors included in our

SEC filings, including our Annual Report filed on Form 10-K. Included

in

this

presentation

are

certain

non-GAAP

financial

measures

that

are

not

determined

in

accordance

with

US

generally

accepted

accounting

principles.

These

financial

performance

measures

are

not

indicative

of

cash

provided

or

used

by

operating

activities

and

exclude

the

effects

of

certain

operating,

capital

and

financing

costs

and

may

differ

from

comparable

information

provided

by

other

companies,

and

they

should

not

be

considered

in

isolation,

as

an

alternative

to,

or

more

meaningful

than

measures

of

financial

performance

determined

in

accordance

with

US

generally

accepted

accounting

principles.

These

financial

performance

measures

are

commonly

used

in

the

industry

and

are

presented

because

Lumos

Networks

Corp.

believes

they

provide

relevant

and

useful

information

to

investors.

The

Company

utilizes

these

financial

performance

measures

to

assess

its

ability

to

meet

future

capital

expenditure

and

working

capital

requirements,

to

incur

indebtedness

if

necessary,

and

to

fund

continued

growth.

Lumos

Networks

Corp.

uses

these

financial

performance

measures

to

evaluate

the

performance

of

its

business,

for

budget

planning

purposes

and

as

factors

in

its

employee

compensation

programs. |

2

Enhancing efficiencies for our customers…

Lumos Networks provides next-

generation communication solutions

and personalized service to customers

in the Mid-Atlantic region, over an

advanced fiber network. |

3

Our product strategy is to be first to offer next-generation products to customers in our

regional markets

Next-generation communication solutions

Metro Ethernet

•

Ethernet connectivity among multiple locations in the same city or region

•

Speeds ranging from 1.5 Mbps to 10 Gbps

IP Services

•

IP-enabled product offerings that combine voice and data services over a

dedicated broadband facility utilizing VoIP protocols

•

Enables advanced features and dynamic bandwidth allocation

Broadband

•

Dedicated

Internet

connections

–

up

to

10

Gbps

•

Broadband

XL

high

speed

Internet

over

fiber

–

10

to

20

Mbps

•

DSL over copper with speeds up to 6 Mbps

Wholesale Carrier Services

•

IP-based Ethernet transport over fiber

•

Fiber connectivity to cell sites for wireless carriers facilitates rapidly growing

demand for data, driven by 4G

•

High-bandwidth transport over copper

Flagship Products |

4

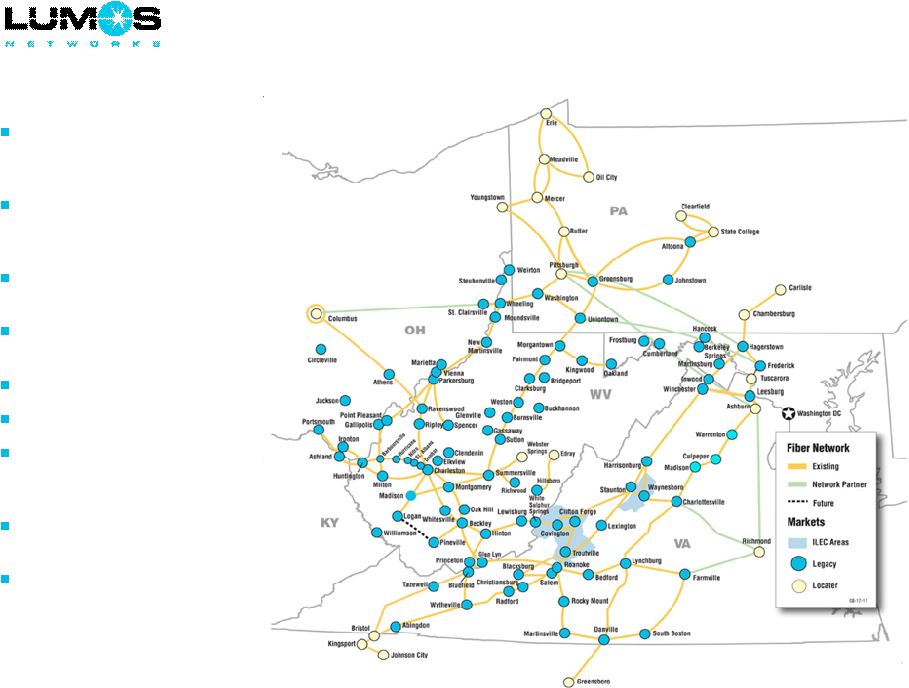

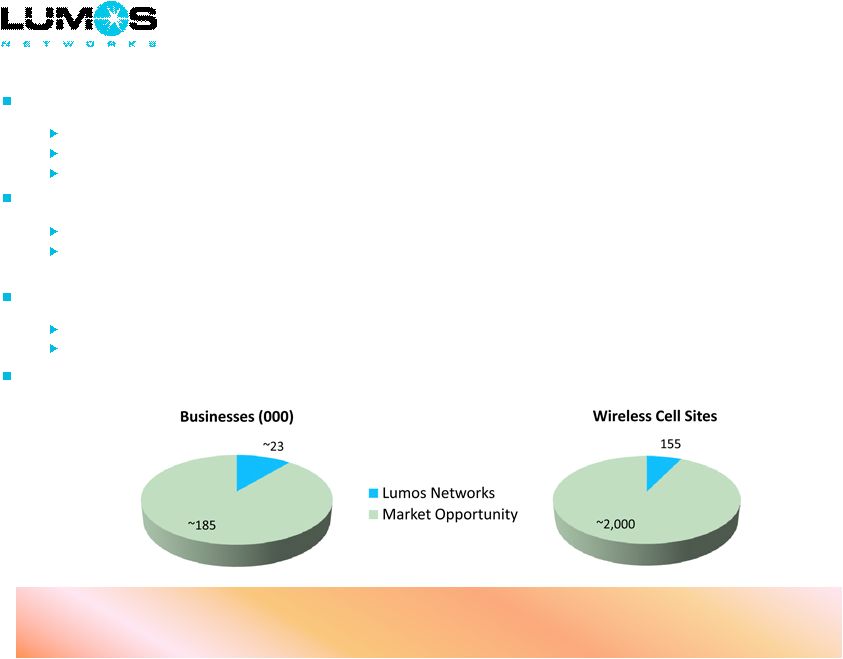

Provides service to more than

100 markets in Mid-Atlantic

region

Network footprint includes

approximately 185,000

businesses

Supports IP based and

Ethernet applications

Over 50,000 current

customer relationships

5,800 fiber route miles

State-of-the-art IP network

Approximately 2,000 cell sites

within three miles of existing

network

RLEC with 98% 6MB+

broadband coverage

Video and fiber passes

approximately one-third of

the RLEC base

Advanced, dense regional fiber network serves attractive markets

4 |

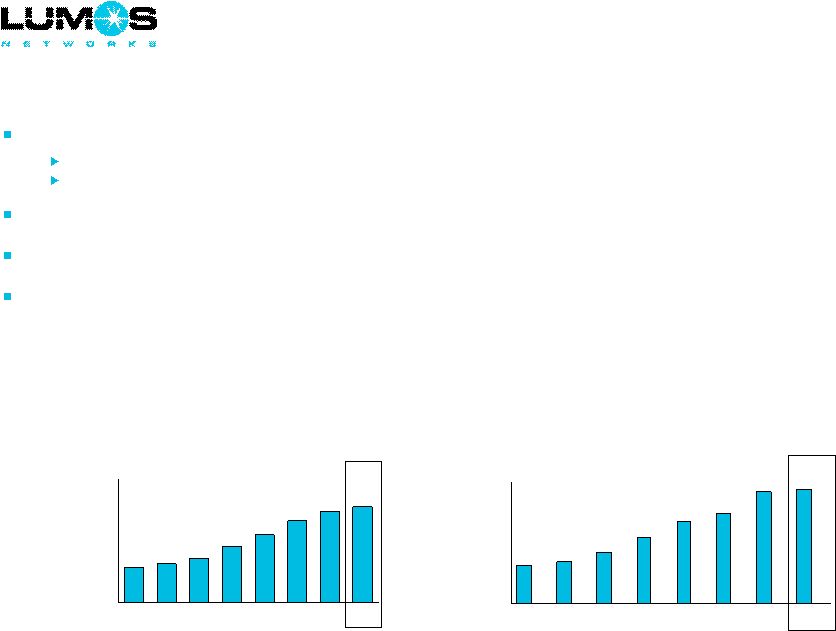

5

57

63

71

91

109

132

148

155

0

50

100

150

200

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Q3-11

Q4-11

Q1-12

Fiber-Fed Cell Sites

687

705

752

830

903

949

1051

1066

500

600

700

800

900

1000

1100

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Q3-11

Q4-11

Q1-12

On-Net Buildings

Network positioned for the future

Significant network investments (~$300 million) in previous 24 months

Enhancement

through

capital

expenditures;

Expansion

through

acquisitions

Ongoing

investments

to

support

growth

Connections to major data centers support exploding Cloud computing demand

Capacity to support significant market opportunity for on-net retail and wholesale

customer expansion Extensive rural fiber network footprint creates competitive

advantages allowing Lumos Networks to offer next-generation communication

products in regional markets |

6

Brand positioning highlights our innovative services and commitment to provide support from

well- trained, dedicated and accessible employees

“Our technology comes with people”

Experienced direct sales and sales engineering teams in-market

Exceptional customer service

93% of calls answered in less than one minute

90% first-call resolution

Net Promoter scores in top tier across all industries

Strong long-term customer relationships

89% of key vertical account revenues in 2007 are still billing

80% of monthly recurring revenues of $1,000 or greater in 2007 are still billing

Experienced management team

Each member of operating management has 10 or more years of experience with wireline

business Key contributors to development of Competitive segment and transition to data

strategy Led execution and integration of recent acquisitions

|

7

Leverage regional scale

Sell

advanced

data

services

to

recently-entered

Pennsylvania

and

West

Virginia

markets

Increase on-net buildings and expand reach in existing markets

Leverage sophisticated sales and sales engineering teams

Up-sell existing enterprise customers to capture growing data demand

Sell advanced services, including cloud computing and hosting

On-network profile facilitates growth of bandwidth and new applications with minimal

incremental investment

Aggressively pursue fiber-to-the-cell opportunities

Strong early-stage wireless carrier demand in footprint

Positioned for regional 4G deployment expected in 2012 and beyond

Expand footprint through organic edge-out and accretive acquisitions

Opportunities offer attractive returns as revenue density enhances capital

efficiency and on-network sales drive margin growth

Strategies for growth |

8

Up-sell existing enterprise customers

•

2 locations -

Leased facilities and fiber

•

Primarily Voice Service

•

Monthly Recurring Revenue (MRR) = $2K

•

37 locations -

Primarily On-net locations

•

Voice Service + Metro Ethernet Network

•

Increased MRR to $65K

•

Capital investment = $1.0M

•

Payback ~ 18 months

Enterprise Case Study B

Healthcare Customer

Yesterday

Today

Today

Yesterday

•

Data circuits

•

Monthly Recurring Revenue (MRR) = $11K

•

Data circuits, Internet bandwidth, IP voice

and connection to major data center

•

Increased MRR to $29K

•

Capital investment = $100K

•

Payback ~ 7 months

Enterprise Case Study A

Education Customer |

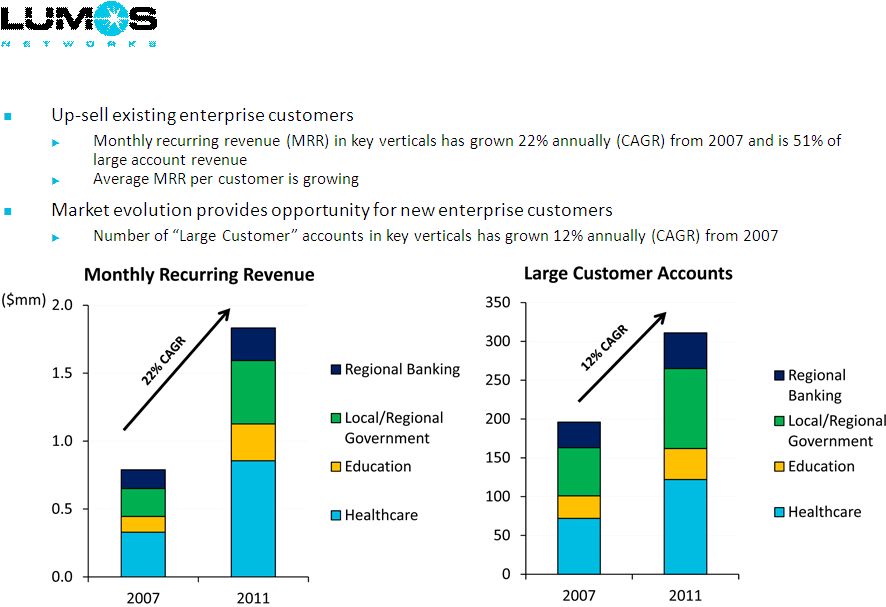

Double-digit enterprise growth trends in key verticals

9

Note:

Organic

growth,

excluding

acquisitions.

“Large

Customers”

are

defined

as

customers

with

$1,000

or

greater

MRR. |

Fiber to the

cell site: High growth wholesale opportunity Approximately 2,000 sites within three

miles of existing network First customer provides a five-year payback and funds the

site Average of more than two carriers per site

Second and successive customers drive cash flow and margin

Long-term

growth

in

bandwidth

demand

and

additional

carriers

continue

to

enhance

returns

Illustrative Wireless Cell Site Economics

Average

Capital

Investment

$80K/site

One Carrier

Annual EBITDA:

$15K to $18K

Payback:

5 years

Two Carriers

Annual EBITDA:

$30K to $36K

Payback:

2 to 3 years

10

Three to Five

Carriers

Annual EBITDA:

$45K to $90K

Payback:

1 to 2 years

Contracts of 5 to 10 years and multiple carriers per site drive

long-term profitable revenue streams |

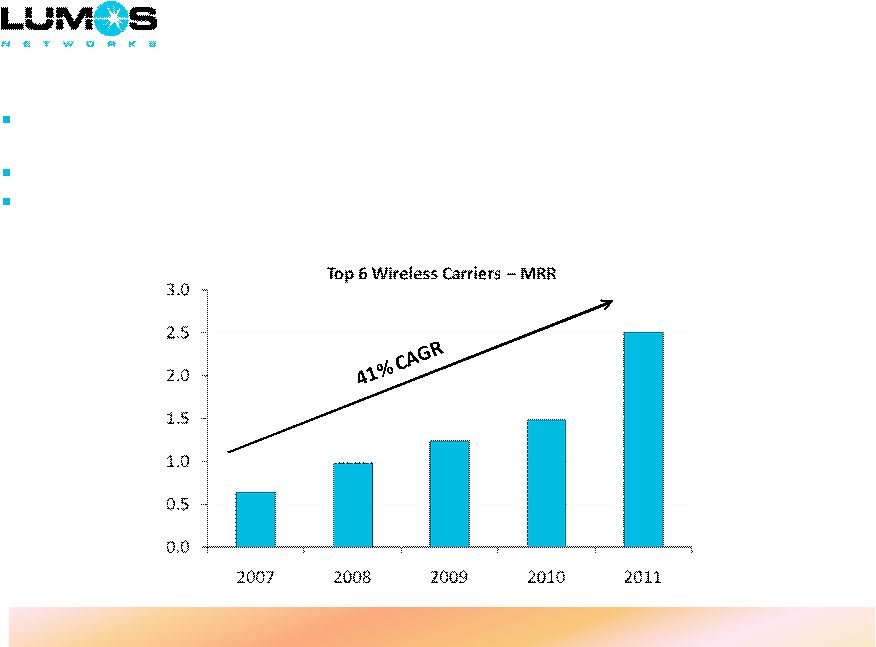

Wholesale

growth: Strong and accelerating with 4G Monthly

Recurring

Revenue

(MRR)

from

Top

6

wireless

carriers

has

grown

41%

annually

(CAGR)

from

2007 to 2011

Early-stage:

Significant

increases

in

demand

will

be

driven

by

future

4G

deployment

4G deployment in Lumos Networks region commenced in the second half of 2011 and is expected

through 2014

11

($mm)

Fiber connections expected to nearly double, reaching approximately 300 by year-end

2012 |

12

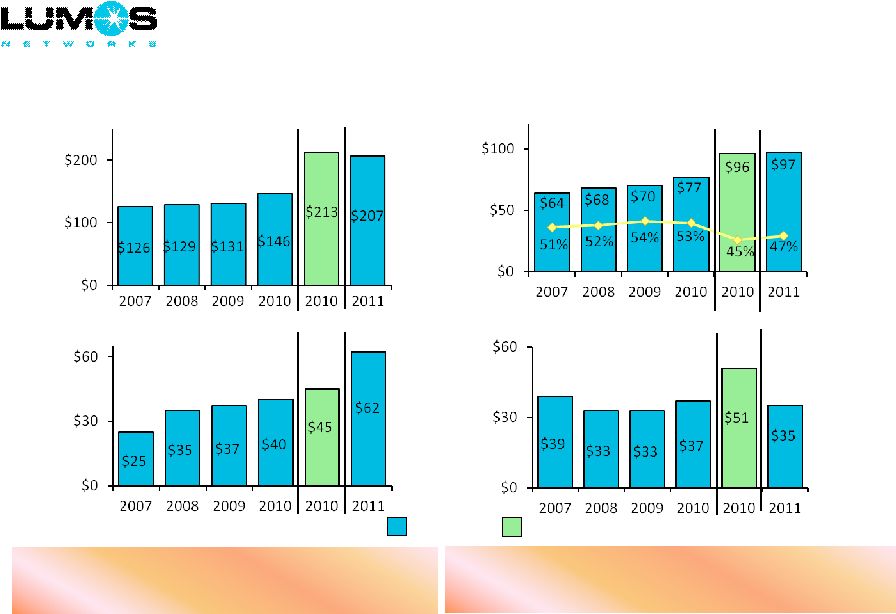

Strong margins and recurring free cash flow

($ in millions)

(1)

Pro forma 2010 includes FiberNet results from January 1, 2010.

(2)

Throughout this presentation, Free Cash Flow is defined as consolidated adjusted EBITDA less

CAPEX. (3)

2011 includes one-time capital expenditures related to the integration of FiberNet.

Free Cash Flow

(2)(3)

Total Revenue

Adj. EBITDA/Margin %

Capital Expenditures

(3)

Historical/Actual

Pro forma for FiberNet

Pro

forma

(1)

Pro

forma

(1)

Pro

forma

(1)

Pro

forma

(1)

2011 reflects post-acquisition network capital investments to

support market expansion and service offerings

Recurring cash flow stream to support dividend:

Unique among Competitive providers

Current annualized dividend of $12 million ($0.56 per share)

|

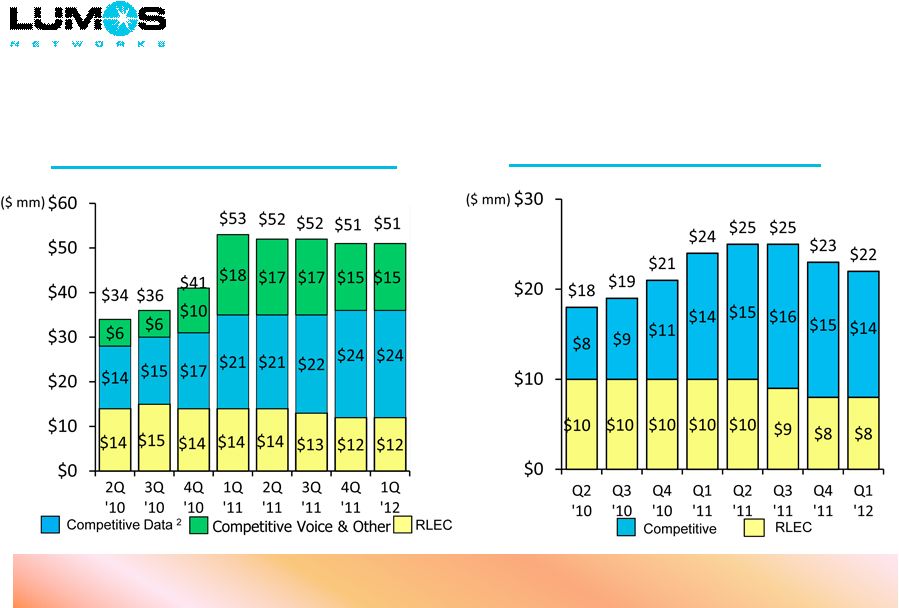

13

Adjusted EBITDA

(1)

Revenue

(1)

Operating strategy and acquisitions successfully shifting business mix

Data focus drives growth in the Competitive segment: 16% year over year data revenue growth ² RLEC access revenues impacted by Regulatory Reform and

continued network grooming by carriers

(1)

Reported results; not pro forma for acquisitions.

(2)

Includes

enterprise,

wholesale

and

SMB/residential

data;

1Q

2012

up

16%

over

1Q

2011. |

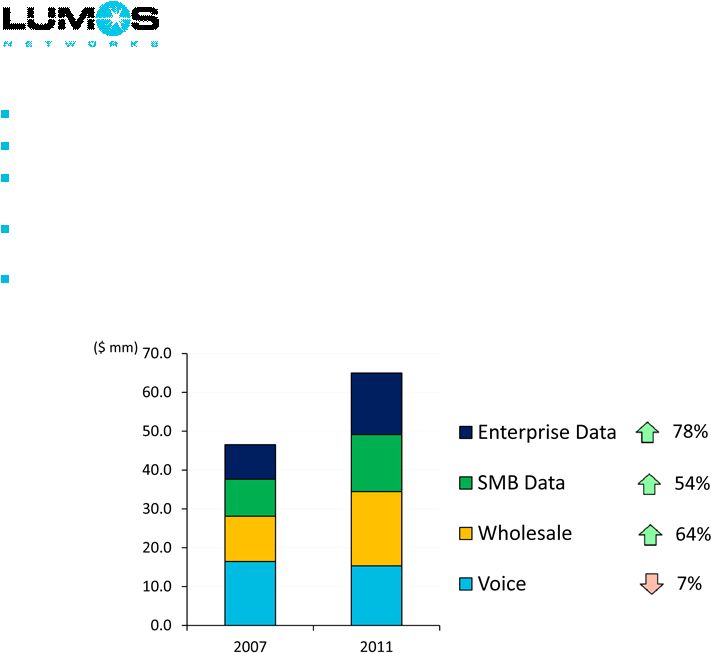

14

Addressable market significantly increased

Recent network investments made to generate increasing returns in 2012 and beyond

IP voice products were launched into 30 new markets in 2011, an increase of 79% for the year;

two additional IP voice markets added YTD 2012

Metro Ethernet fiber ring reach now in 29 new markets; two additional to be added in the

second half of 2012

As markets mature, revenues grow with increased penetration and data demand

Early stages of revenue growth potential from acquisitions

Competitive

Revenues

-

Virginia |

Capitalization

15

As of

March 31, 2012

($mm)

Cash and cash equivalents

$0.0

Restricted cash

7.2

$7.2

Revolver ($60 million total)

$ 6.1

Term Loan A

110.0

Term Loan B

199.0

315.1

Capital leases

1.9

Total Debt

$317.0

Total Debt / LTM Adjusted EBITDA

3.4x

Net Debt / LTM Adjusted EBITDA

3.4x

Available capital to support growth initiatives |

Business

Outlook 16

Cash needs funded from operations

Actual

Low

High

Revenue

Competitive

$155

$159

$164

% of total revenue

75%

80%

80%

RLEC

$52

$41

$41

% of total revenue

25%

21%

20%

Total Revenue

$207

$200

$205

Adjusted EBITDA

$97

$85

$90

% of total revenue

47%

43%

44%

Capital Expenditures

$62

$52

$60

% of total revenue

30%

26%

29%

Free Cash Flow

(adjusted EBITDA less Capex)

$35

$33

$30

% of total revenue

17%

17%

15%

Cash Interest

$2

$13

$13

% of total revenue

1%

7%

6%

Cash Taxes

$1

$1

$1

% of total revenue

-

1%

0%

Dividends

$0

$12

$12

% of total revenue

-

6%

6%

Debt Repayment

$1

$2

$2

% of total revenue

-

1%

1%

Other Increase (Decrease)

$1

$3

$3

% of total revenue

-

2%

1%

Net Cash (before working capital)

$32

$8

$5 |

17

Key Success Factors

Leveraging Network

Infrastructure

•

5,800 route-mile state-of-the-art fiber optic network

•

Unique regional footprint with attractive enterprise and wholesale markets

•

Position in multiple key vertical markets

Focus on Revenue Growth:

Data Opportunity

•

Continue innovative leadership position

•

Expand product offerings

•

Leverage up-sell opportunity of existing accounts

Solid Execution

•

Sales force expansion and productivity

•

Installation streamlining and productivity

•

Automated customer interfaces

Financial Performance

•

Adjusted EBITDA generation

•

Capital expenditure efficiency

•

Cash flow from operations

•

Return to shareholders |

Appendix

****************** |

19

Adjusted EBITDA Reconciliation

($ in millions)

2007

2008

2009

2010

2011

Operating Income (Loss)

$36

$39

$41

$41

($36)

Depreciation and Amortization

27

27

29

31

43

Equity Based Compensation

1

1

-

2

2

Asset Impairment Charge

-

-

-

-

86

Business Separation Charges

-

-

-

-

2

Acquisition Related Charges

-

-

-

3

-

Voluntary Retirement and Workforce Reduction Plans

-

1

-

-

-

Adjusted EBITDA

$64

$68

$70

$77

$97

Year Ended

6/30/2010

9/30/2010

12/31/2010

3/31/2011

6/30/2011

9/30/2011

12/31/2011

3/31/2012

Operating Income (Loss)

$10

$11

$9

$12

$13

$13

($75)

$12

Depreciation and Amortization

8

7

9

11

11

11

10

9

Equity Based Compensation

-

-

1

1

1

1

-

1

Asset Impairment Charge

-

-

-

-

-

-

86

-

Business Separation Charges

-

-

-

-

-

-

2

-

Acquisition Related Charges

-

1

2

-

-

-

-

-

Adjusted EBITDA

$18

$19

$21

$24

$25

$25

$23

$22

Three Months Ended |

20

2012 Financial Guidance

1

(as of May 3, 2012)

($ in millions)

(1)

These estimates are based on management’s current expectations. These

estimates are forward-looking and actual results may differ materially. Please see “Special

Note from the Company Regarding Forward-Looking Statements" in the Lumos

Networks Corp. first quarter 2012 earnings release dated May 3, 2012.

(2)

Based on the mid-points of the above guidance ranges.

(3)

Represents the most recent cash dividend paid, annualized. Dividend payments

are reviewed quarterly by the board of directors and are subject to change.

(4)

Includes cash reimbursements received from Federal stimulus awards, which provide

50% funding to bring broadband services and infrastructure to Alleghany County,

Virginia partially offset by one-time severance benefits which were provided

for in the employment agreement of an executive officer. (5)

Before discretionary payments to the credit facility Revolver loan and changes to

working capital. Business Outlook ¹

Operating Revenues

50

$

to

51

$

200

$

to

205

$

Adjusted EBITDA

21

$

to

22

$

85

$

to

90

$

Capital Expenditures

52

$

to

60

$

Reconciliation of Operating Income to Adjusted EBITDA

Operating Income

9

$

to

10

$

42

$

to

44

$

Depreciation and amortization

9

38

to

40

Equity based compensation charges

3

5

to

6

Adjusted EBITDA

21

$

to

22

$

85

$

to

90

$

Projected Cash Flows for the Year 2012 ¹

Adjusted EBITDA ²

88

$

Less: Capital expenditures ²

(56)

32

Less:

Cash interest, net of interest income

(13)

Cash taxes

(1)

Cash flows, net, before dividends and debt payments

18

Less:

Cash dividends: $0.14 per share per quarter

3

(12)

Scheduled 2012 debt payments

(2)

Plus:

Other, net

4

3

Projected Cash Flows, net

5

7

$

Second Quarter 2012

2012 Annual |