Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Big Bear Mining Corp. | Financial_Report.xls |

| EX-31.1 - Big Bear Mining Corp. | ex31-1.htm |

| EX-32.1 - Big Bear Mining Corp. | ex32-1.htm |

| EX-32.2 - Big Bear Mining Corp. | ex32-2.htm |

| EX-31.2 - Big Bear Mining Corp. | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2011

|

||

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from [ ] to [ ]

|

| Commission file number 001-32904 |

|

BIG BEAR MINING CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

20-4350486

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification

No.)

|

|

60 E. Rio Salado Parkway, Suite 900, Tempe, Arizona

|

85281

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

|

480.253.0323

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common stock, par value of $0.001

|

|||||||

|

(Title of class)

|

|||||||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act.

|

|||||||

|

Yes ¨ No x

|

|||||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

|

|||||||

|

Yes ¨ No x

|

|||||||

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.

|

|||||||

|

Yes x No ¨

|

|||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registration statement was required to submit and post such files).

|

|||||||

|

Yes ¨No x

|

|||||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|||||||

|

¨

|

|||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|||||||

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

||||

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|||||||

|

Yes ¨ No x

|

|||||||

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2011 was $6,894,400 based on a $0.078 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

|

|

|

120,463,632 as of April 26, 2012

|

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

11

|

|

Item 1B.

|

Unresolved Staff Comments

|

15

|

|

Item 2.

|

Properties

|

15

|

|

Item 3.

|

Legal Proceedings

|

37

|

|

Item 4.

|

Mining Safety Disclosures

|

37

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

37

|

|

Item 6.

|

Selected Financial Data

|

38

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

38

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

42

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

42

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

57

|

|

Item 9A.

|

Controls and Procedures

|

57

|

|

Item 9B.

|

Other Information

|

58

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

58

|

|

Item 11.

|

Executive Compensation

|

63

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

66

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

66

|

|

Item 14.

|

Principal Accounting Fees and Services

|

67

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

67

|

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms "we", "us" and "our" mean Big Bear Mining Corp., a Nevada corporation, unless otherwise indicated.

General Overview

We were incorporated in the State of Nevada on April 14, 2005. At inception, we were an exploration stage company engaged in the acquisition, exploration and development of mineral properties. In December 2005, Mr. Aaron Hall, our former President, acquired a mineral claim known as the Holy Cross Property which comprised 500 hectares located 145 kilometers west of Prince George, British Columbia, Canada. Mr. Hall as a licensed free miner staked the claims on our behalf. On February 20, 2006, we reimbursed Mr. Hall $1,000 for the Holy Cross Property. Based on the information available to us, we determined that the Holy Cross Property did not, in all likelihood, contain a commercially viable mineral deposit, and we therefore abandoned any further exploration on the property.

As a result, we investigated several other business opportunities to enhance shareholder value.

Effective January 21, 2010, the Nevada Secretary of State effected a forward stock split of our authorized and issued and outstanding shares of common stock on a one (1) old for fifty (50) new basis, such that our authorized capital increased from 30,000,000 shares of common stock with a par value of $0.001 to 1,500,000,000 shares of common stock with a par value of $0.001 and, correspondingly, our issued and outstanding shares of common stock increased from 2,779,000 shares of common stock to 138,950,000 shares of common stock. All share amounts have been adjusted to present the stock-split retroactively.

On March 31, 2010, we entered into a financing agreement with Intosh Services Limited, whereby we had the right to request Intosh to purchase up to $1,400,000 of our securities until March 31, 2011, unless extended by either our company or Intosh for an additional twelve (12) months. The financing agreement was not extended with Intosh.

Under the terms of the agreement, we had the right to from time to time request a purchase from Intosh up to $200,000 (each, an "Advance") per request for operating expenses, acquisitions, working capital and general corporate activities. Following receipt of any Advance, we were required to issue shares of our common stock at $0.70 per share.

As of September 30, 2010, in accordance with the financing agreement our company received Advances of $1,400,000 for which the shares were issued on September 7, 2010.

-4-

Effective April 1, 2010, we entered into a property purchase option agreement (the “Rubicon Option Agreement”) with Perry English for Rubicon Minerals Corp. (“Rubicon”) for the right and option to acquire from Rubicon up to 100% interest in a total of 14 mining claims (the “Rubicon Claims”) in the Red Lake Mining Division of Northwestern Ontario, Canada. Considerations for the 100% interest are as follows:

|

-

|

Initial cash payment of $20,000 (paid);

|

|

-

|

Cash payment of $15,000 (paid) and issuance of common shares of the Company valued at $30,000 on April 1, 2011 (333,333 shares approved for issuance on April 5, 2011, value at $0.09 per share which was the closing trading price on March 31, 2011);

|

|

-

|

Cash payment of $20,000 and issuance of common shares of the Company valued at $30,000 on April 1, 2012;

|

|

-

|

payment of $25,000 and issuance of common shares of the Company valued at $30,000 on April 1, 2013; and

|

|

-

|

Cash payment of $30,000 on April 1, 2014

|

In accordance with the Rubicon Option Agreement, Rubicon retains a royalty of 2% of the net smelter returns, 50% of which our company has the option to purchase with cash payment of $1,000,000. The work commitment on the Rubicon claims is $56,400 per year. The Rubicon Option Agreement was relinquished and an impairment charge of $65,000 was recorded as of December 31, 2011.

Effective April 11, 2010, we entered into a property purchase option agreement (the “Sol d’or Option Agreement”) with Perry English for Rubicon, whereby we are entitled to acquire from Rubicon up to 100% interest in nine claims in the Birch/Uchi portion of the Red Lake Mining Division of Northwestern Ontario, Canada, and to participate in the further exploration and development of the property. Considerations for the 100% interest in the nine claims are as follows:

|

-

|

Initial cash payment of $16,000 (paid) and issuance of 20,000 shares of the Company’s common stock (issued);

|

|

-

|

Cash payment of $15,000 (paid) and issuance of 20,000 shares of the Company’s common stock on April 11, 2011 (approved for issuance on April 11, 2011, valued at $2,000);

|

|

-

|

Cash payment of $20,000 and issuance of 20,000 shares of the Company’s common stock on April 11, 2012;

|

|

-

|

Cash payment of $25,000 and issuance of 20,000 shares of the Company’s common stock on April 11, 2013; and

|

|

-

|

Cash payment of $35,000 on April 11, 2014.

|

In accordance with the Sol d’or Option Agreement, Rubicon retains a royalty of 2% of the net smelter returns, 50% of which we have the option to purchase with cash payment of $1,000,000. The work commitment on the Sol d’or property is $41,700 per year. The Sol d’or Option Agreement was relinquished and an impairment charge of $62,200 was recorded as of December 31, 2011.

-5-

Effective April 13, 2010, we entered into a property purchase option agreement (the “Stevens Lake Option Agreement”) with Perry English for Rubicon, whereby we are entitled to acquire up to 100% interest in three claims in the Birch/Uchi portion of the Red Lake Mining Division of Northwestern Ontario, Canada, and to participate in the further exploration and development of the property. Considerations for the 100% interest in the nine claims are as follows:

|

-

|

Initial cash payment of $7,000 (paid) and issuance of 20,000 shares of the Company’s common stock (issued);

|

|

-

|

Cash payment of $12,000 (paid) and issuance of 20,000 shares of the Company’s common stock on April 13, 2011 (approved for issuance on May 5, 2011, valued at $1,400);

|

|

-

|

Cash payment of $15,000 and issuance of 20,000 shares of the Company’s common stock on April 13, 2012;

|

|

-

|

Cash payment of $20,000 and issuance of 20,000 shares of the Company’s common stock on April 13, 2013; and

|

|

-

|

Cash payment of $30,000 on April 13, 2014.

|

In accordance with the Stevens Lake Option Agreement, Rubicon retains a royalty of 2% of the net smelter returns, 50% of which we have the option to purchase with cash payment of $1,000,000. The work commitment for the Stevens Lake property is $9,600 per year. The Stevens Lake Option Agreement was relinquished and an impairment charge of $36,200 was recorded as of December 31, 2011.

On July 20, 2010, we issued 450,000 common shares to Vista Partners LLC pursuant to our letter agreement with Vista Partners LLC dated June 10, 2010. On December 16, 2010 upon renewal of the consulting agreement with Vista we issued another 450,000 shares of our company’s common stock. On June 21, 2011, upon another renewal of the consulting agreement with Vista, we issued another 1,500,000 shares of our company’s common stock. The securities issued under the letter agreement have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from the registration requirements.

Effective August 2, 2010, the Company entered into a property purchase option agreement (the “Rattlesnake Hills Option Agreement”) with John Glasscock, a director of the Company, whereby the Company is entitled to acquire up to 100% interest in 452 mineral claims located in Natrona County, Wyoming. Considerations for the 100% interest in the claims are as follows:

|

-

|

Initial cash payment of $250,000 (paid);

|

|

-

|

Issuance of 1,000,000 shares of the Company’s common stock within 30 days of the agreement (issued);

|

|

-

|

Issuance of second 1,000,000 shares of the Company’s common stock on or before the first anniversary of the agreement (approved for issuance on August 11, 2011, valued at $67,000);

|

|

-

|

Issuance of third 1,000,000 shares of the Company’s common stock on or before the second anniversary of the agreement;

|

|

-

|

Payments for all property costs which include annual lease payments estimated at $63,000 required by the State of Wyoming (2010 and 2011 payments were made).

|

In accordance with the Rattlesnake Hills Option Agreement, Mr. Glasscock retains a royalty of 2% of the net smelter returns, 50% of which we have the option to purchase with cash payment of $1,000,000.

The work commitment on the Rattlesnake Hills property in accordance with the option agreement is $800,000 during the first year, $1,200,000 during the second year and $1,600,000 during the third year. The terms for the work commitment were amended on July 19, 2011, whereby the second year’s work commitment of $1,200,000 was extended by 90 days to October 31, 2012, and the first year commitment was reduced to $652,724. In relation to the amendment 1,500,000 shares of the Company’s common stock were approved for issuance to Mr. Glasscock on August 11, 2011, valued at $100,500.

-6-

On September 9, 2010, in accordance with our company’s Rattlesnake Hills Option Agreement dated August 2, 2010, 1,000,000 shares of our company’s common stock were issued as consideration for the property. On December 16, 2010 upon renewal of the consulting agreement with VISTA we issued further 450,000 shares of the Company’s common stock after the Board of Directors’ approval. The securities issued under the Letter Agreement have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from the registration requirements.

Effective March 29, 2011, we entered into a letter of intent for a property purchase option agreement (the “Lewiston Property Option Agreement”) with Golden Predator Mines US Inc. (“GPMUS”), a private Nevada corporation, whereby our company is entitled to acquire 100% interest in mineral claims located in the Lewiston Mining District, Fremont Co., Wyoming. The agreement provides our company a period of 45 days to conduct due diligence. Upon completion of due diligence, our company, at its sole discretion, has the option to either relinquish or exercise its purchase option. On May 10, 2011 our company completed its due diligence and elected to exercise its purchase option. Considerations for the 100% interest in the claims are as follows:

|

-

|

Cash payments of $200,000 as follows:

|

|

·

|

$40,000 by March 29, 2012 ($10,000 paid on April 14, 2011 as non-refundable deposit within five business days from the Effective Date); the remaining $30,000 has not been paid as of the date of this filing, however. The Company received on extension for payment through June 29, 2012.

|

|

·

|

$40,000 by March 29, 2013;

|

|

·

|

$40,000 by March 29, 2014;

|

|

·

|

$80,000 by March 29, 2015;

|

|

-

|

Issuance of 1,100,000 shares of the Company’s common stock as follows:

|

|

·

|

500,000 shares by May 15, 2011 (approved for issuance on May 9, 2011, valued at $40,000)

|

|

·

|

200,000 shares by each of March 29, 2012, 2013 and 2014;

|

|

-

|

Incur exploration expenditures of $1,000,000 as follows:

|

|

·

|

$100,000 by March 29, 2012; the Company has met this requirement as of the date of this filing.

|

|

·

|

$200,000 by March 29, 2013;

|

|

·

|

$500,000 by March 29, 2014;

|

|

·

|

$200,000 by March 29, 2015.

|

-7-

In addition to above consideration, as required by the option agreement, we will make payments for all taxes and mining claims fees and other charges required to maintain the Lewiston Property in good standing. Annual property taxes are estimated to be $102,000 and annual lease payments are estimated to be $17,500.

Upon conveyance of the Lewiston claims, GPMUS will retain an incremental sliding scale interest in net smelter returns of 3% to 5%, which will be contingent upon the price of gold.

Effective March 30, 2011, we entered into a financing agreement with Intosh Services Limited, whereby we had the right to request Intosh to purchase up to $500,000 of our common stock at $0.15 per share. As of December 31, 2011, we have received $250,000 for 1,666,667 shares. The related shares were issued on April 6, 2011.

On July 28, 2011, our company signed an engagement letter with MidSouth Capital Inc. (“MidSouth”) whereby MidSouth assists our company in raising equity financing for the following consideration:

|

-

|

Issue 500,000 shares of our company’s common stock five business days after the execution of the engagement letter, with the related shares issued on July 29, 2011;

|

|

-

|

10% of the capital raised by MidSouth for our company; and

|

|

-

|

Issue 100,000 shares of our company’s common stock per every $100,000 cash raised for the period of two years.

|

The agreement is for a twelve-month initial period with an option to renew for an additional six months.

On August 24, 2011, Southern Legacy Minerals, Inc., purchased a total 22,000,000 shares of our common stock from Steve Rix, our former director and officer, in a private transaction for $125,000. Southern Legacy now owns 32.1% of our company’s issued and outstanding shares of common stock.

On November 28, 2011, our company signed an engagement letter with World Stock Exchange, LLC whereby World Stock Exchange assists our company in raising equity financing for the following consideration:

|

-

|

Issue 300,000 shares of our company’s common stock, valued at $7,590, due upon execution of the engagement letter, with the related shares issued on December 9, 2011;

|

|

-

|

10% of the capital raised by World Stock Exchange for our company; and

|

The agreement is for a twelve-month initial period.

On December 12, 2011, the Company signed an advertising, public relations and marketing letter with StockVest Inc. whereby StockVest will provide advertising service for the Company for the following consideration:

|

-

|

750,000 restricted shares, valued at $20,250

|

The contract expires June 15, 2012. The related shares were issued in 2011. The Company chose to renew their contract early on March 5, 2012 for the following consideration:

|

-

|

1,500,000 restricted shares

|

The contract expires December 31, 2013. The related shares were issued on March 8, 2012.

Our fiscal year end is December 31.

Our Current Business

We are an exploration stage company engaged in the acquisition and exploration of mineral interests and resource properties in North America. We maintain our statutory registered agent's office at 1859 Whitney Mesa Drive, Henderson, Nevada 89014 and our business office is located at 60 E Rio Salado Parkway, Suite 900, Tempe, Arizona 85281.

-8-

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Since we are an exploration stage company, there is no assurance that a commercially viable mineral reserve exists on any of our current or future properties, To date, we do not know if an economically viable mineral reserve exists on our property and there is no assurance that we will discover one. Even if we do eventually discover a mineral reserve on our property, there can be no assurance that we will be able to develop our property into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

Our current operational focus is to complete the terms of the Rattlesnake Hills and Lewiston Property Option Agreements, and to conduct exploration activities on each of the properties, including the Elk City, ID claims.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Governmental Regulations

We currently hold options to acquire properties in the states of Wyoming and Idaho Our mineral exploration program will be subject to regulations similar to the following:

|

·

|

Locating claims

|

|

·

|

Posting claims

|

|

·

|

Working claims

|

|

·

|

Reporting work performed

|

Prior to proceeding with any exploration work, we must apply for a notice of work permit. Additionally, the properties we are acquiring in the Rattlesnake Hills region have some split estate land where we have to create contracts with the surface land owners.

We are committed to complying with and are, to our knowledge, in compliance with, all governmental and environmental regulations applicable to our company and our properties. Permits from a variety of regulatory authorities are required for many aspects of mineral exploration and reclamation. We cannot predict the extent to which these requirements will affect our company or our properties if we identify the existence of minerals in commercially exploitable quantities. In addition, future legislation and regulation could cause additional expense, capital expenditure, restrictions and delays in the exploration of our properties.

-9-

Research and Development

We have incurred $Nil in research and development expenditures over the last two fiscal years.

Employees

Currently, we do not have any employees. Our directors, executive officers and certain contracted individuals play an important role in the running of our company. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Item 1A. Risk Factors

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

We need to continue as a going concern if our business is to succeed, if we do not we will go out of business.

Our independent registered public accounting firm’s report on our audited financial statements for the year ended December 31, 2011 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are our accumulated deficit since inception, our failure to attain profitable operations and our dependence upon adequate financing to pay our liabilities. If we are not able to continue as a going concern, it is likely investors will lose their investments.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

Because we have commenced limited business operations, we face a high risk of business failure.

We have limited business operations, accordingly, we have no way to evaluate the likelihood that our business will be successful. We were incorporated on April 14, 2005 and have been involved primarily in organizational activities and the acquisition of our mineral properties. We have not earned any revenues.

-10-

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the mineral claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We lack an operating history and we expect to have losses in the future.

We have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the following:

|

|

·

|

Our ability to locate a profitable mineral property;

|

|

|

·

|

Our ability to generate revenues; and

|

|

·

|

Our ability to reduce exploration costs.

|

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

We have no known ore reserves and we cannot guarantee we will find any gold or if we find gold, that production will be profitable. Even if we are successful in discovering gold or other mineralized material we may not be able to realize a profit from its sale. If we cannot make a profit, we may have to cease operations.

We have no known ore reserves. We have not identified any gold on the mineral claims and we cannot guarantee that we will ever find any gold. Even if we find that there is gold on our mineral claims, we cannot guarantee that we will be able to recover the gold. If we cannot find gold or it is not economical to recover the gold, we will have to cease operations.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Because we are small and do not have much capital, we must limit our exploration and consequently may not find mineralized material. If we do not find mineralized material, we will cease operations.

Because we are small and do not have much capital, we must limit our exploration. Because we may have to limit our exploration, we may not find mineralized material, although our mineral claims may contain mineralized material. If we do not find mineralized material, we will cease operations.

If we become subject to onerous government regulation or other legal uncertainties, our business will be negatively affected.

There are several governmental regulations that materially restrict mineral property exploration and development. Under the mining laws of the jurisdictions in which our properties are located, we are required to obtain work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. While these current laws do not affect our current exploration plans, if we proceed to commence drilling operations on the mineral claims, we will incur modest regulatory compliance costs.

-11-

In addition, the legal and regulatory environment that pertains to the exploration of ore is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue to source exploration mineral claims. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of gold exist on our properties Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Because the SEC imposes additional sales practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty in reselling your shares and may cause the price of the shares to decline.

Our shares qualify as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934, which imposes additional sales practice requirements on broker/dealers who sell our securities in this offering or in the aftermarket. In particular, prior to selling a penny stock, broker/dealers must give the prospective customer a risk disclosure document that: contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; contains a description of the broker/dealers' duties to the customer and of the rights and remedies available to the customer with respect to violations of such duties or other requirements of Federal securities laws; contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask prices; contains the toll free telephone number for inquiries on disciplinary actions established pursuant to section 15(A)(i); defines significant terms used in the disclosure document or in the conduct of trading in penny stocks; and contains such other information, and is in such form (including language, type size, and format), as the SEC requires by rule or regulation. Further, for sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement before making a sale to you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the price of the shares to decline.

-12-

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

Trading of our stock may be restricted by the SEC's Penny Stock Regulations which may limit a stockholder's ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

Anti-Takeover Provisions

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

Our By-laws contain provisions indemnifying our officer and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification of our officer and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officer.

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

-13-

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

Our executive, administrative, and operating offices are located at 60 E Rio Salado Parkway, Suite 900, Tempe, Arizona 85281. We currently lease approximately 268 square feet at a monthly cost of $2,219.00. We believe these facilities are adequate for our current needs and that alternate facilities on similar terms would be readily available if needed.

Property held by us: As of the date of this current report on Form 10-K, we hold options to acquire interests in Rattlesnake Hills and Lewiston Properties. For a description of the option agreements, please see the section entitled “Business” above.

Rubicon Option Agreement: Shabu Lake - Skinner Claims

Our Red Lake Property consists of 14 claims comprising approximately 6,680 acres in the prolific Red Lake Mining Division of Northwestern Ontario, Canada. These claims are located in the Shabu Lake area and are accessible by road. This property has multiple reported gold occurrences on it (Ontario Geological Survey Open File Report 5835) as well as multiple documented copper/nickel occurrences (Preliminary Map P973 Shabumeni River - Narrow Lake area).

Previous exploration was hampered by inaccessibility but the construction of an all-season logging road in recent years has alleviated this and enhanced the possibility of discovering new gold and base metal zones. In addition, follow up work on previous occurrences is now more economically viable.

Location and Access

The property lies in northwest part of the Birch-Confederation Lakes greenstone belt some 75 km east-northeast of Red Lake straddling the Skinner township / Shabu Lake area boundary. It comprises a contiguous group of claims (~175 units, 6,988 acres) extending 11.5 km from Leonard Lake in the east to Shabu Lake in the northwest.

The east part of the property is road accessible from Highway 105 in Ear Falls, eastwards towards Gold Pines on Lac Seul on Highway 653, then northeastwards along the South Bay Road and finally north on the Joyce Road which crosses the southeast extremity of the property. The South Bay and Joyce Roads are both well maintained, gravel logging access roads.

Northwest parts of the property are accessible by float plane available at the South End of Confederation Lake (Kabeelo’s; ~30 km), Ear Falls (several; 75 km) and Red Lake (e.g, Greens, 75 km).

Title

The properties are all unpatented mining claims in good standing with the Ontario Ministry of Northern Development, Mines and Foresty (MNDMF) registered to Perry English. Perry English has granted an option to Big Bear Mining which requires cash and stock payments, the terms of which are set out in the section entitled “Business”. In order to maintain ownership of the property we must maintain the option agreement in good standing and meet the work requirements of the MNDMF which are annual requirements calculated on the property size. On an annual basis the MNDMF requires eligible work to be carried out on the property with a cash value of CAD$56,400.

-14-

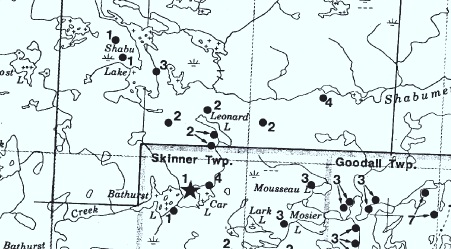

Figure 1. Shabu-Skinner Claims (outlined in red; UTM Zone 15; NAD’83). Joyce Road (access in brown).

History

Parker and Atkinson (1993) record several gold showings on the property dating from 1926. Past work in the area has focused on the Bathurst Mine on Carr Lake which lies on the adjoining property south and east.

Parker and Atkinson (1993; Appendix A) provide detailed descriptions and histories of specific showings. Table 1 below lists work reported in the Shabu lake map area (NTS 52N07SW). Available data suggest that there is a significant and varied base of work on which to design further exploration programs. In recent work (circa 2004) by Fronteer, completed only on the Leonard Lake portion of the property, can be effectively applied to the central and western portions.

Table 1. Assessment files in the Shabu Lake map area (NTS 52N07SW).

|

AFRI File

|

Year

|

AFRO ID

|

Performed For

|

Drilling

|

Geology

|

Geochem

|

Geophysics

|

|

52N07SW0008

|

1963

|

DDH 10

|

FLINT ROCK MINES LTD

|

x

|

|||

|

52N07SW0007

|

1967

|

DDH 11

|

MADSEN RL AU MINES LTD

|

x

|

|||

|

52N07SW0005

|

1969

|

DDH 13

|

G J CIGLEN

|

x

|

|||

|

52N07SW0006

|

1969

|

DDH 12

|

FLINT ROCK MINES LTD

|

x

|

|||

|

52N07SW0003

|

1985

|

2.7641

|

SUMMIT RED L GOLD MINES LTD

|

x

|

x

|

||

|

52N07SW0002

|

1987

|

63.519

|

FLINT ROCK MINES LTD

|

x

|

x

|

||

|

52N07SW0004

|

1988

|

DDH 14

|

SHABU GOLD MINES LTD

|

x

|

|||

|

52N07SW9913

|

1993

|

2.1494

|

ASARCO EXPL CO OF CAN LTD

|

x

|

x

|

||

|

52N07SW2001

|

2002

|

2.25014

|

FRONTEER DVLPMT GROUP INC

|

x

|

x

|

x

|

|

|

52N08NE2003

|

2003

|

2.27483

|

ILBEY ENTERPRISES LTD

|

x

|

x

|

||

|

52N07SW2002

|

2004

|

2.27325

|

FRONTEER DVLPMT GROUP INC

|

x

|

|||

|

52N07SW2003

|

2004

|

2.27924

|

FRONTEER DVLPMT GROUP INC

|

x

|

-15-

Property Status

This option was relinquished as of December 31, 2011.

Existing or potential economic significance

The property represents an early stage gold exploration property containing several gold-in-quartz showings whose known extent is limited.

Appendix 1. Showings on (SB-1 to 3) and adjacent to (SB-4, SK-1 to 4) property

Figure 2. Gold showings on and near Skinner-Shabu Claim Group (Parker and Atkinson, 1993)

SHABU LAKE AREA (NTS 52N07SW)

Code Name

SB-1 Flint Rock Mines Ltd. Occurrence (Shabu Lake Occurrence)

SB-2 Leonard Lake Occurrences

-16-

SB-3 Madsen Red Lake Gold Mines Occurrence

SB-4 Sheehan Lake Prospect

SKINNER TOWNSHIP (52N07SW)

SK-1 Bathurst Mine

SK-2 Dunkin Prospect

SK-3 Noramco Explorations Inc., Skinner Township Occurrences

SK-4 Price-Logan Occurrence

|

Code

|

SB-1

|

|

Name

|

FLINT ROCK MINES LTD. OCCURRENCE (SHABU LAKE OCCURRENCE) -

|

|

Map area

|

SHABU LAKE AREA

|

|

NTS

|

52N07SW

|

|

LOCAION

|

The Flint Rock Mines Ltd. occurrence is situated on leased mining claims KRL 51180 to 51191 inclusive. The main No. l vein is located about 1.2 km due west of Shabu Lake on leased claims KRL 51184 and 51186.

|

|

DESCRIPTION

|

|

Regional Structures

|

Fyon and ODonnell (1986) noted that the main structure at Shabu Lake is a complex or refolded fold. According to Fyon and ODonnell (1986): "A tight syncline with a highly strained (possibly sheared) core trends northwest, parallel to the northwestern arm of the lake. A second fold axial trace trends north-northeast, and defines a broad syncline in the southeastern section of the lake.”

|

|

Geology

|

Northeast-trending, fine-grained metasediments are intercalated with minor metavolcanic flows of the Cycle n metavolcanic sequence (Thurston 1986) and are intruded by granodioritic rocks of the Mainprize Lake granitoid complex.

|

|

|

Mineralization

|

|

No. l vein

|

The No. l vein occurs along the southern claim boundaries of leased claims KRL 51184 and 51186. The east-trending quartz vein has been traced by diamond drilling along the contact between biotite granodiorite and a diorite dike, for a strike length of 800 m. The vein is 0.1 to 0.6 m wide and contains sparse amounts of disseminated galena, pyrite, chalcopyrite and visible gold (Pryslak 1974).

|

|

No. 2 vein

|

The No. 2 vein is approximately 460 m northwest of the No. l vein and is situated on leased mining claim KRL 51188. The east-trending vein dips 90 and is 5 cm to 30 cm wide with a strike length of 47 m. The vein is hosted by a narrow inclusion of metasediments and by biotite granodiorite and gabbro. Pryslak (1974) reported that the vein contained up to 10% galena and 2% chalcopyrite.

|

|

Alteration and deformation

|

Alteration and deformation associated with the quartz veins is very minimal and consists of silicification, epidotization and hematization with very minor shearing.

|

|

OWNERSHIP AND DEVELOPMENT

|

|

1937

|

Prospectors Airways Ltd. conducted trenching, channel sampling and diamond drilled 28 holes totalling 6500 feet on the No. l Vein zone.

|

|

1963

|

Flint Rock Mines Ltd. diamond drilled 7 holes totalling 1999 feet on the No. l and No. 2 veins.

|

|

1969

|

Flint Rock Mines diamond drilled 2 holes totalling 950 feet to test the base metal potential of a pyritic zone on the west shore of Shabu Lake (leased claim KRL 51180).

|

|

1987

|

Flint Rock Mines conducted linecutting and induced polarization and resistivity surveys over the property and diamond drilled 6 holes totalling 2217.6 feet.

|

|

ECONOMIC FEATURES

|

|

No. 1 Vein

|

The No. l vein hosts an auriferous section which is 180 m long with an average width of 0.49 m and an average grade of 0.85 ounce Au per ton (Pryslak 1974). This zone was drilled to a depth of 90 m.

|

-17-

|

No. 1 Vein

|

Diamond drilling conducted on the No. l vein in 1937 by Prospectors Airways Ltd. Intersected narrow sections assaying as high as 0.43 and 0.77 ounce Au per ton.

|

|

No. 1 Vein

|

Drilling conducted by Flint Rock Mines Ltd. in 1963, on the No. l vein, intersected narrow sections assaying as high as 0.8 ounce Au per ton and 0.72 ounce Au per ton.

|

|

No. 2 Vein

|

A grab sample taken by A.P. Pryslak (1974) from the No. 2 vein assayed 0.01 ounce Au per ton, 0.09% Cu and 1.45% Pb.

|

|

No. 2 Vein

|

Drill holes completed by Flint Rock Mines Ltd. in 1987 intersected narrow sections of gold mineralization such as: 1.065 ounces Au per ton across 0.45 feet, 0.139 Au per ton across 1.5 feet, 0.145 ounce Au per ton across 0.39 feet, 0.231 ounce Au per ton across 0.3 feet and 0.388 ounce Au per ton across 0.5 feet.

|

|

Code

|

SB-2

|

|

Name

|

LEONARD LAKE OCCURRENCES

|

|

Map area

|

SHABU LAKE AREA

|

|

NTS

|

52N07SW

|

|

LOCATION

|

The Leonard Lake occurrences consist of 5 separate showings situated in the immediate vicinity of Leonard Lake in the Shabu Lake area.

|

|

North

|

The North showing is situated 805 m due north of Leonard Lake;

|

|

West

|

West showing occurs 1.7 km west of the lake;

|

|

East

|

East showing is situated 2 km due east of the lake;

|

|

Shore

|

Shore showing is located on the southwest shore of Leonard Lake; and

|

|

South

|

South showing is located 500 m southwest of the lake. Leonard Lake is situated immediately north of the Skinner Township boundary line.

|

|

DESCRIPTION

|

|

Regional Structures

|

The northwest-trending Swain Lake fault extends from Swain Lake through the southeastern end of Leonard Lake (Pryslak 1972, 1974).

|

|

Geology

|

East-trending, intermediate to mafic metavolcanic rocks are intercalated with abundant fine-grained metasediments of the Cycle II sequence (Thurston 1986) and are intruded by gabbro and granodioritic rocks of the Mainprize Lake granitoid complex.

|

|

North and West

|

The North and West showings consist of test pits sunk on quartz veins within granodioritic rocks at the contacts between granodiorite and metasediments and granodiorite and mafic metavolcanic rocks.

|

|

East

|

The East showing consists of quartz veins hosted by fine-grained metasediments consisting of greywacke, siltstone and argillite.

|

|

Shore

|

The Shore showing consists of several trenches sunk on quartz veins hosted by intermediate pyroclastic rocks which have been altered to chlorite-sericite schist (Pryslak 1974).

|

|

Shore

|

The Shore showing is situated on the extreme northwest extension of the Swain Lake fault.

|

|

South

|

The South showing (formerly situated on claim KRL 4841) consists of 3 separate east-trending quartz veins dipping between 60 and 80 to the south. The veins are hosted by narrow shear zones up to 4 feet wide in coarse-grained diorite/gabbro. The quartz veins range in strike length from 20 to 110 feet (Bruce 1929).

|

|

South showing

|

The quartz veins at the South showing have been reported (Bruce 1929) to contain massive arsenopyrite in "considerable quantities". Bruce (1929) reported that "gold occurs with the arsenopyrite".

|

|

West showing

|

Pryslak (1974) reported arsenopyrite in quartz veins at the West showing.

|

-18-

OWNERSHIP AND DEVELOPMENT

|

1927

|

Leonard Narrow Lake Mines Ltd. conducted extensive stripping and trenching in the vicinity of Leonard Lake. The most promising showing on the property was the South showing situated on mining claims KRL 4841.

|

|

1966

|

A portion of the property was staked by Madsen Red Lake Gold Mines Ltd.

|

|

1967

|

Madsen Mines conducted electromagnetic and magnetic surveys over the area.

|

|

1969

|

C.C. Huston and Associates flew airborne electromagnetic, magnetic and radiometric surveys over the area.

|

|

1988

|

Canadian Eagle Exploration Inc. flew airborne electromagnetic, magnetic and resistivity surveys over a portion of the area.

|

ECONOMIC FEATURES

|

West, North & East

|

Pryslak (1974) has indicated the presence of gold at the West, North and East showings on map P. 973, but no specific gold values have been reported.

|

|

South

|

Bruce (1929) also reports the presence of gold at the South showing.

|

|

Code

|

SB-3

|

|

Name

|

MADSEN RED LAKE GOLD MINES OCCURRENCE

|

|

Map area

|

SHABU LAKE AREA

|

|

NTS

|

52N07SW

|

|

LOCATION

|

The Madsen Red Lake Gold Mines prospect consists of several sulphide shownings situated on the south and southeast shore of Shabu Lake.

|

|

DESCRIPTION

|

|

Regional Structures

|

A syncline with a highly strained core trends northwest, parallel to the northwestern arm of Shabu Lake and a second fold axial trace trends north-northeast, and defines a broad syncline in the southeastern section of Shabu Lake (Fyon and ODonnell (1986))

|

|

Geology

|

Northwest-trending, pillowed and massive mafic metavolcanic flows outcrop on the east shore of Shabu Lake. A 400- to 500-foot thick marble unit (Pryslak 1974) which extends along the southeast shore of Shabu Lake is overlain to the east by fine-bedded, siliceous metasediments which are 200 feet thick (Pryslak 1974). The supracrustal rocks are part of the Cycle II metavolcanic sequence (Thurston 1986). The metasediments and metavolcanic rocks are intruded by porphyritic, biotite granodiorite of the Mainprize Lake granitoid comples.

|

|

Mineralization

|

The marble and siliceous metasediments host abundant disseminated and massive sulphide mineralization consisting of pyrite and pyrrhotite, with minor chalcopyrite, sphalerite and galena. Lenses of massive sulphides are up to 10 feet wide.

|

OWNERSHIP AND DEVELOPMENT

|

1966

|

A contiguous group of 79 mining claims was staked by Madsen Red Lake Gold Mines Ltd.

|

|

1967

|

Madsen Mines conducted linecutting, electromagnetic and magnetic surveys trenching, sampling and diamond drilled 10 holes totalling 3,370 feet.

|

|

1969

|

C.C. Huston and Associates flew airborne electromagnetic, magnetic and radiometric surveys over the area.

|

|

1988

|

Canadian Eagle Exploration Inc. (formerly Shabu Gold Mines Ltd.) flew airborne electromagnetic, resistivity and magneti surveys over the area.

|

|

ECONOMIC FEATURES

|

Four drill holes completed by Madsen Red Lake Gold Mines Ltd. intersected narrow sections of anomalous gold mineralization in siliceous metasediments and marble hosting variable amounts of pyrrhotite and pyrite. Some of the drill intersections were:

|

|

Drill Hole No.

|

Intersection (ounce Au per ton)

|

|

5

|

0.04 across 4.1 feet

|

|

5

|

0.08 across 1.8 feet

|

|

6

|

0.08 across 5 feet

|

|

6

|

0.04 across 2.1 feet

|

|

7

|

0.04 across 5 feet

|

|

8

|

0.04 across 8 inches

|

|

9

|

0.04 across 1-foot

|

|

9

|

0.04 across 5 feet

|

-19-

|

Code

|

SB-4

|

|

Name

|

SHEERAN LAKE PROSPECT

|

|

Area

|

SHABU LAKE AREA

|

|

NTS

|

52N07SW

|

|

LOCATION

|

The Sheehan Lake prospect consists of 35 trenches located about 400 m due south of Sheehan Lake (local name) in the Shabu Lake area. Sheehan Lake is a small lake situated along the Shabumeni River and is approximately 6.6 km due west of Shabumeni Lake.

|

DESCRIPTION

|

Regional Structures

|

No major regional structures have been identified in the vicinity of the Sheehan Lake prospect.

|

|

Geology

|

The Sheehan Lake prospect is hosted by hornblende granodiorite of the Mainprize Lake granitoid complex. The occurrence is about 500 m due north of the contact between the granitoid rocks and a thick unit of fine-grained metasediments. Pryslak (1974) located 35 trenches which range from 2 m to 36 m in length. The trenches occur at intervals of 9 m in a west-northwest direction for a strike length of 270 m.

|

|

Mineralization

|

Gold mineralization occurs within a sheared alteration zone consisting of silicified, carbonatized and variably pyritic, hornblende granodiorite. The alteration zone contains 10% to 20% iron carbonate, 2% to 8% disseminated pyrite (Prylak 1974) and minor galena and chalcopyrite.

|

OWNERSHIP AND DEVELOPMENT

|

1937

|

Prospectors Airways Ltd. staked 15 mining claims at Sheehan Lake and conducted trenching, stripping and 3500 feet of diamond drilling.

|

|

1969

|

Noranda Exploration Co. Ltd. conducted ground magnetic and electromagneticsurveys in the vicinity of the prospect.

|

|

1973

|

Staked by P. Henniston.

|

|

1982

|

Dome Exploration visited and sampled the property.

|

|

1984

|

Summit Red Lake Gold Mines Ltd. conducted ground magnetic and electromagnetic surveys and humus and lithogeochemical surveys.

|

|

1987

|

Shabu Gold Mines Ltd. conducted an electromagnetic survey and diamond drilled 23 holes totalling 10 437.7 feet.

|

|

1988

|

Canadian Eagle Exploration Inc. (formerly Shabu Gold Mines Ltd.) flew airborne magnetic, electromagnetic and resistivity surveys over the property.

|

-20-

ECONOMIC FEATURES

Diamond drilling conducted by Shabu Gold Mines Ltd. in 1987 intersected 0.078 ounce Au per ton across 24.8 feet, while 4 other narrow intersections assayed up to 0.06 ounce Au per ton (The Northern Miner, April 6, 1987, p. 7). Numerous sections with high silver values such as, 1.83 ounces Ag per ton across 17.5 feet, were also intersected in drill core.

Six chip samples ranging in length from 1.2 m to 6 m were taken from the trenches by A.P. Pryslak (1974) and assayed between 0.01 and 0.07 ounce Au per ton.

|

Code

|

SB-2

|

|

Name

|

LEONARD LAKE OCCURRENCES

|

|

Map Area

|

SHABU LAKE AREA

|

|

NTS

|

52N/7 SW

|

|

LOCATION

|

The Leonard Lake occurrences consist of 5 separate showings situated in the immediate vicinity of Leonard Lake in the Shabu Lake area. The North showing is situated 805 m due north of Leonard Lake; the West showing occurs 1.7 km west of the lake; the East showing is situated 2 km due east of the lake; the Shore showing is located on the southwest shore of Leonard Lake; and the South showing is located 500 m southwest of the lake. Leonard Lake is situated immediately north of the Skinner Township boundary line.

|

[DUPLICATE]Code SK-1

|

Name

|

BATHURST MINE

|

|

Map area

|

SKINNER TOWNSHIP

|

|

NTS

|

52N07SW

|

|

LOCATION

|

The Bathurst Mine is located on leased mining claim KRL 321974 (formerly KRL 4758) which is part of a group of 12 contiguous leased claims situated between Bathurst and Car lakes in the northwest corner of Skinner Township. Numerous pits and trenches are located on several of the leased claims.

|

|

DESCRIPTION

|

|

Regional Structures

|

The Bathurst Mine property is situated within the contact strain aureole of the Trout Lake batholith in the east-northeast-trending Swain Lake deformation zone (Fyon and Lane 1986).

|

|

Geology

|

Mafic, massive and pillowed metavolcanic flows of the Cycle II sequence (Thurston 1985) are intruded by coarse-grained gabbroic and dioritic sills and dikes and by wide felsite dikes commonly striking between 090 and 110° and dipping 75° to the south. The Bathurst Mine is approximately 600 m east of the contact between mafic metavolcanic rocks and granitic rocks of the Trout Lake batholith. Mafic, metavolcanic rocks commonly contain abundant green, fibrous, amphibole. The metavolcanic rocks are commonly foliated in a northerly direction, parallel to the contact of the Trout Lake batholith.

|

|

Mineralization

|

Mineralized quartz veins are hosted by numerous discrete, east- and east-southeast- trending shear zones in excess of 3 m wide. Shear and fracture zones commonly occur along the contacts of felsite dikes and also within the dikes.

|

|

|

The sheared wall rocks are chloritized and/or talcose and host calcite-filled extension veins. Wall rocks immediately adjacent to the quartz veins are commonly silicified. Alteration is confined to the shear zones.

|

|

|

Numerous trenches and pits have been sunk on 12 mineralized shear zones hosting fine-grained, white, sugary quartz veins and a few pale blue vitreous veins. The quartz veins contain minor amounts of disseminated pyrite associated with iron carbonate and chloritic wall rock fragments. Quartz veins may also contain sphalerite, chalcopyrite, galena, arsenopyrite, pyrrhotite and spectacular, coarse, visible gold. Sulphides are commonly concentrated within the quartz at quartz vein/wall rock contacts and are finely disseminated in the sheared wall rocks.

|

|

|

The quartz veins range between 2 and 9 feet in width with some strike lengths in excess of 1000 feet. Many of the quartz veins have been deformed and are folded and flat-lying (Bruce 1929; Fyon and O'Donnell 1986). The folded veins commonly have a shallow plunge to the southwest. The shaft was sunk on the No. l, 2, 3 and 4 veins on leased mining claim KRL 321974 (formerly KRL 4758). These veins were the most important on the property and contained the most abundant visible gold.

|

-21-

OWNERSHIP AND DEVELOPMENT

|

1926

|

Gold was discovered in wide quartz veins at Car and Bathurst lakes.

|

|

1927

|

Bathurst Mines Ltd. acquired 30 contiguous mining claims consisting of the Bathurst, Price-Logan, and Daipre-Cobourn properties; trenching, stripping and sampling delineated 7 gold-bearing zones.

|

|

1928

|

A two-compartment shaft was sunk to a depth of 223 feet on mining claim KRL 4758 and a level was started at 200 feet.

|

|

1929

|

The shaft was deepened to 300 feet with levels at 200 and 300 feet; 1109 feet of crosscutting and 2046 feet of drifting was completed; a mill was installed and produced 149.06 ounces of gold and 50 ounces of silver for a total value of S3107 (Rogers and Young 1930), a different production figure of 160 ounces of gold was also reported for the same year (Harding 1936); the mine was closed by the end of the year.

|

|

1932

|

The mine was reopened and a production of S1500 (Sinclair et al. 1934) was recorded by the end of the year when the mine was closed once more.

|

|

1934

|

The shaft was deepened to 420 feet and the mine was reported to have produced 74.51 ounces of gold and 6 ounces of silver from 130 tons of ore (Bathurst Mines Ltd., assessment files, Resident Geologist's office, Red Lake).

|

|

1935

|

Erie Canadian Gold Mines Ltd. optioned the property and conducted extensive surface work.

|

|

1936

|

Car Lake Syndicate commenced underground operations and completed 30 feet of crosscutting, 131 feet of drifting and 52 feet of raising on the 200-foot level; the mine produced 84 ounces of gold and 36 ounces of silver from 432 tons of ore (Bathurst Mines Ltd., assessment files, Resident Geologist's office, Red Lake; Sinclair et al. 1938), however, conflicting production figures of 76.92 ounces of gold and 28 ounces of silver produced from 307 tons of ore (Young 1938); and 120 ounces of gold produced from 320 tons of ore (Sinclair et al. 1939) are also reported for the same year.

|

|

1937

|

Gleemar Gold Mines Ltd. resumed underground operations and completed 200 feet of drifting and 100 feet of crosscutting on the 300-foot level.

|

|

1958

|

Bathurst Selective Mines Securities Ltd. conducted prospecting, stripping, trenching and sampling on the property.

|

|

1963-1964

|

Bathurst Selective Mines Securities Ltd. diamond drilled 6 holes totalling 727 feet on mining claims KRL 50904 and 50907 and conducted a considerable amount of trenching.

|

|

1966

|

Ground magnetic and electromagnetic surveys were conducted by Cana Exploration Consultants Ltd. for G. Jones.

|

|

1967

|

Victoria Algoma Mineral Co. Ltd. completed l diamond drill hole to a depth of 901 feet on mining claim KRL 50907.

|

|

1969

|

Kendon Copper Mines Ltd. diamond drilled 10 holes totalling 2508 feet on mining claims KRL 62528 and 62529.

|

|

1972-1973

|

The property was staked by a group of prospectors from Ear Falls and optioned to All Canadian Mining and Exploration Co. who conducted geological mapping and diamond drilled 7 holes totalling 587 feet on mining claims KRL 321974 and 368355; extensive trenching was also completed on the property.

|

|

1975-1977

|

Stripping and trenching was conducted by A. Bertram and G. Alcock.

|

|

1979-1980

|

St. Mary's Explorations Ltd. acquired a 70% interest in the Bathurst property; the company diamond drilled 2 holes totalling 303.9 feet on mining claim KRL 321974.

|

|

1983

|

Twelve mining claims encompassing the Bathurst property were brought to lease.

|

|

1986

|

B. Cronley conducted stripping and trenching on 3 claims, KRL 828013, 828014 and 828016. The claims were situated along the southeast shore of Bathurst Lake and were tied-on to the southwest end of the group of leased claims which encompasses the Bathurst Mine property.

|

|

1986-1987

|

Eastmont Gold Mines Ltd. conducted stripping, trenching, sampling, geological mapping, ground magnetic and electromagnetic surveys on the 12 leased claims of the Bathurst property and on adjacent mining claims; the company conducted diamond drilling on the leased claims in 1987, but results were not reported.

|

ECONOMIC FEATURES

|

Production

|

The Bathurst Mine produced approximately 307.57 ounces of gold and 92 ounces of silver (Rogers and Young 1930; Harding 1936; Sinclair et al. 1934, 1938, 1939; Young 1938; Bathurst Mines Ltd., assessment files, Resident Geologist's office, Red Lake). Reserves at the mine have been reported to be 80 000 tons grading 0.578 ounce Au per ton (Energy, Mines and Resources 1989).

|

-22-

|

No. 2 Vein

|

Grab samples from the various quartz veins on the Bathurst property have assayed greater than 4.0 ounces Au per ton.

|

|

|

Diamond drilling on the No. 2 Vein by All Canadian Mining and Exploration Co. intersected 0.87 ounce Au per ton across 5 feet.

|

|

|

An underground chip sample from the No. 2 Vein taken by Erie Canadian Mining Ltd. assayed 0.54 ounce Au per ton across 4.72 feet.

|

|

No. 3 Vein

|

Chip samples taken by Erie Canadian Mines Ltd. during surface sampling of the No. 3 Vein gave an average assay of 1.5 ounces Au per ton across 2 feet for a length of 165 feet.

|

|

No. 3 Vein

|

Assays of samples taken from the No. 3 Vein on the 200-foot level of the mine averaged 0.52 ounce Au per ton across 3.5 feet for a length of 180 feet.

|

|

No. 4 Vein

|

Grab samples taken by B.T. Atkinson from the No. 4 Vein analyzed 1720 and 7230 ppb Au; while samples from the No. 5 and No. 7 veins analyzed 3920 ppb Au and 735 ppb Au, respectively (Geoscience Laboratories Section, Ontario Geological Survey, Toronto). Visible gold was noted in a number of veins. A quartz vein known as the "Golden Sidewalk" has produced some spectacular specimens of native gold.

|

|

KRL 828013

|

Seven grab samples taken by B.T. Atkinson from trenches sunk by B. Cronley on claim KRL 828013 analyzed 1220 ppb Au and 2.27o MoS2 ; and 20, 6, 7, 5 and 4 ppb Au.

|

|

Code

|

SK-2

|

|

Name

|

DUNKIN PROSPECT

|

|

Map area

|

SKINNER TOWNSHIP

|

|

NTS

|

52N02SW

|

|

LOCATION

|

The Dunkin prospect consists of a shaft and several separate gold showings, known as the No. l, No. 2, No. 2a, No. 2b, Vihonen (No. 3), Tie-Line and Harbour showings. The gold showings are situated along the north shore of the northwest arm of Narrow Lake in the southeast corner of Skinner Township.

|

|

DESCRIPTION

|

|

Regional Structures:

|

The Dunkin prospect is situated within the west- to northwest-trending Narrow Lake deformation zone (Fyon and Lane 1986; Fyon and O'Donnell 1986).

|

|

Geology

|

Massive, mafic, pillowed and variolitic metavolcanic flows of the Cycle II sequence (Thurston 1985) are intruded by fine- to medium-grained, magnetite-bearing gabbroic sills and minor feldspar porphyry dikes. The Dunkin prospect is approximately 3.6 km east of the contact between mafic metavolcanic rocks and granitic rocks of the Trout Lake batholith.

|

|

|

The majority of gold-bearing quartz veins at the Dunkin prospect are hosted by numerous narrow, discrete, shear zones trending between 050 and 110 and commonly dipping 70 to 80 north. Shear zones at the No. 2 and Vihonen (No. 3) showings dip between 15 and 30 to the northwest.

|

|

|

Host rocks consist of variably sheared and altered mafic metavolcanic flows and/or magnetite-bearing, medium-grained gabbro. Sheared wall rocks are chloritized, carbonatized and weakly sericitized.

|

|

Mineralization

|

Quartz veins at the Dunkin prospect commonly consist of massive, milky-white quartz containing minor amounts of disseminated pyrite, chlorite, iron carbonate and visible gold.

|

|