Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDMENT TO CURRENT REPORT - Air Transport Services Group, Inc. | a2012amended8kacover-may11.htm |

0 Annual Meeting Of Stockholders May 11, 2012

Safe Harbor Statement Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, changes in market demand for our assets and services, the cost and timing associated with the modification of Boeing 767 and 757 aircraft, the availability and costs to acquire used passenger aircraft for freighter conversion, ABX Air’s ability to maintain on-time service and control costs under its operating agreement with DHL, and other factors that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. 1

2 Strategy and 2011 Progress Joe Hete Chief Executive Officer

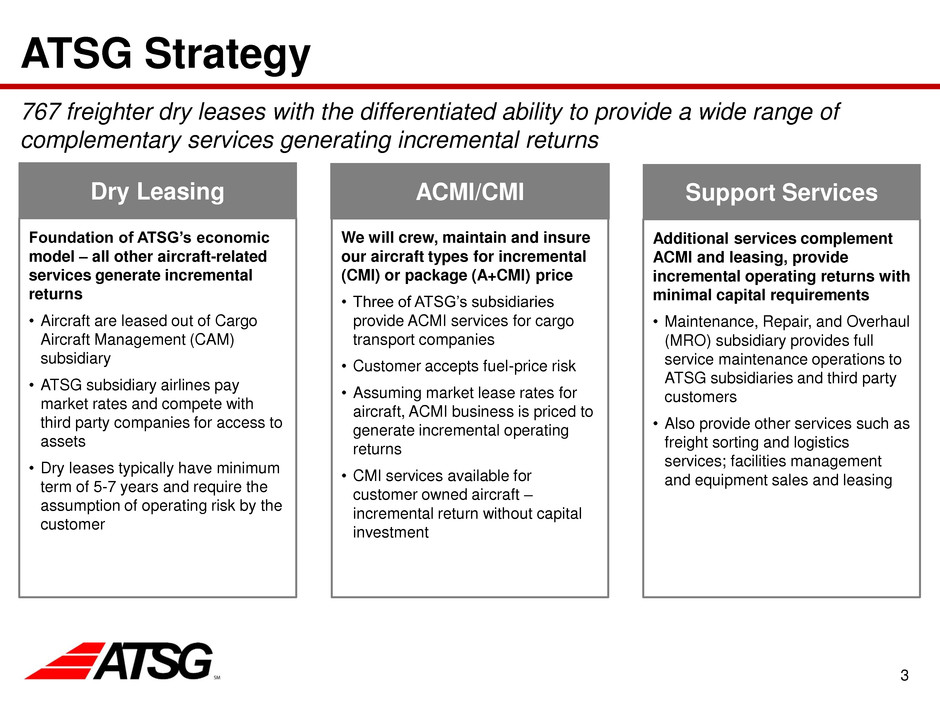

3 ATSG Strategy 767 freighter dry leases with the differentiated ability to provide a wide range of complementary services generating incremental returns Dry Leasing ACMI/CMI Support Services Foundation of ATSG’s economic model – all other aircraft-related services generate incremental returns • Aircraft are leased out of Cargo Aircraft Management (CAM) subsidiary • ATSG subsidiary airlines pay market rates and compete with third party companies for access to assets • Dry leases typically have minimum term of 5-7 years and require the assumption of operating risk by the customer We will crew, maintain and insure our aircraft types for incremental (CMI) or package (A+CMI) price • Three of ATSG’s subsidiaries provide ACMI services for cargo transport companies • Customer accepts fuel-price risk • Assuming market lease rates for aircraft, ACMI business is priced to generate incremental operating returns • CMI services available for customer owned aircraft – incremental return without capital investment Additional services complement ACMI and leasing, provide incremental operating returns with minimal capital requirements • Maintenance, Repair, and Overhaul (MRO) subsidiary provides full service maintenance operations to ATSG subsidiaries and third party customers • Also provide other services such as freight sorting and logistics services; facilities management and equipment sales and leasing

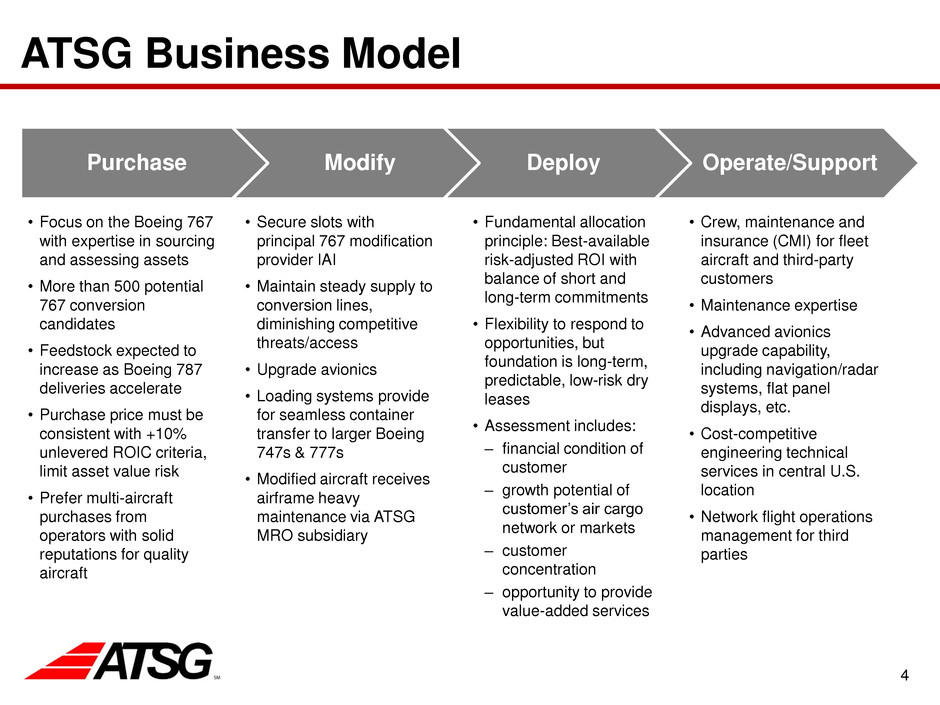

4 ATSG Business Model Purchase Modify Deploy Operate/Support • Focus on the Boeing 767 with expertise in sourcing and assessing assets • More than 500 potential 767 conversion candidates • Feedstock expected to increase as Boeing 787 deliveries accelerate • Purchase price must be consistent with +10% unlevered ROIC criteria, limit asset value risk • Prefer multi-aircraft purchases from operators with solid reputations for quality aircraft • Secure slots with principal 767 modification provider IAI • Maintain steady supply to conversion lines, diminishing competitive threats/access • Upgrade avionics • Loading systems provide for seamless container transfer to larger Boeing 747s & 777s • Modified aircraft receives airframe heavy maintenance via ATSG MRO subsidiary • Fundamental allocation principle: Best-available risk-adjusted ROI with balance of short and long-term commitments • Flexibility to respond to opportunities, but foundation is long-term, predictable, low-risk dry leases • Assessment includes: – financial condition of customer – growth potential of customer’s air cargo network or markets – customer concentration – opportunity to provide value-added services • Crew, maintenance and insurance (CMI) for fleet aircraft and third-party customers • Maintenance expertise • Advanced avionics upgrade capability, including navigation/radar systems, flat panel displays, etc. • Cost-competitive engineering technical services in central U.S. location • Network flight operations management for third parties

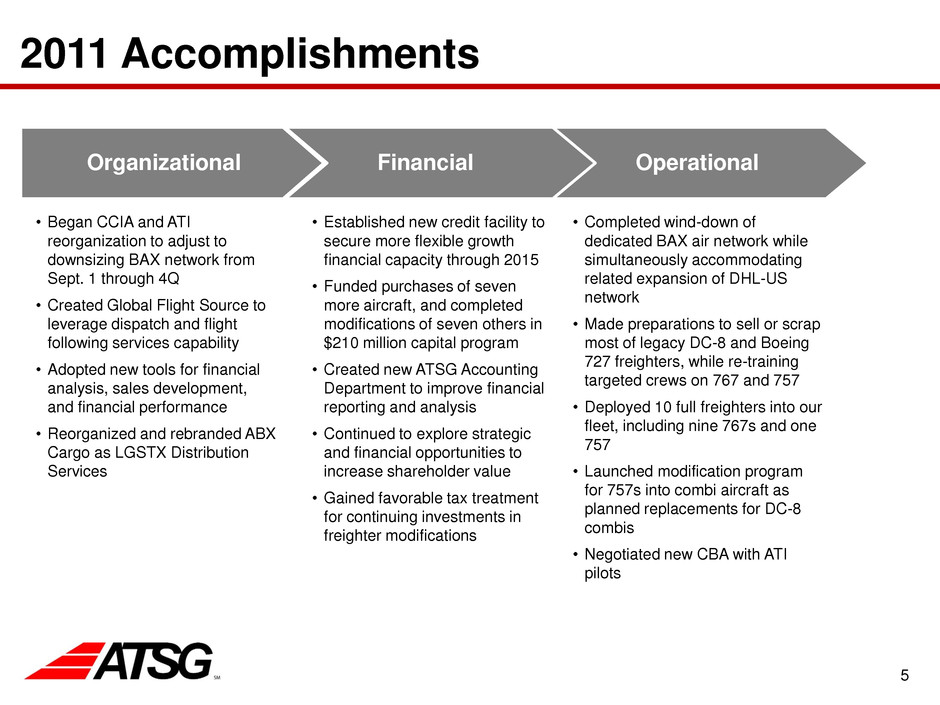

5 2011 Accomplishments Organizational Financial Operational • Began CCIA and ATI reorganization to adjust to downsizing BAX network from Sept. 1 through 4Q • Created Global Flight Source to leverage dispatch and flight following services capability • Adopted new tools for financial analysis, sales development, and financial performance • Reorganized and rebranded ABX Cargo as LGSTX Distribution Services • Established new credit facility to secure more flexible growth financial capacity through 2015 • Funded purchases of seven more aircraft, and completed modifications of seven others in $210 million capital program • Created new ATSG Accounting Department to improve financial reporting and analysis • Continued to explore strategic and financial opportunities to increase shareholder value • Gained favorable tax treatment for continuing investments in freighter modifications • Completed wind-down of dedicated BAX air network while simultaneously accommodating related expansion of DHL-US network • Made preparations to sell or scrap most of legacy DC-8 and Boeing 727 freighters, while re-training targeted crews on 767 and 757 • Deployed 10 full freighters into our fleet, including nine 767s and one 757 • Launched modification program for 757s into combi aircraft as planned replacements for DC-8 combis • Negotiated new CBA with ATI pilots

6 Financial Review Quint Turner Chief Financial Officer

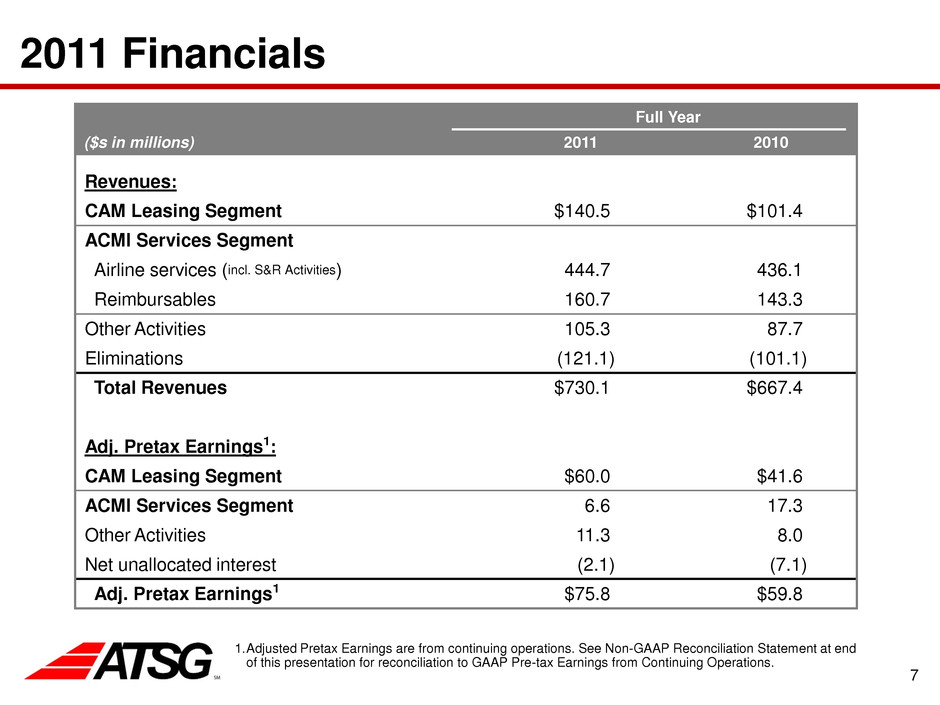

7 2011 Financials Full Year ($s in millions) 2011 2010 Revenues: CAM Leasing Segment $140.5 $101.4 ACMI Services Segment Airline services (incl. S&R Activities) 444.7 436.1 Reimbursables 160.7 143.3 Other Activities 105.3 87.7 Eliminations (121.1) (101.1) Total Revenues $730.1 $667.4 Adj. Pretax Earnings1: CAM Leasing Segment $60.0 $41.6 ACMI Services Segment 6.6 17.3 Other Activities 11.3 8.0 Net unallocated interest (2.1) (7.1) Adj. Pretax Earnings1 $75.8 $59.8 1.Adjusted Pretax Earnings are from continuing operations. See Non-GAAP Reconciliation Statement at end of this presentation for reconciliation to GAAP Pre-tax Earnings from Continuing Operations.

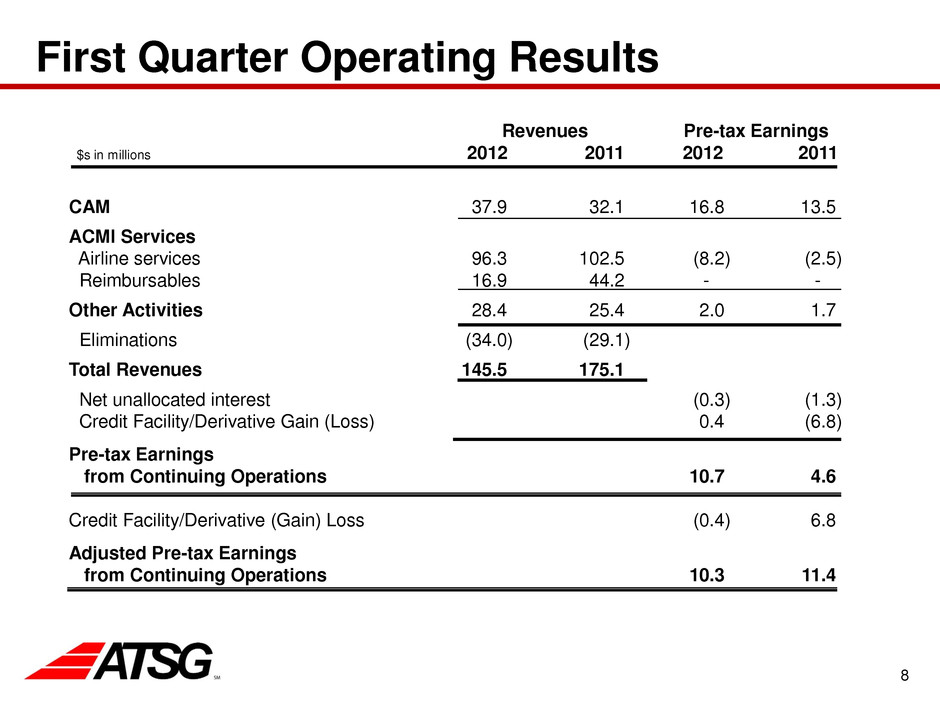

8 First Quarter Operating Results CAM 37.9 32.1 16.8 13.5 ACMI Services Airline services 96.3 102.5 (8.2) (2.5) Reimbursables 16.9 44.2 - - Other Activities 28.4 25.4 2.0 1.7 Eliminations (34.0) (29.1) Total Revenues 145.5 175.1 Net unallocated interest (0.3) (1.3) Credit Facility/Derivative Gain (Loss) 0.4 (6.8) Pre-tax Earnings from Continuing Operations 10.7 4.6 Credit Facility/Derivative (Gain) Loss (0.4) 6.8 Adjusted Pre-tax Earnings from Continuing Operations 10.3 11.4 Revenues Pre-tax Earnings 2012 2011 2012 2011 $s in millions

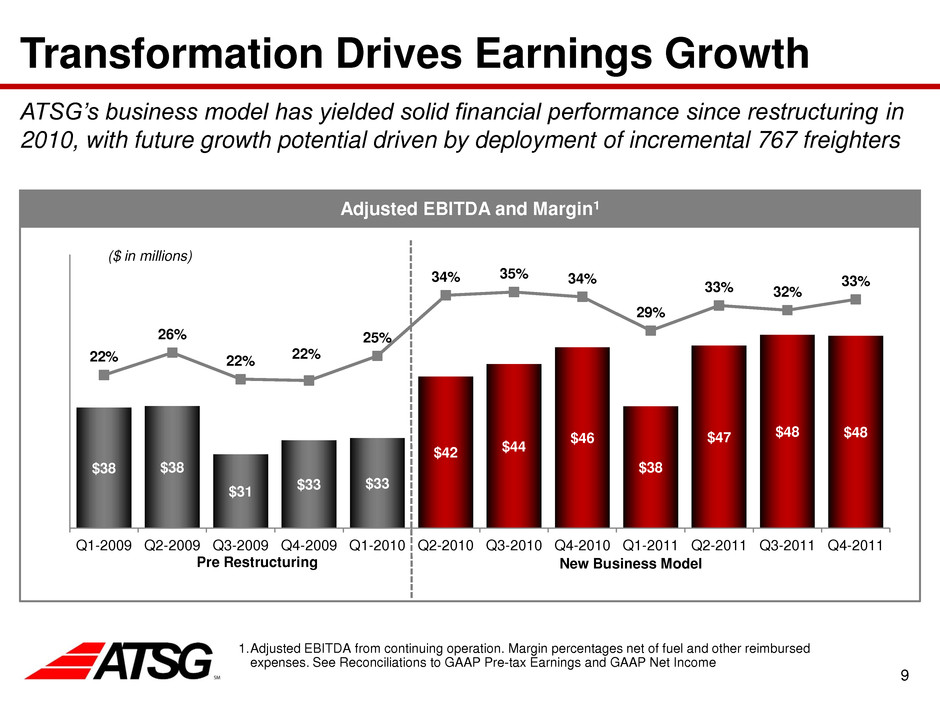

9 Transformation Drives Earnings Growth ATSG’s business model has yielded solid financial performance since restructuring in 2010, with future growth potential driven by deployment of incremental 767 freighters Adjusted EBITDA and Margin1 1.Adjusted EBITDA from continuing operation. Margin percentages net of fuel and other reimbursed expenses. See Reconciliations to GAAP Pre-tax Earnings and GAAP Net Income Pre Restructuring New Business Model $38 $38 $31 $33 $33 $42 $44 $46 $38 $47 $48 $48 22% 26% 22% 22% 25% 34% 35% 34% 29% 33% 32% 33% Q1-2009 Q2-2009 Q3-2009 Q4-2009 Q1-2010 Q2-2010 Q3-2010 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 ($ in millions)

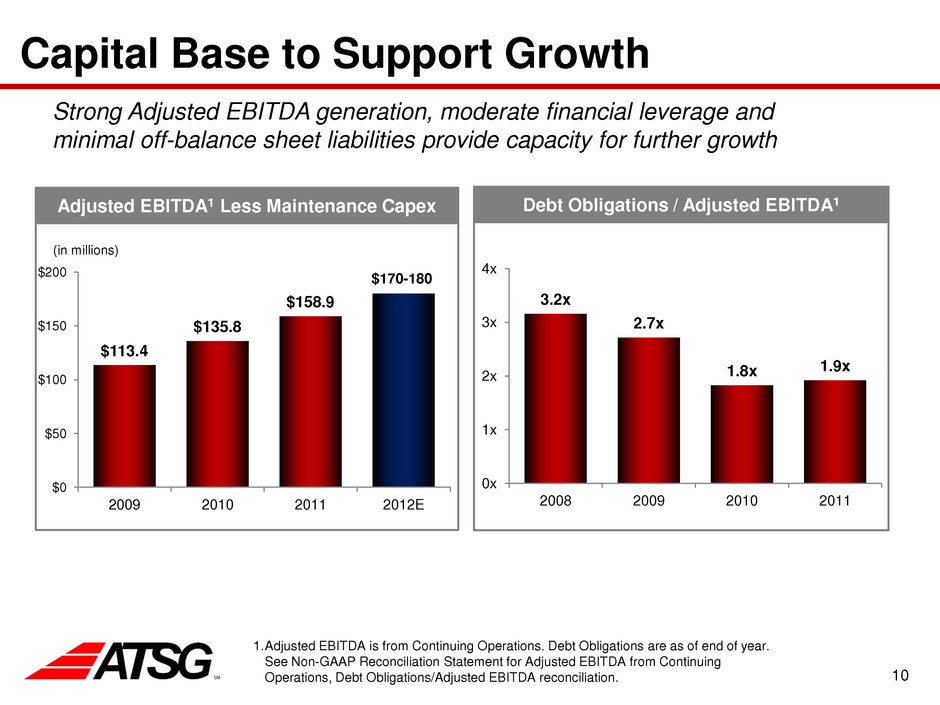

10 Capital Base to Support Growth Debt Obligations / Adjusted EBITDA1 Strong Adjusted EBITDA generation, moderate financial leverage and minimal off-balance sheet liabilities provide capacity for further growth 1.Adjusted EBITDA is from Continuing Operations. Debt Obligations are as of end of year. See Non-GAAP Reconciliation Statement for Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA reconciliation. Adjusted EBITDA1 Less Maintenance Capex 3.2x 2.7x 1.8x 1.9x 0x 1x 2x 3x 4x 2008 2009 2010 2011 $113.4 $135.8 $158.9 $0 $50 $100 $150 $200 2009 2010 2011 2012E (in millions) $170-180

11 Marketing Outlook Rich Corrado Chief Commercial Officer

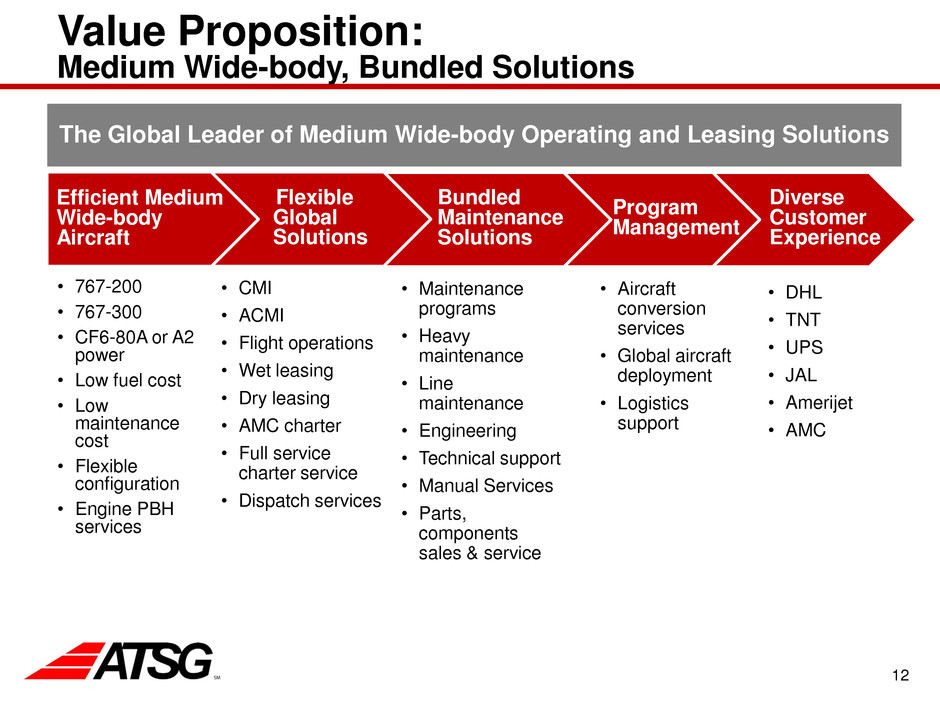

12 Value Proposition: Medium Wide-body, Bundled Solutions • 767-200 • 767-300 • CF6-80A or A2 power • Low fuel cost • Low maintenance cost • Flexible configuration • Engine PBH services The Global Leader of Medium Wide-body Operating and Leasing Solutions Efficient Medium Wide-body Aircraft • CMI • ACMI • Flight operations • Wet leasing • Dry leasing • AMC charter • Full service charter service • Dispatch services • Maintenance programs • Heavy maintenance • Line maintenance • Engineering • Technical support • Manual Services • Parts, components sales & service • Aircraft conversion services • Global aircraft deployment • Logistics support • DHL • TNT • UPS • JAL • Amerijet • AMC Bundled Maintenance Solutions Program Management Diverse Customer Experience Flexible Global Solutions

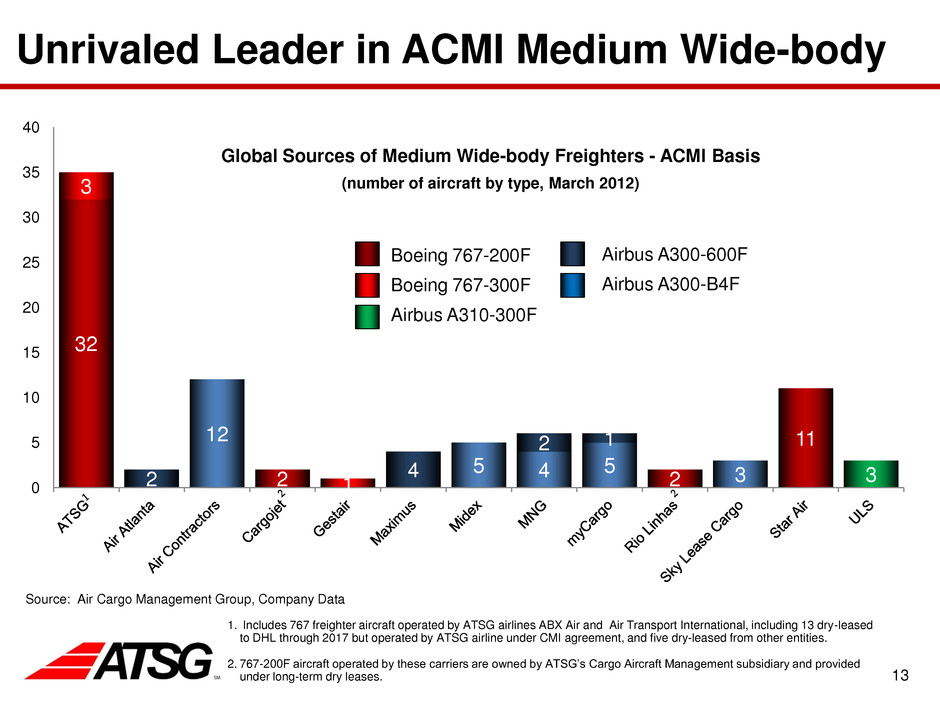

13 Unrivaled Leader in ACMI Medium Wide-body 32 2 2 11 3 1 12 5 4 5 3 2 4 2 1 3 0 5 10 15 20 25 30 35 40 Global Sources of Medium Wide-body Freighters - ACMI Basis (number of aircraft by type, March 2012) 1. Includes 767 freighter aircraft operated by ATSG airlines ABX Air and Air Transport International, including 13 dry-leased to DHL through 2017 but operated by ATSG airline under CMI agreement, and five dry-leased from other entities. 2. 767-200F aircraft operated by these carriers are owned by ATSG’s Cargo Aircraft Management subsidiary and provided under long-term dry leases. Source: Air Cargo Management Group, Company Data Boeing 767-200F Boeing 767-300F Airbus A310-300F Airbus A300-600F Airbus A300-B4F

14 (Fastest Growing Regions, 2009-2029) ATSG’s Global Opportunities Projected Long-Term Annual Demand Growth Source: Boeing World Air Cargo Forecast Large Freighter Markets ATSG Target Markets Americas • Strong growth • ATSG has Miami hub • Ideal 767 range/payload fit for north-south routes Intra Asia • Rapid economic growth • Manufacturing moving inland China and to Emerging Markets, i.e. Vietnam, Thailand • China becoming consumer nation, to/from China • Ideal 767 range/payload fit as feeder aircraft Middle East • Strong growth • Aging, unreliable Airbus fleets due for replacement Dry Lease Only Large Domestic Growth • Intra-China • Intra-Brazil • Intra-India ATSG’s Current Opportunities 3.0% 3.6% 4.2% 5.1% 5.6% 5.7% 6.0% 6.5% 6.6% 6.7% 7.9% 9.2% Intra-N. Amer. Intra-Europe Europe-N. Amer. Europe-Africa Europe-L. Amer. L. Amer.-N. Amer. Europe-Mideast S. Asia-Europe Europe-Asia Asia-N. America Intra Asia Intra China

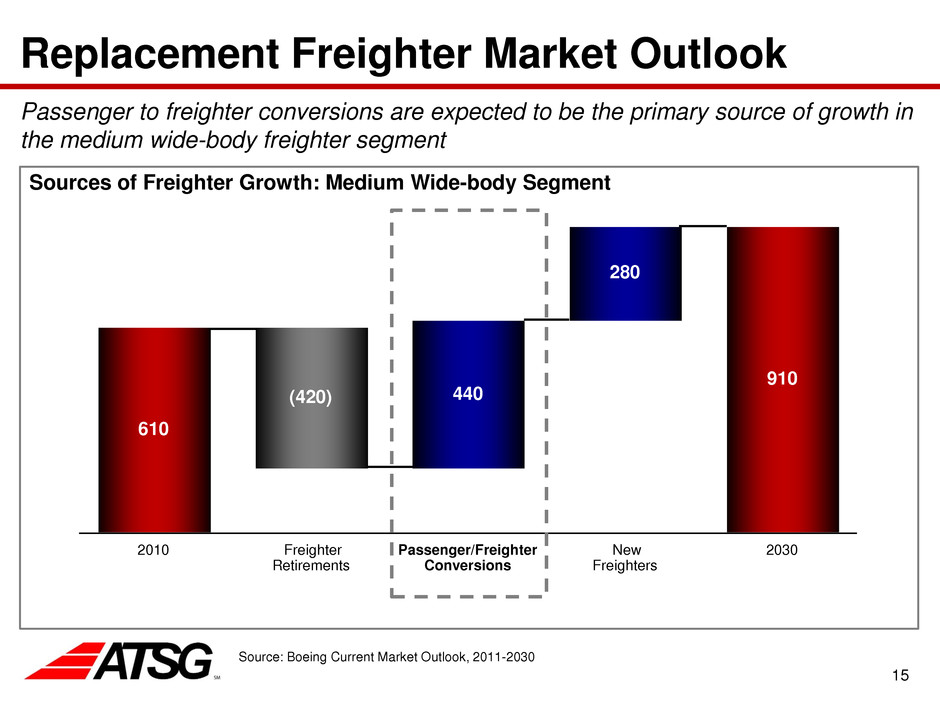

15 Replacement Freighter Market Outlook Passenger to freighter conversions are expected to be the primary source of growth in the medium wide-body freighter segment Sources of Freighter Growth: Medium Wide-body Segment Source: Boeing Current Market Outlook, 2011-2030 2030 910 New Freighters 280 Passenger/Freighter Conversions 440 Freighter Retirements (420) 2010 610

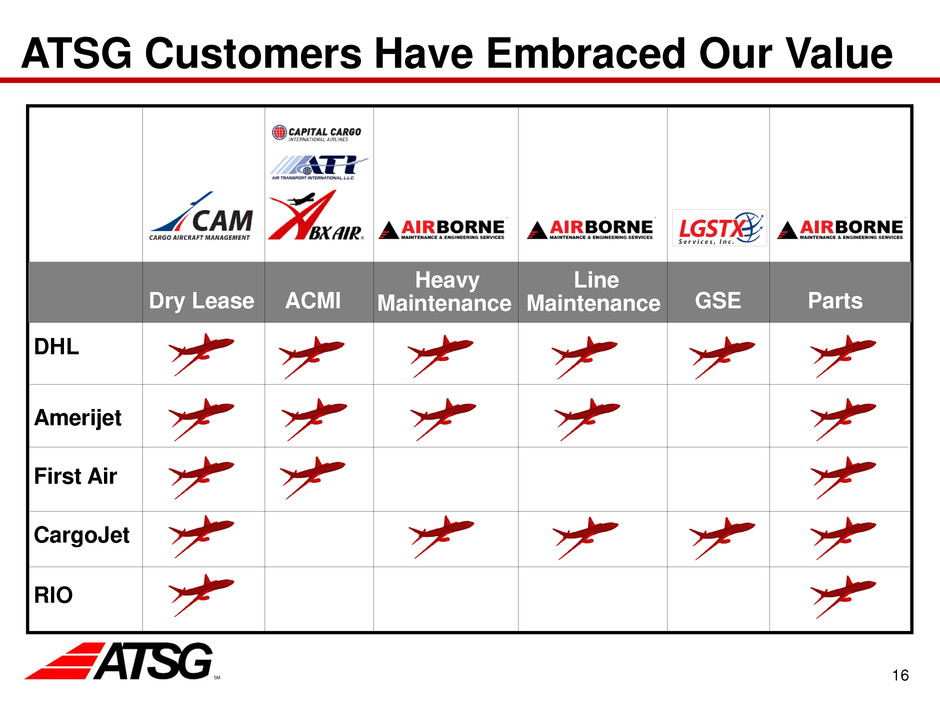

16 ATSG Customers Have Embraced Our Value Dry Lease ACMI Heavy Maintenance Line Maintenance GSE Parts DHL Amerijet First Air CargoJet RIO

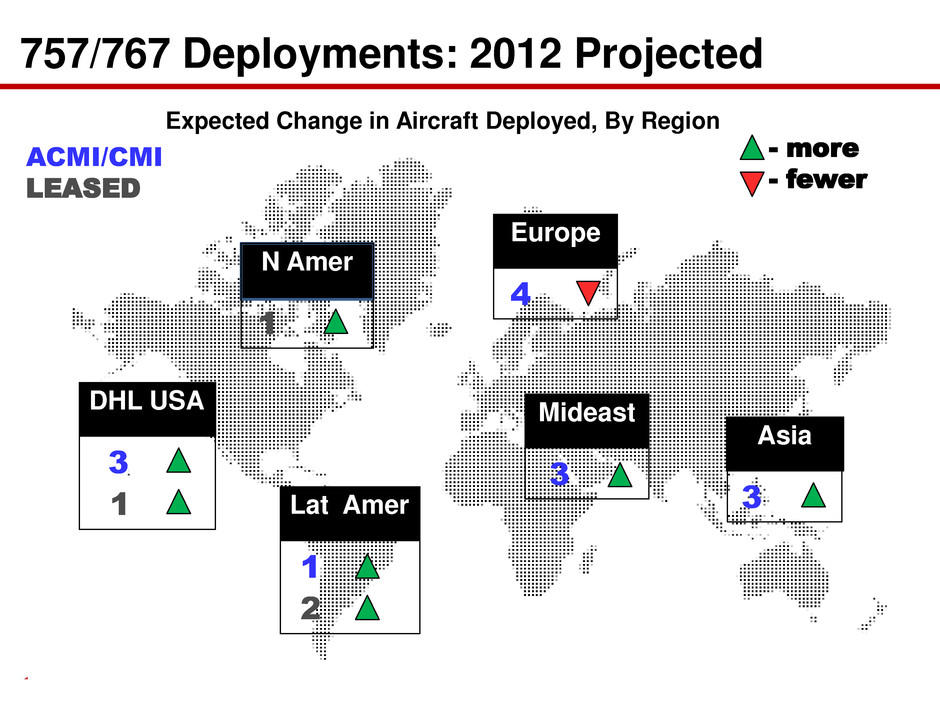

17 757/767 Deployments: 2012 Projected ACMI/CMI LEASED Lat Amer 2011 2012 1 2 DHL USA 2011 2012 3 1 Europe 2011 2012 4 Asia 2011 2012 3 Mideast 2011 2012 3 - more - fewer N Amer 2011 2012 1 Expected Change in Aircraft Deployed, By Region

18 2012 Outlook Joe Hete Chief Executive Officer

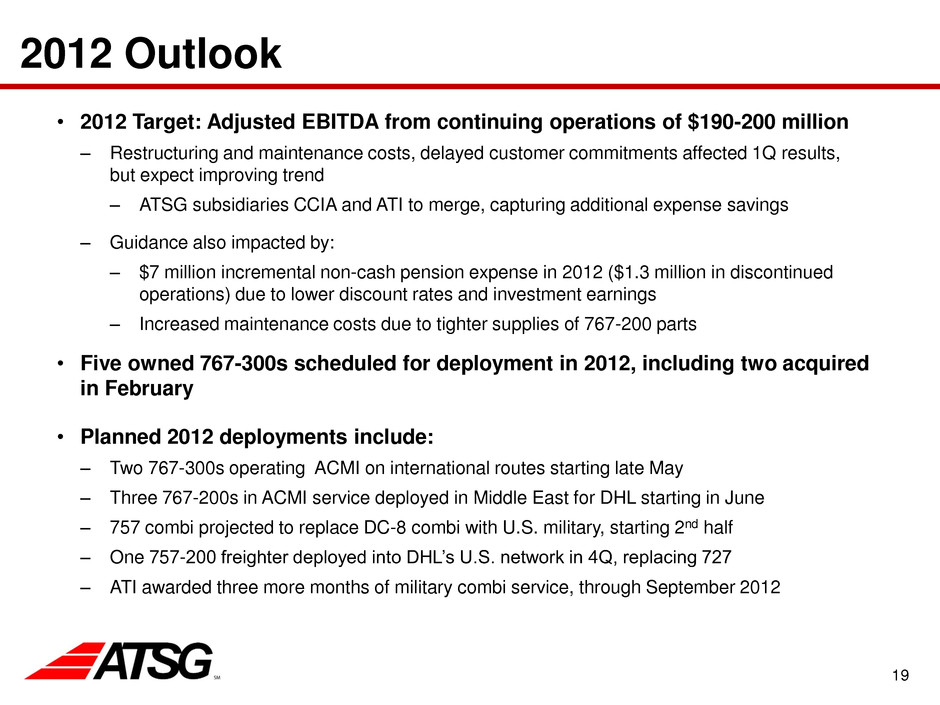

19 2012 Outlook • 2012 Target: Adjusted EBITDA from continuing operations of $190-200 million – Restructuring and maintenance costs, delayed customer commitments affected 1Q results, but expect improving trend – ATSG subsidiaries CCIA and ATI to merge, capturing additional expense savings – Guidance also impacted by: – $7 million incremental non-cash pension expense in 2012 ($1.3 million in discontinued operations) due to lower discount rates and investment earnings – Increased maintenance costs due to tighter supplies of 767-200 parts • Five owned 767-300s scheduled for deployment in 2012, including two acquired in February • Planned 2012 deployments include: – Two 767-300s operating ACMI on international routes starting late May – Three 767-200s in ACMI service deployed in Middle East for DHL starting in June – 757 combi projected to replace DC-8 combi with U.S. military, starting 2nd half – One 757-200 freighter deployed into DHL’s U.S. network in 4Q, replacing 727 – ATI awarded three more months of military combi service, through September 2012

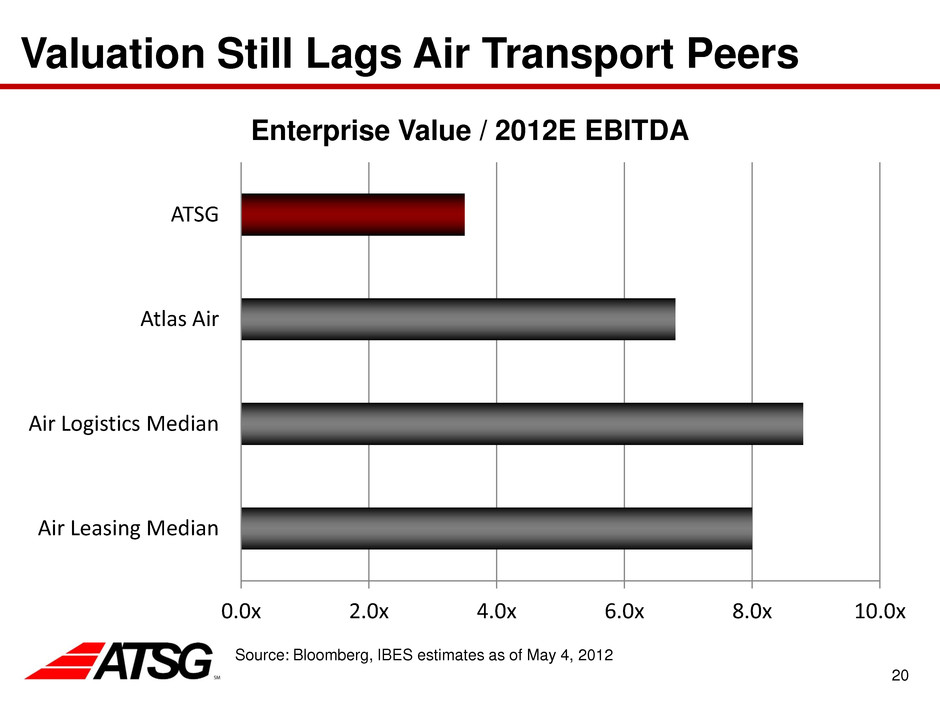

20 Valuation Still Lags Air Transport Peers 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x Air Leasing Median Air Logistics Median Atlas Air ATSG Enterprise Value / 2012E EBITDA Source: Bloomberg, IBES estimates as of May 4, 2012

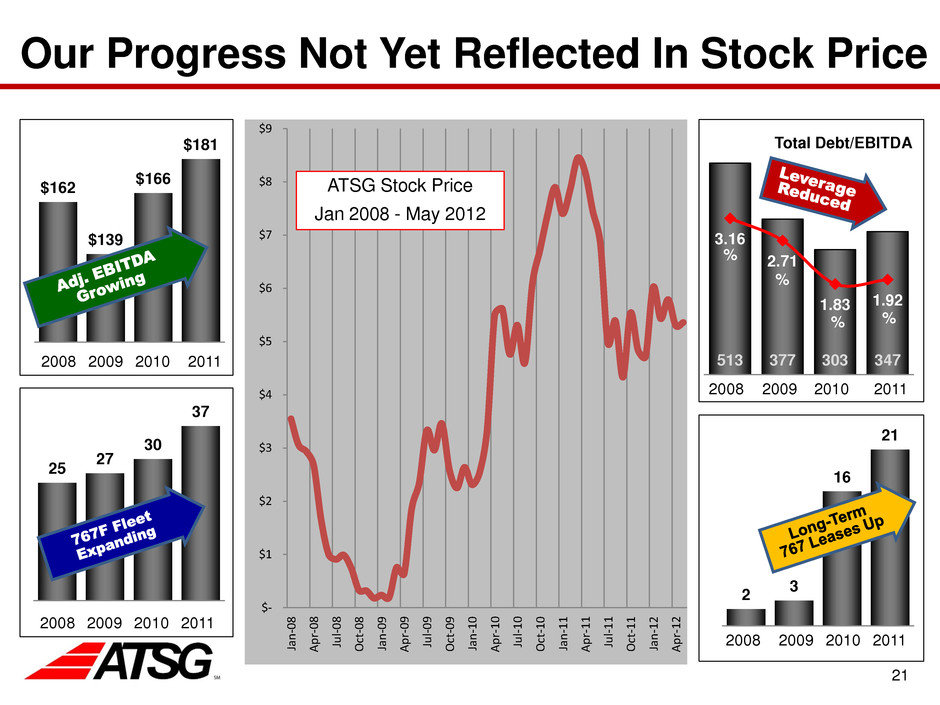

21 Our Progress Not Yet Reflected In Stock Price $- $1 $2 $3 $4 $5 $6 $7 $8 $9 Ja n -0 8 A p r- 0 8 Ju l- 0 8 Oc t- 0 8 Ja n -0 9 A p r- 0 9 Ju l- 0 9 Oc t- 0 9 Ja n -1 0 A p r- 1 0 Ju l- 1 0 Oc t- 1 0 Ja n -1 1 A p r- 1 1 Ju l- 1 1 Oc t- 1 1 Ja n -1 2 A p r- 1 2 $162 $139 $166 $181 513 377 303 347 3.16 2.71 1.83 1.92 Total Debt/EBITDA 2008 2009 2010 2011 25 27 30 37 2 3 16 21 ATSG Stock Price Jan 2008 - May 2012 2008 2009 2010 2011 2008 2009 2010 2011 2008 2009 2010 2011 % % % %

22 Annual Meeting Of Stockholders May 11, 2012 Questions?

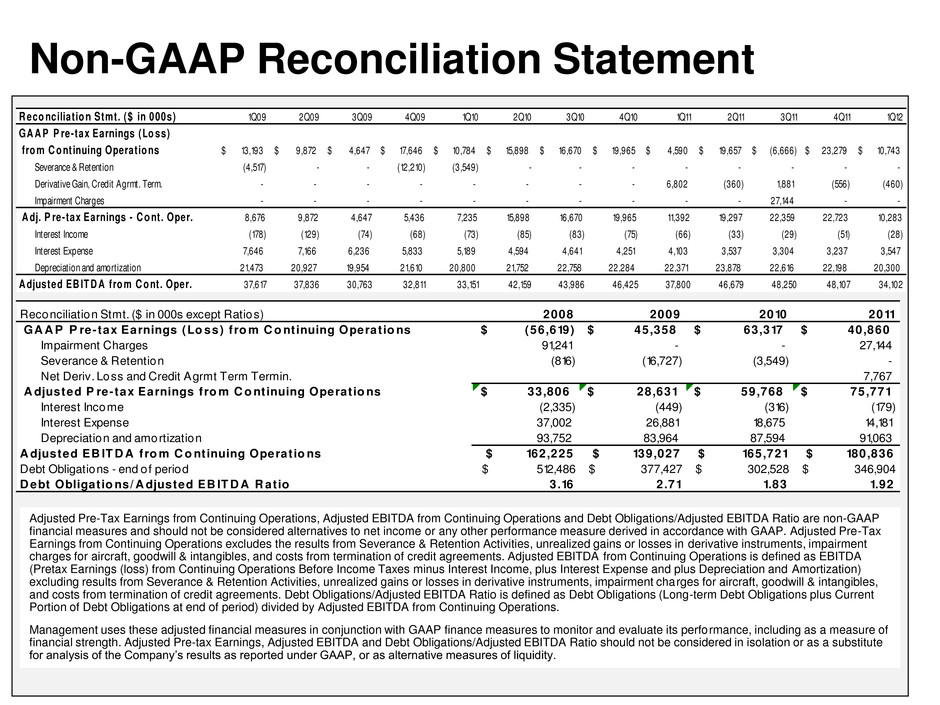

Non-GAAP Reconciliation Statement 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 13,193$ 9,872$ 4,647$ 17,646$ 10,784$ 15,898$ 16,670$ 19,965$ 4,590$ 19,657$ (6,666)$ 23,279$ 10,743$ Severance & Retention (4,517) - - (12,210) (3,549) - - - - - - - - Derivat ive Gain, Credit Agrmt. Term. - - - - - - - - 6,802 (360) 1,881 (556) (460) Impairment Charges - - - - - - - - - - 27,144 - - 8,676 9,872 4,647 5,436 7,235 15,898 16,670 19,965 11,392 19,297 22,359 22,723 10,283 Interest Income (178) (129) (74) (68) (73) (85) (83) (75) (66) (33) (29) (51) (28) Interest Expense 7,646 7,166 6,236 5,833 5,189 4,594 4,641 4,251 4,103 3,537 3,304 3,237 3,547 Depreciat ion and amort izat ion 21,473 20,927 19,954 21,610 20,800 21,752 22,758 22,284 22,371 23,878 22,616 22,198 20,300 37,617 37,836 30,763 32,811 33,151 42,159 43,986 46,425 37,800 46,679 48,250 48,107 34,102 GA A P P re-tax Earnings (Lo ss) R eco nciliat io n Stmt. ($ in 000s) A djusted EB IT D A fro m C o nt. Oper. fro m C o ntinui g Operat io ns A dj. P re-tax Earnings - C o nt. Oper. Adjusted Pre-Tax Earnings from Continuing Operations, Adjusted EBITDA from Continuing Operations and Debt Obligations/Adjusted EBITDA Ratio are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance with GAAP. Adjusted Pre-Tax Earnings from Continuing Operations excludes the results from Severance & Retention Activities, unrealized gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Adjusted EBITDA from Continuing Operations is defined as EBITDA (Pretax Earnings (loss) from Continuing Operations Before Income Taxes minus Interest Income, plus Interest Expense and plus Depreciation and Amortization) excluding results from Severance & Retention Activities, unrealized gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end of period) divided by Adjusted EBITDA from Continuing Operations. Management uses these adjusted financial measures in conjunction with GAAP finance measures to monitor and evaluate its performance, including as a measure of financial strength. Adjusted Pre-tax Earnings, Adjusted EBITDA and Debt Obligations/Adjusted EBITDA Ratio should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as alternative measures of liquidity. 2008 2009 2010 2011 ( 6,619)$ 45,358$ 63,317$ 40,860$ Im airment Charges 9 ,241 - - 27,144 Sev rance & Retenti n (816) (16,727) (3,549) - Net Deriv. Loss and Credit Agrmt Term Termin. 7,767 33,806$ 28,631$ 59,768$ 75,771$ Interest Income (2,335) (449) (316) (179) Interest Expense 37,002 26,881 18,675 14,181 Depreciation and amortization 93,752 83,964 87,594 91,063 $ 162,225 $ 139,027 $ 165,721 $ 180,836 $ 512,486 $ 377,427 $ 302,528 $ 346,904 3.16 2.71 1.83 1.92 Reconciliation Stmt. ($ in 000s except Ratios) D ebt Obligat io ns/ A djusted EB IT D A R atio GA A P P re-tax Earnings (Lo ss) fro m C o ntinuing Operat io ns A djusted EB IT D A fro m C o ntinuing Operat io ns Debt Obligations - end of period A djusted P re-tax Earnings fro m C o ntinuing Operat io ns