Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANIXTER INTERNATIONAL INC | d351760d8k.htm |

First Quarter 2012

Investor Presentation

Exhibit 99.1 |

Investor Presentation First Quarter 2012

2

Safe Harbor Statement

The

statements

in

this

presentation

that

use

such

words

as

“believe,”

“expect,”

“intend,”

“anticipate,”

“contemplate,”

“estimate,”

“plan,”

“project,”

“should,”

“may,”

”will,”

or similar expressions are forward-looking statements. They are subject

to a number of factors that could cause the company’s actual results to

differ materially from what is indicated here. These factors include general

economic conditions, the level of customer demand particularly for capital projects

in the markets we serve, changes in supplier sales strategies or

financial viability, risks associated with the sale of nonconforming products and services, political, economic or

currency risks related to foreign operations, inventory obsolescence, copper price

fluctuations, customer viability, risks associated with accounts receivable,

the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks

and risks associated with integration of acquired companies. These

uncertainties may cause our actual results to be materially different than

those expressed in any forward looking statements. We do not undertake to update any forward looking statements.

Please see the company’s Securities and Exchange Commission filings for more

information. Non-GAAP Statement

This report includes certain financial measures computed using non-Generally

Accepted Accounting Principles (“non-GAAP”) components as

defined by the Securities and Exchange Commission (“SEC”). Specifically, net sales, comparisons to the prior

corresponding period, both worldwide and in relevant geographic segments, are

discussed in this report both on a Generally Accepted Accounting Principle

(“GAAP”) basis and excluding acquisitions and foreign exchange and copper price effects (non-

GAAP). The Company believes that by reporting organic growth which excludes

the impact of acquisitions, foreign exchange and copper prices, both

management and investors are provided with meaningful supplemental information to understand and analyze

the Company’s underlying sales trends and other aspects of its financial

performance. The Company also presents certain profitability

and

cash

flow

information

in

this

report

excluding

special

items

which

have

been

identified

in

the

Company’s

earnings

releases as the Company believes that by reporting such information, both

management and investors are provided with meaningful supplemental

information to understand and analyze the Company’s underlying trends and other aspects of its financial

performance.

Non-GAAP financial measures provide insight into selected financial information

and should be evaluated in the context in which they are presented.

These non-GAAP financial measures have limitations as analytical tools, and should not be considered in

isolation from, or as a substitute for, financial information presented in

compliance with GAAP, and non-financial measures as reported by the

Company may not be comparable to similarly titled amounts reported by other companies. The non-GAAP financial

measures should be considered in conjunction with the consolidated financial

statements, including the related notes, and Management’s Discussion

and Analysis of Financial Condition and Results of Operations included the Company’s Annual Reports

on Form 10-K and Quarterly Reports on Form 10-Q as filed with the

SEC. Management does not use these non-GAAP financial measures for

any purpose other than the reasons stated above. |

Investor Presentation First Quarter 2012

3

Company Overview

World-class global distributor with three distinct end markets:

–

Enterprise Cabling & Security Solutions: data, voice, video and security

network communication products

–

Electrical Wire & Cable: electrical and electronic wire & cable

–

OEM

Supply:

fasteners

and

“C”

Class

components

Anixter adds value to the distribution process by providing customers access

to innovative inventory management programs, over 450,000 products and

more than $1 billion in inventory

Global industrial distributor whose success is built on specialization

–

Products, systems, process and solutions expertise

–

Customized supply chain services

–

Global implementation with local service

Anixter Pulls Together its Robust Capabilities in a Coordinated

Manner that Allows for Specialization and Scalability |

Investor Presentation First Quarter 2012

4

Customer Value Proposition

Global Operational Consistency

–

Same Systems, Process and Services Provided Globally but with Local

Personnel, Language and Currency

Global Infrastructure

–

Ship orders from inventory stock for delivery within 24-48 hours to all major

global markets

Supply

Chain

Optimization

to

Reduce

Customers’

Overall

Cost

–

Pre-Installation / Production Product Preparation

–

Feed the Job / Factory Just-in-time

–

Industry Leading Customized Electronic Tools Sets

Technical Expertise

–

Infrastructure / Product Design Support

–

Product Recommendation for Applications

–

Quality Testing and Inspection in Anixter Lab and Quality Centers

|

Investor Presentation First Quarter 2012

5

End Market Common Characteristics

Small percentage of customer total spend

Large volume of discrete part numbers

Large number of manufacturers across customer bill of material

Customer process cost may exceed values of materials

Products have a “technology”

component that may not be fully

understood by the customer

Total Customer Spending

Large Number of Application

Critical SKUs, but Only 5-10% of Customer Spending.

Significant Opportunity for Anixter to Add Value Based on Product

Knowledge, Application Knowledge and Supply Chain Services

|

Investor Presentation First Quarter 2012

6

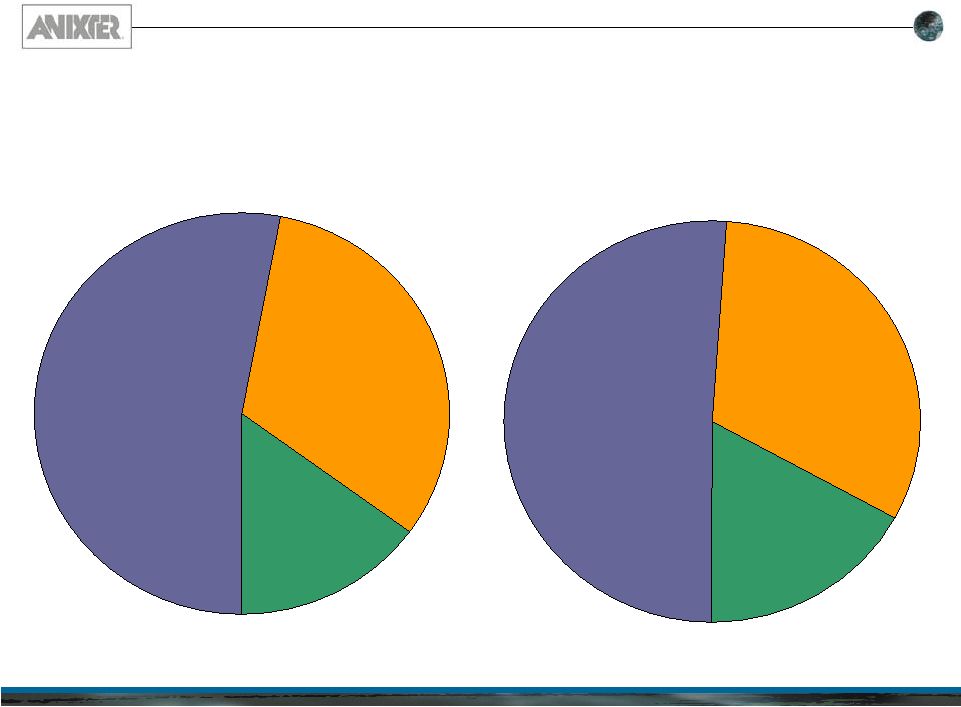

End-Market Focus

Focused Leadership in Diverse Markets

OEM Supply

17%

Electrical and Electronic

Wire & Cable

32%

Enterprise Cabling &

Security Solutions

51%

2012 Sales Mix -

Q1 YTD

OEM Supply

15%

Electrical and Electronic

Wire & Cable

32%

Enterprise Cabling &

Security Solutions

53%

2011 Sales Mix |

Investor Presentation First Quarter 2012

7

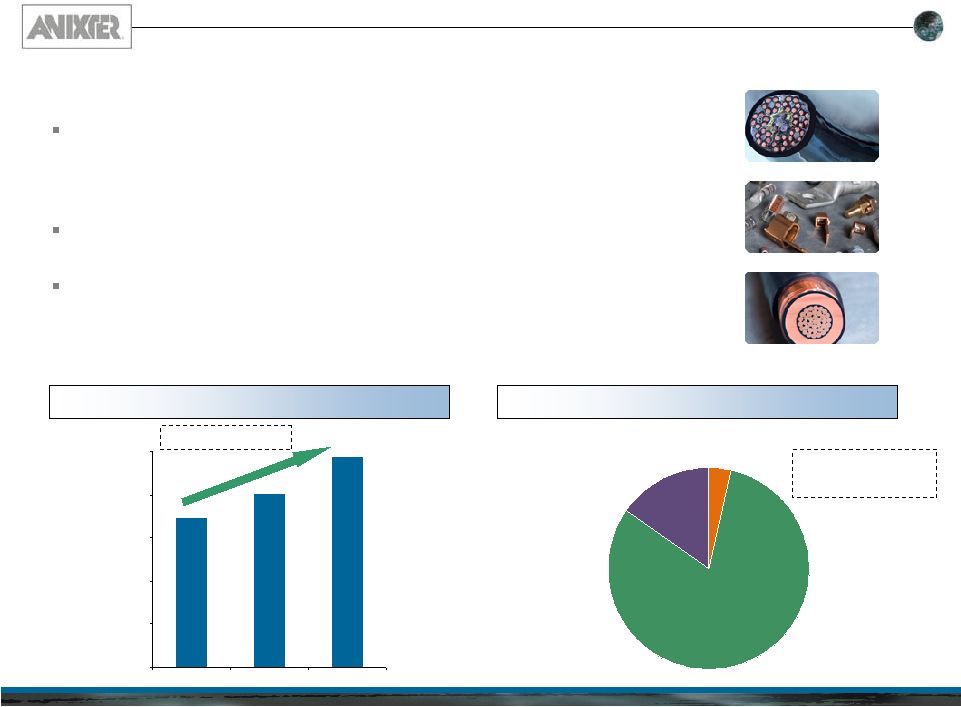

Enterprise Cabling and Security Solutions Overview

Products

Copper and fiber data cables, connectors, racks,

cabinets, patch panels, video surveillance and

access control devices, support and supply items

Technology

Industry leadership in development of product

standards; only distributor operated, UL

certified, testing lab; network design support

services

Supply Chain

Sourcing, logistics, inventory management,

product enhancement and packaging,

deployment in over 50 countries

Drivers

Expansion

of

bandwidth

–

applications

and

users, new facilities, support for existing

networks, enhanced security

51% |

Investor Presentation First Quarter 2012

8

ECS experienced 11.4% growth in 2011 with varying levels of

activity across its geographic footprint (5.8% organic growth)

–

Growth was driven by strong activity in the Emerging Markets and

moderate growth in North America

–

Experienced a slight decline in Europe (1.4% y-o-y) due to the

challenging macroeconomic environment

Growth in the Security segment continues across all geographies

–

15% organic growth y-o-y (excludes benefit from the Clark acquisition)

–

Momentum driven by continued investment in security and the shift to

more sophisticated Internet Protocol-based systems

Emerging

Markets

North America

Europe

12%

17%

71%

ECS Revenue Growth

2011 ECS Revenue by Geography

$2,744

$2,913

$3,246

$2,400

$2,600

$2,800

$3,000

$3,200

$3,400

2009

2010

2011

($ in millions)

Capitalizing on End Market Growth Opportunities

Enterprise Cabling and Security Solutions (“ECS”)

8.8% CAGR since 2009 |

Investor Presentation First Quarter 2012

9

Wire & Cable Overview

Products

Industrial power, control and instrumentation

cables, connectors, support and supplies,

industrial automation

Technology

Product specification (conductor count and

jacketing) based on application knowledge and

installed environmental condition

Supply Chain

Sourcing, logistics, inventory management,

cutting, dying, striping, bundling, project

management in 12 countries

Drivers

New industrial construction, major equipment

and facility overhauls, day-to-day

maintenance, OEM production, and industrial

automation

32% |

Investor Presentation First Quarter 2012

10

Capitalizing on End Market Growth Opportunities

Electrical and Electronic Wire & Cable (“W&C”)

W&C realized 21.7% growth in 2011 driven by growth across all

geographic regions

–

Growth in N.A. and Europe was complemented by significant

acceleration in the Emerging Markets (~82% organic growth)

Anixter captured market share gains across all geographies

resulting in organic growth of 13.1%

Demand has been driven by project activity in the Power

Generation, Industrial, Oil and Gas and Mining sectors

–

Global investment in Industrial Plants, Natural Resource Development

and Power Generation should drive continued sales momentum

W&C Revenue Growth

2011 W&C Revenue by Geography

Emerging

Markets

North America

Europe

15%

4%

81%

$1,386

$1,603

$1,950

$0

$400

$800

$1,200

$1,600

$2,000

2009

2010

2011

($ in millions)

18.6% CAGR since 2009

Emerging Markets Revenue

increased from 2% in 2010 |

Investor Presentation First Quarter 2012

11

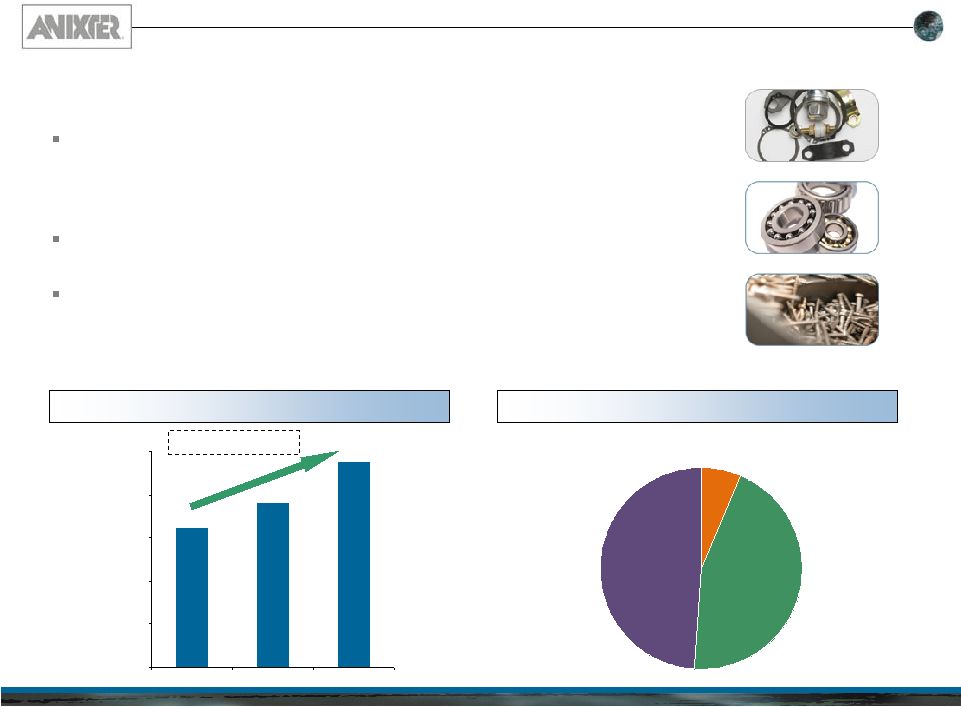

OEM Supply Overview

Products

Fasteners and “C”

class components

Technology

Product design support, quality and inspection

programs including full metallurgical testing

capabilities in North America, Europe and Asia

Supply Chain

Sourcing, just-in-time systems, quality and

inspection, inventory management, bin

replenishment in 21 countries

Drivers

Improved supply chain efficiency, global

expansion and outsourcing

17% |

Investor Presentation First Quarter 2012

12

Capitalizing on End Market Growth Opportunities

OEM Supply

OEM Supply achieved 25.3% growth in 2011 driven by organic

growth of ~20%+ in each geographic region

–

43.2% organic growth in the Emerging Markets driven by multinational

customers’

increasing preference for a single global partner

Recovery in manufacturing is lifting production rates for Anixter’s

customers, yielding strong sales in the OEM Supply end market

Recent sales initiatives are continuing to drive new business wins

for part packages at both existing and new customers

–

Leading to a strong pipeline of opportunities in the Americas, Europe

and the rest of the world

OEM Revenue Growth

2011 OEM Revenue by Geography

Emerging

Markets

North America

Europe

49%

6%

45%

$650

$759

$952

$0

$200

$400

$600

$800

$1,000

2009

2010

2011

21.0% CAGR since 2009

($ in millions) |

Investor Presentation First Quarter 2012

13

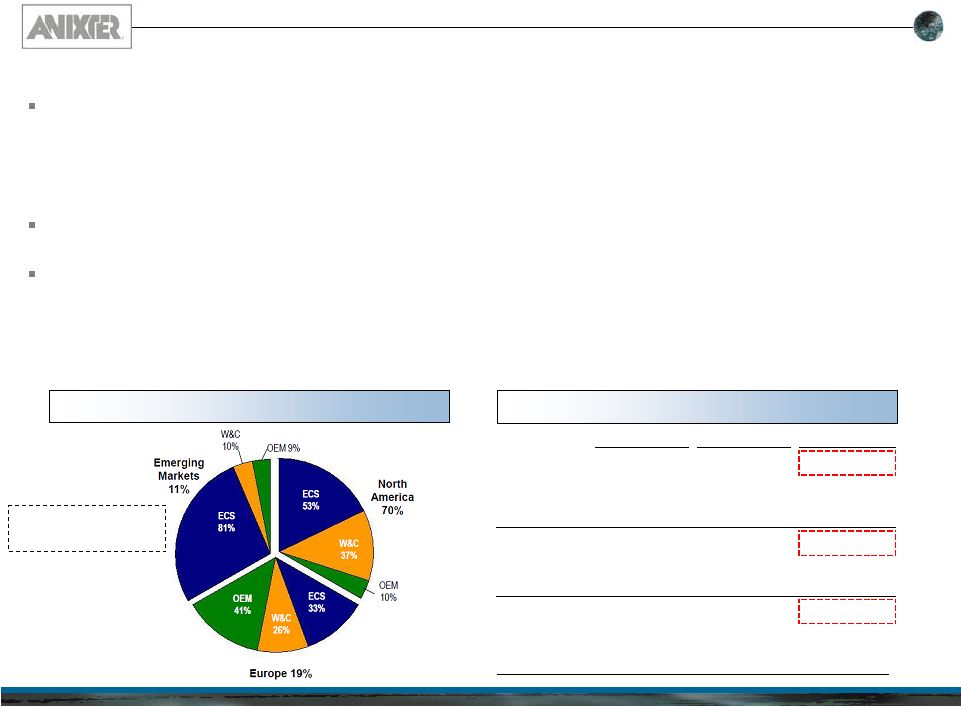

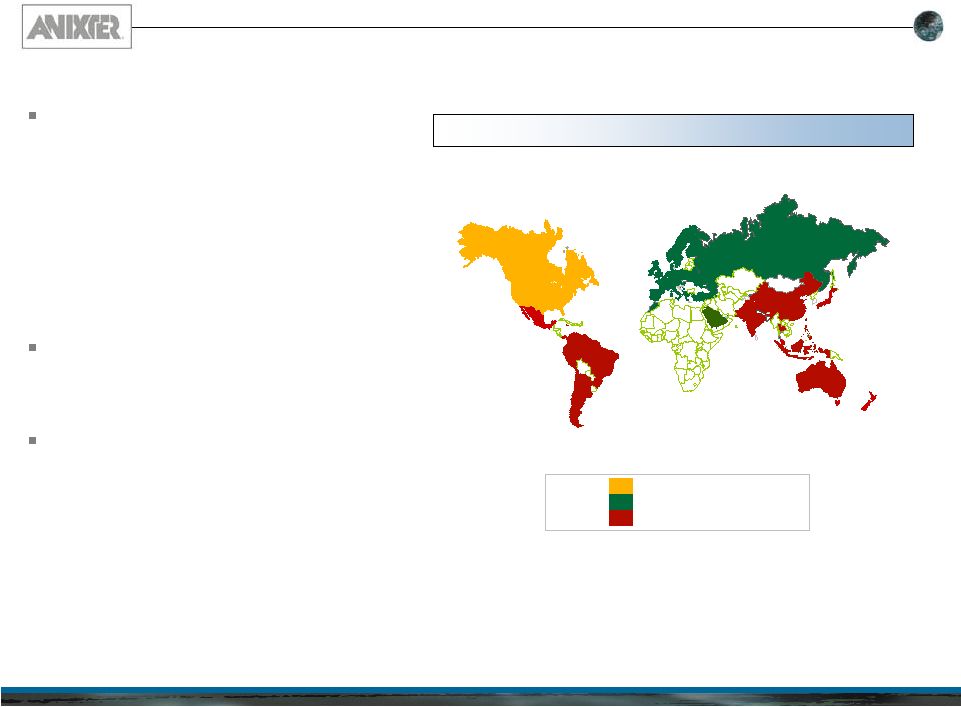

Strategic Geographic Expansion

2011 End Market Sales by Geography

3% increase in Emerging

Market sales mix (as a percent

of total sales) since 2007

Strong Growth Across All Geographies

In addition to continued introduction of new products and technologies, selectively

expanding its geographic presence is a focus for Anixter

–

Electrical Wire & Cable and OEM Supply offer strong opportunities to drive growth

by expanding into countries where Anixter’s offering is primarily limited

to cabling and security –

Expanding

geographic

penetration

beyond

principal

cities

creates

additional

opportunities

Anixter often tailors its offerings to local specifications, or to include locally

manufactured products, which helps increase product acceptance as it expands

its geographic footprint –

Opened Anixter Morocco SARL to capitalize on growth opportunities in the region

–

Established

a

new

JV

–

Anixter

Saudi

Arabia

Limited

to

expand

Middle

East

presence

–

Opened new sales branches in China, Brazil and Peru, and added new dedicated W&C

specialists Continuing investment in the emerging markets to expand presence across geographies

and end markets. Recent achievements include: FYE2011

FYE2010

% Growth

Net Sales

Net Sales

Y-o-Y

North America

$4,302.5

$3,701.2

16.2%

Drivers:

Europe

$1,150.0

$1,008.4

14.0%

Drivers:

Emerging Markets

$694.4

$564.9

22.9%

Drivers:

-

Strong market share growth in Fasteners with both existing and

new OEM Customers

-

W&C project growth across various industries

-

Strong project growth in W&C, principally in resource extraction

and energy

-

Organic growth rates in Security products in mid-teens

-

Strong market share growth in Fasteners with both existing and

new OEM Customers

-

83% growth in W&C as a result of 2010 investment in W&C sales

specialists

-

46% growth in Fasteners as a result of market share wins in China

and Mexico |

Investor Presentation First Quarter 2012

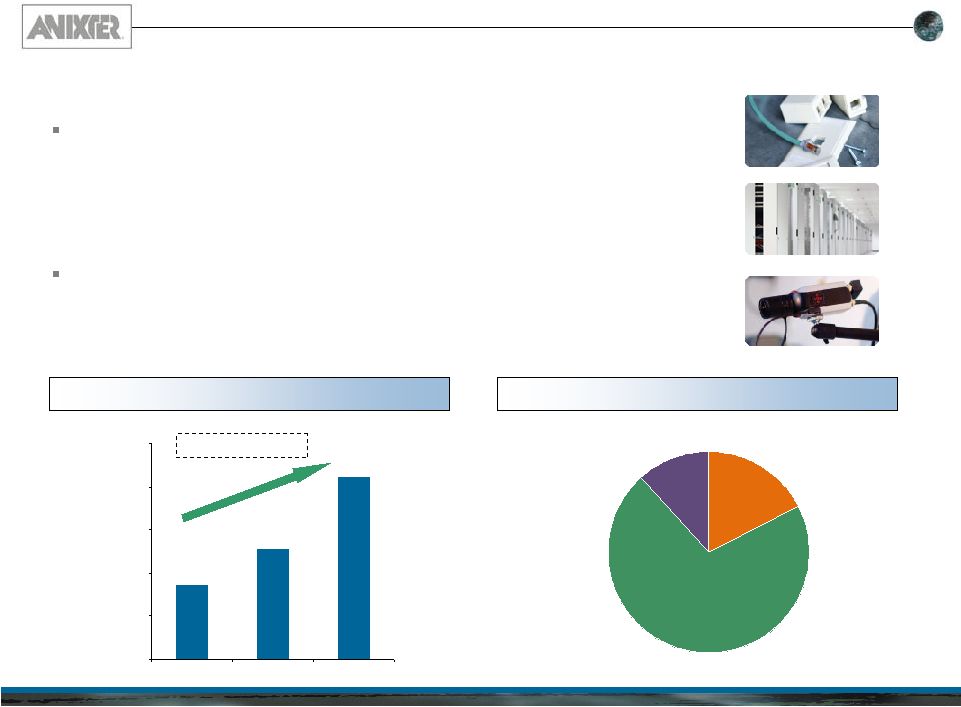

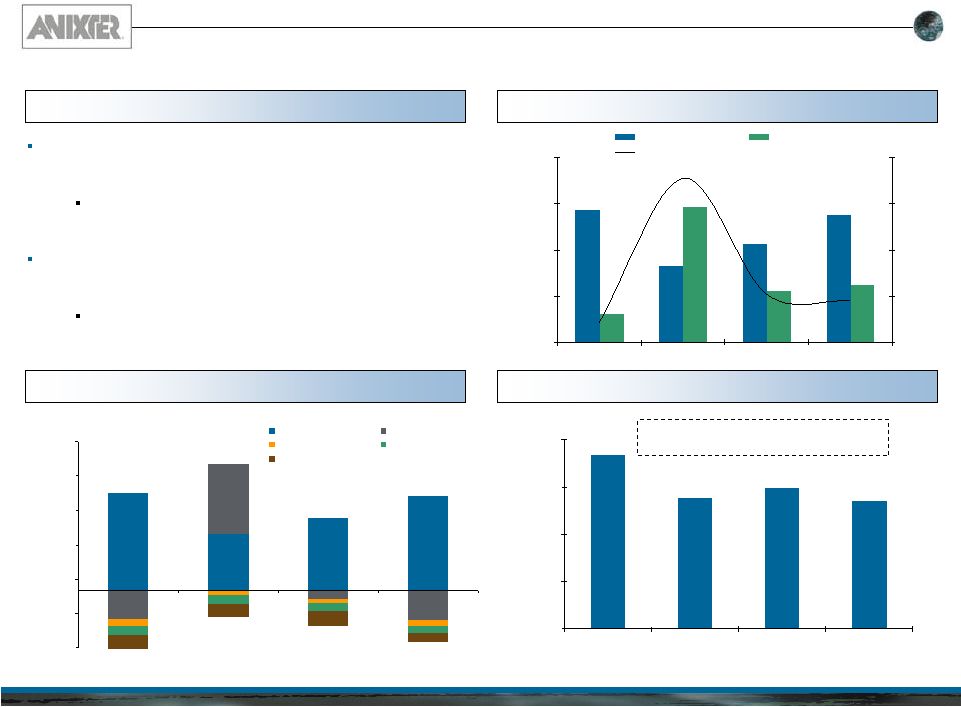

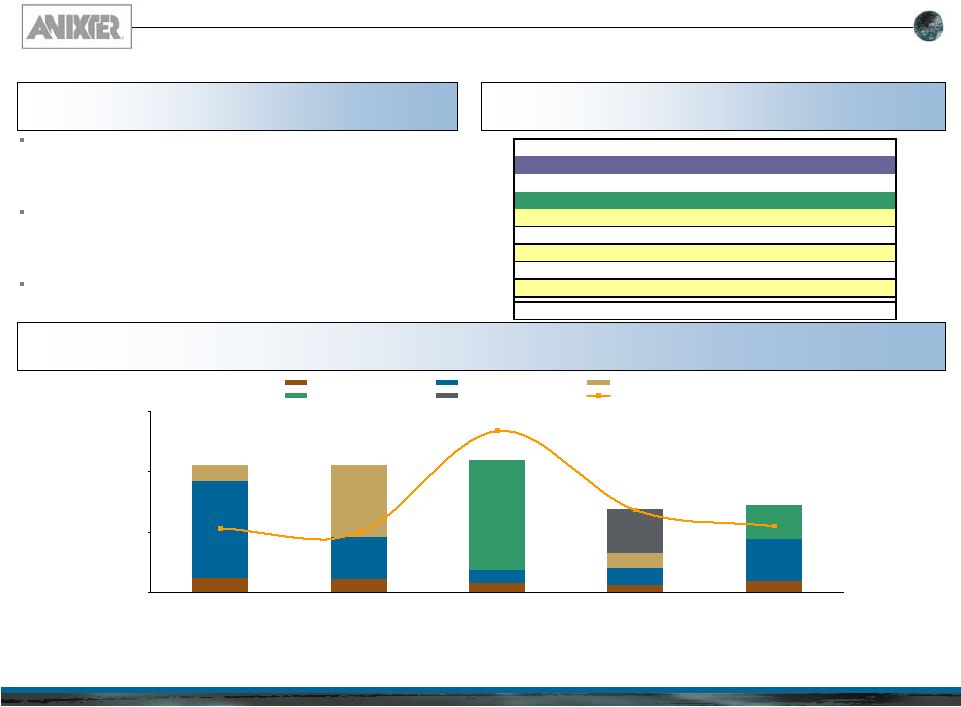

14

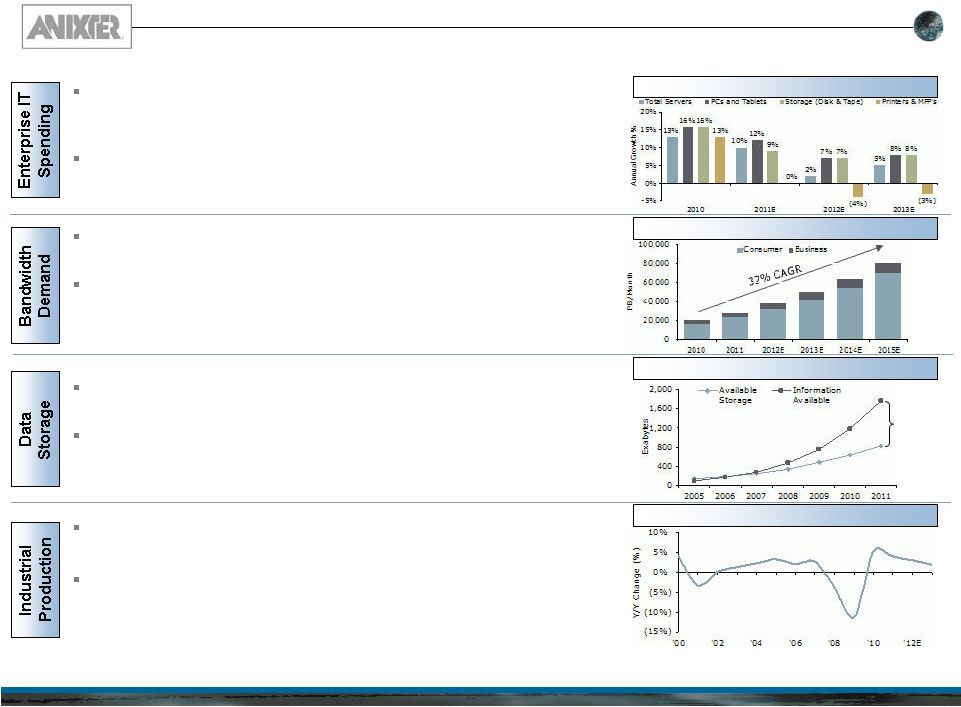

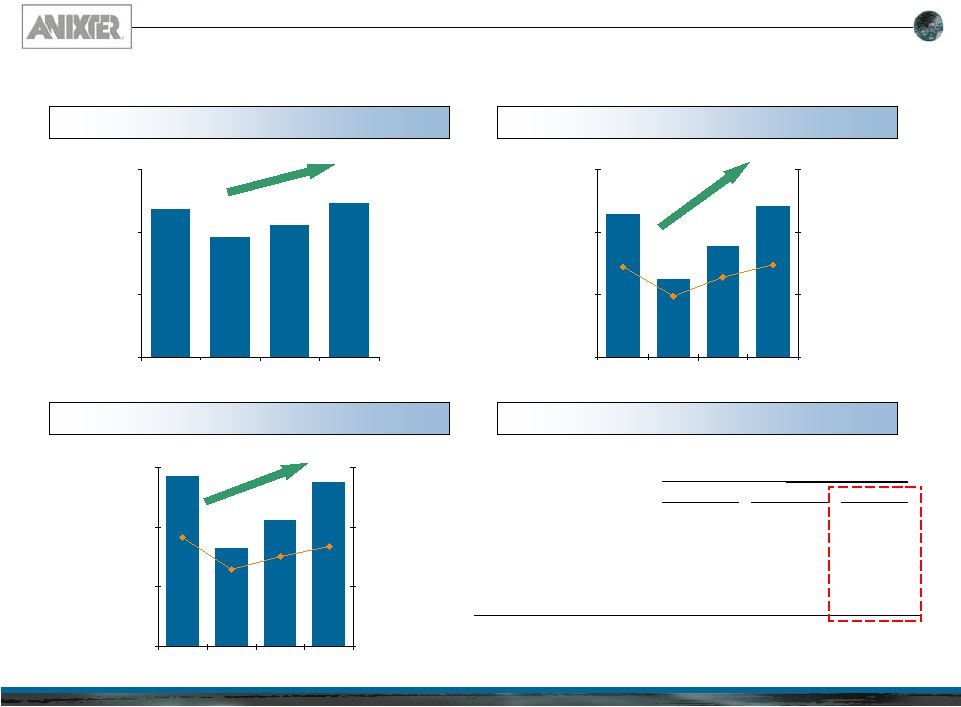

Positive Industry Fundamentals

Source:

Equity

research,

International

Data

Corporation

(IDC),

Federal

Reserve

Board,

U.S.

Federal

Reserve

-

Industrial

Production

&

Capacity

Utilization

Data storage capacity has not kept pace with IP traffic growth

resulting in an increasing supply shortage

Companies now spend 15% of an IT budget on data storage, and

are adding, on average, nearly 50% more storage capacity

annually

Industrial Production has rebounded since the 2008-2009

contraction

Industrial Production growth in February increased 4.0% year over

year, suggesting modest but steady U.S. industrial production

gains over the past year

In 2012, U.S. broadband traffic is projected to increase by

approximately 50% on fixed networks and 100% on mobile networks

Consumers

are

demanding

“always-on”

mobile

access

to

apps,

video,

and

bandwidth-intense

content

–

growing

use

of

media

rich

content continues to strain bandwidth capacity

Corporate profits and modernization of telecom / data center

infrastructure fueled growth in Enterprise IT Spending in 2010

and 2011

Analysts are predicting 6% annualized growth over the next five

years driven by burgeoning demand in Asia and emerging markets

Global IP Traffic

Projected Enterprise IT Spending

Digital Storage Shortage

Unsustainable

dynamic will

lead to server

growth

Industrial Production

This information has been obtained from third party sources. While we believe

these sources are reliable, we have not independently verified this information and we make no representation as to its accuracy. |

Investor Presentation First Quarter 2012

15

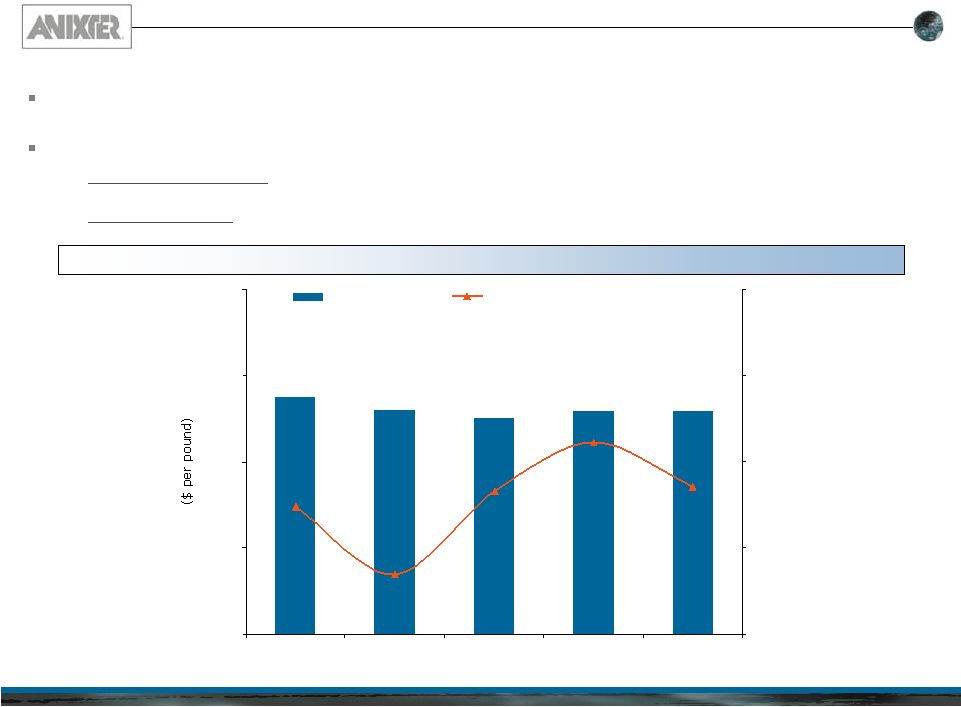

Stable Margins Despite Input Cost Volatility

Anixter has realized stable to modestly improved gross margins coming out of the

downturn despite volatility in copper prices

The Company has effectively managed margins through a mixture of:

23.7%

23.0%

22.5%

22.9%

22.9%

$3.0

$1.4

$3.3

$4.4

$3.4

$0.0

$2.0

$4.0

$6.0

$8.0

2007

2008

2009

2010

2011

10.0%

15.0%

20.0%

25.0%

30.0%

Gross Profit Margin

Copper Price ($ per pound)

Gross Profit Margins and Input Commodity Costs

This information has been obtained from third party sources. While we believe

these sources are reliable, we have not independently verified this information and we make no representation as to its accuracy.

Copper price source: www.metalprices.com

–

Market Diversification: favorable change in mix across geographies and end markets

resulting from Anixter’s focused expansion strategy

–

Pricing Discipline: continual progress in recovering cost increases through price increases

to customers |

Investor Presentation First Quarter 2012

16

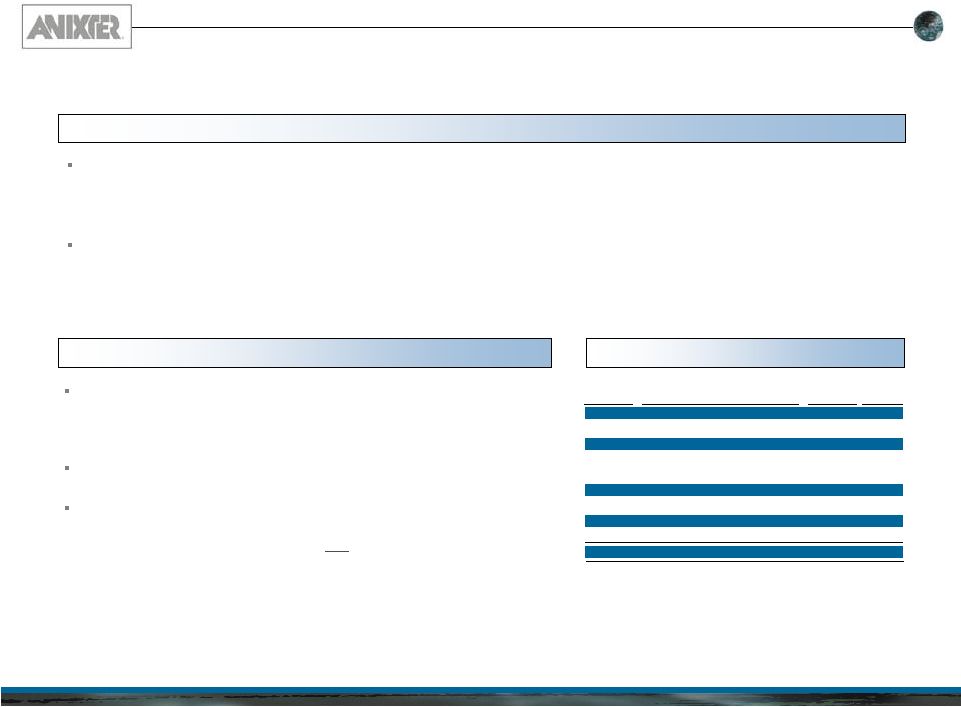

Long Term Growth Strategy

Anixter has driven consistent organic growth through a focus on:

–

Constant refresh and expansion of product offerings

–

Increased geographic penetration in countries with existing operations

–

Expansion of the Company’s geographic footprint, particularly in high growth

economies The Company has also leveraged its expertise in supply chain service

offerings to capture growth opportunities created by trends in outsourcing

and globalization Anixter utilizes a consistent approach in pursuing

acquisition activity –

Acquisitions are targeted that either complement capabilities in

their

existing

end

markets,

or

help

further

geographic

expansion

in

targeted regions

The

Company

has

traditionally

pursued

“tuck-in”

acquisitions

which

it

can fund with liquidity on hand

While Anixter continually evaluates opportunities, management is

selective in pursuing transactions

–

Must

have

attractive

valuations

and

make

strategic

sense

Acquisition Strategy

Organic Growth Strategy

Acquisition History

Price Paid

End

Date

Company Acquired

($ in MM)

Market

Dec-10

Clark Security Products

$36.4

ECS

Oct-08

World Class Wire & Cable Inc.

$61.4

W&C

Sep-08

Sofrasar SA

$20.7

OEM

Sep-08

Camille

Gergen

GmbH

&

Co,

KG;

Camille

Gergen

Verwaltungs

GmbH

$19.4

OEM

Aug-08

QSN Industries, Inc.

$76.1

OEM

Aug-08

Quality Screw de Mexico SA

$4.5

OEM

May-07

Eurofast SAS

$26.9

OEM

Apr-07

Total Supply Solutions Limited

$8.3

OEM

5 Year Total

$253.6 |

Investor Presentation First Quarter 2012

17

Global Distribution Infrastructure

Creates High Barrier to Entry

L

C

NORTH AMERICA

EUROPE

EMERGING MARKETS

One of a Kind Global Distribution Network

Significant Geographic Presence

Distribution capabilities built

on a best-in-class distribution

network with distinct

capabilities to serve customers

–

Approximately 225 strategically

located distribution facilities

worldwide with 7 million square

feet of warehouse space

Large technical sales force

–

Operates in 50 countries, over 35

currencies and over 30 languages

Significant scale in a highly

fragmented industry allows

Anixter to offer customers a

unique value proposition:

–

Global operational consistency

–

Supply chain optimization

–

Technical expertise |

Investor Presentation First Quarter 2012

18

Demonstrated Ability to Manage Through Down Cycles

Countercyclical Cash Flow Profile…

…And Strong Free Cash Flow Conversion

Proactive Management of Cash Flow Drivers…

…and Conservative Management of Debt

During periods of economic volatility, Anixter benefits from

increased cash flow due to reduced working capital

requirements

Management has demonstrated its ability to leverage

free cash flow to reduce debt and preserve operating

flexibility

The Company’s prudent cash management is bolstered by its

ability to monetize a significant portion of EBITDA into free

cash flow

From

FY08

–

FY11,

Anixter

averaged

a

cash

flow

conversion rate of approximately 74%

($ in millions)

($ in millions)

($ in millions)

$1,102

$810

$830

$892

$0

$300

$600

$900

$1,200

2008

2009

2010

2011

$413

$318

$429

$247

$91

$439

$166

$186

21%

178%

52%

45%

$0

$150

$300

$450

$600

2008

2009

2010

2011

0%

50%

100%

150%

200%

Adjusted EBITDA

Free Cash Flow

FCF Conversion

$429

$247

$318

$413

($123)

$307

($34)

($127)

($32)

($22)

($20)

($26)

($41)

($37)

($36)

($32)

($56)

($62)

($42)

$91

$439

$166

$186

($142)

($250)

($100)

$50

$200

$350

$500

$650

2008

2009

2010

2011

Adjusted EBITDA

Working Capital

Capital Expenditures

Cash Interest

Cash Taxes

Over $290 million of debt repaid from 2008 -

2011 |

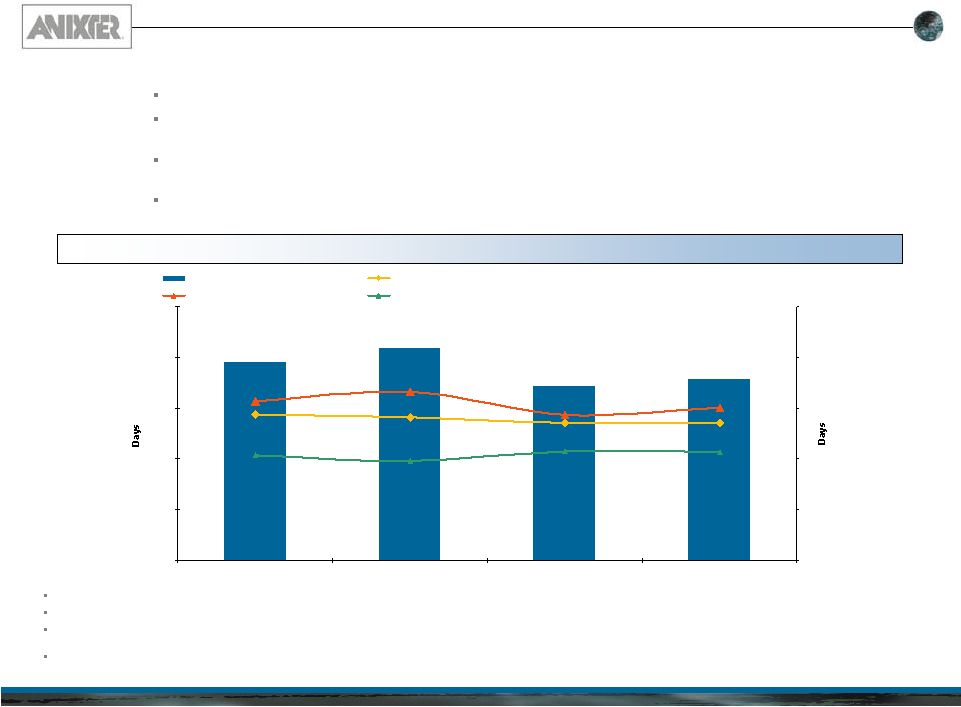

Investor Presentation First Quarter 2012

19

Efficient Working Capital Management

Days Sales Outstanding (“DSO”) is calculated by deriving the average of

the last 5 quarter end Accounts Receivable balances divided by Annual Sales multiplied by 360 days

Days Inventory On Hand (“DIO”) is calculated by deriving the average of

the last 5 quarter end Inventory balances divided by Annual Cost of Goods Sold multiplied by 360 days

Days

Payable

On

Hand

(“DPO”)

is

calculated

by

deriving

the

average

of

the

last

5

quarter

end

Accounts

Payable

balances

divided

by

Annual

Cost

of

Goods

Sold

multiplied

by

360

days

Cash Conversion Cycle is defined as DSO plus DIO minus DPO

Increased Efficiency in Working Capital Management Driving Measurable Results

0

25

50

75

100

125

2008

2009

2010

2011

0

25

50

75

100

125

Cash Conversion Cycle

Days Sales Outstanding

Days Inventory On Hand

Days Payable

Anixter’s focus on working capital management has yielded measurable

results The Company’s cash conversion cycle (“CCC”) decreased

significantly in 2010 and Anixter maintained a similar level in 2011 (16

day decrease in CCC from 2009 to 2011) The Company’s ability to

effectively manage working capital while maintaining its ability to quickly

respond

to

customer

orders

is

a

direct

result

of

its

operational

focus

The improved efficiency reduces the cash investment needed during growth periods

freeing up cash flow to be directed toward other strategic

initiatives |

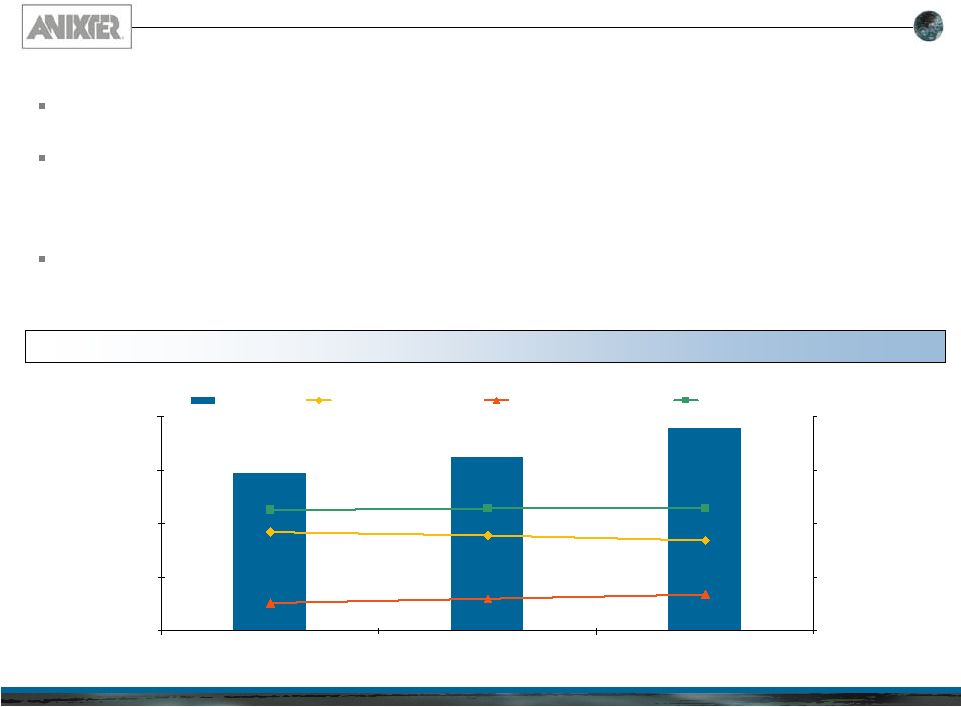

Investor Presentation First Quarter 2012

20

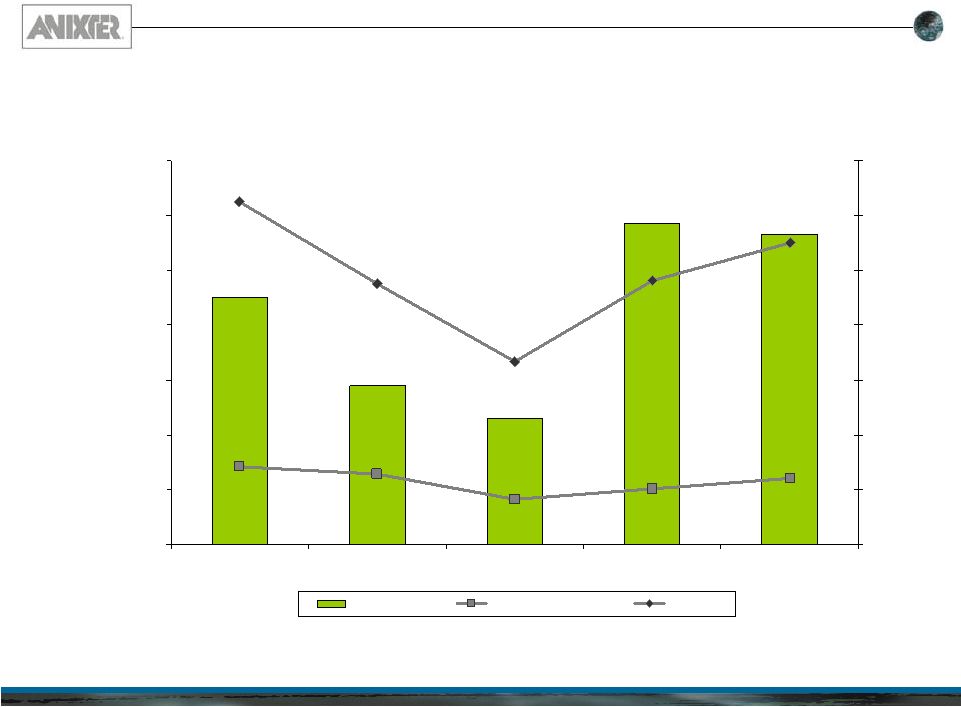

Strong Operating Leverage in Recovering Economy

Focus on Productivity-Driven Cost Management is Yielding Results

Anixter continues to capitalize on revenue growth opportunities across end markets

and increasing market

share

coming

out

of

the

downturn

–

top

line

growth

of

10.4%

in

2010

and

16.5%

in

2011

The Company’s ability to utilize existing capacity to meet increased volume

demand has allowed for growth with limited near-term expense

additions –

Drove incremental operating profit (change in operating profit divided by change

in sales) of over 11% for full year 2011

Leverage of the existing cost base, combined with active cost management, is

driving company-wide margin enhancement

–

Increase

in

EBITDA

margin

of

150

bps

from

2009

-

2011

($ in millions)

$4,779.6

$5,274.5

$6,146.9

18.5%

17.8%

16.9%

6.7%

6.0%

5.2%

22.9%

22.9%

22.5%

$0.0

$1,625.0

$3,250.0

$4,875.0

$6,500.0

2009

2010

2011

0.0%

10.0%

20.0%

30.0%

40.0%

Net Sales

Operating Exp. Margin

Adjusted EBITDA margin

Gross Profit Margin |

Investor Presentation First Quarter 2012

21

Disciplined Capital Structure Management

Strong Financial Position

Strong Liquidity Profile Provides Cushion in

both Periods of Growth and Downturns…

…and Conservative Net Leverage Profile Allows

Management’s Focus to Remain on Operations

–

Renewal of the A/R Securitization

Anixter also used free cash flow to reduce debt by over

$290 million from 2008 to 2011

Today total leverage stands at 2.0x (1.7x net leverage)

with manageable near-term maturities

Anixter’s strong cash flow profile is complemented by

a solid liquidity profile

–

Allows Company to manage liabilities and

pursue strategic initiatives without putting

pressure on operating flexibility

Anixter has historically maintained a conservative

leverage profile with manageable debt maturities

–

Company maintained net leverage that peaked

at 2.9x throughout the downturn

$65

$112

$78

$106

$248

$313

$260

$313

$60

$195

$100

$0

$150

$300

$450

$600

$750

2008

2009

2010

2011

Cash

Revolver Availability

ARC Availability

$519

$338

$620

$373

($ in millions)

Note: Liquidity

defined

as

Cash

plus

availability

under

Credit

Lines,

including

ARC.

Net

Leverage

is

defined

as

Total

Debt

minus

Cash

divided

by

Adjusted

EBITDA.

The

calculation

of

Adjusted

EBITDA

is

provided

in the Appendix. Total Leverage is defined as Total Debt divided by Adjusted

EBITDA 2.4x

2.9x

2.6x

1.7x

0.0x

1.3x

2.5x

3.8x

2008

2009

2010

2011

Proven Commitment to Proactive Management of

Debt

Maturities

In 2009, Anixter accessed the markets via $200 million

Sr. Notes in order to provide “dry powder” to address

potential near-term maturities, including:

Potential “put” of the 3.25% Convertible Notes |

Investor Presentation First Quarter 2012

22

Prudent Approach to Capital Allocation

Senior Management has a Record of

Strategically Balancing Capital Distributions

5-Year

Snapshot

Highlights

Discipline

in

Anixter’s

Capital Management

Capital Needs Supported by Cash Flow and Supplemented With Very Conservative Use of

Debt ($ in millions)

Anixter generates significant Cash Flow from Operations (CFO) -

covers all debt service and business investment (cap ex + acquisitions)

needs

–

Over last 5 years, 70%+ of CFO used for this purpose

In evaluating best use of additional capital, Anixter has selected to

periodically return a portion to shareholders

–

Use of special dividend / share repurchases allows Anixter to

make distributions opportunistically

Net leverage and liquidity subsequent to a distribution never moved

over 2.9x or under $338 million, respectively

$195

$125

$138

$441

$144

$0

$150

$300

$450

2007

2008

2009

2010

2011

CapEx

Share Repurchases

Acquisitions

Debt Reduction

Special Dividends

Operating Cash Flow

Amount: $108MM

Net Leverage: 1.7x

Liquidity: $519MM

Amount: $152MM

Net Leverage: 2.6x

Liquidity: $338MM

Amount: $35MM

Net Leverage: 2.9x

Liquidity: $620MM

Amount: $105MM

Net Leverage: 2.4x

Liquidity: $373MM

Amount: $242MM

Net Leverage: 2.0x

Liquidity: $405MM

Share repurchases

and special

dividends

Total Cash from Operations

1,043.7

$

Capital Outlay

$

% of CFO

Capital Expenditures

136.4

13.1%

Debt Reduction

354.1

33.9%

Share Repurchases

530.0

50.8%

Special Dividends

111.0

10.6%

Acquisitions

253.6

24.3%

Total Capital Overlay

1,385.1

$

132.7%

5-Year Summary (2007-2011)

Net Leverage is defined as Total Debt minus Cash divided by Adjusted EBITDA.

The calculation of Adjusted EBITDA is provided in the Appendix. |

Investor Presentation First Quarter 2012

23

Experienced Management Team

Management Overview

Continuity within senior management was instrumental in Anixter’s

effective navigation through the recent economic cycle

–

CEO has 22 years of experience at the Company

–

Management team averages 25 years at the Company

–

Business Unit Presidents’

average 32 years of combined experience at

Anixter (including time with acquired company)

Name

Position

Years of Service

Robert J. Eck

President & Chief Executive Officer

22

Ted A. Dosch

Executive Vice President –

Finance & Chief Financial Officer

3

Bill Galvin

Executive Vice President, Enterprise Cabling & Security Solutions

24

Giulio Berardesca

Executive Vice President, Wire & Cable

38

Bill Standish

Executive Vice President, Operations

28

David Woodcock

President, Anixter Fasteners

34 |

Investor Presentation First Quarter 2012

24

Solid

Financial

Performance

–

Q411

Snapshot

Solid quarter with all end markets

delivering year-over-year growth

–

Represents

the

Company’s

8

consecutive quarter of net sales

growth at the end of 2011

Net Sales growth of 8% driven by growth

across all end markets and geographies

Year-over-year operating profit was up

17% and operating margin expanded by

40 bps

–

Highlights the leverage in Anixter’s

operating structure

Strong working capital management

allowed the Company to generate

$112.9 million in cash flow from

operations (including discontinued

operations)

Diluted EPS from continuing operations

increased 26% to $1.49

Solid operating performance driven by strong cost

management and operating leverage

QTR 12/31/11

Sales

$1,499.0

Growth

8%

Operating Income

$91.6

Growth

17%

EBITDA

$102.6

Margin

7%

Diluted EPS

$1.49

Y-O-Y Increase

26%

Free Cash Flow

$134.6

Liquidity

$519.0

th

(in millions, except share amounts) |

Investor Presentation First Quarter 2012

25

(in millions, except per share amounts)

Mar 30, 2012

Apr 1, 2011

% Chg

Sales

$1,522.7

$1,470.8

4%

Operating Income **

$86.7

$82.8

5%

Net Income **

$47.0

$44.2

6%

Diluted Earnings Per Share **

$1.37

$1.22

12%

Cash Flow Used In Operations

$(64.7)

$(5.5)

nm

Strong Operating Leverage in Recovering Economy

2012 Results –

First Quarter

First Quarter *

*

All amounts exclude discontinued operations with the exception of cash flow from

operations. **

First

quarter

of

2012

operating

income

of

$86.7

million

improved

by

12%

compared

to

$77.5

million

in

the

year

ago

quarter.

The

operating

profit

in

the

prior year quarter included a European restructuring charge of $5.3 million ($3.3

million net of tax, or $0.09 per diluted share). Excluding this charge,

operating income increased by 5%. In the first quarter of 2012, the Company

recorded a charge for interest and penalties associated with prior year tax

liabilities of $1.7 million ($1.1 million net of tax, or $0.03 per diluted share)

and a tax benefit of $9.7 million ($0.28 per diluted share) primarily related to

the reversal of deferred income tax valuation allowances in certain foreign

jurisdictions. After adjusting for these items, net income from continuing

operations in the first quarter of 2012 would have been $47.0 million, or $1.37 per diluted

share, which compares to adjusted net income from continuing operations of $44.2

million, or $1.22 per diluted share, in the prior year quarter (an increase

of 12% per diluted share). |

Investor Presentation First Quarter 2012

26

(in millions, except per share amounts)

Dec. 30,

2011

Dec. 31,

2010

% Chg

Sales

$6,146.9

$5,274.5

17%

Operating Income **

$368.1

$267.2

38%

Net Income **

$193.2

$127.2

52%

Diluted Earnings Per Share **

$5.49

$3.58

53%

Cash Flow From Operations

$144.4

$195.2

(26%)

Strong Operating Leverage in Recovering Economy

2011 Results –

December YTD

December YTD *

* All amounts exclude discontinued operations with the exception of cash flow from operations.

** In 2011, operating income increased 36% to $362.8 million as compared to $267.2 million in

the prior year. In 2011, the Company recorded a charge of $5.3 million ($3.3 million net

of tax, or $0.09 per diluted share) related to facility consolidations and headcount reductions in Europe. Excluding the restructuring charge,

operating income increased 38%. In 2011, the Company also recorded net tax benefits of $10.8

million ($0.31 per diluted share). In 2010, the Company recorded a tax benefit of $1.3

million ($0.03 per diluted share) related to the reversal of prior year foreign taxes, recognized a foreign exchange gain of $2.1 million ($0.8

million net of tax, or $0.02 per diluted share) associated with its Venezuela operations and

recognized a loss of $31.9 million ($19.8 million net of tax, or $0.55 per diluted share)

associated with the early retirement of debt. For the year ended December 30, 2011, the Company reported net income from continuing operations of

$200.7 million, or $5.71 per diluted share, compared to $109.5 million, or $3.08 per diluted

share, in the year ago period, representing an increase of 83%. After adjusting for these items, net income increased to $193.2

million in 2011 from $127.2 million in 2010 while diluted earnings per share increased to $5.49 in

2011 from $3.58 in 2010 (an increase of 53% per diluted share). |

Investor Presentation First Quarter 2012

27

Solid Financial Position

Strength to Continue to Capitalize on Recovery

Cash used in operations plus capital expenditures totaled $74.7

million for First Quarter 2012

Debt to Total Capital of 44.0% combined with cash balances of

$71.9 million and $301.0 million in available credit facilities

Good Borrowed Capital Credit Profile

–

5.5% weighted average cost borrowed capital

–

Scheduled maturities well spaced over coming years |

Investor Presentation First Quarter 2012

28

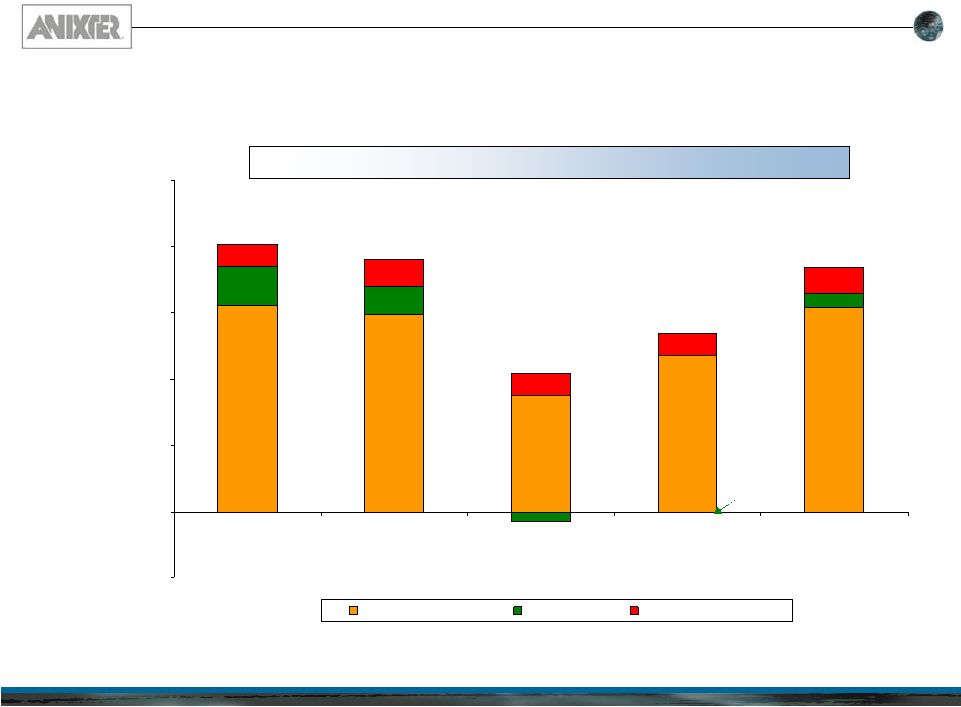

Flexible / Scalable Business Model

Earnings and Cash Flow Relationship to Sales Changes

($300.00)

($200.00)

($100.00)

$0.00

$100.00

$200.00

$300.00

$400.00

$500.00

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

Cash Flow *

Operating Profit **

Sales Growth Over Prior Year

*

Net cash provided by (used in) operating activities (including ARC assets change)

less capital expenditures. **

Operating profit from continuing operations excluding special items outlined in the

Company’s Earnings Releases. (Dollars in Millions)

% Sales Growth over P.Y.

Fiscal Year

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

Investor Presentation First Quarter 2012

29

Key Investment Themes

Positioned to Optimize Benefits of Economic Recovery and

Long Term Growth

Broad End market / Geographic / Customer Diversity

Concentrated Operations and Management Infrastructure for

Operational Leverage

Strong Financial Position / Liquidity

Long History of Shareholder favorable Capital Structure Management

–

Share

Repurchases

(11%

of

outstanding

shares

repurchased

in

last

30

months)

–

Special Dividends (most recently $3.25 per share Q4 2010 and $4.50 per

share Q2 2012)

–

Responsible Levels of Leverage

Experienced Senior Management Team

–

CEO –

22 Years at Anixter

–

Senior Management Team Averages 25 Years at Anixter |

Investor Presentation First Quarter 2012

30

Appendix |

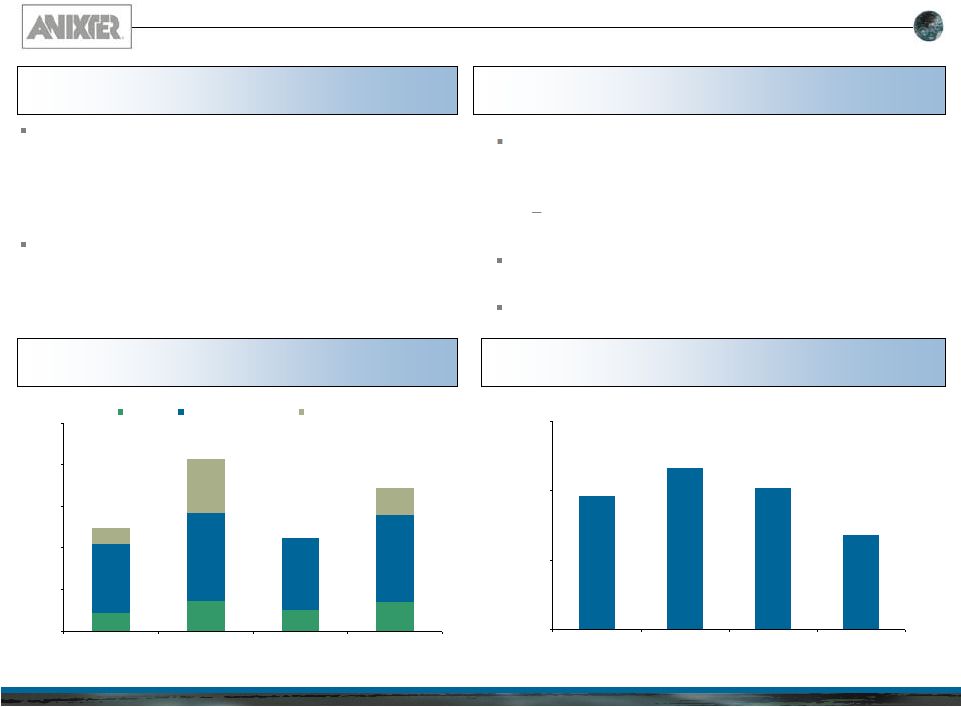

Investor Presentation First Quarter 2012

31

Historical Financial Results

Net Sales*

Operating Income & Margin*

EBITDA & Margin*

$5,891

$4,780

$5,275

$6,147

$0

$2,500

$5,000

$7,500

2008

2009

2010

2011

($ in millions)

$342

$185

$267

$363

5.9%

5.1%

3.9%

5.8%

$0

$150

$300

$450

2008

2009

2010

2011

0.0%

4.0%

8.0%

12.0%

Operating Leverage is Yielding Results*

Note: Excludes $100 million Goodwill Impairment in 2009

* Adjusted to exclude divested Aerospace business

($ in millions)

($ in millions)

($ in millions)

$429

$247

$318

$413

7.3%

5.2%

6.0%

6.7%

$0

$150

$300

$450

2008

2009

2010

2011

0.0%

4.0%

8.0%

12.0%

Fiscal Year End

12/30/2011

12/31/2010

% Change

Sales

$6,146.9

$5,274.5

17%

Operating Income

$362.8

$267.2

36%

Adj. EBITDA

$412.7

$317.7

30%

Net Income

1

$200.7

$109.5

83%

Diluted Earnings Per Share

1

$5.7

$3.1

85%

1

From Continuing Operations |

Investor Presentation First Quarter 2012

32

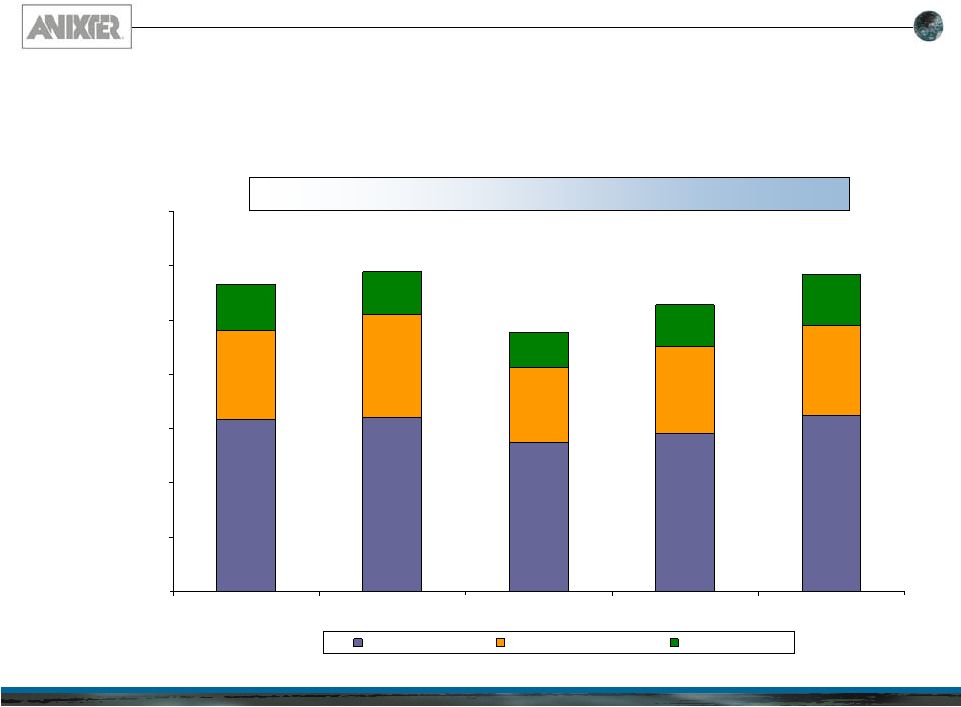

End Market Sales Mix

57.4%

54.4%

55.9%

55.2%

52.8%

29.0%

32.2%

29.0%

30.4%

31.7%

13.6%

13.4%

15.1%

14.4%

15.5%

0

1000

2000

3000

4000

5000

6000

7000

2007

2008

2009

2010

2011

(Dollars in Millions)

Enterprise

Electrical W&C

OEM Supply

$5,662

$5,891

$4,780

$5,274

$6,147

Fiscal Year |

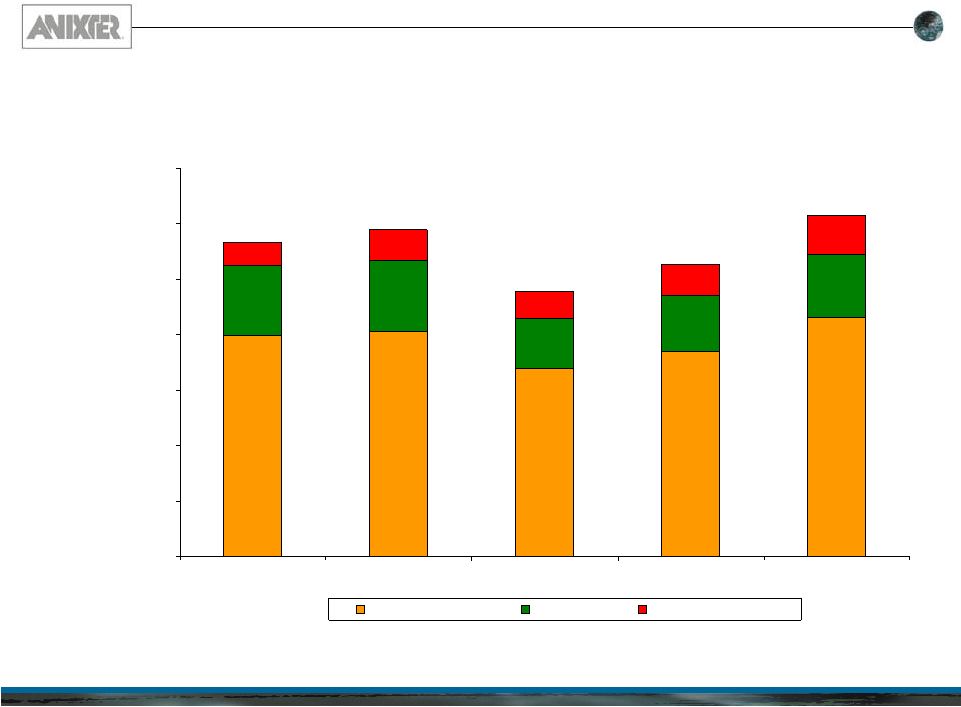

Investor Presentation First Quarter 2012

33

Sales Mix by Geography

71.1%

68.9%

70.4%

70.2%

70.0%

18.6%

21.8%

22.3%

19.1%

18.7%

10.3%

9.3%

7.3%

10.7%

11.3%

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2007

2008

2009

2010

2011

(Dollars in Millions)

North America

Europe

Emerging Markets

$5,662

$5,891

$4,780

$5,274

$6,147 |

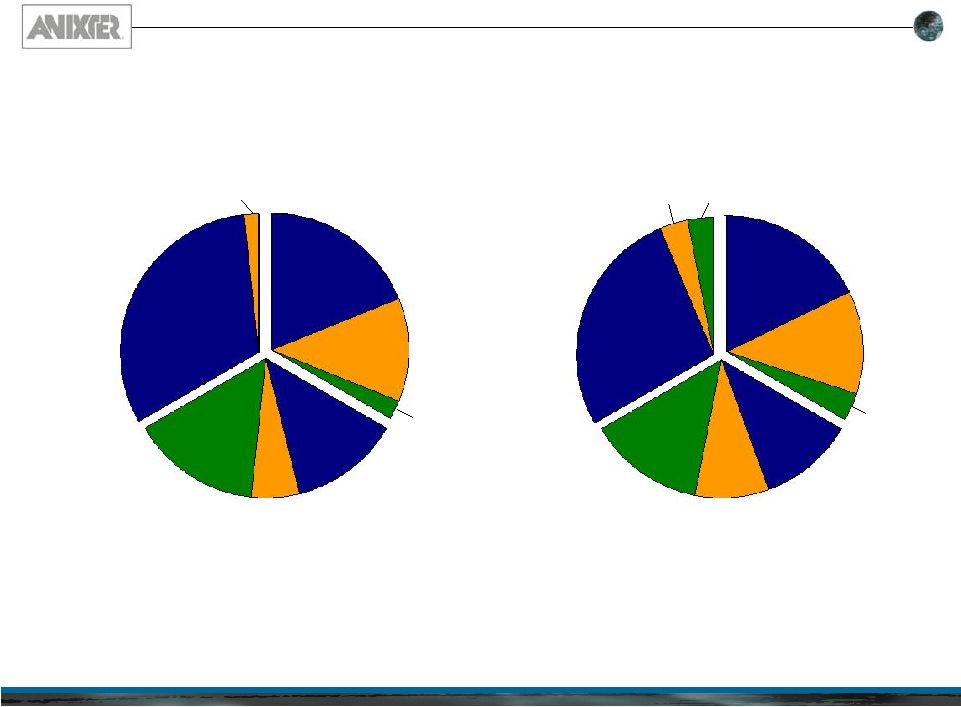

Investor Presentation First Quarter 2012

34

End Market Sales by Geographic Region

2007

ECS

95%

ECS

57%

ECS

38%

OEM

45%

W&C

5%

OEM

7%

North

America

70%

Europe 22%

Emerging

Markets

8%

2011

W&C

36%

ECS

33%

W&C

26%

W&C

37%

W&C

10%

OEM

10%

Europe 19%

Emerging

Markets

11%

OEM 9%

ECS

81%

ECS

53%

OEM

41%

North

America

70%

W&C

17% |

Investor Presentation First Quarter 2012

35

2011 Segment and End Market Sales Growth

Actual and Organic

Twelve Months

Twelve Months

Ended

Ended

Twelve Months

(In millions)

December 2011

Acquisition

Foreign Exchange

Copper

December 2011

Ended

Actual

Organic

(as reported)

Impact

Impact

Impact

(as adjusted)

December 2010

Growth

Growth

North America

Enterprise Cabling and Security

2,301.6

$

(120.1)

$

(11.4)

$

-

$

2,170.1

$

2,060.7

$

11.7%

5.3%

Wire & Cable

1,579.6

-

(21.9)

(93.4)

1,464.3

1,288.6

22.6%

13.6%

OEM Supply

421.3

-

(0.2)

-

421.1

351.9

19.7%

19.7%

Total North America

4,302.5

$

(120.1)

$

(33.5)

$

(93.4)

$

4,055.5

$

3,701.2

$

16.2%

9.6%

Europe

Enterprise Cabling and Security

380.8

$

-

$

(18.6)

$

-

$

362.2

$

367.0

$

3.7%

-1.4%

Wire & Cable

299.7

-

(10.3)

(10.9)

278.5

275.6

8.8%

1.1%

OEM Supply

469.5

-

(19.1)

-

450.4

365.8

28.3%

23.1%

Total Europe

1,150.0

$

-

$

(48.0)

$

(10.9)

$

1,091.1

$

1,008.4

$

14.0%

8.2%

Emerging Markets

Enterprise Cabling and Security

563.5

$

-

$

(14.3)

$

-

$

549.2

$

484.9

$

16.2%

13.2%

Wire & Cable

70.2

-

(0.5)

-

69.7

38.3

83.1%

81.8%

OEM Supply

60.7

(1.1)

-

59.6

41.7

45.8%

43.2%

Total Emerging Markets

694.4

$

-

$

(15.9)

$

-

$

678.5

$

564.9

$

22.9%

20.1%

Anixter International

Enterprise Cabling and Security

3,245.9

$

(120.1)

$

(44.3)

$

-

$

3,081.5

$

2,912.6

$

11.4%

5.8%

Wire & Cable

1,949.5

-

(32.7)

(104.3)

1,812.5

1,602.5

21.7%

13.1%

OEM Supply

951.5

-

(20.4)

-

931.1

759.4

25.3%

22.6%

Total Anixter International

6,146.9

$

(120.1)

$

(97.4)

$

(104.3)

$

5,825.1

$

5,274.5

$

16.5%

10.4%

Twelve Months

Twelve Months

Ended

Ended

Twelve Months

December 2011

Acquisition

Foreign Exchange

Copper

December 2011

Ended

Actual

Organic

(as reported)

Impact

Impact

Impact

(as adjusted)

December 2010

Growth

Growth

Enterprise Cabling and Security

3,245.9

$

(120.1)

$

(44.3)

$

-

$

3,081.5

$

2,912.6

$

11.4%

5.8%

Wire & Cable

1,949.5

-

(32.7)

(104.3)

1,812.5

1,602.5

21.7%

13.1%

OEM Supply

951.5

-

(20.4)

-

931.1

759.4

25.3%

22.6%

Total Anixter International

6,146.9

$

(120.1)

$

(97.4)

$

(104.3)

$

5,825.1

$

5,274.5

$

16.5%

10.4%

Adjustments for:

Adjustments for:

YTD 2011 Sales Growth

End Market Sales Growth |

Investor Presentation First Quarter 2012

36

Geographic Segment Operating Profit

83.6%

77.3%

78.4%

89.9%

88.0%

-0.3%

14.4%

10.8%

-7.3%

10.7%

8.3%

10.8%

17.4%

12.3%

-100

0

100

200

300

400

500

2007

2008*

2009 *

2010 *

2011*

(Dollars in Millions)

North America

Europe

Emerging Markets

$368

$403

$380

$267

$195

Fiscal Year

*

Adjusted for special items outlined in the Company’s Earnings Releases.

5.7% |

Investor Presentation First Quarter 2012

37

Operating Profit Adjusted for Unusual Items

2001 (f)

2002

2003

2004 (e)

2005

2006 (d)

2007

2008 (c)

2009 (b)

2010

2011 (a)

Operating profit (1)

$102.0

$87.2

$88.1

$127.7

$175.4

$317.3

$402.7

$341.5

$84.8

$267.2

$362.8

Sales

$5,661.5

$5,891.0

$4,779.6

$5,274.5

$6,146.9

Operating profit margin

7.1%

5.8%

1.8%

5.1%

5.9%

Restructuring

31.7

-

-

5.2

-

-

-

8.1

5.7

-

5.3

Europe goodwill impairment

-

-

-

1.8

-

-

-

-

100.0

-

-

Receivable losses from customer bankruptcies

-

-

-

-

-

-

-

24.1

-

-

-

Inventory adjustment

-

-

-

(10.2)

-

-

-

2.0

4.2

-

-

Stock-based compensation modification

-

-

-

-

-

-

-

4.2

-

-

-

Sales tax related settlement

-

-

-

-

-

(2.2)

-

-

-

-

-

Amortization of Goodwill

9.0

-

-

-

-

-

-

-

-

-

-

Total adjustments

40.7

-

-

(3.2)

-

(2.2)

-

38.4

109.9

-

5.3

Operating profit, adjusted

$142.7

$87.2

$88.1

$124.5

$175.4

$315.1

$402.7

$379.9

$194.7

$267.2

$368.1

Sales

$5,661.5

$5,891.0

$4,779.6

$5,274.5

$6,146.9

Adjusted operating profit margin

7.1%

6.4%

4.1%

5.1%

6.0%

Fiscal Year

Adjustments to operating profit

(f) Adjusted EBITDA for fiscal 2001 excludes a restructuring charge of $31.7 million associated with

reducing the Company’s workforce, closing or consolidating certain facilities and exiting

the Korean market. Additionally, 2001 included goodwill amortization of $9.0 million which was no longer amortized beginning in 2002.

(c) Adjusted EBITDA for fiscal 2008 also excludes: $24.1 million related to receivable losses from

customer bankruptcies, $2.0 million related to the inventory lower of cost or market

adjustments and $8.1 million primarily related to personnel severance costs related to staffing

reductions and exit costs associated with leased facilities. (d) Adjusted EBITDA for fiscal

2006 excludes a $2.2 million favorable sales-tax related settlement in Australia. (e)

Adjusted EBITDA for fiscal 2004 excludes net favorable adjustments to cost of sales of $10.2 million arising primarily from the reduction in risks associated with the value of certain

inventories, an impairment charge of $1.8 million to write down to fair value the value assigned to a

tradename and unfavorable expenses of $5.2 million related to the relocation of the

Company’s largest distribution facility, severance costs associated with staffing reductions in

Europe and acquisition-related charges. (1) All periods restated for 2010 divestiture of

Aerospace (a) Adjusted EBITDA for fiscal 2011 also excludes $5.3 million related to facility

consolidations and headcount reductions in Europe. (b) Adjusted EBITDA for fiscal 2009

excludes: $100.0 million of non-cash goodwill impairment charge related to the European operations, $5.7 million of severance costs related to

staffing reductions in Europe and $4.2 million related to exchange rate-driven lower of cost or

market adjustment on inventory in Venezuela. |

Investor Presentation First Quarter 2012

(1)

-

Calculated by taking FCF / EBITDA

EBITDA is defined as income

(loss) from continuing operations before interest, income taxes, depreciation and amortization. Adjusted EBITDA is defined as

EBITDA before foreign exchange and other non-operating expenses, loss on early retirement of debt

and stock-based compensation. (a) Adjusted EBITDA for fiscal 2011 also excludes $5.3

million related to facility consolidations and headcount reductions in Europe. (b) Adjusted EBITDA for fiscal 2009 excludes: $100.0 million of non-cash goodwill impairment

charge related to the European operations, $5.7 million of severance costs related to staffing

reductions in Europe and $4.2 million related to exchange rate-driven lower of cost or market adjustment on inventory in Venezuela.

(c) Adjusted EBITDA for fiscal 2008 also excludes: $24.1 million related to receivable losses from

customer bankruptcies, $2.0 million related to the inventory lower of cost or market

adjustments and $8.1 million primarily related to personnel severance costs related to staffing reductions and exit costs associated with leased

facilities.

38

EBITDA and Free Cash Flow

(In millions)

Adjusted EBITDA

FY 08 (c)

FY 09 (b)

FY 10

FY 11 (a)

11 Q4

Net income (loss) from continuing operations

$153.8

($41.4)

$109.5

$200.7

$49.8

Interest expense

60.5

66.1

53.6

50.1

12.0

Income taxes

100.7

39.8

70.7

102.8

27.4

Depreciation

24.9

24.1

22.5

22.1

5.5

Amortization of intangible assets

9.7

13.0

11.3

11.4

2.7

EBITDA

$349.6

$101.6

$267.6

$387.1

$97.4

Foreign exchange and other non-operating expense (income)

26.5

19.2

1.5

9.2

2.4

Loss on early retirement of debt

-

1.1

31.9

-

-

Stock-based compensation

18.2

15.2

16.7

11.1

2.8

Facility consolidation and headcount reductions

8.1

5.7

-

5.3

-

Europe goodwill impairment

-

100.0

-

-

-

Inventory lower of cost or market adjustment in Venezuela

-

4.2

-

-

-

Receivable losses from customer bankruptcies

24.1

-

-

-

-

Inventory lower of cost or market adjustment

2.0

-

-

-

-

Adjusted EBITDA

$428.5

$247.0

$317.7

$412.7

$102.6

Free Cash Flow

FY 08

FY 09

FY 10

FY 11

11 Q4

Adjusted EBITDA

428.5

247.0

317.7

412.7

102.6

Capital Expenditures

(32.4)

(21.9)

(19.6)

(26.4)

(6.6)

Cash-Taxes

(141.5)

(56.2)

(61.9)

(41.9)

(10.6)

Working Capital

(122.8)

306.9

(33.5)

(127.1)

52.0

Cash Interest

(40.7)

(37.2)

(36.4)

(31.6)

(2.8)

Free Cash Flow

$91.1

$438.6

$166.3

$185.7

$134.6

FCF Conversion (1)

21.3%

177.6%

52.3%

45.0%

32.8%

Average Rate (FY 2008 to FY 2011)

74.0%

Notes: |

Investor Presentation First Quarter 2012

39

Return on Tangible Capital

4.53

4.57

3.86

3.98

4.30

7.1%

6.4%

4.1%

5.1%

6.0%

27.5%

24.1%

16.7%

23.8%

31.3%

3.4

3.6

3.8

4.0

4.2

4.4

4.6

4.8

2007

2008*

2009*

2010

2011*

Asset Turns

0%

5%

10%

15%

20%

25%

30%

35%

%

Asset Turns

Operating Profit %

ROTC %

*

Operating profit % adjusted for special items outlined in the Company’s

earnings releases (identified on p. 37). Asset Turns is defined as annual net sales divided by

year to date average tangible capital. Return on Tangible Capital (“ROTC”) is defined as year to date

operating profit excluding intangible amortization divided by year to date average tangible capital. |

Investor Presentation First Quarter 2012

40

Debt-To-Total Capital Trend

$830

$942

$1,101

$892

$810

46.3%

50.7%

44.8%

46.9%

44.7%

0

200

400

600

800

1,000

1,200

2007

2008

2009

2010

2011

Total Debt $ millions

0%

10%

20%

30%

40%

50%

60%

70%

80%

% Debt / Total Capital

Total Debt

% Debt / Total Capital |