Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION OF THE LEBRECHT GROUP, APLC - Wisdom Homes of America, Inc. | srer_ex51.htm |

| EX-23.1 - CONSENT OF TAVARAN, ASKELSON & COMPANY, LLC - Wisdom Homes of America, Inc. | srer_ex231.htm |

As filed with the Securities and Exchange Commission on May 10 , 2012

Registration No. 333-172543

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________

Amendment No. 9

to

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_____________

SearchCore, Inc.

(Exact name of registrant as specified in its charter)

_____________

|

Nevada

|

8741

|

43-2041643

|

||

|

(State or other jurisdiction of

incorporation or organization

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

_____________

|

1300 Dove Street, Suite 100

Newport Beach, CA 92660

|

(855) 420-2262

|

|

|

(Address, including zip code, of registrant’s

principal executive offices)

|

(Telephone number,

including area code)

|

_____________

James Pakulis, Chief Executive Officer

SearchCore, Inc.

1300 Dove Street, Suite 100

Newport Beach, CA 92660

(855) 420-2262

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

COPIES TO:

Brian A. Lebrecht, Esq.

The Lebrecht Group, APLC

9900 Research Drive

Irvine, CA 92618

(949) 635-1240

_____________

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | |||

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount

to be

registered

|

Proposed

maximum

offering price

per share

|

Proposed

maximum

aggregate

offering price

|

Amount of

registration

fee

|

||||||||||||

|

Common Stock offered for sale

|

5,000,000 | $ | 3.00 | $ | 15,000,000 | $ | 1741.50 | |||||||||

|

Common Stock of certain selling shareholders

|

4,397,500 | (1) | $ | 2.80 | (2) | $ | 12,313,000 | $ | 1,429.54 | |||||||

|

Total Registration Fee

|

$ | 3,171.04 | ||||||||||||||

(1) Consists of shares of common stock held by 30 selling shareholders. Pursuant to Rule 416 of the Securities Act, this registration statement shall be deemed to cover additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms that provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior to completion of the distribution of the securities covered by this registration statement as a result of a split of, or a stock dividend paid with respect to, the registered securities.

(2) The registration fee is calculated pursuant to Rule 457(c) of the Securities Act of 1933 based on the average of the high and low transaction prices on February 22, 2011.

|

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

Subject to Completion, Dated May 10 , 2012

PROSPECTUS

Up to 9,397,500 shares of common stock

SEARCHCORE, INC.

We are hereby registering 5,000,000 shares, representing 5.7% of our outstanding common stock if all shares are sold, for sale by us to investors at a price of $3.00 per share. We are also hereby registering up to 4,397,500 shares, representing approximately 5.3% of our current outstanding common stock, for sale by 30 of our existing shareholders. This offering will terminate on the earlier of (i) when all 9,397,500 shares are sold or (ii) on the date which is three years after the effective date hereof, unless we terminate it earlier.

Investing in the common stock involves risks. SearchCore, Inc. (formerly General Cannabis, Inc.), while not a development stage company, is a company with limited operations, limited income, and limited assets, and you should not invest unless you can afford to lose your entire investment. See “Risk Factors” beginning on page 4. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Our common stock is governed under The Securities Enforcement and Penny Stock Reform Act of 1990, and as a result you may be limited in your ability to sell our stock.

Shares sold for our benefit will be sold at a price of $3.00 per share. These shares will be offered by certain of our officers and directors, primarily, James Pakulis and Douglas Francis, our Chief Executive Officer and President, respectively, on a best efforts basis with no minimum.

Shares sold by selling stockholders will be sold by them on their own behalf at prevailing market prices or at privately negotiated prices. The selling stockholders, and any participating broker-dealers, may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the “Securities Act,” and any commissions or discounts given to any such broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. SearchCore, Inc. is not selling any of the shares held by selling stockholders and therefore will not receive any proceeds therefrom. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common stock.

Our common stock is quoted on the OTCQX tier of the marketplace maintained by OTC Markets Group, Inc. under the symbol “SRER.” The closing price of our common stock as reported by OTC Markets Group, Inc. on March 16, 2012 was $0.75.

The date of this prospectus is __________________, 2012

3

PROSPECTUS SUMMARY

SEARCHCORE, INC.

We are a technology service provider, currently primarily involved in the medicinal cannabis industry.

We are not engaged in the growing, harvesting, cultivation, possession, or distribution of cannabis. Instead, we assist the physicians, dispensaries, and end-users within the medicinal cannabis industry in finding each other and in advertising their businesses.

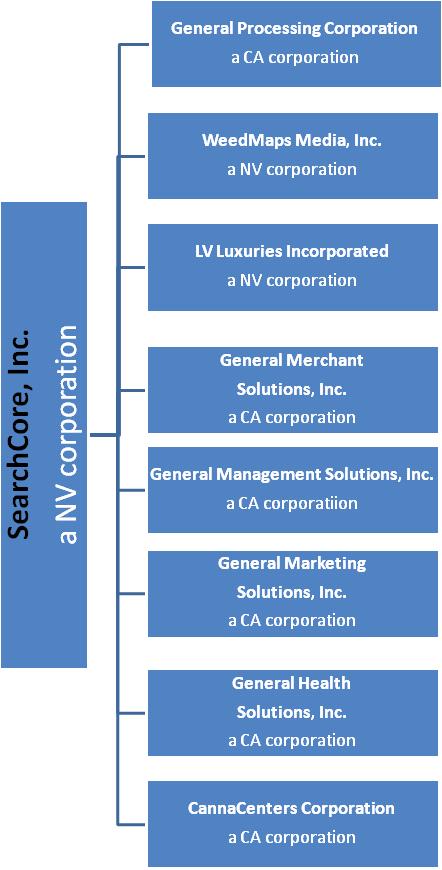

All of our operations are conducted through our wholly-owned subsidiaries, each of which is incorporated or qualified to do business in the states in which it does so.

Recent Name Change

Effective on January 6, 2012, we changed our name from General Cannabis, Inc. to SearchCore, Inc. This change was to more accurately highlight the technology aspect of our business, and our intentions to expand into lines of business outside of the medicinal cannabis industry.

Controlled Substances Act

Because the business activities of some of our customers is illegal under the Federal Controlled Substances Act, we may be deemed to be aiding and abetting illegal activities through the services that we provide to those customers. Thus, our business, and specifically the advertisements we sell for activities that may be deemed to be illegal under federal law, may be found to be in violation of this law, and the federal government could decide to bring an action against us. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Corporate Information

SearchCore, Inc. was formed on July 14, 2003 in the State of Nevada as Tora Technologies, Inc. On November 21, 2006, it changed its name to Makeup.com Limited, on January 29, 1010, it changed its name to LC Luxuries Limited, and on November 5, 2010, it changed its name to General Cannabis, Inc. Finally, on January 6, 2012, the company changed its name to SearchCore, Inc.

Our corporate headquarters are located at 1300 Dove Street, Suite 100, Newport Beach, California 92660, and our telephone number is (855) 420-2262. Our website is http://www.searchcore.com/. Information contained on our website is not incorporated into, and does not constitute any part of, this prospectus.

4

The Offering

|

Securities Offered:

|

|

|

Shares Offered by SearchCore:

|

We are registering to sell to new investors up to 5,000,000 shares of common stock. We will sell these shares to new investors at $3.00 per share. |

|

Shares Offered by Selling Stockholders:

|

We are registering 4,397,500 shares for sale by 30 selling stockholders, all of which are existing holders of our common stock (see list of Selling Stockholders).

|

5

RISK FACTORS

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information, together with the other information contained in this prospectus, before you decide to buy our common stock. If one or more of the following events actually occurs, our business will suffer, and as a result our financial condition or results of operations will be adversely affected. In this case, the market price, if any, of our common stock could decline, and you could lose all or part of your investment in our common stock.

We face risks in developing our products and services and eventually bringing them to market. We also face risks that we will lose some, or all of our market share in existing businesses to competition, or we risk that our business model becomes obsolete. The following risks are material risks that we face. If any of these risks occur, our business, our ability to achieve revenues, our operating results and our financial condition could be seriously harmed. We are not engaged in the growing, harvesting, cultivation, possession, or distribution of cannabis. Instead, we assist the physicians, dispensaries, and end-users within the medicinal cannabis industry in finding each other. The physicians and medical clinics are our direct clients. However, other entities in the medicinal cannabis industry, such as dispensaries, may and do utilize our internet finder sites in order to procure business.

Risk Factors Related to the Business of the Company

Some of the business activities of some of our customers, while believed to be compliant with applicable state law, are illegal under federal law because they violate the Federal Controlled Substances Act. If our customers are closed by law enforcement authorities, it will materially and adversely affect our business.

The medicinal cannabis industry is currently conducted in the 16 states, plus the District of Columbia, that have passed laws either decriminalizing or legalizing the medicinal use of cannabis. However, under United States federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Most of our customers are dispensaries that possess and transfer cannabis which we believe are for medical purposes, and we manage physician offices where patients, if warranted, receive a letter of recommendation from a physician permitting them to enter a dispensary and acquire medicinal cannabis, both of which are considered to be illegal under the Controlled Substances Act. We do have customers that are not involved in the medicinal cannabis industry, although they are not material to our overall business. The federal, and in some cases state, law enforcement authorities have frequently closed down dispensaries and investigated and/or closed physician offices that provide medicinal cannabis recommendations. To the extent that an affected dispensary or physician office is a customer of ours, and that dispensary or physician office is closed, it will negatively affect our revenue, and to the extent that it prevents or discourages new dispensaries and physician offices from entering the medicinal cannabis industry, we will have fewer customers and thus it would have a material negative affect on our business and operations.

Recently, the U.S. Attorney’s Office in California has publicized their intent to pursue not only growers and sellers of medicinal cannabis, but also newspapers, radio stations, and other outlets that run advertisements for medicinal cannabis dispensaries. Dispensaries constitute a material percentage of our revenue stream, and if they were prevented from advertising and thus growing their business, it could have a material adverse effect on ours. In addition, while not specifically identified in the publicized statements, our websites could be considered an outlet that runs advertisements for the medicinal cannabis industry. Thus, our business, and specifically the advertisements we sell for activities that may be deemed to be illegal under federal law, may be found to be in violation of this law, and the federal government could decide to bring an action against us. Legal action by the U.S. Attorney’s Office against outlets such as ours that run advertisements for dispensaries may have a material effect on our business. Predicated on the legal action taken, it may cause a decrease in sales to the point where we are unable to continue as a going concern.

6

Because the business activities of some of our customers is illegal under the Federal Controlled Substances Act, we may be deemed to be aiding and abetting illegal activities through the services that we provide to those customers. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Under United States federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. We provide services to customers that are engaged in those illegal businesses. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a).

Our business, and specifically the advertisements we sell for activities that may be deemed to be illegal under federal law, may be found to be in violation of this law, and the federal government could decide to bring an action against us. As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

On December 19, 2011, we announced in a current report filed with OTC Markets that management believes our acquisition of WeedMaps, LLC in November, 2010 may be more accurately reflected if it was accounted for as a reverse acquisition accompanied by a recapitalization (a capital transaction in substance) with no goodwill being recorded. Likewise, our acquisition of Synergistic Resources, LLC in December, 2010 may be more accurately reflected if it is accounted for as a business combination using the acquisition method (fair value), where the excess of the fair value of consideration transferred is considered to be goodwill. Following consultation with our auditors, on February 28, 2012 we restated our financial statements for the fiscal quarters ended March 31, 2011, June 30, 2011, and September 30, 2011, and for the year ended December 31, 2010. Our restatements included a reduction to the amount allocated to the management contract intangible asset and the amortization period, the reclassification of the earn-out provision from equity to liability, and the expensing of the capitalized software costs. See Note 25 to our Financial Statements.

We previously concluded that the net change in the fair value of the earn-out liability was immaterial to our net income and as a result did not record a change in the earn-out liability. However, after further consideration of qualitative as well as quantitative factors, we concluded that the change in the fair value of the earn-out liability was material to our operations and as a result, we recorded a change in the earn-out liability at December 31, 2011. The correction of this error resulted in the fair value of the earn-out liability at December 31, 2011. See Note 26 to our Financial Statements. We cannot assure that there are no significant deficiencies or material weaknesses in our existing controls or that we have effective disclosure controls and procedures and internal controls over financial reporting.

The restatement of these financial statements may lead to legal and regulatory issues. If such issues were to arise, the defense of any such issues may cause the diversion of management’s attention and resources, and may require the payment of damages if any such claims or proceedings are not resolved in our favor. Even if resolved favorably, there could be significant expenses. This may also affect our ability to raise capital or obtain financing. Additionally this may result in the resignation of our auditors which may, among other things, cause a delay in the preparation of future financial statements and increase expenditures related to the retention of new auditors. The process of retaining new auditors may limit our access to the capital markets for an extended period of time. Moreover, the potential negative publicity focusing on the restatement and negative reactions from stockholders, creditors or others with whom business is conducted, in conjunction with or separately from, the occurrence of any of the foregoing, could harm our business and reputation and cause the price of our common stock to decline.

7

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of operations. We may not successfully address all of the risks and uncertainties or successfully implement our existing and new products and services. If we fail to do so, it could materially harm our business and impair the value of our common stock, resulting in a loss to shareholders. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate. Although we were incorporated in Nevada in 2003, the vast majority of the business that we conduct now was started or acquired in 2010. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing new products and services. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development, the inability to employ or retain talent, inadequate sales and marketing, and regulatory concerns. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce, curtail, or discontinue operations. No assurance can be given that we can or will ever be successful in our operations and operate profitably.

Approximately 14% of our gross revenue in 2011 came from a single contractual arrangement with a professional medical corporation that owns medicinal cannabis clinics. During February 2012, we committed to a definitive plan to terminate the management agreement and services associated with the agreement, which resulted in our Medical Clinic Management segment being reported as discontinued operations. As a result, we will lose significant revenue.

We have decided to terminate our management agreement resulting in the closure of General Health Solutions, Inc., which constitutes our entire Medical Clinic Management segment. During February 2012, we committed to a definitive plan to terminate the management agreement and services associated with the agreement, which resulted in General Health Solutions, Inc., our Medical Clinic Management segment being reported as discontinued operations. We anticipate being fully divested of all management responsibilities as per the management agreement by the close of the first quarter of 2012. For comparative purposes, all prior periods presented have been restated to reflect the reclassification of this segment to discontinued operations on a consistent basis. As a result, we did not record approximately $2 million in revenues for the fiscal year ended December 31, 2011. See Note 9. Discontinued Operations.

If we are unable to meet our future capital needs, we may be required to reduce or curtail operations, or shut down completely.

To date we have relied on cash flow from operations and funding from a small group of individual investors, including James Pakulis, to fund operations. We have limited cash liquidity and capital resources. Our cash on hand as of December 31, 2011, was approximately $1.51 million. For the year ended December 31, 2011, our total revenue was approximately $11.92 million, our operating income was $1.45 million, and our net income from continuing operations was approximately $1.02 million.

Our future capital requirements will depend on many factors, including our ability to market our products successfully, cash flow from operations, locating and retaining talent, and competing market developments. Our business model requires that we spend money (primarily on advertising and marketing) in order to generate revenue. Based on our current financial situation we may have difficulty continuing our operations at their current level, or at all, if we do not raise additional financing in the near future. Additionally, we would like to continue to acquire assets and operating businesses, which will likely require additional cash. Although we currently have no specific plans or arrangements for acquisitions or financing, we intend to raise funds through private placements, public offerings or other financings. Any equity financings would result in dilution to our then-existing stockholders. Sources of debt financing may result in higher interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we may be required to reduce, curtail, or discontinue operations. There is no assurance that our existing cash flow will be adequate to satisfy our existing operating expenses and capital requirements.

8

Because we face intense competition, we may not be able to operate profitably in our markets.

The market for the services that we offer is highly competitive. The competition will most likely increase if more states permit the use of medicinal cannabis. The increased competition may hinder our ability to successfully market our products and services. We may not have the resources, expertise or other competitive factors to compete successfully in the future. We expect to face additional competition from existing competitors and new market entrants in the future. Some of our competitors will have greater resources than we do. As a result, these competitors may be able to:

|

●

|

develop and expand their product and service offerings more rapidly;

|

|

●

|

adapt to new or emerging changes in customer requirements more quickly;

|

|

●

|

take advantage of acquisition and other opportunities more readily; and

|

|

●

|

devote greater resources to the marketing and sale of their products and adopt more aggressive pricing policies than we can. See “The Company - Competition.”

|

If no additional states allow the medicinal use of cannabis, or if one or more states that currently allow it reverse their position, we may not be able to continue our growth, or the market for our products and services may decline.

Currently, sixteen states and the District of Columbia allow the use of medicinal cannabis. There can be no assurance that the number of states that allow the use of medicinal cannabis will grow, and if it does not, there can be no assurance that the sixteen existing states and/or the District of Columbia won’t reverse their position and disallow it. If either of these things happens, then not only will the growth of our business be materially impacted, we may experience declining revenue as the market for our products and services declines.

If we are unable to attract and retain key personnel, we may not be able to compete effectively in our market.

Our success will depend, in part, on our ability to attract and retain key management, including primarily James Pakulis and Douglas Francis, but also our technical experts and sales and marketing personnel. We attempt to enhance our management and technical expertise by recruiting qualified individuals who possess desired skills and experience in certain targeted areas. We have also employed management from companies that we have acquired. Our inability to retain employees and attract and retain sufficient additional employees, and information technology, engineering and technical support resources, could have a material adverse effect on our business, financial condition, results of operations and cash flows. The loss of key personnel could limit our ability to develop and market our products.

Because our officers and directors control a large percentage of our common stock, they have the ability to influence matters affecting our shareholders.

Our officers and directors beneficially own over 68% of our outstanding common stock. As a result, they have the ability to influence matters affecting our shareholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares. Because they control such shares, investors may find it difficult to replace our directors and management if they disagree with the way our business is being operated. Because the influence by these insiders could result in management making decisions that are in the best interest of those insiders and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock. See “Principal Shareholders.”

9

We may not be able to effectively manage our growth and operations, which could materially and adversely affect our business.

We have, and may in the future, experience rapid growth and development in a relatively short period of time. The management of this growth will require, among other things, continued development of our financial and management controls and management information systems, stringent control of costs, increased marketing activities, the ability to attract and retain qualified management personnel and the training of new personnel. We intend to utilize outsourced resources, and hire additional personnel, in order to manage our expected growth and expansion. Failure to successfully manage our possible growth and development could have a material adverse effect on our business and the value of our common stock.

In the states where medicinal cannabis is permitted, local laws and regulations could adversely affect our clients, including causing some of them to close, which would materially and adversely affect our business.

Even in areas where the medicinal use of cannabis is legal under state law, there are also local laws and regulations that affect our clients. For example, in some cities or counties a medical cannabis dispensary is prohibited from being located within a certain distance from schools or churches. These local laws and regulations may cause some of our customers to close, impacting our revenue and having a material effect on our business and operations. In addition, the enforcement of identical rules or regulations as it pertains to medicinal cannabis may vary from municipality to municipality, or city to city.

Our websites are visible in jurisdictions where medicinal use of cannabis is not permitted, and as a result we may be found to be violating the laws of those jurisdictions.

Internet websites are visible by people everywhere, not just in jurisdictions where the activities described therein are considered legal. As a result, we may face legal action from a state or other jurisdiction against us for engaging in activity illegal in that state or jurisdiction.

Our industry is experiencing rapid growth and consolidation that may cause us to lose key relationships and intensify competition.

The medicinal cannabis industry is undergoing rapid growth and substantial change. This includes new states that may allow medicinal use of marijuana. This has resulted in increasing consolidation and formation of strategic relationships. For example, we have already consolidated several businesses in the medicinal cannabis industry, and we have entered into strategic advertising relationships with a laboratory that tests cannabis. A cancellation of our relationship with this group or any group that we form a relationship in the future may have a negative impact on the company because it could limit our advertising exposure or the number of customers that use our websites. We make no assurance that any relationship we have established will continue.

Acquisitions or other consolidating transactions that don’t involve us could nevertheless harm us in a number of ways, including:

|

●

|

we could lose strategic relationships if our strategic partners are acquired by or enter into relationships with a competitor (which could cause us to lose access to distribution, content, technology and other resources);

|

|

●

|

The relationship between us and the strategic partner may deteriorate and cause an adverse effect on our business;

|

|

●

|

we could lose customers if competitors or users of competing technologies consolidate with our current or potential customers; and

|

|

●

|

our current competitors could become stronger, or new competitors could form, from consolidations.

|

Any of these events could put us at a competitive disadvantage, which could cause us to lose customers, revenue and market share. Consolidation could also force us to expend greater resources to meet new or additional competitive threats, which could also harm our operating results.

10

We rely on the continued reliable operation of third parties’ systems and networks and, if these systems and networks fail to operate or operate poorly, our business and operating results will be harmed.

Our operations are in part dependent upon the continued reliable operation of the information systems and networks of third parties. These include a variety of service providers including web browsers sites such as Google or MSN in which the majority of our customers locate us, internet and telephone providers or other communication providers such as for cell phone and texting. If these third parties do not provide reliable operation, our ability to service our customers will be impaired and our business, reputation and operating results could be harmed.

The Internet and our network are subject to security risks that could harm our business and reputation and expose us to litigation or liability.

Online commerce and communications depend on the ability to transmit confidential information and licensed intellectual property securely over private and public networks. Any compromise of our ability to transmit and store such information and data securely, and any costs associated with preventing or eliminating such problems, could damage our business, hurt our ability to distribute products and services and collect revenue, threaten the proprietary or confidential nature of our technology, harm our reputation, and expose us to litigation or liability. We also may be required to expend significant capital or other resources to protect against the threat of security breaches or hacker attacks or to alleviate problems caused by such breaches or attacks. Any successful attack or breach of our security could hurt consumer demand for our products and services, and expose us to consumer class action lawsuits and harm our business.

We may be unable to adequately protect our proprietary rights.

Our ability to compete partly depends on the superiority, uniqueness and value of our intellectual property and technology, including both internally developed technology and technology licensed from third parties. To the extent we are able to do so, in order to protect our proprietary rights, we will rely on a combination of trademark, copyright and trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions. Despite these efforts, any of the following occurrences may reduce the value of our intellectual property:

|

●

|

Our applications for trademarks and copyrights relating to our business may not be granted and, if granted, may be challenged or invalidated;

|

|

●

|

Issued trademarks and registered copyrights may not provide us with any competitive advantages;

|

|

●

|

Our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology;

|

|

●

|

Our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we develop; or

|

|

●

|

Another party may obtain a blocking patent and we would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products.

|

We may be forced to litigate to defend our intellectual property rights, or to defend against claims by third parties against us relating to intellectual property rights.

We may be forced to litigate to enforce or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of other parties’ proprietary rights. Any such litigation could be very costly and could distract our management from focusing on operating our business. The existence and/or outcome of any such litigation could harm our business.

Further, because the content of much of our intellectual property concerns cannabis and other activities that are not legal in some state jurisdictions, we may face additional difficulties in defending our intellectual property rights.

11

Interpretation of existing laws that did not originally contemplate the Internet could harm our business and operating results.

The application of existing laws governing issues such as property ownership, copyright and other intellectual property issues to the Internet is not clear. Many of these laws were adopted before the advent of the Internet and do not address the unique issues associated with the Internet and related technologies. In many cases, the relationship of these laws to the Internet has not yet been interpreted. New interpretations of existing laws may increase our costs, require us to change business practices or otherwise harm our business.

It is not yet clear how laws designed to protect children that use the Internet may be interpreted, and such laws may apply to our business in ways that may harm our business.

The Child Online Protection Act and the Child Online Privacy Protection Act impose civil and criminal penalties on persons distributing material harmful to minors (e.g., obscene material) over the Internet to persons under the age of 17, or collecting personal information from children under the age of 13. We do not knowingly distribute harmful materials to minors or collect personal information from children under the age of 13. The manner in which these Acts may be interpreted and enforced cannot be fully determined, and future legislation similar to these Acts could subject us to potential liability if we were deemed to be non-compliant with such rules and regulations, which in turn could harm our business.

We may be subject to market risk and legal liability in connection with the data collection capabilities of our products and services.

Many of our products are interactive Internet applications that by their very nature require communication between a client and server to operate. To provide better consumer experiences and to operate effectively, our products send information to our servers. Many of the services we provide also require that a user provide certain information to us. We post an extensive privacy policy concerning the collection, use and disclosure of user data involved in interactions between our client and server products.

Because we are in the cannabis industry, we have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional risk and financial liabilities.

Insurance that is otherwise readily available, such as workers compensation, general liability, and directors and officers insurance, is more difficult for us to find, and more expensive, because we engaged in the medicinal cannabis industry. Thus far, we have been successful in finding such policies, however it is at a cost that is higher than other businesses. There are no guarantees that we will be able to find such insurances in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

Risks Related To Our Common Stock

As a result of published articles and research reports, and television interviews by our Chief Executive Officer that mentioned our offering, we may have violated Section 5 of the Securities Act, and may have to rescind sales of our securities pursuant to this Prospectus.

Section 5 of the Securities Act prohibits the offer and sale of the securities included in this Prospectus prior to the effectiveness of the registration statement of which this Prospectus is a part. During the time that this Prospectus was under review by the Commission, several articles and research reports were published that referenced us, the medicinal cannabis industry, and this offering. In addition, our Chief Executive Officer, James Pakulis, participated in television interviews with Fox News and MSNBC that discussed the company, the medicinal cannabis industry, and this offering. It is possible that these public communications could be considered an offer of securities in violation of Section 5. If they were deemed to be an offer in violation of Section 5 by the Commission or a state securities regulator, they could force us to make a rescission offer to some or all of the purchasers of the securities. At the time of a rescission offer, we may or may not have the resources to fund the repurchase of the securities, and it may have a detrimental effect on our business and operations.

12

Our common stock is listed for quotation on the OTCQX tier of the marketplace maintained by OTC Markets Group, Inc., which may make it more difficult for investors to resell their shares due to suitability requirements.

Our common stock is currently quoted on the OTCQX tier of the marketplace maintained by OTC Markets Group, Inc. Broker-dealers often decline to trade in over the counter stocks given the market for such securities are often limited, the stocks are more volatile, and the risk to investors is greater. These factors may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of their shares. This could cause our stock price to decline.

If we are unable to pay the costs associated with being a public, reporting company, we may not be able to continue trading on the OTCQX and/or we may be forced to discontinue operations.

We expect to have significant costs associated with being a public, reporting company, which may raise substantial doubt about our ability to continue trading on the OTCQX and/or continue as a going concern. These costs include compliance with the Sarbanes-Oxley Act of 2002, which will be difficult given the limited size of our management, and we will have to rely on outside consultants. Accounting controls, in particular, are difficult and can be expensive to comply with.

Our ability to continue trading on the OTCQX and/or continue as a going concern will depend on positive cash flow, if any, from future operations and on our ability to raise additional funds through equity or debt financing. If we are unable to achieve the necessary product sales or raise or obtain needed funding to cover the costs of operating as a public, reporting company, our common stock may be deleted from the OTCQX and/or we may be forced to discontinue operations.

We do not intend to pay dividends in the foreseeable future.

We do not intend to pay any dividends in the foreseeable future. We do not plan on making any cash distributions in the manner of a dividend or otherwise. Our Board presently intends to follow a policy of retaining earnings, if any.

We have the right to issue additional common stock and preferred stock without consent of stockholders. This would have the effect of diluting investors’ ownership and could decrease the value of their investment.

We have additional authorized, but unissued shares of our common stock that may be issued by us for any purpose without the consent or vote of our stockholders that would dilute stockholders’ percentage ownership of our company.

In addition, our certificate of incorporation authorizes the issuance of shares of preferred stock, the rights, preferences, designations and limitations of which may be set by the Board of Directors. Our certificate of incorporation has authorized issuance of up to 20,000,000 shares of preferred stock in the discretion of our Board. The shares of authorized but undesignated preferred stock may be issued upon filing of an amended certificate of incorporation and the payment of required fees; no further stockholder action is required. If issued, the rights, preferences, designations and limitations of such preferred stock would be set by our Board and could operate to the disadvantage of the outstanding common stock. Such terms could include, among others, preferences as to dividends and distributions on liquidation.

13

Our President and Chief Executive Officer will eventually be permitted to sell some of their stock, which may have a negative effect on our stock price and ability to raise additional capital, and may make it difficult for investors to sell their stock at any price.

Douglas Francis and James Pakulis, our President and Chief Executive Officer, respectively, are the owners of an aggregate of 57,804,579 shares of our common stock, representing over 68% of our total issued shares. On October 17, 2011, we entered into a Lock-Up Agreement with each of them that prevents them from selling any of their securities until the earlier to occur of (i) three months after effectiveness of the registration statement of which this prospectus is a part, (b) we are no longer selling our securities in a primary sale pursuant to the registration statement, or (c) the closing sale price for our common stock is over $3.00 for twenty (20) consecutive trading days. Once one or more of these conditions are satisfied, either of them may be able to sell up to 1% of our outstanding stock (currently approximately 831,000 shares) every 90 days in the open market pursuant to Rule 144, which may have a negative effect on our stock price and may prevent us from obtaining additional capital. In addition, if either of them are selling their stock into the open market, it may make it difficult or impossible for investors to sell their stock at any price.

Our common stock is governed under The Securities Enforcement and Penny Stock Reform Act of 1990.

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such exceptions include any equity security listed on NASDAQ and any equity security issued by an issuer that has (i) net tangible assets of at least $2,000,000, if such issuer has been in continuous operation for three years, (ii) net tangible assets of at least $5,000,000, if such issuer has been in continuous operation for less than three years, or (iii) average annual revenue of at least $6,000,000, if such issuer has been in continuous operation for less than three years. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

14

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this prospectus, including the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation, and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are only predictions and involve known and unknown risks and uncertainties, including the risks outlined under “Risk Factors” and elsewhere in this prospectus.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievement. We are not under any duty to update any of the forward-looking statements after the date of this prospectus to conform these statements to actual results, unless required by law.

15

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders in this offering. However, if we are able to sell the entire 5,000,000 shares we will receive up to $15,000,000 from the sale of common stock we are registering at $3.00 per share, in an offering conducted by our officers and directors.

We do not intend to engage any broker/dealers for the sale of the shares, and thus do not expect to pay any sales commissions, in which event, if all shares are sold, the net proceeds to us would be $15,000,000 based on an offering price of $3.00 per share. However, if we do decide to pay sales commissions, the net proceeds (at an offering price of $3.00 per share and potential sales commissions of up to 10% of the gross proceeds) from the sale of all the shares which we intend to offer to new investors would then be a maximum of $13,500,000. Furthermore, we will have paid expenses in connection with the registration and sale of the common stock by the selling security holders, who may be deemed to be underwriters in connection with their offering of shares.

These proceeds would be received from time to time as sales of these shares are made by us. As set forth in the following table, we will use those proceeds primarily for the acquisition of Internet intellectual property and revenue generating businesses, plus additional staffing needs, with the remainder used for general working capital for operations. We intend to use the proceeds in the following order of priority:

|

Assumed Offering (1)

|

Maximum Offering

|

|||||||||||||||

|

Description of Use

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||||||

|

Internet Domain Name Acquisitions

|

$ | 2,000,000 | 40 | % | $ | 5,000,000 | 33.3 | % | ||||||||

|

Business Acquisitions

|

1,000,000 | 20 | % | 6,000,000 | 40.0 | % | ||||||||||

|

Staffing Needs

|

500,000 | 10 | % | 1,500,000 | 10.0 | % | ||||||||||

|

Working Capital

|

1,500,000 | 30 | % | 2,500,000 | 16.7 | % | ||||||||||

|

Total (2)

|

$ | 5,000,000 | 100.0 | % | $ | 15,000,000 | 100.0 | % | ||||||||

|

(1)

|

Assumes that we raise $5,000,000 in this offering. This offering is conducted on a best efforts basis with no minimum; therefore, we could raise less than $5,000,000.

|

|

(2)

|

The Offering is being sold by our officers and directors, who will not receive any compensation for their efforts. No sales fees or commissions will be paid to such officers or directors. Shares may be sold by registered broker or dealers who are members of the NASD and who enter into a Participating Dealer Agreement with us. Such brokers or dealers may receive commissions up to ten percent (10%) of the price of the Shares sold.

|

16

The above budgeted amounts are only for initial working purposes since we do not know how much we will need to spend on these items. Even if we are able to sell the maximum shares and we are not able to sufficiently expand operations and increase revenues, we do not know how long these funds will last, and we have no other specific plans for raising additional funds. The portion of any net proceeds not immediately required will be invested in certificates of deposit or similar short-term interest bearing instruments.

DETERMINATION OF OFFERING PRICE

Our management has established the price of $3.00 per share based upon their estimates of the market value of SearchCore, Inc. (formerly General Cannabis, Inc.) and the price at which potential investors might be willing to purchase the shares offered. In making the determination as to the offering price, our management considered factors such as our revenues, our net income, the price that other arms-length investors have paid recently for our common stock, the number of shares of our common stock that are issued and outstanding, as well as the number of shares in our float, and the impact on our market of the extended quiet period necessitated by the registration statement of which this Prospectus is a part.

We are registering up to 4,397,500 shares for resale by existing holders of our common stock. These shares may be sold by the selling stockholder at prevailing market prices or privately negotiated prices on any over the counter quotation medium or inter-dealer quotation system.

17

The following table provides information with respect to shares offered by the selling stockholders:

|

Selling stockholder

|

Shares for

sale

|

Shares before offering

|

Percent before offering

|

Shares after offering

|

Percent after offering (1)

|

||||||||||||||

|

Ardelu Trust (2)

|

200,000 | 200,000 |

<1%

|

- | - | ||||||||||||||

|

Steven J. Baldwin

|

20,000 | 20,000 |

<1%

|

- | - | ||||||||||||||

|

Robert S. Wrinkle

|

2,000 | 2,000 |

<1%

|

- | - | ||||||||||||||

|

Harvey L. & Harlene F. Backman Rev Fam Tr (3)

|

36,000 | 36,000 |

<1%

|

- | - | ||||||||||||||

|

James A. & Jenifer A. Ryan

|

1,000 | 1,000 |

<1%

|

- | - | ||||||||||||||

|

Mark & Analee Reutlinger (Community Property)

|

100,000 | 100,000 |

<1%

|

- | - | ||||||||||||||

|

Mircha Panduru

|

5,000 | 5,000 |

<1%

|

- | - | ||||||||||||||

|

Ronald L. Webb

|

3,000 | 3,000 |

<1%

|

- | - | ||||||||||||||

|

Raphael A. Morris

|

100,000 | 100,000 |

<1%

|

- | - | ||||||||||||||

|

Robert and Leonora Turkovich, JT

|

30,000 | 30,000 |

<1%

|

- | - | ||||||||||||||

|

Robert M. Phillps

|

1,000 | 1,000 |

<1%

|

- | - | ||||||||||||||

|

Sherrie L. Backman

|

20,000 | 20,000 |

<1%

|

- | - | ||||||||||||||

|

Brian Fritz

|

15,000 | 15,000 |

<1%

|

- | - | ||||||||||||||

|

Penelope S. McTaggart

|

50,000 | 50,000 |

<1%

|

- | - | ||||||||||||||

|

David E. Backman

|

10,000 | 10,000 |

<1%

|

- | - | ||||||||||||||

|

Monty M. Elkins 1995 Trust (4)

|

4,500 | 4,500 |

<1%

|

- | - | ||||||||||||||

|

Ronnie Colsen

|

50,000 | 50,000 |

<1%

|

- | - | ||||||||||||||

|

Mark Oring

|

25,000 | 25,000 |

<1%

|

- | - | ||||||||||||||

|

Craig R. Jonov

|

100,000 | 100,000 |

<1%

|

- | - | ||||||||||||||

|

Kim Opler

|

375,000 | 375,000 |

<1%

|

- | - | ||||||||||||||

|

Donald B. Lashley

|

125,000 | 125,000 |

<1%

|

- | - | ||||||||||||||

|

Millennium Trust Company, LLC FBO Sherrie Backman Roth IRA

|

30,000 | 30,000 |

<1%

|

- | - | ||||||||||||||

|

Revyv, LLC (5)

|

250,000 | 500,000 |

<1%

|

250,000 |

<1%

|

||||||||||||||

|

Synergistic Resources, LLC (6)

|

2,000,000 | 2,000,000 | 2.40% | - | - | ||||||||||||||

|

Justin Hartfield (7)

|

250,000 | 8,200,000 | 9.84% | 7,950,000 | 9.0 | % | |||||||||||||

|

Keith Hoerling (7)

|

250,000 | 8,200,000 | 9.84% | 7,950,000 | 9.0 | % | |||||||||||||

|

Millennium Trust Company, LLC FBO David E Backman Roth IRA #90GP29016

|

50,000 | 50,000 |

<1%

|

- | - | ||||||||||||||

|

Nina Beatrice Rung-Hoch

|

120,000 | 120,000 |

<1%

|

- | - | ||||||||||||||

|

The Lebrecht Group, APLC (8)

|

100,000 | 100,000 |

<1%

|

- | - | ||||||||||||||

|

Adnant, LLC (9)

|

75,000 | 75,000 |

<1%

|

- | - | ||||||||||||||

|

Total

|

4,397,500 | 20,547,500 | 24.7 | % | 16,150,000 | 18.3 | % | ||||||||||||

18

|

(1)

|

Based on 88,340,256 shares outstanding, which includes the 5,000,000 shares offered for sale to new investors by us in this offering. This offering is on a best-efforts basis with no minimum, therefore, we could sell less than 5,000,000 shares being offered to new investors.

|

|

(2)

|

The trust is controlled by Randall Delue.

|

|

(3)

|

The trust is controlled by Harvey L. & Harlene F. Backman, its Trustees.

|

|

(4)

|

The trust is controlled by Monty M. Elkins, its Trustee.

|

|

(5)

|

Revyv, LLC is controlled by James Johnson, Robert Johnson, and David Johnson, its members. James Johnson and David Johnson were formerly employed by our wholly-owned subsidiary, General Management Solutions, Inc.

|

|

(6)

|

Synergistic Resources, LLC is controlled by Brent Inzer, its manager. Brent Inzer is employed by us.

|

|

(7)

|

All shares of stock held by Mr. Hartfield and Mr. Hoerling (whether included in this registration statement or not) are subject to a written lock-up agreement whereby none of the shares may be sold prior to June 30, 2011, up to twenty five percent (25%) of the shares may be sold beginning on June 30, 2011, and the remaining shares may be sold beginning on November 30, 2011. Mr. Hartfield and Mr. Hoerling are employed by us.

|

|

(8)

|

The Lebrecht Group, APLC is our legal counsel. Voting and dispositive control for securities owned by The Lebrecht Group, APLC is with Brian A. Lebrecht.

|

|

(9)

|

Adnant, LLC is controlled by Sabas Carrillo, its manager. Mr. Carrillo provides services to us as an independent contractor in the areas of accounting and financial statement preparation.

|

All of the shares held by the selling stockholders are restricted securities as that term is defined in Rule 144 promulgated under the Securities Act of 1933. Further, SearchCore, Inc. (formerly General Cannabis, Inc.) was, prior to November 19, 2010, a non-operating shell company. As a result, selling shareholders are not eligible to resell their shares in the open market unless and until the earlier of (i) the effectiveness of the registration statement of which this Prospectus is a part, or (ii) until SearchCore “cures” its shell status by meeting the following requirements: (1) it is no longer a shell company as defined in Rule 144(i)(1), (2) it is subject to the reporting requirements of the Exchange Act and has filed all reports (other than Form 8-K reports) required under the Exchange Act for the preceding 12 months (or for a shorter period that the issuer was required to file such reports and materials); and, (3) it has filed current “Form 10 information” with the Commission reflecting its status as an entity that is no longer an issuer described in Rule 144(i)(1), and at least one year has elapsed since the issuer filed that information with the Commission. The Company filed “Form 10 information” with the Commission on March 3, 2011. Those selling stockholders that are affiliates will further be limited to selling a maximum of one percent (1%) of our outstanding shares of common stock every 90 days.

19

PLAN OF DISTRIBUTION

We, through our officers and directors, intend to offer up to 5,000,000 shares at a price of $3.00 per share to potential investors. We have not at this point engaged any broker-dealers licensed by The Financial Industry Regulatory Authority for the sale of these shares and presently have no intention to do so. If we engaged any broker-dealers, they may be acting as underwriters for the offering of these shares.

Our officers and directors intend to seek to sell the common stock to be sold by us in this offering by contacting persons with whom they have had prior contact who have expressed interest in us, and by seeking additional persons who may have interest through various methods such as mail, telephone, and email. Any solicitations by mail, telephone, or email will be preceded by or accompanied by a copy of this Prospectus. We do not intend to offer the securities over the Internet or through general solicitation or advertising. Our officers and directors are relying on an exemption from registration as a broker-dealer pursuant to Rule 3a4-1 of the Securities Exchange Act of 1934 in that they are not statutorily disqualified, are not associated with a broker or dealer, are not receiving compensation related to these transactions, and perform substantial other duties for us.

Our common stock is quoted on the OTCQX tier of the marketplace maintained by OTC Markets Group, Inc. under the symbol “SRER.” The selling stockholders will be able to sell their shares referenced under “Selling Security Holders” from time to time at prevailing market prices or in privately negotiated sales. Any securities sold in brokerage transactions will involve customary brokers’ commissions.

We will pay all expenses in connection with the registration and sale of the common stock by the selling security holders, who may be deemed to be underwriters in connection with their offering of shares. The estimated expenses of issuance and distribution are set forth below:

|

Registration Fees

|

Approximately

|

$ | 7,900 | ||

|

Transfer Agent Fees

|

Approximately

|

500 | |||

|

Costs of Printing and Engraving

|

Approximately

|

500 | |||

|

Legal Fees

|

Approximately

|

45,000 | |||

|

Accounting and Audit Fees

|

Approximately

|

35,000 | |||

|

Total

|

$ | 88,900 |

Under the securities laws of certain states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. The selling stockholders are advised to ensure that any underwriters, brokers, dealers or agents effecting transactions on behalf of the selling stockholders are registered to sell securities in all fifty states. In addition, in certain states the shares of common stock may not be sold unless the shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and we have complied with them. The selling stockholders and any brokers, dealers or agents that participate in the distribution of common stock may be considered underwriters, and any profit on the sale of common stock by them and any discounts, concessions or commissions received by those underwriters, brokers, dealers or agents may be considered underwriting discounts and commissions under the Securities Act of 1933.

20

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such exceptions include any equity security listed on NASDAQ and any equity security issued by an issuer that has (i) net tangible assets of at least $2,000,000, if such issuer has been in continuous operation for three years, (ii) net tangible assets of at least $5,000,000, if such issuer has been in continuous operation for less than three years, or (iii) average annual revenue of at least $6,000,000, if such issuer has been in continuous operation for less than three years. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

In accordance with Regulation M under the Securities Exchange Act of 1934, neither we nor the selling stockholders (other than our officers and directors who will sell shares of common stock on our behalf, and then only in compliance with Regulation M) may bid for, purchase or attempt to induce any person to bid for or purchase, any of our common stock while we or they are selling stock in this offering. Neither we nor any of the selling stockholders intends to engage in any passive market making or undertake any stabilizing activity for our common stock. None of the selling stockholders will engage in any short selling of our securities. We have been advised that under the rules and regulations of the FINRA, any broker-dealer may not receive discounts, concessions, or commissions in excess of 10% in connection with the sale of any securities registered hereunder.

On October 17, 2011, we entered into a Lock-Up Agreement with James Pakulis and Douglas Francis that prevents them from selling any of their securities until the earlier to occur of (i) three months after effectiveness of the registration statement of which this prospectus is a part, (b) we are no longer selling our securities in a primary sale pursuant to the registration statement, or (c) the closing sale price for our common stock is over $3.00 for twenty (20) consecutive trading days.

21

DESCRIPTION OF SECURITIES

Our authorized capital stock consists of 200,000,000 shares of common stock, par value $0.001, and 20,000,000 shares of preferred stock, par value $0.001. As of the date of this Registration Statement, there are 83,340,256 shares of our common stock issued and outstanding, and no shares of preferred stock issued or outstanding.

Common Stock. Each shareholder of our common stock is entitled to a pro rata share of cash distributions made to shareholders, including dividend payments. The holders of our common stock are entitled to one vote for each share of record on all matters to be voted on by shareholders. There is no cumulative voting with respect to the election of our directors or any other matter. Therefore, the holders of more than 50% of the shares voted for the election of those directors can elect all of the directors. The holders of our common stock are entitled to receive dividends when and if declared by our Board of Directors from funds legally available therefore. Cash dividends are at the sole discretion of our Board of Directors. In the event of our liquidation, dissolution or winding up, the holders of common stock are entitled to share ratably in all assets remaining available for distribution to them after payment of our liabilities and after provision has been made for each class of stock, if any, having any preference in relation to our common stock. Holders of shares of our common stock have no conversion, preemptive or other subscription rights, and there are no redemption provisions applicable to our common stock.

Preferred Stock. We are authorized to issue 20,000,000 shares of preferred stock. The rights, privileges, and preferences of our preferred stock can be set by our Board of Directors without further shareholder approval. We have not authorized or established any series’ of preferred stock, and none are anticipated. There are no shares of preferred stock issued or outstanding. The availability or issuance of these shares could delay, defer, discourage or prevent a change in control.

Dividend Policy. We have not declared or paid a cash dividend on our capital stock in our last two fiscal years and we do not expect to pay cash dividends on our common stock in the foreseeable future. We currently intend to retain our earnings, if any, for use in our business. Any dividends declared in the future will be at the discretion of our Board of Directors and subject to any restrictions that may be imposed by our lenders.

Options, Warrants and Convertible Securities. On November 19, 2010, we entered into an Agreement and Plan of Reorganization and Merger pursuant to which we acquired 100% of the membership interests of WeedMaps, LLC, a Nevada limited liability company. In addition to the consideration paid, the two principals of WeedMaps, LLC can collectively earn up to an aggregate of Sixteen Million (16,000,000) additional shares of our common stock pursuant to certain earn-out provisions in the Purchase Agreement (which earn-out provisions have been satisfied for the first year; we correspondingly expect to issue 6,000,000 shares in the second quarter of 2012).

Pursuant to the terms of a marketing services agreement with Crystal Research Associated, LLC dated October 5, 2010, we issued four-year warrants to acquire 250,000 shares of our common stock at $4.00 per share. Crystal Research will perform traditional investor relations services for us, including public dissemination of our financial and other information, as well as the preparation of a research report and up to four quarterly updates.

INTEREST OF NAMED EXPERTS AND COUNSEL

The Lebrecht Group, APLC serves as our legal counsel in connection with this offering. The Lebrecht Group owns 100,000 shares of our common stock.

22

DESCRIPTION OF BUSINESS

Recent Name Change

Effective on January 6, 2012, we changed our name from General Cannabis, Inc. to SearchCore, Inc. This change was to more accurately highlight the technology aspect of our business, and our intentions to expand into lines of business outside of the medicinal cannabis industry. Our core service is to help businesses (currently dispensaries) connect with consumers and businesses in their internet searches. Currently, when a consumer or business utilizes our technological platform, they are searching primarily for dispensaries, dispensary related items, social engagement and/or reviews. We believe that the success of our technology enables us to expand to non-cannabis related industries and provide comparable features. The company has not yet identified the specific industries in which it will offer our technological services. However, once we identify a viable industry, we will then apply the same technological methodology that we apply to the medicinal cannabis industry. Specifically, retaining a sales team to contact stores in that industry and offer our finder site and search engine optimization services. The stores will pay a fee to us, and we then will market and promote their products and services on a custom website. The end result is increased traffic to the stores, and increased revenue to us. Therefore, our business model is being modified in the sense that we are intending to expand our technology based services to a larger audience.

We provide a focused variety of services to the medicinal cannabis industry. We are not engaged in the growing, harvesting, cultivation, possession, or distribution of cannabis. Instead, we assist the physicians, dispensaries, and end-users in the medicinal cannabis industry in finding each other and in advertising their businesses. We were incorporated in the State of Nevada in 2003.

The Medicinal Cannabis Industry

Sixteen states, plus the District of Columbia, have adopted laws that exempt patients from state criminal penalties who use medicinal cannabis under a physician’s supervision. These are collectively generally referred to as the states that have de-criminalized medicinal cannabis, although there is a subtle difference between de-criminalization and legalization, and each state’s laws are different. The states are as follows (in alphabetical order):

|

·

|

Alaska,

|

|

·

|

Arizona,

|

|

·

|

California,

|

|

·

|

Colorado,

|

|

·

|

Delaware

|

|

·

|

District of Columbia,

|

|

·

|

Hawaii,

|

|

·

|

Maine,

|

|

·

|

Michigan,

|

|

·

|

Montana,

|

|

·

|

Nevada,

|

|

·

|

New Jersey,

|

|

·

|

New Mexico,

|

|

·

|

Oregon,

|

|

·

|

Rhode Island,

|

|

·

|

Vermont, and

|

|

·

|

Washington.

|

23

As of April 2012, twelve states have pending legislation or ballot measures to legalize medical marijuana. The states are as follows (in alphabetical order):

|

·

|

Alabama,

|

|

·

|

Connecticut,

|

|

·

|

Idaho,

|

|

·

|

Illinois,

|

|

·

|

Kansas,

|

|

·

|

Maryland,

|

|

·

|

Massachusetts,

|

|

·

|

Missouri,

|

|

·

|

New Hampshire,

|

|

·

|

New York,

|

|

·

|

Ohio, and

|

|

·

|

Pennsylvania,

|

Medical cannabis decriminalization is generally referred to as the removal of all criminal penalties for the private possession and use of cannabis by adults, including cultivation for personal use and casual, nonprofit transfers of small amounts. Legalization is generally referred to as the development of a legally controlled market for cannabis, where consumers purchase from a safe, legal, and regulated source.

The United States federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances, including cannabis, in a schedule. Cannabis is classified as a Schedule I drug, which is viewed as highly addictive and having no medical value. Doctors may not prescribe cannabis for medical use under federal law, however they can recommend its use under the First Amendment. In 2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis will not be denied services or other medications that are denied to those using illegal drugs.

Our Principal Services

Our principal services are offered through the following wholly owned subsidiaries.

WeedMaps Media, Inc.

WeedMaps Media, Inc. is our wholly-owned subsidiary, and its primary operation is the Internet website, www.weedmaps.com. WeedMaps.com is an online finder site service that allows patients to find local medical cannabis dispensaries, which are also referred to as collectives. Dispensaries are locations where patients who have received letters of recommendation from a health care provider can purchase medicinal cannabis, as well as a variety of other non-cannabis related items including, but not limited to, apparel accessories, posters, bumper stickers, concert tickets, books and musical CD’s.

24

WeedMaps.com specializes in search engine optimization (SEO) for widely used medical cannabis industry search terms. The dispensaries pay a fee to WeedMaps in order to subscribe to the various services available. WeedMaps.com has an estimated six million page views per month. WeedMaps.com generates income by providing the dispensary owner a variety of advertising choices, including gold, silver and bronze advertising packages. The Gold Listing comes up first on the Google Map, first on the Regional Listing Page, and first on the Featured Five Slide Bar and also has a large distinctive red icon on the Google map all of which, taken together, allow for heightened visibility. The Silver Listing comes up second on the Regional listing Page, second on the Featured Five Slide Bar and has a large distinctive blue icon on the Google map allowing for heightened visibility. The Bronze listing comes up third on the Regional Listing Page and third on the Featured Five Slide Bar. The preferred positions convert at higher click through rate to the customer’s actual listing page. On average, the click through rate for a premium listing compared to a standard listing in their geographical regions is 4-to-1 for a Gold, 3-to-1 for a Silver and 2-to-1 for a Bronze. Predicated on the select package, WeedMaps markets the respective dispensary online, and advertises their products.

The range of prices charged for each advertising package tier differs per region, and per each tier package. We currently market to 140 regions. Regions are internally created based on geographic location and demographics. The smallest number and the highest number of regions over the past six months is 130 and 150, respectively. The complete range of pricing includes the following: Gold packages range from $700 to $10,000 per month; the Silver Package range is from $500 to $6,000 per month; the Bronze Package range is from $500 to $5,000 per month; the Copper Package range is from $500 to $4,000 per month; and the Nickel Package range is from $500 to $3,000 per month. Listing costs vary per region based on site traffic, number of page views received per region, geographical demographics, and patient demand.