Attached files

| file | filename |

|---|---|

| 8-K - MEADOWBROOK INSURANCE GROUP, INC 8-K 5-10-2012 - MEADOWBROOK INSURANCE GROUP INC | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - MEADOWBROOK INSURANCE GROUP INC | ex99_1.htm |

EXHIBIT 99.2

Investor Supplement

First Quarter 2012

2

Forward-Looking Statements

Certain statements made by Meadowbrook Insurance Group, Inc. in this presentation may

constitute forward-looking statements including, but not limited to, those statements that

include the words "believes," "expects," "anticipates," "estimates," or similar expressions.

Please refer to the Company's most recent 10-K, 10-Q, and other Securities and Exchange

Commission filings for more information on risk factors. Actual results could differ materially.

These forward-looking statements involve risks and uncertainties including, but not limited to

the following: the frequency and severity of claims; uncertainties inherent in reserve estimates;

catastrophic events; a change in the demand for, pricing of, availability or collectability of

reinsurance; increased rate pressure on premiums; obtainment of certain rate increases in

current market conditions; investment rate of return; changes in and adherence to insurance

regulation; actions taken by regulators, rating agencies or lenders; obtainment of certain

processing efficiencies; changing rates of inflation; and general economic conditions.

Meadowbrook is not under any obligation to (and expressly disclaims any such obligation to)

update or alter its forward-looking statements whether as a result of new information, future

events or otherwise.

constitute forward-looking statements including, but not limited to, those statements that

include the words "believes," "expects," "anticipates," "estimates," or similar expressions.

Please refer to the Company's most recent 10-K, 10-Q, and other Securities and Exchange

Commission filings for more information on risk factors. Actual results could differ materially.

These forward-looking statements involve risks and uncertainties including, but not limited to

the following: the frequency and severity of claims; uncertainties inherent in reserve estimates;

catastrophic events; a change in the demand for, pricing of, availability or collectability of

reinsurance; increased rate pressure on premiums; obtainment of certain rate increases in

current market conditions; investment rate of return; changes in and adherence to insurance

regulation; actions taken by regulators, rating agencies or lenders; obtainment of certain

processing efficiencies; changing rates of inflation; and general economic conditions.

Meadowbrook is not under any obligation to (and expressly disclaims any such obligation to)

update or alter its forward-looking statements whether as a result of new information, future

events or otherwise.

Notes on Non-GAAP Financial Measures

(1)Net operating income is a non-GAAP measure defined as net income excluding after-tax

realized gains and losses.

realized gains and losses.

(2)Accident year combined ratio is a non-GAAP measure that the impact of any adverse or

favorable development on prior year loss reserves.

favorable development on prior year loss reserves.

These non-GAAP metrics are common measurements for property and casualty insurance

companies. We believe this presentation enhances the understanding of our results by

highlighting the underlying profitability of our insurance business. Additionally, these measures

are key internal management performance standards.

companies. We believe this presentation enhances the understanding of our results by

highlighting the underlying profitability of our insurance business. Additionally, these measures

are key internal management performance standards.

3

Presentation Outline

Detail Financial Review

Return on Average Equity Analysis

Investment Portfolio Review

Workers’ Comp Accident Year Loss & ALAE

Analysis

Analysis

4

I. Detailed Financial Review

5

First Quarter 2012 vs. 2011

Underwriting and Investing

Activities

Activities

Top line earned premium growth driven by

rate increases, maturation of existing

programs, and new business initiatives

from recent years.

rate increases, maturation of existing

programs, and new business initiatives

from recent years.

Excluding the changes in net ultimate loss

estimates on prior year loss reserves, profit

from underwriting activities has increased

meaningfully year over year.

estimates on prior year loss reserves, profit

from underwriting activities has increased

meaningfully year over year.

Net Commissions & Fees

Increase in top line driven primarily by

commission revenues generated from a

Michigan agency that was acquired in the

fourth quarter of 2011.

commission revenues generated from a

Michigan agency that was acquired in the

fourth quarter of 2011.

General, selling & administrative expenses

were up slightly and partially offset the

increase in revenues..

were up slightly and partially offset the

increase in revenues..

Other Expenses

Other expenses were in line with prior year

quarter.

quarter.

Taxes

The effective federal tax rate on operating

income was 18.6% compared to 27.7% in

the prior year first quarter. The lower tax

rate primarily reflects tax exempt interest

accounting for a larger portion of pre-tax

income in 2012.

income was 18.6% compared to 27.7% in

the prior year first quarter. The lower tax

rate primarily reflects tax exempt interest

accounting for a larger portion of pre-tax

income in 2012.

6

First Quarter 2012 vs. 2011 Combined Ratio Analysis

Loss and LAE Ratio

The 2012 results include 5.3 points due to an increase in

net ultimate loss estimates on 2011 and prior accident

years. By contrast, the 2011 results include 1.9 points

due to a decrease in net ultimate loss estimates on 2010

and prior accident years.

net ultimate loss estimates on 2011 and prior accident

years. By contrast, the 2011 results include 1.9 points

due to a decrease in net ultimate loss estimates on 2010

and prior accident years.

The 2012 accident year loss and LAE ratio was 63.5%,

compared to 65.6% for the first quarter of 2011.

compared to 65.6% for the first quarter of 2011.

Expense Ratio

The improvement in the expense ratio primarily reflects

a reduction in variable compensation and a shift in

business mix that resulted in a lower commission

expense as compared to the prior year quarter.

a reduction in variable compensation and a shift in

business mix that resulted in a lower commission

expense as compared to the prior year quarter.

7

II. Return on Average Equity Analysis

8

ROAE (Net Operating Income) Components

2011 Including and Excluding Storm Losses

2011 Including and Excluding Storm Losses

9

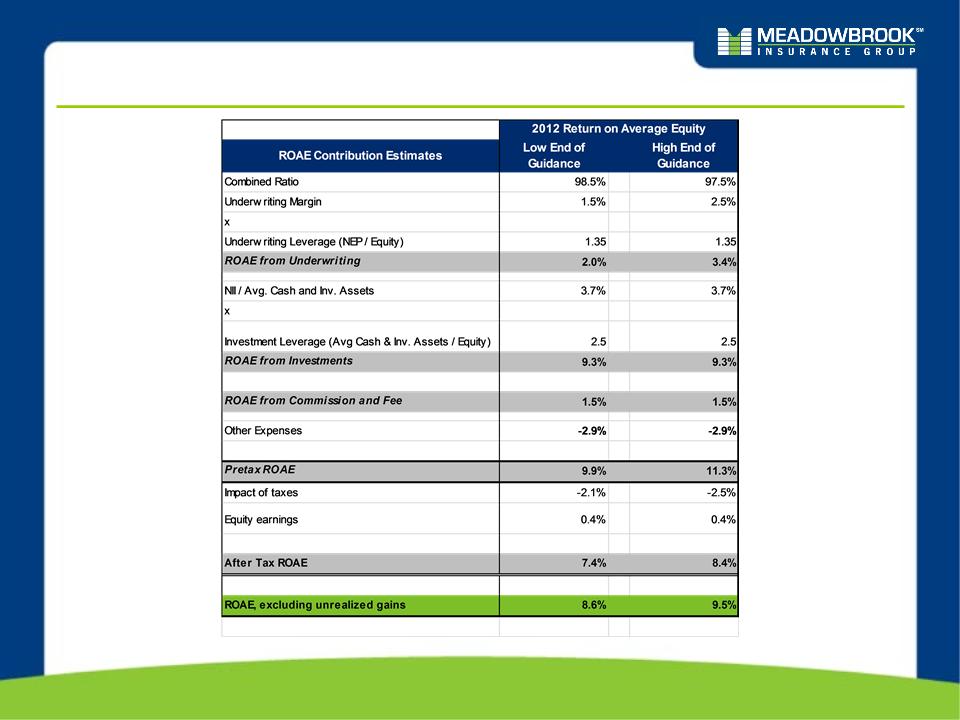

ROAE & Combined Ratio Illustration

We strive to deliver predictable earnings across the market cycle with a return on average

equity target of 10% - 17%; we view this objective relative to risk free and reinvestment

rates.

equity target of 10% - 17%; we view this objective relative to risk free and reinvestment

rates.

2012 Guided Range - Our 2012 guided range translates into an ROAE range of 7.4% to 8.4%.

10

III. Investment Portfolio Review

11

Investment Portfolio Review

We maintain a high-quality, low-risk investment portfolio.

Portfolio Allocation and Quality

NOTE: Data above as of March 31, 2012

Low equity risk exposure

• 98% fixed income and

cash

cash

• 2% equity

High credit quality

• 99% of bonds are

investment grade

investment grade

• Average S&P rating of

AA/Moody’s of Aa3

AA/Moody’s of Aa3

Duration

• Fixed income effective

duration is 4.7

duration is 4.7

• Duration on Reserves

is approximately 3.8

is approximately 3.8

|

$’s in (000’s)

|

%

Allocation 03/31/2012 |

Fair Value

|

Gross

Unrealized Gain Position |

Avg.

Moody's |

Avg.

S&P |

|

Fixed Income

|

|

|

|

|

|

|

US Government and Agencies

|

2%

|

$ 23,116

|

$ 1,629

|

Aaa

|

AA+

|

|

Corporate

|

39%

|

$ 574,813

|

$ 41,679

|

A2

|

A

|

|

Mortgage and Asset Backed

|

14%

|

$ 211,756

|

$ 13,881

|

Aaa

|

AA+

|

|

Municipal

|

43%

|

$ 625,116

|

$ 46,100

|

Aa2

|

AA+

|

|

Preferred Stock Debt

|

0%

|

$ 2,355

|

$ 431

|

Ba2

|

BB

|

|

Total Fixed Income

|

98%

|

$1,437,157

|

$

103,721 |

|

|

|

Equities

|

|

|

|

|

|

|

Preferred Stock

|

1%

|

$ 12,423

|

$ 2,228

|

|

|

|

Mutual Funds

|

1%

|

$ 15,460

|

$ 697

|

|

|

|

Total Equities

|

2%

|

$ 27,883

|

$ 2,925

|

|

|

12

Government and Agency - March 31, 2012 Profile

Summary Profile

$23.1M market value; approximately 2% of

the managed portfolio

the managed portfolio

Rated Aaa by Moody’s and AA+ by S&P

March 31, 2012 Net unrealized gain was

$1.6 M

$1.6 M

Average investment yield: 3.0%

Government & Agency vs. Entire

Portfolio

Portfolio

13

Corporate Fixed Income - March 31, 2012 Profile

Summary Profile

$574.8M market value; 39% of the investment

portfolio

portfolio

March 31, 2012 Net unrealized gain was

$41.7M.

$41.7M.

Average investment yield: 4.8%

Quality Indicators

Corporate vs. Entire Portfolio

Corporate Profile

|

|

Corporates

|

|

Average Quality

|

A

|

|

Investment Grade

|

100%

|

|

|

|

|

A-/A3 or Better

|

75%

|

|

AII BBB and Baa

|

25%

|

|

Not Rated

|

0%

|

|

Non Investment Grade

|

0%

|

|

Consumer Non-Cyclical

|

18.4%

|

|

Banking

|

13.7%

|

|

Energy

|

10.8%

|

|

Basic Industry

|

10.2%

|

|

Electric

|

9.2%

|

|

|

7.3%

|

|

Capital Goods

|

6.1%

|

|

|

5.2%

|

|

Communications

|

4.8%

|

|

|

3.5%

|

|

All Other Sectors

|

10.8%

|

14

Municipal Bonds - March 31, 2012 Profile

Summary Profile

$625.0M market value; 43% of the

investment portfolio

investment portfolio

March 31, 2012 Net unrealized gain was

$46.1M

$46.1M

• Tax exempt unrealized gain $40.6M

• Taxable unrealized gain $ 5.5M

Average tax equivalent yield: 5.4%

Quality Indicators & Geographic

Distribution

Distribution

Municipals vs. Entire Portfolio

|

State

|

% of Municipal Allocation

|

|

Texas

|

8.1%

|

|

Washington

|

6.6%

|

|

New York

|

5.9%

|

|

Colorado

|

4.8%

|

|

Tennessee

|

4.1%

|

|

Arizona

|

3.5%

|

|

Nevada

|

3.3%

|

|

Virginia

|

3.1%

|

|

Oregon

|

3.0%

|

|

Missouri

|

2.9%

|

|

All other

|

54.7%

|

15

Structured Securities - March 31, 2012 Profile

Summary Profile

$211.8M market value; 14% of the managed

portfolio

portfolio

March 31, 2012 Net unrealized gain was $13.0M

• RMBS unrealized gain $10.0M

• CMBS unrealized loss $ 2.0M

• ABS unrealized loss $ 1.0M

Average investment yield: 5.0%

Quality Indicators

Structured vs. Entire Portfolio

Structured Profile

16

Equities - March 31, 2012 Profile

Summary Profile

$27.8million market value; 2% of the managed

portfolio

portfolio

March 31, 2012 Net unrealized gain was $2.9M

Preferred stock unrealized gain $2.2M

Bond mutual fund unrealized gain

$0.7M

$0.7M

Average tax equivalent yield: 8.7%

Equities vs. Entire Portfolio

Equity Mix

17

IV. Workers’ Comp (W/C) Accident Year Loss & ALAE Analysis

18

W/C Accident Year Loss & ALAE Analysis

Rollforward of Loss & ALAE Ratio (2009AY to 2011AY)

NOTE: See next page for explanations A through E.

*2009 and 2010 re-estimated AY loss & ALAE ratios reflect reserve adjustments made following the accident year based on new loss

development information gathered subsequent to the accident year through 12/31/2011 as reflected in our insurance subsidiaries’ 2011

Combined Annual Statement Schedule P.

development information gathered subsequent to the accident year through 12/31/2011 as reflected in our insurance subsidiaries’ 2011

Combined Annual Statement Schedule P.

19

W/C Accident Year Loss & ALAE Analysis

NOTE: The following explanations relate to loss & ALAE rollforward on the prior page.

A: The 2009 AY results reflect a single large claim that added $2.7M, or 1.6% to the loss & ALAE ratio.

B: When new programs are initiated there can be timing issues that impact schedule P. Schedule P

reports all claims in the accident year based on the claim date. Earned premium is recorded in the

accounting period in which it is booked. Therefore, there could be a mismatch of losses and premiums

within schedule P between two accident years. This was the case in our 2009AY and 2010AY schedule P

as we initiated a large new program in the second half of 2009. From a schedule P perspective, there

were fewer months of net earned premium as compared to loss and ALAE for the 2009AY. Adjusting

schedule P for this timing difference, our 2009AY would have improved by 1.9%. Please note, the timing

difference referred to does not impact the comparability of our GAAP financial results, rather it is just an

anomaly that needs to be adjusted for when analyzing schedule P.

reports all claims in the accident year based on the claim date. Earned premium is recorded in the

accounting period in which it is booked. Therefore, there could be a mismatch of losses and premiums

within schedule P between two accident years. This was the case in our 2009AY and 2010AY schedule P

as we initiated a large new program in the second half of 2009. From a schedule P perspective, there

were fewer months of net earned premium as compared to loss and ALAE for the 2009AY. Adjusting

schedule P for this timing difference, our 2009AY would have improved by 1.9%. Please note, the timing

difference referred to does not impact the comparability of our GAAP financial results, rather it is just an

anomaly that needs to be adjusted for when analyzing schedule P.

C: The remainder of the improvement between the 2009AY and the 2010AY was driven primarily by a shift

in premium volume, as new business that was added in 2010 had a lower loss & ALAE ratio than the prior

year (NOTE: NEP increased from $163.8M in 2009 to $275.6M in 2010, driven primarily by two large

programs that were initiated in the second half of 2009).

in premium volume, as new business that was added in 2010 had a lower loss & ALAE ratio than the prior

year (NOTE: NEP increased from $163.8M in 2009 to $275.6M in 2010, driven primarily by two large

programs that were initiated in the second half of 2009).

D: In 2011 we initiated efforts to remediate two programs that were not meeting our targets through

significant price increases and reducing the premium volume for this business through tightening

underwriting standards. These efforts enhanced our 2011 AY loss & ALAE ratio by 1.8%.

significant price increases and reducing the premium volume for this business through tightening

underwriting standards. These efforts enhanced our 2011 AY loss & ALAE ratio by 1.8%.

E: The remaining improvement in the 2011AY & ALAE loss ratio is driven primarily by earned rate

increases that have been obtained and outpace increasing loss costs in combination with underwriting

actions taken (NOTE: NEP increased from $275.6M in 2010 to $306.1M in 2011).

increases that have been obtained and outpace increasing loss costs in combination with underwriting

actions taken (NOTE: NEP increased from $275.6M in 2010 to $306.1M in 2011).

20

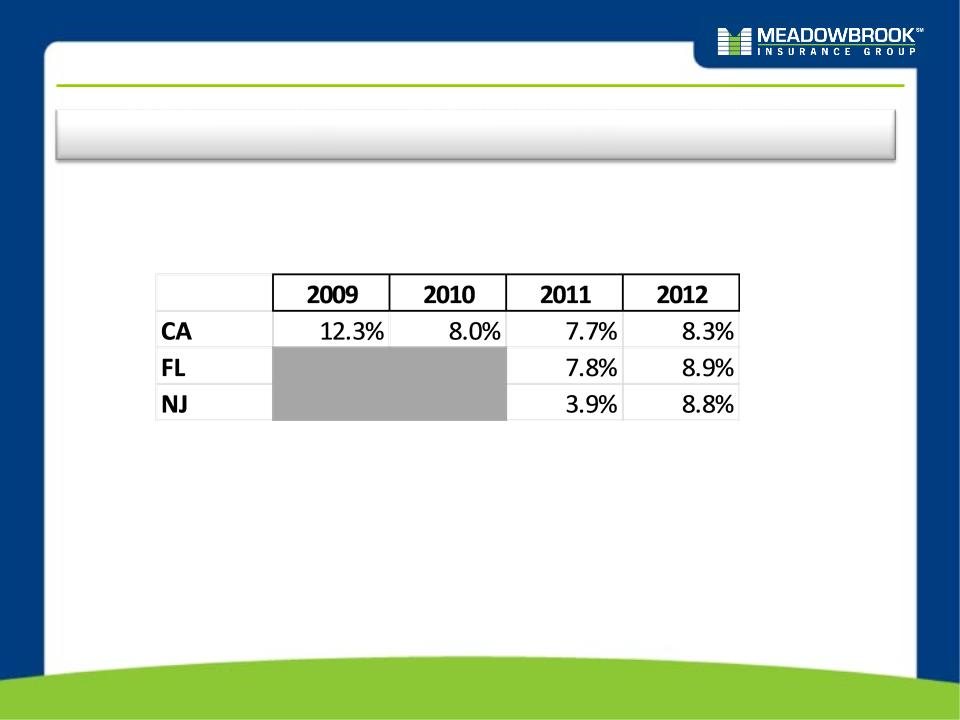

W/C Accident Year Loss & ALAE Analysis

Cumulative filed rate increases on W/C line of business between 1/1/2010 and

3/31/2012 has been 16.3%.

3/31/2012 has been 16.3%.

*NOTE: The filed rate changes presented above are on a written basis. there is a lag between written and earned premium. To

illustrate, the 2010 rate increases would have a larger benefit to the 2011AY vs. the 2010 AY as these rate increases earn out

on a pro rata basis over the life of the policy.

illustrate, the 2010 rate increases would have a larger benefit to the 2011AY vs. the 2010 AY as these rate increases earn out

on a pro rata basis over the life of the policy.

Summary of Key Filed W/C Rate Increases by

State*

State*