Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST NIAGARA FINANCIAL GROUP INC | d350875d8k.htm |

Exhibit 99.1

| Sandler O'Neill Investor Visit Gregory W. Norwood Chief Financial Officer Mark Rendulic EVP - Retail Banking Andrew Fornarola Managing Director - Consumer Finance |

| Safe Harbor Statement This presentation contains forward-looking information for First Niagara Financial Group, Inc. Such information constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) which involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements. |

| 3 |

| Retail: Positioned for Continuing Success Leaders with Proven Experience - Retail Deposit Services 4 Average 25 years of experience |

| Retail: Deposit Product Offerings 5 |

| Retail: Business Initiatives Relationships Small Business Deposits Deposit Pricing Business Initiatives Leverage density and products to penetrate customer share of wallet Reward valued relationships through preferred pricing or exception pricing Increase the proportion of Transactor/ Saver /Borrower households Improve targeting to maximize sales efficiency Grow low-cost checking account balances Continue to improve fair value exchange and minimize pain points for customer Simple, fast & easy Continue to enhance deposit analytics to better evaluate deposit relationship and profitability Use deposit model to determine base, retention and acquisition rates Differentiate pricing for lower cost channels / less profitable customers Expand sales force geographically within Bank's footprint Drive new loan and deposit production Fees Leverage wealth management opportunities to drive fee income Leverage credit card capabilities to improve cross-sale and interchange fees Channels Drive down cost to serve Invest in digital platform Optimize call center capabilities Optimize brand distribution |

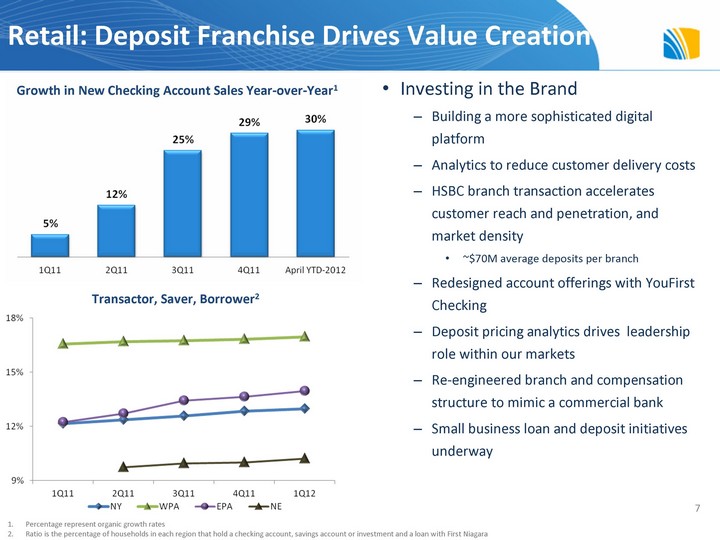

| Retail: Deposit Franchise Drives Value Creation Growth in New Checking Account Sales Year-over-Year1 Percentage represent organic growth rates Ratio is the percentage of households in each region that hold a checking account, savings account or investment and a loan with First Niagara 7 Transactor, Saver, Borrower2 Investing in the Brand Building a more sophisticated digital platform Analytics to reduce customer delivery costs HSBC branch transaction accelerates customer reach and penetration, and market density ~$70M average deposits per branch Redesigned account offerings with YouFirst Checking Deposit pricing analytics drives leadership role within our markets Re-engineered branch and compensation structure to mimic a commercial bank Small business loan and deposit initiatives underway |

| 8 |

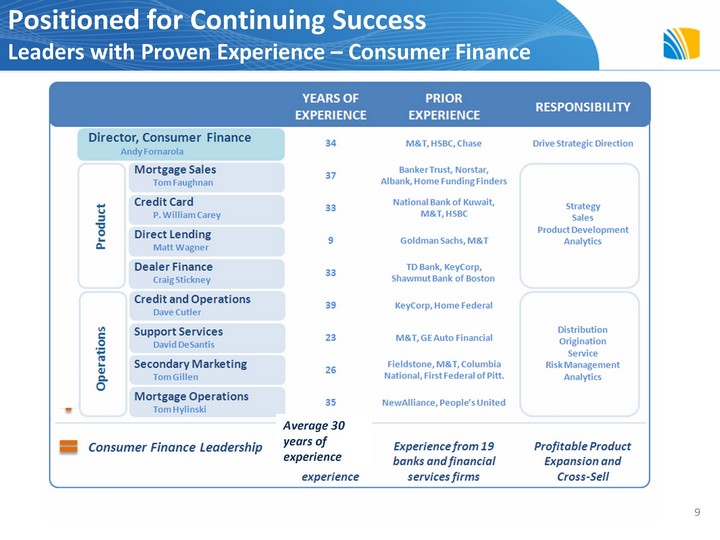

| Positioned for Continuing Success Leaders with Proven Experience - Consumer Finance 9 Average 30 years of experience |

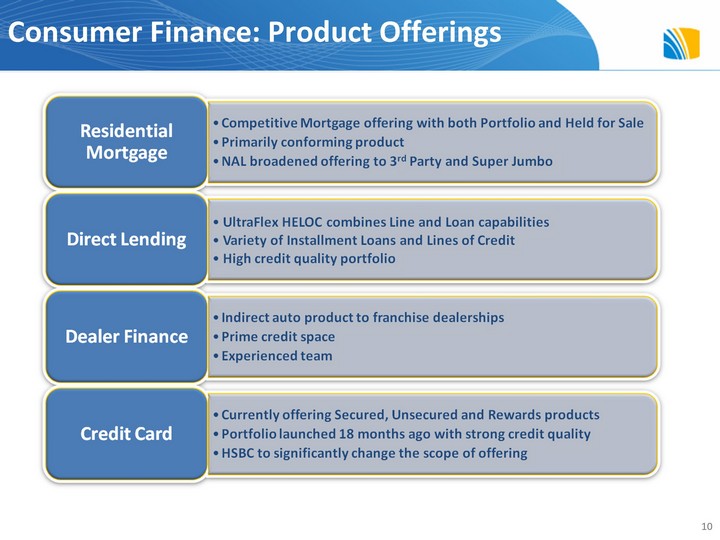

| Consumer Finance: Product Offerings 10 |

| Credit Card Dealer Finance Residential Mortgage Direct Lending Business Strategy Support Services Build- out Consumer Finance Initiatives 11 Standard card offering Branch / Relationship based originations Participate in bank-wide payments strategy Counter-cyclical opportunity to generate assets Leverage existing Consumer Finance infrastructure Organic growth through footprint lending leveraging an originator model Migrate to "Fee Income" vs. Portfolio Model Functional specialists Drive and support scalability Increase data analytics Branch / Relationship based originations Leverage existing Consumer Finance infrastructure |

| Consumer Finance -- HSBC Credit Card Acquisition Provides Opportunity Post Conversion First Niagara will be a Top 35 credit card provider in the U.S. HSBC will drive 10x increase in credit card receivables New operating platform and product suite expands customer choice and capabilities Multiple product offerings 6 Consumer cards 2 Business cards Newly designed, robust rewards program Increases fee generation opportunity Marketing to promote debit & credit card usage Post HSBC Conversion Demographics 12 HSBC Branches |

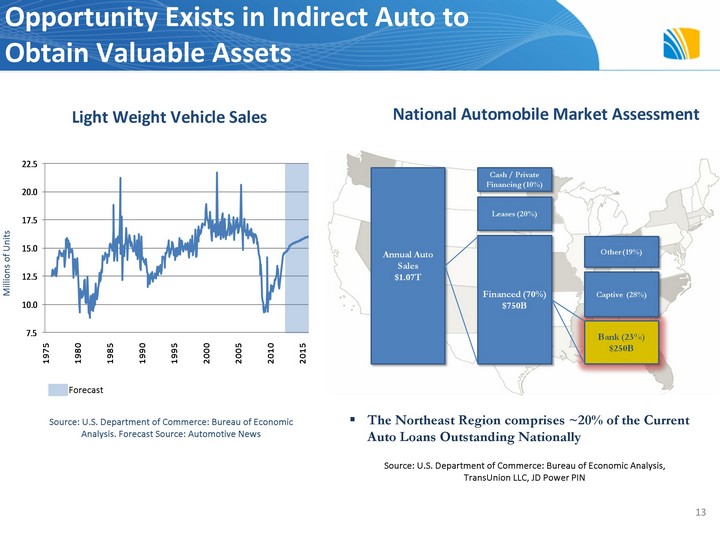

| Opportunity Exists in Indirect Auto to Obtain Valuable Assets Source: U.S. Department of Commerce: Bureau of Economic Analysis. Forecast Source: Automotive News Millions of Units Light Weight Vehicle Sales Forecast National Automobile Market Assessment The Northeast Region comprises ~20% of the Current Auto Loans Outstanding Nationally Source: U.S. Department of Commerce: Bureau of Economic Analysis, TransUnion LLC, JD Power PIN 13 |

| 14 |

| 15 Commercial: Positioned for Continuing Success Leaders with Proven Experience YEARS OF EXPERIENCE PRIOR EXPERIENCE RESPONSIBILITY EVP, Commercial Banking Dan Cantara 30 Public Accounting Drive Strategic Direction and Credit Culture Enterprise Banking Leader, New England Regional President Dave Ring 30 Wells Fargo, Wachovia, NatWest, People's United Co-Chair Senior Loan Committee, Direct Lending Across All Regions Upstate NY Regional President Peter Cosgrove 31 Troy Savings Bank Drive Commercial Lending Sales and Service in Each of Their Respective Regions Western PA Regional President Todd Moules 24 National City Drive Commercial Lending Sales and Service in Each of Their Respective Regions Eastern PA Regional President Bob Kane 32 PNC Drive Commercial Lending Sales and Service in Each of Their Respective Regions Managing Director, Specialized Banking Buford Sears 33 Citizens & Southern, M&T Direct Specialized Lending Business Units Senior Director, CRE Greg Gilroy 29 Bank of America, HSBC Direct CRE Lending Across The Franchise Line of Business Manager - Healthcare Matthew Huber 25 Key, M&T Bank Healthcare Lending Managing Director, Financial Services Thomas Saunders 27 Chemical Bank, Brown Brothers Harriman & Co., BONY - Mellon Financial Services Group Managing Director, Capital Markets Diego Tobon 24 National City, PNC Direct Capital Markets Business Commercial Leadership Team Average 29 years of experience Experience from eight commercial and regional banks Consistent, Significant Growth |

| Commercial: Lines of Business 16 |

| Commercial Initiatives 17 Equipment Finance Healthcare Commercial Real Estate Asset Based Lending Business Initiatives Continue synergies with Municipal and Healthcare lines of business Adding business development staff to improve coverage across FNFG footprint Use leasing as introduction for full service relationships Drive production growth through new lending teams in New England and Eastern PA Focus on tax-credit equity investment initiative Adding business development staff across the footprint Diversify portfolio by industry segment Geographic expansion - across New England, and around Philadelphia Corporate & Business Banking Improve efficiency by scaling back-office processes Continue to move up market with products and services Drive "share of wallet" through relationship based model Government Banking Adding business development staff in Eastern PA and New England Further enhance cross sell of non-deposit products - leasing, insurance etc. |

| Loan Syndications International/ Foreign Exchange Derivatives Product Group Business Initiatives Becoming "lead" rather than participant Support consistent underwriting standards across all regions Re-align key support areas to promote lead agency growth CRE syndication team on board Continued focus on product education and proactive marketing Enhance origination process for efficiency Adding additional sales resources to maximize product penetration Commercial Initiatives 18 Fully integrate on-line customer platform with back office Focus on becoming our client's providers of international banking services Establish additional foreign correspondent banking relationships Private Client Services (PCS) First Niagara Risk Management (FNRM) Expand sales force geographically within Bank's footprint Establish cross-selling culture with PCS as value-added contributors Improve efficiencies by standardizing policies and procedures across all regions Utilize competitive benchmarking to maximize operational efficiency and scalability Focus on cross-sell collaboration with other business units |