Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Santa Fe Petroleum, Inc. | Financial_Report.xls |

| EX-31.02 - EXHIBIT 31.02 - Santa Fe Petroleum, Inc. | exhibit31-02.htm |

| EX-32.01 - EXHIBIT 32.01 - Santa Fe Petroleum, Inc. | exhibit32-01.htm |

| EX-31.01 - EXHIBIT 31.01 - Santa Fe Petroleum, Inc. | exhibit31-01.htm |

| EX-32.02 - EXHIBIT 32.02 - Santa Fe Petroleum, Inc. | exhibit32-02.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2012

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission file number: 333-173302

BABY ALL CORP.

(Exact name of registrant as specified in its charter)

|

Deleware

|

99-0362658

|

|

(state or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer I.D. No.)

|

|

c/o Efrat Schwartz

|

||

|

17 HaRav Frank Street

|

||

|

Jerusalem 96387, Israel

|

|

c/o Efrat Schwartz

|

||

|

17 HaRav Frank Street

|

||

|

Jerusalem 96387, Israel

(Address of principal executive offices)

972-2-6415-008

(Issuer's telephone number)

with a copy to:

Zouvas Law Group, P.C.

2368 Second Avenue

San Diego, CA 92101

Telephone (619) 688-1116

|

Facsimile: (619) 688-1716

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes oNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No (Not required)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o Accelerated Filer

o

Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

As of March 31, 2012, there were 5,500,000 shares of the registrant’s $0.0001 par value common stock issued and outstanding.

Page - 1

TABLE OF CONTENTS

|

|

PAGE

|

|||

|

PART I

|

|

FINANCIAL INFORMATION

|

||

|

ITEM 1.

|

|

3

|

||

|

ITEM 2.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

11

|

||

|

ITEM 3.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

13

|

||

|

ITEM 4.

|

CONTROLS AND PROCEDURES

|

14

|

||

|

PART II

|

OTHER INFORMATION

|

|||

|

ITEM 1.

|

LEGAL PROCEEDINGS

|

14

|

||

|

ITEM 1A.

|

RISK FACTORS

|

14

|

||

|

ITEM 2.

|

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

14

|

||

|

ITEM 3.

|

DEFAULTS UPON SENIOR SECURITIES

|

14

|

||

|

ITEM 4.

|

[REMOVED AND RESERVED]

|

14

|

||

|

ITEM 5.

|

OTHER INFORMATION

|

14

|

||

|

ITEM 6.

|

|

16

|

Special Note Regarding Forward-Looking Statements

Information included in this Form 10-Q contains forward-looking statements that may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Baby All Corp. (the “Company”), to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,”

“intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that these projections included in these forward-looking statements will come to pass. Actual results of the Company could differ materially from those expressed or implied by the forward-looking statements as a result of various factors. Except as required by applicable laws, the Company has no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

*Please note that throughout this Quarterly Report, and unless otherwise noted, the words "we," "our," "us," the "Company," or "BABA" refers to Baby All Corp.

Page - 2

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

|

Financial Statements-

|

|

|

Balance Sheets as of March 31, 2012 and December 31, 2011

|

F-1

|

|

Statements of Operations for the Three Months Ended

|

|

|

March 31, 2012 and 2011 and Cumulative from Inception

|

F-2

|

|

Statement of Changes in Stockholders’ Equity for the Period from Inception

|

|

|

Through March 31, 2012

|

F-3

|

|

Statements of Cash Flows for the Three Months Ended

|

|

|

March 31, 2012 and 2011 And Cumulative from Inception

|

F-4

|

|

Notes to Financial Statements

|

F-5

|

Page - 3

BABY ALL CORP.

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEET

FOR THE THREE MONTHS ENDED MARCH 31, 2012 AND 2011

AND CUMULATIVE FROM INCEPTION (NOVEMBER 30, 2010)

|

ASSETS

|

||||||||

|

As of

|

As of

|

|||||||

|

March 31,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

(Unaudited)

|

(Audited)

|

|||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | - | $ | 300 | ||||

|

Deferred offering costs

|

- | 20,000 | ||||||

|

Total current assets

|

- | 20,300 | ||||||

|

Total Assets

|

$ | - | $ | 20,300 | ||||

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 4,000 | $ | 41,125 | ||||

|

Loans from related parties - Directors and stockholders

|

- | 22,900 | ||||||

|

Total current liabilities

|

4,000 | 64,025 | ||||||

|

Total liabilities

|

4,000 | 64,025 | ||||||

|

Commitments and Contingencies

|

||||||||

|

Stockholders' (Deficit):

|

||||||||

|

Common stock, par value $.0001 per share, 200,000,000 shares

|

||||||||

|

authorized; 5,500,000 and 3,000,000 shares issued

|

||||||||

|

and outstanding, respectively

|

550 | 300 | ||||||

|

Additional paid-in capital

|

54,750 | - | ||||||

|

(Deficit) accumulated during the development stage

|

(59,300 | ) | (44,025 | ) | ||||

|

Total stockholders' (deficit)

|

(4,000 | ) | (43,725 | ) | ||||

|

Total Liabilities and Stockholders' (Deficit)

|

$ | - | $ | 20,300 | ||||

The accompanying notes to condensed financial statements are an integral part of these statements.

F - 1

BABY ALL CORP.

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2012 AND 2011,

AND CUMULATIVE FROM INCEPTION (NOVEMBER 30, 2010)

THROUGH MARCH 31, 2012

(Unaudited)

|

Three Months Ended

|

Cumulative

|

|||||||||||

|

March 31,

|

From

|

|||||||||||

|

2012

|

2011

|

Inception

|

||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | ||||||

|

Expenses:

|

||||||||||||

|

Filing fees

|

- | - | 6,600 | |||||||||

|

Professional fees

|

5,845 | 7,100 | 33,815 | |||||||||

|

Consulting fees

|

6,696 | 6,696 | ||||||||||

|

Patent

|

- | - | 7,500 | |||||||||

|

Legal - incorporation

|

- | - | 1,955 | |||||||||

|

Other

|

1,032 | - | 1,032 | |||||||||

|

Total expenses

|

13,573 | 7,100 | 57,598 | |||||||||

|

(Loss) from Operations

|

(13,573 | ) | (7,100 | ) | (57,598 | ) | ||||||

|

Other Income (Expense)

|

(1,702 | ) | - | (1,702 | ) | |||||||

|

Provision for income taxes

|

- | - | - | |||||||||

|

Net (Loss)

|

$ | (15,275 | ) | $ | (7,100 | ) | $ | (59,300 | ) | |||

|

(Loss) Per Common Share:

|

||||||||||||

|

(Loss) per common share - Basic and Diluted

|

$ | (0.00 | ) | $ | (0.01 | ) | ||||||

|

Weighted Average Number of Common Shares

|

||||||||||||

|

Outstanding - Basic and Diluted

|

4,510,989 | 3,000,000 | ||||||||||

The accompanying notes to condensed financial statements are an integral part of these statements.

F - 2

BABY ALL CORP.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY

FOR THE PERIOD FROM INCEPTION (NOVEMBER 30, 2010)

THROUGH MARCH 31, 2012

(Unaudited)

|

Accumulated

|

||||||||||||||||||||

|

Stock

|

During the

|

|||||||||||||||||||

|

Common stock

|

Subscription

|

Development

|

||||||||||||||||||

|

Shares

|

Amount

|

Receivable

|

Stage

|

Totals

|

||||||||||||||||

|

Balance - at inception

|

- | $ | - | $ | - | $ | - | |||||||||||||

|

Common stock issued for cash

|

3,000,000 | 300 | (300 | ) | - | - | ||||||||||||||

|

Net (loss) for the period

|

- | - | - | (10,455 | ) | (10,455 | ) | |||||||||||||

|

Balance - December 31, 2010

|

3,000,000 | $ | 300 | $ | (300 | ) | $ | (10,455 | ) | $ | (10,455 | ) | ||||||||

|

Stock subscription payment received

|

- | - | 300 | - | 300 | |||||||||||||||

|

Net (loss) for the period

|

- | - | - | (33,570 | ) | (33,570 | ) | |||||||||||||

|

Balance - December 31, 2011

|

3,000,000 | $ | 300 | $ | - | $ | (44,025 | ) | $ | (43,725 | ) | |||||||||

|

Common stock issued for cash

|

2,500,000 | 250 | 54,750 | - | 55,000 | |||||||||||||||

|

Net (loss) for the period

|

- | - | - | (15,275 | ) | (15,275 | ) | |||||||||||||

|

Balance - March 31, 2012

|

$ | 5,500,000 | $ | 550 | $ | 54,750 | $ | (59,300 | ) | $ | (4,000 | ) | ||||||||

The accompanying notes to condensed financial statements are an integral part of these statements.

F - 3

BABY ALL CORP.

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2012 AND 2011,

AND CUMULATIVE FROM INCEPTION (NOVEMBER 30, 2010)

THROUGH MARCH 31, 2012

(Unaudited)

|

Three Months Ended

|

Cumulative

|

|||||||||||

|

March 31,

|

From

|

|||||||||||

|

2012

|

2011

|

Inception

|

||||||||||

|

Operating Activities:

|

||||||||||||

|

Net (loss)

|

$ | (15,275 | ) | $ | (7,100 | ) | $ | (59,300 | ) | |||

|

Adjustments to reconcile net (loss) to net cash

|

||||||||||||

|

(used in) operating activities:

|

||||||||||||

|

Changes in net assets and liabilities-

|

||||||||||||

|

Deferred offering costs

|

20,000 | - | - | |||||||||

|

Accounts payable and accrued liabilities

|

(37,125 | ) | 1,000 | 4,000 | ||||||||

|

Net Cash Used in Operating Activities

|

(32,400 | ) | (6,100 | ) | (55,300 | ) | ||||||

|

Investing Activities:

|

- | - | - | |||||||||

|

Net Cash Used in Investing Activities

|

- | - | - | |||||||||

|

Financing Activities:

|

||||||||||||

|

Proceeds from stock issued

|

55,000 | 300 | 55,300 | |||||||||

|

Loans from related parties - directors and stockholders

|

(22,900 | ) | 6,100 | - | ||||||||

|

Net Cash Provided by Financing Activities

|

32,100 | 6,400 | 55,300 | |||||||||

|

Net (Decrease) Increase in Cash

|

(300 | ) | 300 | - | ||||||||

|

Cash - Beginning of Period

|

300 | - | - | |||||||||

|

Cash - End of Period

|

$ | - | $ | 300 | $ | - | ||||||

|

Supplemental Disclosure of Cash Flow Information:

|

||||||||||||

|

Cash paid during the period for:

|

||||||||||||

|

Interest

|

$ | - | $ | - | $ | - | ||||||

|

Income taxes

|

$ | - | $ | - | $ | - | ||||||

F - 4

BABY ALL CORP.

NOTES TO FINANCIAL STATEMENTS

Note 1- Summary of Significant Accounting Policies

Basis of Presentation and Organization

Baby All corp. (“Baby All” or the “Company”) is a Delaware corporation in the development stage and has not commenced operations. The Company was incorporated under the laws of the State of Delaware on November 30, 2010. The business plan of the Company is to seek third party entities interested in licensing the rights to manufacture and market the patent design of an “Infant medicine dispenser”. The accompanying financial statements of the Company were prepared from the accounts of the Company under the accrual basis of accounting.

Unaudited Interim Financial Statements

The interim financial statements of the Company as of March 31, 2012, and for the periods then ended, and cumulative from inception, are unaudited. However, in the opinion of management, the interim financial statements include all adjustments, consisting of only normal recurring adjustments, necessary to present fairly the Company’s financial position as of March 31, 2012, and the results of its operations and its cash flows for the periods ended March 31, 2012, and cumulative from inception. These results are not necessarily indicative of the results expected for the calendar year ending December 31, 2012. The accompanying financial statements and notes thereto do not reflect all disclosures required under

accounting principles generally accepted in the United States. Refer to the Company’s audited financial statements as of December 31, 2011, filed with the SEC, for additional information, including significant accounting policies.

Cash and Cash Equivalents

For purposes of reporting within the statement of cash flows, the Company considers all cash on hand, cash accounts not subject to withdrawal restrictions or penalties, and all highly liquid debt instruments purchased with a maturity of three months or less to be cash and cash equivalents.

Revenue Recognition

The Company is in the development stage and has yet to realize revenues from operations. Once the Company has commenced operations, it will recognize revenues when delivery of goods or completion of services has occurred provided there is persuasive evidence of an agreement, acceptance has been approved by its customers, the fee is fixed or determinable based on the completion of stated terms and conditions, and collection of any related receivable is probable.

Loss per Common Share

Basic loss per share is computed by dividing the net loss attributable to the common stockholders by the weighted average number of shares of common stock outstanding during the period. Fully diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There were no dilutive financial instruments issued or outstanding for the period ended March 31, 2012.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

The Company maintains a valuation allowance with respect to deferred tax assets. The Company establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration the Company’s financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carryforward period under the Federal tax laws.

Changes in circumstances, such as the Company generating taxable income, could cause a change in judgment about the realizability of the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimate.

F - 5

Fair Value of Financial Instruments

The Company estimates the fair value of financial instruments using the available market information and valuation methods. Considerable judgment is required in estimating fair value. Accordingly, the estimates of fair value may not be indicative of the amounts the Company could realize in a current market exchange. The carrying value of accrued liabilities, and loans from directors and stockholders approximated fair value due to the short-term nature and maturity of these instruments.

Deferred Offering Costs

The Company defers as other assets the direct incremental costs of raising capital until such time as the offering is completed. At the time of the completion of the offering, the costs are charged against the capital raised. Should the offering be terminated, deferred offering costs are charged to operations during the period in which the offering is terminated.

Impairment of Long-Lived Assets

The Company evaluates the recoverability of long-lived assets and the related estimated remaining lives when events or circumstances lead management to believe that the carrying value of an asset may not be recoverable. For the period ended March 31, 2012, no events or circumstances occurred for which an evaluation of the recoverability of long-lived assets was required.

Common Stock Registration Expenses

The Company considers incremental costs and expenses related to the registration of equity securities with the SEC, whether by contractual arrangement as of a certain date or by demand, to be unrelated to original issuance transactions. As such, subsequent registration costs and expenses are expensed as incurred.

Estimates

The financial statements are prepared on the basis of accounting principles generally accepted in the United States. The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and expenses. Actual results could differ from those estimates for the period ended made by management.

Fiscal Year End

The Company has adopted a fiscal year end of December 31.

Recent Accounting Pronouncements

In May 2011, the FASB issued ASU 2011-04, "Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards ("IFRSs")." Under ASU 2011-04, the guidance amends certain accounting and disclosure requirements related to fair value measurements to ensure that fair value has the same meaning in U.S. GAAP and in IFRS and that their respective fair value measurement and disclosure requirements are the same. ASU 2011-04 is effective for public entities during interim and annual periods beginning after December 15, 2011. Early adoption is not permitted. The Company does not believe that the adoption of ASU 2011-04

will have a material impact on the Company's results of operation and financial condition.

In June 2011, the FASB issued ASU No. 2011-05, "Comprehensive Income (ASC Topic 220): Presentation of Comprehensive Income," ("ASU 2011-05") which amends current comprehensive income guidance. This accounting update eliminates the option to present the components of other comprehensive income as part of the statement of shareholders' equity. Instead, comprehensive income must be reported in either a single continuous statement of comprehensive income which contains two sections, net income and other comprehensive income, or in two separate but consecutive statements. ASU 2011-05 will be effective for public companies during the interim and annual periods beginning after Dec. 15, 2011 with early adoption permitted.

The Company does not believe that the adoption of ASU 2011-05 will have a material impact on the Company's results of operation and financial condition.

There were various other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries. None of the updates are expected to a have a material impact on the Company's financial position, results of operations or cash flows.

Page - 9

Note 2- Development Stage Activities and Going Concern

The Company is currently in the development stage, and has no operations. The business plan of the Company is to seek third party entities interested in licensing the rights to manufacture and market the patent design of an “Infant medicine dispenser”.

On December 13, 2010, the Company entered into a Patent Transfer and Sale Agreement whereby the Company acquired all of the right, title and interest in the patent known as the “Infant medicine dispenser” for consideration of $7,500 including attorney's fees. The United States Design Patent number is 380828.

The Company commenced a capital formation activity by filing a Registration Statement on Form S-1 to the SEC to register and sell in a self-directed offering 2,500,000 shares of newly issued common stock at an offering price of $0.03 per share for proceeds of up to $75,000. The Registration Statement was declared effective on January 9, 2012. On Febtuary 6, 2012, the Company issued 2,500,000 shares of common stock pursuant to the Registration Statement on Form S-1 for proceeds of $75,000. The offering costs of $20,000 related to this capital formation activity were charged against the capital raised.

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation of the Company as a going concern. The Company has not established any source of revenue to cover its operating costs, and as such, has incurred an operating loss since inception. Further, as of March 31, 2012, the cash resources of the Company were insufficient to meet its current business plan, and the Company had negative working capital. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the

possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

Note 3- Patent

On December 13, 2010, the Company entered into a Patent Transfer and Sale Agreement whereby the Company acquired all of the right, title and interest in the patent known as the “Infant medicine dispenser” for consideration of $7,500 including attorney's fees. The United States Design Patent number is 380828. Under the terms of the Patent Transfer and Sale Agreement, the Company was assigned rights to the patent free of any liens, claims, royalties, licenses, security interests or other encumbrances. The cost of obtaining the patent was expensed.

Note 4- Common Stock

On December 1, 2010, the Company issued 3,000,000 shares of its common stock to individuals who are Directors and officers of the company for $300. The Company received payment of the receivable in January 2011.

The Company commenced a capital formation activity by filing a Registration Statement on Form S-1 to the SEC to register and sell in a self-directed offering 2,500,000 shares of newly issued common stock at an offering price of $0.03 per share for proceeds of up to $75,000. The Registration Statement was declared effective on January 9, 2012. On Febtuary 6, 2012, the Company issued 2,500,000 shares of common stock pursuant to the Registration Statement on Form S-1 for proceeds of $75,000. The offering costs of $20,000 related to this capital formation activity were charged against the capital raised.

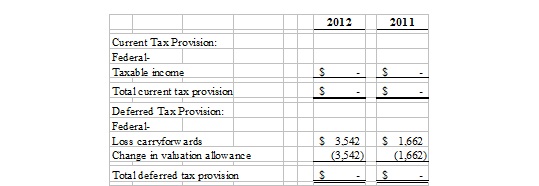

Note 5- Income Taxes

The provision (benefit) for income taxes for the periods ended March 31, 2012 and 2011, was as follows (assuming a 23% effective tax rate)

Page - 10

The Company had deferred income tax assets as of March 31, 2012 and December 31, 2011, as follows:

The Company provided a valuation allowance equal to the deferred income tax assets for the periods ended March 31, 2012 and December 31, 2011, because it is not presently known whether future taxable income will be sufficient to utilize the loss carryforwards.

As of March 31, 2012, the Company had approximately $52,000 in tax loss carryforwards that can be utilized in future periods to reduce taxable income, and expire by the year 2032.

The Company did not identify any material uncertain tax positions. The Company did not recognize any interest or penalties for unrecognized tax benefits.

The Company will file income tax returns in the United States. All tax years are closed by expiration of the statute of limitations.

Note 6- Related Party Transactions

As described in Note 4, on December 1, 2010, the Company issued 3,000,000 shares of its common stock to Directors and officers for $300 receivable. The Company received payment of the receivable in January 2011.

|

ITEM 2.

|

MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

Forward-Looking Statements

Certain statements contained in this Quarterly Report, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to the future operating performance of Baby All Corp and the services we expect to offer and other statements contained herein regarding matters that are not historical facts, are “forward-looking” statements. Future filings with the Securities and Exchange Commission, future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may contain forward-looking statements, because such statements include risks and

uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

This Management’s Discussion and Analysis or Plan of Operations (“MD&A”) section of this Report discusses our results of operations, liquidity and financial condition, and certain factors that may affect our future results. You should read this MD&A in conjunction with our audited financial statements and accompanying notes included in this Report. This plan of operation contains forward-looking statements that involve risks, uncertainties, and assumptions. The actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, but not limited to, those presented under “Risk Factors” or elsewhere in this

Report.

Corporate Background

We were incorporated in Delaware on November 30, 2010 and are a development stage company. On December 13, 2010, we entered into an exclusive worldwide patent sale agreement (the “Design Patent Transfer and Sale Agreement “) with Mrs. Julie Franchi, the inventor and seller of the patent, in relation to the sale and transfer of United States Design Patent Number 380828 for an infant medicine dispenser (the “Patent’). The technology that is the subject of the Patent has the potential to provide an additional way in which infants are given medicine and potentially liquid vitamins and other liquids in small quantities. Baby All Corp. purchased the Patent from Mrs. Julie Franchi

, the inventor, in exchange for a payment to Mrs. Franchi of US $5,000 (five thousand United States Dollars), according to the conditions specified in the Design Patent Transfer and Sale Agreement. There is no relationship between Mrs. Franchi, the seller, and Baby All Corp., its directors, or its affiliates. We do not know whether Mrs. Franchi has any experience in developing patents or in developing products based on or embodying her inventions. The seller was not able to commercialize the product due to a lack of funds. The seller did not build a prototype and a working prototype has not been built since we purchased rights to the patent and hence no testing has been done to determine the ability of the technology to perform as we expect, its reliability, or its cost effectiveness.

The patented invention that Baby All Corp. purchased from Mrs. Franchi is based on a design patent for an infant medicine dispenser with measurements on the side to enable someone to easily measure the appropriate amount to dispense. The top of the dispenser is similar to an infant bottle, enabling a child to easily suck the medicine out of the dispenser.

Page - 11

We were not involved in the design and patenting process for the patented technology, and we have not incurred any costs associated with the design and patenting of the technology. The only costs we have incurred to date have been the costs associated with our acquisition of the Patent from the inventor, which amounted to $5,000 to purchase the Patent and $2,500 in related legal fees. We plan to rely on third parties to develop, manufacture, and market our proposed product. In this regard, we plan to license the patent to a third-party to design, manufacture, and market a product based on the Patent against an initial payment to us and a percentage royalty to be paid quarterly.

Business Summary

We were incorporated in Delaware on November 30, 2010 and are a development stage company. A Design Patent Transfer and Sale Agreement was signed between Mrs. Julie Franchi (the inventor and seller), in relation to a patented technology on December 13, 2010, granting Baby All Corp. exclusive rights, title and interest in and to the Design Patent Number: 380828 and all Intellectual Property rights, free and clear of any lien, charge, claim, preemptive rights, etc. for an infant medicine dispenser.

The seller of the Patent was not able to commercialize the product due to a lack of funds. The seller did not build a prototype and a working prototype has not been built since we purchased rights to the patent and hence no testing has been done to determine the ability of the technology to perform as we expect its reliability, or its cost effectiveness.

The patented invention is for a specially designed infant feeding-type bottle that allows parents and other care givers to administer liquid medications to infants in a more convenient and familiar structure. The Patent’s dispenser design specifies using a small plastic bottle similar in shape to a conventional baby bottle but of a much smaller size. The bottle design will be marked with measurement lines and corresponding dosage notations ranging from ¼ teaspoon to 2 teaspoons or 1cubic centimeter (cc) to 10, depending on manufacturing decisions and market preferences. According to the patent, the top of the infant medicine dispenser is fitted with a rubber nipple cap that is easily detachable to allow

washing and reuse. This rubber cap would be held against the top of the bottle by a screw-on plastic ring mechanism that fits over the nipple cap and rests against the rubber lip at the bottom of the nipple.

The principal benefits offered by this design are convenience and familiarity. It is our belief that without a device such as this, it might be difficult to confirm whether or not the child ingested the appropriate quantity of the liquid medication being administered. One approach has been to use an eye dropper or similar device. This however, is less familiar to an infant than a standard bottle-type design and the child might push the eye dropper or other device away from its mouth. The feeling that this is not something known to the child, combined with what may be an unpleasant or unfamiliar taste associated with the medication, might trigger the child’s natural response to reject the

medicine.

It is our belief that by using the patented infant medicine dispenser design, the potential problems of an unfamiliar object is reduced and, in its place, an object is used with which the child is familiar and with which positive attributes are associated.

Even very young children, who are familiar to a standard bottle, will be comfortable with a bottle. For children who are exclusively breast-fed, it is possible that our design may not have any advantage over other products on the market.

While our patent design does offer benefits for children who are already familiar with being fed with standard bottles (including design and nipple formulation), our product is similar to all other infant medicine dispensers in regards that it will not alleviate the issue of a child having an adverse reaction to the unexpected taste of the medicine. However, we believe that the child’s negative reaction will be less when administered through a familiar design, such as our product.

It is our belief that this arrangement should result in more convenience for the parent or caregiver, as it allows them to carry a single dose of a child’s medication when travelling for a short period of time, rather than carrying the entire bottle of medication. Furthermore, our product makes giving children more convenient because the dose can be measured at any time, for example, while an infant is sleeping, and administered later when the child is awake. While a sick child may need more attention while it is awake, doctors prescribe a specific dose. Measuring this calmly and storing it in a convenient, already measured location, such as our product, means it can be given at the appropriate time, no

matter where the child or caregiver is currently located. Since some medications, for example some antibiotics given to children for ear infections, requires refrigeration, it is better to only remove a single dose from the refrigerated container, leaving the container refrigerated, as per the instructions on the package, while traveling with a single non-refrigerated dose until it is time to administer it.

We have not had any actual testing to our patented technology.

Other products currently available on the market include devices shaped to please a child, but none are designed as our product. The market offerings include pacifier-type devices which would be strange for a child that is not accustomed to using a pacifier, or even, specifically, that type of pacifier. Further, there is a device shaped like an elephant. While this will entertain the child, it is not in a form to which the child is accustomed to seeing or putting in his or her mouth. While our research found a medical bottle which included a syringe inside of it in which the medicine is contained, we did not find any device similar to our patented design whereby the medicine is put directly into the device and not

through a syringe. We believe that the inclusion of a syringe device inside a familiar bottle/nipple combination may complicate the process of administering the medication. While this process may lessen a child’s negative response to the foreign taste of the medication because the medicine is mixed with formula or some other liquid, it may also require the child to ingest a greater quantity of liquid. Also, it may complicate the cleaning process, requiring more attention from the caregiver at a time when the child may need more attention.

Page - 12

We believe the design of our device makes measuring and administering medication simple and effective because our product has the familiar shape and feel of a standard bottle and nipple, so even very young children are comfortable with the familiarity of the design. As we are interested in finding a third party partner to help us bring our product to the market, Baby All and its product do not yet have any position in the market.

While we believe children will feel comfortable with the familiarity of our product, which is similar to standard bottles used for drinking, there is the risk that caregivers may reject the need for our product, opting instead for traditional methods of administering medicine to their children.

Employees

Other than our current Directors and officers, we have no other full time or part-time employees. The Company has 2 outside consultants.

Transfer Agent

We have engaged Nevada Agency and Trust as our stock transfer agent. Nevada Agency and Trust is located at 50 West Liberty Street, Reno, Nevada 89501. Their telephone number is (775) 322-0626 and their fax number is (775) 322-5623. The transfer agent is responsible for all record-keeping and administrative functions in connection with our issued and outstanding common stock.

Plan of Operation

Baby All’s infant medicine dispenser, which is a specially designed infant feeding-type bottle, allows parent and other care givers to administer liquid medications to infants in a more convenient and familiar structure. The design, development, manufacturing, and marketing of a commercial product will be carried out by 3rd party partners who agree to license the design and pay a portion of future royalties to maintain the license on an ongoing basis.

General Working Capital

We have raised as of today, $75,000 in gross proceeds pursuant to the effective Registration Statement on Form S-1, filed with the Securities and Exchange Commission on January 9 2012 and issued 2,500,000 free trading shares .

We are not aware of any material trend, event or capital commitment, which would potentially adversely affect liquidity. In the event such a trend develops, we believe that we will have sufficient funds available to satisfy working capital needs through lines of credit and the funds expected from equity sales.

Liquidity and Capital Resources

Our balance sheet as March 31 2012 reflects cash in the amount of $0. Cash and cash equivalents from inception to date have been sufficient to provide the operating capital necessary to operate to date. The operating expenses and net loss for the three months ended March 31 2012 and March 31 2011 amounted to $13,573, $15,275 and $7,100, respectively .

We do not have sufficient resources to effectuate our business plan in full . We expect to incur a minimum of $100,000 in expenses during the next twelve months of operations. Accordingly, we will have to raise the funds to pay for these expenses. We might do so through a private offering or thru additional debt or equity financing . There can be no assurance that additional capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Going Concern Consideration

Our auditors have issued an opinion on our annual financial statements which includes a statement describing our going concern status. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills and meet our other financial obligations. This is because we have not generated any revenues and no revenues are anticipated until we begin marketing the product. Accordingly, we must raise capital from sources other than the actual sale of the product. We must raise capital to implement our project and stay in business.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

ITEM 3. QUANTITATIVE AND QUALITATATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Page - 13

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by our company in the reports that it files or submits under the Exchange Act is accumulated and communicated to our management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions

regarding required disclosure. Our management carried out an evaluation under the supervision and with the participation of our Principal Executive Officer and Principal Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 ("Exchange Act").

Based on this evaluation, our principal executive and principal financial and accounting officer concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) were effective as of March 31, 2012.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Exchange Act Rules 13a-15 or 15d-15 that occurred during our last fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

1.

|

Quarterly Issuances:

|

|

None.

|

|

2.

|

Subsequent Issuances:

|

|

|

None.

|

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. REMOVED AND RESERVED

ITEM 5. OTHER INFORMATION

Quarterly Events

On March 20, 2012, a majority of the Company’s Board of Director voted to authorize a 2.4:1 forward stock split (the “Forward Stock Split”). Consistent with the Company’s Articles of Incorporation and Delaware General Corporation Law, the action which was supported by a majority the shareholder action took effect on the opening of business Tuesday, April 03, 2012.

Page - 14

Subsequent Events

On April 3, 2012 the Company executed a forward split, changing every 1 share of common stock for 2.4 shares of common stock.

On April 19, 2012 a Letter of Intent ("LOI") was signed between the Company and Santa Fe Operating, Inc., for the exchange of shares of the Company (BABA), for all of the issued and outstanding shares of Santa Fe Operating, Inc., and related matters.

It is contemplated that the stockholders of Santa Fe would be issued a minimum of 33,478,261 shares of the Company's Common Stock and no more than 44,478,261 shares of BABAD Common Stock would be outstanding after such issuance if Santa Fe successfully completes an offering of its common stock resulting in gross proceeds of at least $2,500,000 prior to the deduction of any expenses related thereto. Additionally, shareholders of Santa Fe would be issued warrants to purchase 6,773,106 shares of the Company's common stock.

The closing of the proposed transaction is subject to the satisfactory completion of due diligence, the completion of definitive documents and the approval by the Boards of Directors of both BABA and Santa Fe. At closing, Santa Fe's management will assume management of BABA and a majority of directors of BABA will be directors nominated by Santa Fe.

Page - 15

|

3.1

|

Articles of Incorporation (Filed as Exhibit 3.1 to Registration Statement on Form S1, filed with the Securities and Exchange Commission on April 5, 2011)

|

|||

|

3.2

|

Bylaws of the Company (Filed as Exhibit 3.2 to Registration Statement on Form S1, filed with the Securities and Exchange Commission on April 5, 2011)

|

|||

|

31.01

|

||||

|

31.02

|

||||

|

32.01

|

||||

|

32.02

|

||||

Page - 16

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Baby All Corp.

a Delaware corporation

|

May 10, 2012

|

By:

|

/S/ Efrat Schwartz

|

|

Efrat Schwartz

|

||

|

Its:

|

CEO and a director

|

|

|

May 10, 2012

|

By:

|

/S/ Merav Shalom

|

|

Merav Shalom

|

||

|

Its:

|

Principal Accounting and Financial Officer, and Secretary

|

Page - 17

Exhibit 31.01

CERTIFICATION OF THE PRINCIPAL EXECUTIVE OFFICER PURSUANT TO RULE 13a-14

I, Efrat Schwartz, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Baby All Corp.;

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

|

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

May 10, 2012

|

By:

|

/S/ Efrat Schwartz

|

|

Efrat Schwartz

|

||

|

Its:

|

CEO and a director

|

Page - 18

|

|

Exhibit 31.02

CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER PURSUANT TO RULE 13a-14

I, Merav Shalom, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Baby All Corp.;

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

|

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

May 10, 2012

|

By:

|

/S/ Merav Shalom

|

|

Merav Shalom

|

||

|

Its:

|

Principal Accounting and Financial Officer, and Secretary

|

Page - 19

Exhibit 32.01

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Baby All Corp. (the “Company”) on Form 10-Q for the period ending March 31, 2012 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Efrat Schwartz, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that, to the best of my knowledge and belief:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

|

/s/ Efrat Schwartz

By: Efrat Schwartz

Its: CEO and a Director

|

|

Dated: May 10, 2012

|

|

A signed original of this written statement required by Section 906, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed form within the electronic version of this written statement has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

Page - 20

Exhibit 32.02

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Baby All Corp. (the “Company”) on Form 10-Q for the period ending March 31, 2012 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Merav Shalom, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that, to the best of my knowledge and belief:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

|

/s/ Merav Shalom

By: Merav Shalom

Its: Principal Accounting and Financial Officer, Secretary and Director

|

Dated: May 15, 2012

A signed original of this written statement required by Section 906, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed form within the electronic version of this written statement has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

Page - 21