Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d348118d8k.htm |

First Quarter

2012 Earnings

Conference Call

May 8, 2012

©2012 Oldemark LLC

Exhibit 99.1 |

JOHN

BARKER

CHIEF COMMUNICATIONS OFFICER |

Today’s Agenda

The Wendy’s Company

Financial Update

Steve Hare

CEO Overview

Emil Brolick

Q&A |

The Wendy’s Company

Forward-Looking Statements and

Non-GAAP Financial Measures

This presentation, and certain information that management may discuss in connection

with this presentation, contains certain statements that are not historical

facts, including information concerning possible or assumed future results

of

our

operations.

Those

statements

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995 (The “Reform Act”). For all forward-looking

statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Reform Act. Many important factors could affect our

future results and could cause those results to differ materially from those

expressed in or implied by our forward-looking statements. Such factors, all

of which are difficult or impossible to predict accurately, and many of

which

are

beyond

our

control,

include

but

are

not

limited

to

those

identified

under

the

caption

“Forward-Looking

Statements”

in

our

news

release

issued

on

May

8,

2012

and

in

the

“Special

Note

Regarding

Forward-Looking

Statements

and

Projections”

and

“Risk

Factors”

sections of our most recent Form 10-K / Form 10-Qs.

In addition, this presentation and certain information management may discuss in

connection with this presentation reference non- GAAP financial measures,

such as adjusted earnings before interest, taxes, depreciation and amortization, or adjusted EBITDA,

and adjusted earnings per share. Adjusted EBITDA and adjusted earnings per share

exclude certain expenses, net of certain benefits. Reconciliations of

non-GAAP financial measures to the most directly comparable GAAP financial measures are provided

in the Appendix to this presentation, and are included in our news release issued on

May 8, 2012 and posted on www.aboutwendys.com.

The Wendy’s Company |

STEVE

HARE

CHIEF FINANCIAL OFFICER |

The Wendy’s Company

Q1 2012 Financial Summary

Fourth consecutive quarter of positive SSS

Q1 2012 system SSS of 0.8% lower than expected

Lost momentum from strong +5.1% SSS in 4Q 2011

Margin negatively impacted by product mix and commodities

Revising Adjusted EBITDA from continuing operations outlook to

$320 to $335 million

Investing in business to drive future growth

|

Q1 2012 Financial Highlights

Q1 2012 N.A. Same-

Store Sales

Company-owned +0.8%

Franchise

Systemwide

Company Restaurant

Margin

Q1 2012 11.8%

Q1 2011 13.4%

(160) bps

Key Margin

Variance

Commodities

(220) bps

January

February

March

+0.7%

+0.7% |

The Wendy’s Company

Q1 2012 Financial Highlights

* See reconciliation of Adjusted EBITDA (earnings before interest, taxes,

depreciation and amortization), Adjusted Income and Adjusted Earnings

per Share from continuing operations attributable to The Wendy’s Company in the appendix.

($ in Millions except per share amounts)

Q1 2012

Q1 2011

Better/

(Worse)

Sales

519.9

$

509.3

$

10.6

$

Franchise revenues

73.3

73.2

0.1

Total revenues

593.2

$

582.5

$

10.7

$

Adjusted EBITDA*

63.9

$

73.7

$

(9.8)

$

Income from continuing operations

attributable to The Wendy's Company

12.4

$

$ (0.3)

12.7

$

Reported EPS

0.03

$

$ 0.00

0.03

$

Adjusted income from continuing operations

attributable to The Wendy's Company*

3.3

$

9.3

$

(6.0)

$

Adjusted EPS*

0.01

$

0.02

$

(0.01)

$ |

Income from Continuing Operations and Special Items

* See reconciliation of Adjusted Income and Adjusted Earnings Per Share

from Continuing Operations in the appendix. The Wendy’s

Company Reconciliation of Adjusted Income and Adjusted Earnings per Share from

Continuing Operations to Income (Loss) and Earnings per Share from Continuing

Operations Attributable to The Wendy's Company (Unaudited)

(In thousands, except per share amounts)

Adjusted income and adjusted earnings per share from continuing operations

Plus (less):

Gain on sale of investment, net

Impairment of long-lived assets

Facilities relocation and other transition costs

Transaction related costs

Arby's indirect corporate overhead in general and administrative

(G&A)

SSG purchasing cooperative expense reversal in G&A

Total Adjustments

Income (loss) from continuing operations and earnings per share

Net income attributable to noncontrolling interests

Income (loss) and earnings per share from continuing operations attributable to The

Wendy's Company per share

per share

3,347

$

0.01

$

9,300

$

0.02

$

17,978

0.05

-

-

(2,783)

(0.01)

(4,873)

(0.01)

(3,429)

(0.01)

-

-

(379)

(0.00)

(1,187)

(0.00)

-

-

(4,970)

(0.01)

-

-

1,434

0.00

11,387

0.03

(9,596)

(0.02)

14,734

0.04

(296)

(0.00)

(2,384)

(0.01)

-

-

12,350

$

0.03

$

(296)

$

(0.00)

$

2012

2011

First Quarter |

The Wendy’s Company

Q1 2012 Cash Flow

($ in Millions)

Q1 2012

Net Income

14.7

$

Less: Adjustments

(29.8)

Cash flow used in operations

(15.1)

Capital expenditures

(47.0)

Restaurant acquisitions

(2.6)

Proceeds from sale of investment

24.4

Dividends paid

(7.8)

Other financing / investing activities

(2.3)

Net cash decrease before debt payments

(50.4)

Repayments of long-term debt

(6.4)

Net decrease in cash after debt payments

(56.8)

Beginning cash balance

475.2

Ending cash balance

418.4

$ |

Q1 2012 Consolidated Debt

* See reconciliation of Adjusted EBITDA (earnings before interest, taxes,

depreciation and amortization) in the appendix ($ in Millions)

Senior Debt

1,328.2

$

Capital Leases and Other Debt

24.2

Total Debt

1,352.4

Less: Cash and Cash Equivalents

418.4

Net Debt

934.0

$

TTM Adjusted EBITDA*

321.2

$

Total Debt / TTM Adjusted EBITDA*

4.2x

Net Debt / TTM Adjusted EBITDA*

2.9x

April 1, 2012

The Wendy’s Company |

The Wendy’s Company

Refinancing: Transaction Summary

Wendy’s International, Inc. raising $1.125 billion of new secured

term loans

and $200 million of revolving Credit Facility

Improves covenant flexibility, extends maturity and increases

liquidity Annual interest savings of $25 million

Transaction proceeds will be used*:

To redeem or repurchase Wendy’s Restaurants’

existing 10% Senior Notes due 2016

To refinance the Company’s existing credit facilities

For

general

corporate

purposes,

including

the

funding

of

related

transaction

fees

and

expenses

Timing

May 15: Settlement of tender

July 16: Expected completion of the call

* Subject to market conditions and other factors, Wendy’s

Restaurants currently intends to redeem on July 16 any Senior Notes that remain outstanding following consummation of the tender offer. |

2012 and Long-Term Outlook

2012 outlook for Adjusted EBITDA from Continuing

Operations lowered to a range of $320 to $335 million

Reaffirming long-term average annual Adjusted EBITDA

growth rate in the high-single-digit to low-double-digit

range beginning in 2013

The Wendy’s Company |

2012 Revised Outlook

Sales momentum from October 2011 launch of Dave’s Hot ‘N

Juicy Cheeseburger line did not carry over into Q1 2012

The “W”

Cheeseburger diluted marketing message and cannibalized positive

momentum from Dave’s Hot ‘N’

Juicy

Q1 marketing calendar did not drive sales

Intense competitive couponing and discounting

Wendy’s marketing messages were less effective in driving

transactions The Wendy’s Company |

2012 Revised Outlook

Unfavorable product mix resulted in negative impact on margin

The “W”

Cheeseburger was mispriced at $2.99

More beef on the “W”

(4.5 ounces) than on Dave’s Hot ‘N’

Juicy (4 ounces)

Caused trade-down from premium rather than trade-up from

value Raising the “W”

a la carte price from $2.99 to $3.19 prior to March promotion did not

achieve desired results

Consumers changed buying behavior

Managed check by buying fewer or different items to maintain or reduce

spending Resulted in less leverage on fixed costs

The Wendy’s Company |

The Wendy’s Company |

Wendy’s Long-Term Strategic Growth Components

2013 & Beyond

High-single to

low-double digit

Adjusted

EBITDA

growth rate

Int’l

Franchise

Acquisitions/

Sales

Financial Mgmt.

Breakfast / 24 HR

New Restaurant Development

Image Activation

North American Business Improvement

The Wendy’s Company |

EMIL

BROLICK

PRESIDENT & CHIEF EXECUTIVE OFFICER |

The Wendy’s Company

1

st

Quarter Below Expectations

Refining marketing messages

Dynamic consumer & market environment

Restaurant execution improving

Big brand image building

2012: Transition year |

The Wendy’s Company

We Remain Confident in

Our Strategies

“A Cut Above”

brand positioning

“Recipe to Win”

Growth platforms to produce shareholder value

Financial resources

Building people capabilities

Iron-willed determination |

“A CUT ABOVE” |

The Wendy’s Company

A CUT ABOVE

Why it will work

The Wendy’s Company

The Wendy’s Company

Reimaging the Restaurants

Reimaging the People

Reimaging the Experience

Reimaging the Food

Reimaging the Brand Communications |

The Wendy’s Company

The Wendy’s Company |

The Wendy’s Company

Wendy’s Advertising Awareness Levels Have Spiked to Highest

Levels in Over 2 Years

Jan ‘09

Jul ‘09

Jan ‘10

Jul ‘10

Jan ‘11

Jul ‘11

Feb ‘12

TV Advertising (Aided) |

Source: Millward Brown. Data based on Q3 2011, Q4 2011, Q1 2012.

Since the Launch of Dave’s Hot ‘N Juicy Cheeseburgers,

Wendy’s has Made Gains in Hamburger Attributes

Great Tasting Hamburgers

Use Fresh, Never Frozen Beef

Q3 ‘11

Q4 ‘11

Q1 ‘12

Competitor B

Competitor A

Competitor B

Competitor A

The Wendy’s Company |

The Wendy’s Company

P

P

RICE

RICE

P

P

RODUCT

RODUCT

P

P

ROMOTION

ROMOTION

P

P

LACE

LACE

P

P

ERFORMANCE

ERFORMANCE

P

P

EOPLE

EOPLE

RECIPE TO WIN |

PRICE:

Price/Value Imbalance

Company Stores

In 2011, Single transitioned to include cheese in standard build.

2011 pricing reflects blended cheese/no cheese price, prior years show pricing

for Single no cheese. $4.09

$2.49

$3.49

$1.69

$0.99

$0.99

Annual Price Trends

Annual Price Trends

The Wendy’s Company

+$1.50

-

$0.70

Gap

+$3.10

-

$2.50

Gap

+$3.10

-

$2.50

Gap |

The Wendy’s Company

P

Right Price …

Right Size …

Right Quality …

Moving to a tighter 99-cent value menu

EVERYDAY VALUE MENU

JR. CHEESEBURGER

99

?

CRISPY CHICKEN SANDWICH

99

?

5-PC. SPICY CHICKEN NUGGETS

99

?

VALUE NATURAL-CUT FRIES

99

?

VALUE SOFT DRINK

99

?

SMALL FROSTY

99

?

The Wendy’s Company

RICE

Testing products / prices at “value”

tiers

above 99 cents |

IMAGE

ACTIVATION •

•Customer reaction extremely positive

•

P

The Wendy’s Company

Ten 2011 prototypes exceeding sales

expectations

LACE

Elevates customer experience with

innovative interior and exterior designs |

IMAGE ACTIVATION PERFORMANCE

Consumer Insights on Restaurant Design

Consumer Insights on Restaurant Design

All Interiors are a “WOW”

customer experience

Welcoming, Positive Ambiance: Fireplaces, Lounge Seating, Booths,

TVs Separation Between Order Placement and Pick Up

New Queue and Front Counter are Differentiators, Not Typical QSR

The Wendy’s Company |

The Wendy’s Company

IMAGE ACTIVATION PROGRESS

•

2012

•

50 reimages

•

20 new builds

•

Testing with select franchisees

•

2013

•

Plan to accelerate with tiered

investment approach

•

Developing financing sources for

franchisees |

Deliver “A Cut Above”

customer experience

Provide a Fast Casual experience at traditional QSR price

The Wendy’s Company

P

EOPLE

Improving Reliability and Predictability |

Executive Leadership:

Hired Craig Bahner, Chief Marketing Officer

Hired Scott Weisberg, Chief People Officer

Promoted John Peters, SVP of Operations

The Wendy’s Company

P

EOPLE |

The Wendy’s Company

PERFORMANCE

Sparkle Operators Evaluation (SOE) scores at all-time highs

“A”

Restaurants

“F”

Restaurants

SOE Score

2.1%

3.6%

6.3%

13.3%

16.2%

25.1%

29.3%

17.4%

1.0%

0.3%

0.5%

0.4%

75.3%

79%

82%

85%

85%

86%

66%

70%

74%

78%

82%

86%

0%

10%

20%

30%

40%

2007

2008

2009

2010

2011

Q1 '12

A

F

SOE |

The Wendy’s Company

PROMOTION: Advertising

New advertising campaign and strategy:

Began April 2

Features two consumer champions:

Consumer advocate

Wendy Thomas

Smartly challenges consumer food choices and promotes the

benefits of choosing Wendy’s |

The Wendy’s Company

PROMOTION: Advertising

Product / Promotion

•

Contemporizes brand

•

Sets expectations for the Wendy’s

experience

•

76% positive sentiment in social

media; 18,000+ new campaign

conversations; mentioned every 132

seconds.

Advocate for consumers

“Now, That’s Better” |

The Wendy’s Company

PROMOTION: Advertising

Brand Promise

•

Demonstrates brand values:

Quality, Fresh preparation,

Honest Food

•

Sets expectation for

Wendy’s quality

Brand heritage and

ambassador: Wendy Thomas |

P

RODUCT

Spicy Chicken Guacamole Club |

The Wendy’s Company

PRODUCT: Strengthen The

Core Hamburgers:

Promotional LTO

Heritage Products:

Baked

Potato, Frosty and Chili

Salads:

Seasonal favorite |

The Wendy’s Company

P

RODUCT

Direct Mail Coupons |

The Wendy’s Company

Brand Access and Asset Utilization

Breakfast is most rapidly growing

QSR daypart past five years & next

five years

Breakfast is 22% of QSR traffic,

17% of QSR sales

Puts Wendy’s in position to serve

24 hours |

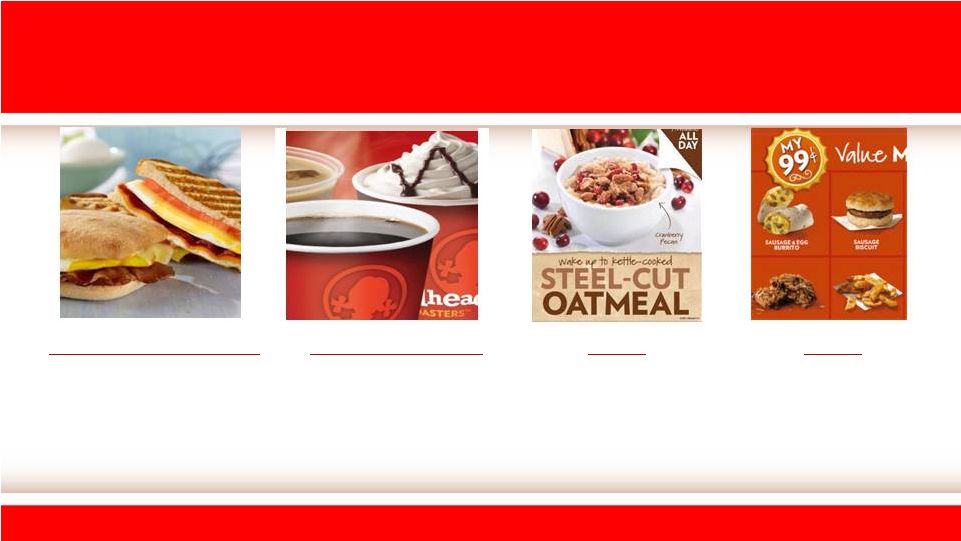

The Wendy’s Company

Breakfast Menu Strategy

Premium ingredients and authentic preparation

Distinctive

Artisan Egg Sandwich

Mornin’

Melt Panini

Biscuit Sandwiches

Coffee Credibility

Red Head Roasters

Orange Juice

Soft Drinks

Differentiation

Home-Style Potatoes

Steel-Cut Oatmeal

Fruit Cup

Everyday Affordability

Sausage & Egg Burrito

Oatmeal Bar

Sausage Biscuit

Signature

Sandwiches

Beverages/Coffee

Sides

Value |

The Wendy’s Company

Breakfast Next Steps

Focused on improving breakfast sales and profitability

Expand to Northeastern U.S. market in summer 2012

Adding breakfast to certain reimaged and new restaurants

Evaluating optimal expansion strategy |

INTERNATIONAL

OPPORTUNITY |

The Wendy’s Company

International Update

Development Update

Total (open / commitments) ~ 1,000 restaurants

Buenos Aires, Argentina

Opened 4 restaurants in Q1, increasing total restaurant

count to 354

Added 37 new restaurant commitments increasing total

commitments to 636

Signed development agreement with Wissol Group for

Georgia & Republic of Azerbaijan for 25 restaurants

|

The Wendy’s Company

International Update

Following Recipe to Win: 6 P’s

Refining menu architecture to drive

“A Cut Above”

positioning

Launching Dave’s Hot ‘N Juicy in

many markets in May and June

Translating and activating

“Now That’s Better”

campaign

Premium Porcini Mushroom

Chicken Sandwich in Japan |

The Wendy’s Company

Wendy’s Long-Term Strategic Growth Components

Int’l

New Restaurant Development

Image Activation

2013 & Beyond

High-single to

low-double digit

Adjusted

EBITDA

growth rate

Franchise

Acquisitions/

Sales

Financial Mgmt.

Breakfast / 24 HR

North American Business Improvement |

The Wendy’s Company

Summary

We know what we want to be…“A Cut Above”

We know how to get there…“The Recipe to Win”

We have the growth platforms to produce shareholder value

We have the financial resources

We are building the people capability

We have great franchise partners

We have iron-willed determination |

JOHN

BARKER

CHIEF COMMUNICATIONS OFFICER |

The Wendy’s Company

May 23:

Morgan Stanley Retail Conference

May 24:

The Wendy’s Company Annual Meeting

June 28:

Investor Day in Dublin, OH

August 9:

2Q Earnings Release

Upcoming Investor Calendar |

The Wendy’s Company

JUNE INVESTOR DAY

•

Management Presentations

•

Image Activation restaurant tours

•

Formal invitations will be e-mailed

Thursday, June 28 in Dublin, OH

The Wendy’s Company

Restaurant Support Center

June 28, 2012

8:00 am –

4:00 pm |

©2012 Oldemark LLC

The Wendy’s Company |

Appendix |

Reconciliation

of

Adjusted

EBITDA

from

Continuing

Operations

to

Net

Income

(Loss)

Attributable

to

The

Wendy’s

Company

(Unaudited)

2012

2011

Adjusted EBITDA from continuing operations

63,881

$

73,725

$

(Less) plus:

Depreciation and amortization

(32,311)

(30,314)

Impairment of long-lived assets

(4,511)

(7,897)

Facilities relocation and other transition costs

(5,531)

-

Transaction related costs

(612)

(1,884)

Arby's

indirect

corporate

overhead

in

general

and

administrative

(G&A)

-

(7,888)

SSG purchasing cooperative expense reversal in G&A

-

2,275

Operating profit

20,916

28,017

Interest expense

(28,235)

(29,442)

Gain on sale of investment, net

27,407

-

Other income, net

1,524

253

Income

(loss)

from

continuing

operations

before

income

taxes

and

noncontrolling

interests

21,612

(1,172)

(Provision for) benefit from income taxes

(6,878)

876

Income (loss) from continuing operations

14,734

(296)

Loss from discontinued operations, net of income taxes

-

(1,113)

Net income (loss)

14,734

(1,409)

Net income attributable to noncontrolling interests

(2,384)

-

Net income (loss) attributable to The Wendy's Company

12,350

$

(1,409)

$

First Quarter

(In thousands)

The Wendy’s Company |

Reconciliation of Adjusted Income from Continuing Operations and

Adjusted

Earnings per Share to Income (Loss) from Continuing Operations and Earnings

per Share Attributable to The Wendy’s Company

(Unaudited)

(In thousands, except per share amounts)

per share

per share

Adjusted income and adjusted earnings per share from continuing operations

3,347

$

0.01

$

9,300

$

0.02

$

Plus (less):

Gain on sale of investment, net

17,978

0.05

-

-

Impairment of long-lived assets

(2,783)

(0.01)

(4,873)

(0.01)

Facilities relocation and other transition costs

(3,429)

(0.01)

-

-

Transaction related costs

(379)

(0.00)

(1,187)

(0.00)

Arby's

indirect

corporate

overhead

in

general

and

administrative

(G&A)

-

-

(4,970)

(0.01)

SSG purchasing cooperative expense reversal in G&A

-

-

1,434

0.00

Total Adjustments

11,387

0.03

(9,596)

(0.02)

Income (loss) from continuing operations and earnings per share

14,734

0.04

(296)

(0.00)

Net income attributable to noncontrolling interests

(2,384)

(0.01)

-

-

Income

(loss)

and

earnings

per

share

from

continuing

operations

attributable

to

The

Wendy's

Company

12,350

$

0.03

$

(296)

$

(0.00)

$

2012

2011

First Quarter

The Wendy’s Company |