Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WELLS FARGO & COMPANY/MN | d348103d8k.htm |

| EX-4.3 - FORM OF MEDIUM-TERM NOTES - WELLS FARGO & COMPANY/MN | d348103dex43.htm |

| EX-4.4 - FORM OF MEDIUM-TERM NOTES - WELLS FARGO & COMPANY/MN | d348103dex44.htm |

| EX-8.2 - OPINION OF SULLIVAN & CROMWELL LLP REGARDING THE NOTES - WELLS FARGO & COMPANY/MN | d348103dex82.htm |

| EX-4.2 - FORM OF MEDIUM-TERM NOTES - WELLS FARGO & COMPANY/MN | d348103dex42.htm |

| EX-5.1 - OPINION OF FAEGRE BAKER DANIELS LLP REGARDING THE NOTES - WELLS FARGO & COMPANY/MN | d348103dex51.htm |

| EX-8.1 - OPINION OF SULLIVAN & CROMWELL LLP REGARDING THE PRODUCT SUPPLEMENTS - WELLS FARGO & COMPANY/MN | d348103dex81.htm |

Exhibit 4.1

[Face of Note]

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (“DTC”), to the Company or its agent for registration of transfer, exchange or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as requested by an authorized representative of DTC (and any payment is made to Cede & Co. or such other entity as is requested by an authorized representative of DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

| CUSIP NO. 94986RJJ1 |

||

| REGISTERED NO. |

FACE AMOUNT: $ |

WELLS FARGO & COMPANY

MEDIUM-TERM NOTE, SERIES K

Due Nine Months or More From Date of Issue

Notes Linked to a Currency Basket

due November 7, 2016

WELLS FARGO & COMPANY, a corporation duly organized and existing under the laws of the State of Delaware (hereinafter called the “Company,” which term includes any successor corporation under the Indenture hereinafter referred to), for value received, hereby promises to pay to CEDE & Co., or registered assigns, an amount equal to the Redemption Amount (as defined below), in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts, on the Stated Maturity Date. The “Initial Stated Maturity Date” shall be November 7, 2016. If the Exchange Rates (as defined below) for the Basket Components (as defined below) are published on the final scheduled Calculation Day (as defined below), the Initial Stated Maturity Date will be the “Stated Maturity Date.” If the Exchange Rate for a Basket Component is not published on the final scheduled Calculation Day, and the Average Ending Level (as defined below) has not been determined as provided in this Security prior to three Business Days (as defined below) prior to the Initial Stated Maturity Date, the “Stated Maturity Date” shall be postponed to the third Business Day following the date on which the Average Ending Level is determined. This Security shall not bear any interest.

Any payments on this Security at Maturity will be made against presentation of this Security at the office or agency of the Company maintained for that purpose in the City of Minneapolis, Minnesota and at any other office or agency maintained by the Company for such purpose.

“Face Amount” shall mean, when used with respect to this Security, the amount set forth on the face of this Security as its “Face Amount.”

Determination of Redemption Amount

The “Redemption Amount” of this Security will equal:

| • | If the Average Ending Level is greater than or equal to the Starting Level, the Face Amount plus the greater of: |

| (i) | the Minimum Return; and |

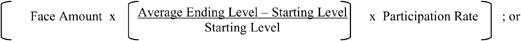

| (ii) |

|

| • | If the Average Ending Level is less than the Starting Level: the Face Amount plus the Minimum Return. |

“Basket” shall mean a basket comprised of the following Basket Components, with the return of each Basket Component relative to the U.S. Dollar having the weighting in the Basket noted parenthetically: the Australian Dollar (33.4%); the Norwegian Krone (33.3%); and the Canadian Dollar (33.3%).

“Basket Component” shall mean each of the Australian Dollar; the Norwegian Krone; and the Canadian Dollar.

The “Pricing Date” shall mean April 30, 2012.

The “Starting Level” is 100.

The “Average Ending Level” will be calculated based on the weighted returns of the Basket Components, each relative to the U.S. Dollar, and will be equal to the product of (i) 100 and (ii) an amount equal to 1 plus the sum of: (A) 33.4% of the Average Component Return of the Australian Dollar; (B) 33.3% of the Average Component Return of the Norwegian Krone; and (C) 33.3% of the Average Component Return of the Canadian Dollar.

The “Minimum Return” is 2% of the Face Amount.

The “Average Component Return” of a Basket Component will be equal to:

Average Component Level – Initial Component Level

Initial Component Level

where,

| • | the “Initial Component Level” is the Exchange Rate of such Basket Component on the Pricing Date; and |

| • | the “Average Component Level” will be the arithmetic average of the Exchange Rate of such Basket Component on the Calculation Days. |

2

The Initial Component Levels of the Basket Components are as follows: Australian Dollar (1.04105); Norwegian Krone (0.17457); and Canadian Dollar (1.01220).

The “Participation Rate” is 100%.

The “Exchange Rate” for each Basket Component on any Currency Trading Day, for purposes of determining the Average Component Return, will be determined as follows:

| • | Australian Dollar – the rate for conversion of Australian Dollars into U.S. Dollars (expressed as the number of U.S. Dollars per 1 Australian Dollar) equal to the WM/Reuters Closing Spot Rate (Mid) as calculated at approximately 4:00 p.m. London time and published at approximately 4:15 p.m. London time as referenced by Bloomberg page WMCO1 “AUD” below “MID,” or any successor or replacement service or page, on such Currency Trading Day. |

| • | Norwegian Krone – the rate for conversion of Norwegian Kroner into U.S. Dollars (expressed as the number of U.S. Dollars per 1 Norwegian Krone) equal to one divided by the WM/Reuters Closing Spot Rate (Mid) as calculated at approximately 4:00 p.m. London time and published at approximately 4:15 p.m. London time as referenced by Bloomberg page WMCO1 “NOK” below “MID,” or any successor or replacement service or page, rounded to five decimal places, with .000005 rounded upwards to .00001, on such Currency Trading Day. |

| • | Canadian Dollar – the rate for conversion of Canadian Dollars into U.S. Dollars (expressed as the number of U.S. Dollars per 1 Canadian Dollar) equal to one divided by the WM/Reuters Closing Spot Rate (Mid) as calculated at approximately 4:00 p.m. London time and published at approximately 4:15 p.m. London time as referenced by Bloomberg page WMCO1 “CAD” below “MID,” or any successor or replacement service or page, rounded to five decimal places, with .000005 rounded upwards to .00001, on such Currency Trading Day. |

“Business Day” shall mean a day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in New York, New York or Minneapolis, Minnesota.

The “Calculation Days” shall be, for each Basket Component, on the last Currency Trading Day of each April and October for that Basket Component, commencing October 2012 and ending October 2016. If the Exchange Rate for a Basket Component is not published on a Calculation Day, such Calculation Day for such Basket Component will be postponed to the first succeeding Currency Trading Day on which the Exchange Rate for such Basket Component is published. If such first succeeding Currency Trading Day has not occurred as of the fifth scheduled Currency Trading Day after a scheduled Calculation Day for such Basket Component, that fifth scheduled Currency Trading Day shall be deemed a Calculation Day. If a Calculation Day has been postponed five scheduled Currency Trading Days after a scheduled Calculation

3

Day for such Basket Component and such fifth scheduled Currency Trading Day is not a Currency Trading Day, or if the Exchange Rate with respect to such Basket Component on such fifth scheduled Currency Trading Day is not published, the Calculation Agent will determine the Exchange Rate of such Basket Component on such fifth scheduled Currency Trading Day in a commercially reasonable manner. Notwithstanding a postponement of a Calculation Day for a particular Basket Component due to the non-publication of the Exchange Rate for such Basket Component, the originally scheduled Calculation Day will remain a Calculation Day for any Basket Component for which an Exchange Rate is published.

A “Currency Trading Day,” with respect to a Basket Component, means a day on which commercial banks are open for business (including dealings in foreign exchange in accordance with the market practice of the foreign exchange market) in New York, New York and in the principal financial center for the applicable Basket Component (Sydney, Australia, with respect to the Australian Dollar; Oslo, Norway, with respect to the Norwegian Krone; and Toronto, Canada, with respect to the Canadian Dollar) and are not otherwise required by law, regulation or executive order to close.

“Calculation Agent Agreement” shall mean the Calculation Agent Agreement dated as of May 8, 2012 between the Company and the Calculation Agent, as amended from time to time.

“Calculation Agent” shall mean the Person that has entered into the Calculation Agent Agreement with the Company providing for, among other things, the determination of the Average Ending Level and the Redemption Amount, which term shall, unless the context otherwise requires, include its successors under such Calculation Agent Agreement. The initial Calculation Agent shall be Wells Fargo Securities, LLC. Pursuant to the Calculation Agent Agreement, the Company may appoint a different Calculation Agent from time to time after the initial issuance of this Security without the consent of the Holder of this Security and without notifying the Holder of this Security.

Adjustments to a Basket Component

If, after the Pricing Date and on or before a Calculation Day, any country issuing a Basket Component (the “issuing entity”) has lawfully eliminated, converted, redenominated or exchanged its lawful currency that was in effect on the Pricing Date (an “original currency”) for a successor currency, then for the purpose of calculating the Average Component Return for such Basket Component, the Basket will include the successor currency and no longer include the original currency. The Initial Component Level for the successor currency, and the Exchange Rate of the successor currency on any prior Calculation Days used in the calculation of the Average Component Level of such successor currency, will be adjusted to reflect such successor currency in accordance with the exchange ratio set by the issuing entity for converting the original currency into the successor currency on the date that the elimination, conversion, redenomination or exchange occurred. If there is more than one such date prior to a Calculation Day, the date closest to such Calculation Day will be selected.

4

Calculation Agent

The Calculation Agent will determine the Redemption Amount and the Average Ending Level. In addition, the Calculation Agent will (i) determine whether the Exchange Rate for a Basket Component is not published, and, if so, determine such Exchange Rate in a commercially reasonable manner, (ii) select a successor or replacement service or page if needed, and (iii) determine if adjustments are required to the Exchange Rate of a Basket Component as described in this Security.

The Company covenants that, so long as this Security is Outstanding, there shall at all times be a Calculation Agent (which shall be a broker-dealer, bank or other financial institution) with respect to this Security.

All determinations made by the Calculation Agent with respect to this Security will be at the sole discretion of the Calculation Agent and, in the absence of manifest error, will be conclusive for all purposes and binding on the Company and the Holder of this Security. All percentages and other amounts resulting from any calculation with respect to this Security will be rounded at the Calculation Agent’s discretion.

Redemption and Repayment

This Security is not subject to redemption at the option of the Company or repayment at the option of the Holder hereof prior to November 7, 2016. This Security is not entitled to any sinking fund.

Acceleration

If an Event of Default, as defined in the Indenture, with respect to this Security shall occur and be continuing, the Redemption Amount (calculated as set forth in the next sentence) of this Security may be declared due and payable in the manner and with the effect provided in the Indenture. The amount payable to the Holder hereof upon any acceleration permitted under the Indenture will be equal to the Redemption Amount hereof calculated as provided herein; provided, however, that the Redemption Amount will be calculated using (A) the Exchange Rates ascertained on the Calculation Day(s) that occurred before the date of acceleration and (B) the Exchange Rates ascertained on the date of acceleration and on each of the Currency Trading Days leading up to the date of acceleration in such aggregate number (including the date of acceleration) equal to the number of Calculation Days scheduled to occur after the date of acceleration.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

5

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature or its duly authorized agent under the Indenture referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

[The remainder of this page has been left intentionally blank]

6

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed under its corporate seal.

| DATED: | ||||||||

| WELLS FARGO & COMPANY | ||||||||

| By: | ||||||||

| Its: | ||||||||

| [SEAL] | ||||||||

| Attest: | ||||||||

| Its: | ||||||||

TRUSTEE’S CERTIFICATE OF

AUTHENTICATION

This is one of the Securities of the

series designated therein described

in the within-mentioned Indenture.

| CITIBANK, N.A., as Trustee | ||

| By: | ||

| Authorized Signature | ||

OR

| WELLS FARGO BANK, N.A., as Authenticating Agent for the Trustee | ||

| By: | ||

| Authorized Signature | ||

7

[Reverse of Note]

WELLS FARGO & COMPANY

MEDIUM-TERM NOTE, SERIES K

Due Nine Months or More From Date of Issue

Notes Linked to a Currency Basket

due November 7, 2016

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued and to be issued in one or more series under an indenture dated as of July 21, 1999, as amended or supplemented from time to time (herein called the “Indenture”), between the Company and Citibank, N.A., as Trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee and the Holders of the Securities, and of the terms upon which the Securities are, and are to be, authenticated and delivered. This Security is one of the series of the Securities designated as Medium-Term Notes, Series K, of the Company, which series is limited to an aggregate principal amount or face amount, as applicable, of $25,000,000,000 or the equivalent thereof in one or more foreign or composite currencies. The amount payable on the Securities of this series may be determined by reference to the performance of one or more equity-, commodity- or currency-based indices, exchange traded funds, securities, commodities, currencies, statistical measures of economic or financial performance, or a basket comprised of two or more of the foregoing, or any other market measure or may bear interest at a fixed rate or a floating rate. The Securities of this series may mature at different times, be redeemable at different times or not at all, be repayable at the option of the Holder at different times or not at all and be denominated in different currencies.

Article Sixteen of the Indenture shall not apply to this Security.

The Securities are issuable only in registered form without coupons and will be either (a) book-entry securities represented by one or more Global Securities recorded in the book-entry system maintained by the Depositary or (b) certificated securities issued to and registered in the names of, the beneficial owners or their nominees.

The Company agrees, to the extent permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest against a Holder of this Security.

Modification and Waivers

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company and the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the

8

time Outstanding of all series to be affected, acting together as a class. The Indenture also contains provisions permitting the Holders of a majority in principal amount of the Securities of all series at the time Outstanding affected by certain provisions of the Indenture, acting together as a class, on behalf of the Holders of all Securities of such series, to waive compliance by the Company with those provisions of the Indenture. Certain past defaults under the Indenture and their consequences may be waived under the Indenture by the Holders of a majority in principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series. Solely for the purpose of determining whether any consent, waiver, notice or other action or Act to be taken or given by the Holders of Securities pursuant to the Indenture has been given or taken by the Holders of Outstanding Securities in the requisite aggregate principal amount, the principal amount of this Security will be deemed to be equal to the amount set forth on the face hereof as the “Face Amount” hereof. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

Defeasance

Section 403 and Article Fifteen of the Indenture and the provisions of clause (ii) of Section 401(1)(B) of the Indenture, relating to defeasance at any time of (a) the entire indebtedness on this Security and (b) certain restrictive covenants and certain Events of Default, upon compliance by the Company with certain conditions set forth therein, shall not apply to this Security. The remaining provisions of Section 401 of the Indenture shall apply to this Security.

Authorized Denominations

This Security is issuable only in registered form without coupons in denominations of $1,000 or any amount in excess thereof which is an integral multiple of $1,000.

Registration of Transfer

Upon due presentment for registration of transfer of this Security at the office or agency of the Company in the City of Minneapolis, Minnesota, a new Security or Securities of this series, with the same terms as this Security, in authorized denominations for an equal aggregate Face Amount will be issued to the transferee in exchange herefor, as provided in the Indenture and subject to the limitations provided therein and to the limitations described below, without charge except for any tax or other governmental charge imposed in connection therewith.

This Security is exchangeable for definitive Securities in registered form only if (x) the Depositary notifies the Company that it is unwilling or unable to continue as Depositary for this Security or if at any time the Depositary ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, and a successor depositary is not appointed within 90 days after the Company receives such notice or becomes aware of such ineligibility, (y) the Company in its sole discretion determines that this Security shall be exchangeable for definitive Securities in registered form and notifies the Trustee thereof or (z) an Event of Default with respect to the Securities represented hereby has occurred and is continuing. If this Security is exchangeable pursuant to the preceding sentence, it shall be exchangeable for definitive Securities in registered form, having the same date of issuance, Stated Maturity Date and other terms and of authorized denominations aggregating a like amount.

9

This Security may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor of the Depositary or a nominee of such successor. Except as provided above, owners of beneficial interests in this Global Security will not be entitled to receive physical delivery of Securities in definitive form and will not be considered the Holders hereof for any purpose under the Indenture.

Prior to due presentment of this Security for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Trustee nor any such agent shall be affected by notice to the contrary.

Obligation of the Company Absolute

No reference herein to the Indenture and no provision of this Security or the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the Redemption Amount at the times, place and rate, and in the coin or currency, herein prescribed, except as otherwise provided in this Security.

No Personal Recourse

No recourse shall be had for the payment of the Redemption Amount, or for any claim based hereon, or otherwise in respect hereof, or based on or in respect of the Indenture or any indenture supplemental thereto, against any incorporator, stockholder, officer or director, as such, past, present or future, of the Company or any successor corporation, whether by virtue of any constitution, statute or rule of law, or by the enforcement of any assessment or penalty or otherwise, all such liability being, by the acceptance hereof and as part of the consideration for the issuance hereof, expressly waived and released.

Defined Terms

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture unless otherwise defined in this Security.

Governing Law

This Security shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of laws.

10

ABBREVIATIONS

The following abbreviations, when used in the inscription on the face of this instrument, shall be construed as though they were written out in full according to applicable laws or regulations:

| TEN COM | — | as tenants in common | ||

| TEN ENT | — | as tenants by the entireties | ||

| JT TEN | — | as joint tenants with right of survivorship and not as tenants in common | ||

| UNIF GIFT MIN ACT — | Custodian | |||||||

| (Cust) | (Minor) |

| Under Uniform Gifts to Minors Act | ||

| (State) | ||

Additional abbreviations may also be used though not in the above list.

FOR VALUE RECEIVED, the undersigned hereby sell(s) and transfer(s) unto

Please Insert Social Security or

Other Identifying Number of Assignee

(PLEASE PRINT OR TYPE NAME AND ADDRESS INCLUDING POSTAL ZIP CODE OF ASSIGNEE)

11

the within Security of WELLS FARGO & COMPANY and does hereby irrevocably constitute and appoint attorney to transfer the said Security on the books of the Company, with full power of substitution in the premises.

| Dated: | ||||||

NOTICE: The signature to this assignment must correspond with the name as written upon the face of the within instrument in every particular, without alteration or enlargement or any change whatever.

12