Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Tower Group International, Ltd. | d348822d8k.htm |

1.

First Quarter 2012

Earnings Call Presentation

Exhibit 99.1 |

1

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a "safe

harbor" for forward-looking statements. This presentation and any

other written or oral statements made by or on behalf of Tower may

include forward-looking statements that reflect Tower's current

views with respect to future events and financial performance. All statements

other than statements of historical fact included in this presentation are

forward-looking statements. Forward-looking statements can

generally be identified by the use of forward-looking terminology such as "may," "will," "plan," "expect,"

"project," "intend," "estimate," "anticipate,"

"believe" and "continue" or their negative or variations or similar terminology.

All forward-looking statements address matters that involve risks and

uncertainties. Accordingly, there are or will be important factors that

could cause the actual results of Tower to differ materially from those indicated in these

statements. Please refer to Tower’s filings with the SEC, including

among others Tower’s Annual Report on Form 10-K for the year

ended December 31, 2011 and subsequent filings on Form 10-Q, for a description of the important factors that

could cause the actual results of Tower to differ materially from those

indicated in these statements. Forward-looking statements

speak only as of the date on which they are made, and Tower undertakes

no obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future developments or otherwise.

Notes on Non-GAAP Financial Measures

Operating income excludes realized gains and losses, acquisition-related

transaction costs and the results of the reciprocal business, net of

tax. This is a common measurement for property and casualty insurance companies. We

believe this presentation enhances the understanding of our results of

operations by highlighting the underlying profitability of our insurance

business. Additionally, these measures are a key internal management performance

standard. Operating earnings per share is operating income divided by diluted

weighted average shares outstanding. Operating return on equity is

annualized operating income divided by average common stockholders' equity.

Total premiums include gross premiums written through our insurance

subsidiaries and produced as managing general agent on behalf of other

insurance companies, including the reciprocal exchanges. |

2

Overview of the Operating Results |

3

First Quarter Snapshot

Strong operating results, positive market trends and key accomplishments

•

Operating earnings of $21.9M

•

Positive market and pricing trends

•

Initiated successful rollout of personal lines system

Key strategic transaction with Canopius Group, Ltd. (April 25, 2012)

»

20% organic growth in premiums written and managed

»

7.8% increase from 1Q 2011

•

Investment commitment in Canopius

•

Options to accomplish two key strategic objectives:

»

Investment of $75M represents 10.7% interest in Canopius to assist in its

acquisition of Omega Insurance Holdings

»

Potentially establish a presence at Lloyd’s, subject to the approval of

Lloyd’s and the Financial Services Authority

»

Merger with Canopius’

Bermuda reinsurance subsidiary to regain the Bermuda

platform |

4

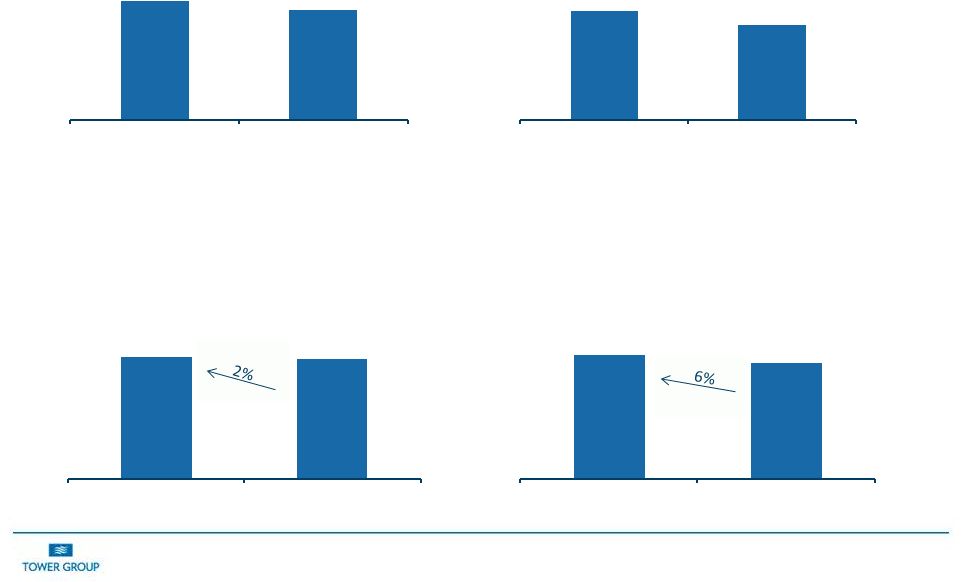

0.56

0.49

1Q12

1Q11

Operating EPS($)

21.9

20.3

1Q12

1Q11

Operating Earnings ($ millions)

1Q12 Highlights

*Stockholders equity reduced by $77 million from stock repurchases and dividends

since 1Q11 1Q11 includes $9.8 million of winter storm losses

1Q11 includes $0.23 per share of winter storm losses

1,058

1,043

1Q12

1Q11

Stockholders' Equity ($ millions)*

26.83

25.24

1Q12

1Q11

Book Value per Share ($)* |

5

99.2

97.6

1Q12

1Q11

Combined Ratio Excluding the Reciprocals (%)

8.4

7.8

1Q12

1Q11

Operating Return on Equity (%)

1Q12 Highlights

467

390

1Q12

1Q11

Gross Premiums Written and Managed

($ millions)

1Q11 includes $9.8 million of winter storm losses

|

6

Organic

Growth

Initiative

–

1

st

Quarter

Update

•

Expanded into mono-line commercial property, inland marine and surety

lines of business •

Began expanding personal package policies outside Northeast focusing on

affluent clients •

Began reorganizing the personal lines department under new leadership with

national expansion plans

•

Created new business unit, National Commercial Property, to focus on

underwriting builders risk

and

mono-line

commercial

property

(as

a

standalone

product

rather

than

as

a

part

of

package policy)

•

Continued to see profitable growth from newly created assumed reinsurance and

customized solution business units ($54 million of GWP in the

first quarter) •

Continued

to

hire

talented

underwriting

managers

to

head

various

business

units

•

Established

a

new

research

department

headed

by

a

new

manager

to

research,

identify

and

analyze profitable growth opportunities

•

Hired several marketing executives to implement our organic growth

initiative Products

Develop Entrepreneurial Businesses

Improve Growth-Related Business Functions |

7

Commercial

Personal

Insurance

General

Specialty

Services

Business Units / Products

Small Business,

Middle Market and

National Property

National Programs, E&S,

Assumed Reinsurance and

Customized Solutions

Homeowners

and private

passenger auto

Fees from

Insurance Services

1Q 12 GPW* ($ millions)

$191

$146

$130

$7**

1Q11 GPW* ($ millions)

$165

$ 98

$127

$7**

1Q12 GPW Growth

16%

49%

2%

n/a

Commercial Consolidated

Loss Ratio

67.6%

51.7%

n/a

Expense Ratio

34.3%

37.3%

n/a

Combined Ratio

101.9%

89%

n/a

Retention

77%

91%

n/a

Renewal Change

2.7

3.0%

n/a

Business Segment Results

* Gross premiums written and managed

** Total revenue for the segment |

8

Net Loss and Loss Expense Ratio, Excluding Reciprocals

1Q12 Prior year loss development

•

Mostly

from

discontinued

commercial

business

from

2010

and

prior

accident

years

•

Slight revision to the loss development factors based on year end study

Improving loss ratio trends for the remainder of 2012

•

Improved profitability of existing businesses due to re-underwriting and

pricing actions •

Increased premium growth from newly created business units focused on

profitable specialty and property businesses

•

Declining impact of businesses terminated in 2010 and 2011

64.2

60.7

64.7

60.2

-3.56

-2.1

-2.4

1Q12

Storms

Dev.

Pro

-

Forma

1Q12

1Q11

Storms

Dev.

Pro

-

Forma

1Q11

Loss Ratio (%)

1Q12

1Q11 |

9

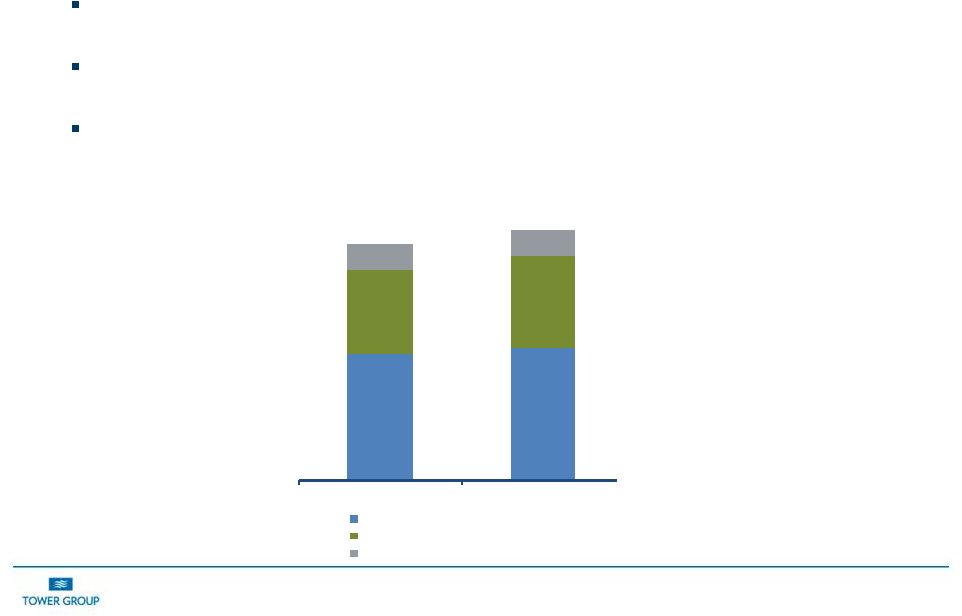

Expense Ratio Excluding Reciprocals

Revised

allocation

to

claims

costs

resulted

in

1

point

year

over

year

increase

in

other underwriting expenses (OUE) expenses

Commission rate higher year over year due to assumed reinsurance, this should

trend down in second half of year

As

systems

initiatives

relating

to

personal

lines

are

completed,

we

expect

scale

advantage to drive expense ratio down

17.6%

18.4%

11.7%

12.9%

3.6%

3.7%

32.9%

35.0%

1Q11

1Q12

Commissions, net of ceding commissions

OUE, net of fees

BB&T expenses |

10

Improving Investment Performance

Alternative

investment

commitment

remains

modest

but

assets

have

begun

to

generate positive returns in 1Q12 and should provide higher yield and

diversification from interest rate risk inherent in fixed-income

investments, and reduce capital markets volatility

Operating cash flows improved in 1Q12 as compared to 1Q11. 2011

operating

cash flows were largely invested in opportunistic repurchases of

Tower common

stock

$2,438

$2,260

3-31-2012

3-31-2011

Cash and Invested Assets

($millions)

4.7

4.8

3-31-2012

3-31-2011

Yield (%)

$32

$31

3-31-2012

3-31-2011

Net Investment Income

($millions)

Equivalent Fixed Income

Tax -

|

11

Positive Trends and Guidance

($ in millions)

2012 Target*

1Q12

Trend

through remainder of 2012

Annual GPW Growth

5%

-

10%

20.0%

Anticipate growth on the upper end of our 5% to 10% range due to

organic growth initiatives and improving market conditions

Loss Ratio

62%

-

63%

64.2%

The loss ratio trend for 2012 should improve due to re-underwriting

and pricing actions , shift to profitable specialty and property

business and declining impact of the runoff business

Expense Ratio

33.5%

-

34.5%

35.0%

Expense ratio should benefit over remainder of year from lower

acquisition cost trends, lower systems costs at end of year and

leveling of OUE by year end

Combined Ratio

95.5%

-

97.5%

99.2%

Future improvement will be driven primarily by reduction in loss

and expense ratios expected over the balance of the year

Investment Yield

4.7%

-

5.0%

4.7%

Continued growth in invested asset base and book yield

stabilization due to alternative and strategic investments

Operating ROE & 2012

Guidance

9%

-

10%

$2.60

-

$2.70

8.4%

Consistent with prior guidance the first half of the year is expected

to remain below our 9% to 10% guidance and we expect to see

improvement to 10%-12% range occurring in second half of year

and continuing into 2013

*Excludes reciprocals |

12

Review of the recent transaction with Canopius Group, Ltd

|

13

Five Year Goals 2010 –

2014

Transform Tower from a Northeast insurance company into a National

insurance company

Develop a robust product platform of commercial, specialty and

personal lines products

Expand our business model to enhance profitability (fee income,

Bermuda reinsurance capacity and Lloyds platform)

Improve our systems infrastructure and redesign our organizational

structure to support our growth

Deliver ROE that exceeds our target of 10% to 12% by 2014

|

14

Canopius Investment

Strategic Rationale:

•

Canopius transaction provides Tower with the opportunity to further

enhance our business model:

»

Obtain the assistance of Canopius with the establishment of a

presence at Lloyd’s, subject to the approval of Lloyd’s and the

Financial Services Authority

»

Possible merger with Canopius’s Bermuda reinsurance subsidiary,

which would result in the CastlePoint platform regaining its Bermuda

domicile status

Investment:

•

The $75 million investment is subject to completion of the acquisition by

Canopius of Omega Insurance Holdings Limited

•

Represents 10.7% ownership interest in Canopius

•

Funded from Tower’s existing investment portfolio

•

Investment in Canopius will be accounted by Tower using the equity

method, and therefore Tower’s pro rata portion of Canopius’

earnings will

be included in Tower’s quarterly operating results

|

15

Background on Canopius

Canopius is a privately-owned international insurance and reinsurance

group underwriting a diversified portfolio of business from its

operations at Lloyd’s and around the world

•

2011 gross premiums written of 616 million GBP

•

Underwriting

activities

are

mainly

conducted

through

its

managed

syndicates

at

Lloyd's: Syndicate 4444 (composite) and Syndicate 260 (motor).

Tower currently provides 6% quota share reinsurance of Canopius Syndicate

4444

Tower’s investment in Canopius is contingent on its acquisition of Omega

Insurance Holdings Ltd.

•

Subject

to

necessary

regulatory

consents

and

acceptance

of

offer

by

Omega

shareholders

•

Acquisition should deliver substantial scale benefits to Canopius

|

16

Lloyd’s option

Strategic rationale:

•

Obtains the assistance of Canopius with the establishment of a presence at

Lloyd’s, subject to the approval of Lloyd’s and the Financial

Services Authority •

Accelerates Tower’s ability to access profitable specialty and

international business underwritten through the Lloyds market

•

Gains

Canopius’s

expertise

in

the

Lloyd's

market

and

minimizes

execution

risk

of

acquiring

or

developing a standalone Lloyd’s managing agency and syndicate

Terms of the agreement:

•

As

a

condition

of

the

transaction,

Tower

will

increase

its

quota

share

reinsurance

of

Canopius’

Syndicate 4444 to 10% in 2013

»

Projected writings of approximately $100M

•

Tower

may

also

elect

to

reinsure

a

greater

portion

of

Canopius’s

Direct

and

Facultative

(D&F)

Property business

»

Potential

for

modest

additional

writings

in

2012

and

up

to

$30M

-

$40M

in

2013

•

Formation of own Corporate Member (an entity that provides funding for

Lloyd’s syndicates) and syndicate

»

Enables Tower to take full advantage of the leverage opportunities offered by

Lloyd’s |

17

Bermuda Option

Background:

•

Tower’s acquisition of CastlePoint Holdings, Ltd. In 2009 resulted in

Tower’s Bermuda based reinsurer, CastlePoint Reinsurance Company,

becoming subject to U.S taxation •

After deploying the excess capital resulting from the CastlePoint

acquisition, Tower has been seeking a means to enhance the

profitability of CastlePoint Re •

Tower’s

merger

option

has

a

term

that

extends

18

months

following

Canopius’s

acquisition

of

Omega

Canopius’s Bermuda reinsurance company subsidiary

•

Over $300M in shareholder capital as of year-end 2011

•

Reinsures

Lloyd’s

business

from

Canopius’s

Lloyds

syndicate

as

well

as

a

small

amount

of

third

party business.

Resulting

benefits

to

Tower

if

option

is

exercised

and

merger

is

successfully

executed:

•

CastlePoint Re would cease to be a subsidiary of a U.S company

•

The capital in the Bermuda subsidiaries would represent about 50% of

Tower’s total shareholder platform

•

Tower will exercise this option only if we believe the transaction is

immediately accretive to earnings and increases ROE target above the

current10% to 12% range |