Attached files

| file | filename |

|---|---|

| 8-K - ESSEX PROPERTY TRUST INC 8-K 5-8-2012 - ESSEX PROPERTY TRUST, INC. | form8k.htm |

EXHIBIT 99.1

Baird Growth Stock Conference

Via - Sunnyvale, CA

May 8-10, 2012

Table of Contents

Pages

Section I. Overview: Top Performing REIT 3-7

Section II. Financial Information 8-10

Section III. Investment Strategy: West Coast Focus 11-16

Section IV. Value Creation Platforms 17-22

2

About Essex Property Trust

Multifamily Real Estate Investment Trust (REIT)

§ Supply-constrained coastal markets in California

and Washington

and Washington

§ Founded in 1971

§ IPO in 1994 at $19.50/sh (today stock is $157/sh)

§ 158 apartment communities with +32,600 units

§ $8.0 billion total market capitalization(1)

Strategy

§ Drive rent growth on high occupancy

§ Add value through redevelopment

§ Acquire and develop West Coast properties in areas

with high growth prospects

with high growth prospects

§ Maintain strong balance sheet and financial

flexibility

flexibility

Management Team

§ Top executives share an average tenure of over 20

years

years

Overview

Southern CA

50% of NOI

50% of NOI

Northern CA

33% of NOI

33% of NOI

Seattle

17% of NOI

(1) As of 4/30/12.

3

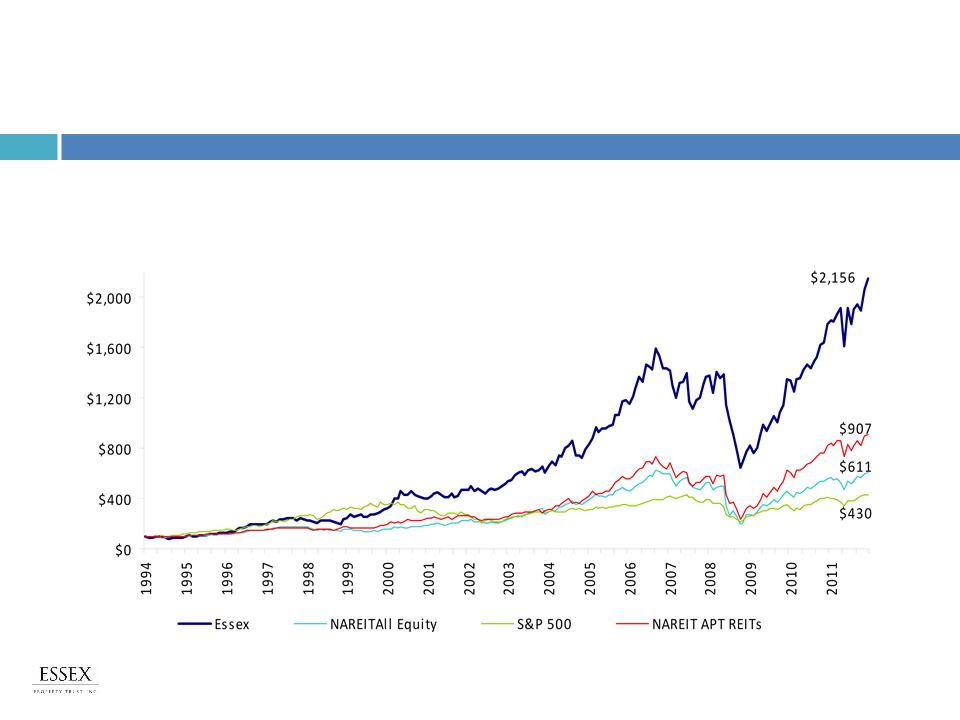

STRONG TRACK RECORD

Total Return Since IPO (2)

Performance Record

Essex Outperforms Peers

(1) As of 5/2/12.

(2) Source: NAREIT. Represents the value of a $100 investment and reinvestment of all dividends. As of April 30, 2012.

§ 19% compound annual total return since IPO

§ 27 % total return in 2011 - sector leading

§ 14% year-to-date total return (1)

4

Overview

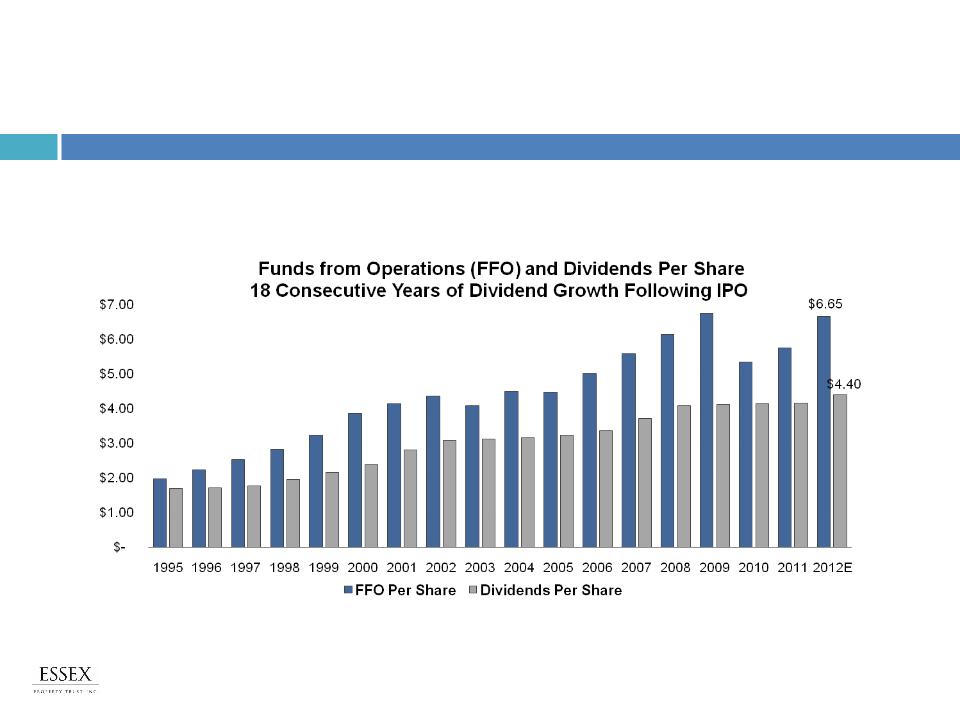

Long Track Record of Consistent Financial Performance

5

Overview

§ 7% Compound Annual Growth in FFO per share since IPO

§ 6% Compound Annual Dividend Growth per share since IPO

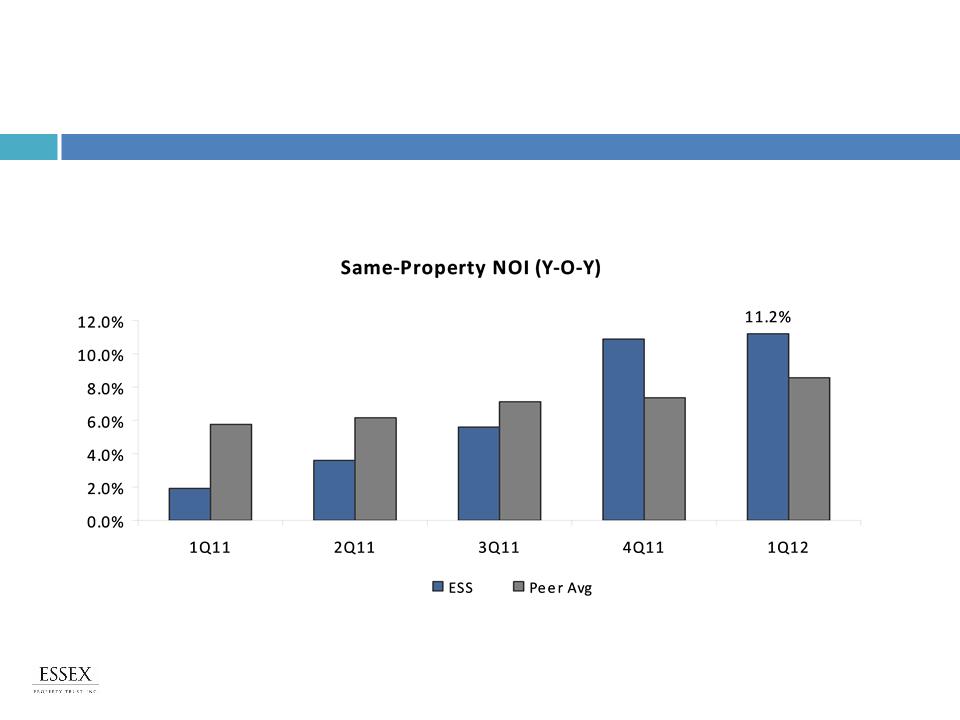

Rents and Net Operating Income (NOI) Accelerating

Source: Peer group includes 11 multifamily REITs for 2011 and 7 multifamily REITs that have reported 1Q12 results

6

§ Rents and NOI are accelerating in all our markets

Overview

§ Northern California and Seattle continue to outperform

§ Southern California continues slow-steady recovery

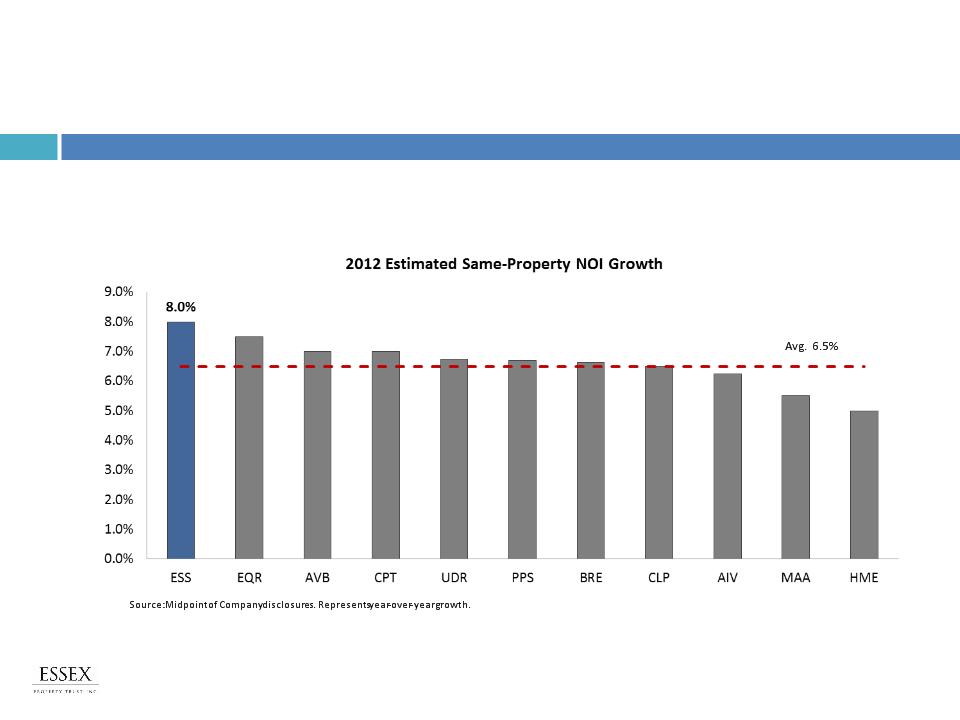

Essex Projected to Lead NOI Growth in 2012

7

Overview

Financial Information

Reveal (formerly Millennium) - Woodland Hills, CA

Conservatively Proportioned & Flexible Balance Sheet

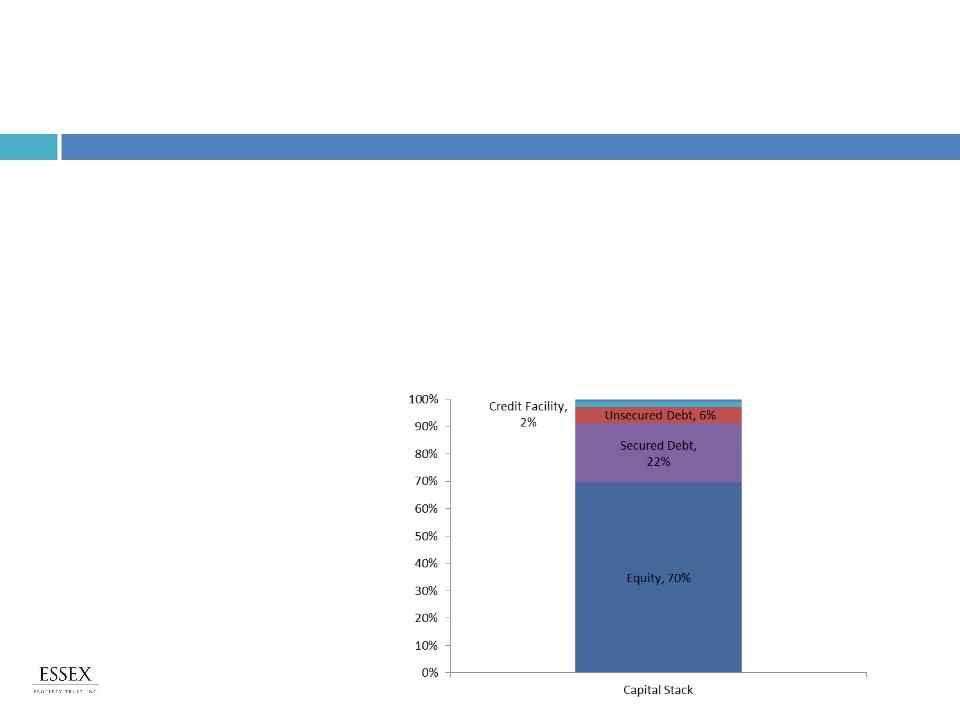

§ Leverage: 30% on a debt to total market capitalization basis

§ One of the lowest within the multifamily peer group

§ Debt: Debt to adjusted EBITDA is expected to be approximately 7.0X by year-end 2012

§ Liquidity: Nearly $400 million in available liquidity from cash on hand, marketable securities, and unused

balance on our line of credit

balance on our line of credit

§ NOI: Unencumbered NOI was 44% at year-end 2011 versus 35% at year-end 2010

§ Expect to be at +50% by year end 2012.

§ Debt Maturity: Limited near term with less than 15% of debt coming due over the next 3 years

§ Investment Grade Ratings:

§ S&P: BBB

§ Moody’s: Baa2

§ Fitch: BBB

Source: Company filings as of 3/31/12

Preferred Stock, 1%

9

Financial Information

FFO Per Share Guidance

$6.52-$6.77

Same Property Revenue Growth (Midpoint)

6.0%

Same Property NOI Growth of the Consolidated portfolio (Midpoint) *

8.0%

Market Expectations

2012

2012

2012

Market

Market

Market

Job Growth

Rent Growth

Occupancy

Southern California

1.1%

5.7%

95.5%

Northern California

1.9%

8.6%

96.8%

Seattle Metro

2.0%

9.0%

95.5%

Weighted Average

1.4%

7.3%

96.0%

US Economic Assumptions

GDP Growth of 2.6%

Job Growth of 1.3%

Target Acquisitions

$300 million - $500 million

* Excludes joint ventures which have greater exposure to Seattle and Northern California

2012 Guidance

10

Financial Information

West Coast Fundamentals

II. Investment Strategy

Anavia - Anaheim, CA

Why Focus on the West Coast

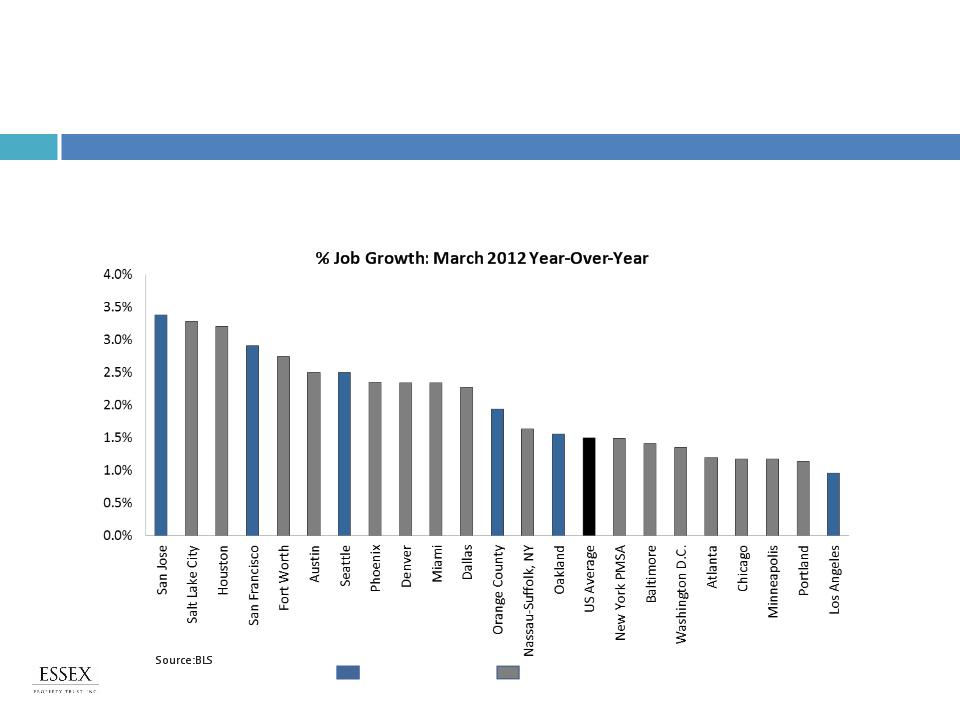

Strong Job Growth

§ Tech jobs leading

Favorable Demographics

§ Strong Demand From Echo Boomers (age 20-34) and Baby Boomers

Rents Rebound from Recessionary Lows

§ Rents declined further and recovered later relative to other major U.S. metros

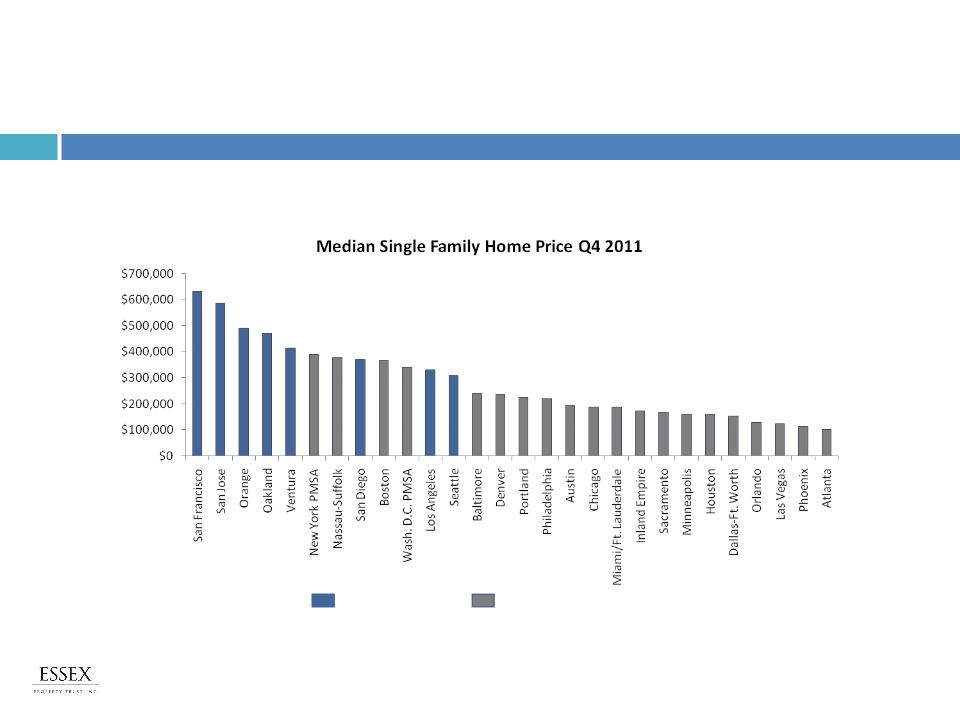

Headwinds to Homeownership

§ High cost of for-sale housing in coastal areas

§ Lending standards tightened

Low Housing Supply

§ Below 1% annual addition to residential stock

Investment Strategy

Via - Sunnyvale, CA

12

Job Growth: NOT Evenly Distributed

§ Job growth in many Essex markets outpaces U.S. average

§ LA job growth improving and expected to be 1% in 2012

Investment Strategy

13

Essex Markets

Other Markets

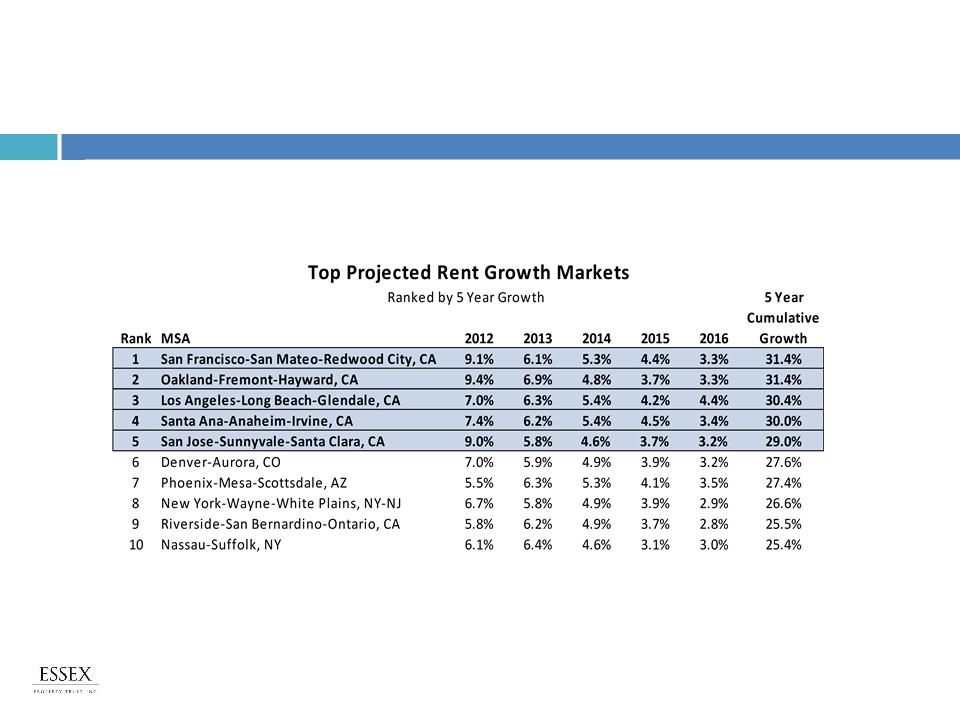

Strong Projected Rent Growth: Essex in Top 5 Markets

Source: Axiometrics

§ Approximately 65% of Essex’s NOI is located in the top five projected rent growth markets in

the nation over the next five years

the nation over the next five years

14

Investment Strategy

Single-Family Prices Restrict Homeownership

§ Despite the fall in home prices since 2008, prices remain high in Essex markets

Investment Strategy

|

Sources: National Association of Realtors, Dataquick, Essex

|

Essex Markets

Other Markets

15

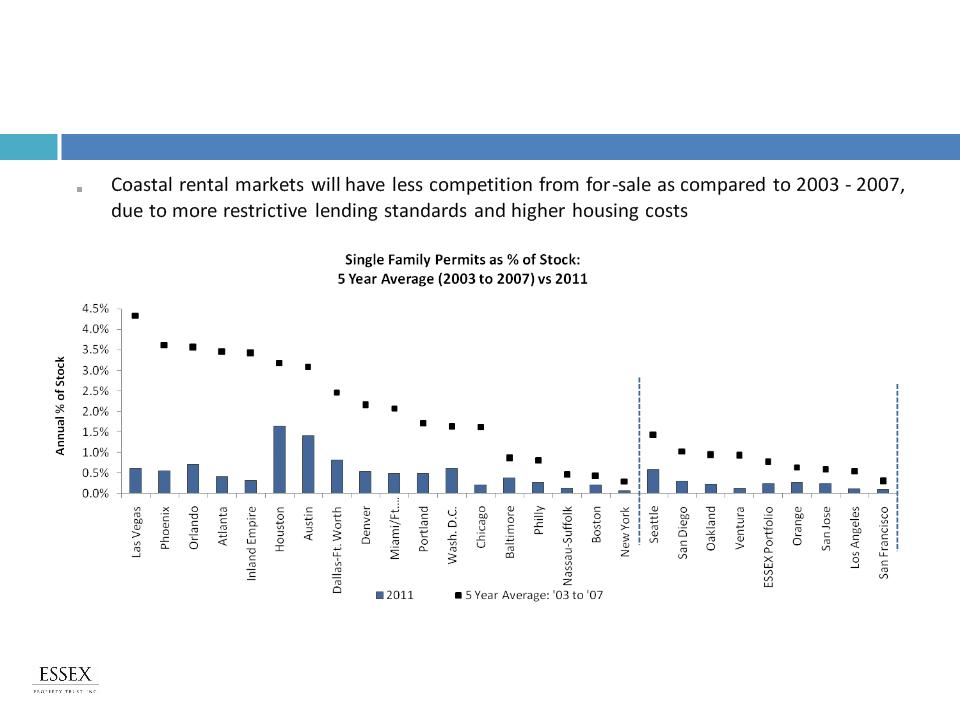

Supply: For-Sale Supply Risk Low

|

Source: U.S. Census

|

Essex Portfolio

16

16

Investment Strategy

Value Creation Platforms

Bella Villagio - San Jose, CA

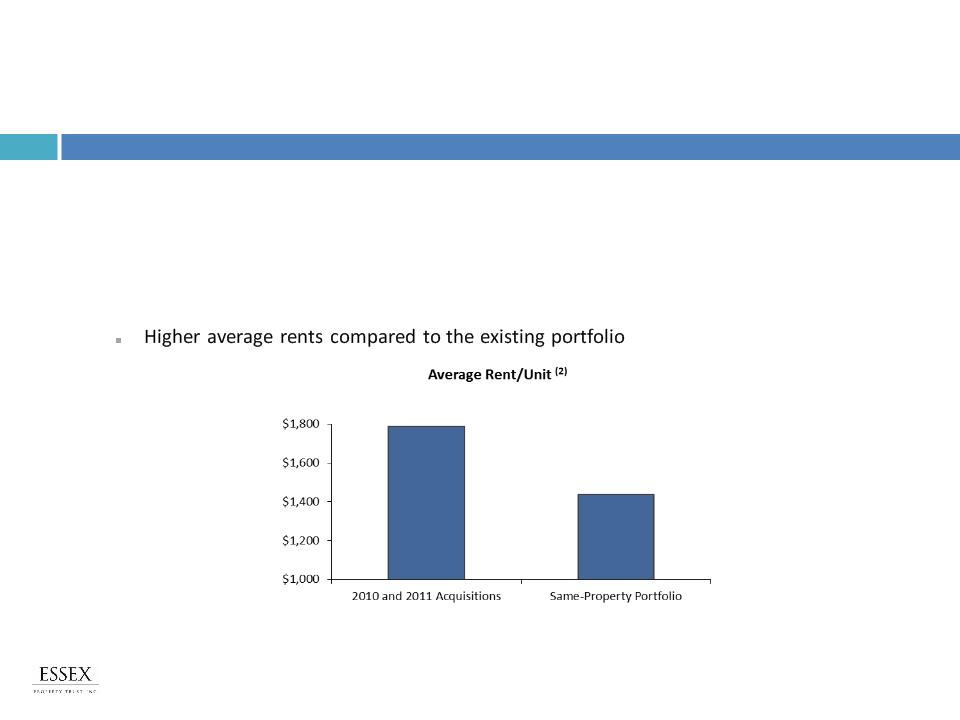

§ Acquired $1.2 billion of assets since the beginning of 2010, representing a 30%

expansion of gross asset value (1)

expansion of gross asset value (1)

§ Estimated 5.5% yield in 2012, expected to grow to 6.25% in 2013

§ Improved the Net Asset Value, Cash Flow and Growth Prospects of the Company

§ Upgraded the Quality of the Portfolio

Active Acquirer

Core Competencies: Acquisitions

(2) Represents the consolidated same property portfolio as of 12/31/11 and the consolidated acquisitions as of 12/31/11.

(1) Includes joint ventures at 100%.

18

5 Developments Under Construction - $516 Million

Core Competencies: Development

Queen Anne

275 units

$79.1 million estimated total cost

November 2012 estimated completion date

50% owned by ESS

Epic

San Jose, CA

Phase I - 280 units

Phase II & III - 480 units

$192 million estimated total cost (Ph I and II)

May 2013 estimated completion date

55% owned by ESS

19

5 Developments Under Construction - $516 Million

Core Competencies: Development

West Dublin

Dublin, CA

309 Units

$94.5 million estimated total cost

June 2013 estimated completion date

55% owned by ESS

Santa Monica

West Hollywood, CA

184 Units

$75.4 million estimated total cost

July 2014 estimated completion date

50% owned by ESS

Fountain at La Brea

West Hollywood, CA

187 Units

$75.0 million estimated total cost

February 2014 estimated completion date

50% owned by ESS

20

West Dublin -

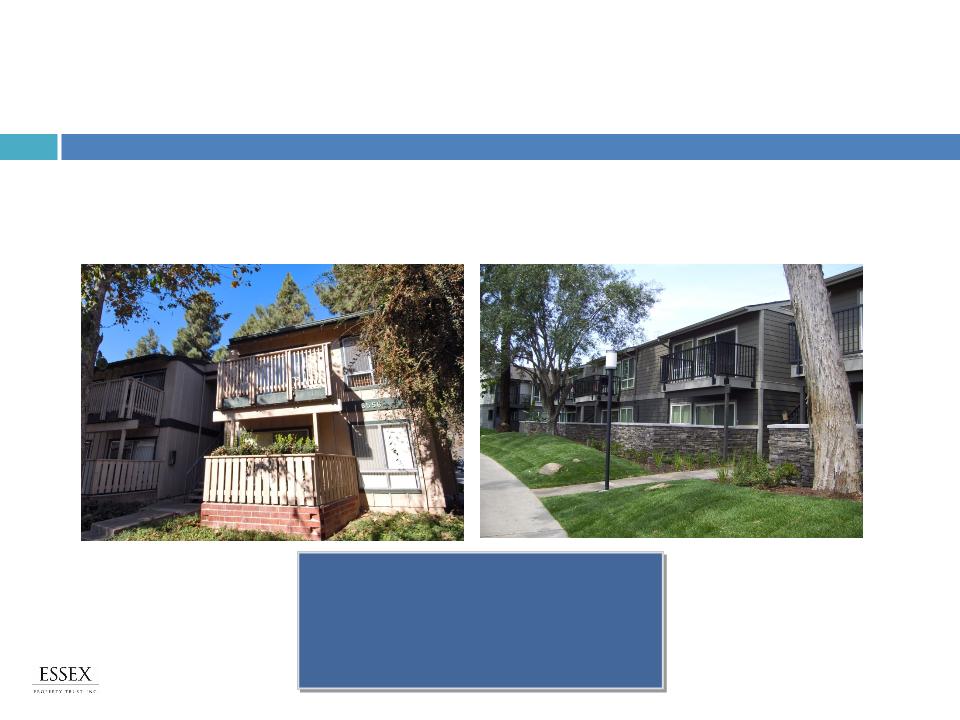

Redevelopment and Selective Repositioning

§ Capitalize on the strategy of owning Class B quality assets in A locations, which leads to

greater renovation potential

greater renovation potential

§ Focus on rent justified improvements to maximize NOI and value

Before

After

The Bluffs II

San Diego, CA

224 units

$9.7 million renovation cost

$43,300 cost per unit

9-10% estimated return

21

Core Competencies: Redevelopment

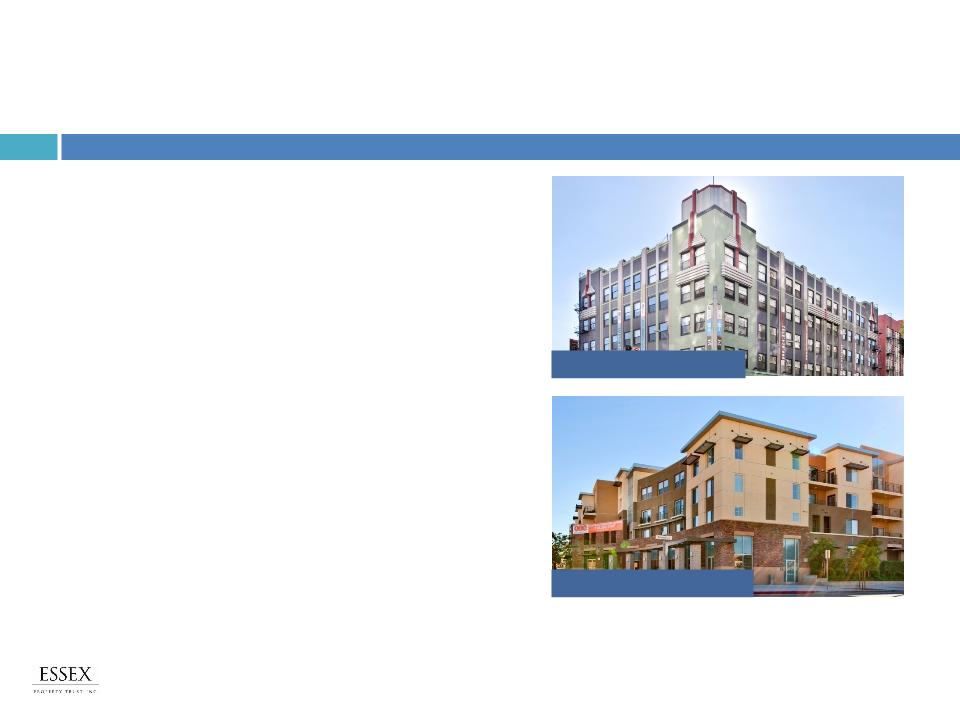

Key Strengths

§ Attractive market fundamentals in West

Coast markets

Coast markets

§ Strong growth prospects

§ FFO per diluted share projected to grow

18% for 2012

18% for 2012

§ Strong balance sheet with ample financial

flexibility to take advantage of attractive

opportunities as they arise

flexibility to take advantage of attractive

opportunities as they arise

§ Proven management team with superior

results

results

416 on Broadway - Glendale, CA

Santee Court - Los Angeles, CA

22

Safe Harbor Disclosure

Certain statements in this presentation, which are not historical facts, may be considered forward-looking

statements within the meaning of the federal securities laws. The forward looking statements, some of which

can be identified by terms and phrases such as “forecast”, “estimate”, “expect”, “anticipate”, “should”,

“could”, “may”, and similar expressions, reflect the current views of Essex Property Trust, Inc. (“Essex” or the

“Company”) and its affiliates with respect to future events and are subject to risks and uncertainties. Such

forward-looking statements involve the risk that actual results could be materially different from those

described in such forward-looking statements. Factors that could cause actual results to be materially different

are discussed under the caption “Risk Factors” in Item 1A of the Company’s Report on Form 10-K for the year

ended December 31, 2011. All forward-looking statements and reasons why results may differ included in this

presentation are made of the date hereof, and we assume no obligation to update any such forward-looking

statements or reasons why actual results may differ.

statements within the meaning of the federal securities laws. The forward looking statements, some of which

can be identified by terms and phrases such as “forecast”, “estimate”, “expect”, “anticipate”, “should”,

“could”, “may”, and similar expressions, reflect the current views of Essex Property Trust, Inc. (“Essex” or the

“Company”) and its affiliates with respect to future events and are subject to risks and uncertainties. Such

forward-looking statements involve the risk that actual results could be materially different from those

described in such forward-looking statements. Factors that could cause actual results to be materially different

are discussed under the caption “Risk Factors” in Item 1A of the Company’s Report on Form 10-K for the year

ended December 31, 2011. All forward-looking statements and reasons why results may differ included in this

presentation are made of the date hereof, and we assume no obligation to update any such forward-looking

statements or reasons why actual results may differ.

23

For additional information, please contact the Company’s

Investor Relations department at (650) 849-1600.

Investor Relations department at (650) 849-1600.

Fourth & U - Berkeley, CA

416 on Broadway - Glendale, CA

Joule - Seattle, WA

Via - Sunnyvale, CA

Axis 2300 - Irvine, CA

Arbors at Park Rose - Oxnard, CA