Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE - Xylem Inc. | d345872dex991.htm |

| 8-K - FORM 8-K - Xylem Inc. | d345872d8k.htm |

Q1

2012 Earnings Release May 3, 2012

Exhibit 99.2 |

Forward

Looking Statements 2

This document contains information that may constitute “forward-looking statements.”

Forward-looking statements by their nature address matters that are, to different degrees,

uncertain. Generally, the words “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “believe,” “target” and similar expressions

identify forward-looking statements, which generally are not historical in nature. However,

the absence of these words or similar expressions does not mean that a statement is not forward-looking.

These forward-looking statements include, but are not limited to, statements about the separation

of Xylem Inc. (the “Company”) from ITT Corporation, the terms and the effect of the

separation, the nature and impact of the separation, capitalization of the Company, future

strategic plans and other statements that describe the Company’s business strategy, outlook, objectives, plans

intentions or goals, and any discussion of future operating or financial performance. All statements

that address operating performance, events or developments that we expect or anticipate will

occur in the future — including statements relating to orders, revenues, operating margins

and earnings per share growth, and statements expressing general views about future operating

results — are forward-looking statements. Caution should be taken not to place undue reliance on any such forward-looking statements

because they involve risks, uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied in, or reasonably inferred from, such

statements. The Company undertakes no obligation to publicly update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise, except as

required by law. In addition, forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially from the Company’s

historical experience and our present expectations or projections. These risks and uncertainties include, but are

not limited to, those set forth in Item 1A of our Annual Report on Form 10-K, and those described

from time to time in subsequent reports filed with the Securities and Exchange Commission. |

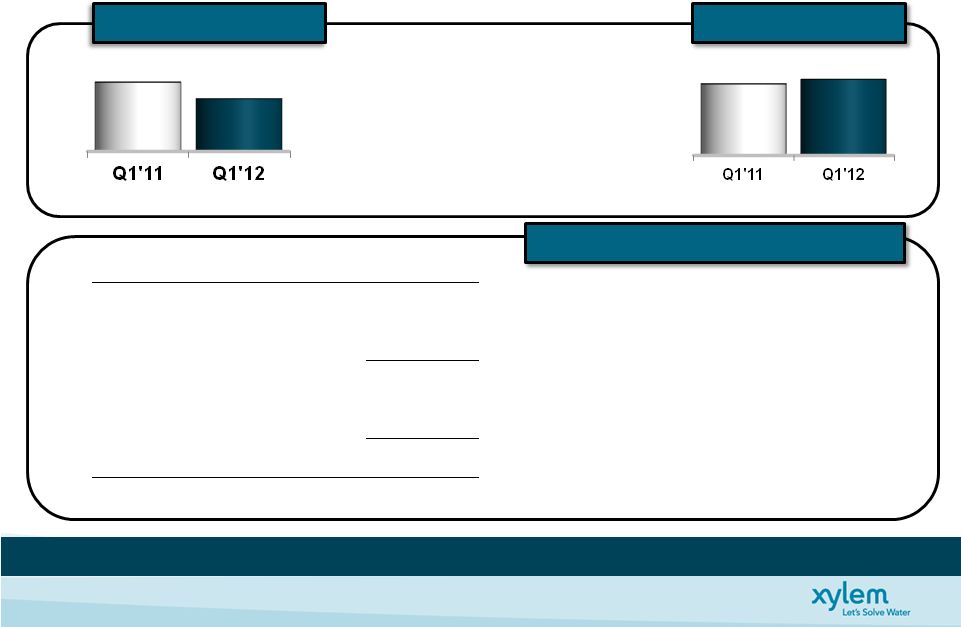

Q1’12 Financial Performance Summary

3

* See Appendix for Non-GAAP Reconciliations

Orders

> $1B

Record Milestone; Book to Bill 1.09

Revenue

$925M

+6% (Constant Currency Basis)*

Gross Margin

39.2%

+130 bps

Operating Margin *

11.2%

12.3% ex. Stand-Alone Costs; +70 bps

EPS *

$0.36

+9% Normalized Growth

Free Cash Flow *

$41M

61% Conversion …

Typical Seasonality

Solid Q1 Performance … Confident in Ability to Deliver a Strong 2012

|

Q1’12 Performance Summary

4

Making Significant Progress on Key Focus Priorities

Advancing Our Strategic Position

•

YSI Acquisition …

EPS Accretive …

Integration Ahead of Plan, Launched Cross Branded Products

•

Recognizing Revenue Synergies Across Analytics

•

Opened New Distribution and Customer Service Center in Russia

Deploying Innovation & New Product Applications and Services

•

Bell & Gossett Awarded the PM Engineer Magazine Product of the Year Award

•

Bell & Gossett Little Red School House®

Recognized as a Certified LEED (Leading Energy and Engineering

Design) Education Provider

•

Flygt Experior -

2012 Ringier Technology Innovation Award

Continued Strong Execution

•

Deployment of Commercial Excellence ... Continued Strong Price Realization

•

Operational Initiatives Underway To Drive a More Competitive Cost Structure

|

Geographic and End Market Q1’12 Performance

5

Performance In-Line With Expectations

Geographic Region

End Market

(% of 2011 Revenue)

+

Emerging Markets

+

Lat. Am., Asia Pac., E. Europe

-

Middle East

+

U.S.

=

Europe

+

Industrial

(~40%)

=

Public

Utility

(~36%)

+

Commercial

(~12%)

-

Residential

(~9%)

-

Agriculture

(~3%) |

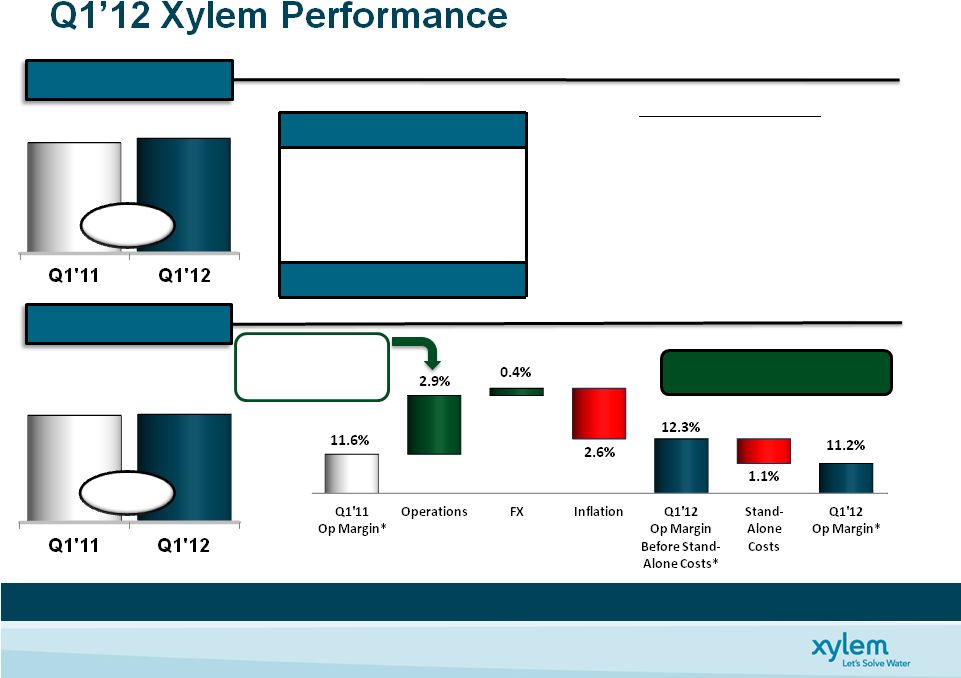

6

See appendix for non-GAAP reconciliations

* Excludes non-recurring separation costs of $5M and $3M in Q1 2012 and Q1 2011,

respectively Q1 Performance Drivers

+

Industrial & Commercial Strength

+

YSI Acquisition Adds 4%

=

Public Utility Stable

–

Residential Market Headwind

+

Building Backlog …

Record Orders $1B

(Dollars, In Millions)

(Dollars, In Millions)

Q1 Growth

Q1 Growth

Organic

+2%

FX

-2%

Acquisition

+4%

Total

Total

+4%

+4%

Cost Reductions

+2.7%

Price

+1.5%

Acquisitions

+0.5%

Vol/Mix/Invest

-

1.8%

Delivered

Mid-Single

Digit

Top

Line

Growth

…

Solid

Operating

Performance

890

925

+4%

103

104

+1%

Incremental Margin ~18%

Incremental Margin ~18%

(Ex. FX & Stand Alone Costs)

(Ex. FX & Stand Alone Costs)

Operating Income *

Operating Income *

Revenue

Revenue |

Q1’12 EPS *

Q1’12 Xylem Performance

7

9% Normalized EPS Growth

Interest

($0.06)

Stand-Alone

($0.04)

Separation Costs $0.01

* See Appendix for Non-GAAP Reconciliations

Operational Performance:

+

Base Business / –

Investments

+

YSI Acquisition …

EPS Accretive

–

Operating Tax Rate

Spin Related:

–

Interest Expense

–

Stand-Alone Costs

–

Separation Costs

9%

9%

Normalized

Normalized

EPS Growth

EPS Growth

Q1'11

GAAP EPS

Adjustments

Normalized

Q1'11 EPS

Operational

Performance

Adjusted

Q1'12 EPS

Separation

Costs

Q1'12

GAAP EPS

$0.42

$0.33

$0.36

$0.34

$0.03

$0.09

$0.02 |

Q1’12 Water Infrastructure Performance

8

Significant Margin Expansion Driven by Strategic Acquisitions & Initiatives

See appendix for non-GAAP reconciliations

* Excludes Q1 2012 non-recurring separation costs of $2M

+6%

(Dollars, In Millions)

(Dollars, In Millions)

+20%

Incremental Margin ~26%

(Ex. FX & Stand Alone Costs)

Q1 Organic Growth Drivers

•

Transport +3%

+

Global Industrial …

Dewatering Strong

=

Public Utility Flat

•

Treatment -3%

–

Developed Markets Soft …

Project Timing

+

Double-Digit Emerging Markets Growth

•

Test -2% (Excludes YSI,

Double-Digit Growth)

–

Exceptionally Strong Q1’11

Cost Reductions

+2.7%

Price

+0.9%

Acquisitions

+0.6%

Vol/Mix/Invest

-

0.7%

Operating Income *

Revenue

Q1 Growth

Q1 Growth

Organic

+2%

FX

-2%

Acquisition

+6%

Q1'11

Q1'12

551

Q1'11

Q1'12

64

Q1'11

Op Margin

Operations

FX

Inflation

Q1'12

Op Margin

Before

Stand-

Alone*

Stand-

Alone

Q1'12

Op Margin*

11.6%

13.4%

13.2%

2.4%

0.2%

3.5%

0.7%

77

584

Total

Total

+6%

+6% |

Q1’12 Applied Water Performance

9

Results As Expected …

Confident in Delivering Operational Improvement

Flat

See appendix for non-GAAP reconciliations

* Excludes Q1 2012 non-recurring separation costs of $1M

(Dollars, In Millions)

(Dollars, In Millions)

-11%

•

Building Services +2%

+

Commercial Market Share Gains

–

Residential Weakness …

Europe & Warm US Winter

–

Emerging Markets Down …

Middle East Instability

•

Industrial Water +2%

+

General Industrial and Food & Beverage Strength

–

Leisure Marine

•

Irrigation -4%

=

Continued Strength in US …

Strong Q1’11

Cost Reductions

+2.5%

Price

+2.6%

Vol/Mix/Invest

-

3.1%

Unfavorable Mix

•

Marine Down …

Q2’12 Improvement Opportunity

•

Warm US Winter Drove Lower High Margin Business

Revenue

Operating Income *

Q1 Growth

Q1 Growth

Organic

+1%

FX

-1%

Acquisition

-

Total

Total

Flat

Flat

Q1'11

Q1'12

355

Q1'11

Q1'12

46

Q1'11

Op Margin

Operations

FX

Inflation

Q1'12

Op Margin

Before

Stand-Alone*

Stand-

Alone

Q1'12

Op Margin*

13.0%

12.1%

11.5%

0.1%

2.8%

0.6%

2.0%

41

355 |

Xylem

Financial Position 10

•

Free Cash Flow $41M

•

Typical Seasonality

•

Impact of Stand-Alone Costs & Interest

•

Working Capital Investment

•

Increased Capex for Growth Initiatives

•

Capex > 1 Reinvestment Ratio

•

Strong Cash Position

•

No Significant Debt Maturities Until 2016

•

31% Net Debt to Net Capital

•

1.3x Net Debt/Adj. TTM EBITDA

•

$600M Revolving Credit Facility Undrawn

•

Access to Commercial Paper

FCF%

68%

61%

W/C%**

24.1%

23.1%

March 31, 2012

Cash

347

Debt

1,206

Net Debt

859

Shareholders’

Equity

1,949

Net Capital

2,808

Net Debt to Net Capital

31%

(Dollars, In Millions)

(Dollars, In Millions)

(Dollars, In Millions)

* See Appendix for Non-GAAP Reconciliations

** (AR+INV-AP)/ TTM Revenue (Adjusted for Acquisitions)

Free Cash Flow *

Free Cash Flow *

Working Capital

Working Capital

Capital Summary/Liquidity

Capital Summary/Liquidity

Strong

Cash

Flow

…

Healthy

Balance

Sheet

...

Providing

Flexibility

54

41

843

897 |

2012 Guidance |

2012

Financial Guidance Summary 12

2012 Full Year

Financial Outlook

Growth

2012E vs. 2011

Total Revenue

$3.9B -

$4.0B

4% -

6% (Organic)

Water Infrastructure

$2.5B -

$2.6B

5% -

7% (Organic)

Applied Water

$1.4B -

$1.5B

2% -

6% (Organic)

Segment Margin*

14.5% -

15.0%

+50 to +100 bps

Operating Margin*

12.7% -

13.3%

Flat to +60 bps (incl. incremental

stand-alone costs $25M-$30M)

EPS *

$1.80 -

$1.95

-7% to +1% on Adjusted Basis

+8% to +17% on Normalized Basis

Free Cash Flow Conversion

95%

Excluding one-time separation costs

* See Appendix for Non-GAAP Reconciliations

Solid

Q1’12

Performance

…

Affirming

Full

Year

Guidance |

2012

Xylem Performance 13

Affirming 2012 EPS Outlook

Illustration of Mid Point Guidance

•

Operational performance $0.21, includes YSI contribution, FX and

tax headwind

•

Projected structural tax rate ~25%

•

Nine months incremental interest expense normalization

•

Full year impact of stand alone costs …

in line with expectations

* See Appendix for Non-GAAP Reconciliations

Includes

unfavorable tax

rate change of 1%

13%

13%

Normalized

Normalized

EPS Growth

EPS Growth

2012 EPS * Outlook

Adjusted

FY'11 EPS

Incremental

Interest

Expense

Incremental

Stand-

Alone Costs

Normalized

FY'11 EPS

Operational

Performance

Adjusted

FY'12 EPS

$1.93

$1.66

$1.87

$0.16

$0.11

$0.21 |

Key

Takeaways 14

•

Solid

Q1

Performance

…

As

Expected

•

End Market Conditions Consistent with 2012 Guidance

Assumptions

•

YSI …

Further Demonstrates Inorganic Growth Capabilities, and

Our Ability to Acquire & Effectively Integrate

•

Strong Financial Position & Strong Cash Flow Generation

•

Confident in Ability to Deliver a Strong 2012 |

Appendix |

2012

Revenue Outlook 16

Strong

Underlying

Growth

…

FX

Shift

from

Tailwind

to

Headwind

Xylem

Xylem

Xylem

3.9 -

4.0

(Dollars, In Billions)

2011

2012

Comments

Organic

Growth

7%

4-6%

-

1H’12 tough compare vs. strong 1H’11

-

2H’12 stronger than 1H

FX

(Translation)

4%

(3)%

~65% international revenues

Top foreign currencies:

Euro, CAD, AUD, GBP, SEK

Acquisition

8%

2%

2012 represents YSI

2011 represents incremental Godwin,

Nova, OI Analytics and YSI

Total Growth

19%

3-5%

Quarterly

Revenue Profile

(% of FY Revenue)

Q1

Q2

Q3

Q4

2009-2011

Composite

22%

25%

25%

28%

3.8

2011

2012 Outlook |

2012

Margin Outlook 17

Solid Margin Performance …

On Track to Meet Long Term Objective

Includes Stand-Alone

Costs of ~70 bps

Includes Stand-Alone

Costs of ~10 bps

Op Margin Expansion (Ex. Stand Alone Costs) **

Op Margin Expansion (Ex. Stand Alone Costs) **

•

Segment Op Margin 14.5% -

15.0%

•

Comm’l & Oper’l Excellence Initiatives

•

Acquisition margin accretive

•

Organic growth investments

•

Inflation ~3%

•

Operating Margin 12.7% -

13.3%

•

Includes stand-alone costs ~$25M-$30M

Segment Margin *

Segment Margin *

Operating Margin *

Operating Margin *

12.7% -

13.3%

See appendix for non-GAAP reconciliations

*Excludes non-recurring separation costs of $87M and $15M-$20M for 2011 and

2012, respectively ** Adjusted for non recurring separation costs and stand

alone costs 9.6%

14.5% -15.0%

14.0%

2012

Outlook

2011

2012

Outlook

2011

12.7%

9.7%

12.1%

12.8%

13.7%

2011

2010

2009

2008

2012

Midpoint

Driving Consistent

Improvements

…

On

Track to Meet Long

Term Objective |

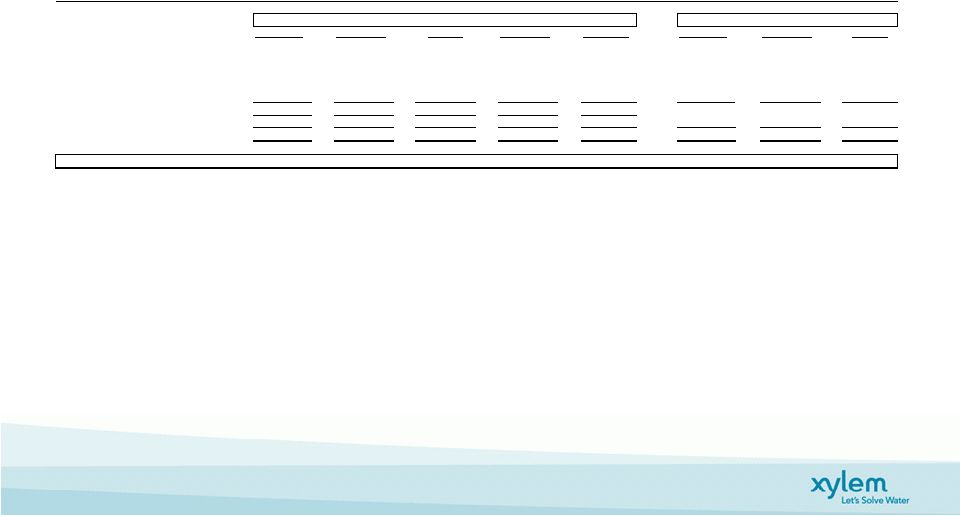

Quarterly Financial Performance

18

($M, Except

EPS)

Q1’10

Q2’10

Q3’10

Q4’10

FY’10

Q1’11

Q2’11

Q3’11

Q4’11

FY’11

Q1’12

Revenue

686

775

806

935

3,202

890

971

939

1,003

3,803

925

COGS

431

484

497

576

1,988

553

592

574

623

2,342

562

Gross Profit

255

291

309

359

1,214

337

379

365

380

1,461

363

SG&A

164

170

183

220

737

210

219

215

233

877

231

R&D

18

17

18

21

74

24

26

23

27

100

28

Separation Costs

-

-

-

-

-

3

18

46

20

87

5

Restructuring &

Asset Impairment

Charges, net

4

3

1

7

15

-

-

2

-

2

-

Op Income

69

101

107

111

388

100

116

79

100

395

99

Interest Expense

-

-

-

-

-

-

1

1

15

17

14

Other Non-Op

-2

-1

3

-

-

1

-

4

-

5

(1)

Income before Tax

67

100

110

111

388

101

115

82

85

383

84

Tax

11

15

19

14

59

23

43

5

33

104

21

Net Income

56

85

91

97

329

78

72

77

52

279

63

EPS –

Diluted *

$0.30

$0.46

$0.49

$0.53

$1.78

$0.42

$0.39

$0.42

$0.28

$1.50

$0.34

* On October 31, 2011, Xylem Inc. completed the spin-off through a

tax-free stock dividend to ITT Corporation’s shareholders. ITT

Corporation shareholders received one share of our common stock for each share of

ITT common stock. As a result on October 31, 2011, we

had

184.6

million

shares

of

common

stock

outstanding

and

this

share

amount

is

being

utilized

to

calculate

earnings

per

share

for

all

periods presented prior to the spin-off. |

Non-GAAP Measures

19

Management views key performance indicators including revenue, gross margins, segment operating income

and margins, orders growth, free cash flow, working capital, and backlog, among others. In

addition, we consider certain measures to be useful to management and investors evaluating our

operating performance for the periods presented, and provide a tool for evaluating our ongoing operations, liquidity and

management of assets. This information can assist investors in assessing our financial performance and

measures our ability to generate capital for deployment among competing strategic alternatives

and initiatives. These metrics, however, are not measures of financial performance under GAAP

and should not be considered a substitute for revenues, operating income, net income, earnings per share (basic and diluted) or net cash

from operations as determined in accordance with GAAP. We consider the following non- GAAP measures, which may not be comparable to similarly

titled measures reported by other companies, to be key performance indicators: “Organic

revenue" and "Organic orders” transactions, and contributions from

acquisitions and divestitures. Divestitures include sales of portions of our business that did not meet the

criteria for classification as a discontinued operation or insignificant portions of our business that

we did not classify as a discontinued operation. The

period-over-period change resulting from foreign currency fluctuations assumes no change in exchange rates from the prior period.

“Constant currency”

conversion rate.

This approach is used for countries where the functional currency is the local currency.

“EBITDA” defined

adjustment to EBITDA to exclude for one-time separation costs

associated with the Xylem spin-off from ITT Corporation.

“Operating Income *” and “Adjusted EPS”

with the Xylem spin-off from ITT Corporation and tax- related special items. “Normalized EPS”

tax- related special items, as well as an adjustment to reflect

the incremental current period amount of interest expense and stand alone costs in the prior

comparable period. “Free Cash Flow”

other significant items that impact current results which management believes are not related to our

ongoing operations and performance. Our definition of free cash flows does not consider non-discretionary cash payments, such as debt.

as

revenue

and

orders,

respectively,

excluding

the

impact

of

foreign

currency

fluctuations,

intercompany

defined

as

financial

results

adjusted

for

currency

by

translating

current

period

and

prior

period

activity

using

the

same

currency

as

earnings

before

interest,

taxes,

depreciation,

amortization

expense,

and

share

-based

compensation.

“Adjusted

EBITDA”

reflects

the

defined as operating income and earnings per share, adjusted to exclude one-time separation costs associated

as

earnings

per

share,

adjusted

to

exclude

one

-time

separation

costs

associated

with

the

Xylem

spin-off

from

ITT

Corporation

and

defined as net cash from operating activities, as reported in the Statement of

Cash Flow, less capital expenditures as well as adjustments for

defined

defined |

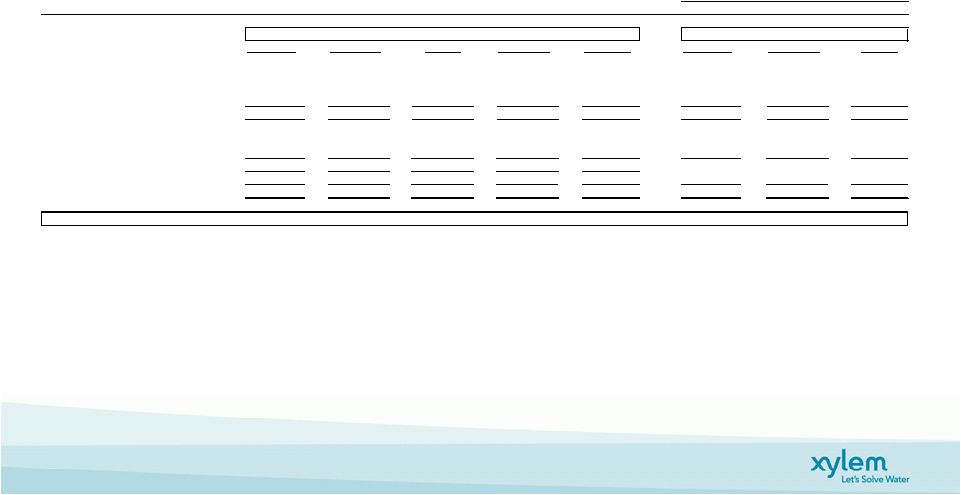

Non-GAAP Reconciliation:

Organic & Constant Currency Revenue / Order Growth

20

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (B + D) / A

Orders

Change

% Change

Change

% Change

Orders

Orders

2012 v. 2011

2012 v. 2011

FX Contribution

Eliminations

Adj. 2012 v. 2011

Adj. 2012 v. 2011

2012

2011

Quarter Ended March 31, 2012

Xylem Inc.

1,004

978

26

2.7%

(37)

18

-

7

0.7%

4.5%

Water infrastructure

638

612

26

4.2%

(37)

13

-

2

0.3%

6.4%

Applied Water

382

381

1

0.3%

-

5

(1)

5

1.3%

1.6%

Revenue

Change

% Change

Change

% Change

Revenue

Revenue

2012 v. 2011

2012 v. 2011

FX Contribution

Eliminations

Adj. 2012 v. 2011

Adj. 2012 v. 2011

2012

2011

Quarter Ended March 31, 2012

Xylem Inc.

925

890

35

3.9%

(34)

14

-

15

1.7%

5.5%

Water infrastructure

584

551

33

6.0%

(34)

10

1

10

1.8%

7.8%

Applied Water

355

355

-

0.0%

-

5

-

5

1.4%

1.4%

Note: Due to rounding and intersegment eliminations the sum of segment amounts may not agree to

Xylem totals. Acquisitions /

Divestitures

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Revenue / Order Growth

($ Millions)

(As reported -

GAAP)

(As Adjusted -

Organic) |

Non-GAAP Reconciliation: Adjusted Diluted EPS

21

Q1 2012

Q1 2011

Net Income

63

78

Separation costs, net of tax

4

2

Adjusted Net Income before Special Tax Items

67

80

Special Tax Items

-

-

Adjusted Net Income

67

80

Diluted Earnings per Share

$0.34

$0.42

Separation costs per Share

$0.02

$0.01

Adjusted diluted EPS before Special Tax Items

$0.36

$0.43

Special Tax Items per Share

$0.00

$0.00

Adjusted diluted EPS

$0.36

$0.43

Adjusted Diluted EPS

For The Three Months Ended 2012 & 2011

($ Millions, except per share amounts)

Xylem Inc. Non-GAAP Reconciliation |

Non-GAAP Reconciliation: Normalized EPS

22

Q1 2011

Q1 2012

As Reported

Adjustments

Adjusted

Adjustments

Normalized

As Reported

Adjustments

Adjusted

Total Revenue

890

890

890

925

925

Operating Income

100

3

a

103

(10)

c

93

99

5

a

104

Operating Margin

11.2%

11.6%

10.4%

10.7%

11.2%

Interest Expense

-

-

(13)

d

(13)

(14)

(14)

Other Non-Operating Income (Expense)

1

1

1

(1)

(1)

Income before Taxes

101

3

104

(23)

81

84

5

89

Provision for Income Taxes

(23)

(1)

b

(24)

5

e

(19)

(21)

(1)

b

(22)

Net Income

78

2

80

(18)

62

63

4

67

Diluted Shares

184.6

184.6

185.9

185.9

Diluted EPS

0.42

$

0.01

$

0.43

$

(0.10)

$

0.33

$

0.34

$

0.02

$

0.36

$

a

One time separation costs

b

Tax impact of one time separation costs

c

Incremental stand alone costs incurred in 2012

d

Incremental interest expense on long-term debt incurred in 2012

e

Tax impact of incremental interest expense and stand alone costs incurred in 2012

Xylem Inc. Non-GAAP Reconciliation

Normalized and Adjusted Diluted EPS

($ Millions, except per share amounts) |

23

Non-GAAP Reconciliation: Segment Operating Income

Adjusted Segment Operating Income

Q1

'12

'11

Total Revenue

• Water Infrastructue

584

551

• Applied Water

355

355

Operating Income

• Water Infrastructue

75

64

• Applied Water

40

46

Separation Costs

• Water Infrastructue

2

-

• Applied Water

1

-

Adjusted Operating Income*

• Water Infrastructue

77

64

• Applied Water

41

46

Operating Margin

• Water Infrastructue

12.8%

11.6%

• Applied Water

11.3%

13.0%

Adjusted Operating Margin*

• Water Infrastructue

13.2%

11.6%

• Applied Water

11.5%

13.0%

*Adjusted Operating Income excludes non-recurring separation costs

Xylem Inc. Non-GAAP Reconciliation

Segment Operating Income

($ Millions) |

Non-GAAP Reconciliation: Free Cash Flow

24

2012

2011

Net Cash - Operating Activities

61

71

Capital Expenditures

(31)

(19)

Free Cash Flow, including separation costs

30

52

Separation Costs (Cash Paid incl. Capex)

11

2

Free Cash Flow, excluding separation costs

41

54

Net Income

63

78

Separation Costs, net of tax

4

2

Adjusted Net Income

67

80

Free Cash Flow Conversion

61%

68%

Xylem Inc. Non-GAAP Reconciliation

Net Cash - Operating Activities vs. Free Cash Flow

For The Three Months Ended 2012 & 2011

($ Millions)

Three Months Ended |

25

Non-GAAP Reconciliation: Xylem EBITDA & Adj. EBITDA

2012

Q1

Q1

Q2

Q3

Q4

Total

Pre-Tax Net Income

84

101

115

82

85

383

Interest, net

13

-

-

1

16

17

Depreciation

23

22

25

25

21

93

Amortization

11

11

10

11

12

44

Stock

Compensation 5

3

2

2

6

13

EBITDA

136

137

152

121

140

550

Separation Costs

5

3

18

46

20

87

Adjusted

EBITDA 141

140

170

167

160

637

Revenues

925

890

971

939

1,003

3,803

Adjusted EBITDA Margin

15.2%

15.7%

17.5%

17.8%

16.0%

16.7%

2011

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA by Quarter

Total Xylem

($ Millions) |

26

Non-GAAP Reconciliation: Water Infrastructure EBITDA & Adj. EBITDA

2012

Q1

Q1

Q2

Q3

Q4

Total

Pre-Tax Net Income

75

65

93

88

99

345

Interest, net

-

-

-

(1)

-

(1)

Depreciation

16

16

19

19

14

68

Amortization

10

9

9

9

9

36

Stock

Compensation 1

-

-

1

1

2

EBITDA

102

90

121

116

123

450

Separation Costs

2

-

2

8

6

16

Adjusted

EBITDA 104

90

123

124

129

466

Revenues

584

551

602

584

679

2,416

Adjusted EBITDA Margin

17.8%

16.3%

20.4%

21.2%

19.0%

19.3%

2011

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA by Quarter

Water Infrastructure

($ Millions) |

27

Non-GAAP Reconciliation: Applied Water EBITDA & Adj. EBITDA

2012

Q1

Q1

Q2

Q3

Q4

Total

Pre-Tax Net Income

40

46

51

37

25

159

Interest, net

-

-

-

-

-

-

Depreciation

6

6

6

6

7

25

Amortization

1

2

1

2

1

6

Stock Compensation

1

-

-

1

1

2

EBITDA

48

54

58

46

34

192

Separation Costs

1

-

-

9

4

13

Adjusted

EBITDA 49

54

58

55

38

205

Revenues

355

355

385

368

336

1,444

Adjusted EBITDA Margin

13.8%

15.2%

15.1%

14.9%

11.3%

14.2%

2011

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA by Quarter

Applied Water

($ Millions) |

Non-GAAP Reconciliation: Guidance

28

Illustration of Mid Point Guidance

2012 Guidance

FY '11

FY '12

As Reported

Adjustments

Adjusted

Adjustments

Normalized

As Reported

Adjustments

Adjusted

Total Revenue

3,803

3,803

3,803

3,950

3,950

Segment Operating Income

503

29

a

532

(8)

d

524

577

8

h

585

Segment Operating Margin

13.2%

14.0%

13.8%

14.6%

14.8%

Corporate Expense

108

(58)

b

50

20

e

70

81

(10)

h

71

Operating Income

395

87

482

(28)

454

496

18

514

Operating Margin

10.4%

12.7%

11.9%

12.6%

13.0%

Interest Expense

(17)

(17)

(39)

f

(56)

(51)

(51)

Other Non-Operating Income (Expense)

5

5

5

-

-

Income before Taxes

383

87

470

(67)

403

445

18

463

Provision for Income Taxes

(104)

(7)

c

(111)

16

g

(95)

(111)

(5)

i

(116)

Net Income

279

80

359

(51)

308

334

13

347

Diluted Shares (j)

185.3

185.3

185.9

185.9

Diluted EPS

1.50

$

0.43

$

1.93

$

(0.27)

$

1.66

1.80

0.07

1.87

a

One time separation costs incurred at the segment level

b

One time separation costs incurred at the corporate level

c

Net tax impact of above items, plus the addition of 2011 special tax items

d

Incremental stand alone costs to be incurred in 2012 at the segment level ($8M)

e

Incremental stand alone costs to be incurred in 2012 at the corporate level ($20M)

f

Incremental interest expense on long-term debt to be incurred in 2012

g

Tax impact of incremental interest expense and stand alone costs to be incurred in 2012

h

Expected one time separation costs of $8M and $10M to be incurred at the segments and

headquarters, respectively. i

Tax impact of one time separation costs expected to be incurred in 2012.

j

Full year 2012 diluted shares outstanding are based on diluted shares outstanding for quarter

ended March 31, 2012 ($ Millions, except per share amounts)

Guidance

Xylem Inc. Non-GAAP Reconciliation |

29

NYSE: XYL

http://investors.xyleminc.com

Phil De Sousa, Investor Relations Officer

(914) 323-5930

Janice Tedesco, Investor Relations Coordinator

(914) 323-5931 |