UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No.1

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended December 31, 2009

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to_____________

Commission File Number: 000-52807

China Changjiang Mining and New Energy Company, Ltd.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or Other Jurisdiction of

Incorporation or Organization)

|

75-2571032

(I.R.S. Employer

Identification No.)

|

|

Seventeenth Floor, Xinhui Mansion, Gaoxin Road

|

+86(29) 8833-1685 |

| Hi-Tech Zone, Xi’An P.R. China 71005 | |

| (Address of Principal Executive Offices; Zip Code) | (Registrant’s Telephone Number) |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share (Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ü]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [ü]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been bject to such filing requirements for the past 90 days. Yes [ ] No [ü]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ü]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in art III of this Form 10-K or any amendment to this Form 10-K. [ü]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| (Check one): | ||

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [ü] |

1

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ü]

The aggregate market value of the voting common stock held by non-affiliates of the issuer, based on the average bid and asked price of such stock, was $484,321 at December 31, 2009 and the number of shares of voting Series C Preferred Stock issued and outstanding was 500,000.

At December 31, 2009, the registrant had outstanding 24,216,058 shares of common stock, $0.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

CHINA CHANGJIANG MINING AND NEW ENERGY COMPANY LTD.

Amendment No. 1 to Annual Report on FORM 10-K/A

For the Fiscal Year Ended December 31, 2009

|

TABLE OF CONTENTS

|

|

|

|

|

|

PART I

|

|

|

|

|

|

Item 1. Business

|

5

|

|

|

|

|

Item 1A. Risk Factors

|

9

|

|

|

|

|

Item 1B. Unresolved Staff Comments

|

16

|

|

|

|

|

Item 2. Properties.

|

16

|

|

|

|

|

Item 3. Legal Proceedings

|

18

|

|

|

|

|

Item 4. (Removed and Reserved)

|

18

|

|

|

|

|

PART II

|

|

|

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18

|

|

|

|

|

Item 6. Selected Financial Data

|

19

|

|

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

|

|

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

|

28

|

|

|

|

|

Item 8. Financial Statements and Supplementary Data

|

29

|

|

|

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

29

|

|

|

|

|

Item 9A. Controls and Procedures

|

30

|

|

|

|

|

Item 9B. Other Information

|

31

|

|

|

|

|

PART III

|

|

|

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

31

|

|

|

|

|

Item 11. Executive Compensation

|

34

|

|

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

35

|

|

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

35

|

|

|

|

|

Item 14. Principal Accounting Fees and Services

|

37

|

|

|

|

|

PART IV

|

|

|

|

|

|

Item 15. Exhibits, Financial Statement Schedules

|

38

|

3

Explanatory Note

The purpose of this Amendment No. 1 on Form 10-K/A is to amend and restate the Form 10-K of China Changjiang

Mining and New Energy Company, Ltd. (the “Company”) for the year ended December 31, 2009, filed with the

Securities and Exchange Commission (the “SEC”) on April 16, 2010, to respond to comments received by the

Company from the SEC.

Special Notes Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,”

“aim,” “will” or similar expressions, which are intended to identify forward-looking statements. Such statements

include, among others, those concerning market and industry segment growth and demand and acceptance of new

and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements

of the plans, strategies and objectives of management for future operations; any statements regarding future

economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs

about future events. You are cautioned that any such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, including those identified in Item 1A “Risk Factors” included

herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of

the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other

filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our

business, financial condition and results of operations and prospects. The forward-looking statements made in this

report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments

to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

“we,” “us,” “our,” or the “Company” are to CHINA CHANGJIANG MINING AND NEW ENERGY

COMPANY, LTD. and its consolidated subsidiaries;

|

|

•

|

“MT” are to metric tons;

|

|

|

•

|

“PRC” and “China” are to the People’s Republic of China;

|

|

|

•

|

“SEC” are to the Securities and Exchange Commission;

|

|

|

•

|

“Securities Act” are to the Securities Act of 1933, as amended;

|

|

|

•

|

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

|

|

|

•

|

“Renminbi” and “RMB” are to the legal currency of China; and

|

|

|

•

|

“U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

|

4

PART I

ITEM 1. BUSINESS.

Our Corporate History and Background

China Changjiang Mining and New Energy Co., Ltd. (the “Company”) is an exploration-stage company engaged in

exploration in Shaanxi Province, China, for commercially recoverable metal-bearing mineral deposits. The

Company has not yet identified any proven or probable mineral reserves, and only limited exploration activity has so

far been undertaken, primarily by governmental bodies in Shaanxi Province. Provided the Company successfully

identifies commercializable mineral deposits, it intends to engage in mining, processing and distributing zinc, lead,

and gold.

The Company is the result of a 2008 share exchange transaction among: (i) North American Gaming and

Entertainment Corporation, a Delaware corporation (“North American”); (ii) Shaanxi Changjiang Petroleum &

Energy Development Stock Co., Ltd. (“CJP”), a limited liability company established and existing under the law of

People’s Republic of China; and (iii) the shareholders of CJP, among whom the predominant shareholder, holding

97.2% of CJP’s shares, was a Hong Kong company, Hong Kong Wah Bon Enterprise Limited (“Wah Bon”). After

completion of the share exchange transaction, the Company went public in the United States through a reverse

merger with North American.

At the time of the share exchange transaction, CJP owned 60%, and the Company continues to control, Shaanxi

Dongfang Mining Co., Ltd., (“Dongfang”) which, as discussed further under “Item 2. Properties,” holds the Chinese

exploration license through which we pursue our exploration activity.

The share exchange was completed on February 4, 2008, resulting in the shareholders of CJP controlling

approximately 96% of the equity ownership of North American At the time of the closing of the share exchange,

North American was a shell company domiciled in Delaware which filed reports under the Exchange Act and whose

shares traded in the U.S. over-the-counter market. Wah Bon caused its subsidiary, CJP, to pay $370,000 in cash,

and Wah Bon delivered shares constituting 97.2% of the outstanding equity of CJP, in exchange for 3,800,000

shares of North American common stock and 500,000 shares of Series C Preferred Stock of North American, which

originally were entitled to 1,218 votes per share. Two U.S. individuals, through their advisory company, Capital

Advisory Services, Inc., were paid in the aggregate 4,500,000 shares of North American. In June 2008, CJP

changed its name to “Shaanxi Changjiang Mining New Energy Co., Ltd.”

Following the share exchange transaction, Wah Bon replaced North American’s Board of Directors.

China Changjiang Mining & New Energy Co., Ltd. was incorporated in the state of Nevada on September 19, 2008

for the purposes of re-domesticating the Company from Delaware to Nevada, adopting the Company’s current name,

and going public in the United States by means of a reverse merger with North American.

Pursuant to Articles of Merger filed with the Secretary of the State of the State of Nevada on December 4, 2008 and

the Secretary of the State of the State of Delaware on April 2, 2009, North American was merged with and into the

Company, with the Company being the surviving entity.

After the close of the 2009 fiscal year, but prior to the filing of this Form 10-K/A, on February 9, 2010, we filed a

Certificate of Amendment to our Articles of Incorporation to effect a 1-for-10 reverse stock split of our common

stock, subject to FINRA approval. The 1-for-10 reverse split was approved by FINRA on July 30, 2010, effective

August 2, 2010.

On September 15, 2010, the Company filed with the Nevada Secretary of State a Certificate of Designation and a

Certificate of Conversion and Elimination of the Series C Convertible Preferred Stock, pursuant to which: (i) all

shares of our Series C Preferred Stock were converted into shares of common stock at a rate of 1,218 shares of

common stock for each outstanding share of Series C Preferred Stock; and (ii) we canceled and eliminated the Series

5

C Preferred Stock. In the aggregate, the outstanding shares of the Company’s Series C Preferred Stock were

converted into 609 million shares of common stock.

As a result of these transactions, we currently have 250,000,000 authorized shares of common stock, par value

$0.01 per share, of which 37,716,588 shares are issued and outstanding on the date of filing of this Form 10-K/A,

and 10,000,000 authorized shares of preferred stock, of which no shares are presently issued and outstanding. At the

time our share exchange transaction was completed, approximately 96% of the outstanding shares of North

American were owned by Wah Bon. See Item 12, “Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters.”

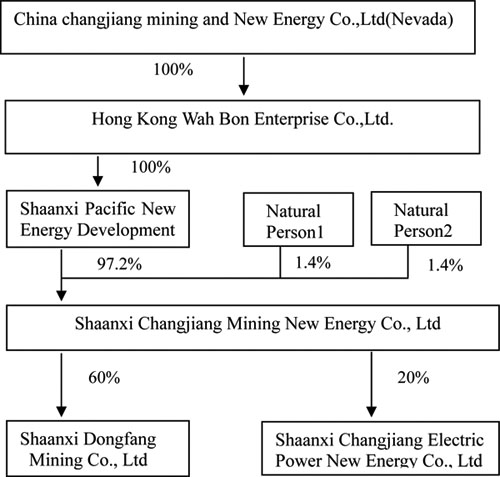

The present corporate structure of our Chinese subsidiaries is as depicted in the chart below:

Our Industry and Principal Market

Sales and Marketing

Although we are still in the exploration phase, we have established a sales and marketing department which is

focused on identifying and establishing relationships with companies that are likely to have a need for our products.

We are seeking to explore further on our property for commercializable zinc, lead and gold deposits. Zinc and lead

can be freely sold and marketed throughout the PRC. China remains a net importer of these metals, and we believe a

customer base exists within China.

Current Business Operations

Our Business

Through our majority-controlled subsidiary, Dongfang, we are engaged in the exploration for commercially

recoverable metal-bearing mineral deposits, such as zinc, lead and gold. Currently, our exploration activities are in a

61.27 square kilometer area in Jiao Shan Zhai, Guo Jia Ling, Xunyang County, in the Shaanxi Province of China. To

date, our activities have not resulted in the location of proven reserves. We also hold land use rights in a 5.7 square

kilometer parcel located in Huanghe Nantan, Heyang County, in the Shaanxi Province of China. We lease a portion

6

of the land use rights on the 5.7 square kilometer parcel to Shaanxi Huanghe Wetland Park Company Ltd.

(“Huanghe”) for the development and operation of a theme park. The term of the lease agreement is from January 1,

2009 to December 31, 2029. The annual rent is approximately $1.1 million. In November 2010, the Company

received the first rent payment under the lease, in the amount of approximately US$601,504. For additional

information, see “Item 2. Properties.”

The following table summarizes the business activities of the Company’s subsidiaries:

Mining Industry

General

If we successfully identify commercializable mineral deposits and obtain the required government license, our

primary business activity is anticipated to be mining, processing and distributing zinc, lead and gold, and other

mineral products. China is currently a net importer of nonferrous metals. There are governmental restrictions on

exploration and mining activity in China, discussed further below.

We believe that China will continue to industrialize and this will cause increased demand for industrial raw

materials such as non-ferrous metals. We expect prices of non-ferrous metals to increase in China in the future,

although prices may experience significant fluctuations.

Competition

We anticipate that our competitors in the nonferrous metals markets will be local and regional mining enterprises.

Other companies in China that mine zinc, lead and gold and that we consider to be likely competitors, include:

Dongschengmiao Mining Industry Co., Ltd., Wancheng Trading & Mining Col, Ltd., Xinjian Woquia Tianzhen

Mining Co., Ltd., and Wulatehouqi Qingshan Nonferrous Metal Development Co., Ltd. These competitors have

more experience in the operation of mines and mining activities and have superior financial resources than we do.

In the past, China protected its domestic metallurgy industry with high tariffs, import quotas and restrictions on

foreign ownership. Due to China’s WTO membership, China has reduced and is expected to further reduce

protection for Chinese companies against foreign competitors. To maintain its WTO membership, China must

gradually reduce its tariffs, quotas and restrictions, and permit foreign enterprises the opportunity to sell and

distribute in China. Tariffs will eventually be eliminated altogether. This is expected to increase the effect of

foreign competition and the importation of foreign products into China. We are unable to predict the effect these

changes may have on our Company.

Business Strategies

Our business strategies and near-term plans are as follows:

7

|

|

•

|

Further evaluate prospecting results to date;

|

|

|

•

|

Perform a rough survey of zinc, lead and gold over a test area; and

|

|

|

•

|

Investigate other metallogenic areas, mainly through surface work, which may be combined with limited tunnel exploration and drilling.

|

Government Regulation

Under a system established by China’s State Council, industrial activity is categorized as “permitted,” restricted,” or

“prohibited.” Our proposed exploration and mining activities fall into the “restricted” category, which means that

we may engage in these activities only with prior governmental approvals, as described below.

Exploration and mining activities are regulated in the PRC. Regulations issued or implemented by the State

Council, the Ministry of Land and Resources, and other relevant government authorities cover many aspects of

exploration and mining of natural resources, including, but not limited to, entry into the mining industry, the scope

of permissible business activities, tariff policies and foreign investment.

The principal regulations governing the mining business in the PRC include:

|

|

•

|

China Mineral Resources Law, which requires a mining business to have exploration and mining licenses from provincial or local land and resources agencies.

|

|

|

•

|

China Mine Safety Law, which requires a mining business to have a safe production license and provides for random safety inspections of mining facilities.

|

|

|

•

|

China Environmental Law, which requires a mining project to obtain an environmental feasibility study of each project.

|

Permits

In China, companies that seek to engage in mining must obtain two separate licenses from the land resource division

of the provincial government. The first license must be obtained before an enterprise may commence mineral

exploration activities. We have obtained this license. The law also requires a second license, for extraction

activities, including the excavation and sale of extracted minerals. As of December 31, 2009, we had not yet

received a mining license. If we do not obtain a mining license, the value of our interest in the mining properties

would be seriously impaired, and would result in a significant loss of value to us.

Mineral exploration also requires approval from the Environmental Department of the provincial government, which

must first determine that the exploration project will not cause environmental harm. In addition, the Security

Department controls strictly the explosives which are needed for exploration. The sale of mineral products is

managed by a joint department including industrial, commercial, taxation, and local public finance authorities.

There are also detailed rules and regulations related to management of the processing and transportation of mineral

products and the approval certificates needed in connection therewith. As of the date of this report, we have

obtained all necessary approvals from the Environmental Department and the Security Department with regard to

our activities to date.

Environmental Impact

Environmental protection laws in China are established on a national basis by the State Environmental Protection

Administration. Provincial and local authorities may set local regulations which may be more restrictive than the

national standards. Environmental standards govern a variety of matters, including disposal of solid waste,

discharge of contaminated water and handling of gases and emissions. The local authorities generally monitor and

enforce the regulations, including the assessment and collection of fees and the imposition of fines and

administrative orders.

8

Because we are still in the exploration stage, our environmental impact has been limited. If we are successful in

commencing our extraction operations, we expect to generate waste water, gases and solid waste. We will therefore

be subject to all national and local regulations governing these activities, and will likely require licenses for the

disposal of water and solid wastes.

Summary of Exploration Activity

Geological Survey

The region in which we have exploration rights is one in which mining activity has long been conducted, and where

there are several operating mines for non-ferrous metals.

We have not conducted geological exploration sufficient to form a conclusion as to whether there are proven or

probable mineral reserves in the area in which we have exploration rights. The principal surveys conducted to date

on this land have been preliminary geological surveys conducted by a unit of the Shaanxi Provincial Government.

It is costly to conduct detailed mineralogy studies, and we may not have the resources to undertake them. If we fail

to identify proven or probable mineral resources, the value of our Company and our securities will be materially and

adversely affected.

Our Employees

As of December 31, 2009, we had an aggregate of 19 employees, of whom 16 were full-time employees. This

includes two people in marketing, one in manufacturing, four in research and development and quality control, two

in financial and accounting, and seven in general management.

Available Information

We currently do not maintain a web site; however, our annual, periodic and current reports can be accessed on the

web site of the SEC at www.sec.gov and printed free of charge.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described

below, together with all of the other information included in this report, before making an investment decision. If

any of the following risks actually occurs, our business, financial condition and results of operations could suffer.

In that case, the trading price of our common stock could decline, and you may lose part or all of your investment.

You should read the section entitled “Special Notes Regarding Forward-Looking Statements” above for a

discussion of what types of statements are forward-looking statements, as well as the significance of such statements

in the context of this report.

RISKS RELATED TO OUR BUSINESS

WE ARE AN EARLY STAGE EXPLORATION COMPANY FACING SIGNIFICANT FINANCIAL AND

OPERATING RISKS.

We are an exploration stage mining company with land use rights to a 61.27 square kilometer tract of land in

Shaanxi Province, in Central China. We also hold land use rights in a 5.7 square kilometer parcel located in

Huanghe Nantan, Heyang County, in the Shaanxi Province of China, which is not held for the purpose of mining.

We seek to determine if there are commercially adequate deposits of zinc, lead and gold within our properties. The

exploration and extraction of mineral deposits involve significant financial risks. The results of exploratory

investigations are not always reliable or accurate even if conducted in strict compliance with professional guidelines.

Furthermore, exploration and extraction activities require substantial investment which must occur over a significant

period of time even though the quantity of minerals within any property is finite. Many properties are unable to

develop commercially viable mines even with positive exploration results. Successful extraction depends on very

9

expensive processes such as drilling, mine construction and establishment of processing facilities. Mines are also

hazardous and only a limited number of qualified, experienced miners exist. The Company must obtain additional

government approvals and must ramp up operations after obtaining permission to begin extraction. We are unable to

assure you that we will ultimately be successful in meeting these challenges or whether we will commence

commercial mining operations. Our failure to do so would have a substantial adverse effect in the value of our

company and our securities.

WE HAVE HAD A LIMITED OPERATING HISTORY AND A HISTORY OF FINANCIAL LOSSES.

We have no revenues from mining and do not anticipate generating mining revenues until exploitation has been

approved and undertaken, the mine infrastructure has been completed and the extraction of minerals has begun.

During the years ended December 31, 2009, 2008 and 2007, we had net losses of $ 921,675, $ 1,700,599, and

$ 568,756, respectively. During the years ended December 31, 2009, 2008 and 2007, we had comprehensive losses of

$ 911,535, $ 2,456,679, and $ 157,620, respectively.

These losses resulted from our exploration activities and corporate expenses, including the amortization of our land

use rights. We may never achieve profitable operations, and if we fail to do so, the value of our Company and our

securities will be substantially adversely affected.

WE HAVE NOT YET OBTAINED ALL OF THE LICENSES REQUIRED BY CHINESE LAW.

China employs a two-stage permitting process for permission to explore and to extract minerals. Although we

obtained the exploration license, as of December 31, 2009, we did not yet have the second required license needed

to permit the excavation and subsequent sale of extracted minerals. We cannot give assurance that we will obtain

this license. If we fail to do so, the value of our interests in the mining properties would be seriously impaired, and

would result in a material loss of value to us and our investors.

THERE IS NO ASSURANCE THAT OUR PROPERTY WILL CONTAIN SUFFICIENT QUANTITIES OF

COMMERCIALLY MARKETABLE MINERALS FOR US TO BECOME COMMERCIALLY VIABLE OR

THAT WE WILL BE ABLE TO ECONOMICALLY EXTRACT THE MINERALS.

We have engaged in limited investigation and geologic testing. There can be no assurance that our initial

exploratory efforts will prove satisfactory or correct, or that commercially mineable mineralization exists on our

property. It may not be economically feasible to profitably extract the minerals for many reasons, including some

reasons which are beyond our ability to control. We can offer no assurance that a profitable mining business will

result from our efforts.

WE HAVE NOT CONDUCTED GEOLOGICAL EXPLORATION SUFFICIENT TO FORM A CONCLUSION

THAT THERE ARE PROVEN OR PROBABLE MINERAL RESERVES ON OUR PROPERTY.

As of December 31, 2009, we had not yet conducted geological explorations sufficient to form a conclusion that

there are proven or probable mineral reserves in the area in which we have exploration rights. The only surveys

conducted on this land through the 2009 calendar year have been preliminary geological surveys conducted by a unit

of the Shaanxi Provincial Government. It is costly to conduct detailed mineralogy studies, and we may not have the

resources to undertake them. If we fail to identify commercially reasonable mineral resources, the value of our

Company and our securities will be materially and adversely affected.

DUE TO OUR LIMITED OPERATING HISTORY AND LIMITED EXPLORATION ACTIVITY, WE ARE

UNABLE TO FORECAST MINING REVENUES.

Due to our limited operating history and limited exploration activity, we are unable to forecast future mining

revenues. We have not yet generated any revenue from mining operations. Our current and future anticipated

expense levels are largely based on our investment plans. Failure to generate revenues, or to attract investment,

10

sufficient to support our planned expenditures, would have a material adverse effect on our business, prospects,

financial condition, and results of operations.

WE WILL NEED ADDITIONAL CAPITAL TO PURSUE OUR PLANS, AND WE MAY NOT BE ABLE TO

OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

As of December 31, 2009 and December 31, 2008, we had current assets of $ 488,698 and $ 850,627,

respectively. The remainder of our assets are illiquid. Exploration activities will likely generate cash flow deficits

and increased capital needs that will exceed our available capital. In that event, we will need to obtain additional

funding.

We currently have no lines of credit or other arrangements for capital and cannot provide any assurance that we will

be able to obtain funding in the future to meet our needs. Even if we locate available capital, it may be on

unfavorable terms. Any future capital investments could dilute or otherwise materially and adversely affect the

rights of our existing shareholders.

FLUCTUATION OF THE CHINESE CURRENCY COULD MATERIALLY AFFECT OUR FINANCIAL

CONDITION AND RESULTS OF OPERATIONS.

We have not yet commenced mining operations and do not have mining revenues. We expect that our future

revenues, if any, and expenses will be generated in China, but our reporting currency is US dollars and reported

results will be affected by exchange rate fluctuations between the RMB and the US dollar. We cannot give any

assurance that the value of the RMB will continue to appreciate, or even remain stable against the US dollar or any

other foreign currency. Accordingly, we may experience economic losses and negative impacts, as reported in U.S.

Dollars, as a result of foreign exchange rate fluctuations.

The RMB is currently not a fully convertible currency. The Chinese government may restrict future access to

foreign currencies for current account transactions. This may make it difficult for us to transfer money from China to

other countries on an economically advantageous basis or even at all. It may also make it difficult for us to pay cash

returns on the investment of foreign capital.

WE MAY BE ADVERSELY AFFECTED BY ENVIRONMENTAL REGULATIONS.

We are subject to China’s national and local environmental protection regulations which currently impose fees for

the discharge of waste substances, require the payment of fines for pollution, and provide for the closure by the

Chinese government of any facility that fails to comply with orders requiring a company to cease or improve upon

certain activities causing environmental damage. Due to the nature of the mining business, future mining operations

could produce significant amounts of waste water, gas, and solid waste materials. Chinese national, provincial, or

local authorities may impose legal requirements which would require additional expenditures on environmental

matters or changes in our processes or systems, the cost of which may exceed our financial resources.

WE DEPEND ON OUR SENIOR MANAGEMENT AND KEY EMPLOYEES, THE LOSS OF WHOM COULD

ADVERSELY AFFECT OUR OPERATIONS.

Our success will depend to a large degree upon our ability to identify, hire, and retain personnel, particularly

experienced miners and persons familiar with the marketing, manufacturing and administrative processes associated

with mining. We depend on the skills of our management team and current key employees, such as Mr. Chen Wei

Dong, our Chairman, President, and Chief Executive Officer. We may be unable to retain our existing key personnel

or attract and retain additional key personnel.

The loss of any of our key employees or the failure to attract, and retain experienced miners or additional key

employees could have a material adverse effect on our business and financial condition.

RISKS RELATED TO OUR INDUSTRY

11

HAZARDS AND RISKS ASSOCIATED WITH MINING MAY CAUSE SUBSTANTIAL DELAYS OF

OPERATIONS AND REQUIRE SIGNIFICANT EXPENDITURES.

The Company's operations are subject to all of the hazards and risks normally incident to the exploration for and

development and production of minerals, any of which could result in damages for which the Company may be held

responsible. Many hazards are beyond our control, such as unusual or unexpected rock formations, bad weather, and

high water tables. We could also experience landslides, cave-ins, flooding or other unfavorable conditions. If we

experience losses from these or other risks, it may cause substantial delays and require significant additional

expenditures. These conditions would adversely affect the Company's business, financial condition and the value of

our securities.

China has experienced a number of serious incidents in its mining industry that resulted in loss of life and serious

personal injury. Some mines have collapsed or were otherwise forced to close due to unsafe conditions. We would

suffer material losses if any of these events were to occur, and they would have a material adverse effect on our

business and the value of our securities.

RISKS RELATED TO THE REAL ESTATE INDUSTRY

THE CHINESE GOVERNMENT OWNS ALL LAND IN CHINA, AND CHINA ISSUES LAND USE RIGHTS

INSTEAD OF LEGAL TITLE TO THE PROPERTIES. THERE IS NO ASSURANCE THAT OUR RIGHTS TO

THE PROPERTIES WILL NOT BE SUBJECT TO IMPAIRMENT OR LOSS.

In China, all property is owned by the central government. Unlike deeds or other evidence of a fee simple ownership

interest, land use rights are always subject to fixed periods and permitted land use, usually for long periods of time.

These periods are frequently 50 years. Disputes over mining claims are common. A loss of our property rights or

mining rights would cause material damage to the Company and the price of its securities and could result in the loss

of the entire value of our Company.

MARKET PRICES FOR NON-FERROUS METALS FLUCTUATE AND COULD ADVERSELY AFFECT THE

VALUE OF OUR COMPANY AND OUR SECURITIES.

Market prices for zinc, lead and gold, the metals for which we explore, experience significant fluctuations in price.

The profitability of any mining operations will be directly related to these market prices. The market prices of non-

ferrous metals are subject to factors beyond our control. These factors include, but are not limited to, changes in

legal and regulatory requirements, changes in the exchange rates of the RMB and other currencies, worldwide

economic conditions, political and economic factors and variations in production costs. A reduction in the price or

demand for lead, zinc or gold would adversely affect our Company and the value of our securities.

WE ARE EXPOSED TO BUSINESS CYCLE RISK .

Our business is located in China and will be conducted in China. We expect to sell any minerals we extract within

China. The need for these minerals throughout the world is affected by the demand for such minerals in China. We

are dependant on the continued economic growth in China to maintain demand for our mineral products. The recent

global recession has adversely affected the non-ferrous metals industry. Our business and results of operation may

be adversely affected if Chinese economic growth were to decline.

SHORTAGES OF CRITICAL PARTS, EQUIPMENT AND SKILLED LABOR MAY ADVERSELY AFFECT

OUR DEVELOPMENT PROJECTS.

The mining industry has been impacted by increased worldwide demand for resources such as input commodities,

drilling equipment, tires and skilled labor. These shortages have caused, and may continue to cause, unanticipated

cost increases and delays in delivery times, potentially impacting operating costs, capital expenditures and

production schedules.

12

RISKS RELATED TO DOING BUSINESS IN THE PEOPLE'S REPUBLIC OF CHINA

WE ARE SUBJECT TO THE POLITICAL AND ECONOMIC POLICIES OF THE PEOPLE’S REPUBLIC OF

CHINA, AND GOVERNMENT REGULATION COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR

INTENDED BUSINESS.

All of our assets and operations are in the PRC. As a result, our operating results and financial performance as well

as the value of our securities could be affected by adverse changes in economic, political and social conditions in

China.

The Chinese government adopted a policy to transition from a planned economy to a market driven economy in

1978. Since then, the economy of the PRC has undergone rapid modernization, although the Chinese government

still exerts a dominant force in the nation's economy. This continues to include reservation to the state of land use

rights or mining and exploration rights, and includes controls on foreign exchange rates and restrictions or

prohibitions on foreign ownership in various industries including mining. All lands in China are state owned and

only limited “land use rights” are conveyed to business enterprises or individuals.

All of our intended exploration and mining activities require approvals from the local government authorities in

China. Obtaining governmental approval is typically a lengthy and difficult process with no guaranty of success.

Since the lands where our exploration activities are located were acquired through the grant of a land use right,

changes in government policy could adversely affect our business.

The Chinese government operates the economy in many industries through various five-year plans and even annual

plans. A large degree of uncertainty is associated with potential changes in these plans. Since China’s economic

reforms have no precedent, there can be no assurance that future changes will not create materially adverse

conditions for our business.

THERE ARE RISKS INHERENT IN DOING BUSINESS IN CHINA OVER WHICH WE HAVE NO

CONTROL.

The political and economic systems of the PRC are very different from those of the United States and other western

countries. China remains volatile with respect to certain social, economic and political issues which could lead to

revocation or adjustment of reforms. There are also issues between China and the United States that could result in

disputes or instabilities. The role of China and its government remain in flux both domestically and internationally,

and could cause shocks or setbacks that may adversely affect our business.

THE CHINESE LEGAL SYSTEM DIFFERS FROM THAT OF THE UNITED STATES, PROVIDING LESS

PROTECTION FOR INVESTORS, AND IT MAY BE DIFFICULT FOR INVESTORS TO SEEK LEGAL

REDRESS AGAINST US OR OUR OFFICERS AND DIRECTORS, INCLUDING CLAIMS THAT ARE

BASED UPON U.S. SECURITIES LAWS.

All of our current operations are conducted in China. All of our current directors and officers are nationals or

residents of China. All of the assets of these persons are located in China. The PRC legal system is a civil law

system. Unlike the common law system, the civil law system is based on written statutes in which decided legal

cases have little value as precedents. Differences in interpretations and rulings can occur with limited opportunity

for redress or appeal.

It may not be possible to effect service of process within the U.S. or elsewhere outside China upon our officers and

directors. Even if service of process were successful, considerable uncertainty exists as to whether Chinese courts

would recognize and enforce U. S. laws or judgments obtained in the U.S. federal and state securities laws as the U.

S. laws confer substantial rights to investors and shareholders that have no equivalent in China. Therefore a claim

against us or our officers and/or directors or even a final judgment in the U. S. may not be recognized or enforced by

Chinese courts.

13

In 1979, the PRC began to reform its legal system and has enacted numerous laws regulating economic and business

development, including those related to foreign investment. Currently many of the approvals required for our

business may be obtained at local or provincial level. We believe that it is relatively easier and faster to obtain

provincial approval than central government approval. Changes to existing laws that repeal or alter local regulatory

authority and preempt it with national laws could negatively affect our business and the value of our securities.

China's regulations and policies regarding investments, including investment in the mining business, are subject to

continued reformation and revisions. They may change in a manner adverse to us and our stockholders.

CHINESE LAWS COULD RESTRICT THE PAYMENT OF DIVIDENDS FROM ANY PROCEEDS

OBTAINED FROM LIQUIDATION OF OUR ASSETS.

All of our assets are located in China. Chinese law governs the distributions that can be made in the event of

liquidation of assets of foreign invested enterprises. While dividend distribution is allowed, some distributions are

subject to the approval from the foreign exchange authority in China. Liquidation proceeds would also be subject to

foreign exchange control. We are unable to predict the outcome in the event of liquidation insofar as it affects

payment to non-Chinese nationals.

RISKS RELATED TO OUR COMMON STOCK

SUSPENSION OF TRADING

The SEC announced a suspension, pursuant to Section 12(k) of the Exchange Act, of trading in the securities of the

Company on April 1, 2011. Questions have arisen regarding the accuracy and completeness of information

contained in the Company’s public filings with the SEC and concerning the company’s financial statements.

The absence of a trading market adversely affects the value of our securities.

THERE IS CURRENTLY A LARGE MARKET OVERHANG IN OUR COMMON STOCK AND FUTURE

SALES OF OUR COMMON STOCK COULD DEPRESS THE MARKET PRICE AND DIMINISH THE

VALUE OF YOUR INVESTMENT.

Subsequent to year-end 2009, we had a 1-for-10 reverse split of our common stock, after which all shares of our

Series C Preferred Stock were converted into an aggregate of 609 million shares of our common stock. This

effectively eliminated the ability of our other common stock holders to have a significant role in the election of

directors and other corporate changes. Future sales of shares of our common stock or securities that are convertible

into our common stock could adversely affect the market price of our common stock. If any of our principal

stockholders sells a large number of shares or if we issue a large number of shares, the market price of our common

stock could significantly decline. Moreover, the perception in the public market that our principal stockholders

might sell shares of common stock could further depress the market for our common stock.

THE MARKET FOR SHARES OF OUR COMMON STOCK HAS BEEN LIMITED AND SPORADIC, AND

THERE IS NO GUARANTEE THAT A MARKET WILL BE AVAILABLE FOR YOU TO SELL YOUR

SHARES.

Shares of our common stock are not listed on any exchange but have been sporadically traded in over the counter

transactions or in inter-dealer quotations. The trading of our stock was suspended by the SEC in April 2011. There is

no assurance that any market makers will in the future post bid and ask prices for our shares of common stock. Our

stock has been very thinly traded and there were many days or weeks that the shares did not trade at all. There is no

assurance that any market will exist at the time that a shareholder wishes to sell his or her shares and there is no

assurance that any market will continue.

14

OUR COMMON STOCK PRICE IS VOLATILE AND MAY NOT APPRECIATE IN VALUE.

The trading of our stock was suspended on April 1, 2011 by the SEC. The market price of shares of our common

stock fluctuated and, if trading resumes, is likely to continue to fluctuate significantly. Fluctuations could be rapid

and severe and may provide investors little opportunity to react. Factors such as changes in commodity prices,

conversion of our preferred shares, results of operations, and a variety of other factors, many of which are beyond

the control of the Company, could cause the market price of our common stock to fluctuate substantially. Also,

stock markets in penny stock shares tend to have extreme price and volume volatility. The market prices of the

securities of many smaller public companies are subject to volatility for reasons that frequently are unrelated to

operating performance, earnings or other recognized measurements of value. This volatility may cause declines,

including very sudden and sharp declines, in the market price of our common stock. We cannot assure investors that

the stock price will appreciate in value, that a market will be available to resell your securities or that the shares will

retain any value at all.

WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH U.S. CORPORATE

GOVERNANCE AND ACCOUNTING REQUIREMENTS.

The SEC issued comment letters on September 28, 2010, February 18, 2011 and April 19, 2011, regarding our Form

10-K for fiscal year ended December 31, 2009, and regarding our Forms 10-Q for fiscal quarters ended March 31,

2010, June 30, 2010 and September 30, 2010. The SEC also issued another letter to us on February 25, 2011

regarding the need to file Form 8-K to disclose non-reliance on our filings, pursuant to a letter addressed to the

Board of Directors of the Company by our former independent accountant, Brock, Schechter & Polakoff, LLP. We

filed Form 8-K and a Form 8-K Amendment on May 31, 2011 and June 6, 2011, respectively, to address the

February 2011 SEC comment letter. On April 4, 2011, the SEC issued a subpoena to the Company as part of its

investigation and required the Company to produce certain documents. We complied with the subpoena and

responded on May 2, 2011 to the Los Angeles Regional Office of the SEC.

On June 7, 2011, the SEC issued another subpoena in furtherance of its investigation and required the Company to

produce additional documents relating to its land use right. We complied with the subpoena and responded on June

24, 2011 to the Los Angeles Regional Office of the SEC.

We expect to incur significant costs associated with these matters, as well as our ongoing public company reporting

requirements and costs associated with corporate governance requirements and other rules implemented by the SEC.

We expect our current SEC matters and these rules and regulations to increase our legal and financial compliance

costs and to make some activities more time-consuming and costly. We also expect it may become more difficult

and more expensive for us to obtain director and officer liability insurance and we may be required to accept

reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a

result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or

as executive officers.

WE DO NOT FORESEE PAYING CASH DIVIDENDS IN THE FORESEEABLE FUTURE.

We have not paid cash dividends on our stock and we do not plan to pay cash dividends on our stock in the

foreseeable future. We intend to retain any earnings to help fund operations. Therefore an investment in our

common stock is not appropriate for investors who require regular and periodic returns on their investments.

OUR STOCK IS A PENNY STOCK. TRADING OF OUR STOCK MAY BE RESTRICTED BY THE SEC’S

PENNY STOCK REGULATIONS AND THE FINRA’S SALES PRACTICES, WHICH MAY LIMIT A

STOCKHOLDER’S ABILITY TO BUY AND SELL OUR STOCK.

The trading of our stock was suspended on April 1, 2011, by the SEC. Our stock is a penny stock. The SEC has

adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as

defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our

securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-

dealers who sell to persons other than established customers and “accredited investors”, as defined. Rule 15g-2

15

requires a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form required by the SEC which provides information about penny

stocks and the nature and level of risks in the penny stock market, and cautions investors against making a hurried

investment decision. The broker-dealer must also provide the customer with the current bid and offer quotations for

the penny stock, the compensation of the broker-dealer and its salesperson in the transaction. The broker-dealer

must also send a confirmation of these prices after the trade. After a purchase of penny stock, the broker-dealer

must send a monthly account statement that gives an estimate of the value of each penny stock purchased.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from

these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment

for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to

these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our

common stock.

In addition to the “penny stock” rules promulgated by the SEC, the Financial Industry Regulatory Authority

(“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must

have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending

speculative, low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts

to obtain information about the customer’s financial status, tax status, investment objectives and other information.

Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced

securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-

dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our

stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable to a smaller reporting company.

ITEM 2. PROPERTIES.

All land in China is owned by the state. Individuals and companies are permitted to acquire rights to use land, or

“land use rights,” for specific purposes. In the case of land used for commercial purposes, the land use rights are

granted for a period of 50 years. The original period, and any subsequent periods, may be renewed prior to their

expiration. Granted land use rights are transferable and may be used as security for borrowings and other

obligations.

Corporate Headquarters

Our corporate headquarters, consisting of 554 square meters, are located at Seventeenth Floor, Xinhui Mansion,

Gaoxin Road, Hi-tech Zone, Xi'An, Shaanxi Provence PRC, Postcode: 710075. Our telephone number is (86)29-

88331685 and our fax number is (86)29-88332335. We have leased our headquarters through January 31, 2013, at a

rental rate of $11,029 per year.

The Dongfang Parcel

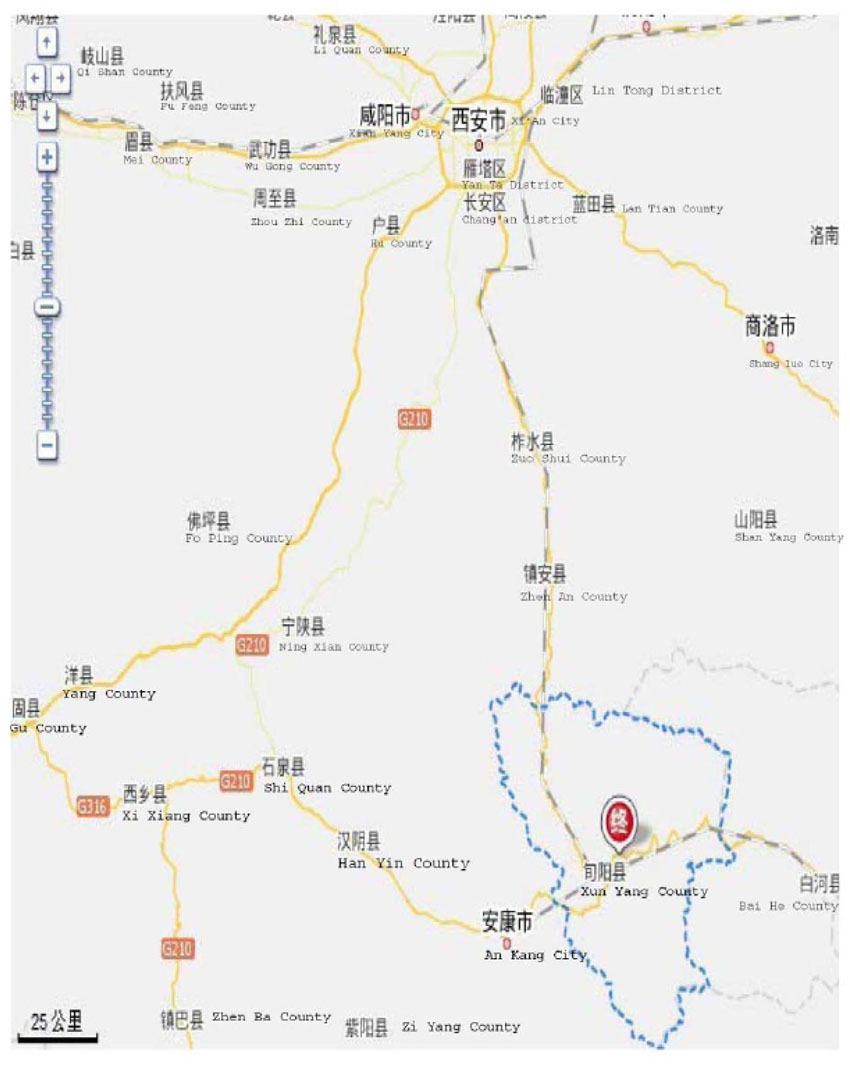

We have mining rights to a 61.27 square kilometer (15,140acres) parcel in the Jiao Shan Zhai Mining Area, located

in Xunyang County-Guo Jia Ling, Xunyang County, Shaanxi Province (the “Donfang Parcel”). Approval of the

exploration rights was granted by the appropriate authorities (Certificate No. 6100000720386). As shown on the

map below, the Dongfang Parcel is located in the Guo Jia Ling- Jiao Shan Zhai Mining Area in eastern Xunyang

County, under the jurisdiction of Shuhe Town, Guankou Town and Gouyuan Village, Xunyang County, Shaanxi

Province.

16

17

Dongfang Mining obtained an exploration license in September, 2003 relating to the exploration for mineral

deposits on this parcel. Also in 2003, the First Geological Team of the Shaanxi Provincial Bureau of Geology and

Mineral Resources undertook a preliminary survey, a geographical profile survey, and performed limited trenching

in 1.15 square kilometers. Also, the Yunnan Nonferrous Geological Institute Physical Branch performed a survey,

using the geophysical transient electromagnetic method. We have not yet established the presence or location of

proven or provable mineral reserves.

Theme Park Parcel

We have land use rights (certificate No. (2006) 3240001), to a 5.7 square kilometer parcel in Huanghe Nantan,

Heyang County, Shaanxi province. We currently lease a portion of this parcel to Shaanxi Huanghe Wet Land Park

Co., Ltd. for the development and operation of a theme park. The lease expires on December 31, 2029.

ITEM 3. LEGAL PROCEEDINGS.

We received a document subpoena dated April 4, 2011, pursuant to which the Enforcement Division of the SEC

informed us that it is conducting an investigation of the Company to determine whether the Company has committed

a violation of the federal securities laws. The subpoena required us to produce certain documents to the SEC, and

we complied and responded on May 2, 2011.

On June 7, 2011, the SEC issued another subpoena in furtherance of its investigation and required the Company to

produce additional documents relating to its land use right. We complied with the subpoena and responded on June

24, 2011 to the Los Angeles Regional Office of the SEC.

ITEM 4. (REMOVED AND RESERVED).

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market information

The trading of our stock was suspended on April 1, 2011 by the SEC. Prior to the suspension, the Company's

common stock was traded over-the-counter and quoted from time to time in the Over-the-Counter (“OTC”) Bulletin

Board under the trading symbol “CHJI.OB”. There is currently no public trading market for the Company's common

stock. The following table sets forth the range of high and low bid prices as reported by the OTC Bulletin Board for

the periods indicated. Such quotations represent inter-dealer prices without retail markup, markdown, or

commission, and may not necessarily represent actual transactions.

18

Holders

As of April 29, 2011, we had 4,069 record holders of our common stock.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying

any cash dividends in the foreseeable future on our common stock. Although we intend to retain our earnings, if

any, to finance the exploration and growth of our business, our board of directors reserves the right to declare and

pay dividends in the future, to the extent permitted by law.

Stock Option Grants

None.

Unregistered Sales of Equity Securities

After the end of fiscal 2009, on January 10, 2010 and January 21, 2010, the Company issued an aggregate of

4,500,000 shares of common stock to Messrs. Donald R. Monroe and Stanley F. Wilson, the principals of Capital

Advisory Services, Inc., in connection with our share exchange transaction. To the best of our knowledge, each of

them now holds 2,250,000 shares of common stock the shares were issued without registration in reliance on section

4(2) of the Securities Act .All issued and outstanding shares of series C Preferred Stock have been converted into an

aggregate amount of 609 million shares of our common stock which were issued without registration in reliance on

SEC Regulation S.

Repurchases of Shares by the Company

None.

ITEM 6. SELECTED FINANCIAL DATA.

Not required for a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and

the related notes thereto as filed with the SEC, and other financial information contained elsewhere in this Form 10-

K/A.

Overview

We are an exploration stage mining company. We have not yet conducted sufficient exploration activity to

determine whether we have any proven or probable mineral reserves. We have sustained losses from operations to

date.

We have exploration rights for a 61.27 sq.km parcel in the Jiao Shan Zhai Mining Area, located in Xunyang County

in the Shaanxi Province of China. Our land use rights are amortized over their 50-year term. We have performed

limited tests on the site but we have not yet determined if the site contains adequate mineralization to support mining

activity.

The following is a summary of land use rights as of December 31, 2009:

|

Cost

|

$18,744,677

|

|

Less: Accumulated amortization

|

2,146,978

|

|

Land use rights, net

|

$16,597,699

|

|

10-KA Exhibit v10-KA

|

19

The land use rights are amortized over the fifty year term. The amortization expense for the year ended

December 31, 2009 and December 31, 2008 was $405,100 and $391,451, respectively.

Since 2003, Dongfang has held licenses for the exploration of minerals and precious metals in the Shaanxi Province

of China. Dongfang was granted an exploration right for zinc, lead and gold at Gan Gou and Guan Zi Gou, Xunyang

County, Shaanxi Province, PRC, on December 31, 2006.

As reflected in the accompanying consolidated financial statements, the Company had an accumulated deficit of

$ 6,258,430 at December 31, 2009, which includes a net loss of $ 921,675 for the year ended December 31,

2009. The Company's current liabilities exceed its current assets by $ 16,620 and the Company used cash of

$ 237,950 in its operations in 2009.

As of December 31, 2009, we had applied for, but had not yet obtained, a license that will permit the excavation and

extraction of minerals. Issuance of that license will depend, in part, on the results of exploration for zinc, lead and

gold at the site.

To date, we have financed our activities from loans received from certain of our directors and other related parties

We mainly received loan from Hongjun Zhang, the stockholder and director of the Company.

We expect to continue to rely on loans from our directors and other related parties. We have no other sources of capital

and there can be no assurance that the Company will be able to meet its obligations or obtain sufficient capital to complete

its plan of operations for the next twelve (12) months.

RESULTS OF OPERATIONS

Comparison of the Years Ended December 31, 2009 and December 31, 2008

The Company is an exploration stage company and has not yet generated mining revenue.

The amortization of land use rights was $ 405,100 in 2009 and $ 391,451 in 2008, both of which have been

included in operating expense. The amortization is a non-cash accounting charge. Business tax was zero both in

2009 and 2008.

Operating Expenses

Total operating expenses for the year ended December 31, 2009 decreased to $ 895,389 from $1,666,930 for the

year ended December 31, 2008. Total expenses, before taxes and non-controlling interests, for the year ended

December 31, 2009 was $ 898,179 as compared to $ 1,665,241 for year ended December 31, 2008. The reduction

was primarily the result of lower legal and professional fees in 2009 than in 2008.

Net Loss

Our net loss for the year ended December 31, 2009 decreased to $ 921,675 from $1,700,599 for the year ended

December 31, 2008. The overall decrease in net loss of $ 778,924, over the prior year period, is primarily due to the

lower legal and professional fees in 2009 than in 2008

Comprehensive Gain (Loss)

Our comprehensive loss for the year ended December 31, 2009 was $10,140 compared with comprehensive

gain of $756,080 in 2008. The change primarily resulted from exchange rates between the U.S. Dollar and the

Chinese Yuan RMB.

20

Stockholders’ Equity

Stockholders' equity decreased by $832,418 to $9,705,366 as of December 31, 2009, or approximately 0.8 %,

from $10,537,784 as of December 31, 2008.The decrease was due to the expense occurred in 2009.

LIQUIDITY AND CAPITAL RESOURCES

General

For the year ended December 31, 2009, net cash used in operating activities was $ 237,950, net cash used in

investing activities was $131,397 and net cash provided by financing activities was $374,624. At December 31,

2009, our cash balance was $27,194 as compared to $23,878 for the prior year.

Cash Flows From Operating Activities

Net cash used in operating activities of $ 237,950 for the year ended December 31, 2009 was primarily attributable

to the net daily operating expense withiout income. The adjustments to reconcile our net loss to

net cash flow, are mainly these: depreciation expense of $ 34,933, amortization of land use rights of $ 406,922,

,adjustment for non-controlling interests of $ 23,496 , a decrease in operating assets of $213,844

and a decrease in operating liability of $4,530.

Cash Flows From Investing Activities

Net cash used in investing activities of $131,397 for the year ended December 31, 2009 was primarily

attributable to$131,397 due from related parties.

Cash Flows From Financing Activities

Net cash of $374,624 provided by financing activities in the year ended December 31, 2009 resulted primarily

from advances from shareholders and related parties, as described above.

FINANCING

We are still an exploration stage company. We ended fiscal 2009 with $27,194 of cash and equivalents. Given our

current cash usage rate, we can provide no assurance that our available cash and the cash we anticipate generating

from operating activities will be sufficient to sustain our operations for the next twelve months.

INTERNAL SOURCES OF LIQUIDITY

There is no assurance that funds from operations will meet the requirements of our daily operations in the future. In

the event that we have insufficient cash to meet our operating requirements, we will need to seek external financing

to maintain liquidity.

EXTERNAL SOURCES OF LIQUIDITY

Our management will review any financing options available to us, but we cannot assure you that we will be able to

secure additional funds from debt or equity financing, as and when we need to or if we can, that the terms of such

financing will be favorable to us and our shareholders.

21

INFLATION

Our management believes that inflation did not have a material effect on our results of operations in 2009.

OFF-BALANCE SHEET ARRANGEMENTS.

We do not have any off-balance sheet arrangements.

CONTRACTUAL OBLIGATIONS

None

SUBSEQUENT DEVELOPMENTS

Non-Reliance issues.

On March 18, 2010, we filed a Form 8-K and an amended Form 10-K for the period ended December 31, 2008. In

consultation with Brock, Schechter & Polakoff (“BSP”), our independent registered public accounting firm at that

time, we concluded on February 22, 2010 that the financial statements for the fiscal year ended December 31, 2008,

as presented in our Report on Form 10-K for that year, should no longer be relied upon due to the accounting issues

more fully described in our Form 8-K filing.

The Company restated its financial statements for the fiscal year ended December 31, 2008 by disclosing the effect

of these accounting issues in our amended Form 10-K.

On May 31 and June 6, 2011, we filed a Form 8-K and a Form 8-K/A to report the resignation of BSP as the

Company’s auditor and that our Annual Report on Form 10-K for the year ended December 31, 2009, and our

Quarterly Reports for the fiscal quarters ended March 31, June 30 and September 30, 2010 could not be relied upon

for the reasons stated in the May 31 Form 8-K. We also reported that we had retained Parker Randall CF (H.K.)

CPA limited (“Parker Randall”) as our audit firm. This Form 10-K/A is being filed to amend our Form 10-K for the

2009 fiscal year and includes our restated financial statements and an audit report thereon from Parker Randall.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Our discussion and analysis of our financial condition and results of operations are based on our consolidated

financial statements, which are prepared in accordance with accounting principles generally accepted in the United

States of America. The preparation of these consolidated financial statements requires us to make estimates,

judgments and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and the

related disclosure of contingent assets and liabilities to comply with generally accepted accounting principles. We

base our estimates on historical experience and on various other assumptions that we believe are reasonable under

the circumstances, the results of which form the basis for making judgments about the carrying values of assets and

liabilities that are not readily apparent from other sources. Actual results could differ from our estimates, which

would affect the related amounts reported in our financial statements.

An accounting policy is considered to be critical if it requires an accounting estimate to be made based on

assumptions about matters that are highly uncertain at the time the estimates are made, and if different estimates that

reasonably could have been used, or changes in the accounting estimates that are reasonably likely to occur, could

materially impact the consolidated financial statements. We believe that the following critical accounting policies

reflect the significant estimates and assumptions which are used in the preparation of the consolidated financial

statements and affect our financial condition and results of operations.

Method of Accounting

The Company maintains its accounts and prepares its financial statements using the accrual method accounting .

The consolidated financial statements and notes are representations of management. Accounting policies

adopted by the Company conform to generally accepted accounting principles in the United States of America

and have been consistently applied.

22

Principles of consolidation

The accompanying consolidated financial statements as of December 31, 2009 and 2010consolidate the financial

statements of North American and its 100% owned subsidiary Wah Bon, 100% owned subsidiary

Tai Ping Yang, 97.2% owned subsidiary Chang Jiang and 60% owned subsidiary Dongfang Mining.

The minority interests represent the minority shareholders' 2.8% and 40% shares of the results of Chang Jiang

and Dongfang Mining respectively.

The accompanying consolidated financial statements as of December 31, 2006 consolidate the financial statements

of Chang Jiang and its 92.93% owned subsidiary Huanghe. The minority interests represent the minority

shareholders' 7.07% share of the results of Huanghe.

Business combinations and consolidated financial statements

Business combinations involving enterprises under common control

A business combination involving enterprises under common control is a business combination in which all of

the combining enterprises are ultimately controlled by the same party or parties both before and after the business

combination, and that control is not transitory. The assets and liabilities obtained are measured at the carrying

amounts as recorded by the enterprise being combined at the combination date. The difference between the

carrying amount of the net assets obtained and amount of consideration paid for the combination (or the value

of shares issued) is accounted for by an adjustment to the capital premium (or share premium) in the capital reserve.

If the balance of the capital premium (or share premium) is insufficient, any excess is charged against retained

earnings. The combination date is the date on which one combining enterprise effectively obtains control of the

other combining enterprises.

Business combinations involving enterprises not under common control

A business combination involving enterprises not under common control is a business combination in which

all of the combining enterprises are not ultimately controlled by the same party or parties both before and after

the business combination. Where 1) the aggregate of the fair value at the acquisition date of assets transferred

(including the acquirer’s previously held equity interest in the acquiree), liabilities incurred or assumed, and

equity securities issued by the acquirer, in exchange for control of the acquiree, exceeds 2) the acquirer’s

interest in the fair value of the acquiree’s identifiable net assets, the difference is recognized as goodwill.

Where 1) is less than 2), the difference is recognized in profit or loss for the current period. The costs of the

issuance of equity or debt securities as a part of the consideration paid for the acquisition are included as a

part of initial recognition amount of the equity or debt securities. Other acquisition-related costs arising from

the business combination are recognized as expenses in the periods in which the costs are incurred. The difference

between the fair value and the carrying amount of the assets transferred is recognized in profit or loss.

The acquisition date is the date on which the acquirer effectively obtains control of the acquiree.

The acquirer, at the acquisition date, allocates the cost of the business combination by recognizing the acquiree’s

identifiable asset, liabilities and contingent liabilities at their fair value at that date.

In a business combination, the acquiree’s deductible temporary differences obtained by the Group are not

recognized if the deductible temporary differences do not satisfy the criteria for recognition of deferred tax

assets at the acquisition date. The Group recognizes the relevant deferred tax assets and reduces goodwill

accordingly if within 12 months of the acquisition date, new or updated information indicates that at the

acquisition date, the obtained deferred tax benefit is expected to be realized in future periods. If the goodwill

is insufficient to be deducted, any remaining deferred tax benefits shall be recognized in profit or loss for the

current period. All other acquired deferred tax benefit shall be included in profit or loss for the current period.

Consolidated financial statements

The consolidated financial statements comprise the Company and its subsidiaries. Control is the power to

govern the financial and operating policies of an entity so as to obtain benefits from its operating activities.

In assessing control, potential voting rights, such as warrants and convertible bonds, that are currently

exercisable or convertible, are taken into account. The consolidated financial statements of subsidiaries

are included in the consolidated financial statements from the date that control commences until the date

that control ceases.

23

Where a subsidiary is acquired during a reporting period through a business combination involving enterprises

under common control, the consolidated financial statements of the subsidiary are included in the consolidated

financial statements as if the combination had occurred at the date that the ultimate controlling party first

obtained control. Therefore the opening balances and the comparative figures of the consolidated financial

statements are restated. In the preparation of the consolidated financial statements, the subsidiary’s assets,

liabilities and results of operations are included in the consolidated balance sheet and the consolidated income

statement, respectively, based on their carrying amounts, from the date that common control was established.

Where a subsidiary is acquired during a reporting period through a business combination involving enterprises

not under common control, the identifiable assets, liabilities and results of operations of the subsidiaries are

consolidated into consolidated financial statements from the date that control commences, based on the fair

value of those identifiable assets and liabilities at the acquisition date.For a business combination not involving

enterprises under common control and achieved in stages, the Group remeasures its previously-held equity

interest in the acquiree to its fair value at the acquisition date. The difference between the fair value and the

carrying amount is recognized as investment income for the current period; the amount recognized in other

comprehensive income relating to the previously-held equity interest in the acquiree is reclassified as investment

income for the current period.

Where the Company acquires a minority interest from a subsidiary’s minority shareholders or disposes of a

portion of an interest in a subsidiary without a change in control, the difference between the amount by which

the minority interests are adjusted and the amount of the consideration paid or received is adjusted to the capital

reserve in the consolidated balance sheet. If the credit balance of capital reserve is insufficient, any excess is

adjusted to retained earnings.

When the Group loses control of a subsidiary due to the disposal of a portion of an equity investment, the

remaining equity investment is remeasured at its fair value at the date when control is lost. The difference

between 1) the total amount of consideration received from the transaction that resulted in the loss of control

and the fair value of the remaining equity investment and 2) the carrying amounts of the interest in the former

subsidiary’s net assets immediately before the loss of the control is recognized as investment income for the

current period when control is lost. The amount recognized in other comprehensive income in relation to the

former subsidiary’s equity investment is reclassified as investment income for the current period when

control is lost.