Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INDEPENDENT BANK CORP | d343482d8k.htm |

| EX-99.2 - PRESS RELEASE - INDEPENDENT BANK CORP | d343482dex992.htm |

Exhibit 99.1

Independent Bank Corp. Parent of Rockland Trust Acquisition of Central Bancorp, Inc. May 1, 2012 NASDAQ: INDB NASDAQ: CEBK

Independent Bank Corp. Parent of Rockland Trust This presentation contains forward-looking information for Independent Bank Corp. Such information constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) which involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements. In connection with the proposed merger, Independent Bank Corp. (“INDB”) will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Central Bancorp, Inc. (“CEBK”) and a Prospectus of INDB, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger when they become available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. You will be able to obtain a free copy of the Proxy Statement/Prospectus, as well as other filings containing information about INDB and CEBK at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from INDB at www.rocklandtrust.com under the tab “Investor Relations” and then under the heading “Documents” or from CEBK by accessing CEBK’s website at www.centralbk.com under the tab “About Us” and then under the heading “Shareholder Information”. INDB and CEBK and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of CEBK in connection with the proposed merger. Information about the directors and executive officers of INDB is set forth in the proxy statement for INDB’s 2012 annual meeting of shareholders, as filed with the SEC. Information about the directors and executive officers of CEBK is set forth in the proxy statement for CEBK’s 2011 annual meeting of shareholders, as filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. You may obtain free copies of this document as described above. Safe Harbor Statement

Independent Bank Corp. Parent of Rockland Trust Strategic Rationale •Attractive financial return –Highly accretive to earnings –IRR of 15.4% –Modest dilution to TBV and TCE/TA with short earn-back period •Significantly increases footprint in eastern Middlesex County, a natural market extension with attractive demographics –Part of the Boston MSA – the 10th largest MSA by population in the U.S. ¹ –Largest population of any county in New England (~1.5 million) and third highest median household income (~$78K)1 •Introduction of INDB operating model will provide: –Significant opportunity for improved efficiencies –Attractive platform for broader INDB product lines 3 (1)Source: SNL Financial Source: SNL Financial; U.S. Bureau of Economic Analysis

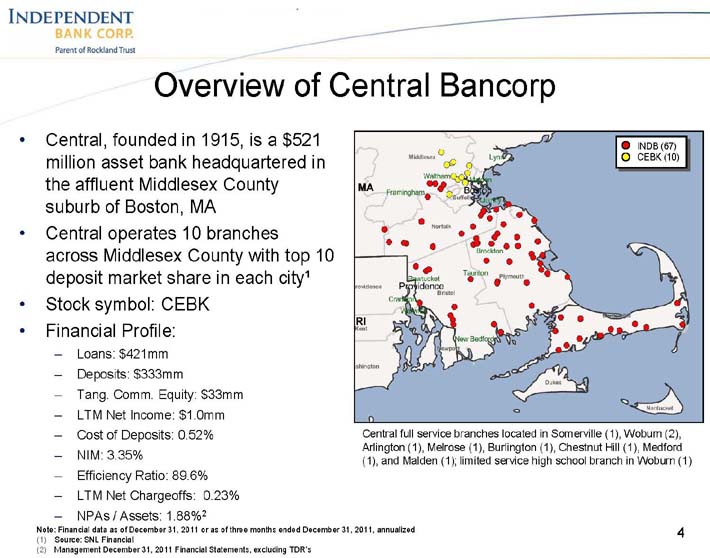

Independent Bank Corp. Parent of Rockland Trust Overview of Central Bancorp •Central, founded in 1915, is a $521 million asset bank headquartered in the affluent Middlesex County suburb of Boston, MA •Central operates 10 branches across Middlesex County with top 10 deposit market share in each city¹ •Stock symbol: CEBK •Financial Profile: –Loans: $421mm –Deposits: $333mm –Tang. Comm. Equity: $33mm –LTM Net Income: $1.0mm –Cost of Deposits: 0.52% –NIM: 3.35% –Efficiency Ratio: 89.6% –LTM Net Chargeoffs: 0.23% –NPAs / Assets: 1.88%2 INDB (67) CEBK (10) Note: Financial data as of December 31, 2011 or as of three months ended December 31, 2011, annualized (1)Source: SNL Financial (2)Management December 31, 2011 Financial Statements, excluding TDR’s Central full service branches located in Somerville (1), Woburn (2), Arlington (1), Melrose (1), Burlington (1), Chestnut Hill (1), Medford (1), and Malden (1); limited service high school branch in Woburn (1)

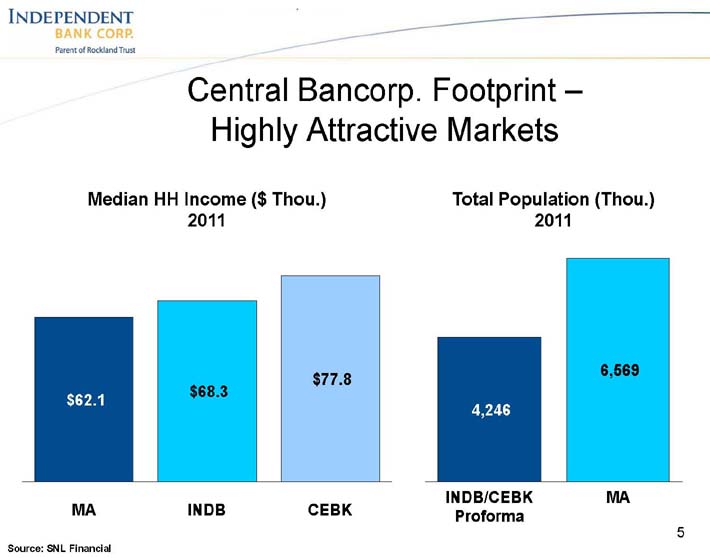

Independent Bank Corp. Parent of Rockland Trust Central Bancorp. Footprint – Highly Attractive Markets 5 $62.1 $68.3 $77.8 MA INDB CEBK Median HH Income ($ Thou.) 2011 4,246 6,569 INDB/CEBK Proforma MA Total Population (Thou.) 2011 Source: SNL Financial

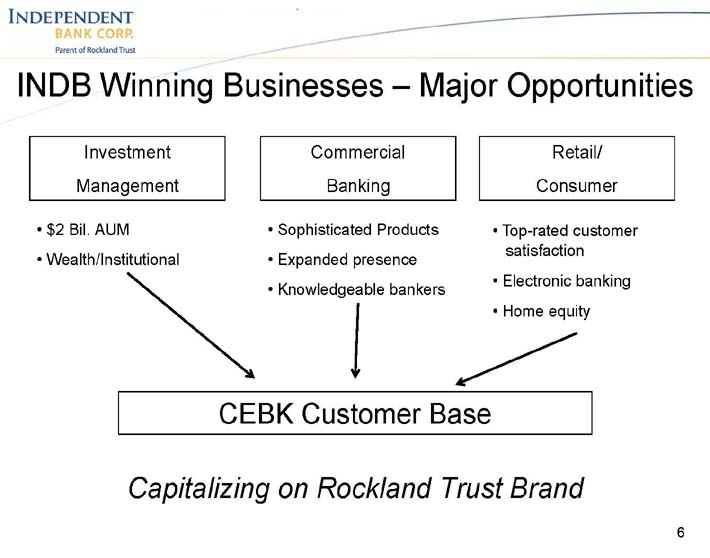

Independent Bank Corp. Parent of Rockland Trust 6 Investment Management Commercial Banking Retail/ Consumer • $2 Bil. AUM • Wealth/Institutional • Sophisticated Products • Expanded presence • Knowledgeable bankers CEBK Customer Base Capitalizing on Rockland Trust Brand • Top-rated customer satisfaction • Electronic banking • Home equity INDB Winning Businesses – Major Opportunities

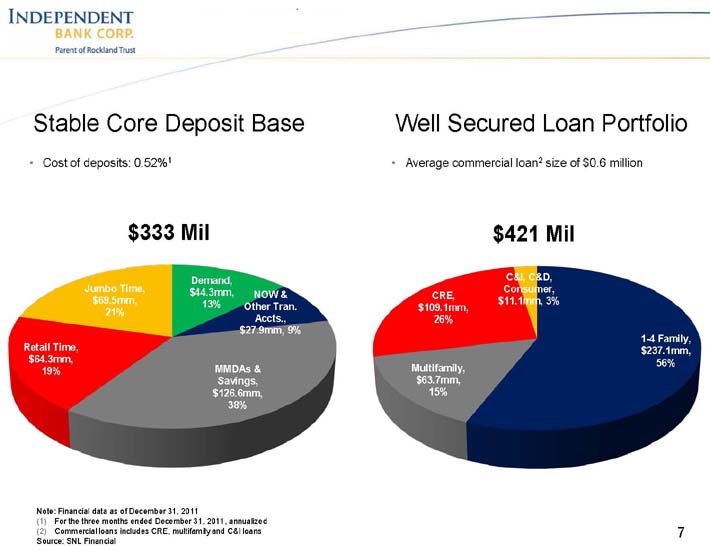

Independent Bank Corp. Parent of Rockland Trust Stable Core Deposit Base Demand, $44.3mm, 13% NOW & Other Tran. Accts., $27.9mm, 9% MMDAs & Savings, $126.6mm, 38% Retail Time, $64.3mm, 19% Jumbo Time, $69.5mm, 21% $333 Mil •Cost of deposits: 0.52%1 Note: Financial data as of December 31, 2011 (1)For the three months ended December 31, 2011, annualized (2)Commercial loans includes CRE, multifamily and C&I loans Source: SNL Financial 7 Well Secured Loan Portfolio •Average commercial loan2 size of $0.6 million 0 1-4 Family, $237.1mm, 56% Multifamily, $63.7mm, 15% CRE, $109.1mm, 26% C&I, C&D, Consumer, $11.1mm, 3% $421 Mil

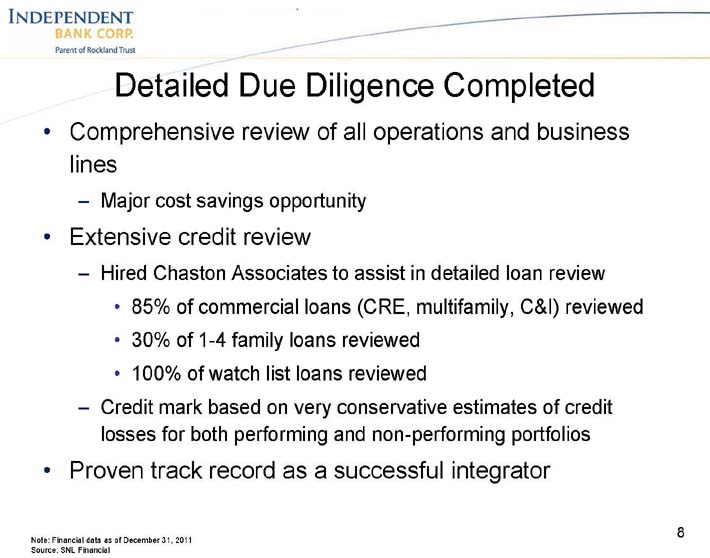

Independent Bank Corp. Parent of Rockland Trust •Comprehensive review of all operations and business lines –Major cost savings opportunity •Extensive credit review –Hired Chaston Associates to assist in detailed loan review •85% of commercial loans (CRE, multifamily, C&I) reviewed •30% of 1-4 family loans reviewed •100% of watch list loans reviewed –Credit mark based on very conservative estimates of credit losses for both performing and non-performing portfolios •Proven track record as a successful integrator 8 Note: Financial data as of December 31, 2011 Source: SNL Financial Detailed Due Diligence Completed

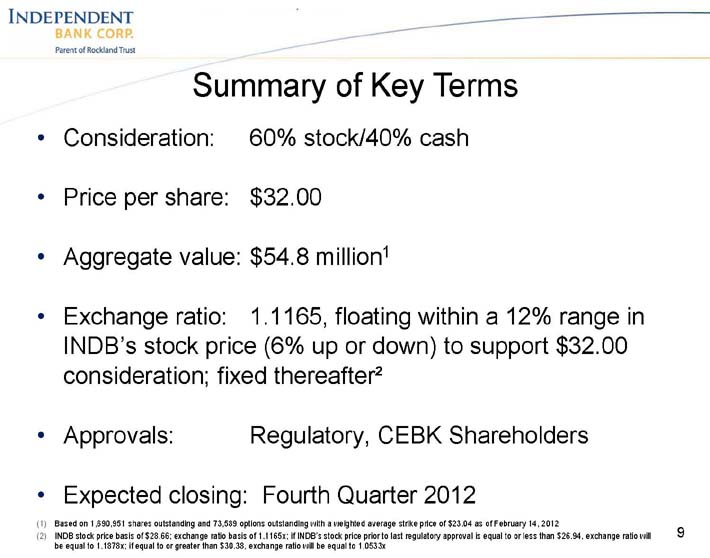

Independent Bank Corp. Parent of Rockland Trust •Consideration: 60% stock/40% cash •Price per share: $32.00 •Aggregate value: $54.8 million1 •Exchange ratio: 1.1165, floating within a 12% range in INDB’s stock price (6% up or down) to support $32.00 consideration; fixed thereafter² •Approvals: Regulatory, CEBK Shareholders •Expected closing: Fourth Quarter 2012 9 (1)Based on 1,690,951 shares outstanding and 73,589 options outstanding with a weighted average strike price of $23.04 as of February 14, 2012 (2)INDB stock price basis of $28.66; exchange ratio basis of 1.1165x; if INDB’s stock price prior to last regulatory approval is equal to or less than $26.94, exchange ratio will be equal to 1.1878x; if equal to or greater than $30.38, exchange ratio will be equal to 1.0533x Summary of Key Terms

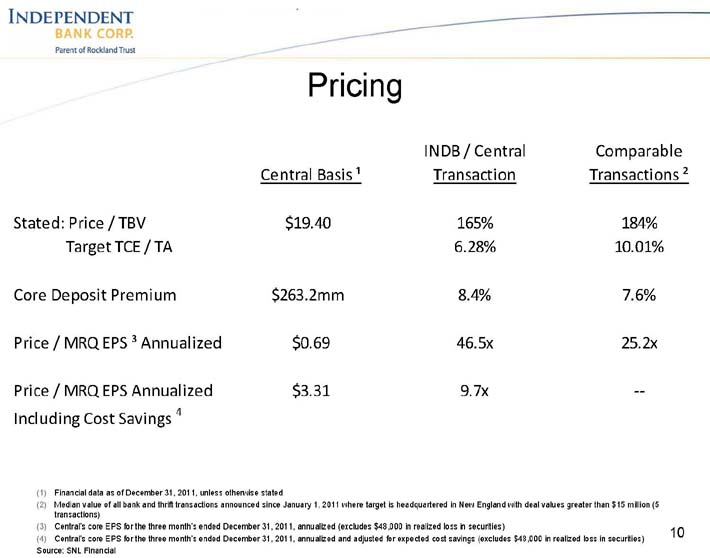

Independent Bank Corp. Parent of Rockland Trust 10 (1)Financial data as of December 31, 2011, unless otherwise stated (2)Median value of all bank and thrift transactions announced since January 1, 2011 where target is headquartered in New England with deal values greater than $15 million (5 transactions) (3)Central’s core EPS for the three month’s ended December 31, 2011, annualized (excludes $48,000 in realized loss in securities) (4)Central’s core EPS for the three month’s ended December 31, 2011, annualized and adjusted for expected cost savings (excludes $48,000 in realized loss in securities) Source: SNL Financial Pricing INDB / CentralComparableCentral Basis ¹TransactionTransactions ²Stated: Price / TBV$19.40165%184%Target TCE / TA6.28%10.01%Core Deposit Premium$263.2mm8.4%7.6%Price / MRQ EPS ³ Annualized$0.6946.5x25.2xPrice / MRQ EPS Annualized$3.319.7x—Including Cost Savings 4

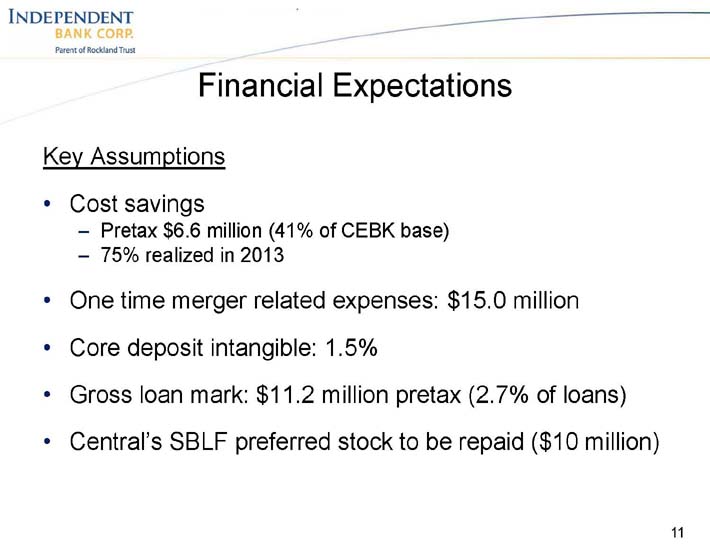

Independent Bank Corp. Parent of Rockland Trust Key Assumptions •Cost savings –Pretax $6.6 million (41% of CEBK base) –75% realized in 2013 •One time merger related expenses: $15.0 million •Core deposit intangible: 1.5% •Gross loan mark: $11.2 million pretax (2.7% of loans) •Central’s SBLF preferred stock to be repaid ($10 million) 11 Financial Expectations

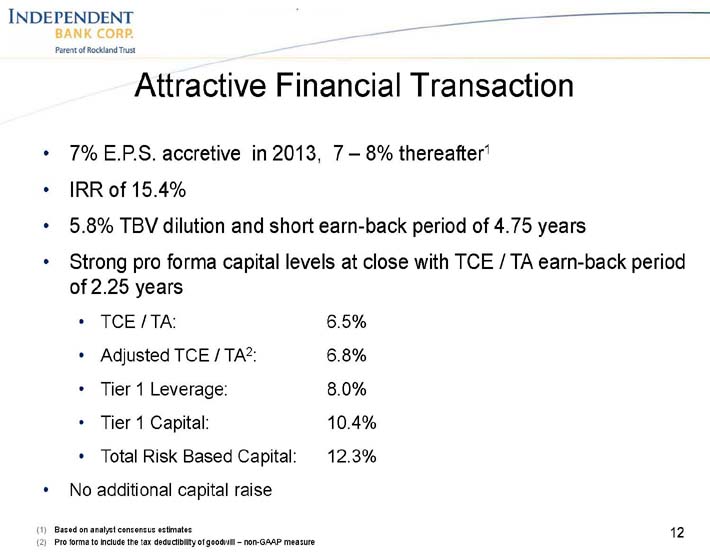

Independent Bank Corp. Parent of Rockland Trust 12 •7% E.P.S. accretive in 2013, 7 – 8% thereafter1 •IRR of 15.4% •5.8% TBV dilution and short earn-back period of 4.75 years •Strong pro forma capital levels at close with TCE / TA earn-back period of 2.25 years •TCE / TA: 6.5% •Adjusted TCE / TA2: 6.8% •Tier 1 Leverage: 8.0% •Tier 1 Capital: 10.4% •Total Risk Based Capital: 12.3% •No additional capital raise (1)Based on analyst consensus estimates (2)Pro forma to include the tax deductibility of goodwill – non-GAAP measure Attractive Financial Transaction

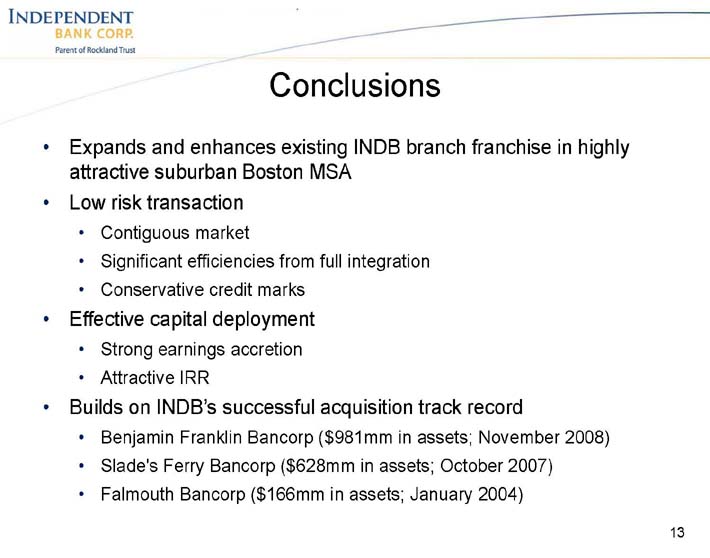

Independent Bank Corp. Parent of Rockland Trust 13 •Expands and enhances existing INDB branch franchise in highly attractive suburban Boston MSA •Low risk transaction •Contiguous market •Significant efficiencies from full integration •Conservative credit marks •Effective capital deployment •Strong earnings accretion •Attractive IRR •Builds on INDB’s successful acquisition track record •Benjamin Franklin Bancorp ($981mm in assets; November 2008) •Slade’s Ferry Bancorp ($628mm in assets; October 2007) •Falmouth Bancorp ($166mm in assets; January 2004) Conclusions

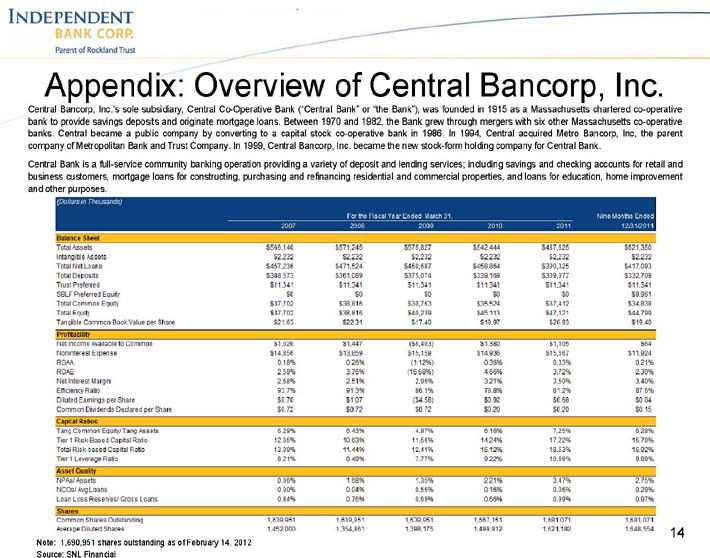

Independent Bank Corp. Parent of Rockland Trust 14 Central Bancorp, Inc.’s sole subsidiary, Central Co-Operative Bank (“Central Bank” or “the Bank”), was founded in 1915 as a Massachusetts chartered co-operative bank to provide savings deposits and originate mortgage loans. Between 1970 and 1982, the Bank grew through mergers with six other Massachusetts co-operative banks. Central became a public company by converting to a capital stock co-operative bank in 1986. In 1994, Central acquired Metro Bancorp, Inc, the parent company of Metropolitan Bank and Trust Company. In 1999, Central Bancorp, Inc. became the new stock-form holding company for Central Bank. Central Bank is a full-service community banking operation providing a variety of deposit and lending services; including savings and checking accounts for retail and business customers, mortgage loans for constructing, purchasing and refinancing residential and commercial properties, and loans for education, home improvement and other purposes. Note: 1,690,951 shares outstanding as of February 14, 2012 Source: SNL Financial Appendix: Overview of Central Bancorp, Inc.

Appendix: Overview of Central Bancorp, Inc. Central Bancorp, Inc.’s sole subsidiary, Central Co-Operative Bank (“Central Bank” or “the Bank”), was founded in 1915 as a Massachusetts chartered co-operative bank to provide savings deposits and originate mortgage loans. Between 1970 and 1982, the Bank grew through mergers with six other Massachusetts co-operative banks. Central became a public company by converting to a capital stock co-operative bank in 1986. In 1994, Central acquired Metro Bancorp, Inc, the parent company of Metropolitan Bank and Trust Company. In 1999, Central Bancorp, Inc. became the new stock-form holding company for Central Bank. Central Bank is a full-service community banking operation providing a variety of deposit and lending services; including savings and checking accounts for retail and business customers, mortgage loans for constructing, purchasing and refinancing residential and commercial properties, and loans for education, home improvement and other purposes. (Dollars in Thousands) For the Fiscal Year Ended March 31, Nine Months Ended 2007 2008 2009 2010 2011 12/31/2011 Balance Sheet Total Assets $566,140 $571,245 $575,827 $542,444 $487,625 $521,350 Intangible Assets $2,232 $2,232 $2,232 $2,232 $2,232 $2,232 Total Net Loans $457,236 $471,524 $460,687 $458,864 $390,325 $417,093 Total Deposits $388,573 $361,089 $375,074 $339,169 $309,077 $332,709 Trust Preferred $11,341 $11,341 $11,341 $11,341 $11,341 $11,341 SBLF Preferred Equity $0 $0 $0 $0 $0 $9,961 Total Common Equity $37,702 $38,816 $30,763 $35,524 $37,412 $34,838 Total Equity $37,702 $38,816 $40,239 $45,113 $47,121 $44,799 Tangible Common Book Value per Share $21.63 $22.31 $17.40 $19.97 $20.93 $19.40 Profitability Net Income Available to Common $1,020 $1,447($6,403) $1,380 $1,105 $64 Noninterest Expense $14,856 $13,859 $15,159 $14,936 $15,667 $11,924 ROM 0.18% 0.26%(1.12%) 0.36% 0.33% 0.21% ROAE 2.59% 3.76%(16.68%) 4.66% 3.72% 2.30% Net Interest Margin 2.68% 2.51% 2.96% 3.21% 3.50% 3.40% Efficiency Ratio 93.7% 91.3% 86.1% 78.8% 81.2% 87.6% Diluted Earnings per Share $0.70 $1.07($4.58) $0.92 $0.68 $0.04 Common Dividends Declared per Share $0.72 $0.72 $0.72 $0.20 $0.20 $0.15 Capital Ratios Tang Common Equity/Tang Assets 6.29% 6.43% 4.97% 6.16% 7.25% 6.28% Tier 1 Risk-Based Capital Ratio 12.05% 10.63% 11.56% 14.24% 17.22% 15.70% Total Risk-based Capital Ratio 13.09% 11.44% 12.41% 15.12% 18.53% 16.92% Tier 1 Leverage Ratio 8.21% 8.49% 7.77% 9.22% 10.66% 9.89% Asset Quality NPAs/ Assets 0.06% 1.68% 1.35% 2.21% 3.47% 2.75% NCOs/Avg Loans 0.00% 0.04% 0.55% 0.16% 0.06% 0.29% Loan Loss Reserves/Gross Loans 0.84% 0.76% 0.69% 0.66% 0.99% 0.97% Shares Common Shares Outstanding 1,639,951 1,639,951 1,639,951 1,667,151 1,681,071 1,681,071 Average Diluted Shares 1,452,000 1,354,961 1,398,175 1,499,912 1,621,182 1,648,554 Note: 1,690,951 shares outstanding as of February 14, 2012 Source: SNL Financial

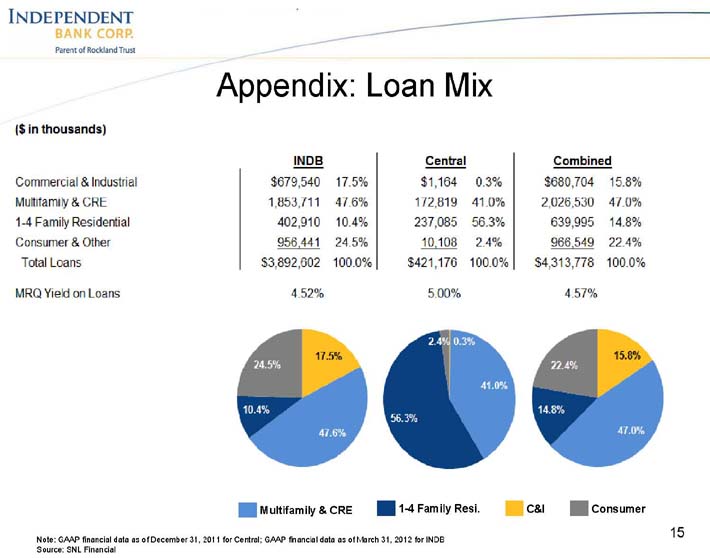

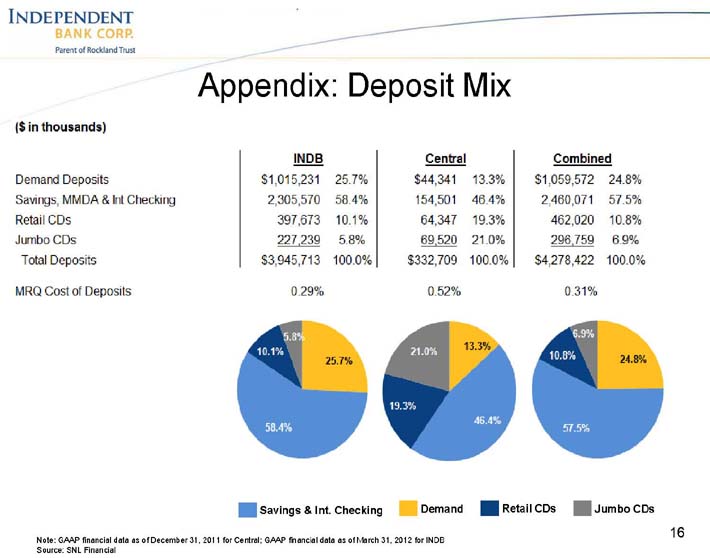

INDEPENDENT BANK CORP. Parent of Rockland Trust Appendix: Loan Mix INDB Central Combined $679,540 17.5% $1,164 0.3% $680,704 15.8% 1,853,711 47.6% 172,819 41.0% 2,026,530 47.0% 402,910 10.4% 237,085 56.3% 639,995 14.8% 950,441 24.5% 10,108 2.4% 966,549 22.4% $3,892,602 100.0% $421,176 100.0% $4,313,778 100.0% 4.52% 5.00% 4.57% ($ in thousands) Commercial & Industrial Multifamily & CRE 1-4 Family Residential Consumer & Other Total Loans MRQ Yield on Loans INDB Central Combined $1,015,231 25.7% $44,341 13.3% $1,059,572 24.8% 2,305,570 58.4% 154,501 46.4% 2,460,071 57.5% 397,673 10.1% 64,347 19.3% 462,020 10.8% 227,239 5.8% 69,520 21.0% 296,759 6.9% $3,945,713 100.0% $332,709 100.0% $4,278,422 100.0% 0.29% 0.52% 0.31% ($ in thousands) Demand Deposits Savings, MMDA & Int Checking Retail CDs Jumbo CDs Total Deposits MRQ Cost of Deposits

Independent Bank Corp. Parent of Rockland Appendix: Deposit Mix NASDAQ Ticker: INDB www.rocklandtrust.com Denis Sheahan—CFO Shareholder Relations: Jennifer Kingston (781) 878-6100