Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | d343301d8k.htm |

Section 2 - Exhibit 99.1

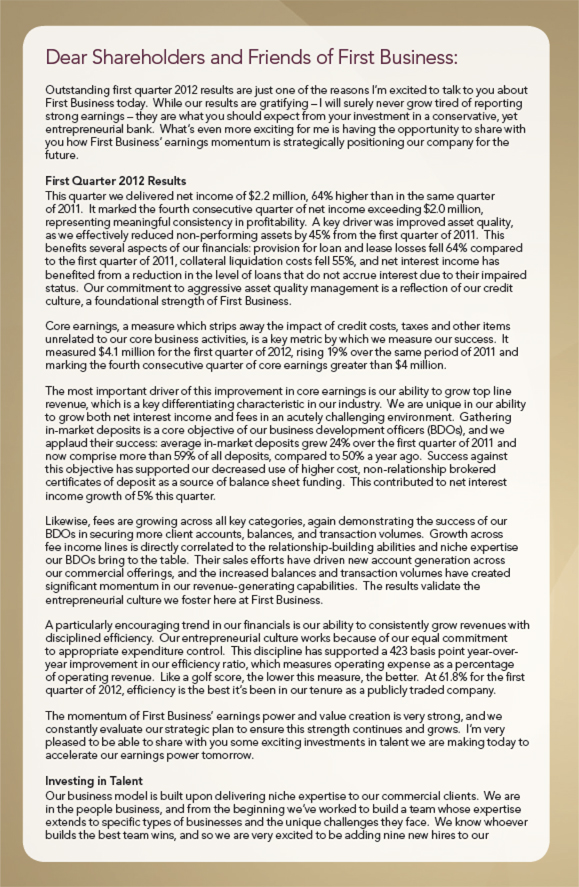

Dear Shareholders and Friends of First Business: Outstanding first quarter 2012 results a re just one of the reasons I’m exerted to talk to you about First Business today. While our results are gratifying -1 will surely never grow tired of reporting strong earnings-they are what you should expect from your investment in a conservative, yet entrepreneurial bank. What’s even more exciting for me is having the opportunity to share with you how First Business’earnings momentum is strategically positioning our compsny forthe future. First Quarter 2012 Result* This quarter we delivered net income of 12.2 million, 64%higherthan In the same quarter of 2011. ft ma rled the fou rth consecutive qua Her of net Income exceed! ng £2.0 m III ion, representing meaningful consistency In profitability. A key driver was inn proved asset quality, as we effectively reduced non-perform ing assets by 45% from the first quarter of 2011. This be n efIts severa I aspects of our fl n ancia Is: p nov isio n fo r lo a n a nd lease losses fel 164% co rnpared to the first quarter of 2011, col lateral liquidation costs fel 155%, and net interest income has baneflted from a reduction in the Ievel of loansthat do not acerue interest duetotheir impaired status. Our commitment to aggressfvie asset quality management is a reflection of our credit curture, a fou ndatio n al stren gth of Fl rst Busi ness. Core earn ings, a measure wh Ich strips away the i rn pact of credit costs, taxes a nd other rte rns unrelated to our co re business activities, is a key metric by which we measure our success. It measured $4.1 million forthe first quarter of 2012, rising 19% over the same period of 2011 and m a rking the fbu rth co n secutive qu arter of core earni ngs greater th an 44 m il I Ion. The most important driver of this improvement in core earn ings is our ability to grow top line revenue, which Is a key differentiating characteristic In our Industry. We are unique in Durability to grow both net Interest income and fees In an acutely challenging environment. Gathering Fn-marketdeposrts is a core objective of our business development of fleers (BDOs), and we appl aud the ir su ccess: ave rage in- ma rl«t deposits g rew 24% over t h e fi rst qu a rter of 2011 a nd now co rnpri se mo re th a n 59% of al I deposits, co rnpa red to 50% a yea r ago. Su ccess agai net this objective has supported our decreased use of higher cost, non-relations hip brokered certificates of deposit as a source of balance sheet fund ing. This contributed to net interest Fnoo rne growth of 5% th is q uarte r LI kew ise, fees a re g rowi ng across a 11 key categories, aga In demo n strati n g the su ccess of our BDOs i n securi ng rno re cl ie nt accou nts, ba lances, and transactio n volu mes. G rowth across fee i n come I i n es is di rectly correl ated to the rel ations h i p-bui Id i n g ab il it ies and n iche expertise our BDOs bring tothe table. Their sales efforts have driven new account gene ration across our commercial offerings, and the Increased balances and transaction volumes have created sig niflcant nnomentu m i n our reve n ue- g a nerati ng capab il rties. Th e resu Its val idate the entrepreneurial curture we foster here at First Busi ness. A pa rticul arly encouragl ng trend i n ou r fin a nclal s ie ou r ab il ity to conslste ntly g row reve n ues w rth dfsc ipl i n ed efficiency. Ou r entne prene uri a I curture works because of ou r equ al co m rnitrnent to appropriate expend rtu re control. This discipline has supported a 423 basis poi nt year-over-yea r i m provement I n ou r efficiency ratio, wh Ich measures ope rati ng expe n se as a pe ncentage of o perati ng reve n ue. Like a golf score, th e lower th is rneasu re, the better. At 61.6% for th e fl rst qua rter of 2012, efflci e n cy is the best it’s been i n our te nu re as a pu bl icly traded conn pany. The momerrtu m of First Busi ness’ ea rn i n g s power a nd va lue c reation Is very stro n g, a n d we oo n stantly eva luate ou r strateg Ic pla n to ensu re th is strength conrtl nues a nd g rows. I ‘rn very pleased to be ab Ie to sh a re w rth you some exciti n g investme nts in talent we are m a king tod ay to accelerate our earnings power tomorrow. Investing in Taknt Our business model is built upon delivering niche expertise to our commercial clients. We are In the people business, and from the beginning we’ve worked to build a team whose expertise extends to specific types of businesses and the unique challenges they face. We know whoever builds the best team wins, and so we are very excited to be add ing nine new hires to our

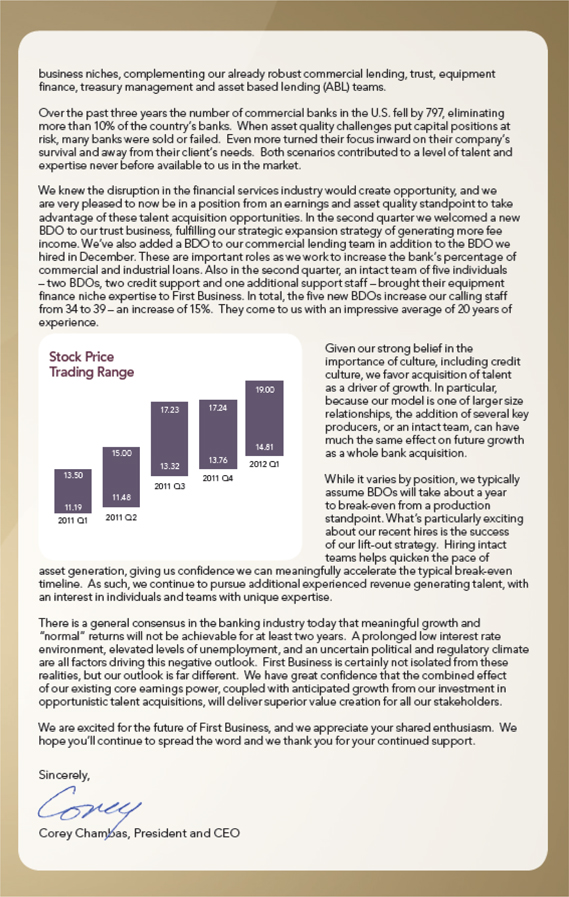

business niches, complimenting our already robust commercial lendfng, trust, equipment finance, treasury management and asset baaed lending (ABL) teams. Ove r the past three years the nu rnber of co mme rcla I ba nks in the U. S. fie II by 797, e I im i n ati n g more th a n 10% of the cou ntry’s ba n ks. Whe n asset q ual rty cha II en ges put cap rtal pos rtio n s art risk, m a ny ban ke were so Id or fa il ed. Even more turned thei r focus inwand o n their com pa ny’s survival and away frorntheirclienrfs needs. Both scenarios contributed to a level of talent and expertise never before available to us in the market. We knew the disruption in the financial services industry would create opportunity, and we are ve ry pleased to now be i n a position fro m a n earn ings and asset qu a lity stand po int to take advantage of these talent acquisition opportunities. In the second quarter we welcomed a new BDQto our trust business, fulfil ling our strategic expansion strategy of gene rating more fee i nco me. We’ve also added a EDO to ou r comm e rcial le ndi ng team in additio n to t he BDO we hired in December. These are important roles asweworkto increase the bank’s percentage of commercial and Industrial loans. Also In the second quarter, an intact learn of five Individuals -two BDOs, two credit support and one additional support staff-brought their equipment flna nee n iche ejiperti se to First Busi ness. In tota I, th e five new BDOs i nc rease ou r cal li ng staff from 34 to 39 - a n inc rease of 1 £%. They com e to us with a n i rnp nessive average of 20 years of experience. GFven our strong belief in the importance of culture, including credit Trading Range culture, we favoracquisrtion of talent R as a d river of growth .InpartJcular, producers, or an intact team, can have 2011 cu While it varies by position, we typically assume BDOs will take about a year