Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - SUNOCO INC | d343801dex21.htm |

| EX-99.1 - JOINT PRESS RELEASE - SUNOCO INC | d343801dex991.htm |

| 8-K - SUNOCO INC--FORM 8-K - SUNOCO INC | d343801d8k.htm |

Energy Transfer Partners, L.P.

Acquisition of Sunoco, Inc.

April 30, 2012 | Investor Presentation

Exhibit 99.2 |

1

Legal Disclaimer

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

Energy Transfer Partners, L.P.

Sunoco, Inc.

3738 Oak Lawn Ave.

1818 Market Street, Suite 1500

Dallas, TX 75219

Philadelphia, PA 19103

Attention: Investor Relations

Attention: Investor Relations

Phone: (214) 981-0795

Phone: (215) 977-6764

E-mail: InvestorRelations@energytransfer.com

E-mail: SunocoIR@sunocoinc.com

PARTICIPANTS IN THE SOLICITATION

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS

In connection with the proposed business combination transaction between Energy Transfer Partners,

L.P. (“ETP”) and Sunoco, Inc. (“Sunoco”), ETP plans to file with the U.S.

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that

will contain a proxy statement/prospectus to be mailed to the Sunoco shareholders in connection

with the proposed transaction. THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION

ABOUT ETP, SUNOCO, THE PROPOSED TRANSACTION AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY/PROSPECTUS CAREFULLY WHEN THEY

BECOME AVAILABLE. Investors and security holders will be able to obtain free copies of the

registration statement and the proxy statement/prospectus and other documents filed with the SEC by

ETP and Sunoco through the web site maintained by the SEC at www.sec.gov. In

addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus by phone, e-mail or written request by

contacting the investor relations department of ETP or Sunoco at the following:

ETP and Sunoco, and their respective directors and executive officers, may be deemed to be

participants in the solicitation of proxies in respect of the proposed transactions

contemplated by the merger agreement. Information regarding directors and executive officers of

ETP’s general partner is contained in ETP’s Form 10-K for the year ended

December 31, 2011, which has been filed with the SEC. Information regarding Sunoco’s

directors and executive officers is contained in Sunoco’s definitive proxy statement dated

March 16, 2012, which is filed with the SEC. A more complete description will be available in

the registration statement and the proxy statement/prospectus. Statements in this document regarding the proposed transaction between ETP and Sunoco, the

expected timetable for completing the proposed transaction, future financial and operating

results, benefits and synergies of the proposed transaction, future opportunities for the combined company, and any other statements about ETP, Energy Transfer Equity,

L.P. (“ETE”), Sunoco Logistics Partners, L.P. (“SXL”) or Sunoco managements’

future expectations, beliefs, goals, plans or prospects constitute forward looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not

statements of historical fact (including statements containing the words “believes,”

“plans,” “anticipates,” “expects,” estimates and similar expressions)

should also be considered to be forward looking statements. There are a number of important factors that

could cause actual results or events to differ materially from those indicated by such forward looking

statements, including: the ability to consummate the proposed transaction; the ability to

obtain the requisite regulatory approvals, Sunoco shareholder approval and the satisfaction of other conditions to consummation of the transaction; the ability of ETP to

successfully integrate Sunoco’s operations and employees; the ability to realize anticipated

synergies and cost savings; the potential impact of announcement of the transaction or

consummation of the transaction on relationships, including with employees, suppliers, customers and

competitors; the ability to achieve revenue growth; national, international, regional and local

economic, competitive and regulatory conditions and developments; technological developments; capital and credit markets conditions; inflation rates; interest

rates; the political and economic stability of oil producing nations; energy markets, including

changes in the price of certain commodities; weather conditions; environmental conditions;

business and regulatory or legal decisions; the pace of deregulation of retail natural gas and electricity and certain agricultural products; the timing and success of

business development efforts; terrorism; and the other factors described in the Annual Reports on Form

10-K for the year ended December 31, 2011 filed with the SEC by ETP, ETE, SXL and

Sunoco. ETP, ETE, SXL and Sunoco disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the

date of this document.

|

2

A Compelling Strategic Transaction

Energy Transfer Partners, L.P. (“ETP”) will acquire 100% of Sunoco,

Inc.’s (“SUN”) outstanding common stock for $50.13 per share

($5.3 billion) Creates a “best in class”

natural gas, crude oil, NGLs

and

refined product logistics platform

–

Provides customers with a full suite of capabilities in key geographic locations

across the U.S. –

Diversifies ETP’s existing natural gas and NGL infrastructure assets into

crude oil and refined products transportation, terminalling and

logistics –

Provides

a

growth

engine

for

ETP

through

ownership

of

the

Sunoco

Logistics

Partners

L.P.

(“SXL”) general partner, incentive distribution rights (“IDRs”)

and 32.4% limited partner interests –

Combination with Energy Transfer platform dramatically expands scale, operational

diversity and geographic footprint of SUN and SXL, enabling businesses to

fully deliver on potential Accretive to ETP cash flow both immediately and

over the long-term, while providing SUN shareholders increased value now

and into the future –

Allows SUN shareholders continued participation in potential upside from synergies

and complementary organic growth projects

Key SUN and SXL management to remain and continue to run businesses and oversee

integration Transaction provides immediate accretion and furthers ETP’s

long-term initiative to enhance the services provided to customers while

expanding its fee-based tariff / margin business mix |

3

ETP Has Rapidly Evolved Into a Diversified

Energy Logistics Company

2004 –

2007

2008 –

2009

2010 –

2011

2012

Acquired TUFCO Pipeline,

Houston Pipeline and

Transwestern Interstate

Pipeline

Completed the first 42-inch

diameter natural gas pipeline in

the state of Texas in 2007 –

Since that time, have

completed and placed in

service nearly 2,500 miles of

large diameter pipe in major

U.S. shale plays

Initiated open season for new

interstate gas pipeline,

Midcontinent Express Pipeline

(“MEP”), a 50/50 joint venture

with Kinder Morgan Energy

Partners (“KMP”)

MEP completed and placed

in-service

Completed Phoenix and San

Juan projects, expanding

Transwestern Pipeline

Initiated open season for new

interstate gas pipeline, Tiger

Pipeline

Initiated open season for new

interstate gas pipeline,

Fayetteville Express Pipeline

(“FEP”), another 50/50 joint

venture with KMP

FEP and Tiger completed

ahead of schedule and

significantly under budget

ETP and Regency acquired

LDHE and formed Lone Star

NGL JV

Lone Star NGL JV announced

new Mt. Belvieu fractionation

plant and West Texas NGL

pipeline projects to significantly

expand liquids platform

Expansion of Eagle Ford shale

projects with the Rich Eagle

Ford Mainline (“REM”) pipeline

and new processing facility in

Jackson County, TX

Completed exit from the propane

business through contribution to

AmeriGas Partners, L.P.

ETP acquired 50% interest in

Citrus, which owns Florida Gas

Transmission

Further announced expansion in

liquids-rich Eagle Ford Shale area

that includes a second Mt. Belvieu

fractionation plant and extensive

organic pipeline infrastructure

supported by long-term fee-based

contracts

ETP announces acquisition of

SUN, creating a “best in class”

natural gas, crude oil, NGLs and

refined product logistics

platform

ETP

has

undertaken

several

initiatives

to

diversify

its

business

with

an

emphasis

on

fee-based

opportunities that expand the services provided to customers

The

acquisition

of

LDH

Energy

Asset

Holdings

LLC

("LDHE”)

in

2011

increased

the

fee-based

services ETP could provide to customers by offering NGL solutions from wellhead to

fractionator The acquisition of SUN further positions ETP as a diversified

midstream company that provides services across the entire midstream value

chain |

4

Our

business

is

“moving

hydrocarbons”

and

the

SUN

acquisition

provides

an

established

and

attractive

platform

to

significantly

increase

our

crude

oil,

refined

products

and

NGL

service

capability

ETP customers’

desire for a fully integrated midstream services company is driving this

transaction Furthers ETP’s long-term initiative to expand its

business mix and diversify and grow its cash flow –

ETP

will

immediately

become

a

leader

in

the

crude

oil,

refined

products

and

NGLs

markets

Significant and growing portion of fee-based cash flow derived from these

markets Enhances the size and scale of the Energy Transfer platform while

reinforcing its position as one of the largest MLPs

Enhances the growth profile of ETP while maintaining investment grade credit

metrics Complementary asset base provides numerous commercial opportunities

anchored by significant inventory of attractive, highly accretive organic

growth projects Retail business with an iconic brand name provides additional

stable cash flow to ETP's overall business mix

Clear line of sight to the exit of SUN’s refining business creates the optimal

timing for a transaction –

SUN will continue pursuing announced potential Carlyle joint venture

Rationale for ETP |

5

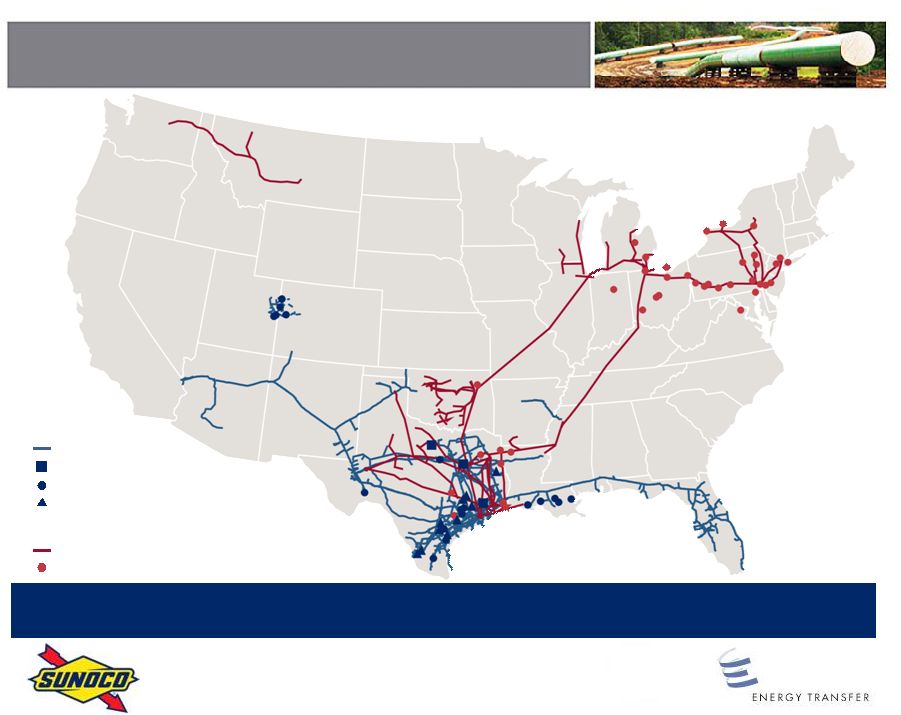

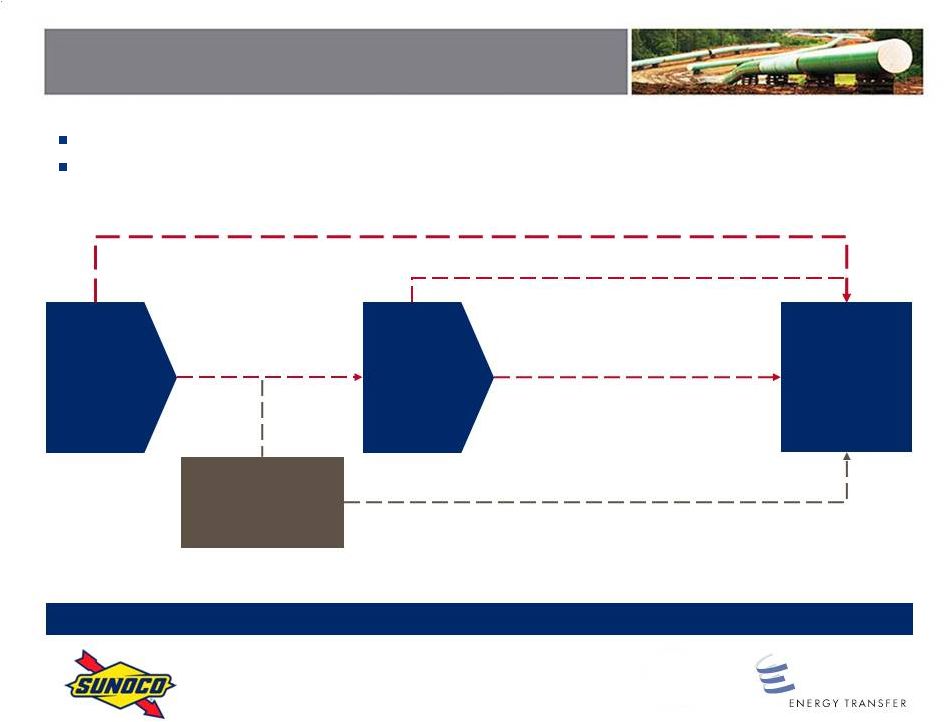

Diversified Energy Logistics Business

The acquisition significantly diversifies ETP’s existing infrastructure assets

into crude oil and refined products transportation, terminalling and

logistics Pipelines

Storage

ETP

SXL

Processing

Treating

Pipelines

Terminals |

6

23,000

Diversified Asset Mix Enhances Credit Profile

Pipeline Mileage

Throughput*

Storage Capacity*

* Throughput and storage capacity converted on a 6:1 Mcf:Bbl basis

Summary Asset Overview

Status Quo

SUN &

Pro Forma

ETP

SXL

ETP

Pipelines (miles):

Natural Gas

21,500

-

21,500

NGL

1,500

40

1,540

Crude Oil

-

5,400

5,400

Refined Products

-

2,500

2,500

Total

7,940

30,940

Operating Metrics:

Natural Gas Throughput (Bcfpd)

22

-

22

NGL Throughput (Mbpd)

576

107

683

Crude Oil Throughput (Mbpd)

-

1,747

1,747

Refined Products Throughput (Mbpd)

-

522

522

Natural Gas Processing Capacity (MMcfpd)

2,662

-

2,662

Natural Gas Treating Capacity (MMcfpd)

1,985

-

1,985

Natural Gas Conditioning Capacity (MMcfpd)

846

-

846

NGL Processing Capacity (Mbpd)

176

-

176

Natural Gas Storage (Bcf)

74

-

74

NGL Storage (MMbbl)

33

1

34

Crude Oil Storage (MMbbl)

-

25

25

Refined Products Storage (MMbbl)

-

16

16

Facilities:

Natural Gas Storage Facilities

3

-

3

NGL Storage Facilities

2

1

3

Crude Oil Storage Facilities

-

4

4

Refined Products Storage Facilities

-

44

44

Natural Gas Process., Treat., Cond. Facilities

35

-

35

NGL Processing Facilities

4

-

4

Retail Marketing Outlets

-

4,900

4,900

Source:

Partnership and company filings

Note:

Joint venture assets reflective of ownership percentage

Includes previously announced projects under construction

|

7

52%

47%

38%

26%

14%

21%

22%

15%

16%

14%

21%

25%

18%

18%

13%

5%

4%

10%

20%

2009

2010

2011

2011

pro forma

Intrastate

Midstream

Interstate

Propane

NGL

Retail

Crude & Refined Products

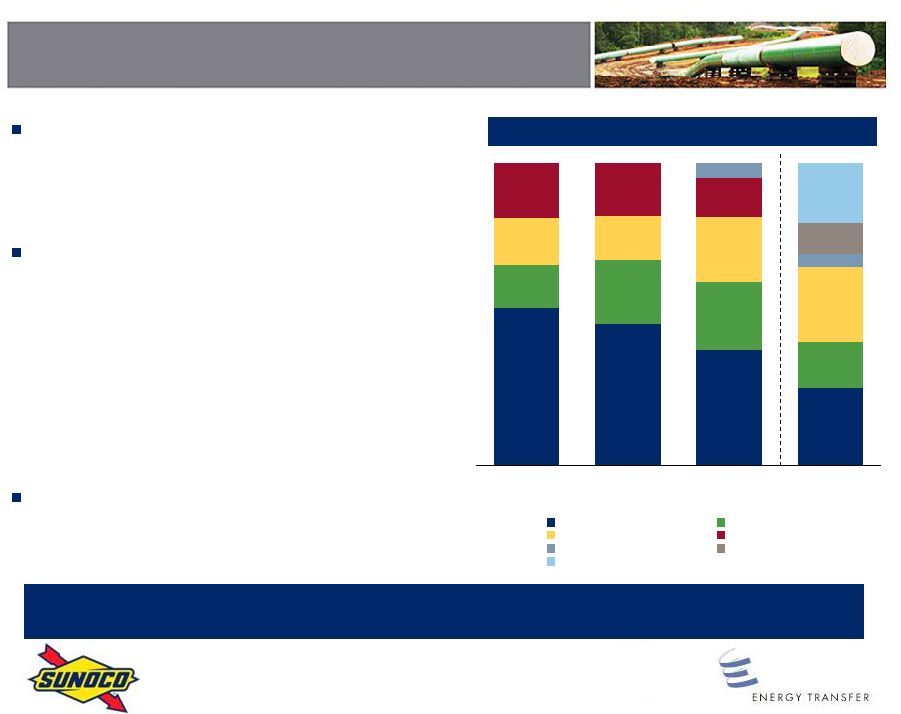

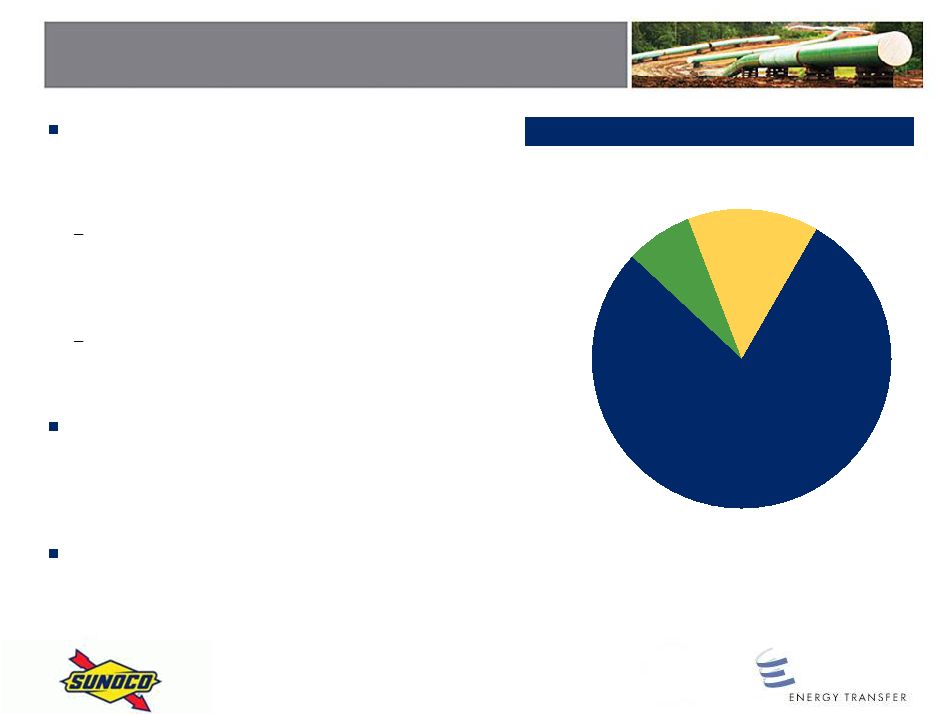

Diversified Pro Forma Cash Flow

Note:

Adjusted EBITDA reconciliation in appendix. ETP adjusted EBITDA excludes

“Other”. (1)

2011 ETP pro forma for contribution of propane to AmeriGas Partners, L.P. and

Citrus acquisition. Excludes distributions from AmeriGas Partners, L.P.

Assumes full consolidation of SXL.

The acquisition diversifies ETP’s business mix and provides an enhanced

portfolio of fee-based tariff / margin organic growth opportunities

Acquisition further enhances ETP’s long-term

initiative to increase fee-based services provided

to producers while expanding ETP’s business mix

and balancing its sources of cash flows

Inventory of attractive identified organic NGL and

crude oil projects at SXL augments ETP’s slate of

growth projects and provides visibility to

meaningful EBITDA growth

–

Pro

forma

combined

2012

growth

capex

of

~$2.2 billion with the vast majority of spending

allocated to NGLs, midstream and crude oil

projects

Retail business provides an additional stable

segment to ETP's overall business mix

(1)

ETP Adjusted EBITDA |

8

LOGISTICS

Sunoco Has Become a Logistics Company

with a Stable Retail Business

Chemicals

Bayport plant closed

Refining

Tulsa refinery sold

Eagle Point refinery

permanently idled

Retail / Marketing

Fulton ethanol plant purchased

Heating oil / propane business

sold

Chemicals

Polypropylene business sold

Retail / Marketing

Purchased 25 retail locations

in NY State

Chemicals

Frankford plant sold

Haverhill plant sold

Refining

Toledo refinery sold

Eagle Point tank farm sold to SXL

Marcus Hook refinery permanently

idled

Retail / Marketing

Expansion into Alabama

Coke

Initial public offering

Refining –

exit announced

Philadelphia refinery

–

Potential JV with Carlyle

(minority interest, Carlyle to

operate, no additional

capital required from SUN)

–

If no suitable exit

transaction can be reached,

expect to idle by August

2012

Coke

Complete spin-off of coke to

SUN shareholders

Retail / Marketing

Acquired 11 retail locations in

Daytona, FL

RETAIL

LOGISTICS

COKE

REFINING

RETAIL

COKE

REFINING

RETAIL

CHEM

CHEM

LOGISTICS

LOGISTICS

COKE

RETAIL

2008 / 2009

2010

2011

2012

REFINING

CHEM |

9

Attractive premium with continued participation in potential upside of a

well-managed, diversified business

–

Immediately crystallizes shareholder value during a time of transition, with recent

full exit from coke and chemicals as well as announced exit from refining

business –

29.0%

premium

to

the

20-day

average

SUN

closing

share

price

(1)

–

50% cash / 50% unit mix allows shareholders to earn attractive ETP yield (~7.5%

based on $3.575 per unit cash distribution on an annualized basis) with an

improved distribution growth profile

Combination with Energy Transfer platform dramatically expands scale, operational

diversity and geographic footprint of SUN and SXL, enabling businesses to

fully deliver on potential Meaningful commercial and operational synergies

with the Energy Transfer family Minimal integration risk and disruptions

given key SUN and SXL managers will remain Key presence to be retained in

Philadelphia region Rationale for SUN and SXL

(1)

As of April 27, 2012. |

10

Transaction Overview

ETP will acquire 100% of SUN’s outstanding common stock for $50.13 per share

($5.3 billion) –

29.0%

premium

to

the

20-day

average

SUN

closing

share

price

(1)

–

Acquisition

of

SUN

shares

funded

with

ETP

common

units

(50%)

and

cash

(50%)

–

Consideration consists of $25.00 of cash and 0.5245x ETP common units per SUN

share SUN shareholders can elect cash, ETP common units or a mix of cash and

ETP common units, subject to pro-ration

$965 million of existing SUN notes (excluding debt at SXL) will remain

outstanding –

No change of control triggered in SUN’s existing notes

Energy Transfer Equity, L.P. (“ETE”) to provide a GP subsidy of $70

million per annum for a period of 3 years to ETP to support the transaction

post-closing SXL will remain a separate, publicly-traded MLP

Transaction offers compelling value to SUN shareholders with an attractive yield and

improved distribution growth profile

(1)

As of April 27, 2012. |

11

Integration Plan

Energy Transfer management team has a proven

track record of successfully integrating

acquisitions

Southern Union (2012), LDHE (2011), Regency

(2010), Canyon (2007), Transwestern (2006),

Titan (2006), HPL (2005), ET Fuel (2004)

Southern Union integration to be substantially

complete by time of SUN transaction closing

The transaction is a bolt-on acquisition, similar to

the LDHE acquisition, and ETP expects minimal

integration risk given key SUN and SXL

management team will remain in place

ETP, SUN and SXL have conservatively identified

$70 million of annual run-rate commercial /

operational synergies

Commercial &

Operational

Synergies

$55

Compensation

& Benefits

$5

Corporate

Overhead

$10

79%

7%

14%

Note:

Based on estimated $70 million of run-rate synergies per annum.

($ in millions)

SUN Synergy Breakdown |

May

2012 Begin drafting

Proxy / registration

statement

Begin regulatory

approval process

File proxy

statement /

S-4

registration

statement

Integration plan will be put in place immediately resulting in one functional

organization at closing Only major regulatory approval is HSR; no issues

expected given business mix 4 -

6 months expected timing from announcement to closing

File for regulatory

approval

-

HSR

-

Other minor approvals

Subject to SEC review

and regulatory approval

2 -

4

weeks

8 -

20 weeks

Q3 / Q4 2012:

SUN

shareholder

vote and

close

Illustrative Transaction Timeline

12

No financing contingency or ETP / SXL unitholder vote provides for high level of deal certainty |

13

Conclusions

Elevates ETP to a leading player in crude oil, refined products and NGL

transportation, terminalling and logistics

Delivers

immediate

premium

to

SUN

shareholders

with

the

ETP

unit

consideration

providing

an

attractive

yield

and

continued

potential

upside

with

an

improved

distribution

profile

Significant, tangible commercial and operational synergies

Enhances the growth profile of ETP while maintaining investment grade credit

metrics High degree of transaction certainty

Key SUN and SXL management to continue to run businesses and oversee

integration A “win-win”

transaction for investors of SUN, SXL and ETP |

Appendix |

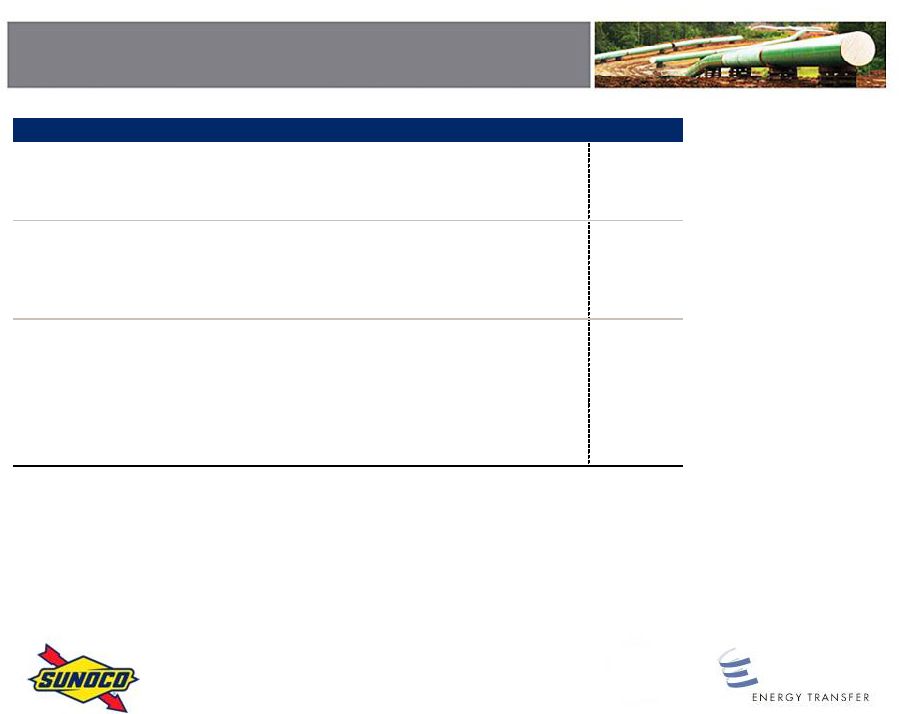

15

Side-by-Side Overview

($ in millions, except per share / unit amounts)

(4)

ETP

(1)

SUN

(2)

SXL

Share / Unit Price (as of 4/27/12)

$47.92

$50.13

$40.99

LP equity market cap

$11,001

$5,321

$4,244

Illustrative GP value

(3)

6,415

–

1,397

Market Capitalization

(3)

$17,415

$5,321

$5,641

Total Debt

8,884

1,020

1,698

Minority Interest

629

–

98

Cash

(710)

(1,531)

(5)

Enterprise Value

$26,218

$4,810

$7,432

Current Yield

7.5%

1.6%

4.2%

Corporate Credit Ratings

Moody's

Baa3

Ba1

Baa2

S&P

BBB-

BB+

BBB

Fitch

BBB-

BB+

BBB

Source: ETP, SUN and SXL public filings. Balance sheet data as of 12/31/2011.

(1)

Pro forma for Citrus acquisition, Propane sale, January 2012 $2,000 million senior notes offering and

January 2012 $750 million tender offer. (2)

SXL not consolidated in SUN data. SUN contribution debt pro forma for $100 million PEDFA bond

redemption. SUN cash pro forma for $100 million PEDFA bond redemption and $200 million

funding of VEBA trust. SUN pro forma for $100 million of total share repurchases through March and April 2012.

(3)

Includes implied value of GP / IDR interest at ETP and SXL based on current yield for illustrative

purposes. (4)

Acquisition price per share.

|

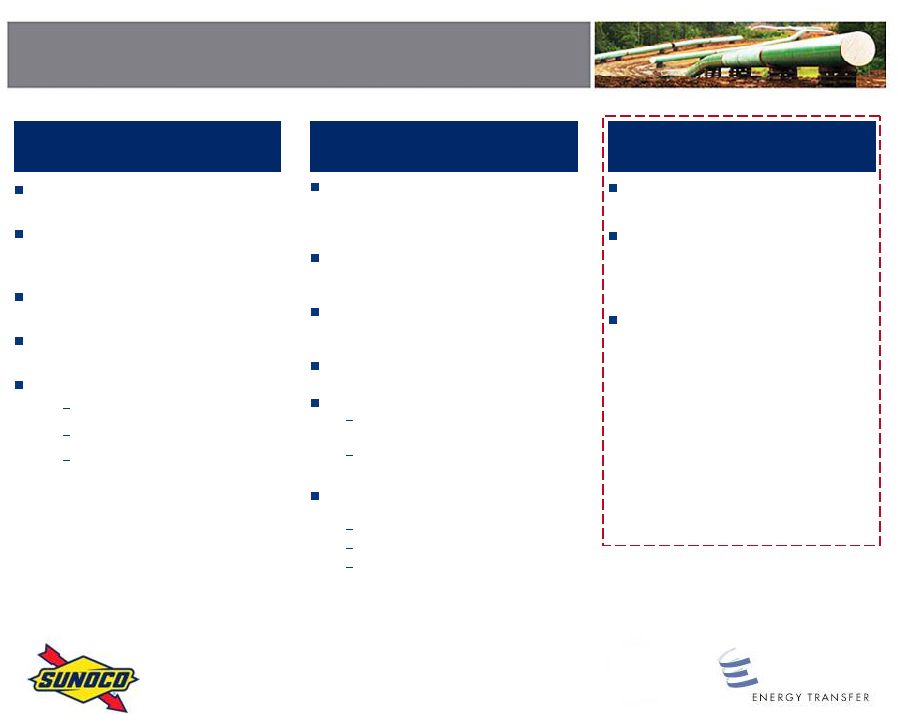

16

Retail Marketing

Logistics

(MLP)

Refining

Announced exit of refining

business in September 2011

Marcus Hook, PA refinery (175

Mbbls/d) permanently idled in

December 2011 but continues to

operate in a terminal capacity

Philadelphia refinery (330

Mbbls/d)

–

Potential JV with Carlyle

(minority interest, Carlyle

to operate, no additional

capital required from

SUN)

–

If no suitable exit

transaction can be

reached, expect to idle

by August 2012

SUN Primary Operating Segments

~2,500 miles of refined products

pipelines located in the

Northeast, Midwest and

Southwest

~5,400 miles of crude oil

pipelines, located principally in

Oklahoma and Texas

~42 million barrels of refined

products and crude oil terminal

capacity

Engaged in the acquisition and

marketing of crude oil

SUN owns:

100% of the SXL GP

interest and IDRs

32.4% of SXL common

units

Historical SUN distributions

received from SXL (pre-tax)

2011 = $97 million

2010 = $91 million

(1)

2009 = $98 million

~4,900 retail outlets for the sale

of gasoline and middle distillates

~5 billion gallons of gasoline and

diesel fuel and ~$500 million of

merchandise sales per year

Strong brand and station image

recognition

Located on the East Coast /

Midwest / Southeast

Historical retail EBITDA

2011 = $261 million

2010 = $269 million

2009 = $241 million

Source: SUN filings and investor presentations.

(1)

SXL distributions to SUN declined in 2010 due to IDR reset which provided SUN with $201 million in cash

proceeds. |

17

Intrastate Transportation

and Storage

Interstate Transportation

Midstream

ETP Primary Operating Segments

Approximately 23,000 miles of natural gas gathering and transportation pipelines, 3

natural gas storage facilities with 74 Bcf of working capacity and 70%

interest in Lone Star NGL joint venture NGL

Oasis Pipeline (600 mi, 1.2

Bcf/d capacity west-to-east, 750

MMcf/d capacity east-to-west)

East Texas Pipeline (370 mi)

Energy Transfer Fuel System

(2,950 mi, total capacity of 5.2

Bcf/d)

–

Includes Bethel storage

facility (6.4 Bcf working

capacity), Bryson storage

facility (6.0 Bcf working

capacity), Godley plant

HPL System (4,350 mi, total

capacity of 5.5 Bcf/d)

–

Includes Bammel storage

facility (62 Bcf working

capacity)

Transwestern Pipeline (2,690

mi; 1,225 MMcf/d mainline

capacity and 1,610 MMcf/d San

Juan Lateral capacity)

Tiger Pipeline (195 mi, 42-inch

pipeline; 2.4 Bcf/d of capacity

sold under 10-15 year

agreements)

FEP Pipeline Joint Venture (185

mi, 42-inch pipeline; initial

capacity of 2.0 Bcf/d with 1.85

Bcf/d sold under 10-12 year

agreements)

–

50/50 joint venture with

Kinder Morgan Energy

Partners, L.P.

Citrus

–

50/50 joint venture with El

Paso Corporation (5,400 mi;

3.1 Bcf/d mainline capacity)

~7,400 mi of natural gas

gathering pipelines

2 natural gas processing plants

15 natural gas treating facilities

11 natural gas conditioning

plants

Joint venture owned 70% by

ETP and 30% by Regency

Energy Partners LP (“RGP”);

ETP operates on behalf of the

joint venture; stand-alone entity

with equal board representation

NGL Storage

–

Mont Belvieu storage facility

(43

million Bbls working

capacity)

–

Hattiesburg storage facility (4

million Bbls of working

capacity)

NGL Pipeline Transportation

–

West Texas NGL Pipeline

(1,066 mi, 144,000 Bbls/d

working capacity)

NGL Fractionation &

Processing (2 cryogenic

processing plants; 25,000

Bbls/d fractionator; Sea Robin

gas processing plant) |

18

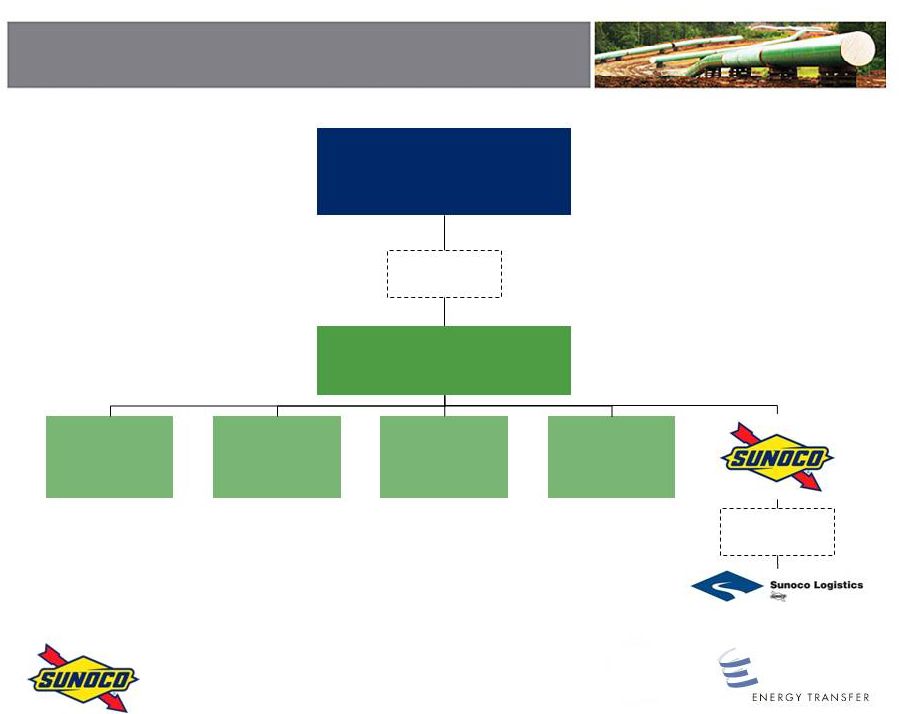

Pro Forma Simplified Structure

ETE

ETP

NGL

Interstate

Transportation

100% ETP IDRs

1.5% GP Interest

22% LP Interest

Midstream

Intrastate

Transportation

and

Storage

100% SXL IDRs

2% GP Interest

32% LP Interest |

19

Adjusted EBITDA reconciliation

Energy Transfer Partners, L.P.

($ in millions)

Fiscal Year Ended December 31,

2009

2010

2011

Net income

$792

$617

$697

Interest expense, net of interest capitalized

394

413

474

Income tax expense

13

16

19

Depreciation and amortization

313

343

431

Non-cash unit-based compensation expense

24

27

37

Losses on disposals of assets

2

5

3

Gains on non-hedged interest rate derivatives

(39)

(5)

77

Allowance for equity funds used during construction

(11)

(29)

(1)

Unrealized (gains) losses on commodity risk management activities

(30)

78

11

Impairment of investment in affiliate

–

53

5

Proportionate share of JV's interest, depreciation and allowance

for equity funds used during construction

22

22

30

Adjusted EBITDA attributable to noncontrolling interest

–

–

(38)

Other, net

(2)

0

(4)

Adjusted EBITDA

$1,477

$1,541

$1,743

Sunoco Retail

($ in millions)

Fiscal Year Ended December 31,

2009

2010

2011

Retail Pretax Income

$146

$176

$169

Depreciation and amortization

95

93

92

Retail Adjusted EBITDA

(1)

$241

$269

$261

(1)

Excludes items deemed to be unusual. |