Attached files

| file | filename |

|---|---|

| EX-31.1 - RADISYS CORP | exhibit31110kaceocertifica.htm |

| EX-99.2 - RADISYS CORP | exhibit992companiesinclude.htm |

| EX-99.1 - RADISYS CORP | exhibit991companiesexclude.htm |

| EX-31.2 - RADISYS CORP | exhibit31110kacfocertifica.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

Form 10-K/A

(Amendment No. 1)

__________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 |

Or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . |

Commission file number 0-26844

__________________________________

RADISYS CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________

Oregon | 93-0945232 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

5435 N.E. Dawson Creek Drive, Hillsboro, OR | 97124 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code | (503) 615-1100 | |

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Name of each exchange on which registered | |

Common Stock, No Par Value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

____________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or in any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o | Accelerated Filer x | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller Reporting Company o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates (based upon the closing price of the NASDAQ Global Select Market on June 30, 2011 of $7.29) of the registrant as of June 30, 2011 was approximately $121,332,128. For purposes of the calculation executive officers, directors and holders of 10% or more of the outstanding common stock are considered affiliates.

Number of shares of common stock outstanding as of April 17, 2012: 28,052,786

DOCUMENTS INCORPORATED BY REFERENCE

None

RADISYS CORPORATION

FORM 10-K/A

TABLE OF CONTENTS

Page | ||

Explanatory Note | ||

PART II | ||

Item 9B. | Other Information | |

PART III | ||

Item 10. | ||

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

PART IV | ||

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | ||

Exhibit Index | ||

2

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this "Amendment") amends Radisys Corporation's (the "Company") Annual Report on Form 10-K for the fiscal year ended December 31, 2011, originally filed with the Securities and Exchange Commission (the "SEC") on March 1, 2012 (the "Original Filing"). We are filing this Amendment to include the information required by Part III of Form 10-K which was not included in the Original Filing because we planned to include such information in a definitive Proxy Statement. However, we will not file a definitive Proxy Statement with the SEC within 120 days after the end of our fiscal year ended December 31, 2011. Accordingly, such information is included in our Form 10-K by this Amendment. In addition, the information about the date, time and location of our 2012 annual meeting of shareholders and the deadline for submitting shareholder proposals for inclusion in the Company's proxy statement for the 2012 annual meeting is provided in this Amendment, as required by Rule 14a-5(f) under the Securities Exchange Act of 1934. Item 9B of Part II has been amended to include this information. Additionally, current dated officer certifications under Section 302 of the Sarbanes-Oxley Act of 2002 are included as exhibits to this Amendment, as required by the SEC rules. Item 15 of Part IV has also been amended to reflect the filing of these currently dated certifications.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing. In this Amendment, unless context otherwise requires, or as otherwise indicated, "we," "us," "our" and similar terms, as well as references to the "Company" and "Radisys" refer to Radisys Corporation and include all of our consolidated subsidiaries.

3

PART II

Item 9B. Other Information

2012 Annual Meeting of Shareholders

Our 2012 annual meeting of shareholders will be held at our headquarters, located at 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124, on June 26, 2012 at 1:00 p.m., Pacific time.

We will consider shareholder proposals, other than proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, for inclusion in the Company's proxy statement for the 2012 annual meeting of shareholders to have been submitted in a timely fashion if such proposals are received by us at our principal offices before the close of business on May 7, 2012. The deadline for proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, remain unchanged.

4

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Board of Directors

Our Board of Directors currently consists of ten members. The directors are elected at the annual meeting of shareholders to serve until the next annual meeting and until their successors are elected and qualified.

Set forth in the table below is the name, age and position with the Company of each of our directors. Additional information about each of the directors is provided below the table and in "Security Ownership of Certain Beneficial Owners and Management." There are no family relationships among our directors and executive officers.

Name | Age | Position | ||

C. Scott Gibson | 59 | Chairman of the Board | ||

Michel A. Dagenais | 59 | Director and Chief Executive Officer | ||

Hubert de Pesquidoux | 46 | Director | ||

Richard J. Faubert | 64 | Director | ||

Scott C. Grout | 49 | Director | ||

Dr. William W. Lattin | 71 | Director | ||

Kevin C. Melia | 64 | Director | ||

David Nierenberg | 58 | Director | ||

M. Niel Ransom | 62 | Director | ||

Lorene K. Steffes | 66 | Director | ||

C. Scott Gibson has served as a Director since June 1993 and as Chairman of our Board of Directors since October 2002. From January 1983 through February 1992, Mr. Gibson co-founded and served as Chief Financial Officer and Senior VP of Operations, then Executive VP and Chief Operating Officer and finally President and Co-Chief Executive Officer of Sequent Computer Systems, Inc. (“Sequent”), a computer systems company. Before co-founding Sequent, Mr. Gibson served as General Manager, Memory Components Operation, at Intel Corporation. Since March 1992, Mr. Gibson has been a director to high technology companies as his full time occupation. Mr. Gibson serves on the boards of several other companies and non-profit organizations, including Triquint Semiconductor, Inc., Pixelworks, Inc., NW Natural, and the St. Johns Medical Center in Jackson, WY. During the past five years, Mr. Gibson was previously a director of Verigy, Pty. and Electroglas, Inc. Each of the boards of directors of the public companies for which Mr. Gibson serves as an audit committee member has determined that he is an "audit committee financial expert" as that term is defined by the rules and regulations of the SEC. Mr. Gibson holds a B.S.E.E. and a M.B.A. from the University of Illinois.

We believe that Mr. Gibson's qualifications to serve as a Director include his extensive experience in the semiconductor and computer systems industries, including co-founding and helping take public a highly successful computer systems company. In addition, his service on boards of other high technology companies, including as a member of audit and compensation committees, gives him financial expertise and understanding of compensation policies as well as extensive organizational leadership skills to assist the CEO with strategic planning.

Michel A. Dagenais has served as our Chief Executive Officer and a Director since July 2011. Mr. Dagenais was previously Continuous Computing Corporation's (“Continuous Computing”) President and Chief Executive Officer and joined Continuous Computing in this role in December 2006. From December 2003 to March 2006, he was President and Chief Executive Officer of Optical Solutions, a provider of fiber optic products to the telecommunications markets, and led the company through a period of unprecedented growth, culminating in the successful acquisition of Optical Solutions by Calix Networks. Mr. Dagenais has over 25 years of experience in the telecommunications industry, including prior executive and management positions at Convergent Networks, Lucent, and Nortel. Mr. Dagenais has a M.Eng. and a B.Eng. in electrical engineering from Carleton University in Ottawa, Canada.

5

We believe that Mr. Dagenais' qualifications to serve as a Director include his years of executive experience with companies in the telecommunications industry, including his positions as an executive with Optical Solutions, Lucent and Nortel, as well as the deep understanding of our people and our products that he has acquired as our Chief Executive Officer. As the only management representative on our Board of Directors, Mr. Dagenais also provides leadership to the Board and its deliberations based on the insight gained from the management of the day-to-day business operation and strategic planning process.

Hubert de Pesquidoux was appointed to serve as a director by the Board on April 11, 2012, to hold the term ending at the upcoming meeting of shareholders. Mr. de Pesquidoux is the former Chief Financial Officer of Alcatel-Lucent and former President and Chief Executive Officer of the Enterprise Business Group of Alcatel-Lucent. In his nearly 20-year career at Alcatel-Lucent SA (and its predecessor, Alcatel), Mr. de Pesquidoux's executive positions included President and Chief Executive Officer of Alcatel North America; Chief Operating Officer of Alcatel USA; President and Chief Executive Officer of Alcatel Canada; Chief Financial Officer of Alcatel USA and Treasurer of Alcatel Alsthom. He joined Alcatel in 1991 after several years in the banking industry. Mr. de Pesquidoux also previously served as Chairman of the Board at Tekelec, and is a member of the Board and Chairman of the Audit Committee of Sequans Communications, a member of the Board and Chairman of the Audit Committee of Mavenir Systems, and a member of the Board of Albaix Energy. Mr. de Pesquidoux holds a master's degree in law and a master's degree in business from the Institute for Political Studies (Sciences Po) in Paris and a DESS in Finance from Paris Dauphine University.

We believe that Mr. de Pesquidoux' qualifications to serve as director include his over 20 years of experience of financial and operational management in the telecommunications industry in the U.S., Canada and Europe. This experience gives Mr. de Pesquidoux a deep understanding of the high technology industry both on the service provider side and the large to small enterprise side, including knowledge relating to sales and marketing, R&D, finance, IT and supply chain. As the founder and owner of a private consulting and advisory firm, Mr. de Pesquidoux brings to the board additional financial and technical expertise. His experience on boards of other companies within our industry, including his former Chairman position at Tekelec, further augment his range of knowledge and understanding of Corporate Governance providing experience on which he can draw while serving as a member of our Board. He also qualifies as an audit committee financial expert from his experience as a Chief Financial Officer of a large public company and his professional qualifications which give him enhanced expertise to assist the Board with its financial oversight function.

Scott C. Grout served as our President and Chief Executive Officer from October 2002 through July 2011. He has served as a Director since October 2002. From May 1998 to October 2002, Mr. Grout was President and Chief Executive Officer of Chorum Technologies, Inc., a privately held provider of fiber optic products based in Richardson, Texas. Prior to joining Chorum, Mr. Grout held various positions at Lucent Technologies, a telecommunications network vendor, including as the Vice President of the Optical Networking Group and a Director of the Access and Optical Networking Group, from June 1984 to May 1998. Mr. Grout received a B.S. in Engineering from the University of Wisconsin at Madison and a M.B.A. from the Sloan School of Management at the Massachusetts Institute of Technology.

We believe that Mr. Grout's qualifications to serve as a Director include his years of executive experience with high technology companies, including his positions as an executive with Chorum Technologies, Inc. and Lucent Technologies, as well as the deep understanding of our people and our products that he acquired as our Chief Executive Officer.

Richard J. Faubert has served as a Director since June 1993. From September 2003 to December 2010, Mr. Faubert served as President, Chief Executive Officer, and Director of Amberwave Systems, Inc., a semiconductor technology company in New Hampshire. From January to September 2003, Mr. Faubert served as Executive Vice President of Novellus Systems, Inc.'s Chemical Mechanical Planarization Business Unit, a company that designs, manufactures, markets and services chemical vapor deposition equipment, used in fabricating integrated circuits. From 1998 through 2002, Mr. Faubert was President, Chief Executive Officer and Director of SpeedFam-IPEC, Inc., a semiconductor capital equipment manufacturing company that was purchased in December 2002 by Novellus Systems Inc. From 1992 through 1998, Mr. Faubert was employed by Tektronix, Inc., a test, measurement and monitoring technology company, first as General Manager of its Instruments Business Unit and then as Vice President and General Manager of the Television and Communications Business Unit, Measurement Business Division. From 1986 through 1992, Mr. Faubert served as Vice President of Product Development of GenRad, Inc. Mr. Faubert serves on the Board of Electro Scientific Industries, Inc. in Portland, Oregon. Mr. Faubert holds a B.S.E.E. from Northeastern University.

We believe that Mr. Faubert's qualifications to serve as a Director include his 38 years of experience as a manager, executive and director of high technology companies, including his experience in leading complex technology enterprises and his experience as the Chief Executive Officer of a semiconductor company. This experience gives Mr. Faubert a deep understanding of best practices in managing complex, high technology businesses from customer requirements through R&D

6

programs.

Dr. William W. Lattin has served as a Director since November 2002. In October 1999, Dr. Lattin retired from Synopsys, Inc., a supplier of electronic design automation software, where he had been an Executive Vice President since October 1994. Prior to joining Synopsys, Dr. Lattin served as President and Chief Executive Officer of Logic Modeling Corp. from 1986 through 1994. From 1975 to 1986, Dr. Lattin held various engineering and management positions with Intel Corporation. Dr. Lattin also serves on the Board of Directors of Easy Street Online Services, Inc. During the past five years, Dr. Lattin was previously a director of Merix Corporation, FEI Corp and Tripwire Inc. Dr. Lattin previously served on our Board of Directors from 1988 to 1999. Dr. Lattin holds a Ph.D. in electrical engineering from Arizona State University and a M.S.E.E. and a B.S.E.E. from the University of California-Berkeley.

We believe that Mr. Lattin's qualifications to serve as a Director include his experience of over 34 years as a manager, executive and director of global technology companies, including Intel and Synopsys. His direct experience with embedded systems design, manufacturing sales and marketing enhances the Board's ability to provide oversight and guidance to our senior executives. His previous experience on boards of other companies within our industry further augment his range of knowledge, providing experience on which he can draw while serving as a member of our Board.

Kevin C. Melia has served as a Director since July 2003. Mr. Melia is the non-executive Chairman of the Vette Corp., a private company in the thermal management business. Mr. Melia is a past Chairman of the Board of IONA Technologies PLC, a leading middleware software company. Prior to joining IONA Technologies, Inc., he was the Co-Founder and Chief Executive Officer of Manufacturers' Services Ltd. (“MSL”) from June 1994 to January 2003. MSL was a leading company in the electronics manufacturing services industry. Mr. Melia also served as Chairman of the Board of MSL from June 1994 to January 2003. Prior to establishing MSL, he held a number of senior executive positions over a five-year period at Sun Microsystems, initially as their Executive Vice President of Operations, then as President of Sun Microsystems Computer Company, a Sun Microsystems subsidiary, and finally as Chief Financial Officer of Sun Microsystems Corporation. Mr. Melia also held a number of senior executive positions in operations and finance over a sixteen-year career at Digital Equipment Corporation. Mr. Melia is a past member of the board of directors of Manugistics Group Inc., a supply chain software application company and is a past member of the board of directors of Eircom PLC, a leading telecom company in Ireland. He is also advisory director of Boulder Brook Partners LLC, a private investment company, a member of the advisory board of C&S Wholesale Grocers and a director of Merrion Capital, a private financial services firm. He is also a member of the board of directors of Greatbatch Company, DCC PLC, and Analogic Corporation and a past member of the board of directors of Horizon Technologies, a European systems integration and distribution company. Mr. Melia is a Chartered Accountant and holds a joint diploma in Management Accounting from the Accounting Institutes of the U.K. and Ireland.

We believe that Mr. Melia's qualifications to serve as a Director include his experience as a senior executive in the U.S. and Europe with a number of global technology companies including his co-founding and taking public of a leading company in the electronics manufacturing outsourcing sector in addition to his management and corporate governance expertise. In addition, Mr. Melia's experience with mergers and acquisitions and private equity gives him broad understanding of corporate investments and acquisitions. He also qualifies as an audit committee financial expert from his experience as a Chief Financial Officer of a large public company and his professional qualifications which give him enhanced expertise to assist the Board with its financial oversight function.

David Nierenberg has served as a Director since March 2011. Mr. Nierenberg is the Founder and President of Nierenberg Investment Management Company, Inc. in Camas, Washington, which manages The D3 Family Funds. Prior to founding Nierenberg Investment Management Company in 1996, Mr. Nierenberg was a General Partner at Trinity Ventures, a venture capital fund, where he invested in financial services, healthcare and turnarounds. Prior to 1985, he was a Partner with Bain & Company, a business and strategy consulting firm. Mr. Nierenberg is a member of the Yale University Development Board, Chairman of the Advisory Board of the Millstein Center for Corporate Governance and Performance at the Yale School of Management and a member of the Advisory Board of the Yale School of Management. He also serves on the Washington State Investment Board. He is Chairman of PSA Healthcare, a leading provider of pediatric home care services, and a member of the board of directors of Electro Scientific Industries, Inc., a designer and manufacturer of sophisticated production equipment used by microelectronics manufacturers, and Kuni Automotive Group, an auto dealership company. Mr. Nierenberg received his B.A. in History from Yale College and his J.D. from Yale Law School. He is a retired member of the Massachusetts bar.

We believe that Mr. Nierenberg's qualifications to serve as a Director include his significant expertise in strategic planning and corporate governance. He also brings broad-based business knowledge to the Board.

7

M. Niel Ransom has served as a Director since August 2010. Mr. Ransom is a principal of Ransomshire Associates, Inc., an advisory firm he founded in 2005. He also serves as a board member of DesignArt Networks, a provider for LTE, WiMAX or HSPA RAN equipment; Capella, a provider of wavelength selective switch modules; Cyan Optics, a provider of packet-optical transport platforms; Polatis, a provider of high performance optical switch solutions in optical communications; and MultiPhy, a provider of integrated circuits for high-speed optical communications. During the last five years, Mr. Ransom was previously a director of ECI Telecom, a provider of networking infrastructure equipment. Previously, as worldwide CTO of Alcatel and a member of its Executive Committee, he was responsible for research, corporate strategy, intellectual property and R&D investment. Prior to that, he directed Alcatel's access and metro optical business in North America. Earlier in his career, he directed the Advanced Technology Systems Center at BellSouth and various development and applied research organizations in voice and data switching at Bell Laboratories. He holds a Ph.D. in electrical engineering from the University of Notre Dame, BSEE and MSEE degrees from Old Dominion University, and an MBA from the University of Chicago.

We believe that Mr. Ransom brings to our Board significant international experience acquired during his service as worldwide CTO of Alcatel. Further, Mr. Ransom's experience at Alcatel enables him to offer valuable perspectives on Radisys' corporate planning and development. As a principal of a private advisory firm, Mr. Ransom brings to the Board significant senior leadership, operational and financial expertise. His board engagements in venture capital-based startups bring valuable insights in emerging technology trends.

Lorene K. Steffes has served as a Director since January 2005. Ms. Steffes is an independent business advisor with executive, business management and technical experience in telecommunications, information technology and high tech industries. From July 1999 to October 2003 she was an executive at IBM Corporation where she served as Vice President and General Manager, Global Electronics Industry. She was based in Tokyo for a time as IBM Vice President, Asia Pacific marketing and sales of solutions for the Telecommunications, Media & Entertainment and Energy & Utilities industries. Prior to her assignment in the Asia Pacific region, she was Vice President of software group services for IBM's middleware products. Ms. Steffes was appointed President and Chief Executive Officer of Transarc Corporation, Inc. in 1997. Prior to this appointment she worked for 15 years in the telecommunications industry at Ameritech, AT&T Bell Laboratories and AT&T Network Systems. Ms. Steffes is a director on the board of PNC Financial Services Corporation and PNC Bank, NA, a member of Women Corporate Directors (WCD) and the National Association of Corporate Directors (NACD). She was formerly a member of the Northern Illinois University College of Liberal Arts and Sciences advisory board and was formerly a trustee on the Carlow College Board in Pittsburgh. She holds a BS in Mathematics and MS in Computer Science from Northern Illinois University.

We believe that Ms. Steffes's qualifications to serve as a Director include her extensive technical knowledge and background, including telecommunications industry experience. Ms. Steffes's experience as a Chief Executive Officer of a high technology company and as a senior executive with a global technology company has given her an understanding of the financial, operational and other aspects of doing business globally. In addition, her service on boards of other companies gives her a deep understanding of the role of the Board of Directors in the Company's governance and operations, and broad experience in corporate strategy development.

Executive Officers

Set forth in the table below is the name, age and position with the Company of each of our executive officers:

Name | Age | Position |

Michel A. Dagenais | 59 | Chief Executive Officer and Director |

Brian Bronson | 40 | President and Chief Financial Officer |

Amit Agarwal | 44 | Vice President & General Manager, Software and Solutions |

Fred Barden | 46 | Vice President of Worldwide Sales |

Keate Despain | 43 | Vice President and General Manager, CBU & ATCA |

John T. Major | 52 | Vice President of Global Operations |

See Michel A. Dagenais' biography above.

Brian Bronson joined us in 1999 and has been an officer since 2000. In July 2011, he was named our President and Chief Financial Officer. Prior to his being named as our Chief Financial Officer in November 2006, Mr. Bronson held the positions of our Vice President of Finance and Business Development and Treasurer and Chief Accounting Officer. Before joining Radisys, from 1995 to 1999, Mr. Bronson held a number of financial management roles at Tektronix, Inc. where he was responsible for investor relations, finance and accounting functions for both domestic and international operations. Prior to

8

joining Tektronix, Inc., Mr. Bronson practiced as a Certified Public Accountant with the accounting firm Deloitte and Touche, LLP. Mr. Bronson holds a bachelors degree in Business Administration and Communications from Oregon State University.

Amit Agarwal joined us in July 2011 as Vice President and General Manager for our Software and Solutions business unit, which includes Trillium software and media server products and services to provide customer specific solutions using Radisys off the shelf hardware and software components. Mr. Agarwal was named an executive officer in 2012. Mr. Agarwal was previously Continuous Computing's Chief Operating Officer from January 2010 to July 2011 and Senior Vice President of Engineering from October 2006 to December 2009. Prior to joining Continuous Computing, Mr. Agarwal held various senior engineering management positions with Trillium and Intel Corporation. Mr. Agarwal holds a Masters degree in telecommunications systems from the Indian Institute of Technology (IIT), Kharagpur, India.

Fred Barden joined us in July 2011 as Vice President of Worldwide Sales and was named an executive officer in January 2012. Mr. Barden was previously Continuous Computing's Vice President of Worldwide Sales since 2010. Prior to Continuous Computing, Mr. Barden was Director of Sales, Americas at Kontron America from December 2004 to December 2009, and prior to that, he spent 15 years as a manufacturers' representative, specializing in sales of embedded products to the Silicon Valley market. Mr. Barden has been instrumental in team building and development, and has applied his industry knowledge and his contacts to develop effective partner and channel strategies throughout his career. Mr. Barden holds a BS degree in Industrial Engineering from Oregon State University and an MBA degree from Santa Clara University with a concentration in Marketing.

Keate Despain joined us in 2007. In May 2011, he was named Vice President & General Manager of our CBU and ATCA divisions. He was named an executive officer in January 2012. Before joining Radisys, Mr. Despain held various marketing leadership positions with Intel Corporation from 1994 to 2007 where he led various groups in the Embedded Microprocessor Group focusing on the communications segment, embedded software, channel management and product marketing. Mr. Despain holds an MBA degree from Arizona State University.

John T. Major joined us in 2008 as Vice President of Global Operations. From January 2008 until joining us, Mr. Major served as Vice President of Global Operations for Planar Systems, a company that provides display technologies and solutions for home, business, medical and industrial needs. Mr. Major also served as Vice President of Supply Chain and Manufacturing Operations for Tektronix, Inc. from October 2003 to January 2008, where he was responsible for worldwide operations, including the deployment of Lean Sigma. Prior to joining Tektronix, Inc., Mr. Major served as Vice President of Customer Support and Service for Xerox Office Printing Business from June 2000 to October 2003. Earlier in his career, Mr. Major served in a number of manufacturing leadership roles at Tektronix, Inc. and Digital Equipment Corporation. Mr. Major holds a Bachelor of Science degree in Mechanical Engineering and an Executive MBA from the University of Washington. On April 23, 2012, the Company and Mr. Major entered into a Transition Agreement pursuant to which Mr. Major's employment with the Company as Vice President of Global Operations will terminate as of June 30, 2012.

Code of Ethics

Our Board of Directors has adopted a Code of Ethics applicable to each of our directors, officers, employees and agents, including our Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions. Our Code of Ethics is available on our website at www.radisys.com under Investor Relations/Corporate Governance.

Director Nomination Process

The Nominating and Governance Committee has a policy with regard to consideration of director candidates recommended by shareholders. The Committee will consider nominees recommended by our shareholders holding no less than 10,000 shares of our common stock continuously for at least 12 months prior to the date of the submission of the recommendation. A shareholder that desires to recommend a candidate for election to our Board of Directors shall direct his or her recommendation in writing to Radisys Corporation, Attention: Corporate Secretary, 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124. The recommendation must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between us and the candidate within the last three years and evidence of the recommending shareholder's ownership of our common stock. In addition, the recommendation shall also contain a statement from the recommending shareholder in support of the candidate, professional references, particularly within the context of the those relevant the membership on our Board of Directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like, personal references and a written indication by the candidate of his or her willingness to serve, if elected.

9

Audit Committee Matters

We maintain an Audit Committee consisting of C. Scott Gibson as Chairman, Hubert de Pesquidoux, William W. Lattin and Kevin C. Melia. All of the members of the Audit Committee are “independent directors” within the meaning of the Nasdaq listing standards and Rule 10A-3 of the Securities Exchange Act of 1934. In addition, our Board of Directors has determined that all four members of the Audit Committee, Hubert de Pesquidoux, C. Scott Gibson, William W. Lattin and Kevin C. Melia, qualify as “audit committee financial experts” as defined by the SEC in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act of 1933 and are independent within the meaning of Rule 10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”). C. Scott Gibson qualifies as an audit committee financial expert by virtue of his service on our audit committee since 1992, the audit committee of Pixelworks, Inc. since 2002, and past service on the audit committees of Inference Corp. and Integrated Measurement Systems. Additionally, Mr. Gibson received an M.B.A. in Finance from the University of Illinois in 1976 and served as CFO and Senior VP of Operations for Sequent Computer Systems from 1983 to 1984. Further, from 1985 to 1988, the CFO of Sequent Computer Systems reported to Mr. Gibson. Mr. Gibson has significant audit committee educational experience, including speaking at several KPMG audit committee forums. Mr. de Pesquidoux qualifies as an audit committee financial expert by virtue of his long service in a number of senior executive positions over 20 years at Alcatel-Lucent and its subsidiaries, including Chief Executive Officer, President and Chief Financial Officer. Mr. de Pesquidoux also serves on the audit committees of Sequans Communications S.A. and Mavenir Systems. Additionally, Mr. de Pesquidoux holds a master's degree in business law from Nancy Law University, is a graduate of the Institute for Political Studies (Sciences Po Paris) with a master's degree in Economics and Finance and holds a master's degree in International Finance from Paris Dauphine University. Mr. Melia qualifies as an audit committee financial expert by virtue of his long service in a number of senior executive positions over a five-year period at Sun Microsystems, including as its Chief Financial Officer, and over a sixteen-year period at Digital Equipment Corporation, as well as by virtue of his status as a Chartered Accountant with a joint diploma in Management Accounting from the Accounting Institutes of the U.K. and Ireland. Dr. Lattin qualifies as an audit committee financial expert by virtue of his years of experience as Chief Executive Officer of Logic Modeling Corp., during which time Dr. Lattin was responsible for supervising Logic Modeling Corp.'s chief financial officer. Our Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities relating to corporate accounting, our reporting practices and the quality and integrity of our financial reports; oversight of audit and financial risk; compliance with law and the maintenance of our ethical standards; and the effectiveness of our internal controls. The full responsibilities of our Audit Committee are set forth in its charter, a copy of which can be found on our website at www.radisys.com under Investor Relations/Corporate Governance. Our Audit Committee met nine times in the last fiscal year.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and persons who own more than 10% of our outstanding common stock to file with the SEC reports of changes in ownership of the common stock of the Company held by such persons. Officers, directors and greater than 10% shareholders are also required to furnish the Company with copies of all forms they file under this regulation. To the Company's knowledge, based solely on a review of the copies of the reports received by the Company during and with respect to fiscal 2011 and on written representations of certain reporting persons, no director, executive officer or beneficial owner of more than 10% of the outstanding common stock of the Company failed to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934.

Certifications

Certifications of our Chief Executive Officer and Chief Financial Officer pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 were filed with the Original Filing. Currently dated certifications pursuant to Section 302, as required by the SEC, are attached to this Amendment.

10

Item 11. Executive Compensation

Executive Compensation Discussion and Analysis (CD&A)

Section I: Executive Summary

2011 was a transformative year for Radisys, with the acquisition and integration of Continuous Computing in July, a change in the Company's senior leadership, and a redefined business strategy that targets the Company to be the world's premier provider of embedded wireless infrastructure solutions. To support and better align executive compensation with the successful execution of our newly defined strategy, our compensation philosophy was revised to include tighter linkage between compensation and the achievement of the newly defined business goals. Beginning in 2012, our compensation programs will reflect this new philosophy.

The Radisys executive compensation philosophy and programs starting in 2012 include:

An executive's total compensation should increase or decrease based on Company and individual performance to reflect our pay for performance philosophy.

• | A stronger “risk/reward” philosophy was adopted which resulted in the 2012 variable cash compensation program now requiring a minimum level of corporate operating income performance to fund any payout. In addition, performance in respect of individual objectives will determine an executive officer's actual payout after plan is funded. There is now significant upside if funding and individual performance exceed goals. Payouts from the incentive plan will now be on an annual basis, rather than a semi-annual basis, to better align compensation with sustained performance against plan objectives. |

• | As the result of introducing greater accountability for the achievement of financial goals into the variable cash compensation component, a stronger emphasis has been placed on ensuring base pay is aligned to the 50th percentile of market as determined by benchmarking. |

• | Equity will continue to be a substantial component of an executive's total compensation given that it ties an executive's long-term interest to that of our shareholders. A combination of performance-based & time-based shares will continue to be used; however, to provide greater retentive value, the vesting period on time-based grants has been increased from three to four years. |

• | Stock ownership guidelines were revised for Named Executive Officers (NEOs) from 1x base pay to 3x base pay for CEO, 2x base pay for President/CFO, and 1x base pay for all other NEOs. |

Linking Pay for Performance:

During 2011, Radisys made progress towards the achievement of its strategic objectives that are intended to improve future revenue growth and profitability.

• | Radisys delivered revenue of $330.9 million, representing 16% year on year growth. |

• | Next generation communications revenue of $167.1 million increased 42% when compared to 2010 and now represents more than half of total Company revenue. |

• | Design wins finished strong in the 2nd half of the year at $195 million of projected revenue over the next five years. |

• | Radisys acquired Continuous Computing and as a result is expected to achieve $13-15 million in integration synergies and has redefined the business strategy. The Company is receiving positive market support for the newly defined strategy. |

• | Non-GAAP EPS of $0.55 grew 10% when compared to 2010. See "Non-GAAP Financial Information" for further information regarding the calculation of non-GAAP EPS. |

As a result of the 2011 financial performance:

• | NEOs earned, on average, 66% of their target variable compensation in 2011 as a result of achieving non-GAAP operating income of 4.9% of revenue vs. the 100% target funding of 8% non-GAAP operating income as a percent of revenue. See “Non-GAAP Financial Information” for further information regarding the calculation of non-GAAP operating income. |

• | The first tranche of performance-based shares granted in October, 2009 under the Radisys Corporation Long Term Incentive Plan (“LTIP”) did not vest in 2011. A minimum of $0.65 of non-GAAP EPS on a rolling four quarter basis is required for LTIP share vesting. |

11

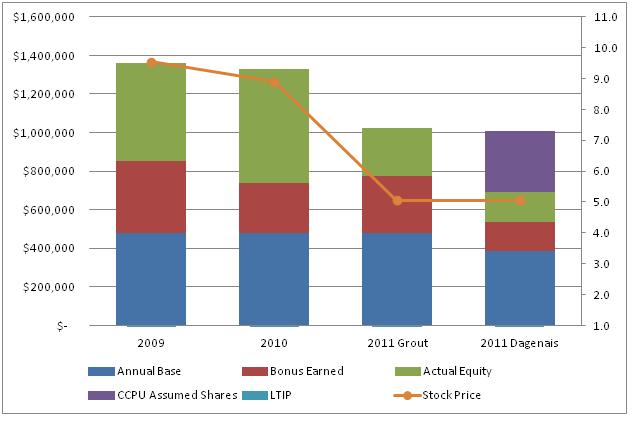

• | The stock price at year-end was $5.06 representing a decline of 43% when compared to the 2010 year-end stock price $8.90. This decline in stock price led to a decrease in all executive officers' total actual and potential compensation as demonstrated by Mr. Grout's decrease in total actual and potential compensation of $340,000 or 58% during this period. This is reflective of the alignment we seek to achieve between our executive officers' compensation and the interests of our shareholders. |

The link between pay and performance is highlighted by the trends in the CEO's compensation below. The graph below demonstrates that our CEO's total actual and potential compensation (sum of annual base pay, bonuses earned, LTIP, actual equity granted and CCPU assumed shares, each as defined below) has aligned to stock price changes over the last three years. In addition, more than 50% of our CEO's compensation has been tied to Company and individual performance for the periods presented below.

“Annual Base”- means the annual base salary effective at year-end.

“Bonus Earned”- means the total short-term cash incentive awards earned during the calendar plan year. For Mr. Dagenais, only his bonus payment for performance during the 2nd half of 2011, after the Continuous Computing acquisition, is included. For Mr. Grout, both 1st & 2nd half bonus payments are included for 2011.

“Actual Equity” - means the value of equity awards outstanding at year-end. For RSUs, such value is the value of unvested RSUs outstanding at year-end. For stock options (vested and unvested), such value is the difference between an option's strike price and the stock price at year-end; if an option's strike price is below the year-end stock price, the value of the option is $0.

“CCPU Assumed Shares” - means those unvested shares issued by Continuous Computing which were converted and assumed by Radisys on the acquisition date.

“LTIP” - means our Long-Term Incentive Plan award which is designed to be paid when the indicated performance targets are hit within a three-year period. To date, no payouts from the LTIP have been made and therefore no actual compensation has been realized.

“Stock Price” - means the closing stock price on the last day of the calendar year.

12

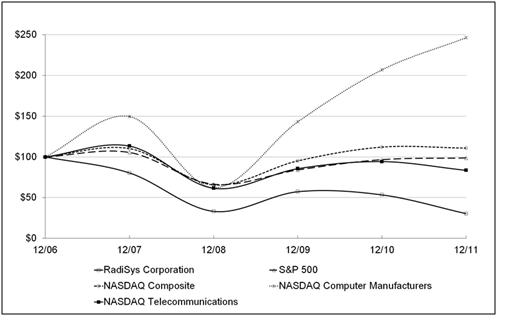

For a comparison of Radisys stock performance to the NASDAQ Composite and other composites at the end of each calendar year, please refer to the table below.

Section II: Compensation Practices

Radisys' compensation practices reflect the Company's compensation philosophy and an alignment to a number of best practices, including:

• | The Compensation & Development Committee oversees all elements of compensation for the executive officers while directly retaining an independent compensation consultant that performs services solely in support of the Committee. |

• | NEOs were expected to maintain an investment in our stock equal to a multiple of 1x annual base salary in 2011. Starting in 2012, ownership guidelines increased to CEO=3x, President/CFO=2x, and other NEOs=1x. We feel this increase in ownership will help to ensure an alignment with stockholder interests. All NEOs must be “net” buyers until stock ownership requirements are fulfilled within a 3-5 year grace period. |

• | Executive officers' change of control agreements provide for a "double trigger" payout with stock acceleration provisions only included for the CEO and President. |

• | Compensation plans are competitive with those of our peer companies. Plans are annually monitored, evaluated and compared against trends in executive compensation. |

• | Equity-based incentive plans prohibit backdating and re-pricing of stock options. |

• | Different metrics are used to measure performance over varying timeframes. For example, earnings per share is used over a 3 year timeframe as the metric for the LTIP while operating income is used on an annual basis for the short-term cash incentive plan. |

• | Special perquisites, tax equalization or gross-up benefits, or benefits designed solely for executive officers are not provided. |

• | The Compensation & Development Committee reviews annually all compensation plans to ensure incentives do not promote taking undue risk. |

Additional best practices are being implemented in 2012 to further strengthen the pay for performance linkage, including:

• | A peer group for benchmarking total shareholder return will be put in place so that pay can be compared to a performance benchmark. |

• | A dashboard, consisting of incentive compensation costs and financial performance metrics, has been created and will be reviewed each quarter by the Compensation and Development Committee. A claw-back provision for the incentive cash and equity plans will be implemented upon final adoption of SEC rules and additional guidance. |

13

In addition, the most recent shareholder advisory vote on compensation of NEOs resulted in a 98% vote “For” the approval of the compensation of our NEOs. The shareholders voted to hold an advisory vote on the compensation of NEOs every year. We intend to hold such advisory vote on compensation each year. The Compensation and Development Committee was aware of and considered the results of the vote when designing the 2012 compensation programs, which are designed to reflect our pay for performance philosophy and further provide that an executive's total compensation should increase or decrease based on Company and individual performance.

The Compensation and Development Committee conducted an assessment of the Company's compensation policies and practices to identify any potential risk arising from such policies and practices that could be reasonably likely to have a material adverse effect on the company. All compensation policies and procedures, including variable cash compensation plans (Incentive Compensation Plan & Sales Commission plan), were included in the review. The review included an analysis of overall compensation costs (total costs, variable incentive costs vs. fixed compensation costs), compensation plan participation by employee group (sales vs. employees vs. senior leaders), metrics and performance goals. No potential risks that could be reasonably likely to have a material adverse effect were identified.

Section III: Elements of Executive Compensation

The following table outlines elements of direct compensation of our NEOs and how it aligns with the Company's philosophy and business objectives.

Compensation Element | What is Rewarded | How it Aligns with Strategic Objectives | Fixed or Variable / Performance Related | ||

Base Salary | ž | Skills and abilities critical to success of the business | ž | Competitive base salaries enable the attraction and retention of talent | Fixed / Merit Increase are Performance Related |

ž | Experience and performance against individual objectives | ž | Merit-based salary increases reflect pay to performance philosophy | ||

ž | Demonstrated success in meeting or exceeding key financial and other business objectives | ||||

Short-Term Incentive (Cash Incentive Plan) | ž | Organization performance during the year against achievement of pre-defined profitability goals | ž | Payout of awards depends on ability to fund and individual and organizational performance | Variable / Performance-Related |

ž | Individual performance during the year measured against identified goals and objectives | ž | Competitive, market-based variable incentive targets enables the attraction and retention of talent | ||

Long-Term Incentives | Stock Options | ž | Value depends on price of the stock; no value unless the stock price increases | Variable / Performance-Related | |

ž | Increase in stock price | ||||

ž | Retention | ž | Four-year vesting supports retention | ||

Restricted Share Units ("RSUs") | ž | Although RSUs always have value, the value increases or decreases as stock price increase or decreases | Variable / Performance-Related | ||

ž | Increase in stock price | ||||

ž | Retention | ž | Four year vesting supports retention | ||

LTIP Award | ž | Payout is based on metrics important to our shareholders | Variable / Performance-Related | ||

ž | Performance relative to pre-determined strategic financial goal (non-GAAP EPS for 2009 grant) | ž | Three-year performance period supports retention | ||

14

In addition to direct compensation, we provide executive officers with the following indirect compensation.

NEOs are provided the same benefit plans as those provided to other employees in the same country. Our U.S. based employee benefit programs include medical/dental/vision plans, Employee Stock Purchase Plan (“ESPP”), 401(k) plan, tuition reimbursement, life insurance, short-term disability and long-term disability.

Our NEOs, certain other senior employees and members of our Board of Directors are also eligible to participate in the Radisys Corporation Deferred Compensation Plan. For further description of our Deferred Compensation Plan, please refer to the narrative following the 2011 Nonqualified Deferred Compensation Table. The gains or losses of participants in the Deferred Compensation Plan based on their investment choices are not a factor in determining a participant's base salary, incentive cash incentive payments, equity awards or any other forms of reward or compensation.

We do not provide our executives with any special perquisites such as club memberships, pension plans, automobile allowances or dwellings for personal use. Relocation packages to newly hired executives and other newly hired employees are defined within our hiring policy and are based on standard market practices for executive-level relocation.

Our NEOs are parties to various severance arrangements, change of control agreements, or both, entered into pursuant to guidelines adopted by our Compensation and Development Committee. The Compensation and Development Committee believes that these agreements may be necessary or advisable to keep executive officers focused on the best interests of shareholders at times that may otherwise cause a lack of focus due to personal economic exposure and extreme turmoil for Radisys. Further, the Compensation and Development Committee believes that they are necessary or advisable for retentive purposes to provide a measure of support to our NEOs who may receive offers of employment from competitors that would provide severance or change of control benefits. Consistent with the practice of a substantial number of companies in our peer group, the change of control agreements provide for a "double trigger" payout only in the event there is a change in control and the executive officer is either terminated from his or her position (other than for cause, death or disability) or resigns for "good reason," which generally means that he or she is moved into a position that represents a substantial change in responsibilities or is required to relocate a substantial distance within a limited period of time after the transaction (i.e. these agreements do not become operative unless both events occur). See "Executive Compensation-Potential Post-Employment Payments" for a description of the severance and change of control agreements with our NEOs.

Section IV: 2011 Compensation Determinations

During 2011, base salary, cash incentive targets and total target cash compensation for our NEOs was adjusted during the annual merit process and as a result of significant role changes. In addition, executive officers received 66% of their variable target cash incentive target because of the alignment between cash incentive payouts and short-term financial goals. Significant changes in the Company's executive officers occurred in 2011, mainly following the acquisition of Continuous Computing, which has contributed to the $13-15 million in anticipated integration synergies. Please refer to the items below for a summary of the changes:

NEOs No Longer with Radisys:

• | Anthony Ambrose, Sr. Divisional Executive, employed through August 31, 2011. |

• | Chris Lepiane, Vice President of World-Wide Sales, employed through December 31, 2011. |

• | Scott Grout, Chief Executive Officer, employed as CEO through July 7, 2011 and as Advisor to the CEO through January 31, 2012. |

NEO Role Changes:

• | Mike Dagenais, Chief Executive Officer, hired at the closing of the Continuous Computing acquisition, effective July 8, 2011. |

• | Brian Bronson promoted from Chief Financial Officer (CFO) to President & CFO effective July 8, 2011. |

• | John Major, Vice President of Global Operations, entered into a Transition Agreement on April 23, 2012 pursuant to which Mr. Major's employment with the Company will terminate as of June 30, 2012. See "Executive Compensation-Potential Post-Employment Payments" for a description of the material terms of the Transition Agreement. |

Changes to Base Salary, Target Cash Incentive, Total Target Cash

Increases to total base salary, target cash incentive, and total target cash typically occur during the annual merit process which provides merit-based increases as determined appropriate using salary benchmarking data, annual performance reviews, and annual budgets. During 2011, further adjustments were made as the result of role changes during

15

the year. For a summary of compensation market percentiles for each currently employed NEO at both the beginning and end of 2011, please refer to the table below.

*General Percentiles for 2011 | |||||

Named Executive Officer | Date | Base Salary | Target Cash Incentive | Total Target Cash Comp. | Comments |

Mike Dagenais (CEO, starting July 8, 2011) | July | 10th - 15th | 25th - 30th | 30th | No increases were made to Mr. Dagenais' compensation during 2011. Note, effective January 1, 2012 an increase to Mr. Dagenais compensation occurred. |

December | 10th - 15th | 25th - 30th | 30th | ||

Scott Grout (CEO, through July 7, 2011) | January | 50th -55th | 35th - 40th | 45th - 50th | An increase in Mr. Grout's variable target % occurred in April during the annual merit process to align his variable target amount to the 50th percentile market goal. |

December | 50th -55th | 40th - 45th | 50th - 55th | ||

Brian Bronson (Chief Financial Officer (CFO) through July 7, 2011; President and CFO starting July 8, 2011) | January | 45th - 50th | 70th - 75th | 60th - 65th | As the result of a promotion to first COO then President, Mr. Bronson's base salary and incentive target increased during 2011. His total compensation continues to align above the 50th percentile due to his dual role as President and CFO. Effective January 1, 2012; however, a decrease to Mr. Bronson's variable target occurred to improve alignment of his total compensation to market goals. |

December | 40th - 45th | 80th | 65th-70th | ||

John Major (VP Global Operations) | January | 50th | 75th - 80th | 75th - 80th | Mr. Major received a 2% increase to both his base salary and variable target % during the annual merit process in alignment with the average budget. His above market cash compensation is supported by his deep domain expertise which has led to the successful outsourcing of manufacturing. |

December | 50th -55th | 80th - 85th | 80th - 85th | ||

Anthony Ambrose, (Sr. Divisional Executive) | January | 55th-60th | 60th-65th | 60th-65th | Mr. Ambrose received a 2% increase to his variable target % during the annual merit process |

August | 55th-60th | 60th-65th | 60th-65th | ||

Chris Lepiane (Vice President of World-Wide Sales) | January | 35th-40th | 50th-55th | 55th-60th | Mr. Lepiane received a 3% increase to his base salary and 4.5% increase to his variable target, aligning him to the target market position of slightly above market on total cash. |

December | 44th-50th | 55th-60th | 60th-65th | ||

*Market percentiles are based on 2011 Radford salary survey data as further explained in Section VII “The Compensation Decision Making Process.”

Annual Merit Increases - Target total cash compensation for executive officers, which includes base pay and variable cash incentive targets, increased an average of 4.6%, or $124,489, on an annual basis during the merit process. The majority of the budget was applied to increasing variable cash incentive targets in order to align executive compensation with our compensation philosophy for both base pay and incentive target cash and to recognize Mr. Bronson for his additional responsibility managing the company's engineering operations and promotion to Chief Operating Officer. As a result of the promotion, Mr. Bronson received equity grants of 6,000 RSUs, 14,000 options and 45,000 LTIP shares.

Executive Officer Promotion and Appointments - During 2011, there were several changes to the senior leadership of the Company, which resulted in the following compensation changes:

• | Mike Dagenais was hired on July 8, 2011 as the Chief Executive Officer with starting cash compensation of $385,000 base pay and a $425,000 variable target pursuant to the Cash Incentive Plan. Equity awards were granted |

16

in the following amounts: 135,000 LTIP shares, 30,000 RSUs and 70,000 options. In addition, Mr. Dagenais' unvested Continuous Computing options were converted to Radisys shares upon the close of the acquisition, resulting in an additional 71,625 options. The combination of Mr. Dagenais' converted and newly granted shares provides for an approximate retentive value of 2.5 times base pay which is above our 2011 goal of 1x base pay.

• | Following the acquisition of Continuous Computing, Mr. Bronson was promoted to the role of President/CFO on July 8, 2011 and received a 7.7% base pay increase, aligning him to the 42nd percentile of market on base pay for the role of President and a new variable target of $300,000 pursuant to the Cash Incentive Plan, aligning him to the 80th percentile on variable target cash for the role of President. In connection with his promotion, Mr. Bronson received grants of 9,000 RSUs and 21,000 options. These grants have helped maintain an approximate retentive value of 1x his base pay. |

Compensation Changes in Alignment of Revised Philosophy - After the Compensation and Development Committee's revisions of the compensation philosophy during the latter half of 2011, further changes were made to compensation.

• | Mr. Dagenais received an increase to both his base salary and variable target percent in recognition that his current total cash compensation was significantly below the 50th percentile for his role as CEO while his demonstrated performance supported total compensation closer to the 50th percentile. Both Radford and Mercer market data for the role of CEO was used to determine the appropriate market target, which was determined to be $500,000 base pay and a 100% of base salary variable target. Mr. Dagenais' base pay was increased to $445,000 and variable target to $445,000, aligning him between the 25th- 30th percentile of market for both base salary and variable target. |

• | Mr. Bronson's variable target was reduced from $300,000 to $280,000 to align his variable target closer to the 50th percentile, per the revised compensation philosophy. |

• | No other changes to executive officer's pay were made during the Compensation and Development Committee's review. The changes were effective January 1, 2012. |

Short-Term Cash Incentive Plan

For 2011, the Cash Incentive Plan was funded at 64.5%. Funding of the Cash Incentive Plan at 100% is based on our strategic non-GAAP operating income target, which is a different target than the Company's annual operating plan. Specifically, the 2011 non-GAAP operating income under the annual operating plan was $17.9 million and actual performance was $15.9 million, or 88% of the annual operating plan, which was also short of our longer-term strategic target of $24 million. Because the longer-term strategic target was not achieved, plan funding was 64.5% of target for the year.

A total of $924,035 was paid to the NEOs via the Cash Incentive Plan during 2011. This amount was 100% funded by the actual 2011 non-GAAP operating income performance relative to target as mentioned above. There were slight adjustments made, relative to the aforementioned formula, to the named executive officers' first half incentive payouts. Mr. Bronson received an additional $10,000 in recognition of his work associated with the acquisition of Continuous Computing and Mr. Major received an additional $3,000 for the additional effort required to outsource manufacturing to our third party manufacturer. Minor adjustments to the NEO's second half incentive payouts included an additional $14,875 for Mr. Dagenais and $13,740 for Mr. Bronson in recognition of their efforts to integrate the company and Continuous Computing. The total of all payouts remained within the funded pool. For 2011, the actual cash incentive payouts for each executive officer were as follows:

2011 Incentive Target at 100% Funding | Actual 2011 Payout | % Attainment | |

*Dagenais, Mike | $212,500 | $153,000 | 72% |

Scott Grout | $476,920 | $295,690 | 62% |

Brian Bronson | $266,365 | $195,714 | 73% |

Anthony Ambrose | $85,680 | $54,835 | 64% |

Christian Lepiane | $180,085 | $111,653 | 62% |

John Major | $177,650 | $113,143 | 64% |

*Mr. Dagenais received $60,000 in August from the 2011 Continuous Computing bonus payout. This payout was determined by the Board of Directors of Continuous Computing and therefore not included in the above.

17

Long-Term Equity Plans

Annual Equity Refresher - For 2011, annual refresher grants of time-based stock were limited to Mr. Major, as Mr. Dagenais received a grant in connection with the acquisition of Continuous Computing, Mr. Bronson received a grant in recognition of his promotion to the President / CFO position, and Mr. Ambrose was no longer employed by the Company at the time of the grants. The Compensation and Development Committee reviewed and approved the select refresher grants. Please refer to the 2011 Grants of Plan Based Awards table for actual share amounts.

Long Term Incentive Plan - On September 30, 2009, the Compensation and Development Committee made the first tranche of grants to participants under the LTIP, with a grant date of October 1, 2009. For this first tranche, the Compensation and Development Committee adopted a target performance goal of non-GAAP earnings per share of $0.75, with performance goal range from $0.65 to $0.85 in increments with payouts ranging from 75% to 125% of the target payout amounts. Non-GAAP earnings per share is measured as the cumulative sum over four consecutive quarters during the first performance period of October 1, 2009 to December 31, 2012. The Compensation and Development Committee reviews performance to goal at the end of each quarter, starting with the quarter that ended September 30, 2010. No payouts were made in 2011 under the LTIP.

Section V: Executive Compensation Philosophy

The Compensation and Development Committee has adopted a philosophy of executive compensation that is based on pay for performance and is competitive with other similar sized, technology companies. Our executive compensation programs are designed to address the following key objectives:

• | To attract and retain executives needed to achieve our business objectives. This objective is achieved through at least annual reviews of executive compensation and benefit programs to ensure market competitiveness. |

• | To substantially link executive compensation with near-term performance on operating plans. This is achieved through cash incentive programs which are directly aligned to key operating goals and strategic objectives. For example, in 2012 minimum performance requirements have been put in place resulting in a steeper risk/reward curve and a zero payout if the minimum level of performance is not achieved. |

• | To provide a reward for longer-term strategic progress and creation of shareholder value. This is achieved through the use of equity-based compensation programs, including the use of performance-based shares. |

Section VI: Compensation Program Descriptions

Base Salary:

As part of the review process, the amount of any annual merit increase to an executive's base salary is determined based on a combination of a Board-approved compensation budget, the current position of the executive's pay against market data and the executive's experience, performance and results during the past year. An executive's base salary is increased if warranted based on the executive's experience, performance and business results, provided the resulting base salary remains within the targeted zone of the market data. By exception, our Compensation and Development Committee may determine that an individual executive's base salary should be above (or below) the targeted zone due to extenuating factors. In this case, the executive's compensation may be outside the targeted zone.

Short-Term Incentives:

Each executive officer is assigned a target amount for the Cash Incentive Plan, expressed as a dollar amount in 2011 and a percentage of base salary starting in 2012. The amounts or percentages are established and reviewed annually against Radford benchmark data for comparable positions and Mercer benchmark data, in addition to Radford, for the CEO position. Executive officer targets, in general, are aligned to the 50th percentile of market. Exceptions may exist based on the executive officer's job responsibilities or experience level.

Payout against targets, as described in Section IV: 2011 Compensation Determinations are mostly attributable to the attainment of a predetermined target level of non-GAAP operating income with modification of such occurring based on individual performance factors. See “Non-GAAP Financial Information” for further information regarding the calculation of non-GAAP operating income. Non-GAAP operating income targets and resulting funding levels are established and approved by the Compensation and Development Committee at the beginning of each year through our annual operating plan process. Actual non-GAAP operating income results measured against these targets determine the size of the available incentive pool. If we under-achieve or over-achieve our objectives for non-GAAP operating income, the incentive pool is

18

adjusted down or up accordingly. In addition, higher or lower achievement of individual annual and strategic objectives impacts an executive officer's payout, but to a lesser extent. The Compensation and Development Committee reviews our Chief Executive Officer's assessment of executive performance and the proposed cash incentive amounts to be paid to each executive. The Compensation and Development Committee ultimately decides the amounts paid to each executive with such quantitative and qualitative modifications as the Compensation and Development Committee may make at its discretion.

The Compensation and Development Committee establishes the maximum payout which could be made on an annual basis at the beginning of the year. For example, the maximum payout which could have been made in 2011 was two times the targeted amount. Individual objectives for each executive officer are developed by the Chief Executive Officer in consultation with the affected executive and then reviewed by the Compensation and Development Committee.

Long-Term Incentives:

Long-term equity incentives in the form of stock options, restricted stock, and performance-based shares are awarded to executive officers because they are a highly effective way to align the interests of management and shareholders, and to motivate management to drive long-term shareholder value.

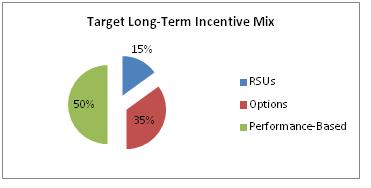

Radford benchmark data for comparable executive positions is used to establish total equity market values at the time of grant. Total annual grant values, including options, RSUs and performance-based shares are targeted to be between the 50th - 75th percentiles of market. Since performance-based shares are not granted on an annual basis, the total grant value may be allocated across multiple years (i.e. the performance period). The Black-Scholes methodology is used for valuing options and the grant date fair value is used for valuing both RSUs and performance-based shares. The targeted grant mix is 50% time-based, of which 70% are options and 30% are RSUs, and 50% performance-based shares.

Time-based equity incentives are granted under the Radisys Corporation 2007 Stock Plan (the "2007 Stock Plan") for annual refresh, promotion and retentive purposes. Refresher grants are typically made in the fall after shareholder approval of additional shares. Because inducement grants were made in 2011 in connection with the acquisition of Continuous Computing, refresher grants were only made to previous Radisys executive officers. In addition to reviewing benchmark data to determine time-based grants, the retentive value of past grants for each executive is reviewed to ensure that the value of unvested equity grants is in line with benchmarks and is of sufficient value to retain and provide strong performance incentive for the executive in future years. All equity grants to newly hired executives and refresher grants to existing executives are reviewed and approved by our Compensation and Development Committee, on the recommendation of the Chief Executive Officer, using the above mentioned factors of market data, the total retention value, and the executive's projected level of future contribution. Grants of equity awards are made at predetermined times and are not intentionally scheduled to coincide with the disclosure of favorable or unfavorable information. Each year we review whether refresher grants are necessary to continue to motivate management and employees while providing long-term incentives.

The Radisys Long-Term Incentive Plan provides performance-based RSUs, intended to create an incentive for exceptional financial performance. LTIP awards vest only upon achievement of certain financial or strategic metrics. Threshold targets have been established by our Compensation and Development Committee to ensure a minimum level of

19

achievement for payout. LTIP targets are intended to be "stretch" goals above the targets in our operating plan and require superior corporate performance to be earned. With respect to the allocation of performance-based shares from the LTIP, the first tranche of grants was made by the Compensation and Development Committee in September 2009. No new tranches of grants were made in 2011.

The Board of Directors revised the officer ownership guidelines in January 2012. Executive officers are now expected to acquire and hold a minimum number of shares equal to a base pay multiple of their annual base salary (CEO=3x, President=2x, NEOs=1x). The minimum amount is expected to be reached within three to five years from January 2012 or three to five years from joining us or being promoted to an executive role. Of our current executive officers, one has already reached this ownership goal.

Section VII: The Compensation Decision Making Process

Compensation and Development Committee

Our Board of Directors has delegated responsibility to the Compensation and Development Committee for final approval of decisions related to base salary, cash incentive targets, equity grants and payments for executive incentive plans, as well as any executive employment offers, executive change of control agreements, severance agreements and other executive compensation programs. The Committee also guides executive development programs and succession planning in order to maintain and develop the Company's leadership team. The Committee maintains an annual calendar to guide the timing of its review, analysis, and decision making related to executive compensation, benefits, and development programs.

The Committee conducts a formal review of each executive's compensation on an annual basis as part of the Company-wide merit review process or more frequently if needed. The review consists of the Committee comparing the cash and equity components of each executive's pay to market data for similar positions; considering recommendations provided by the Chief Executive Officer, President and Chief Financial Officer and Human Resources staff; assessing individual performance; and aligning any pay changes with market and Company performance. The Committee reviews the mix of base salary, incentive cash compensation and equity compensation, but does not attempt to target a specific percentage allocation as each compensation element is compared to market survey data. The Committee believes that the amount of "at risk" compensation tied to meeting company objectives should increase as an executive's compensation and level of responsibility increases. "Tally sheets" are used to consider and evaluate the total potential compensation of executives from all sources upon various scenarios and any benefits associated with termination of employment. Based on this analysis, the Committee is able to make market based decisions that are aligned to the Company's financial and strategic direction.

The Committee and the Chairman of the Board assess the performance of our Chief Executive Officer annually. The Chief Executive Officer performance review process includes a Chief Executive Officer's self-appraisal, a formal Board of Directors evaluation process as well as a performance appraisal delivered by the Chairman of the Board of Directors.

Chief Executive Officer and Management

Under the supervision of the Compensation and Development Committee, our Chief Executive Officer, President and Chief Financial Officer and Human Resources staff have responsibility for the implementation of our executive compensation programs. The Committee reviews the recommendation from the Chief Executive Officer and makes all final compensation decisions. Our Chief Executive Officer is responsible for assessing the performance of each executive reporting to him.

Surveys and Benchmarking

The Radford executive survey is the primary data source for executive compensation market data. The market, for the purposes of executive compensation benchmarking, is defined as high-technology companies with average revenues of $200M to $499M. A list of the companies included in our Radford survey market cut is set forth in Exhibit 99.1.

Radford is a division of Aon Corporation that publishes an independent executive compensation survey and offers consulting services. We believe the Radford executive survey is a leading resource in the technology industry on competitive intelligence for technology executives in the U.S. and provides a reliable market benchmark for our executive positions. The Radford executive survey includes data from over 900 companies and more than 17,600 incumbents representing a wide range of technology sub-industries. The Committee did not use a formal peer group in determining executive compensation in 2011 because it was determined that a well-defined group of comparable publicly-traded companies in the United States operating in the same industry did not exist. For 2012, with a newly defined business strategy to be the world's premier

20

provider of embedded wireless infrastructure solutions, the Committee will be re-looking at defining a peer group. The Committee still believes that the broad technology industry comparison provided by the Radford salary survey is appropriate for executive compensation benchmarking, while a peer list will provide a secondary source which will includes the pay for performance linkage.

To ensure accurate data collection based on actual job duties, our executive positions are individually benchmarked with the Radford survey data using a detailed review of the job responsibilities and scope for each executive role as defined by their job descriptions.

Compensation Consultant