Attached files

Table of Contents

As filed with the Securities and Exchange Commission on April 26, 2012

Registration No. 333-173709

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 11

to

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

WAGEWORKS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 8742 | 94-3351864 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1100 Park Place, 4th Floor

San Mateo, California 94403

(650) 577-5200

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Joseph L. Jackson

Chief Executive Officer

1100 Park Place, 4th Floor

San Mateo, California 94403

(650) 577-5200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David J. Segre, Esq. Mark B. Baudler, Esq. Todd C. Carpenter, Esq. Wilson Sonsini Goodrich & Rosati, Professional Corporation 650 Page Mill Road Palo Alto, CA 94304 (650) 493-9300 |

Kimberly L. Jackson, Esq. Senior Vice President, General Counsel and Secretary 1100 Park Place, 4th Floor San Mateo, California 94403 (650) 577-5200 |

Christopher L. Kaufman, Esq. Tad J. Freese, Esq. Latham & Watkins LLP 140 Scott Drive Menlo Park, CA 94025 (650) 328-4600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | |||

| Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee (3) | ||||

| Common Stock $0.001 par value |

7,475,000 | $12.00 | $89,700,000 | $10,279.62 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of additional shares, if any, that may be purchased by the underwriters. |

| (3) | The Registrant previously paid $10,783.90 in connection with the original filing of this Registration Statement, initially filed with the Commission on April 25, 2011 and the filing of Amendment No. 4 to this Registration Statement, filed on July 19, 2011. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 26, 2012

Prospectus

6,500,000 Shares

Common Stock

This is WageWorks, Inc.’s initial public offering. We are selling 6,500,000 shares of our common stock.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $10.00 and $12.00 per share. Our common stock has been approved for listing on the New York Stock Exchange under the symbol “WAGE.”

The underwriters have an option to purchase a maximum of 975,000 additional shares to cover over-allotments of shares.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” on page 11 of this prospectus.

| Per Share |

Total | |||

| Public Offering Price |

$ | $ | ||

| Discounts and commissions to underwriters(1) |

$ | $ | ||

| Offering proceeds to WageWorks, Inc., before expenses |

$ | $ |

Delivery of the shares of common stock will be made on or about , 2012.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| William Blair |

Stifel Nicolaus Weisel |

| JMP Securities | Needham & Company |

The date of this prospectus is , 2012.

Table of Contents

WageWorks®

> Flexible Spending Accounts

> Commuter Benefits

> Health Savings Accounts

> Health Reimbursement Arrangements

> COBRA

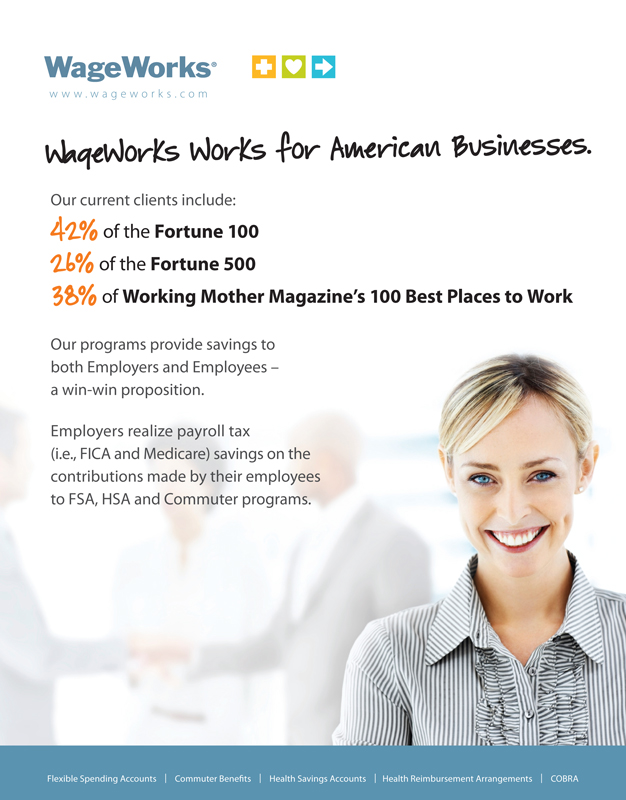

Our programs provide material savings to both Employers and Employees – a win-win proposition.

Employees reduce their taxes by participating in FSA, HSA and Commuter programs.

Fantastic.

Just what working families need.

WageWorks®

Health Care Card

4000 1234 5678 9010

4000

GOOD THRU 12/11

JOHN R. SMITH

DEBIT

VISA

WageWorks®

Commuter Card

TRANSIT

5150 4099 9123

5150

Debit

4567

MasterCard

VALID THRU 12/11

JOHN R. SMITH

www.wageworks.com

Table of Contents

| Page | ||||

| 1 | ||||

| 7 | ||||

| 8 | ||||

| 11 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

40 | |||

| 75 | ||||

| Page | ||||

| 94 | ||||

| 102 | ||||

| 122 | ||||

| 126 | ||||

| 129 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

133 | |||

| 137 | ||||

| 139 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or contained in any related free writing prospectus filed by us with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information that is different from that contained in this prospectus or contained in any related free writing prospectus filed by us with the Securities and Exchange Commission. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

-i-

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” and the consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision.

Company Overview

We are a leading on-demand provider of tax-advantaged programs for consumer-directed health, commuter and other employee spending account benefits, or CDBs, in the United States. We administer and operate a broad array of CDBs, including spending account management programs, such as health and dependent care Flexible Spending Accounts, or FSAs, Health Savings Accounts, or HSAs, Health Reimbursement Arrangements, or HRAs, and commuter benefits, such as transit and parking programs.

We deliver our CDB programs through a highly scalable Benefits-as-a-Service, or BaaS, delivery model that employer clients and their employee participants may access through a standard web browser on any internet-enabled device, including computers, smart phones and other mobile devices, such as tablet computers. Our on-demand delivery model eliminates the need for our employer clients to install and maintain hardware and software in order to support CDB programs and enables us to rapidly implement product enhancements across our entire user base.

Our CDB programs enable employees and their families to save money by using pre-tax dollars to pay for certain of their healthcare and commuter expenses. Employers financially benefit from our programs through reduced payroll taxes, even after factoring in our fees. Under our FSA, HSA and commuter programs, employee participants contribute funds from their pre-tax income to pay for qualified out-of-pocket healthcare expenses not fully covered by insurance, such as co-pays, deductibles and over-the-counter medical products or for commuting costs.

These employee contributions result in savings to both employees and employers. As an example, based on our average employee participant’s annual FSA contribution of approximately $1,400 and an assumed personal combined federal and state income tax rate of 35%, an employee participant will reduce his or her taxes by approximately $490 per year by participating in an FSA. Our employer clients also realize payroll tax (i.e., FICA and Medicare) savings on the pre-tax contributions made by their employees. In the above FSA example, an employer client would save approximately $64 per participant per year, even after the payment of our fees.

Under our HRA programs, employer clients provide their employee participants with a specified amount of available reimbursement funds to help their employee participants defray out-of-pocket medical expenses, such as deductibles, co-insurance and co-payments. All amounts paid by the employer into HRAs are deductible by the employer as an ordinary business expense and are tax-free to the employee.

Our clients include 42 of the Fortune 100, 130 of the Fortune 500 and approximately 3,200 small-and-medium-sized business, or SMB, clients. At January 31, 2012, we had approximately 2.0 million employee participants from approximately 5,000 employer clients. We believe that January 31 is the most appropriate point-in-time measurement date for annual plan metrics. Although plan changes and the entry and exit of employers and participants from our programs are usually decided late in the calendar year during open enrollment to be effective on January 1, it is not unusual for employers to still be submitting updated files of participants in early January. While updates can be delayed past January, any changes from such late updates are usually minimal. Consequently, we believe the January 31 point-in-time measurement date is the most appropriate date to use as a baseline. In 2011, employee participants used over two million WageWorks prepaid debit cards. Our revenues are highly diversified, as our largest client represented only 3.0% of our 2011 revenues

Table of Contents

and our top 10 clients represented only 14.4% of our 2011 revenues. None of the data included herein reflect the two transactions that we have made in 2012. For a discussion of these transactions, see “—Recent Developments” below.

Through a combination of the acquisition and integration of smaller third party administrators, or TPAs, which we refer to as portfolio purchases, and organic growth, we grew our revenue from $108.5 million in 2009 to $115.0 million in 2010 and to $135.6 million in 2011. In each period, our revenue growth resulted primarily from increases in healthcare revenue from portfolio purchases. For each of 2009, 2010 and 2011, clients that accounted for more than 90% of our revenues (excluding interchange fees and vendor commissions) during the year remained under contract with us in the succeeding year. Our net loss was $0.6 million and $17.3 million in the years 2009 and 2010, respectively, and our net income was $33.3 million in 2011. Our Adjusted EBITDA grew from $15.9 million in 2009 to $22.4 million in 2010 and to $30.3 million in 2011, increases of 40% and 36%, respectively. For a discussion of Adjusted EBITDA and a reconciliation of net income (loss) to Adjusted EBITDA, see footnote 2 to “Selected Consolidated Financial Information.”

Industry Overview

Healthcare costs for both employers and employees continue to increase dramatically. To mitigate the continuing rise in healthcare costs, employers are more frequently passing these costs on to employees by increasing deductibles, out-of-pocket limits and non-network provider cost sharing, and by migrating to co-insurance models–systems where employees pay a percentage of the out-of-pocket costs for each healthcare service. As a result, according to a 2011 Hewitt Associates report, average employee out-of-pocket healthcare costs are expected to increase 13.4% from 2011 to 2012.

In addition, rising transportation costs and increasing corporate social responsibility have led to the creation of a variety of programs that are aimed at helping employees understand and reduce their carbon footprint by encouraging alternatives to driving to work. These alternatives include carpooling, cycling and use of public transportation. According to a 2011 American Public Transportation Association report, public transportation is twice as fuel efficient as private automobiles at reducing annual fuel consumption.

CDBs have emerged as an attractive way for employers to offer structured benefit plans to their employees that lessen overall healthcare and transportation costs through the use of tax-advantaged spending accounts.

Employee-funded tax-advantaged spending accounts include:

| • | FSAs, which allow employees to set aside a portion of earnings on a pre-tax basis to pay for certain expenses primarily related to healthcare, but also cover dependent care, vision and dental expenses; |

| • | HSAs, which allow employees to set aside pre-tax earnings for similar expenses, but are available only to individuals who are enrolled in a qualified High Deductible Health Plan; and |

| • | Commuter accounts, which allow employee participants to set aside earnings on a pre-tax basis to cover commuter rail, subway, bus, commuter-related parking and eligible vanpool expenses. |

Employer-funded tax-advantaged spending accounts include:

| • | HRAs, which allow employer clients to provide their employee participants with a specified amount of available reimbursement funds to help their employee participants defray out-of-pocket medical expenses, such as deductibles, co-insurance and co-payments. All amounts paid by the employer into HRAs are deductible by the employer as an ordinary business expense and are tax-free to the employee. |

Our CDB Programs

We focus on providing CDB programs to employer clients of any size. We provide marketing programs that are designed to increase employee participation in our employer clients’ CDB offerings. We believe our employer

-2-

Table of Contents

clients and their employee participants benefit from our superior customer service, efficient workflow processes and advanced monitoring applications. The quality of our customer support has resulted in high levels of client satisfaction and service level performance. We employ a wide range of sophisticated tools to communicate available benefit options to employees and measure the effectiveness of CDB program performance.

We deliver our CDB programs through a BaaS model under which we host and maintain the benefits programs that we provide to our employer clients. Our on-demand delivery model enables employer clients and their employee participants to implement, access and use our proprietary software remotely through a standard web browser on any internet-enabled device, including computers, smart phones and other mobile devices, such as tablet computers. We believe that our on-demand model requires less up-front investment by our employer clients than required by traditional third-party software and hardware options, as well as less personnel resources and implementation services.

Key Business Attributes

Key attributes of our business include the following:

| • | Our revenue is derived almost entirely from recurring monthly fees paid by our employer clients. |

| • | Our focus is to consistently deliver the highest quality service to our employer clients and their employee participants, which primarily means providing employee participants with timely and accurate responses to their inquiries, claims submissions and other account transactions. |

| • | Our CDB programs employ an easy-to-use website interface that provides our employer clients with robust data and reporting capabilities and provides employee participants with direct access to their accounts, claims history and balance information. |

| • | We have historically successfully identified and executed portfolio purchases and integrated the operations of these complementary businesses to expand our employer client base. While we have encountered some challenges in integrating accounting functions in connection with certain of these portfolio purchases, we have leveraged the efficiencies afforded by our on-demand software platform to cross-sell additional CDB products and services to acquired employer clients. We expect to experience similar effects from our recent acquisition that we completed in early 2012. |

| • | Our senior management team has significant operating and service delivery experience with industry-leading businesses. |

| • | We have a large and highly diversified employer client base. |

| • | Our core business is providing a comprehensive array of full-featured CDB programs to employers. |

Our Strategy

Our objective is to enhance our position as a leading provider of CDB account management programs. The key elements of our growth strategy are to:

| • | increase employee participation levels within our existing employer client base; |

| • | cross-sell additional CDB programs to our existing employer clients; |

| • | broaden our employer client base through portfolio purchases; |

| • | gain market share with both Fortune 1000 companies and SMBs by leveraging our multiple sales channels; and |

| • | continually enhance our products and develop new products and functionality. |

-3-

Table of Contents

Recent Developments

Recent Transactions

On January 3, 2012, we completed a portfolio purchase in which we acquired all of the operating assets of The Choice Care Card, LLC, also known as Choice Strategies, or CS, a third party administrator of predominantly SMB HRA accounts, based in Vermont. CS added approximately 5,100 employer clients, primarily in New England, to our business.

On February 1, 2012, we acquired all of the operating assets of TransitCenter, Inc., a New York-based not for profit entity that conducted a business that we refer to as TransitChek, or TC, that provided commuter benefit services to approximately 10,000 predominantly SMB employer clients in the New York tri-state area. The acquisition of TC enabled us to further expand our commuter tax-advantaged benefit offerings in the SMB market with products tailored to SMB needs. We believe this acquisition will help solidify our position as a leading provider of commuter-related CDBs.

The consideration for these two transactions totaled $39.9 million. Of this amount, $39.1 million was paid in January and February 2012. These payments were primarily financed through our revolving credit facility with Union Bank, N.A. There are additional possible contingent payments due in 2012 and 2013 based on the achievement of certain revenue levels. We currently anticipate that the future contingent payments for these two transactions will total approximately $15 million to $17 million, based on the estimated CS revenue for 2012 and 2013 and the estimated TC revenue for the first half of 2012. However, this estimate may change, potentially materially, based on the actual revenue milestones achieved.

In April 2012, we entered into a channel partner arrangement with American Family Life Assurance Company, or Aflac, pursuant to which Aflac’s FSA and commuter account administration business will be transitioned to us by the end of calendar year 2012. The transition of employer clients is expected to take place primarily between July and September. In conjunction with the transition, Aflac and we also entered into a separate reseller arrangement pursuant to which Aflac agents will sell our FSA, HRA, HSA, commuter and COBRA at agreed prices and commission levels to new employers going forward.

We expect the incremental annual revenue associated with this transaction to be between $4 million and $7 million. The timing of the transition of revenue to WageWorks and the one time conversion payments to Aflac are dependent upon the employer clients executing new agreements, a process controlled by our new channel partner. The conversion payments will be calculated as a function of the expected annual revenue for each employer client and will approximate the expected annualized revenue for the existing Aflac customer relationships. These one time conversion payments will be capitalized and amortized over the expected life of the relationships. We will also incur approximately $0.5 million to $0.8 million of one-time transition costs, primarily cost of revenue expenses, to prepare for the additional volume.

Preliminary Estimated Financial Data for the Quarter Ended March 31, 2012

Our consolidated financial data for the quarter ended March 31, 2012 has not been finalized. Our preliminary estimated financial data for the first quarter set forth below are based upon our estimates and subject to completion of our financial closing procedures. This data has been prepared by, and is the responsibility of, management. Our independent registered public accounting firm, KPMG LLP, has not audited, reviewed, compiled or performed any procedures, and does not express an opinion or any other form of assurance with respect to the data. The estimated data are not a comprehensive statement of our financial results for this period and our actual results upon completion of our financial close procedures may differ materially from these estimates.

-4-

Table of Contents

The following data are preliminary estimates for the quarter ended March 31, 2012:

GAAP

| • | We expect revenue to be between $43.5 million and $44.5 million, as compared to $35.3 million for the first quarter of 2011. The estimated increase in revenue is primarily due to post-purchase revenue from our TC acquisition and CS portfolio purchase, which were acquired in February 2012 and January 2012, respectively. In addition, there was an increase of approximately $1.2 million in interchange revenue due to increased debit card usage and to an increase in the number of debit cards issued. |

| • | We expect income from operations to be between $3.0 million and $4.0 million as compared to $3.4 million for the first quarter of 2011. The estimated change in income from operations compared to the corresponding period in 2011 is primarily due to the TC acquisition and CS portfolio purchase, offset in large part by the $1.3 million increase in contingent consideration due to greater than anticipated revenue growth related to our PBS portfolio purchase. |

| • | We expect net income to be between $1.2 million and $2.2 million as compared to a net income of $3.0 million for the first quarter of 2011. The estimated decline in net income is due to a higher effective tax rate in the first quarter of 2012 as a result of the release of our $25.9 million valuation allowance in the fourth quarter of 2011. |

Non-GAAP

| • | We expect Adjusted EBITDA to be between $8.7 million and $9.7 million, as compared to $7.3 million for the first quarter of 2011. The estimated increase is primarily due to our TC acquisition and CS portfolio purchase. The following table provides a reconciliation of net income and estimated income to Adjusted EBITDA: |

| Three Months Ended March 31, |

||||||||

| 2011 | 2012 (estimated) |

|||||||

| (in millions) (unaudited) |

||||||||

| Net income |

$ | 3.0 | $ | 1.2-$2.2 | ||||

| Depreciation |

0.9 | 0.7 | ||||||

| Amortization and change in contingent consideration |

2.5 | 4.4 | ||||||

| Stock-based compensation expense |

0.6 | 0.6 | ||||||

| Interest income |

— | — | ||||||

| Interest expense |

0.1 | 0.4 | ||||||

| Income tax provision |

0.1 | 1.4 | ||||||

| Loss on revaluation of warrants |

0.1 | — | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 7.3 | $ | 8.7-$9.7 | ||||

|

|

|

|

|

|||||

Risks Affecting Us

Our business is subject to a number of risks that you should understand before making an investment decision. These risks are discussed more fully in “Risk Factors” following this prospectus summary. Some of these risks include the following:

| • | any diminution in, elimination of, or change in the availability of, tax-advantaged consumer-directed benefits to employees would materially adversely affect our results of operations, financial condition, business and prospects; |

| • | our ability to grow our business could be materially adversely affected if we fail to successfully identify, acquire or integrate additional portfolio purchase or acquisition targets; |

| • | our business may not grow if our marketing efforts do not successfully raise awareness among employers and employees about the advantages of adopting and participating in CDB programs; |

5

Table of Contents

| • | our results of operations, financial condition, business and prospects would be materially adversely affected if we are unable to retain and expand our employer client base; |

| • | our business may not grow if a greater percentage of employees do not participate in our employer clients’ CDB programs; |

| • | our business and prospects may be materially adversely affected if we are unable to cross-sell our products and services; |

| • | we may be unable to compete effectively against our current and future competitors; and |

| • | we may not accurately estimate the impact of the development and introduction of new products and services on our business. |

Risks Related to this Offering and Ownership of Our Common Stock

There are risks related to this offering and the ownership of our common stock that you should understand before making an investment decision, including that, following the completion of this offering and assuming no exercise by the underwriters of their overallotment option, VantagePoint Capital Partners will hold approximately 52.8% of our common stock and will have the right to designate three members of our board of directors, as well as other rights, which may limit the ability of our public stockholders to affect significant corporate actions. These risks are discussed more fully in “Risk Factors” following this prospectus summary.

Corporate Information

We were incorporated in Delaware in 2000. Our principal executive offices are located at 1100 Park Place, 4th Floor, San Mateo, CA 94403, U.S.A., and our telephone number is 1 (650) 577-5200. Our website address is www.wageworks.com. Information contained on our website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus.

“WageWorks,” “Commuter Express,” “WinFlexOne,” “Fringe Benefits Management Company,” “Choice Strategies,” “TransitChek” and other trademarks, service marks or trade names of WageWorks appearing in this prospectus are the property of WageWorks, Inc. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

-6-

Table of Contents

| Common stock offered by us |

6,500,000 shares |

| Common stock to be outstanding after this offering |

25,733,567 shares |

| Overallotment option |

The underwriters have an option to purchase a maximum of additional shares of common stock from us to cover overallotments. The underwriters could exercise this option at any time within 30 days from the date of the prospectus. |

| Use of proceeds |

We intend to use the net proceeds received by us from this offering for working capital, including funding of customer obligations, and general corporate purposes, including further expansion of our sales and marketing efforts, continued investments in technology and development and for capital expenditures. In addition, we may use a portion of the proceeds of this offering for portfolio purchases or purchases of technologies or assets to expand our employer client base. However, we do not have agreements for any portfolio purchases at this time. See “Use of Proceeds.” |

| NYSE trading symbol |

“WAGE” |

The number of shares of common stock that will be outstanding after this offering is based on the number of shares outstanding as of March 31, 2012 and excludes:

| • | 5,285,433 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2012, at a weighted average exercise price of $7.64 per share; |

| • | 75,000 shares of common stock issuable upon the exercise of a warrant outstanding as of March 31, 2012 to purchase common stock, at an exercise price of $8.20 per share; |

| • | 4,578,567 shares of common stock, on an as-converted basis and assuming the conversion occurs immediately prior to the completion of this offering, issuable upon the exercise of warrants outstanding as of March 31, 2012 to purchase convertible preferred stock, at a weighted average exercise price of $4.76 per share; and |

| • | 270,725 shares of common stock reserved for future issuance under our 2010 Equity Incentive Plan as of March 31, 2012. |

All information in this prospectus reflects a 1-for-2 reverse stock split of our outstanding common stock effected on July 15, 2011.

Unless otherwise indicated, all information in this prospectus assumes:

| • | the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 17,687,612 shares of common stock, effective upon the completion of this offering, except with respect to historical financial information; and |

| • | no exercise by the underwriters of their overallotment option to purchase up to 975,000 additional shares of common stock from us. |

-7-

Table of Contents

Summary Consolidated Financial Data

The information set forth below should be read together with “Capitalization,” “Selected Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

The summary consolidated statements of operations data for the years ended December 31, 2009, 2010 and 2011 have been derived from our audited consolidated financial statements, which are included elsewhere in this prospectus. The following summary consolidated financial data table reflects the 1-for-2 reverse stock split of our outstanding common stock effected on July 15, 2011. Historical results are not necessarily indicative of the results to be expected in the future.

| Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands, except per share data) | ||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||

| Revenues |

$ | 108,461 | $ | 115,047 | $ | 135,637 | ||||||

| Operating expenses |

107,992 | 107,013 | 122,077 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

469 | 8,034 | 13,560 | |||||||||

| Interest and other expense, net |

(608 | ) | (26,488 | ) | (107 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before taxes |

(139 | ) | (18,454 | ) | 13,453 | |||||||

| Income tax (provision) benefit |

(495 | ) | 1,204 | 19,868 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

(634 | ) | (17,250 | ) | 33,321 | |||||||

| Accretion of redemption premium (expense) benefit |

1,037 | (6,740 | ) | (6,209 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) attributable to common stockholders |

$ | 403 | $ | (23,990 | ) | $ | 27,112 | |||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) per share attributable to common stockholders: |

||||||||||||

| Basic |

$ | 0.25 | $ | (15.70 | ) | $ | 17.65 | |||||

| Diluted |

$ | (0.04 | ) | $ | (15.70 | ) | $ | 1.43 | ||||

| Weighted Average Shares: |

||||||||||||

| Basic |

1,606 | 1,528 | 1,536 | |||||||||

| Diluted |

16,864 | 1,528 | |

20,086 |

| |||||||

| Pro forma net income per share attributable to common stockholders (unaudited): |

||||||||||||

| Basic(1) |

$ | 1.72 | ||||||||||

| Diluted(1) |

$ | 1.45 | ||||||||||

| Pro forma weighted average shares outstanding used in computing net income per share attributable to common stockholders (unaudited): |

||||||||||||

| Basic(1) |

|

19,224 |

| |||||||||

| Diluted(1) |

|

22,734 |

| |||||||||

| (1) | See Note 2 to our consolidated financial statements for an explanation of the method used to calculate the unaudited pro forma basic and diluted net income per share for the year ended December 31, 2011. All shares to be issued in the offering were excluded from the unaudited pro forma basic and diluted net income per share calculation. |

-8-

Table of Contents

| At December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 93,261 | $ | 104,280 | $ | 154,621 | ||||||

| Total current assets |

108,515 | 124,337 | 179,829 | |||||||||

| Total assets |

171,478 | 206,831 | 278,696 | |||||||||

| Total current liabilities |

153,303 | 167,648 | 215,645 | |||||||||

| Total liabilities |

167,430 | 182,254 | 218,584 | |||||||||

| Total redeemable convertible preferred stock |

48,043 | 75,960 | 82,169 | |||||||||

| Total stockholders’ deficit |

(43,995 | ) | (51,383 | ) | (22,057 | ) | ||||||

| Years Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Non-GAAP Financial Data: |

||||||||||||

| Adjusted EBITDA (unaudited) |

$ | 15,941 | $ | 22,366 | $ | 30,330 | ||||||

Notes to Summary Balance Sheet Data and Other Data

Definition of Adjusted EBITDA

Adjusted EBITDA is a performance measure that is not calculated in accordance with GAAP. The table immediately following this discussion provides a reconciliation of net income (loss) to Adjusted EBITDA, which is the most directly comparable GAAP measure. Adjusted EBITDA should not be considered as an alternative to net income, income from operations or any other measure of financial performance calculated and presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of other companies because other companies may not calculate Adjusted EBITDA or similarly titled measures in the same manner that we do. We prepare Adjusted EBITDA to eliminate the impact of items that we do not consider indicative of our core operating performance. We encourage you to evaluate these adjustments, the reasons we consider them appropriate and the material limitations of Adjusted EBITDA as described in footnote 2 to “Selected Consolidated Financial Information.”

Our management uses Adjusted EBITDA:

| • | as a measure of operating performance; |

| • | as a factor when determining management’s compensation; |

| • | for planning purposes, including the preparation of our annual operating budget; |

| • | to allocate resources of our business; and |

| • | to evaluate the effectiveness of our business strategies. |

We believe that the use of Adjusted EBITDA provides consistency and comparability with our past financial performance and facilitates period-to-period comparisons of our operating results by management and investors. Although calculation of Adjusted EBITDA may vary from company-to-company, our detailed presentation may facilitate analysis and comparison of our operating results by management and investors with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results in their public disclosures.

-9-

Table of Contents

Reconciliation of Net Income (Loss) to Adjusted EBITDA

The following provides a reconciliation of net income (loss) to Adjusted EBITDA:

| Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| (unaudited) | ||||||||||||

| Net income (loss) |

$ | (634 | ) | $ | (17,250 | ) | $ | 33,321 | ||||

| Depreciation |

4,564 | 4,164 | 3,199 | |||||||||

| Amortization and change in contingent consideration |

8,398 | 7,764 | 11,327 | |||||||||

| Stock-based compensation expense |

2,510 | 2,404 | 2,244 | |||||||||

| Interest income |

(851 | ) | (220 | ) | (36 | ) | ||||||

| Interest expense |

1,102 | 188 | 494 | |||||||||

| Interest expense: amortization of convertible debt discount |

71 | 21,107 | — | |||||||||

| Income tax provision (benefit) |

495 | (1,204 | ) | (19,868 | ) | |||||||

| Loss (gain) on revaluation of warrants |

(70 | ) | 5,413 | (351 | ) | |||||||

| Loss on extinguishment of debt |

356 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 15,941 | $ | 22,366 | $ | 30,330 | ||||||

|

|

|

|

|

|

|

|||||||

-10-

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

Our business is dependent upon the availability of tax-advantaged consumer-directed benefits to employers and employees and any diminution in, elimination of, or change in the availability of, these benefits would materially adversely affect our results of operations, financial condition, business and prospects.

Our business fundamentally depends on employer and employee demand for tax-advantaged consumer-directed health, commuter and other employee spending plan benefits, or CDBs. We are not aware of any reliable statistics on the growth of CDB programs and cannot assure you that participation in CDB programs will grow. Any diminution in or elimination of the availability of CDBs for employees would materially adversely affect our results of operations, financial condition, business and prospects. In addition, incentives for employers to offer CDBs may also be reduced or eliminated by changes in laws that result in employers no longer realizing financial gain from the implementation of these benefits. If employers cease to offer CDB programs or reduce the number of programs they offer to their employees, our results of operations, financial condition, business and prospects would also be materially adversely affected.

In addition, if the payroll tax savings employers currently realize from their employees’ utilization of CDBs become reduced or unavailable, employers may be less inclined to offer these programs to their employees. If the tax savings currently realized by employee participants by utilizing CDBs were reduced or unavailable, we expect employees would correspondingly reduce or eliminate their participation in such CDB plans. Any such reduction in employer or employee incentives would materially adversely affect our results of operations, financial condition, business and prospects.

Future portfolio purchases and acquisitions are an important aspect of our growth strategy, and any failure to successfully identify, acquire or integrate acquisitions or additional portfolio targets could materially adversely affect our ability to grow our business. In addition, costs of integrating acquisitions and portfolio purchases may adversely affect our results of operations in the short term.

Our recent growth has been, and our future growth will be, substantially dependent on our ability to continue to make and integrate acquisitions and complementary portfolio purchases to expand our employer client base and service offerings. Since 2007, we have completed five portfolio purchases and one acquisition, including one portfolio purchase and one acquisition in 2012. The successful integration of these portfolio purchases and acquisitions into our operations on a cost-effective basis is also critical to our future financial performance. While we believe that there are numerous potential portfolio purchases that would add to our employer client base and service offerings, we cannot assure you that we will be able to successfully make a sufficient number of such portfolio purchases in a timely and effective manner in order to support our growth objectives. In addition, the process of integrating portfolio purchases and our most recent acquisition may create unforeseen difficulties and expenditures. We face various risks in making portfolio purchases and any acquisition, including:

| • | our ability to retain acquired employer clients and their associated revenues; |

| • | diversion of management’s time and focus from operating our business to address integration challenges; |

| • | our ability to retain or replace key employees from acquisitions and portfolios we acquire; |

-11-

Table of Contents

| • | cultural and logistical challenges associated with integrating employees from acquired portfolios into our organization; |

| • | our ability to integrate the combined products, services and technology; |

| • | the migration of acquired employer clients to our technology platforms; |

| • | our ability to cross-sell additional CDB programs to acquired employer clients; |

| • | our ability to realize expected synergies; |

| • | the need to implement or improve internal controls, procedures and policies appropriate for a public company at businesses that, prior to the portfolio purchase or acquisition, may have lacked effective controls, procedures and policies, including, but not limited to, processes required for the effective and timely reporting of the financial condition and results of operations of the acquired business, both for historical periods prior to the acquisition and on a forward-looking basis following the acquisition; |

| • | possible write-offs or impairment charges that result from acquisitions and portfolio purchases; |

| • | unanticipated or unknown liabilities that relate to purchased businesses; |

| • | the need to integrate purchased businesses’ accounting, management information, human resources, and other administrative systems to permit effective management; and |

| • | any change in one of the many complex federal or state laws or regulations that govern any aspect of the financial or business operations of our business and businesses we acquire, such as state escheatment laws. |

Portfolio purchases and acquisitions may have a short-term material adverse impact on our results of operations, including a potential material adverse impact on our cost of revenues, as we seek to migrate acquired employer clients to our proprietary technology platforms, typically over the succeeding 12 to 24 months, in order to achieve additional operating efficiencies. For example, our cost of revenues in the fourth quarter of 2010 included additional expenses of $1.8 million due to the purchases of Planned Benefit Systems, or PBS, and the CDB assets of a division of Fringe Benefits Management Company, or FBM. We expect an increase in the dollar amount of cost of revenues in 2012 related to our CS and TC transactions.

Our business may not grow if our marketing efforts do not successfully raise awareness among employers and employees about the advantages of adopting and participating in CDB programs.

Our revenue model is substantially based on the number of employee participants enrolled in the CDB programs that we administer. We devote significant resources to educating both employers and their employees on the potential cost savings available to them from utilizing CDB programs. We have created various marketing, educational and awareness tools to inform employers about the benefits of offering CDB programs to their employees and how our services allow them to offer these benefits in an efficient and cost effective manner. We also provide marketing information to employees that informs them about the potential tax savings they can achieve by utilizing CDB programs to pay for their healthcare, commuter and other benefit needs. However, if more employers and employees do not both become aware of or understand these potential cost savings and choose to adopt CDB programs, our results of operations, financial condition, business and prospects may be materially adversely affected.

If we are unable to retain and expand our employer client base, our results of operations, financial condition, business and prospects would be materially adversely affected.

Most of our revenue is derived from the long term, multi-year agreements that we typically enter into with our employer clients. The initial subscription period is typically three years for our larger employer clients, which we refer to as enterprise clients, and one year for our small- and medium-sized business, or SMB, clients. Our employer clients, however, have no obligation to renew their agreements with us after the initial term and we

-12-

Table of Contents

cannot assure you that our employer clients will continue to renew their agreements at the same rate, if at all. Moreover, most of our employer clients have the right to cancel their agreements for convenience, subject to certain notice requirements. While few employer clients have terminated their agreements with us for convenience, some of our employer clients have elected not to renew their agreements with us. Our employer clients’ renewal rates may decline or fluctuate as a result of a number of factors, including the prices of competing products or services or reductions in our employer clients’ spending levels. If our employer clients do not renew their agreements with us, and we are unable to attract new employer clients, our revenue may decline and our results of operations, financial condition, business and prospects may be materially adversely affected.

Our business may not grow if a greater percentage of employees do not participate in our employer clients’ CDB programs.

Our revenue depends on the number of employees who participate in the CDB programs that we sell to our employer clients. If more employees do not participate in these benefit programs for various reasons, including a lack of information about the tax-related advantages of doing so, insufficient funds to set aside pre-tax income into such programs, concerns about forfeiting contributions due to forfeiture provisions in FSA benefit programs, or otherwise, our business may not grow as we anticipate and that may materially adversely affect our results of operations, financial condition, business and prospects.

Our business and prospects may be materially adversely affected if we are unable to cross-sell our products and services.

A significant component of our growth strategy is the increased cross-selling of products and services to current and future employer clients. In particular, we expect our ability to cross-sell our commuter programs to our healthcare program clients and our healthcare programs to our commuter employer clients to be an important part of this strategy. We may not be successful in cross-selling our products and services if our employer clients find our additional products and services to be unnecessary or unattractive. Any failure to sell additional products and services to current and future clients could materially adversely affect our results of operations, financial condition, business and prospects.

We may be unable to compete effectively against our current and future competitors.

The market for our products and services is highly competitive, rapidly evolving and fragmented. We have numerous competitors, including health insurance carriers, such as Aetna and UHC, human resources consultants and outsourcers, such as Aon Hewitt, payroll providers, such as ADP and Ceridian, national CDB specialists, such as TASC and SHPS, regional third party administrators and commercial banks, such as Bank of America. Many of our competitors, including health insurance carriers, have longer operating histories and significantly greater financial, technical, marketing and other resources than we do. As a result, some of these competitors may be in a position to devote greater resources to the development, promotion, sale and support of their products and services.

In addition, if one or more of our competitors were to merge or partner with another of our competitors, the change in the competitive landscape could materially adversely affect our ability to compete effectively. Our competitors may also establish or strengthen cooperative relationships with our current or future strategic brokers, insurance carriers, payroll services companies, third party advisors or other parties with which we have relationships, thereby limiting our ability to promote our CDB programs with these parties and limiting the number of brokers available to sell or market our programs. If we are unable to compete effectively with our competitors for any of the foregoing reasons or for any other reasons, our results of operations, financial condition, business and prospects could be materially adversely affected.

-13-

Table of Contents

We plan to extend and expand our products and services and introduce new products and services, and we may not accurately estimate the impact of developing and introducing these products and services on our business.

We intend to continue to invest in technology and development to create new and enhanced products and services to offer our employer clients and their participating employees. For example, in 2011, we deployed a mobile application that enables employee participants to access their accounts and submit healthcare and dependent care claims as well as healthcare debit card receipts. Employee participants can securely send digital photos of their receipts to verify expenses and debit card transactions directly from their iPhone®, iPad®, Android™ and Blackberry® devices. We have limited experience in these areas, however, and we may not be able to anticipate or manage new risks and obligations or legal, compliance or other requirements that may arise. In addition, the anticipated benefits of these expanded products and services may not outweigh the costs and resources associated with their development.

Our ability to attract and retain new employer clients and increase revenue from existing employer clients will depend in large part on our ability to enhance and improve our existing products and services and to introduce new products and services. The success of any enhancement or new product or service depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or new product or service. Any new product or service we develop or acquire may not be introduced in a timely or cost-effective manner and may not achieve the broad market acceptance necessary to generate significant revenue. If we are unable to successfully develop or acquire new products or services or enhance our existing products or services to meet client requirements, our results of operations, financial condition, business or prospects may be materially adversely affected.

If the market for our services does not grow as we anticipate, our results of operations, financial condition, business and prospects may be materially adversely affected.

Our future success depends on increasing the number of employer clients and their employee participants to whom we provide our services. However, there is no guarantee that the market for our services will grow as we expect. For example, the value of our services is directly related to the complexity of administering CDB programs and government action that significantly reduces or simplifies these requirements could reduce demand or pricing for our services. If the market for our services declines or develops more slowly than we expect, or the number of employer clients that select us to provide CDB programs to their employee participants declines or fails to increase as we expect, our revenue, results of operations, financial condition, business and prospects could be materially adversely affected.

General economic and other conditions may adversely affect trends in employment and hiring patterns, which could result in lower employee participation in CDB programs, which would materially adversely affect our results of operations, financial condition, business and prospects.

Our revenue is attributable to the number of employee participants at each of our employer clients, which in turn is influenced by the employment and hiring patterns of our employer clients. To the extent that weak economic conditions cause our employer clients to freeze or reduce their headcount or wages paid, demand for our programs may decrease, which could materially adversely affect our results of operations, financial condition, business and prospects. Similarly, our revenue growth opportunities may be negatively affected by such headcount or wage reductions by our potential employer clients.

Our business and prospects may be materially adversely affected if we are unable to maintain high levels of service while reducing operating costs.

One of the key attributes of our business is providing high quality service to our employer clients and their employee participants. While we have exceeded contractual service levels to our enterprise employer clients each month since May 2007, as our business grows and we service increasing numbers of employer clients and their

-14-

Table of Contents

employee participants, we may be unable to sustain these same levels of service, which could have a material adverse effect on our business. Alternatively, we may only be able to sustain high levels of service by significantly increasing our operating costs, which would materially adversely affect our operating results. If we are unable to maintain these high levels of service performance, our brand and reputation could suffer and our results of operations, financial condition, business and prospects would be materially adversely affected.

Failure to effectively develop and expand our direct and indirect sales channels may materially adversely affect our results of operations, financial condition, business and prospects and reduce our growth.

We will need to continue to expand our sales and marketing infrastructure in order to grow our employer client base and our business. We rely on our enterprise sales force to target new Fortune 1000 client accounts, as well as to cross-sell additional products and services to our existing enterprise clients. Effectively training our sales personnel requires significant time, expense and attention. In addition, we utilize various channel brokers, including insurance agents, benefits consultants, regional and national insurance carriers, health plans, payroll companies, banks and regional TPAs, to sell and market our programs to SMB employers. If we are unable to develop and expand our direct sales teams or these indirect sales channels, our ability to attract new employer clients and cross-sell our programs may be negatively impacted and our growth opportunities will be reduced, each of which would materially adversely affect our results of operations, financial condition, business and prospects.

If our efforts to develop and expand our direct and indirect sales channels do not generate a corresponding increase in revenue, our business may be materially adversely affected. In particular, if we are unable to effectively train our sales personnel or if our direct sales personnel are unable to achieve expected productivity levels in a reasonable period of time, we may not be able to increase our revenue and grow our business.

Long sales cycles make the timing of our long-term revenues difficult to predict.

Our sales cycle generally varies in length between two and nine months and, in some cases, even longer depending on the size of the potential client. Factors that may influence the length of our sales cycle include:

| • | the need to educate potential employer clients about the uses and benefits of our CDB programs; |

| • | the relatively long duration of the commitment clients make in their agreements with us or with pre-existing plan administrators; |

| • | the discretionary nature of potential employer clients’ purchasing and budget cycles and decisions; |

| • | the competitive nature of potential employer clients’ evaluation and purchasing processes; |

| • | fluctuations in the CDB program needs of potential employer clients; and |

| • | lengthy purchasing approval processes of potential employer clients. |

The fluctuations that result from the length of our sales cycle may be magnified for large- and mid-sized potential employer clients. If we are unable to close an expected significant transaction with one or more of these potential clients in the anticipated period, our operating results for that period, and for any future periods in which revenue from such transaction would otherwise have been recognized, would be harmed.

Our business and operational results are subject to seasonality as a result of open enrollment for CDB programs and decreased use of commuter program offerings during typical vacation months.

The number of accounts that generate revenue is typically greatest during our first calendar quarter due primarily to three factors. First, new employer clients and their employee participants typically begin service on January 1. Second, during the first calendar quarter, we are also servicing the end of plan year activity for existing clients and employee participants who do not continue participation into the next plan year. Third, we

-15-

Table of Contents

receive the majority of cash for pre-funded accounts from our employer clients in late December or early January, which results in higher cash balances during our first quarter.

Generally, in comparison to other quarters, our revenue is highest in the first quarter and lowest in the second and third quarters. Thereafter, our revenue generally grows gradually in the fourth quarter as our employer clients hire new employees who then elect to participate in our programs, thereby increasing our monthly minimum billing amount. The minimum billing amount is not, however, generally subject to downward revision when employees leave their employers because we continue to administer those former employee participants’ accounts for the remainder of the plan year. Revenue from commuter programs may vary from month-to-month because employees may elect to participate in our commuter programs at any time during the year and may change their election to participate or the amount of their contribution on a monthly basis; however, participation rates in our commuter business typically slow during the summer as people take vacations and do not purchase transit passes or parking passes during that time.

Our operating expenses increase during the fourth quarter because we increase our customer support center capacity to answer questions from employee participants during the open enrollment periods related to their CDB participation decisions. The cost of providing services peaks in the first quarter as new employee participants contact us for information about their CDBs, and as terminating employee participants submit their final claims for reimbursement.

If employee participants do not continue to utilize our prepaid debit cards, our results of operations, business and prospects could be materially adversely affected.

We derive a portion of our revenue from interchange fees that are paid to us when employee participants utilize our prepaid debit cards to pay for certain healthcare and commuter expenses under CDB programs. These fees represent a percentage of the expenses transacted on each debit card. If our employer clients do not adopt these prepaid debit cards as part of the benefits programs they offer, if the employee participants do not use them at the rate we expect, or if other alternatives to prepaid tax-advantaged benefit cards develop, our results of operations, business and prospects could be materially adversely affected.

If we are unable to maintain and enhance our brand and reputation, our ability to sustain and grow our business may be materially adversely affected.

Maintaining and strengthening our brand is critical to attracting new clients and growing our business. Our ability to maintain and strengthen our brand and reputation will depend heavily on our capacity to continue to provide high levels of customer service to our employer clients and their employee participants at cost effective and competitive prices, which we may not do successfully. In addition, our continued success depends, in part, on our reputation as an industry leader in promoting awareness and understanding of the positive impact of CDBs among employers and employees. If we fail to successfully maintain and strengthen our brand, our results of operations, financial condition, business and prospects will be materially adversely affected.

Some plan providers with which we have relationships also provide, or may provide, competing services.

We face competitive risks in situations where some of our strategic partners are also current or potential competitors. For example, certain of the banks we utilize as custodians for our prepaid debit card funds also offer their own HSA products. To the extent that these partners choose to offer competing products and services that they have developed or in which they have an interest to our current or potential clients, our results of operations, business and prospects could be materially adversely affected.

-16-

Table of Contents

We are subject to complex regulation, and any compliance failures or regulatory action could materially adversely affect our business.

The plans we administer and, as a result, our business are subject to extensive, complex and continually changing federal and state laws and regulations, including IRS regulations, ERISA, privacy and HIPAA regulations and Department of Labor regulations, all of which are further described in “Business—Government Regulation” below. If we fail to comply with any applicable law, rule or regulation, we could be subject to fines and penalties, indemnification claims by our clients, or become the subject of a Department of Labor enforcement action, each of which would materially adversely affect our business and reputation.

We may also become subject to additional regulatory and compliance requirements as a result of changes in laws or regulations, or as a result of any expansion or enhancement of our existing products and services or any new products or services we may offer in the future. For example, if we expand our product and service offerings into the health insurance market in the future, we would become subject to state Department of Insurance regulations. Compliance with any new regulatory requirements may divert internal resources and take significant time and effort.

Any claims of noncompliance brought against us, regardless of merit or ultimate outcome, could subject us to investigation by the Department of Labor, the Internal Revenue Service, the Centers for Medicare and Medicaid Services, the Treasury Department or other federal and state regulatory authorities, which could result in substantial costs to us and divert management’s attention and other resources away from our operations. In addition, investor perceptions of us may suffer and could cause a decline in the market price of our common stock. Our compliance processes may not be sufficient to prevent assertions that we failed to comply with any applicable law, rule or regulation.

Changes in healthcare laws and other regulations applicable to our business may constrain our ability to offer our products and services.

Changes in healthcare or other laws and regulations applicable to our business may occur that could increase our compliance and other costs of doing business, require significant systems enhancement, or render our products or services less profitable or obsolete, any of which could have a material adverse effect on our results of operations. For instance, when the new debit card network exclusivity restrictions set forth in the Durbin Amendment to the Electronic Fund Transfer Act are implemented in April 2013, we will be required to use at least two unaffiliated networks for our prepaid debit cards and the card issuers and networks may pass a portion of the implementation costs of such changes to us. While we do not currently expect that this will have, or is reasonably likely to have, a material adverse impact on our financial condition or operating results, we will need to continue to monitor the status of this rule as well as other potential changes in laws or regulations that may impact our business as such changes could potentially adversely affect our business, prospects and results of operations.

There has been an increasing political and regulatory focus on healthcare laws in recent years. While legislation such as the Patient Protection and Affordable Care Act has been signed into law, many of the details necessary to implement the legislation have yet to be defined. For example, any new laws that increase reporting and compliance burdens on employers may make them less likely to offer CDBs to their employees and instead offer employees benefit coverage through state run health insurance exchanges. If employers are less incentivized to offer our CDB programs to employees because of increased regulatory burdens or otherwise, our results of operations and financial condition could be materially adversely affected.

Failure to ensure and protect the confidentiality of participant data could lead to legal liability, adversely affect our reputation and have a material adverse effect on our results of operations, business or financial condition.

We must collect, store and use employee participants’ confidential information, including the transmission of that data to third parties, to provide our services. For example, we collect names, addresses, social security

-17-

Table of Contents

numbers and other personally identifiable information from employee participants. In addition, we facilitate the issuance and funding of prepaid debit cards and, in some cases, collect bank routing information, account numbers and personal credit card information for purposes of funding an account or issuing a reimbursement. We have invested significantly in preserving the security of this data.

In addition, we outsource customer support center services and claims processing services to third-party subcontractors to whom we transmit certain confidential information of our employee participants. We have security measures in place with each of these subcontractors to protect this confidential information, including written agreements that outline how protected health information will be handled and shared. However, there are no assurances that these measures, or any additional security measures that our subcontractors may have in place, will be sufficient to protect this outsourced confidential information from unauthorized security breaches.

We cannot assure you that, despite the implementation of these security measures, we will not be subject to a security breach or that this data will not be compromised. We may be required to expend significant capital and other resources to protect against security breaches or to alleviate problems caused by security breaches. Despite our implementation of security measures, techniques used to obtain unauthorized access or to sabotage systems change frequently. As a result, we may be unable to anticipate these techniques or implement adequate preventative measures to protect this data. Any compromise or perceived compromise of our security could damage our reputation with our clients and brokers, and could subject us to significant liability, as well as regulatory action, which would materially adversely affect our brand, results of operations, financial condition, business and prospects.

Privacy concerns could require us to modify our operations.

As part of our business, we collect employee participants’ personal data for the sole purpose of processing their benefits. For privacy or security reasons, privacy groups, governmental agencies and individuals may seek to restrict or prevent our use of this data. We have incurred, and will continue to incur, expenses to comply with privacy and security standards and protocols imposed by law, regulation, industry standards or contractual obligations. Increased domestic or international regulation of data utilization and distribution practices, including self-regulation, could require us to modify our operations and incur significant additional expense, which could have a material adverse effect on our results of operations, financial condition, business and prospects.

If we fail to effectively upgrade our information technology systems, our business and operations could be disrupted.

As part of our efforts to continue the improvement of our enterprise resource planning, we plan to upgrade our existing information technology systems in order to automate several controls that are currently performed manually. We may experience difficulties in transitioning to these upgraded systems, including loss of data and decreases in productivity as personnel work to become familiar with these new systems. In addition, our management information systems will require modification and refinement as we grow and as our business needs change, which could prolong difficulties we experience with systems transitions, and we may not always employ the most effective systems for our purposes. If we experience difficulties in implementing new or upgraded information systems or experience significant system failures, or if we are unable to successfully modify our management information systems or respond to changes in our business needs, we may not be able to effectively manage our business and we may fail to meet our reporting obligations.

Our future success depends on our ability to recruit and retain qualified employees, including our executive officers.

Our success is substantially dependent upon the performance of our senior management, such as our chief executive officer. Our management and employees may terminate their employment at any time, and the loss of the services of any of our executive officers could materially adversely affect our business. Our success is also

-18-

Table of Contents

substantially dependent upon our ability to attract additional personnel for all areas of our organization. Competition for qualified personnel is intense, and we may not be successful in attracting and retaining such personnel on a timely basis, on competitive terms or at all. If we are unable to attract and retain the necessary personnel, our results of operations, financial condition, business and prospects would be materially adversely affected.

We might require additional capital to support business growth in the future, and this capital might not be available on acceptable terms, if at all.

We believe that our existing cash and cash equivalents, combined with our credit line, expected cash flow from operations and net proceeds of this offering, will be sufficient to meet our operating and capital requirements, as well as anticipated requirements for potential additional portfolio purchases, for at least the next 12 months. Our business and operations may, however, consume resources faster than we currently anticipate. We intend to continue to make investments to support our business growth, including through additional portfolio purchases of complementary businesses, and may require additional funds in the future to respond to business challenges, including the need to develop new features and platforms, enhance our existing programs or improve our operating infrastructure. Accordingly, we may seek to sell additional equity or debt securities or obtain additional debt financing. If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing secured by us in the future could involve restrictive covenants relating to our capital-raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential portfolio purchases. We have not made arrangements to obtain additional financing and there can be no assurances that financing, if required, will be available in amounts or on terms acceptable to us, if at all.

Changes in credit card association or other network rules or standards set by Visa or MasterCard, or changes in card association and debit network fees or products or interchange rates, could materially adversely affect our results of operations, business and financial position.

We, and the banks that issue our prepaid debit cards, are subject to Visa and MasterCard association rules that could subject us to a variety of fines or penalties that may be levied by the card associations or networks for acts or omissions by us or businesses that work with us, including card processors, such as Fidelity National Information Services. The termination of the card association registrations held by us or any of the banks that issue our cards, or any changes in card association or other debit network rules or standards, including interpretation and implementation of existing rules or standards that increase the cost of doing business or limit our ability to provide our products and services, could have a material adverse effect on our results of operations, financial condition, business and prospects. In addition, from time-to-time, card associations increase the organization or processing fees that they charge, which could increase our operating expenses, reduce our profit margin and materially adversely affect our results of operations, financial condition, business and prospects.

Our operating results can fluctuate from period-to-period, which could cause our share price to fluctuate.