Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PACER INTERNATIONAL INC | d340005d8k.htm |

Exhibit 99.1

Pacer International Reports First Quarter Results

DUBLIN Ohio, April 26, 2012(BUSINESS WIRE)—Pacer International, Inc. (Nasdaq: PACR), the asset-light North American freight transportation and logistics services provider, today reported financial results for the three-month period ended March 31, 2012.

FIRST QUARTER RESULTS

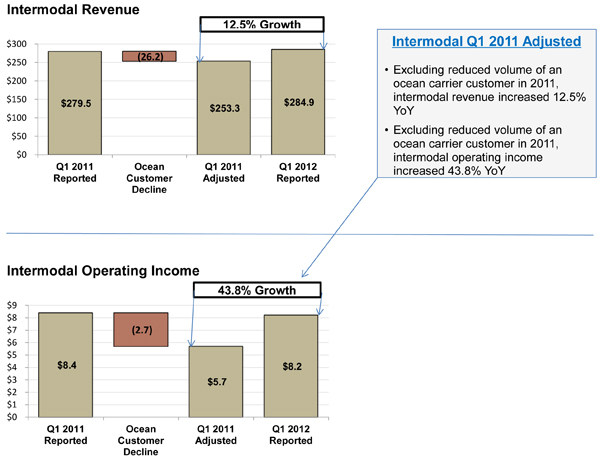

| • | Total intermodal revenue improved $5.4 million or 1.9%. Excluding the impact from the previously announced reduction in volume from an ocean carrier customer of $26.2 million, intermodal revenues grew by 12.5%. Logistics revenues declined by 22.7% to $61.1 million. In total, revenues decreased by 3.5% to $345.9 million; |

| • | Intermodal gross margin declined by $1.9 million. However, excluding the reduced volume from the ocean carrier customer, intermodal gross margin would have increased by $0.8 million or 3.1%. Logistics gross margin declined by $2.4 million; |

| • | Income from operations decreased by $3.9 million in the 2012 period compared to the 2011 period due mainly to lower income in the logistics segment. Income from operations in the intermodal segment, excluding the reduced volume from the ocean carrier customer, grew year over year by 43.8%; |

| • | Selling, general and administrative expenses decreased by $0.5 million or 1.4%; |

| • | Net income decreased $2.3 million to a loss of $0.3 million; and |

| • | Earnings per share decreased from $0.06 in the 2011 period to a loss per share of $0.01 in the 2012 period. |

(In millions, except for per share data)

| 2012 | 2011 | |||||||

| Q1 | Q1 | |||||||

| Revenue |

$ | 345.9 | 358.4 | |||||

| Gross margin |

$ | 37.8 | 42.1 | |||||

| Gross margin % |

10.9 | % | 11.7 | % | ||||

| SG&A |

$ | 36.0 | 36.5 | |||||

| Income from operations |

— | 3.9 | ||||||

| Net income (loss) |

(0.3 | ) | 2.0 | |||||

| Earnings (loss) per share |

$ | (0.01 | ) | 0.06 | ||||

“While our overall results are down year over year driven mainly by logistics, we continued to show strong positive growth in our intermodal segment by achieving double digit revenue growth excluding the year over year portfolio change. In particular the domestic portion of our intermodal segment continues to be very strong with double digit revenue and margin growth year over year”, said Chief Financial Officer John J. Hafferty

“We took several positive steps in the quarter that will continue to enhance our business performance, including our recent announcement of a new trucking alliance with CRST for intermodal drayage, and the naming of a seasoned logistics executive to head up our International Logistics businesses. We are committed to continuing to drive for operational excellence in these businesses to enhance our competitiveness and improve our margins,” said Chief Executive Officer Dan Avramovich

A tabular reconciliation detailing the adjustments made to arrive at the adjusted financial results set forth above and elsewhere in this press release from financial results determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) is contained in the reconciliation schedules attached to this press release.

2012 GUIDANCE

We are reconfirming our 2012 guidance and expect full year revenues to range between $1.500 billion and $1.525 billion, and earnings per share to range between $0.35 and $0.41.

CONFERENCE CALL TODAY Pacer International will hold a conference call for investors, analysts, business and trade media, and other interested parties at 8:30 a.m. ET, today (Thursday, April 26, 2012). To participate, please call five minutes early by dialing (800) 230-1096(in USA) and ask for “Pacer International Earnings Call.” International callers can dial (612) 332-0228.

An audio-only, simultaneous Webcast of the live conference call can be accessed through the Investors link on the company’s website at www.pacer.com. For persons unable to participate in either the conference call or the Webcast, a digitized replay will be available from April 26, 2012 at 11:00 a.m. ET to May 26, 2012 at 11:59 p.m. ET. For the replay, dial (800) 475-6701(USA) or (320) 365-3844 (international), using access code 243560. During such period, the replay also can be accessed through the Events Calendar within the Investors link on the company’s website at www.pacer.com

ABOUT PACER INTERNATIONAL (www.pacer.com)

Pacer International, a leading asset-light North American freight transportation and logistics services provider, offers a broad array of services to facilitate the movement of freight from origin to destination through its intermodal and logistics operating segments. The intermodal segment offers container capacity, integrated local transportation services, and door-to-door intermodal shipment management. The logistics segment provides truck brokerage, warehousing and distribution, international freight forwarding, and supply-chain management services. For more information on Pacer International visit www.pacer.com.

SOURCE: Pacer International, Inc.

USE OF NON-GAAP FINANCIAL MEASURES: This press release contains “non-GAAP financial measures” as defined by the Securities and Exchange Commission. These non-GAAP measures are adjusted intermodal revenue, adjusted intermodal gross margin and adjusted intermodal operating

income, each of which excludes from 2011 results the impact of the previously announced volume reduction of the ocean carrier customer that transitioned its western business directly to the railroad. Non-GAAP measures are used by management and the Board of Directors in their analysis of the company’s ongoing core operating performance. Management believes that these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the company’s core businesses and allows investors to more easily compare operating results from period to period. A tabular reconciliation of the differences between the non-GAAP financial information discussed in this release and the most directly comparable financial information calculated and presented in accordance with GAAP is contained in the financial summary statements attached to this press release.

CERTAIN FORWARD-LOOKING STATEMENTS—This press release contains or may contain forward-looking statements, including earnings per share, and revenue guidance for fiscal year 2012, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on the company’s current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions. Among the important factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements are general economic and business conditions including the current U.S. and global economic environment and the timing and strength of economic recovery in the U.S. and internationally; industry trends, including changes in the costs of services from rail, motor, ocean and air transportation providers; and other risks discussed in the company’s Form 10-K and other filings with the Securities and Exchange Commission, which are incorporated herein by reference. Should one or more of these risks or uncertainties materialize, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described herein as anticipated, believed, expected or intended. Except as otherwise required by federal securities laws, the company does not undertake any obligation to update such forward-looking statements whether as a result of new information, future events or otherwise.

# # # #

INVESTOR CONTACT:

Pacer International, Inc.

Steve Markosky, 614-923-1703

VP Investor Relations & Financial Planning & Analysis

steve.markosky@pacer.com

MEDIA CONTACT:

Princeton Partners

Erin Bijas

Senior Account Manager, Public Relations

(609) 452-8500 x118; 732-895-0792 (mobile)

ebijas@princetonpartners.com

Pacer International, Inc.

Unaudited Condensed Consolidated Balance Sheet

(in millions)

| March 31, 2012 | December 31, 2011 | |||||||

| Assets | ||||||||

| Current assets |

||||||||

| Cash and cash equivalents |

$ | 19.1 | $ | 24.0 | ||||

| Accounts receivable, net |

143.9 | 133.5 | ||||||

| Prepaid expenses and other |

12.7 | 12.3 | ||||||

| Deferred income taxes |

4.3 | 4.0 | ||||||

|

|

|

|

|

|||||

| Total current assets |

180.0 | 173.8 | ||||||

|

|

|

|

|

|||||

| Property and equipment |

||||||||

| Property and equipment, cost |

102.4 | 99.8 | ||||||

| Accumulated depreciation |

(57.5 | ) | (56.1 | ) | ||||

|

|

|

|

|

|||||

| Property and equipment, net |

44.9 | 43.7 | ||||||

|

|

|

|

|

|||||

| Other assets |

||||||||

| Deferred income taxes |

14.1 | 14.1 | ||||||

| Other assets |

11.6 | 11.7 | ||||||

|

|

|

|

|

|||||

| Total other assets |

25.7 | 25.8 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 250.6 | $ | 243.3 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities |

||||||||

| Accounts payable and other accrued liabilities |

$ | 133.4 | $ | 127.1 | ||||

| Long-term liabilities |

||||||||

| Other |

1.9 | 0.9 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

135.3 | 128.0 | ||||||

|

|

|

|

|

|||||

| Stockholders’ equity |

||||||||

| Common stock |

0.4 | 0.4 | ||||||

| Additional paid-in-capital |

305.3 | 304.7 | ||||||

| Accumulated deficit |

(190.5 | ) | (190.2 | ) | ||||

| Accumulated other comprehensive income |

0.1 | 0.4 | ||||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

115.3 | 115.3 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 250.6 | $ | 243.3 | ||||

|

|

|

|

|

|||||

Pacer International, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in millions, except share and per share data)

| Three Months Ended | ||||||||

| March 31, 2012 | March 31, 2011 | |||||||

| Revenues |

$ | 345.9 | $ | 358.4 | ||||

| Operating Expenses: |

||||||||

| Cost of purchased transportation and services |

285.8 | 292.3 | ||||||

| Direct operating expenses (excluding depreciation) |

22.3 | 24.0 | ||||||

| Selling, general and administrative expenses |

36.0 | 36.5 | ||||||

| Depreciation and amortization |

1.8 | 1.7 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

345.9 | 354.5 | ||||||

|

|

|

|

|

|||||

| Income from operations |

— | 3.9 | ||||||

| Interest expense |

(0.5 | ) | (0.6 | ) | ||||

|

|

|

|

|

|||||

| Income (loss) before income taxes |

(0.5 | ) | 3.3 | |||||

| Income tax expense (benefit) |

(0.2 | ) | 1.3 | |||||

|

|

|

|

|

|||||

| Net income (loss) |

$ | (0.3 | ) | $ | 2.0 | |||

|

|

|

|

|

|||||

| Earnings (loss) per share: |

||||||||

| Basic: |

||||||||

| Earnings (loss) per share |

$ | (0.01 | ) | $ | 0.06 | |||

|

|

|

|

|

|||||

| Weighted average shares outstanding |

34,995,976 | 34,934,722 | ||||||

|

|

|

|

|

|||||

| Diluted: |

||||||||

| Earnings (loss) per share |

$ | (0.01 | ) | $ | 0.06 | |||

|

|

|

|

|

|||||

| Weighted average shares outstanding |

34,995,976 | 35,064,375 | ||||||

|

|

|

|

|

|||||

Pacer International, Inc.

Unaudited Condensed Consolidated Statement of Cash Flows

(in millions)

| Three Months Ended | ||||||||

| March 31, 2012 | March 31, 2011 | |||||||

| Cash Flows from Operating Activities |

||||||||

| Net income (loss) |

$ | (0.3 | ) | $ | 2.0 | |||

| Adjustments to reconcile net income (loss) to net cash |

||||||||

| (used in) provided by operating activities: |

||||||||

| Depreciation and amortization |

1.8 | 1.7 | ||||||

| Amortization of deferred gain on sale lease-back transactions |

(0.2 | ) | (0.2 | ) | ||||

| Deferred taxes |

(0.3 | ) | 1.2 | |||||

| Stock based compensation expense |

0.7 | 0.2 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable, net |

(10.4 | ) | 1.4 | |||||

| Prepaid expenses and other |

(0.4 | ) | (2.5 | ) | ||||

| Accounts payable and other accrued liabilities |

6.4 | (1.5 | ) | |||||

| Other long-term assets |

0.1 | (0.1 | ) | |||||

| Other long-term liabilities |

(0.5 | ) | (0.2 | ) | ||||

|

|

|

|

|

|||||

| Net cash (used in) provided by operating activities |

(3.1 | ) | 2.0 | |||||

|

|

|

|

|

|||||

| Cash Flows from Investing Activities |

||||||||

| Capital expenditures |

(3.4 | ) | (1.2 | ) | ||||

| Purchase of railcar assets |

(26.5 | ) | — | |||||

| Net proceeds from sale lease-back transaction |

28.2 | — | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(1.7 | ) | (1.2 | ) | ||||

|

|

|

|

|

|||||

| Cash Flows from Financing Activities |

||||||||

| Net repayments under revolving line of credit |

— | 2.3 | ||||||

| Withholding tax paid upon vesting of restricted and performance stock units |

(0.1 | ) | — | |||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(0.1 | ) | 2.3 | |||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash and cash equivalents |

(4.9 | ) | 3.1 | |||||

| Cash and cash equivalents—beginning of period |

24.0 | 4.2 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents—end of period |

$ | 19.1 | $ | 7.3 | ||||

|

|

|

|

|

|||||

Pacer International, Inc.

Unaudited Results by Segment

(in millions)

| Three Months Ended March 31, | ||||||||||||||||

| 2012 | 2011 | Change | % Change | |||||||||||||

| Revenues |

||||||||||||||||

| Intermodal |

$ | 284.9 | $ | 279.5 | $ | 5.4 | 1.9 | % | ||||||||

| Logistics |

61.1 | 79.0 | (17.9 | ) | (22.7 | ) | ||||||||||

| Inter-segment eliminations |

(0.1 | ) | (0.1 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

345.9 | 358.4 | (12.5 | ) | (3.5 | ) | ||||||||||

| Cost of purchased transportation and services and direct operating expense 1/ |

||||||||||||||||

| Intermodal |

258.1 | 250.8 | 7.3 | 2.9 | ||||||||||||

| Logistics |

50.1 | 65.6 | (15.5 | ) | (23.6 | ) | ||||||||||

| Inter-segment eliminations |

(0.1 | ) | (0.1 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

308.1 | 316.3 | (8.2 | ) | (2.6 | ) | ||||||||||

| Gross margin |

||||||||||||||||

| Intermodal |

26.8 | 28.7 | (1.9 | ) | (6.6 | ) | ||||||||||

| Logistics |

11.0 | 13.4 | (2.4 | ) | (17.9 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 37.8 | $ | 42.1 | $ | (4.3 | ) | (10.2 | )% | |||||||

| Gross margin percentage |

||||||||||||||||

| Intermodal |

9.4 | % | 10.3 | % | (0.9 | )% | ||||||||||

| Logistics |

18.0 | 17.0 | 1.0 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

10.9 | % | 11.7 | % | (0.8 | )% | ||||||||||

| Income (loss) from operations |

||||||||||||||||

| Intermodal |

8.2 | 8.4 | (0.2 | ) | (2.4 | ) | ||||||||||

| Logistics |

(3.2 | ) | (0.2 | ) | (3.0 | ) | 1,500.0 | |||||||||

| Corporate |

(5.0 | ) | (4.3 | ) | (0.7 | ) | 16.3 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | — | $ | 3.9 | $ | (3.9 | ) | (100.0 | )% | |||||||

| 1/ | Direct operating expenses are only incurred in the intermodal segment |

Pacer International, Inc.

Reconciliation of GAAP Results to Adjusted Results

For the Three Months Ended March 31, 2012 and March 31, 2011

(in millions)

| Three Months Ended March 31, 2012 |

Three Months Ended March 31, 2011 | Adjusted Variance |

% Adjusted Variance |

|||||||||||||||||||||

| GAAP | Adjusted | |||||||||||||||||||||||

| GAAP Results | Results | Adjustments | Results | 2012 vs 2011 | 2012 vs 2011 | |||||||||||||||||||

| Revenues |

||||||||||||||||||||||||

| Intermodal |

$ | 284.9 | $ | 279.5 | $ | (26.2 | )/1 | $ | 253.3 | $ | 31.6 | 12.5 | % | |||||||||||

| Cost of purchased transportation and services and direct operating expense |

||||||||||||||||||||||||

| Intermodal |

258.1 | 250.8 | (23.5 | )/1 | $ | 227.3 | 30.8 | 13.6 | ||||||||||||||||

| Gross margin |

||||||||||||||||||||||||

| Intermodal |

26.8 | 28.7 | (2.7 | ) | 26.0 | 0.8 | 3.1 | |||||||||||||||||

| Gross margin percentage |

||||||||||||||||||||||||

| Intermodal |

9.4 | % | 10.3 | % | 10.3 | % | 10.3 | % | (0.9 | )% | ||||||||||||||

| Income (loss) from operations |

||||||||||||||||||||||||

| Intermodal |

$ | 8.2 | $ | 8.4 | $ | (2.7 | ) | $ | 5.7 | $ | 2.5 | 43.8 | % | |||||||||||

| 1/ | Adjustment to reflect previously announced reduction in volume from an ocean carrier customer that transitioned its western U.S. intermodal business directly to the railroad. Purchased transportation and direct operating expenses were adjusted at the average intermodal margin percentage for the 2011 period. |