Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MUTUALFIRST FINANCIAL INC | v310755_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - MUTUALFIRST FINANCIAL INC | v310755_ex99-2.htm |

Annual Meeting MutualFirst Financial, Inc. April 25, 2012 Symbol: MFSF

MutualFirst Financial, Inc. David Heeter President and CEO

MutualFirst Financial, Inc. 122 nd Annual Meeting MutualBank

MutualFirst Financial, Inc. Forward Looking Statement This presentation contains statements which constitute forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may appear in a number of places in this presentation and include statements regarding the intent, belief, outlook, estimate or expectations of the company, its directors or its officers primarily with respect to future events and the future financial performance of the company, including but not limited to preliminary estimated ProForma combined financial information. Readers of this presentation are cautioned that any such forward looking statements are not guarantees of future events or performance and involve risk and uncertainties, and that actual results may differ materially from those in the forward looking statements as a result of various factors. These factors include, but are not limited to, the loss of deposits and loan demand to competitors; substantial changes in financial markets; changes in real estate values and the real estate market; regulatory changes; or other risk factors discussed in the latest SEC form 10 - k. The Company does not undertake – and specifically disclaims any obligation – to publicly release the result of any revisions which may be made to any forward - looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

MutualFirst Financial, Inc. David Heeter President and CEO

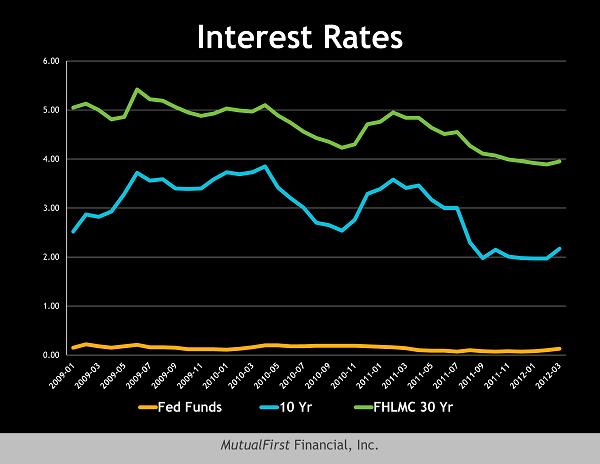

MutualFirst Financial, Inc. 0.00 1.00 2.00 3.00 4.00 5.00 6.00 Percent Fed Funds 10 Yr FHLMC 30 Yr Interest Rates

MutualFirst Financial, Inc. MutualBank Markets Full Service Financial Center MutualWealth Office Lending Office

MutualFirst Financial, Inc. MutualBank Markets Unemployment Statistics National – 8.3% State – 8.6% Footprint – Above Average Footprint – Below Average Contiguous County – Above Average Contiguous County – Below Average 2009 Average – 11.9% 2010 Average – 10.6% 2011 Average – 9.9% 2012 (March) – 9.5%

MutualFirst Financial, Inc. Washington Dodd - Frank effective July 2011

MutualFirst Financial, Inc. Charter Change Federal Reserve FDIC Indiana Department of Financial Institutions

MutualFirst Financial, Inc. Redeemed TARP Small Business Lending Fund

MutualFirst Financial, Inc. New Strategic Plan Credit Quality Earnings Capital Market Management Shareholder Value

MutualFirst Financial, Inc. Max Courtney

MutualFirst Financial, Inc. Vince Turner

MutualFirst Financial, Inc. John Bowles

MutualFirst Financial, Inc. 2011 Operational Focus

MutualFirst Financial, Inc. Gross Loan Balances $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 2009 2010 2011 1st Qtr 2012 $1,062,215 $989,387 $901,900 $919,959 *In Thousands

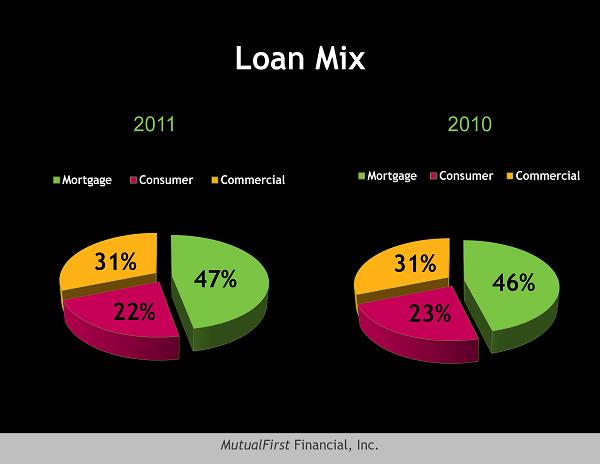

MutualFirst Financial, Inc. Loan Mix 47% 22% 31% 2011 Mortgage Consumer Commercial 46% 23% 31% 2010 Mortgage Consumer Commercial 2011 2010

MutualFirst Financial, Inc. 1 – 4 Family Residential Outstanding Balances $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 2009 2010 2011 1st Qtr 2012 $480,832 $468,502 $436,416 $463,208 *In Thousands

MutualFirst Financial, Inc. Mortgage Loan Originations $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 2009 2010 2011 1st Qtr 2012 $258,608 $185,618 $143,572 $49,922 $199,688 Annualized *In Thousands

MutualFirst Financial, Inc. 45% 55% 2011 40% 60% 2010 Deposit Mix Term Short Term / Core

MutualFirst Financial, Inc. Total Deposits $800,000 $850,000 $900,000 $950,000 $1,000,000 $1,050,000 $1,100,000 $1,150,000 $1,200,000 $1,250,000 $1,300,000 2009 2010 2011 1st Qtr 2012 $1,045,196 $1,121,569 $1,166,636 $1,190,099 *In Thousands

MutualFirst Financial, Inc. Trust Investment Retirement Plan Services

MutualFirst Financial, Inc. Assets Under Management $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 2009 2010 2011 1st Qtr 2012 $379,050 $453,754 $437,969 $454,151 *In Thousands

MutualFirst Financial, Inc. MutualWealth Fee Income Generation $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 $2,600 $2,800 2009 2010 2011 $2,237 $2,556 $2,736 *In Thousands

MutualFirst Financial, Inc. Retirement Plans Mutual Funds Annuities 529 Plans Stocks & Bonds 401k Rollovers

MutualFirst Financial, Inc. MutualFinancial Net Commission $0 $200 $400 $600 $800 $1,000 $1,200 2009 2010 2011 1st Qtr 2012 $665 $1,115 $819 $274 $1,096 Annualized *In Thousands

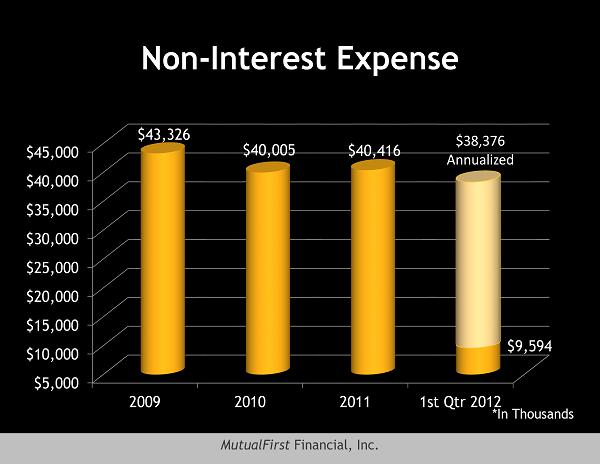

MutualFirst Financial, Inc. Non - Interest Expense $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 2009 2010 2011 1st Qtr 2012 $43,326 $40,005 $40,416 $9,594 $38,376 Annualized *In Thousands

MutualFirst Financial, Inc. Financial Performance

MutualFirst Financial, Inc. Total Assets $1,000,000 $1,050,000 $1,100,000 $1,150,000 $1,200,000 $1,250,000 $1,300,000 $1,350,000 $1,400,000 $1,450,000 2009 2010 2011 1st Qtr 2012 $1,400,885 $1,406,902 $1,427,193 $1,439,146 *In Thousands

MutualFirst Financial, Inc. 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 80.00% 90.00% Investments Loans Deposits Borrowings 2010 2011 Balance Sheet Structure *Percentage of Total Assets Assets Liabilities

MutualFirst Financial, Inc. Total Deposits $800,000 $850,000 $900,000 $950,000 $1,000,000 $1,050,000 $1,100,000 $1,150,000 $1,200,000 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 $1,190,099 *In Thousands

MutualFirst Financial, Inc. 45% 55% 2011 40% 60% 2010 Deposit Mix Term Short Term / Core

MutualFirst Financial, Inc. Loans Receivable $600,000 $650,000 $700,000 $750,000 $800,000 $850,000 $900,000 $950,000 $1,000,000 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 $919,959 *In Thousands

MutualFirst Financial, Inc. Net Interest Margin 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 3.03%

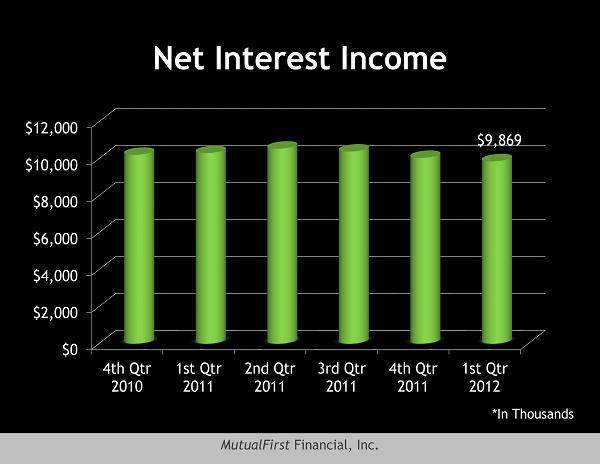

MutualFirst Financial, Inc. Net Interest Income $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 $9,869 *In Thousands

MutualFirst Financial, Inc. Credit Quality

MutualFirst Financial, Inc. Non - Performing Assets/ Total Assets 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 2.62%

MutualFirst Financial, Inc. Non - Performing Loans/ Total Loans 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 3.17%

MutualFirst Financial, Inc. Net Charge - Offs/ Average Loans 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 0.67% *Annualized

MutualFirst Financial, Inc. Allowance for Loan Loss / Non - Performing Loans 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 56.21%

MutualFirst Financial, Inc. Capital

MutualFirst Financial, Inc. 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 Total Risk Based Capital 14.31%

MutualFirst Financial, Inc. Total Stockholder’s Equity $100,000 $105,000 $110,000 $115,000 $120,000 $125,000 $130,000 $135,000 $140,000 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 $134,597 *In Thousands

MutualFirst Financial, Inc. Non - Interest Expense $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 $11,000 4th Qtr 2010 1st Qtr 2011 2nd Qtr 2011 3rd Qtr 2011 4th Qtr 2011 1st Qtr 2012 $9,594 *In Thousands

MutualFirst Financial, Inc. What does the future hold?

MutualFirst Financial, Inc. Thank You

MutualFirst Financial, Inc. 122 nd Annual Meeting MutualBank