Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FARMERS NATIONAL BANC CORP /OH/ | d340871d8k.htm |

| EX-99.2 - EX-99.2 - FARMERS NATIONAL BANC CORP /OH/ | d340871dex992.htm |

| EX-99.1 - EX-99.1 - FARMERS NATIONAL BANC CORP /OH/ | d340871dex991.htm |

| Exhibit 99.3 Annual Shareholders' Meeting April 26, 2012 |

| 2 2 2011 |

| Carl D. Culp Executive Vice President Chief Financial Officer 3 |

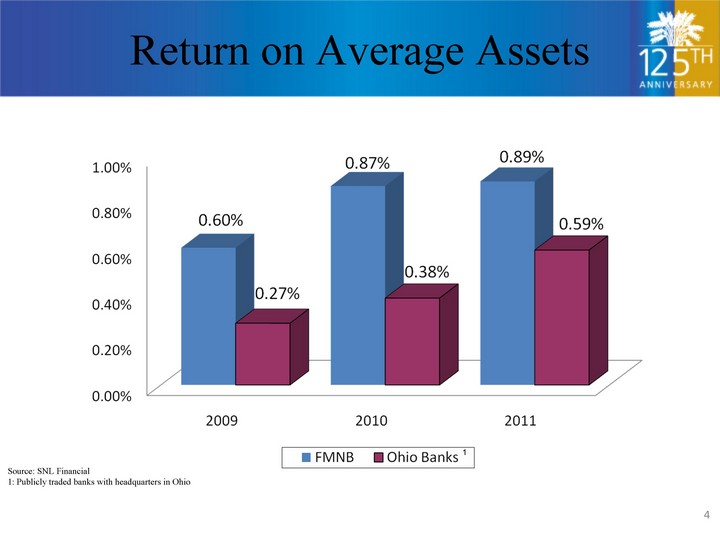

| Return on Average Assets 4 Source: SNL Financial 1: Publicly traded banks with headquarters in Ohio 1 |

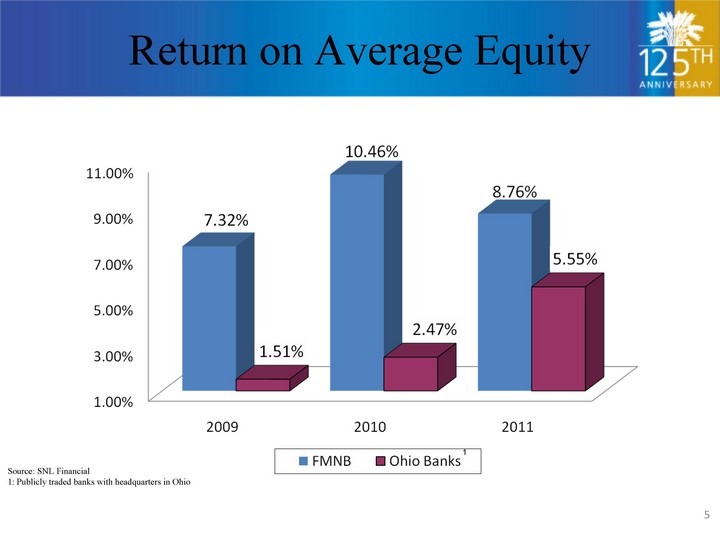

| Return on Average Equity 5 Source: SNL Financial 1: Publicly traded banks with headquarters in Ohio 1 |

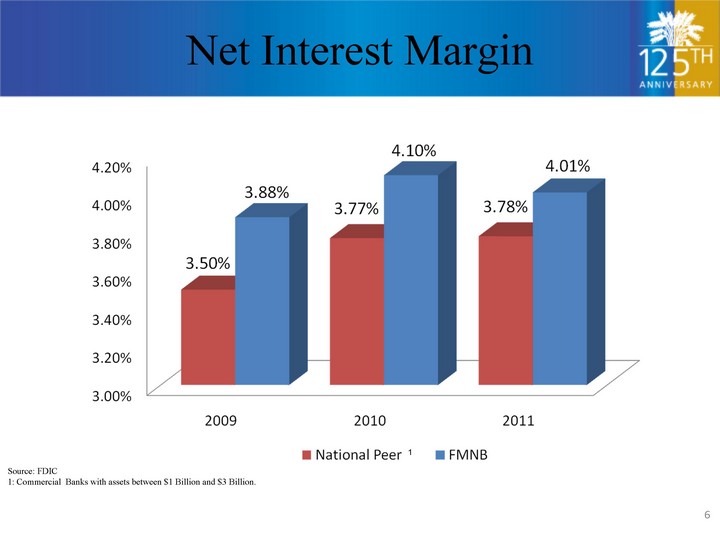

| Net Interest Margin 6 Source: FDIC 1: Commercial Banks with assets between $1 Billion and $3 Billion. 1 |

| Yield on Earning Assets 7 Source: FDIC 1: Commercial Banks with assets between $1 Billion and $3 Billion. 1 |

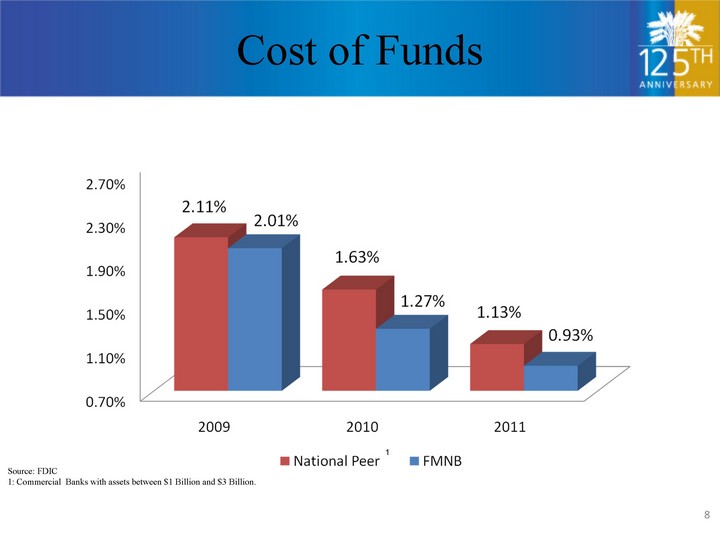

| Cost of Funds 8 Source: FDIC 1: Commercial Banks with assets between $1 Billion and $3 Billion. 1 |

| Growing and Diverse Revenue Streams 9 Fee income is less credit risk sensitive than interest income Farmers capitalizes on relationship management Trust income accounts for almost half of last twelve months non-interest income |

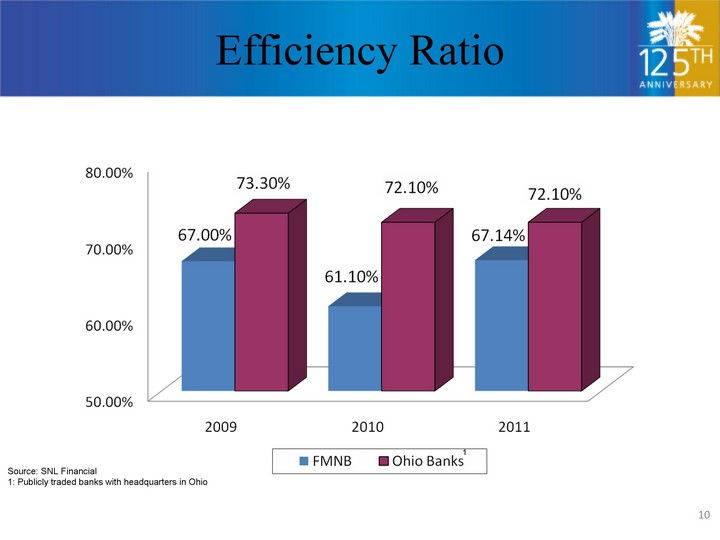

| Efficiency Ratio 10 Source: SNL Financial 1: Publicly traded banks with headquarters in Ohio 1 |

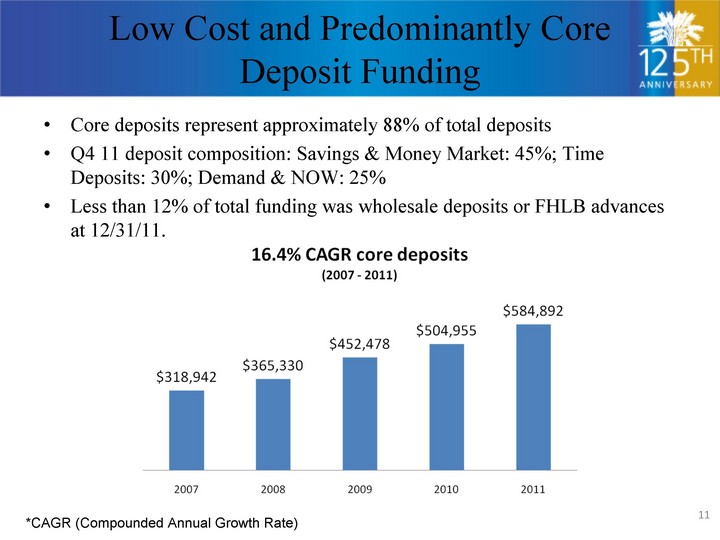

| Low Cost and Predominantly Core Deposit Funding 11 Core deposits represent approximately 88% of total deposits Q4 11 deposit composition: Savings & Money Market: 45%; Time Deposits: 30%; Demand & NOW: 25% Less than 12% of total funding was wholesale deposits or FHLB advances at 12/31/11. *CAGR (Compounded Annual Growth Rate) |

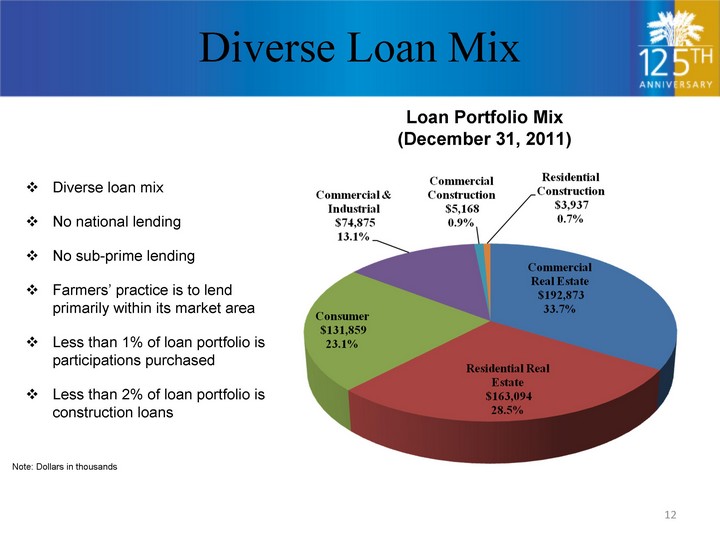

| 12 Diverse loan mix No national lending No sub-prime lending Farmers' practice is to lend primarily within its market area Less than 1% of loan portfolio is participations purchased Less than 2% of loan portfolio is construction loans Loan Portfolio Mix (December 31, 2011) Note: Dollars in thousands Diverse Loan Mix |

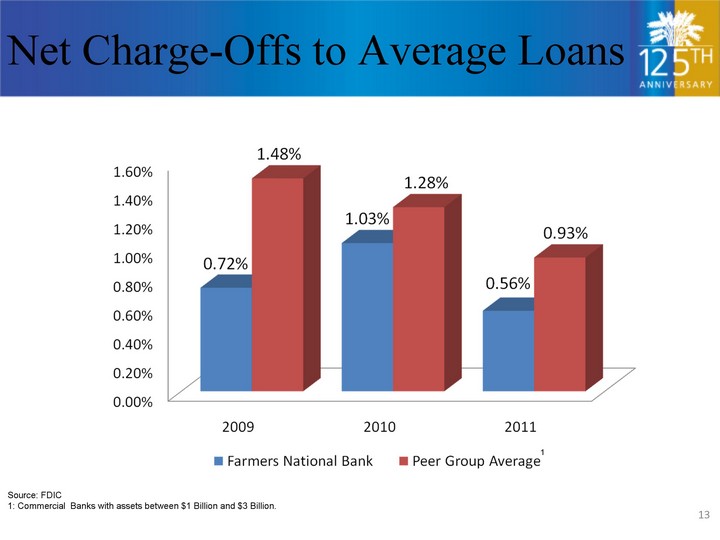

| Net Charge-Offs to Average Loans 13 Source: FDIC 1: Commercial Banks with assets between $1 Billion and $3 Billion. 1 |

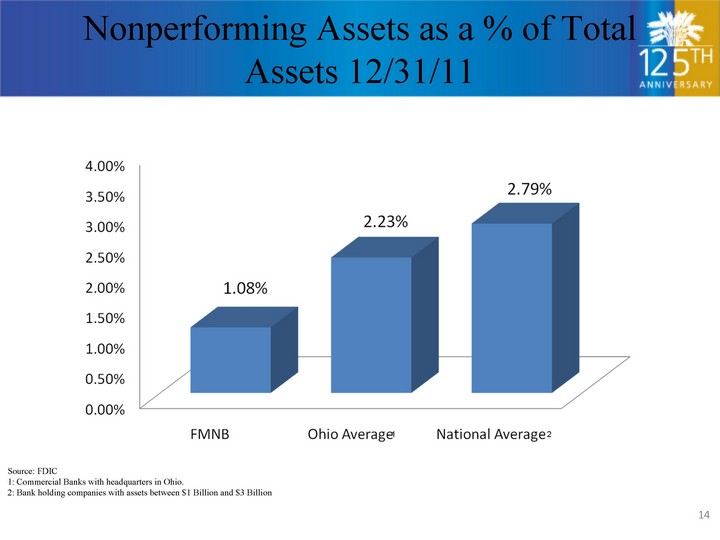

| Nonperforming Assets as a % of Total Assets 12/31/11 14 Source: FDIC 1: Commercial Banks with headquarters in Ohio. 2: Bank holding companies with assets between $1 Billion and $3 Billion 1 2 |

| Highlights of First Quarter 2012 15 Net Income increased 49% to $2.5 million or $0.13 per diluted share for the first quarter of 2012 compared to $1.7 million or $0.10 for the first quarter of 2011. Improved credit quality resulted in a lower loan loss provision. Continued improvement in noninterest income. Deposits increased 16% from March 31, 2011 to March 31, 2012. 117 consecutive quarters of positive earnings. |

| Turning Technologies How many presidents has Farmers National Banc Corp. had in our 125 year history? 8 9 10 11 16 |

| John S. Gulas President & Chief Executive Officer 17 |

| Turning Technologies What percent did our stock increase in value over the last year? 9% 19% 29% 39% 18 |

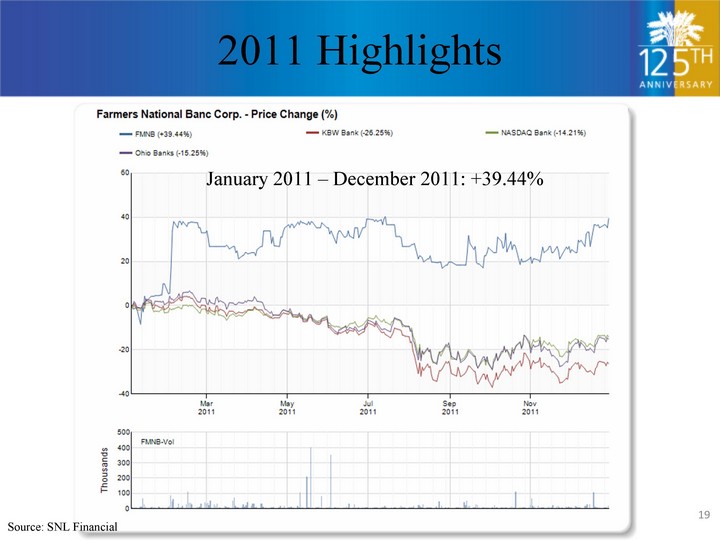

| 2011 Highlights 19 January 2011 - December 2011: +39.44% Source: SNL Financial |

| 2011 Highlights 20 January 2012 - March 2012: +31.11% Source: SNL Financial |

| Turning Technologies On what day did Farmers National Banc Corp. begin trading its common shares on NASDAQ? July 15, 2011 August 15, 2011 September 15, 2011 October 15, 2011 21 |

| 2011 Highlights 22 |

| Turning Technologies How many new locations did Farmers National Banc Corp. announce in the past year? 0 1 2 3 23 |

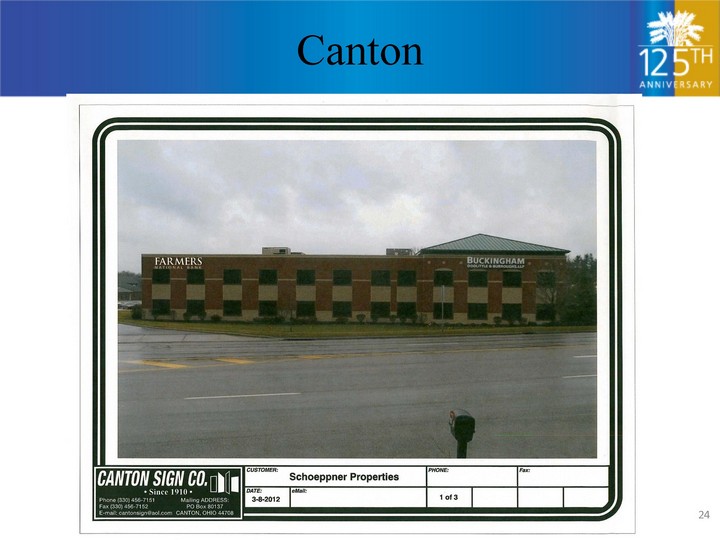

| Canton 24 |

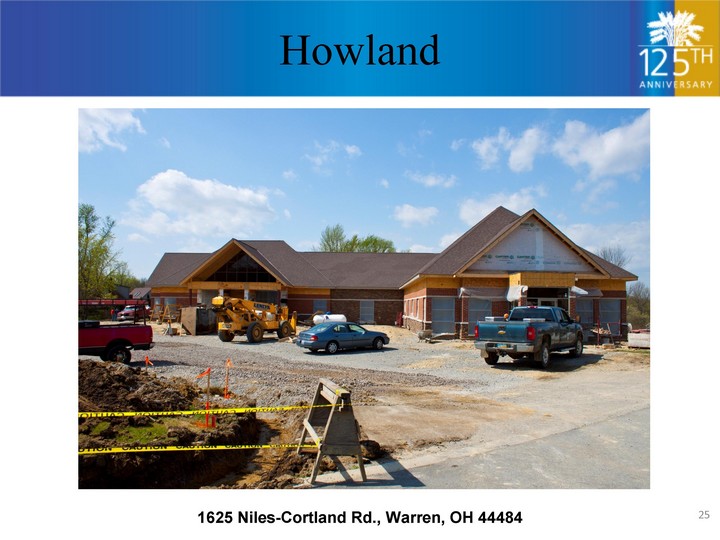

| Howland 25 1625 Niles-Cortland Rd., Warren, OH 44484 |

| McClurg Road 26 |

| Turning Technologies Where is the Farmers National Bank ATM located on the Youngstown State University campus? Jones Hall Beeghly Center Williamson College of Business Cushwa Hall 27 |

| 2011 Highlights Youngstown State University ATM located in Beeghly Center Special checking account offer to students Participated in Welcome Week 28 |

| 2011 Highlights Farmers Shale Resource Team Staffed with banking professionals, accountants and investment experts Expertise needed to assess a customer's needs managing new shale profits and assets, monitor marketplace conditions and present customers with savings and investment options 29 |

| 2011 Highlights Focus on Fee Income Farmers Trust Company $912 Million to $950 Million in Assets under Management Farmers National Insurance Over 280 Property and Casualty Insurance policies sold since March 2010 80 Medicare policies sold during the 2011 Open Enrollment Farmers National Investments Produced over $1.2 Million in Gross Revenues in 2011 30 |

| 2012 Strategic Initiatives Expand Asset Base through Acquisition, Loan and Core Deposit Growth Organic Growth De Novo Acquisition 31 |

| 2012 Strategic Initiatives Diversify Financial Services and Expand Non- Interest Income Mortgage Private Banking Farmers Trust Company Farmers National Investments Farmers National Insurance FAST 32 |

| 2012 Strategic Initiatives Leverage Technology Expand asset base and leverage technology by creating a virtual branch Loan Applications Deposit Applications Mobile Banking E-statements Entering into Social Media 33 |

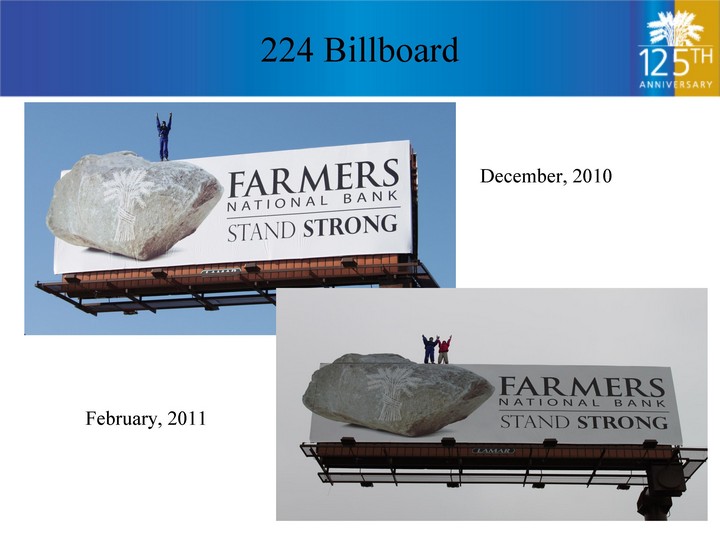

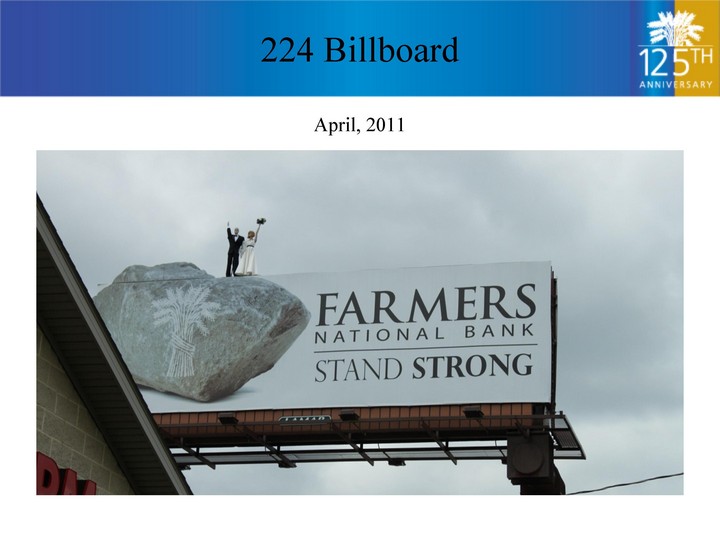

| 2012 Strategic Initiatives Brand Enhancement Utilize brand awareness to acquire customers from competition and new economic resurgance 125 Year Anniversary Bride & Groom Survey 34 |

| 224 Billboard December, 2010 February, 2011 |

| 224 Billboard April, 2011 |

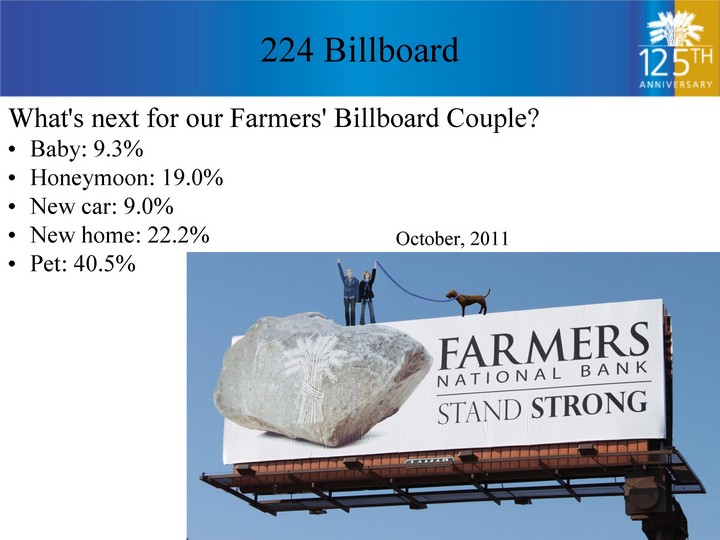

| 224 Billboard What's next for our Farmers' Billboard Couple? • Baby: 9.3% • Honeymoon: 19.0% • New car: 9.0% • New home: 22.2% • Pet: 40.5% October, 2011 |

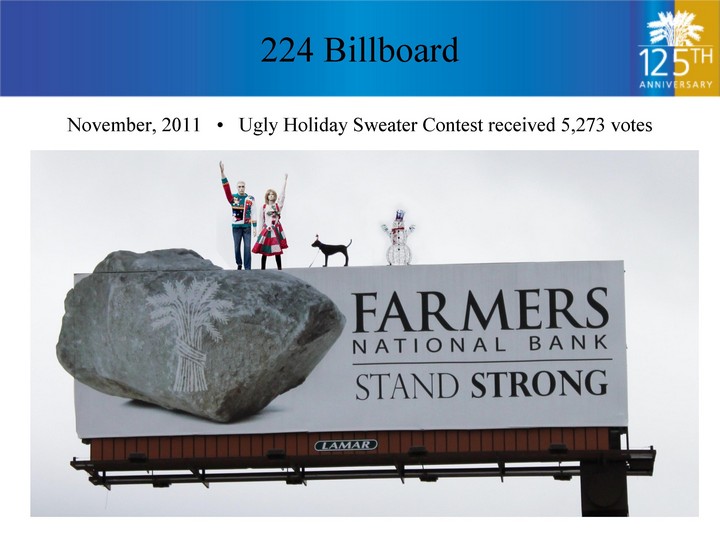

| 224 Billboard November, 2011 • Ugly Holiday Sweater Contest received 5,273 votes |

| Turning Technologies What is next for the mannequins? Baby House Car Vacation 39 |

| 224 Billboard |

| Turning Technologies What is Farmers National Bank's overall customer satisfaction rate? 82% 87% 92% 97% 41 |

| Survey Results Customer and Employee Surveys Conducted in January 2012 Survey Satisfaction Rates Personal Customers: 97.13% Business Customers: 96.10% Overall: 97.03% |

| 2012 Strategic Initiatives Risk Management and Asset Quality Expand asset base with enhanced loan product set SBA SWAP Utica Shale 43 |

| 2012 Strategic Initiatives Attract, Develop and Retain Quality People Key Positions Hired in 2011 and 2012 Farmers National Bank Chief Lending Officer, Joseph Gerzina Commercial Lending Team Leader, Tim Shaffer Mortgage Manager, Christopher Willoughby Mortgage Lending Team Leader, Rocco Page Mortgage Lending Team Leader, George Stoffer Mortgage Loan Consultant, Jim Wellington Corporate Security Officer, Dale Sturdevant Senior Commercial Credit Analyst, Lisa Baird Senior Commercial Credit Analyst, Dana Stine Branch Manager, Austintown, Rick Palmer Farmers Trust Company Chief Investment Officer and Treasurer, Joseph DePascale Senior Portfolio Manager/Investment Team Leader, David Dastoli 44 |

| Questions and Answers |